- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Sanlam Gap Cover

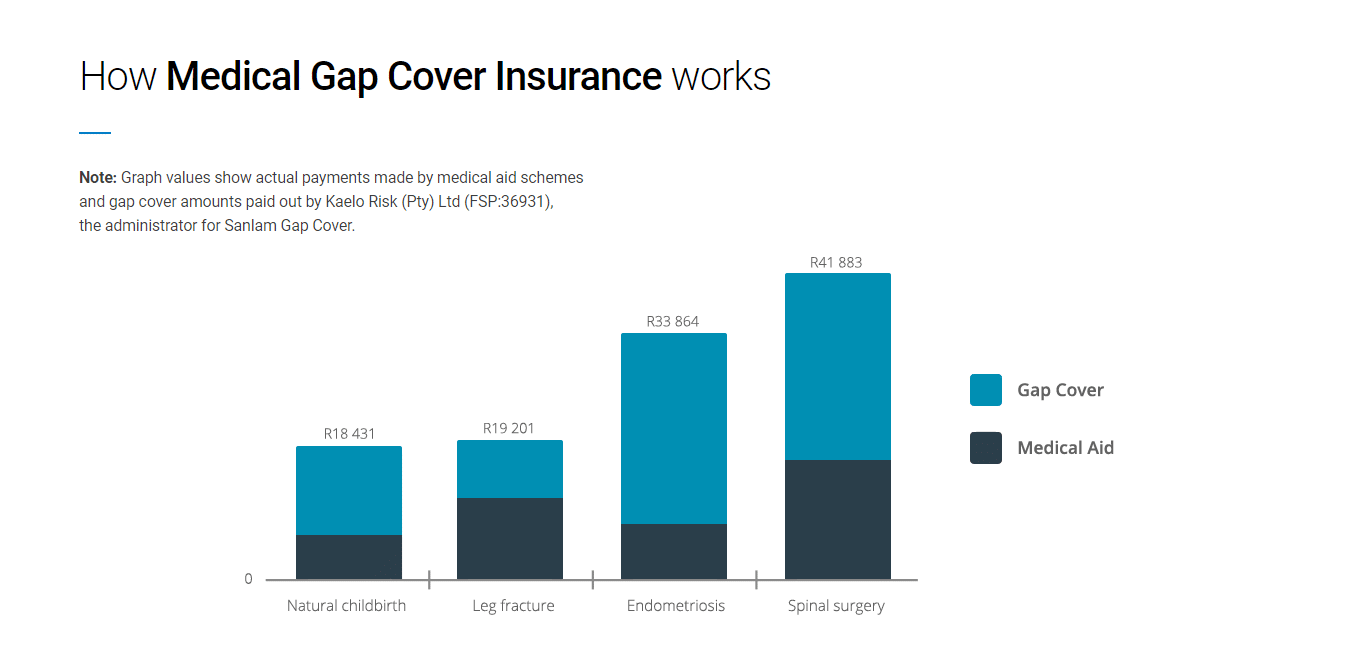

Overall, Sanlam Gap Cover is a trustworthy short-term insurance product designed to provide extra protection for those who already have medical aid. The Sanlam Gap Cover Plans start from R262 ZAR. Sanlam has a trust score of 4.3.

| 🟥 Date Established | 2014 |

| 🟧 Underwriters | Centriq Insurance Company Limited |

| 🟨 Headquartered | Bellville, Cape Town, South Africa |

| 🟩 The average number of members | 50,000+ |

| 🟦 Number of Markets | 1 |

| 🟪 Market Share | <10% |

| 🟥 Number of plans offered | 1 |

| 🟧 Is a Mobile App offered | None |

| 🟨 Customer Support Operating Hours | Monday – Friday – 8 am to 6 pm |

| 🟩 Waiting Period | 3 – 12 months |

| 🟦 Exclusions | ✅ Yes |

Sanlam Gap Cover – 10 Key Point Quick Overview

- ✅ Sanlam Gap Cover Premiums

- ✅ Sanlam Gap Cover – Advantages over Competitors

- ✅ Sanlam Gap Cover Features

- ✅ How to apply for Gap Cover with Sanlam

- ✅ How to Submit a Claim for Gap Cover with Sanlam

- ✅ Sanlam Gap Cover Exclusions and Waiting Periods

- ✅ Sanlam Gap Cover vs Other Notable Providers

- ✅ Sanlam Gap Cover Pros and Cons

- ✅ Our Verdict on Sanlam Gap Cover

- ✅ Sanlam Gap Cover Frequently Asked Questions

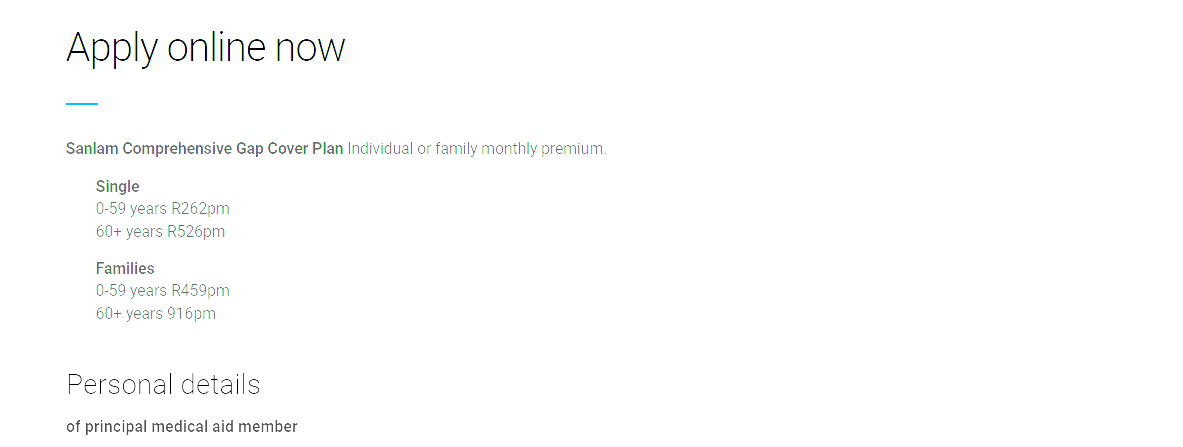

Sanlam Gap Cover Premiums

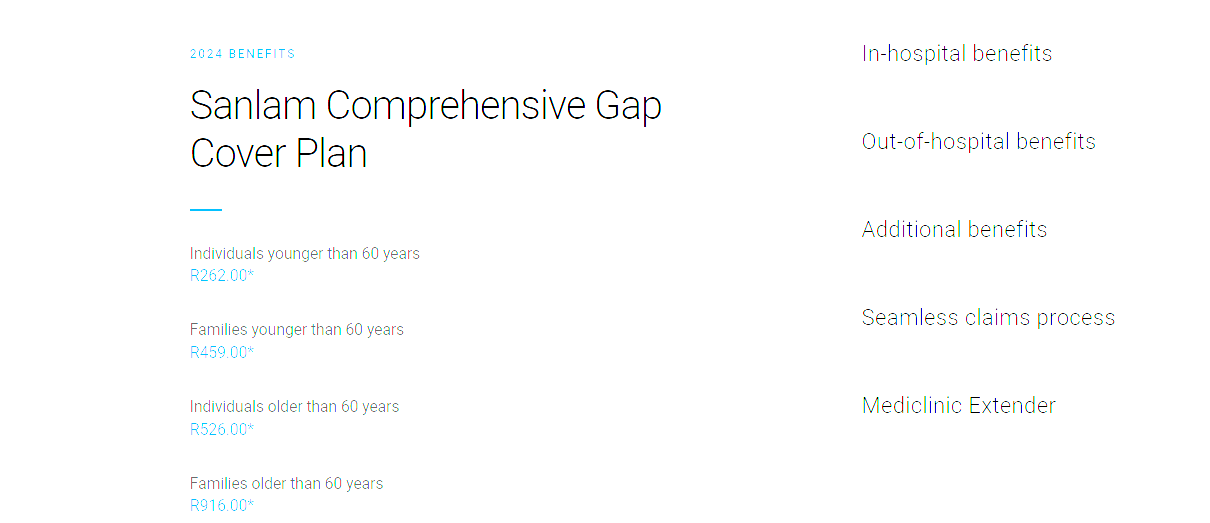

Sanlam Gap Cover Premiums are structured as follows.

| ❤️ Family/Individual Age | Monthly Premium |

| 🧡 Individuals <60 years | R262 per month |

| 💛 Families <60 years | R459 per month |

| 💚 Individuals 60 years> | R526 per month |

| 💙 Families 60 years> | R916 per month |

You might like the 5 Best Gap Cover Options for Under R300

Sanlam Gap Cover – Advantages over Competitors

Choosing Sanlam Gap overcomes with a wide range of advantages, including:

- ✅ Provides cover for the shortfall between your medical scheme rates and what service providers charge for in-hospital treatment.

- ✅ Covers co-payments and deductibles that your medical scheme may require.

- ✅ Offers a cancer diagnosis benefit of R10,000 payable as a lump sum, subject to certain conditions.

- ✅ Provides cover for emergency outpatient services provided within a hospital’s casualty ward, subject to certain limitations.

- ✅ Offers cover the difference between the cost of general and private wards, subject to certain limitations.

- ✅ Covers specialist fees and consultations, subject to certain limitations and waiting periods.

- ✅ Offers the option to choose your preferred hospital network, including Mediclinic or Netcare facilities.

- ✅ Provides quick and efficient claims processing, with payment of approved claims within 7 to 10 working days.

- ✅ Offers a range of cover options to suit different needs and budgets, including individual, family, and corporate cover.

Finally, Sanlam Life Insurance Limited, a reputable and established insurance provider in South Africa, underwrites Sanlam Gap Cover.

Sanlam Gap Cover Features

Sanlam Gap Cover Core Benefits

| 🟥 Tariff shortfalls | This benefit covers shortfalls for surgeons, radiologists, pathologists, and physiotherapists by five times (500%) the Medical Scheme rate. The benefit also covers Prescribed Minimum Benefits (PMBs). Covers an additional five times (500%) for charges above the Medical Scheme rate. |

| 🟧 Co-payments and Deductibles | The Insured Party’s Medical Scheme’s fixed or upfront rand value deductible or co-payment determines the benefit. Unlimited per Insured per Policy. |

| 🟨 Shortfalls from sub-limits | This benefit applies when a Hospital Episode’s charges exceed the Insured Party’s Medical Scheme’s Sub-limit benefit. The benefit is the charged amount minus the Insured Party’s Medical Scheme payment, up to R60,900 per Insured Event. |

| 🟩 Oncology Tariff Shortfalls | This clause only covers oncology and related cancer treatment approved by the Insured Party’s Medical Scheme. This benefit requires your Medical Scheme to pay their portion of your hospital/risk benefit claim. Benefits for charges above the Medical Scheme Tariff are limited to five times (500%) the annual limit per insured per policy. |

| 🟦 Oncology Sub-limits | For this clause to apply, the Insured Party’s Medical Scheme plan type’s oncology Treatment Benefit sub-limit must be exceeded. Oncology and related treatment approved by the Insured Party’s Medical Scheme to treat cancer (malignant neoplasm) during an Insured Event is covered. Unlimited per Insured per Policy. |

| 🟪 Oncology Co-payments | Once related costs exceed the Medical Scheme threshold, the benefit equals the Co-payment. Limited to the 20% Medical Scheme oncology co-payment. |

| 🟥 Out-of-Hospital Tariff Shortfalls | Under this benefit, the Insured Party’s Medical Scheme pays five times (500%) the Medical Scheme rate for outpatient procedures. Unlimited per Insured per Policy. |

| 🟧 Penalty Co-payments | Cover penalty Co-payments or Deductibles up to 30% for voluntary use of a non-Network Hospital by an Insured Party. Limited to two events per family per year, a maximum of R17,500 each. |

| 🟨 Innovative Oncology Medicine | The Insured Party’s Medical Scheme-approved Innovative Oncology Medicines will be covered. Limited to 25% of the drug cost or up to R13,000. |

| 🟩 Dental Reconstruction Benefit | Dental reconstruction surgery due to Accidental Harm or Oncology Treatment after the Inception Date is covered. The benefit is the Treatment cost minus the Medical Scheme’s hospital/risk-benefit. The benefit is limited to two events per family and R49,900 per year. |

Sanlam Gap Cover Additional Benefits

| 🟥 Family Booster | When a child is born prematurely, a lump sum benefit is payable. The lump sum is limited to R15,900. |

| 🟧 Casualty – Child Illness | Benefits under this clause will only be paid for emergency outpatient services provided within a hospital’s casualty ward. The benefit is only payable in the event of after-hours emergency treatment. (Mondays through Fridays between 6 pm and 8 am, and on Saturdays, Sundays, and South African public holidays). The payable benefit is the total cost of treatment less the amount paid by your Medical Scheme from your hospital/risk-benefit. Sanlam Gap Cover will reimburse payments from your available Medical Savings Account or your pocket. There is a limit of two such events per year and a maximum of R2,700 per event. Children under the age of 12 are excluded from cover. |

| 🟨 Accidental Casualty | Cover for emergency out-patient services provided within a hospital’s casualty ward as a direct result of accidental harm. The payable benefit is the total cost of treatment less the amount paid by your Medical Scheme from your hospital/risk-benefit. Sanlam Gap Cover will reimburse payments from your available Medical Savings Account or your pocket. Limited to an R17,400 maximum per insured event. |

| 🟩 Hospital Booster | In the event of an accident or premature birth, a lump-sum payment will be made based on the length of the hospital stay. Up to a maximum of R29,300 annually, this benefit covers two hospital episodes yearly. There is a limit of R480 per day from the first to the thirteenth day (inclusive). From the 14th to the 20th day, there is a limit of R860 per day (inclusive). From the 21st to the 30th day, there is a limit of R1,700 per day (inclusive). After the 30th day of any Hospital Episode, no benefit is payable under this clause. |

| 🟦 Family Protector | The lump sum Benefit is payable in the event of the death or permanent disability of an Insured Party as a result of Accidental Harm as follows: R20,000 for children under the age of six R30,000 for all other insured parties. |

| 🟪 Medical Aid Contribution Waiver | A lump sum Benefit is payable if the Policyholder dies or becomes permanently disabled due to Accidental Harm and is the primary member of the Medical Scheme. The benefit will apply if the Policyholder pays for dependents registered on the Medical Scheme. The benefit is limited to R35 500, and contributions will be covered for six months. This benefit is only available once during the policy’s lifetime. |

| 🟥 Gap Premium Waiver | Policy premiums will be waived in the event of the Policyholder’s death or permanent disability due to an accident. The benefit will apply where the Policyholder is the primary member of the Medical Scheme and only if there are dependents registered on the Gap policy who are being paid for by the Policyholder. Waived for six months from the date of the incident. This benefit is only available once during the policy’s lifetime. |

| 🟧 RAF Claims | The administrator, the nominated Service Provider of Kaelo, provides an end-to-end legal service to assist Insured Parties with legitimate claims against the Road Accident Fund (RAF). The service providers are contracted to Kaelo Risk rather than the insurer, Centriq Insurance Company Limited. |

Sanlam Gap Cover Mediclinic Extender Benefit

The Mediclinic Extender Benefits are available to members who have selected the option on their Sanlam Gap Policy. The Extender Benefit from Mediclinic includes the following.

| 🟥 Casualty Illness | This clause only covers emergency outpatient services provided within a hospital’s casualty ward. This benefit applies only to after-hours treatment in an emergency. After-hour emergency illness is covered only at a Mediclinic for all insured parties (Mondays to Fridays: 6 pm – 8 am, all-day Saturdays, Sundays & public holidays). This benefit is subject to two events per annum and a maximum of R2,500 per insured event. |

| 🟧 Specialist Benefit | This benefit is payable when your medical scheme has paid a portion of your out-of-hospital specialist claim. Sanlam will cover the shortfall of R4,900 per insured party per annum, subject to the overall annual limit. |

| 🟨 Private Ward | This benefit covers the cost difference between general and private wards but only for confinement (childbirth) admissions and only at a Mediclinic hospital if available. The benefit is subject to one event per insured party per annum and a maximum of R4,900, subject to the overall annual limit. |

| 🟩 Cancer Lump Sum Pay-Out | The cancer diagnosis benefit is only payable on a first-time diagnosis as a lump sum of R10,000. The benefit is limited to one claim per insured party. Cancer must be confirmed as at least the medical equivalent of “Stage 2” or higher cancer by an oncologist or pathologist. |

| 🟦 Cashless Co-Payment | The benefit for diagnostic procedures is equal to the fixed value deductible or co-payment amount, as defined in the insured party’s medical scheme rules. It is directly payable to the Mediclinic facility and is unlimited, subject to the overall annual limit. This benefit is only available at a Mediclinic facility. |

| 🟪 Cashless Penalty Co-Payment | The insurer will pay a fixed value penalty co-payment or deductible or a percentage penalty co-payment of no more than 30% for the voluntary use of a Mediclinic facility that is not part of the insured party’s medical scheme hospital network. The benefit is unlimited only at a Mediclinic facility, subject to a maximum of R16,500 per event and subject to the overall annual limit. This benefit is subject to exclusion-related penalties. |

How to apply for Gap Cover with Sanlam

Here is a step-by-step guide on how to apply for gap cover with Sanlam:

- ✅ Visit the Sanlam Gap Cover website or contact a Sanlam financial adviser to discuss your gap cover needs and options.

- ✅ Choose the gap cover option that best suits your needs and budget and review the terms and conditions of the policy carefully.

- ✅ Complete the application form with accurate and complete information, including personal and contact details and any relevant medical information.

- ✅ Provide any required supporting documentation, such as proof of income or medical history, as requested by Sanlam.

- ✅ Submit your application form and supporting documents to Sanlam, either online or via email, post, or in person.

- ✅ Sanlam will review your application and notify you of the outcome by phone or email.

- ✅ Once your application is approved, you will need to make payment of the relevant premium, either as a once-off annual payment or monthly premium.

- ✅ Your gap cover policy will be activated once payment is received, and you will receive confirmation of your cover and the relevant policy documents.

You can then start enjoying the benefits and peace of mind of having a gap cover from Sanlam.

How to Submit a Claim for Gap Cover with Sanlam

To claim from Sanlam Gap Cover, follow these steps:

- ✅ Click on the link provided to access the claim form.

- ✅ Download the form and fill it out completely with all the necessary information.

- ✅ Collect and attach all required supporting documents, including specialists’ accounts, hospital accounts, and your medical scheme statement showing the processing of the accounts and the shortfall.

- ✅ Email your completed claim form and supporting documents to [email protected].

- ✅ If you prefer, you can also submit your claim online by going to www.kaelo.co.za/quick-links.

- ✅ Once Sanlam Gap Cover receives your claim, they will process it within 7 to 10 working days, provided all requirements have been met.

- ✅ Sanlam Gap Cover will notify you of the outcome of your claim via email or phone call.

- ✅ Please note that you have 6 months from the end of the Insured event to submit your claim and relevant documentation. Any claim received for the first time after the 6 months has expired will not be honored.

Lastly, remember that Sanlam Gap Cover is separate from your medical scheme, so your medical scheme call center will not be able to assist you with any questions regarding the policy.

Sanlam Gap Cover Exclusions and Waiting Periods

Sanlam Gap Cover has certain exclusions that are not covered under the policy. Here are some of the common exclusions:

- ✅ Any pre-existing conditions or related complications, unless otherwise stated in the policy.

- ✅ Any treatment, procedure, or service not considered medically necessary, as determined by Sanlam Gap Cover.

- ✅ Treatment, procedures, or services received outside of the Republic of South Africa.

- ✅ Cosmetic surgery, procedures, or treatments, including weight loss surgery, except as required due to an accident.

- ✅ Any conditions or related complications resulting from hazardous activities, including professional sports.

- ✅ Any conditions or related complications resulting from the use of alcohol or drugs, including substance abuse or addiction.

- ✅ Any conditions or related complications resulting from the use of tobacco or smoking.

- ✅ Experimental or investigational treatments, procedures, or services.

- ✅ Any conditions or related complications resulting from war, civil unrest, terrorism, or similar activities.

Any conditions or related complications resulting from suicide or attempted suicide, self-inflicted injury or harm, or illegal activities.

Sanlam Gap Cover Waiting Periods

Sanlam Gap Cover has waiting periods for certain benefits, which means you must wait a specific period after your policy begins before claiming these benefits. Here are some of the common waiting periods for Sanlam Gap Cover:

- ✅ A 3-month waiting period applies to all benefits except emergencies.

- ✅ There is no waiting period for emergency benefits, which means you can claim these benefits immediately after your policy begins.

- ✅ There is a 6-month waiting period for the cancer diagnosis benefit.

- ✅ If you have a pre-existing condition, there is a 12-month waiting period before claiming any related benefits.

Finally, the specialist benefit has a 3-month waiting period.

You might like the Best Medical Aids in South Africa that Cover Tummy Tuck Surgery

Sanlam Gap Cover vs Other Notable Providers

| 🔎 Gap Cover Provider | 🥇 Sanlam | 🥈 Sirago | 🥉 Liberty |

| 🟥 Underwriters | Centriq Insurance Company Limited | Sirago Underwriting Managers | Guardrisk Life Limited (FSP 76) |

| 🟧 Number of Plans | 1 | 8 | 2 |

| 🟨 Average Price | R262 | R131 | R372 |

| 🟩 Waiting Periods | 3 – 12 months | 3 months | 12 Months |

| 🟦 Exclusions | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Oncology Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟥 In-Hospital Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟧 Out-of-Hospital Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Maternity Benefit | None | ✅ Yes | ✅ Yes |

| 🟩 Scopes and Scans | None | None | ✅ Yes |

| 🟦 Co-payment Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Emergency Room | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟥 Accidental Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟧 Trauma Counseling | None | ✅ Yes | ✅ Yes |

| 🟨 Premium Waiver | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟩 Non-DSP Co-Payment | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟦 Prostheses | None | None | ✅ Yes |

| 🟪 Accidental Death/ Permanent Disability | ✅ Yes | ✅ Yes | None |

| 🟥 Travel Cover Extender | None | None | ✅ Yes |

Sanlam Gap Cover Pros and Cons

| ✅ Pros | ❎ Cons |

| Affordable premiums and a range of cover options | Waiting periods for some benefits |

| Covers the shortfall between medical scheme rates and actual medical costs | Exclusions for pre-existing conditions and hazardous activities |

| Covers co-payments, deductibles, and specialist fees | Exclusions for substance abuse and illegal activities |

| Option to choose preferred hospital network, including Mediclinic or Netcare facilities | Cancer diagnosis benefit is limited to one claim per insured party |

Our Verdict on Sanlam Gap Cover

Sanlam Gap Cover offers a valuable solution for those concerned about potential medical expenses that their medical aid may not fully cover. The policy covers a range of expenses, including the shortfall between medical scheme rates and the costs charged by service providers, co-payments, deductibles, and specialist fees. The cover is reasonably priced, with various options for different needs and budgets.

Sanlam’s cancer diagnosis benefit of R10,000 and the option to choose a preferred hospital network, including Mediclinic or Netcare facilities, are additional benefits that set Sanlam Gap Cover apart.

Certain limitations and exclusions should be considered, including waiting periods, pre-existing conditions, and exclusions.

Sanlam Gap Cover Frequently Asked Questions

What is Sanlam Gap Cover?

Sanlam Gap Cover is a medical insurance policy that covers the gap between your medical scheme benefits and the actual medical costs charged by service providers.

How much are the premiums for Sanlam Gap Cover?

The premiums for Sanlam Gap Cover vary depending on the age and family dynamic of the member, starting from R246 for individuals younger than 60 years.

What benefits does Sanlam Gap Cover provide?

Sanlam Gap Cover covers the shortfall between medical scheme rates and actual medical costs, co-payments, deductibles, specialist fees, and emergency out-patient services provided within a hospital’s casualty ward.

Are there waiting periods for benefits under Sanlam Gap Cover?

Yes, there are waiting periods for some benefits, such as the cancer diagnosis benefit and pre-existing conditions.

What is the cancer diagnosis benefit of Sanlam Gap Cover?

The cancer diagnosis benefit in Sanlam Gap Cover provides a lump sum payment of R10,000 upon first-time diagnosis of Stage 2 or higher cancer.

Can I choose my preferred hospital network with Sanlam Gap Cover?

Yes, you can choose your preferred hospital network, including Mediclinic or Netcare facilities.

Are there exclusions in Sanlam Gap Cover?

Yes, there are exclusions such as pre-existing conditions, hazardous activities, substance abuse, illegal activities, and treatments considered medically unnecessary.

How does the claims process work for Sanlam Gap Cover?

The claims process for Sanlam Gap Cover is quick and efficient, with payment of approved claims within 7 to 10 working days.

Does Sanlam Gap Cover cover treatments receive outside of South Africa?

No, Sanlam Gap Cover does not cover treatments received outside of South Africa.

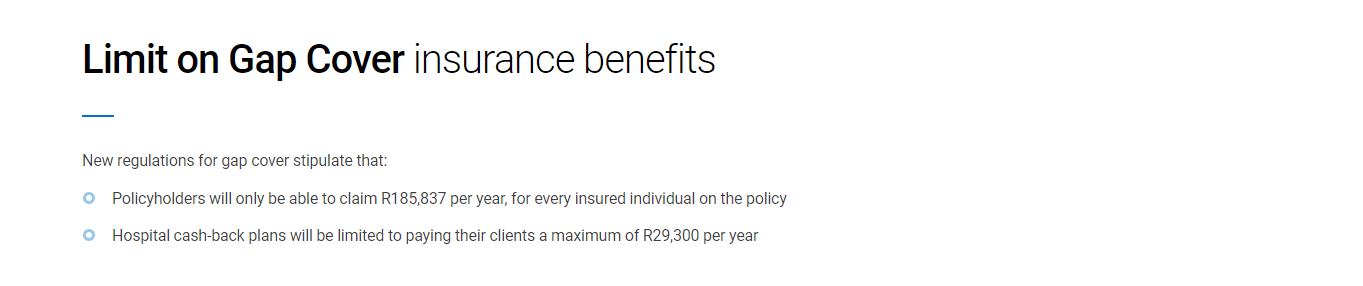

Are there overall annual limits for benefits under Sanlam Gap Cover?

Yes, some benefits are subject to overall annual limits.

Does Sanlam Gap cover dental or optical expenses?

No, Sanlam Gap Cover does not cover dental or optical expenses.

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans