Principle Member

From R2714

Dependant Member

From R2037

Child Dependant

From R1078

Coastal Core

The Coastal Core plan offers various benefits such as Discovery Health Connected Care, pathology, and radiology services, as well as in and out-of-hospital cover.

★★★★★ 4.5/5

Chronic Cover:

Day-to-Day:

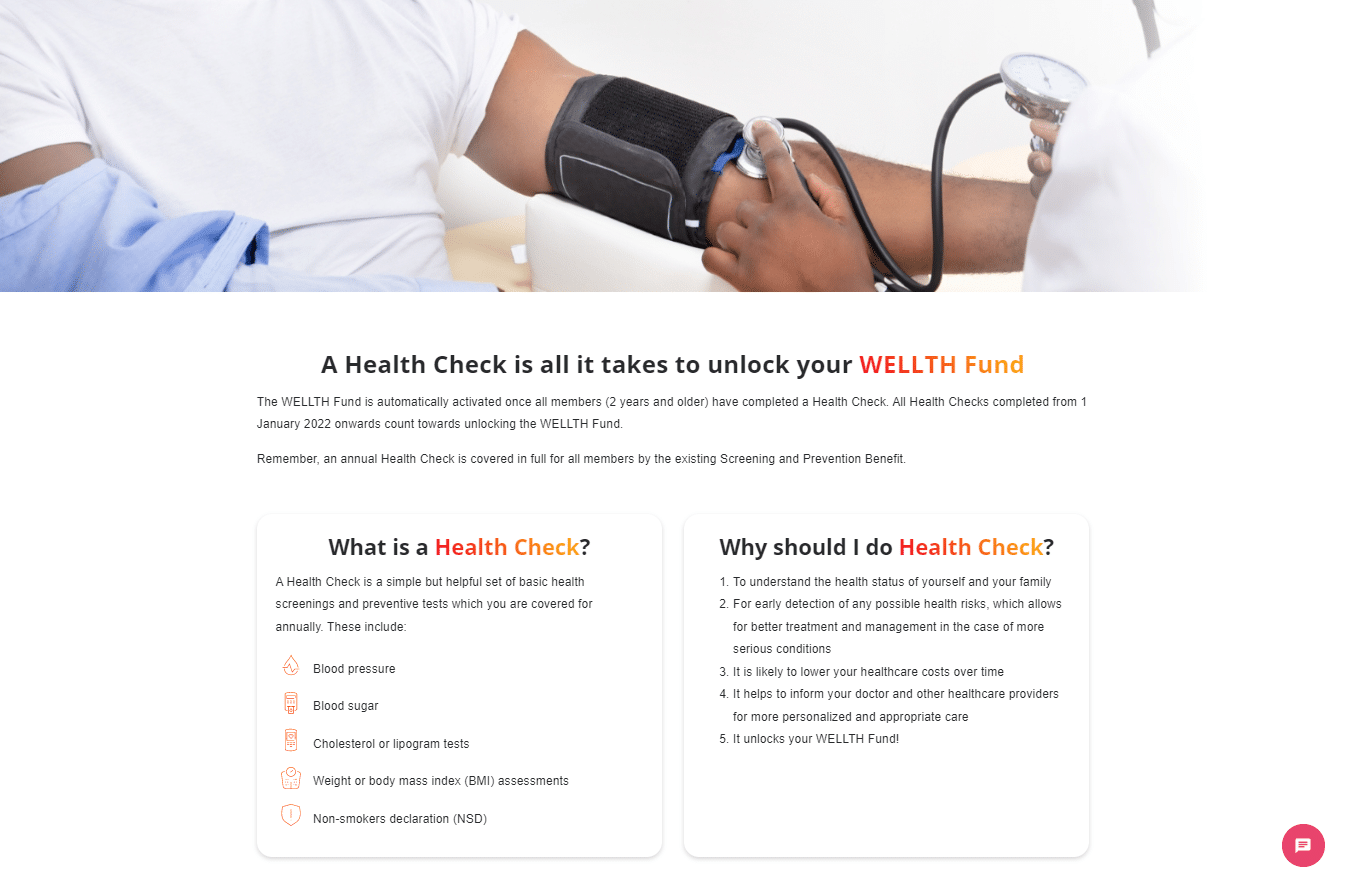

Preventative Care:

Cancer Cover:

Hospitalisation:

Maternity Benefits:

The Coastal Core plan offers various benefits such as Discovery Health Connected Care, pathology, and radiology services, as well as in and out-of-hospital cover.

Tax Deductible:

Travel Cover:

Coastal Core

The Coastal Core plan offers various benefits such as Discovery Health Connected Care, pathology, and radiology services, as well as in and out-of-hospital cover.

★★★★★ 4/5

Principle Member

From R2714

Dependant Member

From R2037

Child Dependant

From R1078

Chronic Cover:

Day-to-Day:

Preventative Care:

Cancer Cover:

Hospitalisation:

Maternity Benefits:

The Coastal Core plan offers various benefits such as Discovery Health Connected Care, pathology, and radiology services, as well as in and out-of-hospital cover.

Tax Deductible:

Travel Cover: