Hospital Plans

Overall, hospital bills in South Africa can be a significant financial burden, especially for those without medical aid. Hospital Plans are an excellent option for those looking for affordable healthcare coverage.

In this article, you will learn:

- The Top 10 Hospital Plans in South Africa (2024) – a List

- Who offers the Best Hospital Plan (Discovery Health, Momentum Health, Bonitas, Medihelp, Genesis, Medshield, Hedhealth, Sizwe Hosmed) in South Africa

- The Cheapest and Most Affordable Hospital Plans in South Africa

- The Best Hospital Plans with Benefits for Pensioners, Maternity Cover, and Cancer treatment

and much, MUCH more!

The 10 Best Hospital Plans in South Africa – a Comparison

| 🔎 Provider | 💙 Hospital Plan | ▶️ Cover Includes |

| 🥇 Discovery Health | KeyCare | Emergency Medical Transportation |

| 🥈 Momentum Health | Custom | Specialist Visits |

| 🥉 Bonitas | BonEssential | Out-of-hospital treatments |

| 🏅 Medihelp | MedVital | Theatre Fees |

| 🎖️ Genesis | MED-100 | In-hospital specialist consultations |

| 🏆 Genesis | MED-200 | Hospitalisation in private hospitals |

| 🥇 Discovery Health | Classic Delta Saver | Day-to-Day Benefits |

| 🥈 Medshield | MediCore | Unlimited Hospitalisation Cover |

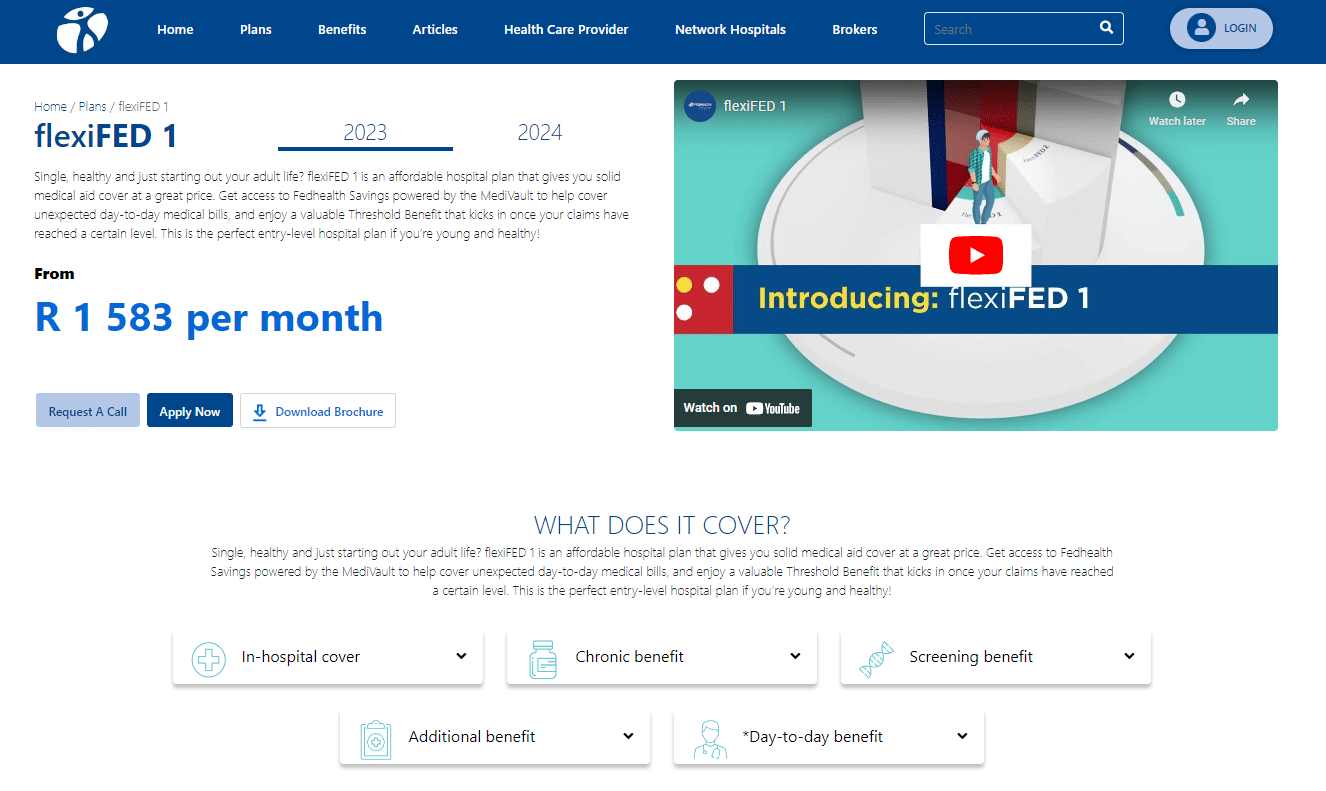

| 🥉 FedHealth | FlexiFED 1 | Day-to-Day Benefits |

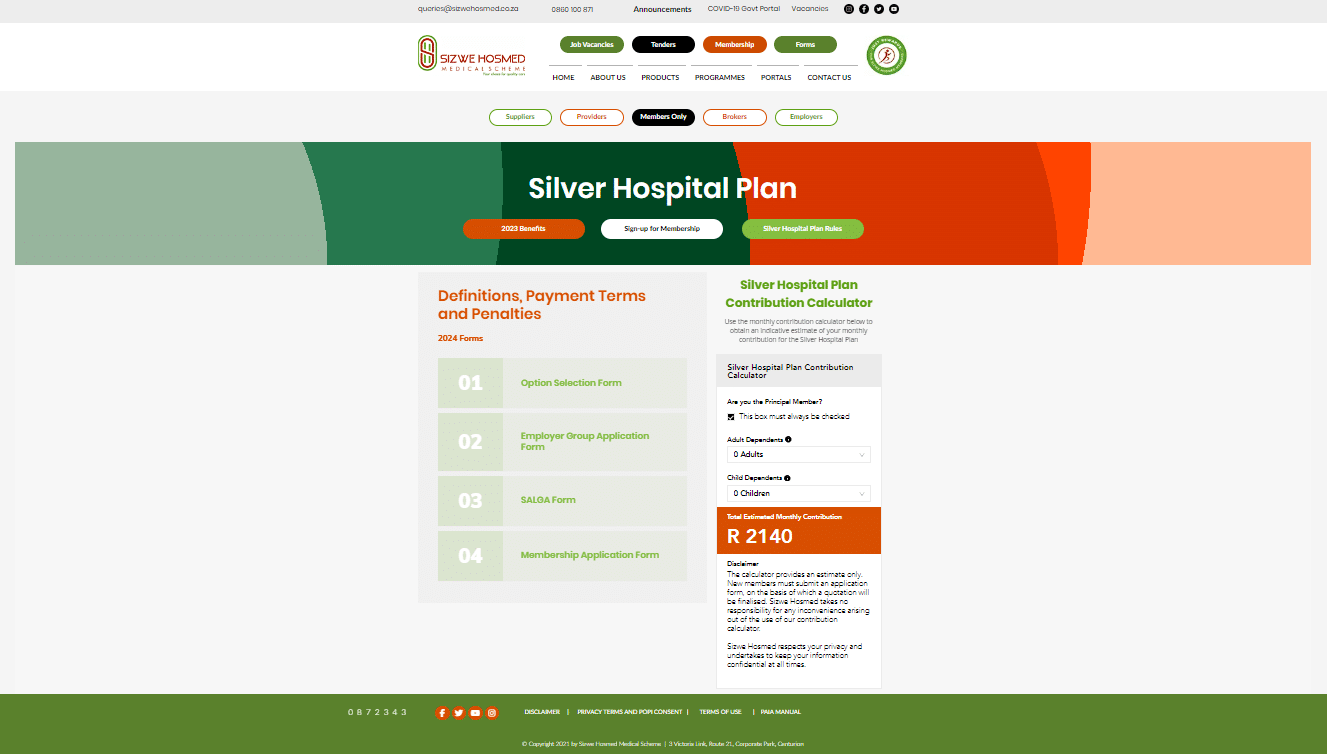

| 🏅 Sizwe Hosmed | Silver | 24/7 emergency assistance |

The 10 Best Hospital Plans in South Africa (2024)

- ☑️ Discovery Health KeyCare Hospital Plan – Overall, the Best Hospital Plan in South Africa

- ☑️ Momentum Health Custom – The Best Comprehensive Hospital Plan

- ☑️ Bonitas BonEssential – Budget-Friendly Hospital Plan Option

- ☑️ Medihelp MedVital – Affordable Hospitalization Plan

- ☑️ Genesis MED-100 – The Best Hospital for Young Professionals

- ☑️ Genesis MED-200 – Access to a Care Management Programme

- ☑️ Discovery Health Classic Delta Saver – Unlimited Hospitalization with a 100% scheme rate

- ☑️ Medshield MediCore – Offers access to Emergency Medical Services

- ☑️ Fedhealth FlexiFED 1 – Cover for various medical services and treatments

- ☑️ Sizwe Hosmed Silver Hospital – The Cheapest Hospital Plans for Families

What are Hospital Plans?

Hospital plans are health insurance policies that cover medical treatment received during hospitalization. They typically cover expenses such as accommodation, surgery, and medication. However, they may not cover outpatient treatments or consultations with medical practitioners.

Why are Hospital Plans Important in South Africa?

Hospital plans are important in South Africa for several reasons.

- ✅ South Africa’s public healthcare system is overworked and frequently unable to treat patients properly. As a result, many people opt for private healthcare, which can be prohibitively expensive. By covering the costs of hospitalization, surgery, and medication, hospital plans can help ease the financial strain of private healthcare.

- ✅ Due to the prohibitive cost of premiums, many people in South Africa do not have access to comprehensive medical aid coverage. For those who cannot afford the more comprehensive cover offered by medical aids, hospital plans provide a more affordable alternative.

- ✅ Hospital plans can serve as a safety net in unforeseen circumstances, such as accidents or sudden illnesses that necessitate hospitalization.

- ✅ A hospital plan can give you peace of mind and financial security in a country with high crime and violence rates.

Lastly, hospital plans can aid in promoting preventative healthcare by encouraging early medical attention for potentially treatable conditions. As a result, this could lessen the strain on South Africa’s healthcare system and boost people’s health.

How do Hospital Plans differ from Medical Aids?

Medical aid options are structured in differently priced tiers, offering a range of value-added benefits depending on the plan selected. Comprehensive medical aid cover can include everything from In-Hospital stays to Day-to-Day medical expenses and may offer access to wellness programs, dental benefits, and better cover of certain treatments and specialists.

On the other hand, hospital plans are risk-based insurance covers that provide financial protection in case of an emergency admission or the need for hospitalization.

While both medical aids and insurance companies can offer hospital plans, those offered by insurance companies are not regulated by the Medical Schemes Act and are considered financial products. Furthermore, hospital plans are better suited for individuals who are healthy and have low-risk lifestyles or who have few day-to-day medical expenses such as visits to doctors, dentists, or optometrists.

For those with more demanding healthcare needs, comprehensive medical aid cover is the more suitable option, particularly for large families with children who may require frequent visits to medical practitioners.

However, for those who cannot afford more extensive coverage, hospital plans can provide a viable alternative that covers emergencies and provides some financial protection.

Understanding Hospitalisation in South Africa

Understanding the South African healthcare system’s inpatient hospitalization process is essential. There are both public and private hospitals in South Africa.

The government supports public hospitals and provides the general public with low- or no-cost medical care.

On the other hand, private hospitals are operated by for-profit businesses and charge patients directly for their care. In most cases, private hospitals offer superior care and better facilities than their public counterparts.

The Cost of Hospitalisation in South Africa

Hospitalization can be expensive in South Africa, especially for private healthcare facilities. Therefore, whether an individual has medical aid or a hospital plan to cover hospitalization costs can significantly impact the total hospitalization cost in South Africa.

By helping to cover the costs of hospitalization, surgery, and medication, medical aid and hospital plans can help reduce the financial burden of private healthcare.

Public vs Private Hospitals in South Africa

The cost, quality of care, and facilities of public and private hospitals in South Africa vary. However, public hospitals provide healthcare services to the general public at no cost or at a significantly reduced rate.

These hospitals are typically overcrowded, and the quality of care varies depending on the hospital and the community it serves. On the other hand, private hospitals are operated by for-profit organizations and charge patients directly for their care.

Private hospitals typically offer superior care and facilities compared to public hospitals but at a much higher cost.

What does a Hospital Plan cover?

A hospital plan is a type of medical assistance offering inpatient care coverage. Hospital plans typically cover costs like lodging, surgery, and medication. However, they may not cover outpatient treatments or consultations with medical practitioners.

The level of coverage provided by a hospital plan can vary depending on the plan selected. While some hospital plans may be more comprehensive in their cover, others may offer additional benefits like access to wellness programs or dental benefits.

In addition, here are some of the components that a hospital plan could cover:

- ✅ This covers the cost of staying in a private, semi-private, or general hospital ward while hospitalized.

- ✅ Specialist fees cover consulting with a specialist while you are in the hospital.

- ✅ Anesthesiologist fees cover the cost of anesthesia administered during surgery or other procedures.

- ✅ Theatre Fees cover the cost of using the operating room for surgery and other procedures.

- ✅ Medication will cover the cost of prescribed medications during your hospital stay.

- ✅ Radiology and pathology cover the cost of X-rays, scans, and blood tests during your hospital stay.

Finally, Emergency Transportation. If there is an emergency, some hospital plans may cover the cost of emergency transportation to a hospital.

10 Best Hospital Plans in South Africa

Several medical aid plans offer standalone hospital plans to South Africans, and these are the Top 10 in 2024:

- ✅ Discovery Health KeyCare Hospital Plan

- ✅ Momentum Health Custom

- ✅ Bonitas BonEssential

- ✅ Medihelp MedVital

- ✅ Genesis MED-100

- ✅ Genesis MED-200

- ✅ Discovery Health Classic Delta Saver

- ✅ Medshield MediCore

- ✅ Fedhealth FlexiFED 1

- ✅ Sizwe Hosmed Silver Hospital

Discovery Health KeyCare Hospital Plan

The Discovery Health KeyCare Hospital Plan is an affordable hospital plan that offers comprehensive hospital coverage for individuals and families. The plan aims to provide affordable access to high-quality private healthcare.

KeyCare Hospital Plan benefits include unlimited hospitalization at a network of hospitals, including private and state facilities. In addition, the plan covers specialist consultations, prescribed medications, and emergency medical transportation.

Furthermore, plan members can access chronic disease benefits covering chronic medication, consultations, and pathology tests. The plan also provides maternity benefits covering prenatal consultations, antenatal classes, and childbirth.

The plan also includes a variety of value-added benefits, including access to a 24-hour medical advice hotline, trauma counseling, and wellness programs. Members can also earn rewards through the Vitality program for leading a healthy lifestyle.

Momentum Health Custom

The Momentum Health Custom Hospital Plan is a comprehensive hospital plan that offers quality private healthcare to individuals and families at an affordable price. In addition, the plan is designed to provide extensive hospitalization benefits, including cover for hospital stays, specialists, and certain prescribed medications.

Some of the key benefits of the Custom Hospital Plan include unlimited hospitalization at a network of hospitals, including private and state facilities. The plan also covers specialist consultations, pathology tests, and radiology procedures.

In addition, plan members can access chronic disease benefits, such as coverage for chronic medication and consultations with specialists. The plan also offers maternity benefits, including cover for prenatal consultations, antenatal classes, and childbirth.

The Custom Hospital Plan also includes various value-added benefits, such as access to a 24-hour medical advice hotline, wellness programs, and emergency medical transportation.

One of the unique features of the Custom Hospital Plan is that it offers members the option to add additional benefits, such as dental cover, primary healthcare benefits, and extended chronic disease benefits. Furthermore, this feature allows members to customize their plans according to their needs and budget.

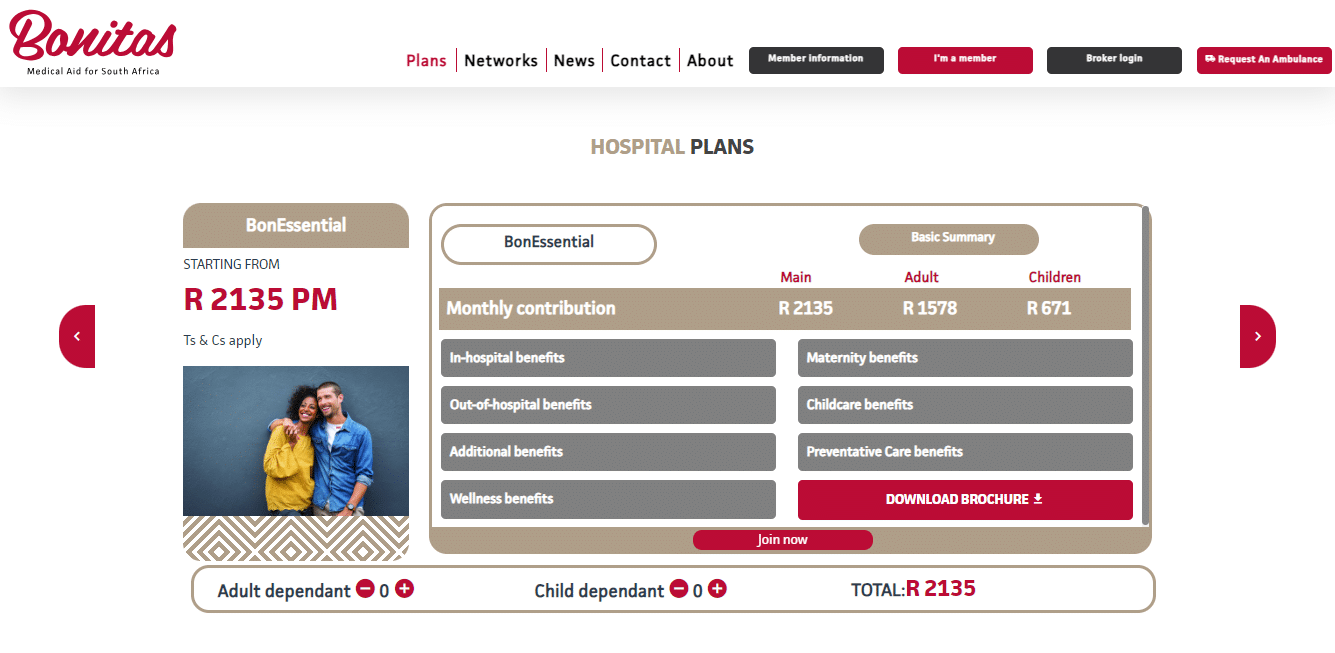

Bonitas BonEssential

The BonEssential hospital plan is a budget-friendly option Bonitas Medical Fund offers hospitalisation benefits to members at an affordable cost. BonEssential is ideal for individuals and families looking for comprehensive hospital coverage without paying high monthly premiums.

The BonEssential plan covers many in-hospital benefits, including accommodation in a private or shared ward, theatre fees, medication, and specialist fees while in the hospital. Furthermore, BonEssential also includes cover for certain out-of-hospital treatments, such as radiology and pathology, up to a specified limit.

One of the unique features of the BonEssential plan is the emergency medical services benefit, which covers the cost of emergency medical transportation to the nearest appropriate medical facility. The plan also offers access to a 24-hour medical advice hotline.

Another benefit of the BonEssential plan is that it includes coverage for certain chronic conditions, such as asthma, diabetes, and hypertension. This cover includes consultations with specialists and chronic medication up to a specified limit.

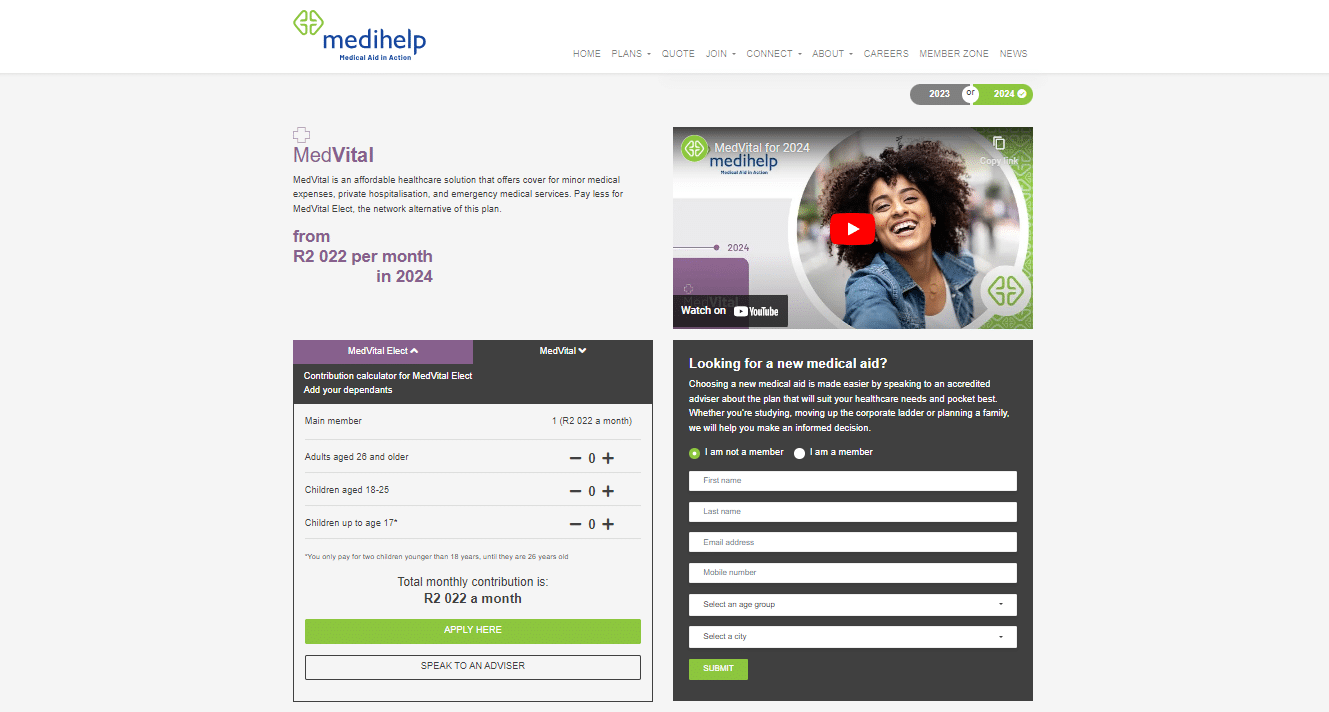

Medihelp MedVital

The MedVital hospital plan is a budget-friendly hospital plan offered by Medihelp Medical Scheme that provides affordable hospitalization benefits to members. Furthermore, MedVital is designed for individuals and families looking for quality healthcare coverage without paying high monthly premiums.

The MedVital plan covers many in-hospital benefits, including accommodation in a private or shared ward, theatre fees, medication, and specialist fees while in the hospital. The plan also includes cover for certain out-of-hospital treatments, such as radiology and pathology, up to a specified limit.

One of the unique features of the MedVital plan is the maternity benefit, which covers the cost of antenatal consultations, delivery in the hospital, and postnatal consultations for the mother and baby.

Furthermore, the plan also covers emergency medical transportation to the nearest appropriate medical facility.

Another benefit of the MedVital plan is covering certain chronic conditions, such as hypertension, diabetes, and asthma. This cover includes consultations with specialists and chronic medication up to a specified limit.

The plan also offers a wellness program with access to various health assessments, health coaching, and wellness tools.

Genesis MED-100

The Genesis MED-100 hospital plan is designed for individuals who need comprehensive hospital coverage but want to keep their premiums affordable. This plan’s benefits include in-hospital specialist consultations, hospitalization in private hospitals, and chronic medication coverage.

Members also have access to the Genesis Care Management Programme, which offers support and guidance for managing chronic conditions such as diabetes and hypertension. The plan includes emergency medical services and accidental trauma cover as well.

However, the plan does have some limitations, such as exclusions for certain treatments, procedures, and chronic conditions. Overall, the Genesis MED-100 hospital plan balances comprehensive hospital cover and affordability.

Genesis MED-200

The Genesis MED-200 hospital plan is designed for individuals who require more comprehensive hospital coverage than the MED-100 plan but still want to keep their premiums affordable.

Some of the benefits of this plan include unlimited hospitalization in private hospitals, in-hospital specialist consultations, and coverage for chronic medication.

Members can access the Genesis Care Management Programme, which offers support and guidance for managing chronic conditions such as diabetes and hypertension.

The plan also includes emergency medical services, accidental trauma cover, and cover for certain preventative tests and screenings. However, the plan has a few exclusions, such as cosmetic surgery, experimental treatments, and certain chronic conditions.

Overall, the Genesis MED-200 hospital plan offers a good balance between comprehensive hospital coverage and affordability.

Discovery Health Classic Delta Saver

The Discovery Health Classic Delta Saver plan is a cost-effective hospital plan that offers quality in-hospital care and some day-to-day benefits. Furthermore, the plan covers unlimited hospitalization at any private hospital with a 100% scheme rate. Some of the benefits of this plan include the following:

- ✅ The plan covers a range of medical expenses, including hospital accommodation, theatre costs, and in-hospital specialists.

- ✅ Members with chronic conditions can get up to 12 chronic medicine benefits.

- ✅ This plan includes a medical savings account that can be used to pay for day-to-day medical expenses such as GP visits, medication, and blood tests.

- ✅ The plan covers maternity consultations, two ultrasound scans, and a 2D fetal assessment scan.

- ✅ Members can access Discovery’s wellness program, including screening tests, preventative care, and health assessments.

- ✅ Members have access to trauma counseling and emergency medical services in the case of a medical emergency.

Overall, the Discovery Health Classic Delta Saver plan is affordable and provides members comprehensive in-hospital cover and some day-to-day benefits.

Medshield MediCore

The Medshield MediCore hospital plan is a hospital plan that offers in-hospital coverage for a range of medical services at private hospitals.

Some of the plan’s benefits include unlimited hospitalization coverage at network hospitals, access to a designated hospital network, and coverage for specialist consultations, radiology, pathology, and medication while in the hospital.

Furthermore, the plan also offers emergency medical services and covers many procedures. In addition, members have access to Medshield’s health and wellness programs. They can also earn rewards for participating in healthy activities.

Fedhealth FlexiFED 1

The Fedhealth FlexiFED 1 plan is a comprehensive medical aid option offering generous benefits for hospital and day-to-day medical expenses. FlexiFED 1 is a traditional medical aid option offering comprehensive coverage for various medical services and treatments.

It is designed for individuals who want high-quality healthcare coverage, focusing on flexibility and affordability. The plan offers unlimited private hospital cover at any Fedhealth network hospital, with no overall annual limit.

Another benefit is that members can choose from various deductibles and co-payments to suit their budgets and needs. In addition, there are no sub-limits on specialist consultations, pathology, radiology, or oncology treatment.

Furthermore, there are additional benefits of the Fedhealth FlexiFED 1 plan:

- ✅ Unlimited hospital cover at any Fedhealth network hospital, including surgery, operating room fees, medications, and more.

- ✅ Comprehensive chronic medications cover many conditions, with no annual maximum.

- ✅ Day-to-day medical benefits cover GP consultations, specialist visits, prescribed medication, and more, with benefits paid at 100% of the Fedhealth rate.

- ✅ Dental and optometric benefits, including routine exams, basic procedures, and emergency care.

- ✅ Maternity benefits, including prenatal and postnatal care, ultrasounds, and other services.

- ✅ Benefits of preventative care, including various screenings and vaccinations.

- ✅ Ambulance transportation and emergency medical treatment are examples of emergency medical services.

- ✅ When traveling within certain geographical regions, travel benefits cover emergency medical treatment.

The plan also includes several value-added benefits, such as health assessments and wellness programs.

Sizwe Hosmed Silver Hospital

The Sizwe Hosmed Hospital plan is designed to cover private hospitalization costs for members in the event of an emergency or planned procedure. Unlike other plans, this one has no overall annual limits, although sub-limits apply to certain procedures.

Furthermore, members can access the Hosmed network of hospitals and providers, which offers unlimited hospitalization coverage.

The plan covers a range of private hospitalization costs, including accommodation, theatre, and specialist fees. It also covers specialized procedures such as maternity, childbirth, dialysis, and chemotherapy. There are no co-payments or deductibles.

In addition to the hospitalization cover, members can add on benefits for chronic medication, day-to-day medical expenses, and funeral cover. Furthermore, the plan offers 24/7 medical advice and emergency assistance, providing members with peace of mind in any health-related emergency.

Members can also manage their plans and claims online through the Hosmed portal, making tracking their health-related expenses easy. However, it is important to note that the plan does not cover out-of-hospital medical expenses.

Types of Hospital Plans in South Africa

In South Africa, there are three main types of hospital plans: comprehensive hospital plans, limited hospital plans, and network hospital plans.

Comprehensive Hospital Plans

Comprehensive hospital plans typically have higher premiums than others and provide the most comprehensive cover.

Furthermore, these plans cover hospitalization expenses for emergency and elective procedures, including room and board, operating room, and specialist fees. Some comprehensive plans may also cover out-of-hospital medical expenses like doctor or specialist consultations.

Limited Hospital Plans

As the name suggests, limited hospital plans provide more limited coverage at a lower price. In addition, these plans typically have sub-limits or annual maximums for certain procedures or hospitalization expenses.

Although limited hospital plans do not cover as much ground as comprehensive plans, they can be a good option for those with a limited budget who want hospitalization coverage.

Network Hospital Plans

Network hospital plans cover inpatient stays at specific hospitals or within a specific network. These plans typically have lower premiums than comprehensive plans. However, there may be restrictions on the hospitals and providers you can use.

Furthermore, to receive cover for hospitalization, members of network hospital plans are typically required to use hospitals and providers within the network.

Considerations when choosing between these Hospital Plan Types

When selecting a hospital plan, it is important to consider your healthcare needs and budget. Comprehensive plans may offer more extensive coverage but may be more expensive. In contrast, limited and network plans may have lower premiums but offer more limited cover.

Therefore, to ensure that you select a plan that meets your specific needs, it is also crucial to comprehend the sub-limits and exclusions of each plan.

How to Choose the Right Hospital Plan for You

Assess your healthcare needs

Start by evaluating your and your family’s healthcare needs. Consider factors such as age, pre-existing medical conditions, and the likelihood that you will require medical care soon.

This evaluation will assist you in determining the level of coverage you require and the type of hospital plan that best meets your requirements.

Consider your budget

As costs vary, you must choose a hospital plan that fits your budget. Consider the monthly premiums, deductibles, and co-payments when comparing various plans. The cheapest option might not always offer the best cover, so remember.

Evaluate the different plans available

There are three types of hospital plans: comprehensive, limited, and network. Evaluate the plans offered by various schemes and insurance providers to determine which meets your needs the best.

Consider the Terms and Conditions

Before enrolling in a hospital plan, make sure you understand the plan’s terms and conditions. Also, watch for exclusions or limitations that may affect your cover, such as waiting periods or sub-limits.

Benefits and Overall Cover

Look for a hospital plan with the benefits and level of coverage that meets your healthcare needs. In addition, ensure that the plan covers the specific medical treatments you may need during a hospital stay.

Reputation and Credibility of the Provider

Select a hospital plan from a reputable and credible medical aid scheme or insurance provider. Investigate the provider’s history, reputation, and excellent customer service record.

Limits and Exclusions

Read the fine print and comprehend the hospital plan’s exclusions and limitations. For example, some plans may have waiting periods, restrictions on pre-existing conditions, or treatment limitations.

Any Additional Benefits

Some hospital plans provide additional benefits, such as wellness programs, emergency medical assistance, and funeral benefits. When comparing plans, take these additional benefits into account.

Consider the Costs

The hospital plan’s cost should be affordable and within your budget. Find a plan that offers the best value by comparing various plans and providers.

The Pros and Cons of Hospital Plans

Advantages of Hospital Plans

- ✅ More affordable monthly premiums than comprehensive medical aid products.

- ✅ Provides peace of mind in the event of an accident or major surgery.

- ✅ Some hospital plans offered by medical aid schemes cover up to 100% of all costs incurred during a member’s hospital stay.

- ✅ Hospital plans purchased from medical aid schemes are subject to the Council for Medical Schemes (CMS) provisions. Therefore, they must cover all prescribed minimum benefits (PMB), even if they were not the reason for admission.

- ✅ Hospital plans suit young, single individuals with good general health and limited incomes.

Disadvantages of Hospital Plans

- ❎ More affordable monthly premiums than comprehensive medical aid products.

- ❎ Provides peace of mind in the event of an accident or major surgery.

- ❎ Some hospital plans offered by medical aid schemes cover up to 100% of all costs incurred during a member’s hospital stay.

- ❎ Hospital plans from medical aid schemes are subject to the Council for Medical Schemes (CMS) provisions. Therefore, they must cover all prescribed minimum benefits (PMB), even if they were not the reason for admission.

- ❎ Hospital plans suit young, single individuals with good general health and limited incomes.

How to Apply for a Hospital Plan

Hospital Plan Eligibility Requirements

- ✅ Individuals must be 18 or older and under 65.

- ✅ Individuals are not eligible for coverage if they have any pre-existing medical conditions.

- ✅ Before accepting an applicant’s application, some providers may require a medical exam or medical records.

The Hospital Plan Application Process

- ✅ Complete an application form and provide personal information such as your full name, date of birth, and contact information.

- ✅ Applicants may also be required to provide information about their medical history and pre-existing conditions.

- ✅ The provider will determine the applicant’s eligibility and may request additional information or documentation.

- ✅ If the application is accepted, the applicant will receive confirmation of their coverage and a policy document outlining the plan’s terms and conditions.

Waiting Periods for Hospital Plans

- ✅ Depending on the provider and the type of treatment or condition being covered, waiting periods typically range from a few weeks to a few months.

- ✅ During the waiting period, policyholders are not covered for hospitalization or treatment for pre-existing conditions or illnesses.

- ✅ Before selecting a hospital plan, comparing the waiting periods for different providers is important.

Understanding the Fine Print of Hospital Plans

Like any other insurance product, hospital plans have terms and conditions that policyholders must understand before signing up.

Therefore, it is essential to carefully read the policy document and ask questions to ensure that the plan meets your needs and budget. Here are some key aspects of the fine print to consider.

Pre-existing Conditions

- ✅ Pre-existing condition restrictions are common in hospital plans.

- ✅ A pre-existing condition is any illness or medical condition a policyholder has been diagnosed with or treated for before enrolling in the plan.

- ✅ Some plans may not cover pre-existing conditions, while others may have waiting periods or additional fees.

- ✅ Disclosing any pre-existing conditions when applying for a hospital plan is critical to avoid disputes or claim rejection later.

Waiting Periods

- ✅ Most hospital plans have waiting periods before policyholders can make a claim.

- ✅ Waiting periods can range from a few days to several months and vary from plan to plan.

- ✅ Waiting periods are intended to prevent fraud and ensure that policyholders do not join the plan solely to file a claim.

- ✅ To avoid any surprises when filing a claim, it is critical to understand the waiting periods of a hospital plan.

Lifetime Limits

- ✅ Some hospital plans may have a lifetime cap on cover.

- ✅ This means that once a policyholder reaches the limit, they are no longer covered for additional treatment.

- ✅ It is critical to understand a hospital plan’s lifetime limit to avoid running out of cover when it is most needed.

Network Providers / Designated Service Providers (DSPs)

- ✅ Hospital plans may have provider networks that policyholders must use to receive full coverage.

- ✅ Network providers are hospitals, clinics, and doctors who have agreements with the plan to provide services at a reduced rate.

- ✅ If policyholders choose to use providers outside of the network, they may be subject to a higher co-payment or deductible, or they may not be covered at all.

- ✅ It is critical to understand the network providers of a hospital plan to ensure that the preferred healthcare providers are included.

Exclusions and Limitations

- ✅ Hospital plans may exclude or limit certain treatments, procedures, or conditions.

- ✅ Some plans, for example, may not cover cosmetic surgery or alternative therapies, and others may limit how long a policyholder stays in the hospital.

- ✅ To avoid any surprises when filing a claim, it is critical to understand the exclusions and limitations of a hospital plan.

Renewals or Cancellations

- ✅ Hospital plans are typically annual contracts that can be renewed or canceled at the end of the term.

- ✅ It is critical to understand a hospital plan’s renewal and cancellation terms to avoid any unexpected changes or fees.

- ✅ Some plans may have automatic renewals, while others may require policyholders to opt in for renewal.

- ✅ It is critical to understand the hospital plan’s cancellation policy to avoid penalties or fees.

Co-payments and Deductibles

- ✅ Hospital plans may require policyholders to pay a portion of the cost of treatment out of their pocket.

- ✅ Co-payments are fixed amounts that policyholders must pay for each hospitalization or procedure. In contrast, deductibles are a percentage of the total cost.

- ✅ Co-payments and deductibles may vary depending on the plan and the type of treatment received.

- ✅ It is critical to understand the co-payments and deductibles of a hospital plan to budget for any out-of-pocket expenses.

Hospital Plan Claims Process

How to Claim on a Hospital Plan

To claim your hospital plan, you should follow these steps:

- ✅ Notify your plan administrator as soon as possible after your hospital admission.

- ✅ Provide your plan administrator with any required documentation, such as your medical history, doctor’s reports, and proof of admission.

- ✅ Your plan administrator will assess your claim and provide pre-authorization for your hospital stay and any related treatments or procedures.

- ✅ Receive treatment according to your doctor’s orders.

Your plan administrator will settle the bill directly with the hospital and provide you with an explanation of benefits (EOB).

What documentation do you need when claiming with a Hospital Plan?

When claiming on your hospital plan, you will typically need to provide the following documentation:

- ✅ Proof of admission to the hospital.

- ✅ A doctor’s report outlining your condition and recommended treatment.

- ✅ Medical history or any previous medical records relevant to your current condition.

- ✅ Invoices and receipts for any expenses related to your hospital stay.

Any other documentation requested by your hospital plan administrator.

How long does it take to receive payment from a Hospital Plan Claim?

The time it takes to receive payment from a hospital plan claim can vary depending on the plan and the complexity of the claim.

In most cases, the hospital plan administrator will settle the bill directly with the hospital. You will receive an explanation of benefits (EOB) outlining what was covered by your plan and any co-payments or deductibles you may be responsible for.

Typically, hospital plans aim to process claims quickly and efficiently. Therefore, you should receive your EOB within a few days of your claim being assessed.

However, if you have any concerns about the processing of your claim, you should contact your hospital plan administrator for further information.

In Conclusion

Hospital Plans are an excellent option for those who are looking for affordable healthcare coverage in South Africa.

You might also like: Discovery Health Review

You might also like: Bonitas Review

You might also like: Medihelp Review

You might also like: Genesis Review

You might also like: Medshield Review

Frequently Asked Questions

What is a hospital plan?

A hospital plan is a type of medical scheme that covers hospitalization and specific medical procedures but typically does not cover day-to-day medical expenses.

How do I choose the best hospital plan?

When choosing a hospital plan consider factors such as the level of hospital cover provided, the monthly premium, and any additional benefits such as cover for chronic conditions.

What is the difference between a hospital plan and a medical aid?

A hospital plan covers hospitalization and specific medical procedures. In contrast, medical aid typically provides more comprehensive cover, including cover for day-to-day medical expenses.

Is a hospital plan enough coverage?

If you have to choose between either a hospital plan or no medical cover at all, a hospital plan is preferable. But if you can afford a full medical scheme membership, it will be even better.

Is there a difference between a hospital plan and medical insurance?

Medical aid hospital plans cover you for hospitalization and chronic conditions under prescribed minimum benefits or day-to-day benefits while medical insurance comprises a pay-out if you are hospitalized and cannot work or earn a living.

What are the requirements to join a hospital plan in South Africa?

To apply for a hospital plan in South Africa, one needs proof that you’ve been a member of a medical scheme before, proof of your relationships with dependents, such as marriage documents and birth certificates, bank statements, and copies of a South African ID or visa.

What is the waiting period for hospital plans?

Depending on the provider and the nature of the procedure or condition, waiting periods for hospital plans in South Africa vary. Most hospital plans have a 3-month waiting period. However, some procedures or conditions, like pregnancy or childbirth, may have longer waiting periods.

Can I upgrade or downgrade my hospital plan?

Depending on the provider’s policies and the terms of your contract, you may be able to upgrade or downgrade your hospital plan. However, administrative fees or waiting periods might be associated with the change.

Can I switch to a different hospital plan?

Yes, you could switch to a different hospital plan in South Africa. However, there could be waiting periods and other restrictions depending on the new plan.

What should I do if my hospital plan claim is denied?

If your hospital plan claim is denied you can appeal the decision with the relevant authorities or seek legal advice.

What happens if I miss a premium payment on my hospital plan?

If you fail to pay your hospital insurance premium by the due date, your coverage may be terminated or suspended. Some service providers may grant a grace period for overdue payments; however, you may be required to pay interest or other fees to reinstate your plan.

Are there any age restrictions for hospital plan cover in South Africa?

There may be minimum and maximum ages for enrollment in different hospital plans.

What is a co-payment relating to hospital plans?

A co-payment is a portion of the hospital bill that you have to pay, typically a percentage of the total cost.

How long does processing a hospital plan claim take?

Depending on the complexity of the claim, the processing time for hospital plan claims can range from a few days to a few weeks.

Can I add dependents to my hospital plan?

Depending on the provider’s policies and the terms of your contract, you can typically add dependents, such as your spouse, children, or other family members, to your hospital plan. You might be required to pay an additional premium and provide proof of their relationship with you.

What is the difference between a hospital plan and medical aid?

A hospital plan only covers in-hospital care, whereas medical aid covers both in-hospital and out-of-hospital care.

Are pre-existing conditions covered under hospital plans?

Pre-existing conditions are typically subject to a waiting period. In some cases, hospital plans may not cover them at all.

How do I cancel my hospital plan?

Depending on the provider’s policies and the terms of your contract, you may be required to cancel your hospital plan by submitting a written request to the provider via mail, email, or an online portal. A cancellation fee or a required notice period may also apply. If you cancel your plan before the end of your commitment period, you may forfeit any accumulated benefits or waiting periods.