- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Fedhealth FlexiFED Savvy Medical Aid Plan

Overall, the Fedhealth FlexiFED Savvy Medical Aid Plan is a trustworthy and comprehensive medical aid plan that offers 24/7 medical emergency assistance and cost-effective cover for chronic benefits to up to 3 Family Members. The Fedhealth FlexiFED Savvy Medical Aid Plan starts from R965 ZAR.

| 👤 Main Member Contribution | R965 |

| 👥 Adult Dependent Contribution | R965 |

| 🍼 Child Dependent Contribution | R709 |

| 📉 Annual Limit | Unlimited Hospital Cover |

| 🦷 Dentistry Benefit | Only in-hospital |

| ➡️ Hospital Cover | Unlimited |

| ↪️ Oncology Cover | Unlimited for PMBs |

| 💶 Prescribed Minimum Benefits | ☑️ Yes |

| 😷Screening and Prevention | ☑️ Yes |

| 💙 Medical Savings Account | ☑️ Yes |

Fedhealth FlexiFED Savvy Plan – 7 Key Point Quick Overview

- ✅ Fedhealth FlexiFED Savvy Plan Overview

- ✅ Fedhealth FlexiFED Savvy Plan Contributions and Medical Savings

- ✅ Fedhealth FlexiFED Savvy Plan Benefits and Cover Comprehensive Breakdown

- ✅ Fedhealth FlexiFED Savvy Plan Exclusions and Waiting Periods

- ✅ Fedhealth FlexiFED Savvy Plan vs. Similar Plans from other Medical Schemes

- ✅ Our Verdict on the Fedhealth FlexiFED Savvy Plan

- ✅ Fedhealth FlexiFED Savvy Plan Frequently Asked Questions

Fedhealth FlexiFED Savvy Plan Overview

The Fedhealth FlexiFED Savvy medical aid plan is one of 8, starting from R965, and includes cost-effective cover for chronic benefits, unlimited private hospital admissions, screening and prevention, day-to-day benefits, and several wellness programs. Gap Cover is not available on the Fedhealth FlexiFED Savvy Plan. However, Fedhealth offers 24/7 medical emergency assistance. According to the Trust Index, Fedhealth has a trust rating of 4.5.

Fedhealth offers 8 medical aid plans:

- 🔎 FlexiFED Savvy

- 🔎 MyFED

- 🔎 Maxima PLUS

- 🔎 Maxima EXEC

- 🔎 FlexiFED 4

- 🔎 FlexiFED 3

- 🔎 FlexiFED 2

- 🔎 FlexiFED 1

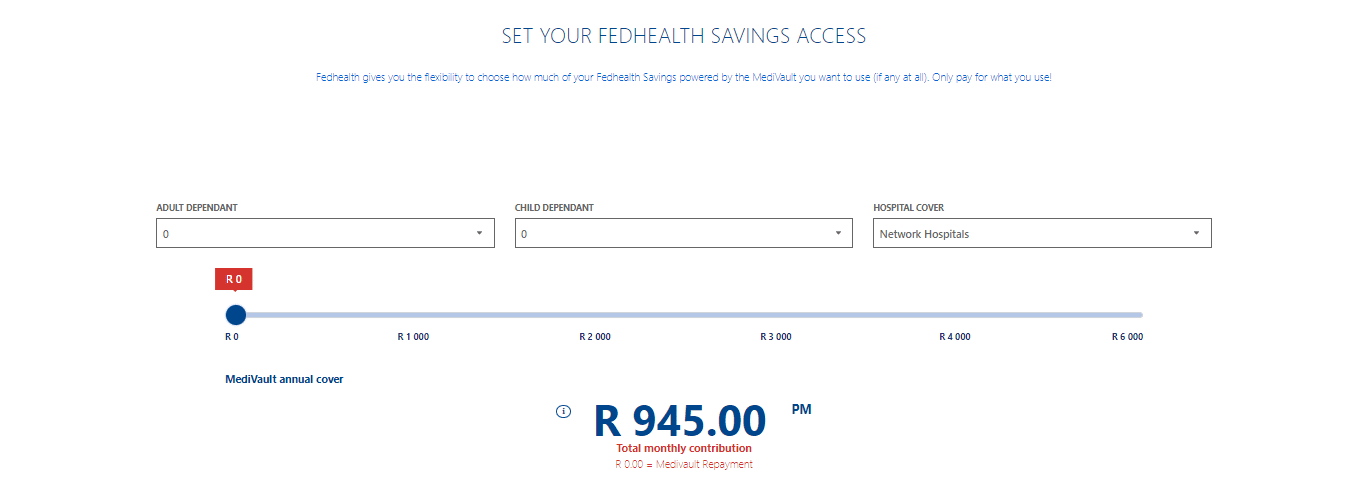

Fedhealth FlexiFED Savvy Plan Contributions and Medical Savings

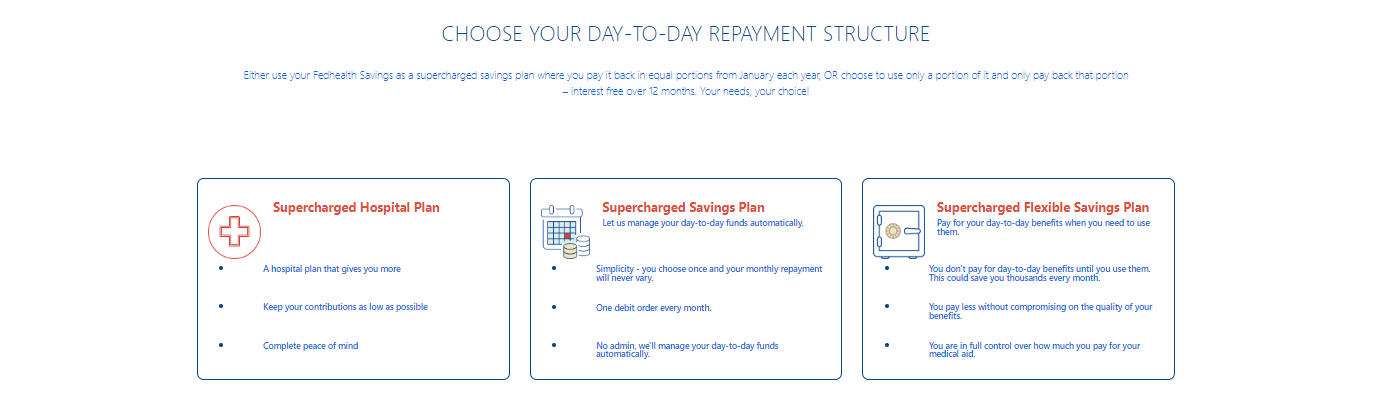

FlexiFED Savvy Contributions

| 🔎 Plan Option | 👤 Main Member | 👥 +1 Dependent | 🍼 +1 Child Dependent |

| 1️⃣ Supercharged Hospital Plan | R965 | R965 | R709 |

| 2️⃣ Supercharged Savings Plan | R1,345 | R1,345 | R1,109 |

| 3️⃣ Supercharged Flexible Savings Plan | R1,445 | R1,345 | R1,209 |

FlexiFED Savvy Savings (Per Main Member or Family)

| 🟦 Savvy Savings | 🔵 Supercharged Savings | 💙 Supercharged Flexible Savings |

| ↪️ Yearly funds available | R4,800 | R6,000 |

You might like: 5 Affordable Medical Aids under R1500

Fedhealth FlexiFED Savvy Plan Benefits and Cover Comprehensive Breakdown

FlexiFED Savvy Supercharged Hospital Plan and In-hospital benefits

- All hospitalization-required treatments and procedures included in the flexiFED plans are covered under this benefit.

- Unless otherwise specified, annual restrictions apply to an entire household.

| 📉 Overall Annual Limit (OAL) | Only available in Fedhealth network hospitals. An R8,000 co-payment will be charged for the voluntary usage of non-network hospitals. |

| 1️⃣ Healthcare Professional Tariff in-hospital (HPT) | – |

| 2️⃣ Fedhealth Network GPs and Specialists | Unlimited cover. |

| 3️⃣ Non-network GPs | Covered up to the Fedhealth Rate. Limited to R2,500 per family/year. |

| 4️⃣ Non-Network Specialists | Covered up to the Fedhealth Rate. |

| ➡️ PMBs treatment | You must use Fedhealth Network Doctors and specialists to receive complete coverage for PMB conditions. If you choose not to use network providers, the Scheme will only reimburse you for treatment up to the Fedhealth Rate for non-network GPs and specialists. If the healthcare practitioner charges extra, you will have a shortfall. |

| 💶 Hospitalization Costs | The unlimited cover is according to the negotiated tariff. Only network hospitals can be used. |

| ☑️ Additional medical services | Paid from day to day unless it is a PMB. |

| 🟦 Hospitalization Alternatives | – |

| 👩⚕️ Nursing services Private nurse practitioners Nursing agencies | Unlimited according to PMB level of care. |

| 💙 Sub-acute facilities Physical Rehabilitation facilities | Unlimited according to PMB level of care. |

| 🚑 Ambulance Services | Unlimited cover using Europ Assistance |

| 🩺 Appliances, external accessories, and orthotics | Unlimited according to PMB level of care. |

| 🩸 Blood, Blood Equivalents, and Blood Products | Unlimited cover. |

| 🅰️ Immune Deficiency relating to HIV | Unlimited according to PMB level of care. |

| 🅱️ Maternity | – |

| 🚩 Fedhealth Network GPs and Specialists | Unlimited and fully covered. |

| 📌 Non-network GPs and Specialists | Covered up to the Fedhealth Rate. Limited to R2,500 per family/year. |

| 📍 Other healthcare professionals | Covered up to the Fedhealth Rate. |

| 🦷 Dentistry | – |

| 🥰 Maxillo-Facial Surgery | Unlimited cover. Subject to approval. |

| 🔴 Oncology | Unlimited PMB care at a designated service provider under the Essential protocol. Non-DSP users must pay a 40% co-payment. Failure to use the Oncology Pharmacy Network and the oncology PPL for chemotherapy, medicine, and consumables connected to cancer treatment will result in a 25% co-payment. |

| ❤️ Organ Transplants | Unlimited according to PMB level of care. |

| 📈 Pathology and Radiology (Basic) | Unlimited up to the Fedhealth Rate for non-DSP or DSP-negotiated rates. |

| 🦾 Physiotherapy | Unlimited up to the Fedhealth Rate for non-DSP or DSP-negotiated rates. |

| 🧠 Psychiatric Services Accommodation in a general ward Procedures ECT Materials and more. | Unlimited according to PMB level of care. |

| 🧬 Renal Dialysis Consultations Visits All services, materials, and medicine associated with the cost of renal dialysis | Unlimited PMB care at Designated Service Provider (DSP). |

| ⚕️ Specialized Radiology | Unlimited according to PMB level of care. |

| ✅ Spinal Surgery | No benefit unless it is according to PMB level of care. |

| 💖 Terminal Care Benefit | No benefit unless it is according to PMB level of care. |

FlexiFED Savvy Chronic Disease Benefits

- Chronic disease coverage is unlimited (CDL).

- HIV/AIDS treatment for mother-to-child transmission, rape, and post-exposure prophylaxis is unlimited.

FlexiFED Savvy Chronic Disease List (CDL)

- ✅ Addison’s Disease

- ✅ Asthma

- ✅ Bipolar Mood Disorder

- ✅ Bronchiectasis

- ✅ Cardiac Failure

- ✅ Cardiomyopathy

- ✅ COPD/ Emphysema/ Chronic Bronchitis

- ✅ Chronic Renal Disease

- ✅ Coronary Artery Disease

- ✅ Crohn’s Disease

and many more.

Did you know that the Fedhealth FlexiFED Savvy is our second choice medical aid plan for farm workers ?

FlexiFED Savvy Screening and Prevention Benefits

- General

- Flu Vaccines – All once every year.

- HIV finger-prick test – All once every year.

- Women’s Health

- Cervical Cancer Screening (Pap Smear) – Female beneficiaries between 21 and 65, once every three years

- Health Risk Assessments

- Wellness screening (BMI, blood pressure, finger prick cholesterol & glucose tests) – All, once every year.

- Preventative screening (waist-to-hip ratio, body fat %, flexibility, posture & fitness) – All, once every year.

READ more: 5 Best Hospital Plans under R300

FlexiFED Savvy Prothesis Benefits

- External Prostheses – Unlimited according to PMB level of care.

- Internal Prostheses – Unlimited according to PMB level of care.

- Aorta Stent Grafts

- Bone lengthening devices, carotid stents, embolic protection devices, etc.

- Cardiac pacemakers, cardiac stents, cardiac valves

- Detachable platinum coils

- Elbow, hip, knee, and shoulder replacement

- Total ankle replacement

- Intraocular lenses (per lens)

- Combined benefit limit for all unlisted internal prosthesis

FlexiFED Savvy Day-to-Day Benefits

| 🔎 Savings Plan | 1️⃣ Supercharged Hospital Plan | 2️⃣ Supercharged Savings Plan | 3️⃣ Supercharged Flexible Savings Plan |

| 🔍 Annual Day-to-Day Funds | R0 | R4,800 per family | R6,000 per family |

Fedhealth FlexiFED Savvy Plan Exclusions and Waiting Periods

FlexiFED Savvy Exclusions

Fedhealth FlexiFED Savvy’s include, but are not limited to, the following:

- Art Therapy

- Aromatherapy

- Herbalists

- Reflexology

- Therapeutic massage therapy

- Appliances, external accessories, and orthotics

- Appliances, devices, and procedures that are not scientifically proven or appropriate

- Back rests and chair seats

- Bandages and dressings, unless specified as PMB

- Beds, mattresses, linen savers, pillows, and overlays

- Blood pressure monitors, and more.

- Blood, Blood Equivalents, and Blood Products

- Erythropoietin unless the appropriate program has approved it

- Hemopure

- Dentistry

- Appointments that have not been kept

- Orthodontic treatment of those 21>

- Dental procedures or devices not considered by the relevant managed healthcare program as essential or clinically necessary, and more.

- Infertility

- Assisted Reproductive Technology or ART

- In-vitro Fertilization (IVF)

- Gamete Intrafallopian Tube Transfer (GIFT), and more.

- Maternity

- 3D and 4D scans

- More than 2 2D scans unless there is a motivation for an appropriate condition.

- Medicine and Injectables

Discover more: Health Insurance for Pregnancy

FlexiFED Savvy Waiting Periods

Fedhealth FlexiFED Savvy typically has the following waiting periods:

- General Waiting periods: This is often three months, depending on your chosen medical aid plan. During this period, you must pay your normal monthly payments. However, you are not eligible for benefits except for some PMB-related claims.

- A secondary waiting period: This is typically around 12 months and pertains to therapy for any pre-existing conditions you had when you joined the program.

Fedhealth FlexiFED Savvy Plan vs. Similar Plans from other Good Medical Aid Schemes

| 🔎 Medical Aid Plan | 🥇 Fedhealth FlexiFED Savvy | 🥈 Momentum Ingwe Plan | 🥉 KeyCare Start Regional |

| 👤 Main Member Contribution | R965 | R541 | R1,102 – R2,597 |

| 👥 Adult Dependent Contribution | R965 | R541 | R1,102 – R2,597 |

| 🍼 Child Dependent Contribution | R709 | R541 | R664 – R795 |

| 📉 Annual Limit | Unlimited Hospital Cover | None | Unlimited Hospital Cover |

| ↪️ Gap Cover | None | ☑️ Yes | ☑️Yes |

| 💙 Mental Healthcare Program | ☑️ Yes | ☑️ Yes | ☑️ Yes |

Our Verdict on the Fedhealth FlexiFED Savvy Plan

Fedhealth FlexiFED Savvy is a comprehensive medical aid plan offering its members various benefits and features. Some of the advantages of this plan include flexible options to suit various budgets and healthcare needs, no overall annual limit, and a choice between various hospital networks. The plan also covers chronic conditions, day-to-day medical expenses, and emergency medical treatment. The drawbacks of this plan include the possibility of higher out-of-pocket expenses, limited cover for certain medical procedures and treatments, and a waiting period for some benefits.

Overall, Fedhealth FlexiFED Savvy is a flexible and comprehensive medical aid plan that can provide members with peace of mind and financial security in the face of unexpected medical expenses.

You might also consider the following options FedHealth has to offer:

- 🥇 Fedhealth FlexiFED 1

- 🥇 Fe dhealth FlexiFED 2

- 🥇 Fedhealth FlexiFED 3

- 🥇 Fedhealth FlexiFED 4

- 🥇 Fedhealth Maxima EXEC

- 🥇 Fedhealth Maxima PLUS

- 🥇 Fedhealth MyFED

Fedhealth FlexiFED Savvy Plan Frequently Asked Questions

What is Fedhealth FlexiFED Savvy?

Fedhealth FlexiFED Savvy is a comprehensive medical aid plan that offers flexible options to suit various budgets and healthcare needs.

What are the advantages of Fedhealth FlexiFED Savvy?

The advantages of Fedhealth FlexiFED Savvy include flexible options, no overall annual limit, a choice between various hospital networks, coverage for chronic conditions, day-to-day medical expenses, and emergency medical treatment.

Does Fedhealth FlexiFED Savvy cover emergency medical treatment?

Yes, Fedhealth FlexiFED Savvy covers emergency medical treatment.

Can I upgrade or downgrade my benefit option under Fedhealth FlexiFED Savvy?

Yes, you can upgrade or downgrade your benefit option under Fedhealth FlexiFED Savvy.

What are the hospital networks available under Fedhealth FlexiFED Savvy?

The hospital networks available under Fedhealth FlexiFED Savvy include private hospitals and clinics.

Does Fedhealth FlexiFED Savvy cover chronic conditions?

Yes, Fedhealth FlexiFED Savvy covers chronic conditions.

What types of day-to-day medical expenses are covered under Fedhealth FlexiFED Savvy?

Day-to-day medical expenses such as consultations, medication, and pathology tests are covered under Fedhealth FlexiFED Savvy.

What are the drawbacks of Fedhealth FlexiFED Savvy?

The drawbacks of Fedhealth FlexiFED Savvy include the possibility of higher premiums, limited cover for certain medical procedures and treatments, and a waiting period for some benefits.

How are premiums calculated under Fedhealth FlexiFED Savvy?

Premiums under Fedhealth FlexiFED Savvy are calculated based on the selected benefit option, age, and the number of dependents.

What is the waiting period for certain benefits under Fedhealth FlexiFED Savvy?

The waiting period for certain benefits under Fedhealth FlexiFED Savvy is typically 3 months.

Can I choose my own doctor under Fedhealth FlexiFED Savvy?

Yes, you can choose your own doctor under Fedhealth FlexiFED Savvy.

Does Fedhealth FlexiFED Savvy cover alternative therapies?

Fedhealth FlexiFED Savvy may cover alternative therapies, depending on the selected benefit option.

You might also like

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans