Pet Insurance

Overall, being a pet parent comes with its fair share of responsibilities, including providing for their health needs. Pet Insurance in South Africa is an excellent way to ensure your furry friend gets the care they need without breaking the bank.

In this article, you will learn:

- The Best Pet Insurance in South Africa (2023) – a List and Comparison

- The Best Pet Insurance for Small and Older Dogs

- What is the Cheapest and Best Pet Insurance in South Africa? – Prices Compared

- How Much is Pet Insurance for Specific Pets (Dogs, Cats, Rabbits)

- The Best Pet Insurance According to Clients – Reviews

and much, MUCH more!

The 5 Best Pet Insurance Providers – a Comparison

| 🔎 Provider | 💶 Plans Price Range | 🦜 Species Covered | 📌 Breed Restrictions |

| 🐶 Dotsure | R89 – R479 p/m | Cats, Dogs, Birds, Reptiles | None |

| 🐱 Oneplan | R80 – R430 p/m | Cats and Dogs | None |

| 🐸 MediPet | R321 – R567 p/m | Cats and Dogs | None |

| 🦎 1st for Women Pet Insurance | R100 – R390 p/m | Cats and Dogs | None |

| 🐁 OUTsurance Pet Insurance | Flexible | Cats and Dogs | None |

The 5 Best Pet Insurance Providers (2024)

- ☑️ Dotsure – Overall, the Best Pet Insurance in South Africa

- ☑️ OnePlan – Unexpected Illness and Accident Cover

- ☑️ MediPet – 24/7 Emergency Assistant

- ☑️ 1st for Women Pet Insurance – Most Affordable Pet Insurance

- ☑️ OUTsurance Pet Insurance – Tailored Pet Insurance Plans

What is Pet Insurance?

Pet insurance is a type of insurance policy that helps cover the cost of veterinary treatment for unexpected illnesses or accidents that may happen to your pet.

Pet insurance aims to provide financial assistance for unexpected veterinary bills and help pet owners manage pet care costs.

Why is Pet Insurance Important in South Africa?

While owning a pet is fulfilling, it can also be quite costly. The expenses of sterilization, regular check-ups, deworming, flea, and tick medication can accumulate over time. However, pet insurance can alleviate some expenses and cover unforeseen circumstances such as surgery or a broken leg.

Therefore, without pet insurance, one may be in a heart-wrenching situation where one cannot afford medical treatment to save their beloved pet’s life.

Considering this, here are the reasons why Pet Insurance is important in South Africa:

- ✅ The price of vet visits, prescriptions, and emergency care can quickly increase over a pet’s lifetime.

- ✅ The financial burden on pet owners can be reduced by pet insurance, which can cover some of these expenses.

- ✅ Accidents and injuries, such as broken legs, are covered by pet insurance.

- ✅ Pet owners may not be able to afford necessary medical care in an emergency if they do not have pet insurance.

Pet insurance provides peace of mind and access to the veterinary care your pet needs to live a long, healthy life.

Benefits of Having Pet Insurance

Some of the benefits of having Pet Insurance include, but are not limited to, the following:

- ✅ You will save on expenses. Veterinarian bills can add up quickly in the event of an emergency. Having a pet insurance policy in place can help to cover the costs. It may save you money eventually, even though you will likely need to pay an excess if your pet requires treatment. Some insurance companies even cover dental care and have a zero-excess option.

- ✅ You can choose your pet’s vet. You will not want to switch veterinarians anytime soon once you have found one adept at dealing with your unyielding cat. Pet insurance allows you to see any veterinarian, unlike most human health insurance plans.

- ✅ You can access after-hours assistance. Because things do not always go as planned, and providing care during non-business hours or in an emergency can be expensive. The good news is that pet insurance will cover anything from late-night emergencies and accidents to illnesses and injuries.

- ✅ Happy, healthy pets. Both right now and in the future. Pet insurance covers unexpected medical expenses, but some policies cover non-emergency care, such as behavioral therapy and complementary therapies.

The peace of mind you will have knowing that your pet is covered in the event of an accident or other mishap is the most important benefit. That is priceless.

Types of Pet Insurance Policies in South Africa

Accident-only Pet Insurance Policies

As the name implies, these policies typically cover accidents or injuries brought on by outside factors, such as being hit by a car or falling from a height. They do not cover illnesses or pre-existing conditions.

Furthermore, accident-only policies are typically the most affordable option and can be a good fit for young, healthy pets.

Comprehensive Pet Insurance Policies

These policies cover all eventualities, including pre-existing conditions, illnesses, and accidents. They might also cover preventative measures like vaccinations, flea and tick treatments, and dental cleanings.

Although more expensive, comprehensive policies give you peace of mind knowing that your pet is protected from almost any hazard.

Routine Care Pet Insurance Policies

These policies cover preventative and routine care, such as vaccinations, dental cleanings, and flea and tick treatments.

Furthermore, these plans also include wellness checks, spaying/neutering, and microchipping. For pet owners who value preventative care more, routine care policies are typically less expensive than comprehensive policies.

Time-Limited Pet Insurance Policies

These policies cover pets for a set amount of time, usually a year. For example, they might cover emergency room visits, prescriptions, and check-ups, but only up to a certain point. The policy will no longer cover once the maximum is reached.

In addition, time-limited policies are typically less expensive than comprehensive policies. However, they cover less ground and may not be appropriate for pets with ongoing medical conditions.

The Pros and Cons of Pet Insurance

Advantages of Pet Insurance

- ✅ Pet insurance can help owners avoid large, unexpected veterinary bills by covering all or a portion of the medical care cost.

- ✅ Because the market for Pet Insurance has grown and become more competitive, you can choose from several reputable plans to cover your furry friend.

- ✅ Since 2019, because of the competition in the Pet Insurance market, several insurers have lifted several restrictions, including pre-existing conditions, breed restrictions, and more.

- ✅ Pet insurance may cover preventative measures like vaccinations, check-ups, and accidents and illnesses, depending on the policy.

- ✅ Most pet insurance plans let owners choose any licensed veterinarian, unlike some human health insurance plans.

- ✅ Some policies reimburse up to 100% of the cost of covered services, reducing the out-of-pocket expense of many procedures.

- ✅ Like any other kind of insurance, pet insurance provides financial security and mental comfort.

- ✅ Payments can be made monthly, quarterly, or annually under many pet insurance policies.

- ✅ Payment is typically made monthly through automatic withdrawal from your bank account, though this varies by plan.

Unlike other medical insurance you may be familiar with, pet insurance does not restrict you to a particular network of veterinarians.

Disadvantages of Pet Insurance

- ❎ Particularly for comprehensive cover, pet insurance premiums can be pricey.

- ❎ Exclusions, such as pre-existing conditions, and limits on cover, such as an annual or lifetime maximum pay-out, are common in pet insurance policies.

- ❎ Many owners of rescue pets find it difficult to find cover for their pets because they might be older than the approved age and have no medical history.

- ❎ Many Pet Insurers in South Africa do not cover exotic pets, which leaves some owners without any cover and expensive vet bills.

- ❎ Pet insurance providers are not required to keep your policy competitive. Instead, they can make any changes when you renew your policy each year.

- ❎ Some pet insurance plans have deductibles or co-payments, which can raise the owner’s out-of-pocket expenses.

- ❎ Pet owners may become frustrated with the lengthy and arduous process of filing a claim with pet insurance.

- ❎ Comparing policies side by side is challenging.

Many pet insurance companies will offer low premiums when your pet is young. However, as they get older, the cost of pet insurance may increase.

5 Best Pet Insurance Schemes in South Africa

Dotsure Pet Insurance

Dotsure provides comprehensive pet insurance policies that cover mishaps, illnesses, and regular vet visits. In addition, they offer various payment options, including monthly, quarterly, and annual payments, and there are no annual limits on payouts.

Furthermore, a vet helpline is available 24 hours a day, 7 days a week, through Dotsure.

Oneplan Pet Insurance

Oneplan provides pet insurance policies that cover mishaps, illnesses, and regular vet visits. In addition, they accept various payment methods, including their proprietary “Onecard” system, which enables immediate payment for veterinary care.

In addition, Oneplan also provides a wellness plan that covers preventative services like check-ups and immunizations.

MediPet Pet Insurance

Pet insurance policies from MediPet cover both catastrophic (accidents and illnesses) and preventative (wellness) care.

In addition, MediPet accepts various payment methods and has no annual cap on payouts. MediPet also offers a pet travel insurance add-on for those who frequently travel with their pets.

1st for Women Pet Insurance

Pet insurance policies from 1st for Women cover unexpected medical expenses, vet visits, and more. They accept pets of any age and have flexible payment plans. For policyholders who do not make a claim for a set amount of time, 1st for Women also offers a “Payback Bonus.”

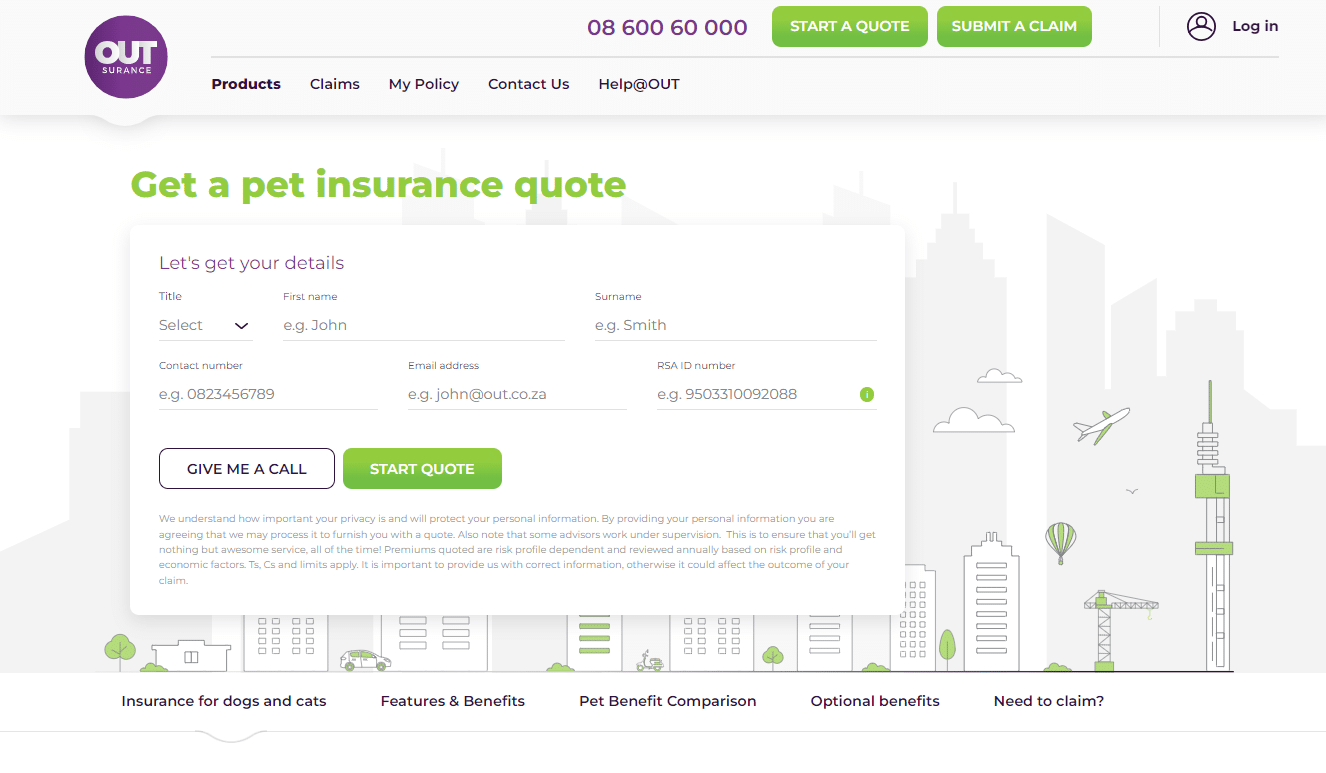

OUTsurance Pet Insurance

OUTsurance provides comprehensive pet insurance policies that cover accidents, illnesses, and routine care. In addition, they have several payment options and no annual withdrawal cap.

OUTsurance also provides a pet assistance benefit, which includes services like lost pet advertising and telephone pet health advice.

Types of Pet Insurance in Terms of Cover

Illness Cover

Illness Cover protects against unforeseen illnesses and medical conditions your pet may contract. Lab tests, x-rays, medication, and surgery are just a few of the costs it typically covers when a pet is sick.

Accidental Injury Cover

Accidental Injury Cover is intended to provide financial protection against accidents involving your pet, such as broken bones, cuts, and other injuries. It typically covers vet costs involved in diagnosing and treating accidental injuries.

Hospitalisation Cover

When your pet becomes ill or hurt and needs to be hospitalized, the costs associated with their care can quickly add up. Hospitalization Coverage can help. It typically covers veterinary hospitalization costs, such as surgery, medications, and other treatments.

Prescribed Medicine Cover

The purpose of Prescribed Medicine Cover is to protect you financially from the excessive cost of your pet’s prescription drugs. Veterinary medicine is expensive, but insurance usually covers the cost of the drugs your pet needs to get better.

Emergency Care Cover

Emergency Care Cover is meant to provide insurance for unexpected medical expenses, hospitalization, or loss of income due to an accident or serious illness.

Furthermore, Emergency Care Cover is designed to cover unexpected medical expenses, including diagnostics, surgery, hospitalization, medication, and care provided outside of regular business hours.

Routine Care Cover

Routine Care Cover offers financial protection against routine medical costs like vaccinations, flea and tick prevention, and dental cleanings.

In addition, routine care coverage is typically an add-on to a comprehensive pet insurance policy. It helps cover the cost of routine preventative care.

Factors to Consider When Choosing a Pet Insurance Policy

Policy Cost

Many variables can affect how much pet insurance costs. Factors that may affect your premiums include (but are not limited to) the following:

- ✅ Your location and the cost of living where you live.

- ✅ The breed and gender of your pet.

- ✅ The age of your pet.

- ✅ Pre-existing conditions that your pet might have.

The cost of claims and the fees of veterinarians may affect services’ premiums. For example, veterinary fees in urban areas are typically more expensive than those in rural areas, reflected in the cover cost.

Furthermore, the complexity and number of treatments available to pet insurance policyholders have increased the cost of claims in recent years.

Your Pet’s Age

Age can play a significant role in the cost of pet insurance. The premium will rise as pets age because, like people, there is a greater likelihood that they will become ill. In addition, pets younger than eight weeks of age typically are not eligible for insurance coverage.

Some insurers will not accept pets over a certain age, making it harder to find cover as your pet gets older.

Furthermore, you start pet insurance when your pet is young, and you can usually keep cover with the same company as your pet ages. As the pet ages and the risk rises, it is crucial to factor in a higher premium.

Your Pet’s Breed

Pet insurance, like reptiles, can be more expensive for exotic or pedigree animals. However, according to claims data, crossbreeds are typically less likely to develop hereditary diseases that can affect purebreds.

Furthermore, the price of veterinary care for your dog will vary depending on the breed.

Your Pet’s Species

Only certain species, like dogs and cats, rarely certain pet insurance providers cover birds and reptiles. However, suppose you have an exotic pet (such as rats, hamsters, etc.). In that case, you may need to look for a specialized insurance provider that covers your pet’s species.

Cover Limits

Pet insurance policies may have annual, per-incident, or lifetime limits on the age they cover. Understanding a policy’s cover limits is crucial because they affect how much you can claim and may have to pay out of pocket.

If your pet has a history of or is at risk for developing health problems in the future, you should select a policy that will adequately cover these costs.

Exclusions

Some pet insurance plans do not cover certain breeds of animals, or it may cost more to cover those breeds. The amount you can claim from many plans is also capped, either annually or throughout your pet’s life.

Accidents, common injuries, and other emergency treatments are not likely to be covered by wellness plans.

Accident-only policies are less likely to cover preventative care and treatment for pre-existing conditions. In contrast, accident and illness policies are more likely to do so. An accident and illness plan with a wellness component offers the most comprehensive coverage.

However, it will have breed restrictions and not cover treatment for a pre-existing condition. Because of this, you must consider each policy’s terms carefully before choosing one for your pet.

Co-pays and Deductibles

As your pet ages, the terms of your policy may change, and you may be required to contribute to a claim in addition to the fixed excess. The excess percentage is frequently referred to as “co-insurance.”

Co-insurance rates can range from 10% to 20% depending on the policy. Although the insurer typically applies co-insurance at policy inception or renewal, you can voluntarily choose these excesses because they can lower the cost of the overall premium.

Waiting Periods

Many pet insurance policies have waiting periods, which are times after purchase when you cannot file a claim for a certain condition.

Depending on the policy and the condition, waiting periods can range from a few days to several months. Consider the policy’s waiting periods to avoid being unprepared for unforeseen illnesses or injuries.

The reputation of the Insurer

After you have whittled down your list of potential service providers to those who will accept your pets, researching their past performance is a good idea. This type of research should include the number of active policies and years in operation.

Gap Cover Options on Pet Insurance

Gap cover, an optional cover offered by some pet insurance policies, pays the difference between the insurance payout and the total cost of care. Gap cover can help you get the best pet care while lowering out-of-pocket costs.

Furthermore, to ensure you are properly covered, you should look into whether or not a policy offers gap cover options and how much they cost.

How to Choose the Best Pet Insurance Provider in South Africa

Choosing the best pet insurance company in South Africa can be difficult. However, getting the right cover for your pet’s needs is essential. Here are some things to keep in mind when looking for pet insurance.

Research and Compare different Pet Insurance Providers

Start by looking into the various pet insurance companies in South Africa. Examine their premiums, deductibles, cover limits, and the diverse types of coverage they provide. Then, compare the features and benefits of each policy to find the one that gives you the most value for money overall.

Read Pet Insurance Online Reviews

Reading online reviews from other pet owners can give you extensive information about the quality of service and coverage provided by different pet insurance providers. To get unbiased advice from other pet owners, look for reviews on unbiased review websites or forums.

Compare Cover Options of Different Pet Insurance Providers

Different pet insurance providers offer several types of coverage, so it is important to choose one that offers cover options that meet your pet’s specific needs.

For example, suppose your pet is older or has a pre-existing condition. In that case, you may need to choose a provider that offers more comprehensive coverage.

Evaluate the Pet Insurance Provider’s Customer Service

When choosing a pet insurance provider, it is important to consider their customer service. Look for a provider that offers excellent customer service, with responsive and knowledgeable representatives who can help you with any questions or concerns.

Find out about the Pet Insurance Provider’s Claims Processing

Claim processing speed and efficiency can be crucial when choosing a pet insurance provider. Look for a provider with a reputation for fast and easy claim processing and a streamlined online claims process.

Ask for Pet Insurance Recommendations

Ask your veterinarian or other pet owners for recommendations on pet insurance providers. Your vet can advise you on the appropriate levels of coverage for your pet’s breed, age, and health. Pet owners can also share their experiences with various pet insurance companies.

Check the Pet Insurer’s Financial Stability

You must select a pet insurance company in a strong financial position to honor claims. Then, verify the financial stability of the pet insurer by checking their ratings with credit rating agencies or industry regulators.

Evaluate any Additional Benefits that the Pet Insurance Provider might offer

Some pet insurance providers offer additional benefits, such as discounts on pet supplies, access to telemedicine services, or assistance finding a lost pet. Consider these additional benefits when choosing a provider that offers the most value for your money.

What is not covered by Pet Insurance?

Here are the most common exemptions that pet insurance policies might not cover:

- ✅ Pet insurance typically does not cover pre-existing conditions. Therefore, you must check if the policy covers the condition before purchasing the policy.

- ✅ Many pet insurance policies do not cover dental treatment for pets.

- ✅ Pet insurance policies typically do not cover regular check-ups, vaccinations, or treatments for worms and fleas.

- ✅ Some insurance companies do not cover pets above a certain age, and older pets usually cost more to insure. Therefore, you must check the age limits before purchasing a policy.

- ✅ Pet insurance policies may not cover certain breeds or have different premium rates due to their inherent health risks.

- ✅ Pet insurance policies may not cover cosmetic or elective procedures like tail docking or ear cropping.

- ✅ Some policies may not cover behavioral issues or have limitations on cover.

- ✅ Alternative therapies like acupuncture or chiropractic may not be covered under some policies.

Finally, Pet insurance may not cover pregnancy-related costs, like prenatal care or delivery.

Steps to protect your furry friend with Pet Insurance in South Africa

Gather the necessary information

You will need to know a lot about your pet before you can buy pet insurance in South Africa.

This includes their breed, age, medical history, and any pre-existing conditions they may have. When deciding how much cover you need, you should also think about their lifestyle and habits.

Choose the best Pet Insurance Policy

Once you have collected all the necessary information about your pet, you can begin researching different pet insurance policies in South Africa.

Next, find insurance plans that provide the level of coverage you require without breaking the bank. Moreover, shop around to find the best plan for you and your pet.

Understand any Policy Exclusions

Make sure you know exactly what your pet insurance will cover before you sign up. Before filing a claim, you must know what is and is not covered by your policy.

Complete the Application

After researching your options, you can apply for pet insurance immediately. This typically entails filling out a form detailing your personal and pet information. Medical records or other information about your pet’s health may also be requested.

Pay the Monthly Pet Insurance Premium

Pay the monthly pet insurance premium after your application has been accepted. This payment ensures that your pet is covered under the policy. Set up automatic payments or a reminder on your calendar to ensure you do not forget to pay your cover.

Make sure you take your pet for regular vet visits

Many pet insurance policies demand that your pet receive routine check-ups and preventative care to be eligible for coverage.

This is because regular check-ups can avert more costly and serious health issues in the future. Check your pet insurance policy to see if there are any preventative care requirements.

Keep Detailed Record

Having thorough records of your pet’s health and medical history can help expedite the claims process if necessary. Keep all invoices and records from the veterinarian in a safe place, and make sure you know how to file a claim with your pet insurance company.

If your policy allows it, add additional cover

If your pet is of a particularly high-risk breed or leads an especially active lifestyle, you might want to add a cover to your policy.

For instance, you might consider including cover for hip dysplasia if your dog is predisposed to the condition. You might also consider including a rider for dental care or alternative treatments.

Review Your Policy and Update it if necessary

You might need to change your pet insurance coverage as your pet ages or their health changes. To ensure that your pet is always covered, reviewing your policy regularly and making any necessary adjustments is a good idea.

In Conclusion

Having a Pet, be it a Dog or Reptile, comes with its fair share of responsibilities, including providing for their health needs. Pet Insurance in South Africa is an excellent way to ensure your furry friend gets the care they need without breaking the bank.

You might also like: Dotsure Pet Insurance Review

You might also like: OnePlan Pet Insurance Review

You might also like: MediPet Pet Insurance Review

You might also like: 1st for Woman Pet Insurance Review

You might also like: Outsurance Pet Insurance Review

Frequently Asked Questions

What is the average cost of Pet insurance in South Africa?

The average cost of Pet insurance in South Africa can vary depending on your pet’s age, breed, and health, as well as the level of coverage you select. However, pet insurance typically costs between R100 and R500 per month.

What are the benefits of having Pet Insurance?

By managing the costs of veterinary bills, pet insurance can help owners avoid difficult decisions and provide their pets with the best possible care. As a result, pet owners may feel more at ease and be able to pay for more sophisticated and specialized treatments.

What is covered under a comprehensive Pet insurance policy?

Accidental injury, illness, hospitalization, prescribed medication, emergency care, and routine care are just some of the situations and costs a comprehensive pet insurance policy typically covers.

What does pet insurance cover?

Pet insurance covers a range of benefits, including accidental injury, illness, and emergency veterinary treatment. It also offers cover for routine care, such as vaccinations, deworming, flea and tick control, and third-party liability.

What is accidental injury cover for pets?

Accidental injury cover for pets helps pet owners cover the cost of veterinary bills and other expenses related to their pets’ injuries caused by accidents.

What is third-party liability coverage for pets?

Third-party liability cover for pets protects pet owners from financial losses if their pets cause damage to other people’s property or injure someone.

Are there cover limits for pet insurance?

Yes, there may be cover limits for pet insurance policies. Pet owners should carefully review the terms and conditions of their policy to understand any limitations or exclusions.

What are optional extras for pet insurance?

Optional extras for pet insurance are additional cover options that pet owners can add to their policy for an additional premium. Examples may include cover for hereditary conditions or dental care.

Can I get Pet insurance for my senior pet?

Yes, you can typically insure your senior pet. However, the cost may be higher due to the increased likelihood of health issues. In addition, some insurers will not cover pets over a certain age, and others will demand a medical exam before they cover an older pet.

How long does it take for a claim to be processed?

Depending on the Pet insurance company and the nature of the claim, processing times can range from a few days to several weeks. Some providers may process claims more quickly than others, and some may even provide express service for certain claims.

Does Pet insurance cover pre-existing conditions?

Pre-existing conditions are typically not covered by pet insurance. In addition, your insurance policy may not cover any costs associated with your pet’s pre-existing condition. Therefore, you must inform the insurer about any pre-existing conditions when requesting cover.

What is the difference between an excess and a co-payment in Pet insurance?

A fixed amount you pay toward a claim’s cost is known as an excess. Co-payments are required in addition to the deductible and are a fixed percentage of the total claim amount.

Is it more expensive to insure a purebred dog than a mixed-breed dog?

Yes, purebred dogs are more likely to contract certain hereditary diseases than mixed-breed dogs, so their insurance costs are higher.

What happens if I miss a monthly premium payment for my Pet insurance?

Your pet insurance policy may be terminated or put on hold if you fail to pay the required monthly premium. Therefore, you must contact your insurance company as soon as you know you might have a problem, allowing you to discuss your options and settle any outstanding premiums.

Does Pet insurance cover alternative therapies?

Some Pet insurance plans may cover alternative treatments like acupuncture, chiropractic care, and homoeopathy. However, verifying with your insurance company whether or not your policy covers these treatments is essential.

Can I change my Pet insurance policy after I have already enrolled?

Yes, you can amend your pet insurance plan after signing up. For example, some insurance companies may let you update your policy, such as raising or lowering your cover, adding or removing certain benefits, or altering your deductible or co-payment.

How do I choose a good pet insurance?

There are several factors to consider before choosing a good pet insurance in South Africa, including age and medical history.

What is the best type of dog insurance to get?

Lifetime coverage is the best sort of dog insurance because these policies have limits that renew each year. Renewing limits protects your dog from long-term or reoccurring illnesses throughout his or her life. The next best type of coverage is typically thought to be maximum benefit.

What are the most common types of pet insurance claims?

Skin diseases, stomach issues, ear infections, seizures, and urinary tract infections were the five most prevalent pet insurance claims.

Does pet insurance cover surgery?

Medically necessary surgeries, including emergency surgeries and some prophylactic procedures, may be covered by pet insurance coverage. Elective or optional procedures are typically not covered, and some surgeries may be excluded if they are related to a pre-existing condition.