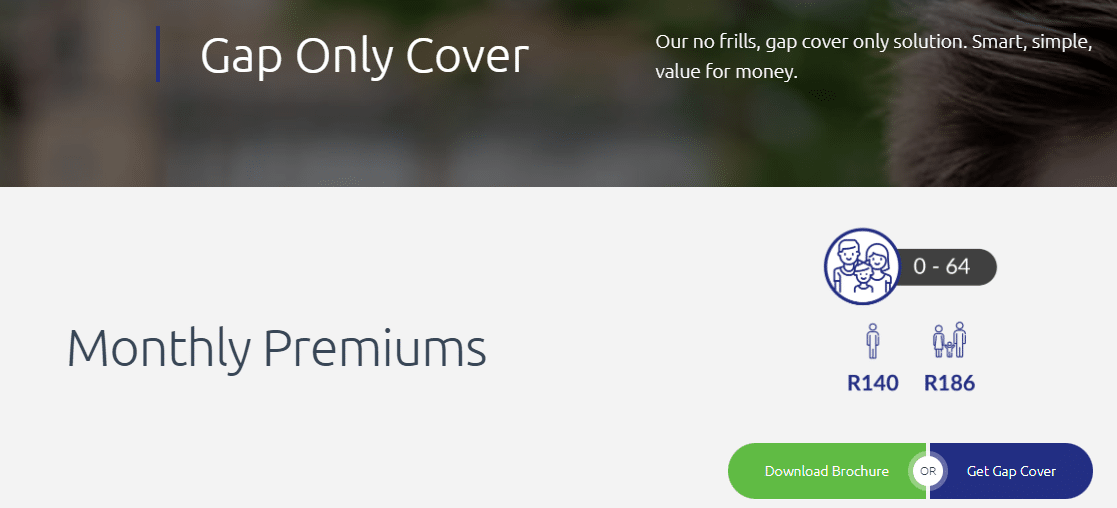

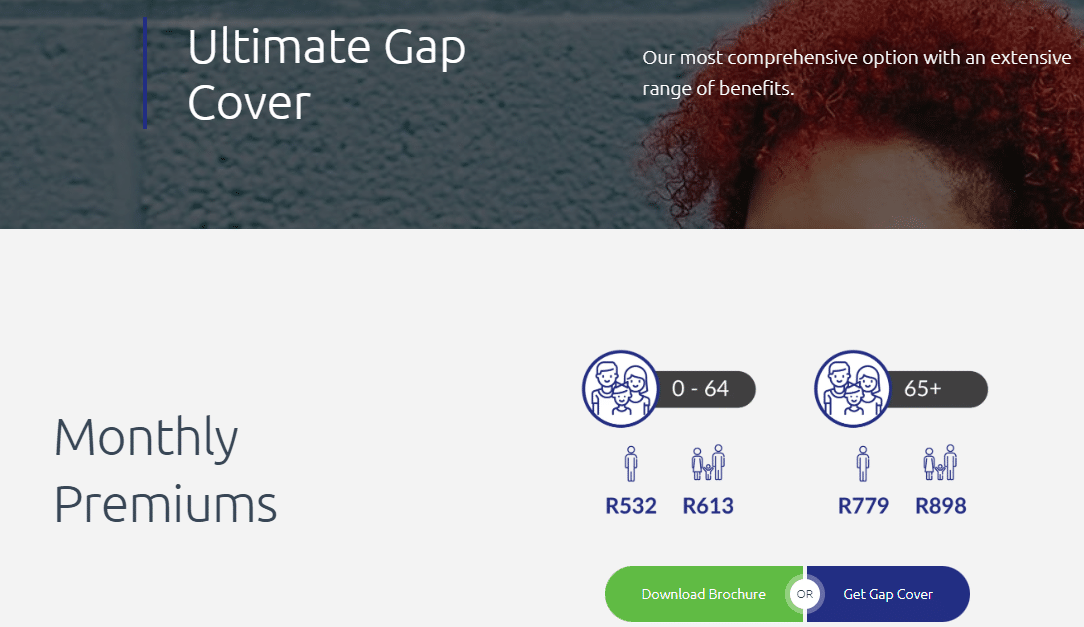

Monthly Premium

From R532

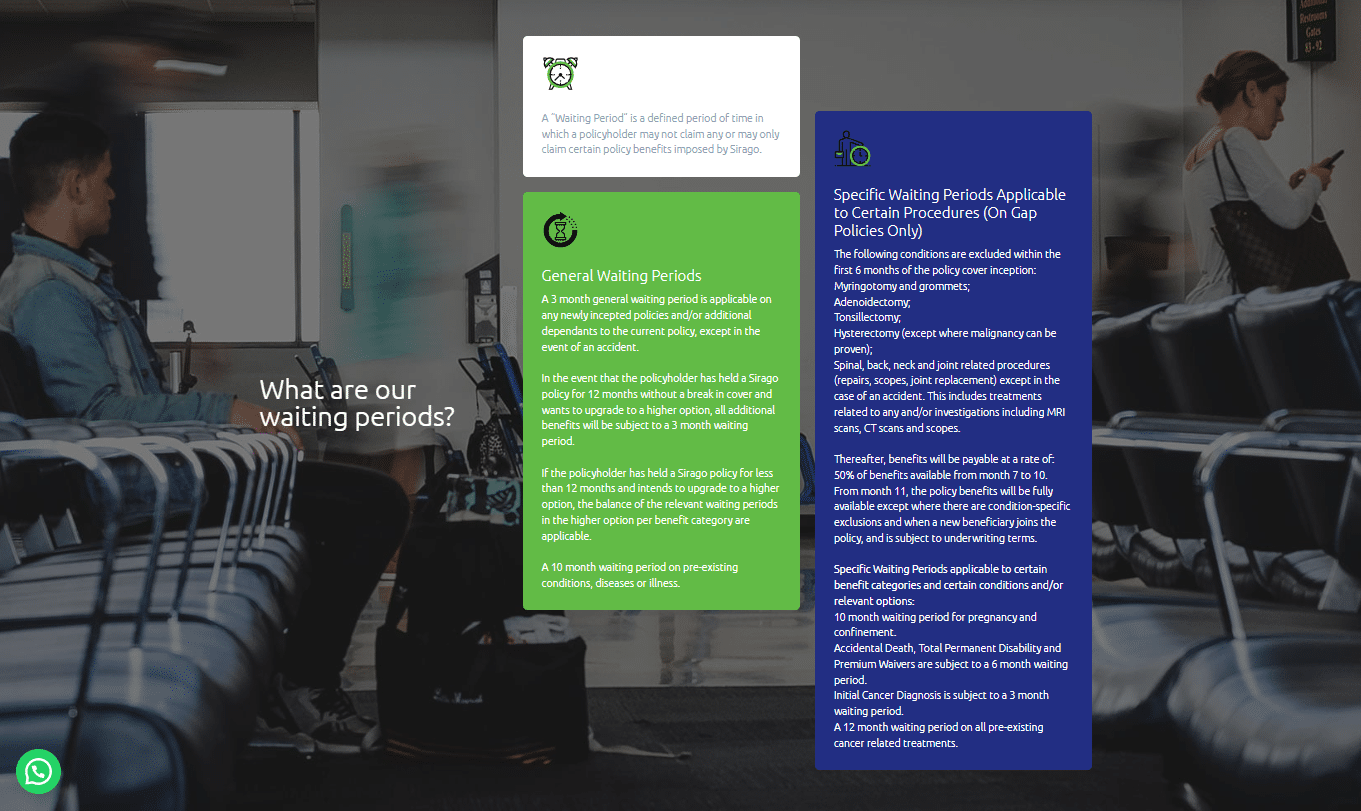

Waiting Period

From 3 months (up to 12)

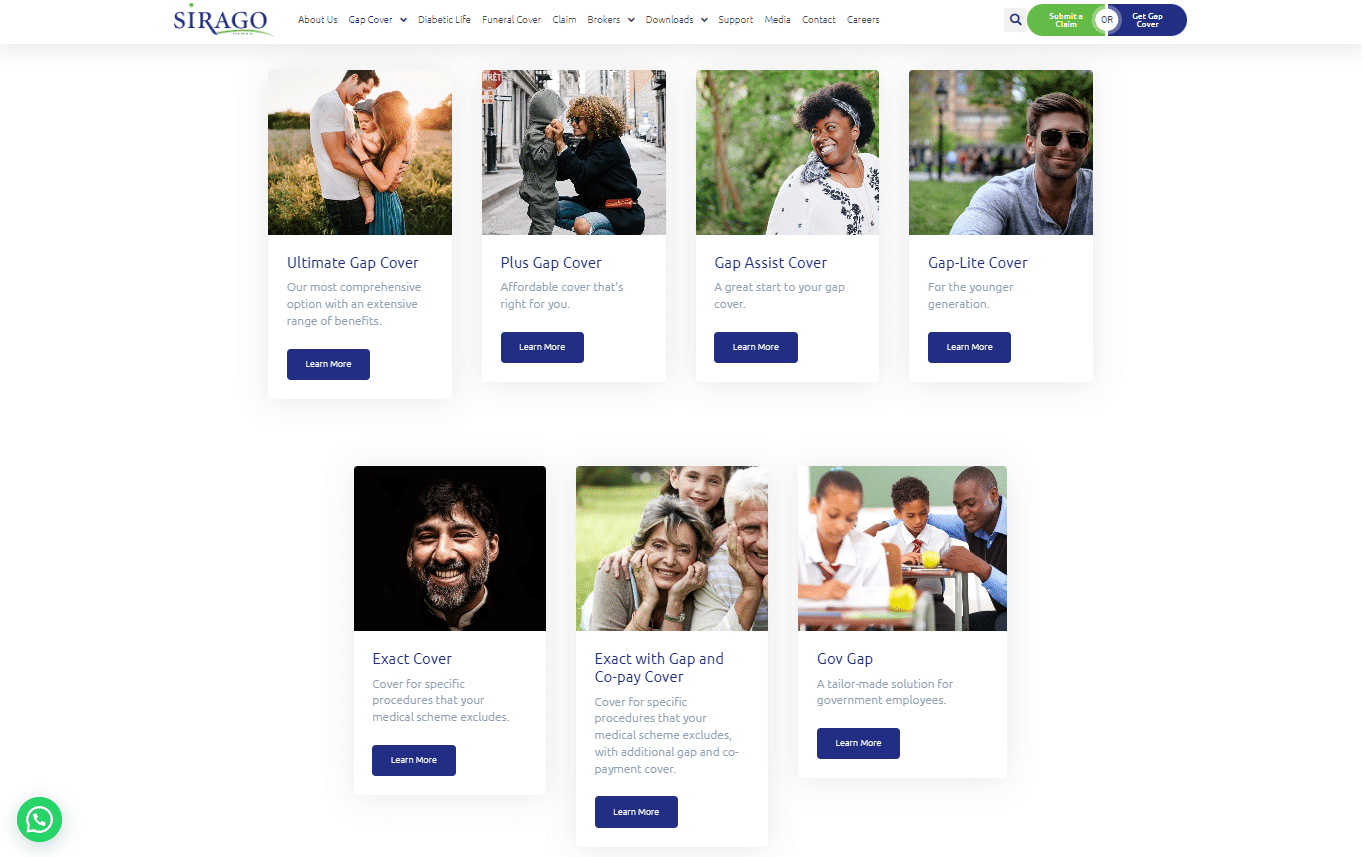

Ultimate Gap

The Ultimate Gap plan offers benefits for both in and out-of-hospital treatments and procedures, penalty fees, step-down facilities, illnesses, primary care, and various other additional advantages.

★★★★★ 4.5/5

Oncology Benefits:

Scopes and Scans:

Accidental Cover:

Trauma Counseling:

Co-Payment Cover:

Maternity Benefits:

The Ultimate Gap plan offers benefits for both in and out-of-hospital treatments and procedures, penalty fees, step-down facilities, illnesses, primary care, and various other additional advantages.

In Hospital Benefits:

Out of Hospital Cover:

Tax Deductible:

Prostheses:

Ultimate Gap

The Ultimate Gap plan offers benefits for both in and out-of-hospital treatments and procedures, penalty fees, step-down facilities, illnesses, primary care, and various other additional advantages.

★★★★★ 4/5

Monthly Premium

From R532

Waiting Period

From 3 months (up to 12)

The Ultimate Gap plan offers benefits for both in and out-of-hospital treatments and procedures, penalty fees, step-down facilities, illnesses, primary care, and various other additional advantages.

In Hospital Benefits:

Out of Hospital Cover:

Tax Deductible:

Prostheses: