Monthly Premium

From R506

Waiting Period

12 Months

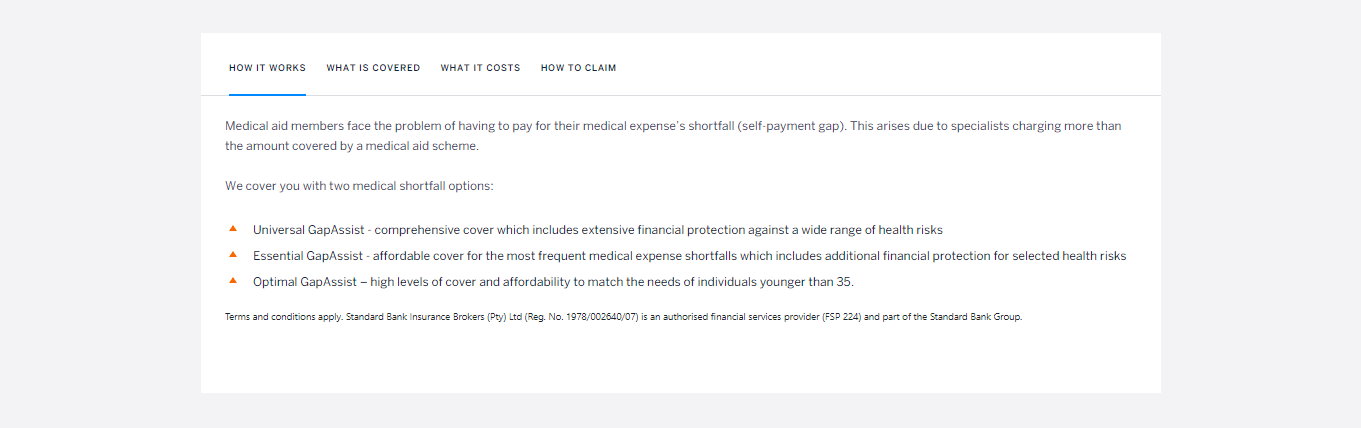

GapAssist Universal

The GapAssist Universal plan provides benefits for both in and out-of-hospital treatment, co-payments, casualty and emergency room services, scopes and scans, and various other additional advantages.

★★★★★ 4.5/5

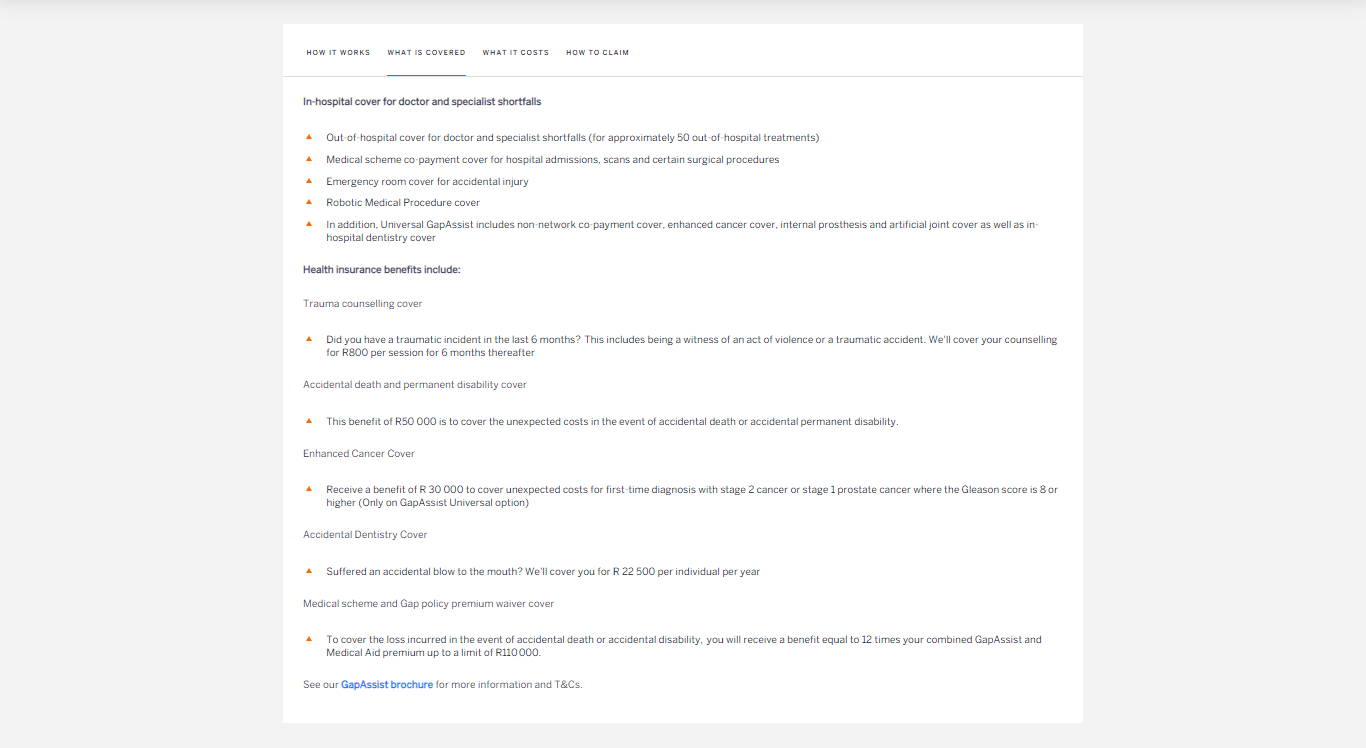

Oncology Benefits:

Scopes and Scans:

Accidental Cover:

Trauma Counseling:

Co-Payment Cover:

Maternity Benefits:

The GapAssist Universal plan provides benefits for both in and out-of-hospital treatment, co-payments, casualty and emergency room services, scopes and scans, and various other additional advantages.

In Hospital Benefits:

Out of Hospital Cover:

Tax Deductible:

Prostheses:

GapAssist Universal

The GapAssist Universal plan provides benefits for both in and out-of-hospital treatment, co-payments, casualty and emergency room services, scopes and scans, and various other additional advantages.

★★★★★ 4/5

Monthly Premium

From R506

Waiting Period

12 Months

The GapAssist Universal plan provides benefits for both in and out-of-hospital treatment, co-payments, casualty and emergency room services, scopes and scans, and various other additional advantages.

In Hospital Benefits:

Out of Hospital Cover:

Tax Deductible:

Prostheses: