Best Pet Insurance Providers in South Africa

Navigating the world of pet insurance can be daunting, especially when looking for the best options in South Africa. With a myriad of providers and plans to choose from, it is easy to feel overwhelmed.

But fear not, we have got you covered. In this article, we will provide a comprehensive guide to the top pet insurance providers in South Africa, helping you compare affordable plans to ensure your beloved pets’ health and safety.

The 5 Best Pet Insurance Providers in South Africa – A Comparison

| 🔎 Provider | 🥇 Dotsure | 🥈 OnePlan | 🥉 MediPet | 🏅 Kido Pet Insurance | 🎖️ 1st For Women Pet Insurance |

| 💴 Plans Price Range | R89 – R479 p/m | R80 – R430 per month | R321 – R567 per month | R180 – R450 | R100 – R390 |

| 🐱 Species Covered | Cats, Dogs, Birds, Reptiles | Cats and Dogs | Cats and Dogs | Cats and Dogs | Cats and Dogs |

| 🐶 Breed Restrictions | None | None | None | None | None |

| 📊 Routine Care | ✅Yes | ✅Yes | ✅Yes | None | ✅Yes |

| 💊 Medication | ✅Yes | ✅Yes | ✅Yes | None | ✅Yes |

The 5 Best Pet Insurance Providers in South Africa (2024)

- ☑️ Dotsure – Overall, the Best Pet Insurance provider in South Africa

- ☑️ Oneplan – Customizable Pet Insurance Plans

- ☑️ MediPet – Includes a Holistic Wellness Option

- ☑️ Kido Pet Insurance – 24-Hour Emergency Helpline Support

- ☑️ 1st for Women Pet Insurance – Covert third-party liability

Understanding Pet Insurance

Protecting your pet’s health and happiness is a top priority in pet ownership. One key aspect of this is understanding and navigating the world of pet insurance.

Whether you are a new pet parent or a seasoned owner, understanding what pet insurance is and why it is important is crucial. This section will provide the essential knowledge you need to make informed decisions about pet insurance.

What is Pet Insurance?

Pet insurance is a type of coverage designed to help protect you financially if your pet gets sick or injured. Just like human health insurance, pet insurance policies can cover a range of healthcare needs for your pet, from accidents and illnesses to routine check-ups and preventive care.

While the specifics of what is covered can vary greatly from one policy to another, the fundamental idea remains: providing a safety net for unforeseen health costs associated with your pet.

However, it is important to remember that pet insurance typically doesn’t cover pre-existing conditions, so it’s often best to get coverage when your pet is young and healthy.

Why is Pet Insurance Important?

Pet insurance plays a vital role in protecting not only the health of your pet but also your finances. Veterinary care can be expensive, particularly for serious illnesses or injuries. An unexpected vet bill can put a significant strain on your finances.

That is where pet insurance comes in. By paying a regular premium, you can have peace of mind knowing that your insurance will cover a substantial portion of these unexpected costs.

Additionally, having pet insurance allows you to focus on what is most important during a pet health crisis – the well-being of your pet – rather than worrying about how you will afford the treatment.

It is a critical part of responsible pet ownership, ensuring that your pet can receive the necessary medical care without the worry of unmanageable costs.

Top Pet Insurance Providers in South Africa

Dotsure Pet Insurance

Dotsure is a reputable pet insurance provider founded in South Africa in 2011. It offers comprehensive and flexible insurance policies for pets, life, and funeral insurance for humans.

The company is committed to giving back to the community, with a portion of every pet insurance policy sold going towards feeding a shelter puppy for a month. Dotsure’s community development team also distributes over a million meals annually to those in need.

Notable features of Dotsure include:

| 🔎 Company Name | 🥇 Dotsure Limited |

| 📌 Founded | 2011 |

| 💴 Plans Price Range | R89 – R479 p/m |

| 🐱 Species Covered | Cats, Dogs, Birds, Reptiles |

| 🐶 Breed Restrictions | None |

| 📈 Sub-limits | ✅Yes |

| 📉 Maximum Limit per claim | Depends on the plan and claim |

| 📊 Routine Care | ✅Yes |

| 🩺 Diagnostic Testing | ✅Yes |

| 💊 Medication | ✅Yes |

| 🧬 Hospitalisation Cover | ✅Yes |

| 🩹 Chronic Support Care | ✅Yes |

| 😣 Accidental Cover | ✅Yes |

| ⚕️ Illness Cover | ✅Yes |

| 🦷 Dental Care | ✅Yes |

| 📍 X-rays | ✅Yes |

Dotsure Pros and Cons

| ✅ Pros | ❎ Cons |

| Comprehensive and flexible insurance policies | Exclusions, restrictions, and waiting periods |

| Positive impact on the community through CSR initiatives | Coverage limitations based on the pet’s age, breed, and health status |

| Efficient and straightforward online claims process | Maximum limits on claim amounts per condition or policy period |

| Customisable policies to fit individual needs and preferences | Exclusions, restrictions, and waiting periods |

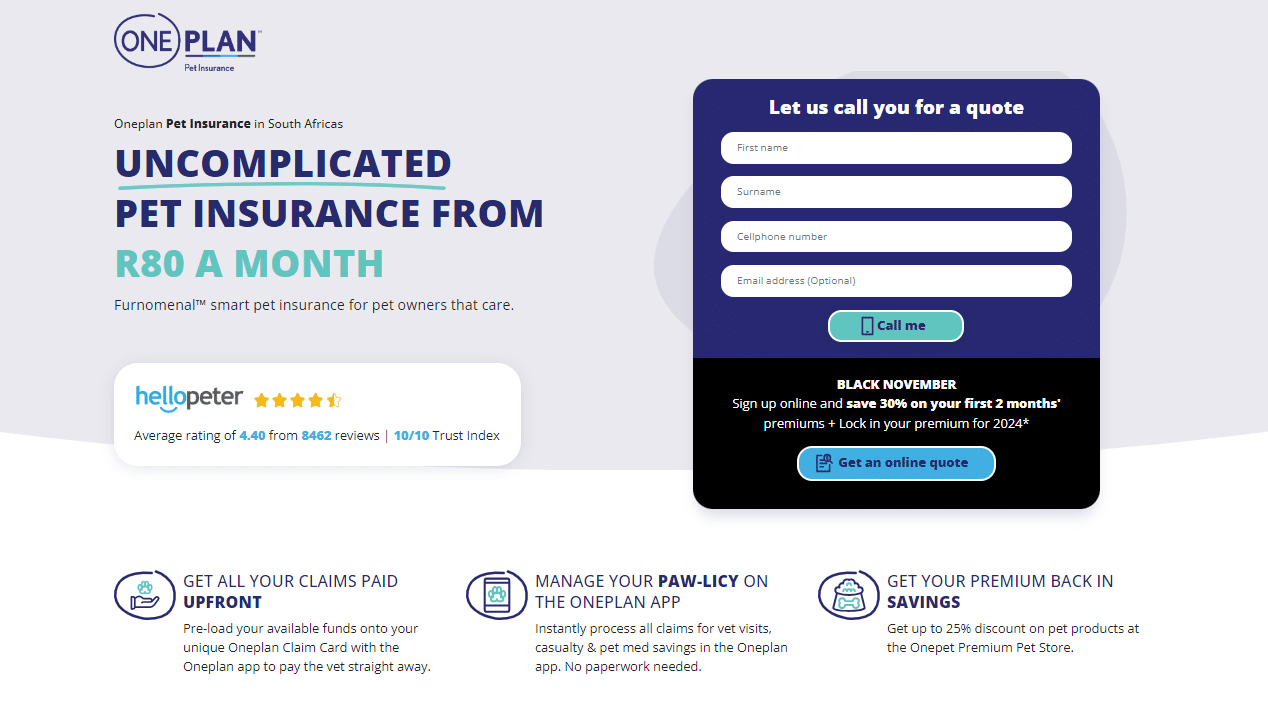

Oneplan Pet Insurance

Oneplan Pet Insurance is a South African-based insurance provider that offers comprehensive and customizable pet insurance plans. The company was founded in 2019 and has a trust rating of 4.4.

Oneplan covers a range of medical expenses if an unexpected illness or accident occurs, including X-rays, emergencies, hospital visits, burial and cremation, kennel stays, and more.

One of its standout features is its flexible payment system, which allows policyholders to pay their premiums monthly instead of an annual lump sum, providing more financial flexibility for pet owners and making pet insurance more accessible.

Oneplan also offers a unique payment system called Onecard, which allows pet owners to preload funds onto a debit card that can be used to pay for veterinary bills as they occur, rather than having to pay upfront and wait for reimbursement

Notable Features of OnePlan include:

| 🔎 Company Name | 🥇 Oneplan™ |

| 📌 Founded | 2019 |

| 💵 Plans Price Range | R80 – R430 per month |

| 🐕 Species Covered | Cats and Dogs |

| 🙈 Do breed restrictions apply | None |

| 📈 Sub-limits | ✅Yes |

| 📉 Maximum Limit per claim | Depends on the plan and claim |

| ❤️ Routine Care | ✅Yes |

| 📊 Diagnostic Testing | ✅Yes |

| 💊 Medication | ✅Yes |

| 🩺 Hospitalisation Cover | ✅Yes |

| 🩹 Chronic Support Care | ✅Yes |

| 😣 Accidental Cover | ✅Yes |

| 🧬 Illness Cover | ✅Yes |

| 🦷 Dental Care | ✅Yes |

| ▶️ X-rays | ✅Yes |

Oneplan Pros and Cons

| ✅ Pros | ❎ Cons |

| Flexible payment system | Cover options may be more limited than other providers |

| A unique payment system called Onecard allows pet owners to preload funds onto a debit card that can be used to pay for veterinary bills as they occur | Waiting periods may be longer than other providers |

| Offers a range of cover options, including accident-only cover, illness-only cover, and comprehensive cover that includes both accident and illness cover | Exclusions for the first 12 months from plan inception, including cancer, arthritis, heart disease, tumours, masses, or growths, etc. |

MediPet Pet Insurance

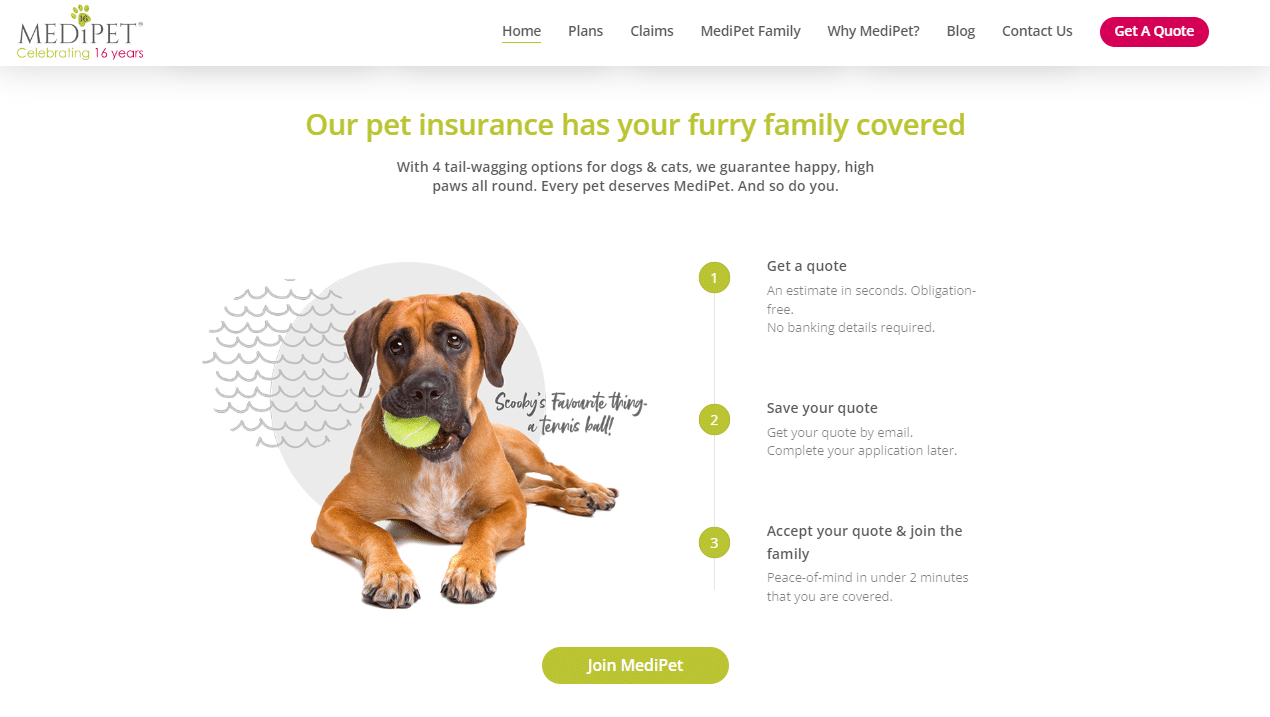

MediPet provides pet insurance for accidents, illnesses, emergencies, and holistic wellness. To enroll, choose the plan that best suits your pet’s needs, pays the monthly premium, and provides basic information about your pet.

If your pet requires medical attention, pay the vet bill upfront, and initiate the claims process with MediPet. There is no maximum age limit for pets with MediPet. However, cover may vary depending on the pet’s age and pre-existing conditions.

MediPet is committed to covering pre-existing conditions that other pet insurance providers may not cover. Benefit Booster is an optional feature of MediPet’s policies that allows you to increase your benefits with a monthly payment for the total cover of an operation or the amount required.

Notable Features of MediPet include:

| 🔎 Company Name | 🥇 MediPet Animal Health Insurance Brokers (Pty) Ltd. |

| 📌 Founded | 2007 |

| 💴 Plans Price Range | R321 – R567 per month |

| 🐱 Species Covered | Cats and Dogs |

| 🙈 Do breed restrictions apply | None |

| 📈 Sub-limits | ✅Yes |

| 📉 Maximum Limit per claim | R13,760 |

| 💙 Routine Care | ✅Yes |

| 🧬 Diagnostic Testing | ✅Yes |

| 💊 Medication | ✅Yes |

| 🩺 Hospitalisation Cover | ✅Yes |

| 🩹 Chronic Support Care | ✅Yes |

| 😣 Accidental Cover | ✅Yes |

| 🤧 Illness Cover | ✅Yes |

| 🦷 Dental Care | ✅Yes |

| 📍 X-rays | ✅Yes |

MediPet Pros and Cons

| ✅ Pros | ❎ Cons |

| No sub-limits within the policy year | MediPet has a 30-day no-claim period, meaning you cannot make any claims within the first 30 days of your policy |

| You can choose your vet if they are registered with the South African Veterinary Council | There are waiting periods for certain treatments and benefits |

| MediPet covers accidents, illnesses, emergencies, and holistic wellness, with options for ongoing chronic cover and Benefit Booster to increase your benefits | Cover may vary depending on the pet’s age and pre-existing conditions |

Kido Pet Insurance

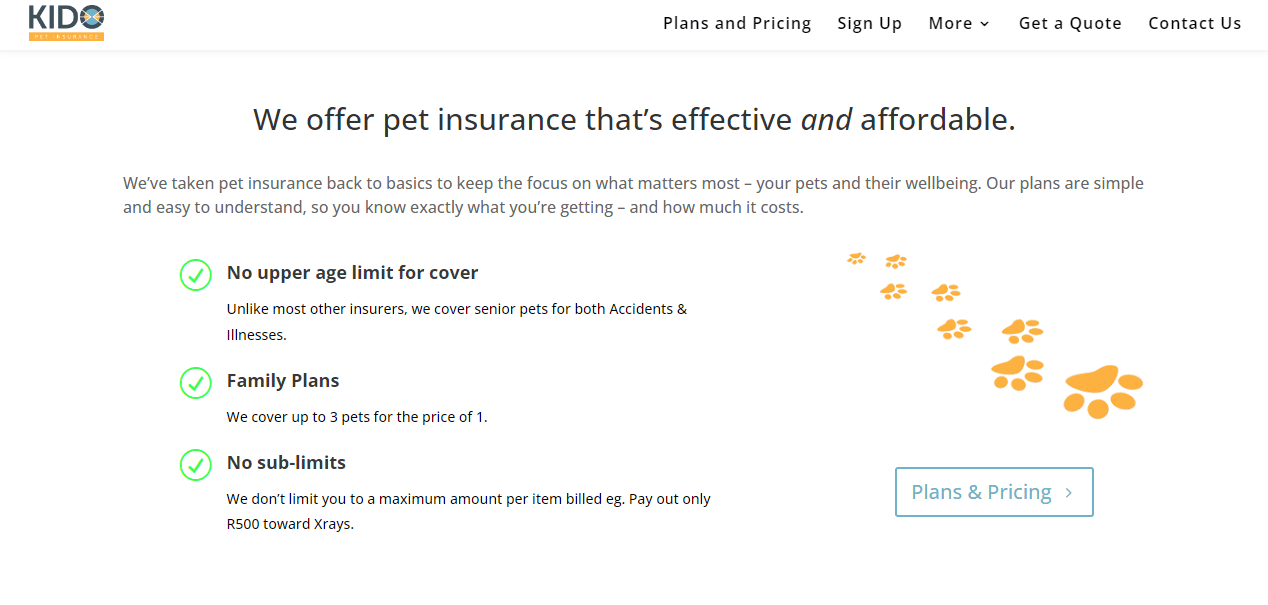

Kido Pet Insurance is a reputable pet insurance provider in South Africa that offers various cover options, including accident-only, illness-only, and comprehensive cover for cats and dogs.

Their policies cover a range of veterinary expenses, including consultations, diagnostic tests, surgery, hospitalization, medication, and more.

In addition to providing insurance cover, Kido Pet Insurance provides policyholders with additional benefits, such as access to a 24-hour helpline staffed by qualified veterinarians who can provide emergency advice and assistance.

Kido is known for providing exceptional customer service, with prompt responses to inquiries and efficient claims handling. They have received positive reviews from satisfied customers who appreciate their personalized approach and attention to detail.

Notable features of Kido Pet Insurance include:

| 🔎 Company Name | 🥇 Kido Pet Insurance |

| 💴 Plans Price Range | R180 – R450 |

| 🐱 Species Covered | Cats and Dogs |

| 🙈 Do breed restrictions apply | None |

| 📈 Sub-limits | ✅Yes |

| 📉 Maximum Limit per claim | R17,500 |

| 🩺 Routine Care | None |

| 🧬 Diagnostic Testing | None |

| 💊 Medication | None |

| 🩹 Hospitalisation Cover | ✅Yes |

| ❤️ Chronic Support Care | None |

| 😣 Accidental Cover | ✅Yes |

| ⚕️ Illness Cover | ✅Yes |

| 🦷 Dental Care | None |

| 📍 X-rays | None |

Kido Pet Insurance Pros and Cons

| ✅ Pros | ❎ Cons |

| Offers a variety of cover options, including accident-only, illness, and comprehensive cover | Does not cover routine care or pre-existing conditions |

| Covers a range of veterinary expenses, including consultations, diagnostic tests, surgery, hospitalisation, medication, and more | Has a claims limit and exclusions, and waiting periods for each policy period |

| Provides additional benefits, such as access to a 24-hour helpline staffed by qualified veterinarians | There are several exclusions |

1st For Women Pet Insurance

1st for Women Pet Insurance is a reputable pet insurance provider in South Africa. The insurance policy is designed to help pet owners cover the cost of veterinary bills and other expenses related to their pets’ health.

It offers coverage for various benefits, including accidental injury, illness, and emergency veterinary treatment. It also covers routine care, such as vaccinations, deworming, and flea and tick control.

Additionally, the policy covers third-party liability, which protects pet owners from financial losses if their pets cause damage to other people’s property or injure someone.

1st for Women Pet Insurance in South Africa is ideal for cats and dogs of all breeds and ages. The policy is flexible, with a range of cover levels and optional extras that can be added to tailor the policy to the needs of individual pets and their owners.

The pet insurance provider also provides a 24/7 emergency and healthcare line for pets, Pet Taxi, covers surgeries, hospitalization, and more.

Notable features of 1st for Women Pet Insurance include:

| 🔎 Company Name | 🥇 First for Women Insurance Company Limited |

| 📌 Founded | 2004 (First for Women) |

| 💴 Plans Price Range | R100 – R390 |

| 🐈⬛ Species Covered | Cats and Dogs |

| 🙈 Do breed restrictions apply | None |

| 📈 Sub-limits | ✅Yes |

| 📉 Maximum Limit per claim | R50,000 |

| 💛 Routine Care | ✅Yes |

| 🧬 Diagnostic Testing | ✅Yes |

| 💊 Medication | ✅Yes |

| 👩⚕️ Hospitalisation Cover | ✅Yes |

| 🩹 Chronic Support Care | None |

| 😣 Accidental Cover | ✅Yes |

| 🩺 Illness Cover | ✅Yes |

| 🦷 Dental Care | ✅Yes |

| 📍 X-rays | ✅Yes |

1st for Women Pet Insurance Pros and Cons

| ✅ Pros | ❎ Cons |

| Covers cats and dogs of all breeds and ages | The policy may be more expensive than other pet insurance policies |

| Offers a range of cover levels and optional extras | The policy may not cover pre-existing conditions |

| Covers many benefits, including accidental injury, illness, emergency veterinary treatment, routine care, and third-party liability | Certain treatments and procedures may be subject to cover limits |

Comparing Pet Insurance Plans

Pet Insurance Coverage Details

| 🔎 Provider | ⚠️ Accident Cover | 🩺 Illness Cover | 🧬 Pre-existing Conditions Covered | 🩹 Routine Care | 💊 Medication | 📌 Hospitalisation | ⛔ Exclusions | 📍 Waiting Periods |

| 🥇 Dotsure | ✅Yes | ✅Yes | None | ✅Yes | ✅Yes | ✅Yes | ✅Yes | 30 days – 12 months |

| 🥈 Oneplan | ✅Yes | ✅Yes | None | ✅Yes | ✅Yes | ✅Yes | ✅Yes | 30 days – 12 months |

| 🥉 MediPet | ✅Yes | ✅Yes | ✅Yes | ✅Yes | ✅Yes | ✅Yes | ✅Yes | 30 days – 6 months |

| 🏅 Kido | ✅Yes | ✅Yes | ✅Yes | None | None | ✅Yes | ✅Yes | 30 days – 12 months |

| 🎖️ 1st For Women Pet | ✅Yes | ✅Yes | None | ✅Yes | ✅Yes | ✅Yes | ✅Yes | 30 days – 12 months |

Pet Insurance Pricing Structures

| 🔎 Insurance Provider | 💴 Premium Range per Pet | 📈 Overall Annual Limit | 📉 Excess | 🐸 Species Covered | 🐱 Min/Max Pet Age |

| 🥇 Dotsure | R89 – R479 | R14,000 – R69,500 | 10% of the claim/min R200 | Cats, Dogs, Exotic Pets | 8 weeks – 9 years |

| 🥈 Oneplan | R80 – R430 | R8,000 – R70,000 | 25% for the first 6 months, 10% from 7th | Cats and Dogs | 8 weeks and no max age limit |

| 🥉 MediPet | R321 – R567 | R25,000 – R65,000 | 15% of the claim/min R250 | Cats and Dogs | 8 weeks to <9 years |

| 🏅 Kido Pet Insurance | R180 – R450 | R16,000 – R25,000 | 15% of the claim/min R250 | Cats and Dogs | 8 weeks and no max age limit |

| 🎖️ 1st for Women Pet | R100 – R390 | R10,000 – R65,850 | 25% (min R500) first 6 months, 10% (min R500) after that | Cats and dogs | 8 weeks – 9 years |

In Conclusion

Choosing the right pet insurance is a crucial decision for pet owners. Considering each provider’s coverage options, cost, and customer service is important. While some insurers offer comprehensive plans covering various medical expenses, others may have more limitations.

Always review the policy details, including exclusions and waiting periods. Pet insurance can provide peace of mind by helping manage unexpected veterinary costs, ensuring your pet gets the best possible care.

Therefore, we recommend comparing different providers and choosing the one that best suits your pet’s needs and budget.

Frequently Asked Questions

What is pet insurance?

Pet insurance is a policy that helps cover the cost of veterinary expenses should your pet become ill or injured.

Why should I consider getting pet insurance in South Africa?

Pet insurance in South Africa can help cover the cost of expensive veterinary treatments and procedures, ensuring your pet gets the care it needs without straining your finances.

Who are the top pet insurance providers in South Africa?

There are several reputable pet insurance providers in South Africa. This article provides a comprehensive review of the best providers in the market.

How do I compare pet insurance plans in South Africa?

When comparing pet insurance plans in South Africa, it is important to consider what is covered, the cost of premiums, the policy’s exclusions, and the insurance provider’s reputation.

What does a good pet health insurance plan in South Africa cover?

A good pet health insurance plan in South Africa should cover a range of veterinary services, including accidents, illnesses, surgeries, diagnostic tests, and sometimes even preventive care.

Are there affordable pet insurance plans in South Africa?

Yes, there are affordable pet insurance plans in South Africa. The plan’s cost will depend on coverage level, your pet’s breed, age, and health status.

What should I consider when choosing a pet insurance provider in South Africa?

When choosing a pet insurance provider in South Africa, consider the cost, coverage, customer reviews, and the provider’s reputation. Reading the fine print to understand any exclusions or limitations is also important.