Principle Member

From R4531

Dependant Member

From R3562

Child Dependant

From R1809

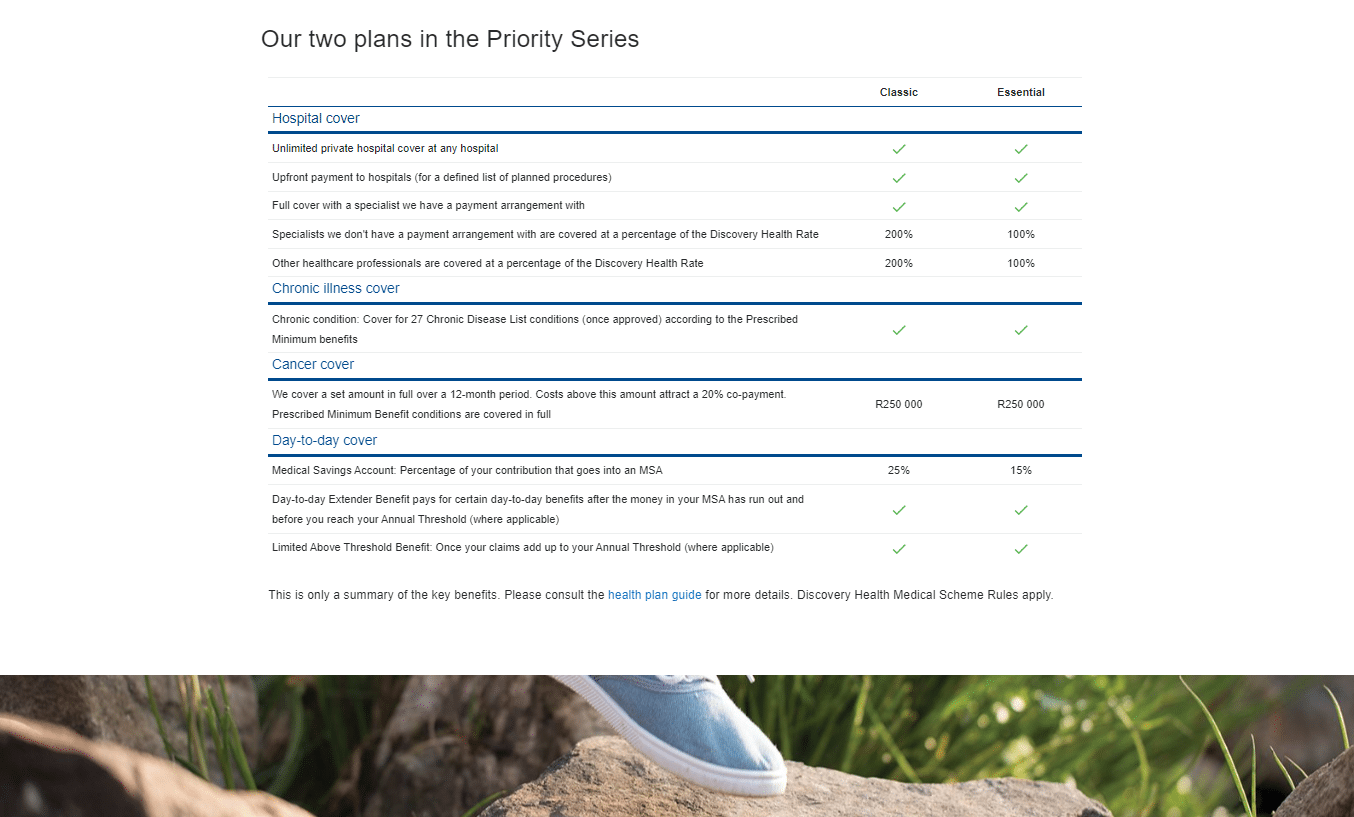

Essential Priority

The Essential Priority plan is a good option for those who prioritize affordability over a wide range of benefits, it provides comprehensive and flexible coverage for medical expenses,

★★★★★ 4.5/5

Chronic Cover:

Day-to-Day:

Preventative Care:

Cancer Cover:

Hospitalisation:

Maternity Benefits:

The Essential Priority plan is a good option for those who prioritize affordability over a wide range of benefits, it provides comprehensive and flexible coverage for medical expenses,

Tax Deductible:

Travel Cover:

Essential Priority

The Essential Priority plan is a good option for those who prioritize affordability over a wide range of benefits, it provides comprehensive and flexible coverage for medical expenses,

★★★★★ 4/5

Principle Member

From R4531

Dependant Member

From R3562

Child Dependant

From R1809

Chronic Cover:

Day-to-Day:

Preventative Care:

Cancer Cover:

Hospitalisation:

Maternity Benefits:

The Essential Priority plan is a good option for those who prioritize affordability over a wide range of benefits, it provides comprehensive and flexible coverage for medical expenses,

Tax Deductible:

Travel Cover: