Principle Member

From R1565

Dependant Member

From R1565

Child Dependant

From R1565

Essential Dynamic Smart

The Essential Dynamic Smart plan is a great option for individuals seeking a basic medical aid plan with several benefits and good value for money.

★★★★★ 4.5/5

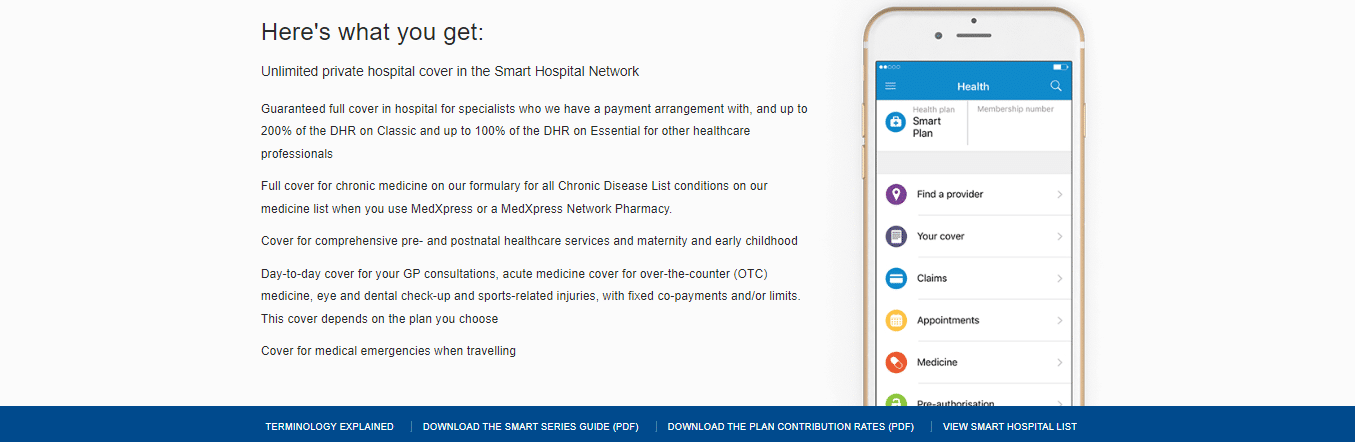

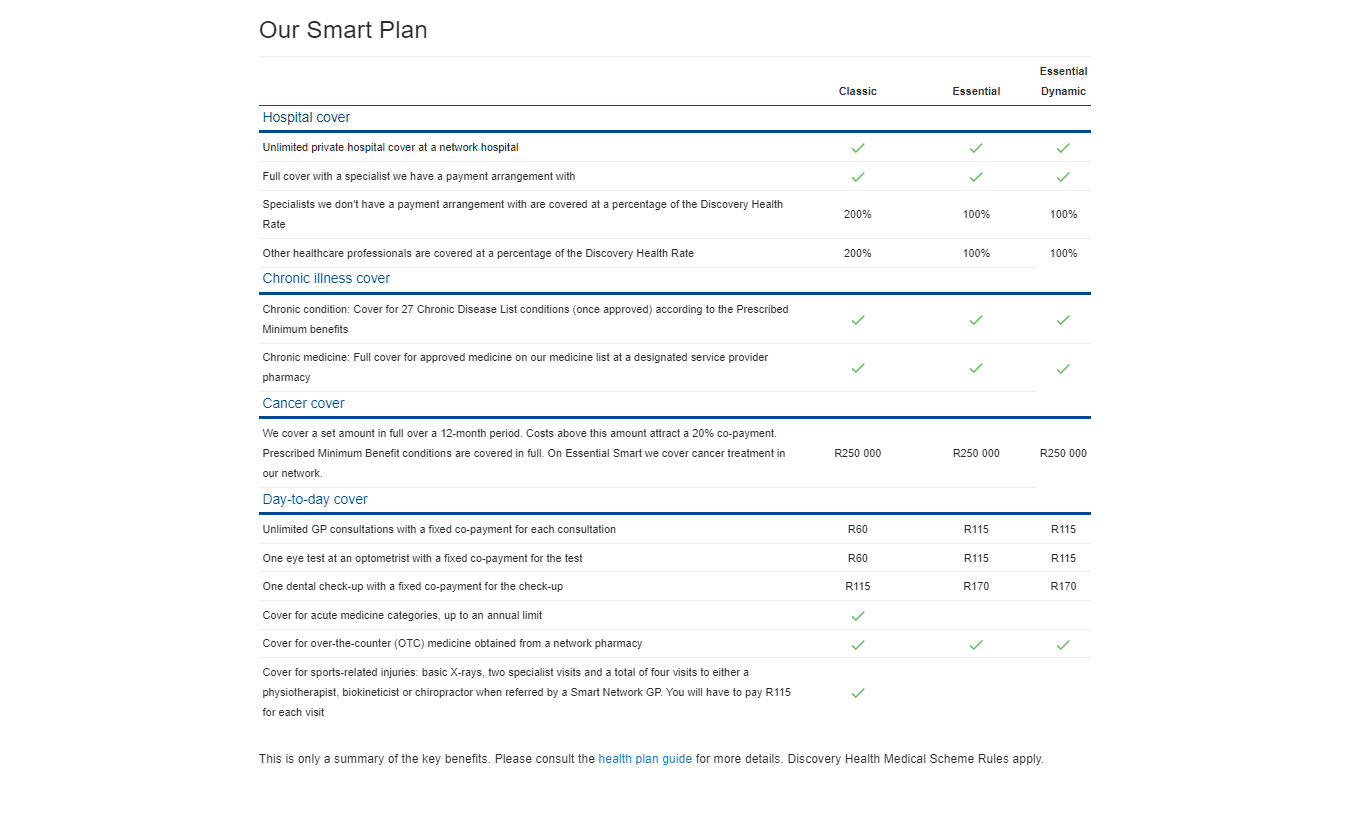

Chronic Cover:

Day-to-Day:

Preventative Care:

Cancer Cover:

Hospitalisation:

Maternity Benefits:

The Essential Dynamic Smart plan is a great option for individuals seeking a basic medical aid plan with several benefits and good value for money.

Tax Deductible:

Travel Cover:

Essential Dynamic Smart

The Essential Dynamic Smart plan is a great option for individuals seeking a basic medical aid plan with several benefits and good value for money.

★★★★★ 4/5

Principle Member

From R1565

Dependant Member

From R1565

Child Dependant

From R1565

Chronic Cover:

Day-to-Day:

Preventative Care:

Cancer Cover:

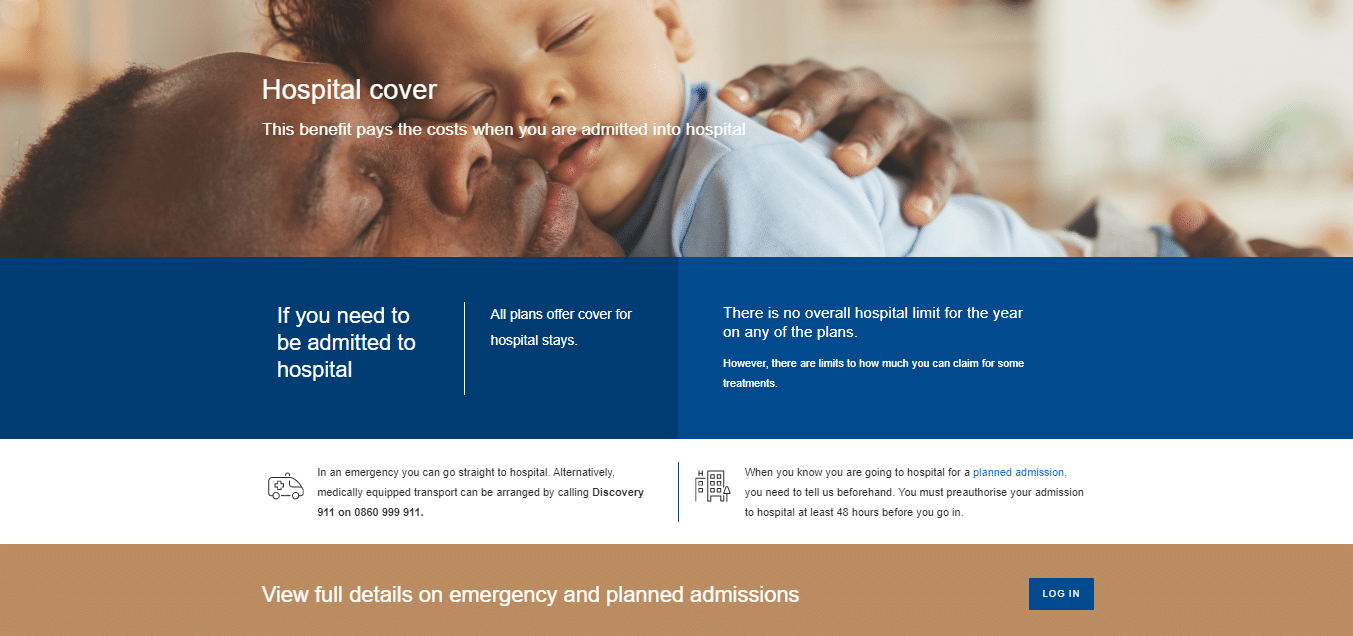

Hospitalisation:

Maternity Benefits:

The Essential Dynamic Smart plan is a great option for individuals seeking a basic medical aid plan with several benefits and good value for money.

Tax Deductible:

Travel Cover: