- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Universal Health Gap Cover

Overall, Universal Health Gap Cover is a trustworthy short-term insurance product designed to provide extra protection for those who already have medical aid. The Universal Health Gap Cover Plans start from R243 ZAR. Universal Health has a trust score of 4.4.

| 🟥 Date Established | 2007 |

| 🟧 Underwriters | Compass Insurance Co Ltd |

| 🟨 Headquartered | Sandton, South Africa |

| 🟩 The average number of members | 1,000+ |

| 🟦 Number of Markets | 1 |

| 🟪 Market Share | <10% |

| 🟥 The number of plans offered | 2 |

| 🟧 Mobile App offered | None |

| 🟨 Social Media Platforms and Links | None |

| 🟩 Customer Support Operating Hours | Weekdays – 8 am to 5 pm |

| 🟦 Waiting Period | 12 months for maternity and 30 days for other benefits |

| 🟪 Exclusions | ✅ Yes |

Universal Health Gap Cover – 11 Key Point Quick Overview

- ✅ Universal Health Gap Cover Premiums

- ✅ Universal Health Gap Cover – Advantages over Competitors

- ✅ Universal Health Gap Cover Features

- ✅ How to apply for Gap Cover with Universal Health

- ✅ How can I change my Universal Health Gap Cover option?

- ✅ How to Submit a Claim for Gap Cover with Universal Health

- ✅ Universal Health Gap Cover Exclusions and Waiting Periods

- ✅ Universal Health Gap Cover vs Other Notable Providers

- ✅ Universal Health Gap Cover Pros and Cons

- ✅ Our Verdict on Universal Health Gap Cover

- ✅ Universal Health Gap Cover Frequently Asked Questions

Universal Health Gap Cover Premiums

- ✅ The premiums include broker commission per current law.

- ✅ Employers paying premiums via debit order must complete a Company Debit Order Form.

- ✅ Large corporate clients may pay premiums via EFT (a minimum monthly premium of R7,500 is required to qualify).

Universal Gap Cover

- ✅ This option covers hospitalization expenses up to five times the Scheme Rate maximum. Included are the additional benefits listed.

Universal Gap Plus Cover

This option covers hospitalization expenses up to five times the Scheme Rate maximum. In addition, the extra benefits of Premium Waiver, Body Repatriation, Motor Hijacking, and Hospital Co-payments are included.

Discover more GAP cover reviews

Universal Health Gap Cover – Advantages over Competitors

Choosing Universal Health Gap Over includes a long list of Advantages, including:

- ✅ Universal Health offers Gap Cover and Gap Plus Cover, which help to bridge the gap between medical aid payouts and actual medical costs.

- ✅ Gap Cover and Gap Plus Cover provide cover for medical expenses that are not covered by medical aids.

- ✅ Universal Health Gap Cover covers co-payments on certain procedures, such as MRI and CT scans.

- ✅ Universal Health Gap Plus Cover covers out-of-hospital procedures like chemotherapy and radiation.

- ✅ Gap Cover and Gap Plus Cover have a maximum benefit limit of R160,000 per person per year, with no overall limit on claims.

- ✅ Universal Health Gap, Cover, and Gap Plus Cover offer a range of benefits not covered by medical aids, including emergency medical evacuation and cover for accidental death and disability.

- ✅ Gap Cover and Gap Plus Cover offer various benefits for specific medical conditions, including cancer, organ transplants, and chronic diseases.

- ✅ Universal Health offers a streamlined claims process and a dedicated customer service team to assist clients throughout the claims process.

- ✅ Universal Health Gap Cover and Gap Plus Cover are affordable, with various pricing options for different budgets.

Finally, Universal Health offers comprehensive, flexible, and affordable Gap Cover options, making it a smart choice for anyone looking to bridge the gap between medical aid payouts and actual medical costs.

Universal Health Gap Cover Features

Universal Gap Cover

Universal Gap Hospital Benefits

- ✅ Underwriters cover in-hospital service provider costs under the Scheme Rate not fully covered by the member’s Medical Scheme.

- ✅ Shortfalls are covered up to 5 times the ruling Scheme Rate.

- ✅ Benefits are payable only if the policyholder is hospitalized and the benefits qualify under the Medical Scheme and Policy terms and conditions.

- ✅ The policy does not cover upgrading from a General Ward to a Private Ward/Room, unauthorized hospitalization, or costs exceeding Medical Scheme Sub-limits.

- ✅ Benefits include coverage for chemotherapy or radiotherapy for non-PMB cancer, non-PMB kidney dialysis, and certain outpatient surgical procedures.

Benefits are limited to R185 838 per policyholder per annum.

Universal Gap Cover Additional Benefits

| 🟥 Premium Waiver | If the principal member cannot work for more than 30 days due to an accident, the underwriters will pay the monthly Medical Scheme membership fee for each month (up to R10,000/month) or part thereof for up to 12 months. |

| 🟧 Body Repatriation | If a policyholder dies in an accident, underwriters will pay up to R20,000 to transport the body to their normal residence within RSA (per policy). |

| 🟨 Cataract Benefit | Underwriters will pay R2,600 if a cataract requires intra-ocular lens surgery. |

| 🟩 Trauma Counselling | If a policyholder commits an act of violence, underwriters will pay R600 per counseling session up to a maximum of R5,000 per policyholder per year. Violence includes assault, robbery, attempted rape, and a fatal car accident. Report this violence to the police and get a case number. |

| 🟦 Motor Hijacking | If a policyholder directly hijacks a motor vehicle or threatens to do so, the underwriters will pay R5,000 (per policy). |

| 🟪 Internal Prostheses | If a policyholder is authorized by their Medical Scheme to have an Internal Prosthesis device fitted and the cost exceeds the Medical Scheme limit, Universal Health shall pay an additional benefit of up to R56,000 per policyholder. |

| 🟥 Casualty/Emergency Room Facility Benefit | Universal Health will pay R1,750 if a policyholder needs emergency medical treatment from a Casualty/Emergency Room Facility. |

Universal Gap Cover Crisis Assistance Facility

The 24-hour call center can help the policyholder if they need Trauma Counselling, Hijack Benefits, or Body Repatriation benefits.

| 🟥 Trauma Counselling Service | Telephonic counseling Referrals to trained professionals that can handle queries |

| 🟧 Hijack Benefit Service | Arranging a pre-paid phone when a theft has occurred. Provision of a rental car if theft has occurred. Provision of a pre-loaded credit card in case of theft. Arranging a locksmith if keys have been stolen. Arrangement for security guards if hijacking happened at home. |

| 🟨 Body Repatriation Service | Repatriation of body Funeral arrangement assistance Assistance in applying for the Death Certificate Referral to undertakers Referral to counseling services for support and advice |

Universal Gap Plus Cover

Universal Gap Plus Hospital Gap Plus Cover

- ✅ Underwriters cover in-hospital service provider costs that qualify under the Scheme Rate but are not fully covered by the member’s Medical Scheme.

- ✅ Shortfalls are covered up to 5 times the ruling Scheme Rate.

- ✅ Benefits are payable only if the policyholder is hospitalized and the benefits qualify under the Medical Scheme and Policy terms and conditions.

- ✅ The policy does not cover upgrading to a Private Ward/Room, unauthorized hospitalization, or costs exceeding Medical Scheme Sub-limits.

- ✅ Costs exceeding Medical Scheme Sub-limits may include physiotherapy, pathology, radiology, or organ transplant.

- ✅ Benefits include Gap cover for certain out-patient procedures such as chemotherapy, radiotherapy, and kidney dialysis.

Benefits are limited to R185,835 per policyholder per annum.

Universal Gap Plus Additional Benefits

| 🟥 Hospital Co-payments | Underwriters will cover the policyholder’s Medical Scheme Option hospital co-payment. This policyholder benefit is limited to the Medical Scheme Option co-payment. |

| 🟧 Penalty co-payments | Universal Health will cover one Medical Scheme co-payment for non-DSP use. One penalty co-payment per family per year, maximum R10,000. |

| 🟨 Dental Surgery Co-Payment Restrictions | These benefits are limited if the policyholder’s Medical Scheme Option authorizes the procedure. |

| 🟩 Dental treatment in a private hospital for persons 13 years and younger | Covered up to R3,000 |

| 🟦 Dental treatment in a private hospital for a person older than 13 years | Covered up to R7,800 |

| 🟪 Dental treatment in a day clinic for persons 13 years and younger | Covered up to R1,350 |

| 🟥 Dental treatment in a day clinic for persons older than 13 years | Covered up to R5,000 |

| 🟧 Premium Waiver | If the principal member cannot work for more than 30 days due to an accident, the underwriters will pay the monthly Medical Scheme membership fee for each month (up to R10,000/month) or part thereof for up to 12 months. |

| 🟨 Body Repatriation | If a policyholder dies in an accident, underwriters will pay up to R20,000 to transport the body to their normal residence within RSA (per policy). |

| 🟩 Cataract Benefit | Underwriters will pay R2,600 if a cataract requires intra-ocular lens surgery. |

| 🟦 Trauma Counselling | If a policyholder commits an act of violence, underwriters will pay R600 per counseling session up to a maximum of R5,000 per policyholder per year. Violence includes assault, robbery, attempted rape, and a fatal car accident. Report this violence to the police and get a case number. |

| 🟪 Motor Hijacking | If a policyholder directly hijacks a motor vehicle or threatens to do so, the underwriters will pay R5,000 (per policy). |

| 🟥 Internal Prostheses | If a policyholder is authorized by their Medical Scheme to have an Internal Prosthesis device fitted and the cost exceeds the Medical Scheme limit, Universal Health shall pay an additional benefit of up to R56,000 per policyholder. |

| 🟧 Casualty/Emergency Room Facility Benefit | Universal Health will pay R1,750 if a policyholder needs emergency medical treatment from a Casualty/Emergency Room Facility. |

| 🟨 Out-of-Hospital Benefits for MRI/CT scans | Universal Health will pay R4 200 if a policyholder’s Medical Scheme authorizes a co-payment MRI/CT scan. |

Universal Gap Plus Crisis Assistance Facility

The 24-hour call center can help the policyholder if they need Trauma Counselling, Hijack Benefits, or Body Repatriation benefits.

| 🟥 Trauma Counselling Service | Telephonic counseling Referrals to trained professionals that can handle queries |

| 🟧 Hijack Benefit Service | Arranging a pre-paid phone when a theft has occurred. Provision of a rental car if theft has occurred. Provision of a pre-loaded credit card in case of theft. Arranging a locksmith if keys have been stolen. Arrangement for security guards if hijacking happened at home. |

| 🟨 Body Repatriation Service | Repatriation of body Funeral arrangement assistance Assistance in applying for the Death Certificate Referral to undertakers Referral to counseling services for support and advice |

Sharpen your knowledge with a better understanding of the Best Medical Aid South Africa

How to apply for Gap Cover with Universal Health

To apply for Gap Cover with Universal Health, follow these steps:

- ✅ Visit the Universal Health website and review the Gap Cover and Gap Plus Cover brochures to determine which option best suits your needs.

- ✅ Once you have selected a plan, complete the online application form, or download and complete it and submit it to Universal Health via email or fax.

- ✅ When submitting your application, you must provide personal and medical information, including medical aid details and any pre-existing medical conditions.

- ✅ Universal Health will assess your application and let you know if it has been accepted. If your application is accepted, you will receive a policy document outlining your cover and any applicable terms and conditions.

Once you have received your policy document, you can enjoy the benefits of your Gap Cover or Gap Plus Cover. If you need to make a claim, follow the claims process outlined in your policy document and contact Universal Health’s customer service team if you need assistance.

How can I change my Universal Health Gap Cover option?

To change your Universal Health Gap Cover option, you will need to follow these steps:

- ✅ Contact Universal Health’s customer service team via phone, email, or writing to request a change to your Gap Cover option.

- ✅ You must provide your policy number and personal details when making the request.

- ✅ Universal Health will assess your request and let you know if the change can be made. Depending on the type of change you request, you may need to undergo medical underwriting, which could result in changes to your premium or benefits.

- ✅ Once your request has been approved, Universal Health will provide you with a revised policy document outlining your new cover and any applicable terms and conditions.

If you have any questions or concerns about changing your Gap Cover option, you can contact Universal Health’s customer service team for assistance.

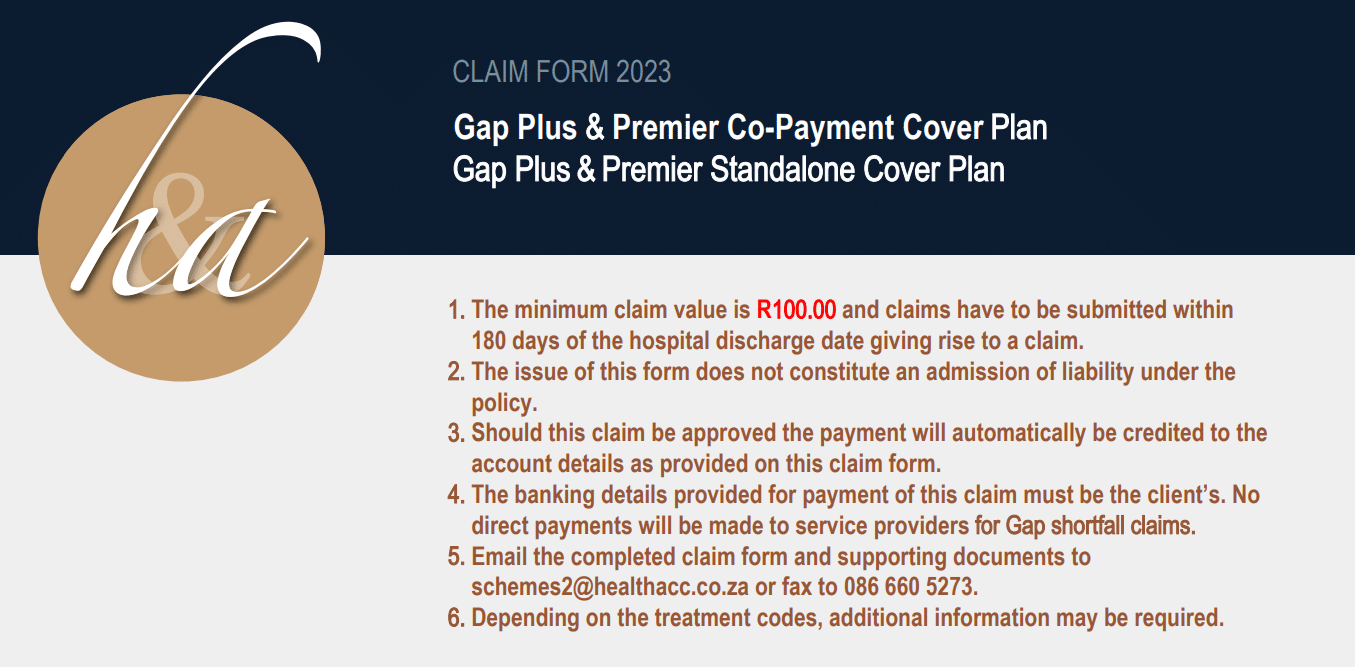

How to Submit a Claim for Gap Cover with Universal Health

Universal Gap Cover

Hospital Gap Cover

If a policyholder has obtained pre-authorization from their Medical Aid for in-hospital treatment that is not excluded under the Gap Cover Plan exclusions, they can submit a claim form to receive benefits. The following steps are necessary to submit a claim:

- ✅ Complete a Claim Form.

- ✅ Submit a copy of the Medical Scheme Remittance Advice that shows the shortfall.

Submit copies of the Hospital account and accounts for the in-hospital medical practitioners.

Premium Waiver

- ✅ If an accident results in a medically necessary absence from work, the principal member can waive the premium by submitting proof of Medical Scheme membership fees, an Accident Report Form, and monthly proof of absence from work due to the accident.

Body Repatriation

- ✅ For Body Repatriation, the policyholder must provide a certified copy of the Death Certificate, proof of residence within RSA borders, and invoices for transportation expenses. Additionally, a Police Report related to the accident is required.

Trauma Counselling

- ✅ To claim Trauma Counselling, the policyholder must submit a police report with a case number and a counseling report with associated accounts.

Motor Hijacking

- ✅ For Motor Hijack claims, proof of the forceful hijacking or threat thereof needs to be supplied by the Police authorities.

Casualty/Emergency Room Facility

A copy of the account is required for Casualty/Emergency Room Facility claims. Furthermore, payments will be made directly into the policyholder’s bank account.

Universal Gap Plus Cover

Hospital Gap Cover – including the co-payment benefit

For Hospital Universal Gap Plus Cover, the policyholder can claim benefits if they have received pre-authorization from their Medical Scheme for in-hospital treatment that is not excluded under the Universal Gap Plus Cover Plan exclusions.

To submit a claim for benefits, the policyholder must follow these steps:

- ✅ Complete a Claim Form.

- ✅ Submit a copy of their Medical Aid Remittance Advice, which illustrates the shortfall, including any co-payment.

- ✅ Submit copies of the Hospital account and the accounts for the in-hospital attending medical practitioners.

If making a co-payment claim, submit a copy of the receipt for the payment of the co-payment.

Premium Waiver

- ✅ If an accident results in a medically necessary absence from work, the principal member can waive the premium by submitting proof of Medical Scheme membership fees, an Accident Report Form, and monthly proof of absence from work due to the accident.

Body Repatriation

- ✅ For Body Repatriation, the policyholder must provide a certified copy of the Death Certificate, proof of residence within RSA borders, and invoices for transportation expenses. Additionally, a Police Report related to the accident is required.

Trauma Counselling

- ✅ To claim Trauma Counselling, the policyholder must submit a police report with a case number and a counseling report with associated accounts.

Motor Hijacking

- ✅ For Motor Hijack claims, proof of the forceful hijacking or threat thereof needs to be supplied by the Police authorities.

Casualty/Emergency Room Facility

A copy of the account is required for Casualty/Emergency Room Facility claims. Furthermore, payments will be made directly into the policyholder’s bank account.

Universal Health Gap Cover Exclusions and Waiting Periods

Universal Health Gap Cover Exclusions

Universal Health’s gap cover exclusions will align with the exclusions of the policyholder’s medical aid.

Universal Health Gap Cover Waiting Periods

There will be a 12-month exclusion for pre-existing conditions, a 12-month waiting period for maternity, and a 30-day waiting period for all other benefits for voluntary groups and individuals.

There is no upper age limit for enrollment, but premiums vary between those up to age 65 and those older than age 65. Refer to your application for specifics. The waiver of pre-existing exclusions and waiting periods must be considered for mandatory groups with more than 35 employees.

Universal Health Gap Cover vs Other Notable Providers

| 🔎 Gap Cover Provider | 🥇 Universal Health | 🥈 Discovery Health | 🥉 Zestlife |

| 🟥 Number of Plans | 2 | 2 | 3 |

| 🟧 Average Price | R243.09 | R143 | R225 |

| 🟨 Waiting Periods | 12 months | 12 Months | 3 – 12 months |

| 🟩 Exclusions | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟦 Oncology Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 In-Hospital Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟥 Out-of-Hospital Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟧 Maternity Benefit | ✅ Yes | ✅ Yes | None |

| 🟨 Scopes and Scans | None | ✅ Yes | ✅ Yes |

| 🟩 Co-payment Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟦 Emergency Room | ✅ Yes | None | ✅ Yes |

| 🟪 Accidental Cover | ✅ Yes | None | ✅ Yes |

| 🟥 Trauma Counseling | ✅ Yes | None | ✅ Yes |

| 🟧 Premium Waiver | ✅ Yes | None | ✅ Yes |

| 🟨 Non-DSP Co-Payment | ✅ Yes | None | ✅ Yes |

| 🟩 Prostheses | ✅ Yes | None | ✅ Yes |

| 🟦 Accidental Death/ Permanent Disability | None | None | ✅ Yes |

| 🟪 Travel Cover Extender | ✅ Yes | ✅ Yes | None |

READ more about the 5 Best Gap Cover Options for Under R200

Universal Health Gap Cover Pros and Cons

| ✅ Pros | ❎ Cons |

| Helps bridge the gap between medical aid pay-outs and actual medical costs | Premiums can add cost to already existing medical aid premiums |

| Provides cover for medical expenses that are not covered by medical aids | The maximum benefit limit can limit cover |

| Offers benefits that are not covered by medical aids, such as cover for co-payments on certain procedures, out-of-hospital procedures, emergency medical evacuation, and accidental death and disability | Some pre-existing conditions may not be covered |

| Streamlined claims process and resolute customer service team make claiming benefits easy | Some medical procedures may not be covered depending on the plan chosen |

| Affordable pricing options to suit different budgets | Some benefits may have waiting periods before they become effective |

| No overall limit on claims | Some plans may have exclusions or limitations on cover |

Our Verdict on Universal Health Gap Cover

Universal Health offers Gap Cover and Gap Plus Cover, which help bridge the gap between medical aid payouts and actual medical costs. In addition, Gap Cover and Gap Plus Cover cover medical expenses not covered by medical aids.

The plans offer benefits that are not covered by medical aids, such as cover for co-payments on certain procedures, out-of-hospital procedures, emergency medical evacuation, and accidental death and disability.

Gap Cover and Gap Plus Cover have a maximum benefit limit of R160,000 per person per year, with no overall limit on claims. The streamlined claims process and dedicated customer service team make it easy for clients to claim benefits.

You might consider advancing your healthcare knowledge about Best Health Insurance Companies South Africa

Universal Health Gap Cover Frequently Asked Questions

What is Universal Health Gap Cover?

Universal Health Gap Cover is insurance that helps bridge the gap between medical aid payouts and actual medical costs.

How does Universal Health Gap Cover work?

Universal Health Gap Cover covers medical expenses not covered by medical aids, such as co-payments on certain procedures, out-of-hospital procedures, and emergency medical evacuation.

Policyholders can submit a claim for benefits assessment if they have received pre-authorization from their Medical Scheme for in-hospital treatment that is not excluded under the Universal Gap Plus Cover Plan exclusions.

How much does Universal Health Gap Cover cost?

The cost of Universal Health Gap Cover depends on the plan chosen and the individual’s circumstances. The Universal Gap Cover starts from R243.09 per month.

What benefits are included in Universal Health Gap Cover?

Universal Health Gap Cover includes cover for co-payments on certain procedures, out-of-hospital procedures, emergency medical evacuation, and accidental death and disability. There are also plans available with cover for internal prostheses and body repatriation.

How do I submit a claim for Universal Health Gap Cover?

To submit a claim for benefits, the policyholder must complete a Claim Form, submit a copy of their Medical Aid Remittance Advice illustrating the shortfall, and submit copies of the Hospital account and the accounts for the in-hospital attending medical practitioners.

Is there a waiting period for Universal Health Gap Cover?

Yes, some benefits may have to wait periods before they become effective. The waiting period may vary depending on the plan chosen.

Can I change my Universal Health Gap Cover option?

Yes, you can change your Universal Health Gap Cover option. Contact Universal Health’s customer service team to request a change to your Gap Cover option.

What is the maximum benefit limit for Universal Health Gap Cover?

Gap Cover and Gap Plus Cover have a maximum benefit limit of R160,000 per person per year.

Are pre-existing conditions covered under Universal Health Gap Cover?

Some pre-existing conditions may not be covered under Universal Health Gap Cover. The terms and conditions of the plan chosen will determine the extent of cover.

Does Universal Health Gap Cover have any exclusions or limitations on the cover?

Yes, some plans may have exclusions or limitations on cover. Therefore, it is important to review the terms and conditions of the plan chosen to understand what is covered and what is not.

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans