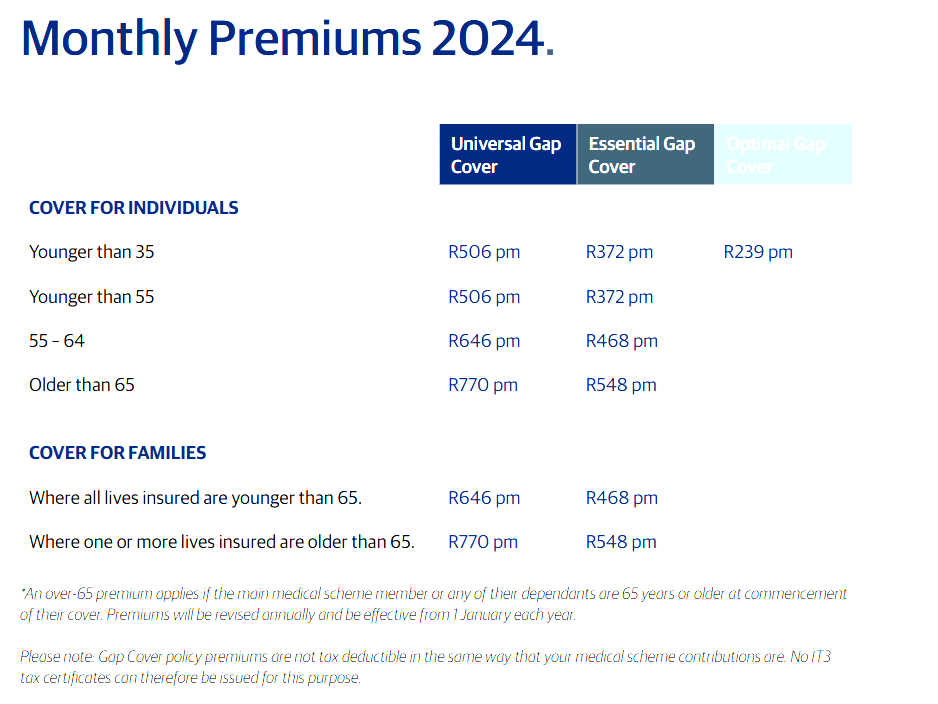

Monthly Premium

From R506

Waiting Period

12 months

Universal

The Universal plan offers a range of benefits, including coverage for non-network co-payments, oncology treatments, internal prostheses, casualties, robotic medical procedures, and various other additional advantages.

★★★★★ 4.5/5

Oncology Benefits:

Scopes and Scans:

Accidental Cover:

Trauma Counseling:

Co-Payment Cover:

Maternity Benefits:

The Universal plan offers a range of benefits, including coverage for non-network co-payments, oncology treatments, internal prostheses, casualties, robotic medical procedures, and various other additional advantages.

In Hospital Benefits:

Out of Hospital Cover:

Tax Deductible:

Prostheses:

Universal

The Universal plan offers a range of benefits, including coverage for non-network co-payments, oncology treatments, internal prostheses, casualties, robotic medical procedures, and various other additional advantages.

★★★★★ 4/5

Monthly Premium

From R506

Waiting Period

12 months

The Universal plan offers a range of benefits, including coverage for non-network co-payments, oncology treatments, internal prostheses, casualties, robotic medical procedures, and various other additional advantages.

In Hospital Benefits:

Out of Hospital Cover:

Tax Deductible:

Prostheses: