Principle Member

From R7842

Dependant Member

From R7185

Child Dependant

From R1500

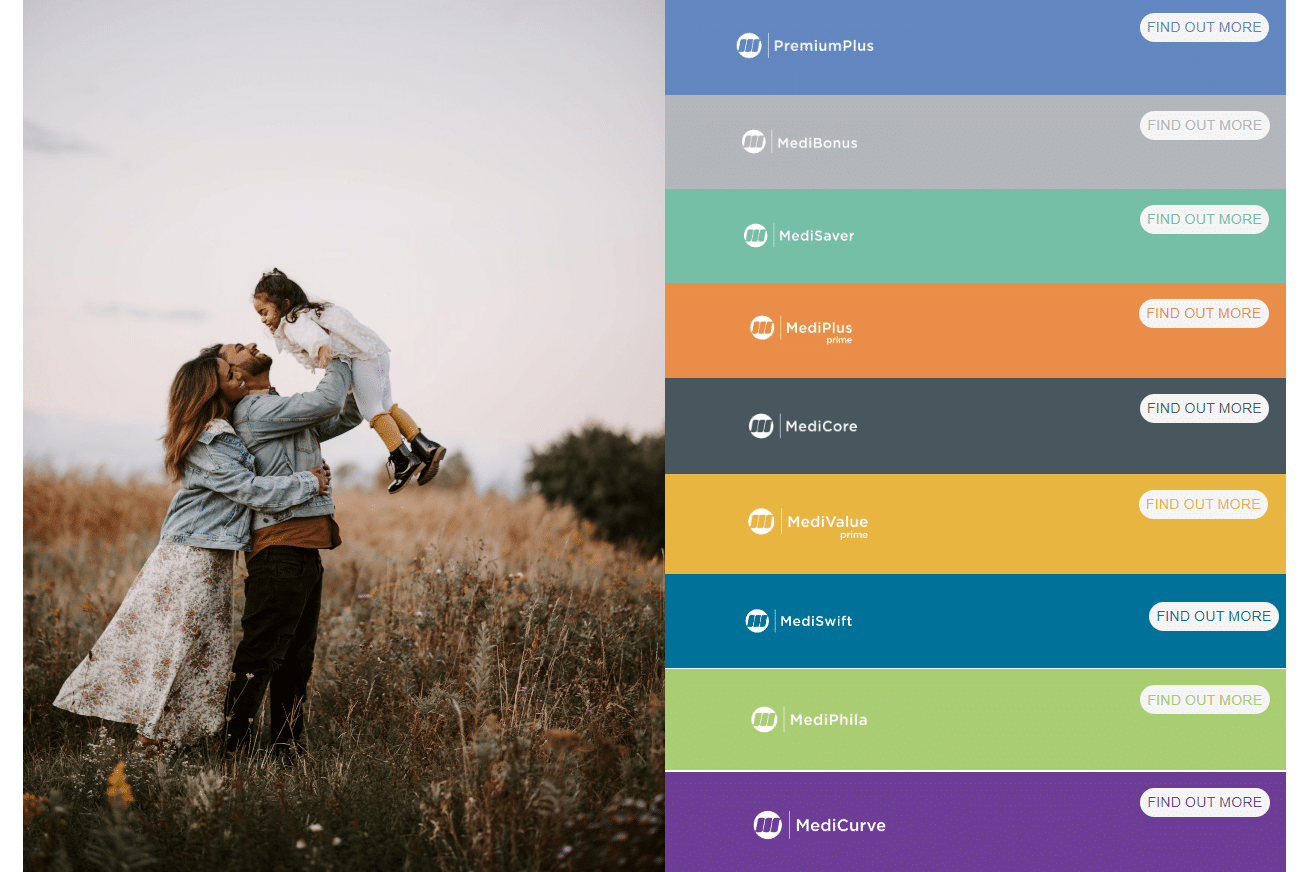

PremiumPlus

The PremiumPlus plan offers emergency medical response services by both air and road, a medical savings account, coverage for chronic medication, SmartCare benefits, Day-to-Day benefits, and more.

★★★★★ 4.5/5

Chronic Cover:

Day-to-Day:

Preventative Care:

Cancer Cover:

Hospitalisation:

Maternity Benefits:

The PremiumPlus plan offers emergency medical response services by both air and road, a medical savings account, coverage for chronic medication, SmartCare benefits, Day-to-Day benefits, and more.

Tax Deductible:

Travel Cover:

PremiumPlus

The PremiumPlus plan offers emergency medical response services by both air and road, a medical savings account, coverage for chronic medication, SmartCare benefits, Day-to-Day benefits, and more.

★★★★★ 4/5

Principle Member

From R7842

Dependant Member

From R7185

Child Dependant

From R1500

Chronic Cover:

Day-to-Day:

Preventative Care:

Cancer Cover:

Hospitalisation:

Maternity Benefits:

The PremiumPlus plan offers emergency medical response services by both air and road, a medical savings account, coverage for chronic medication, SmartCare benefits, Day-to-Day benefits, and more.

Tax Deductible:

Travel Cover: