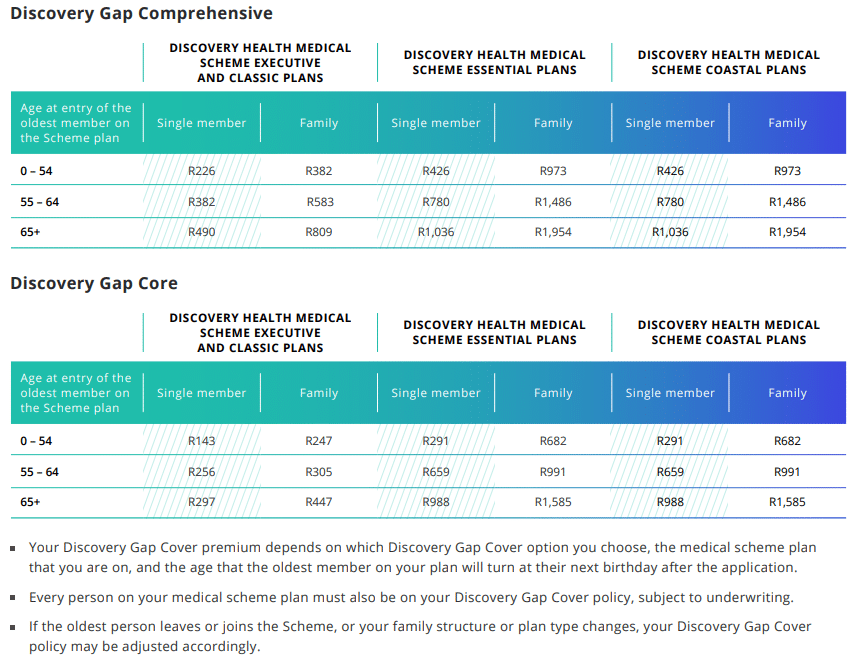

Monthly Premium

From R143

Waiting Period

12 months

Core

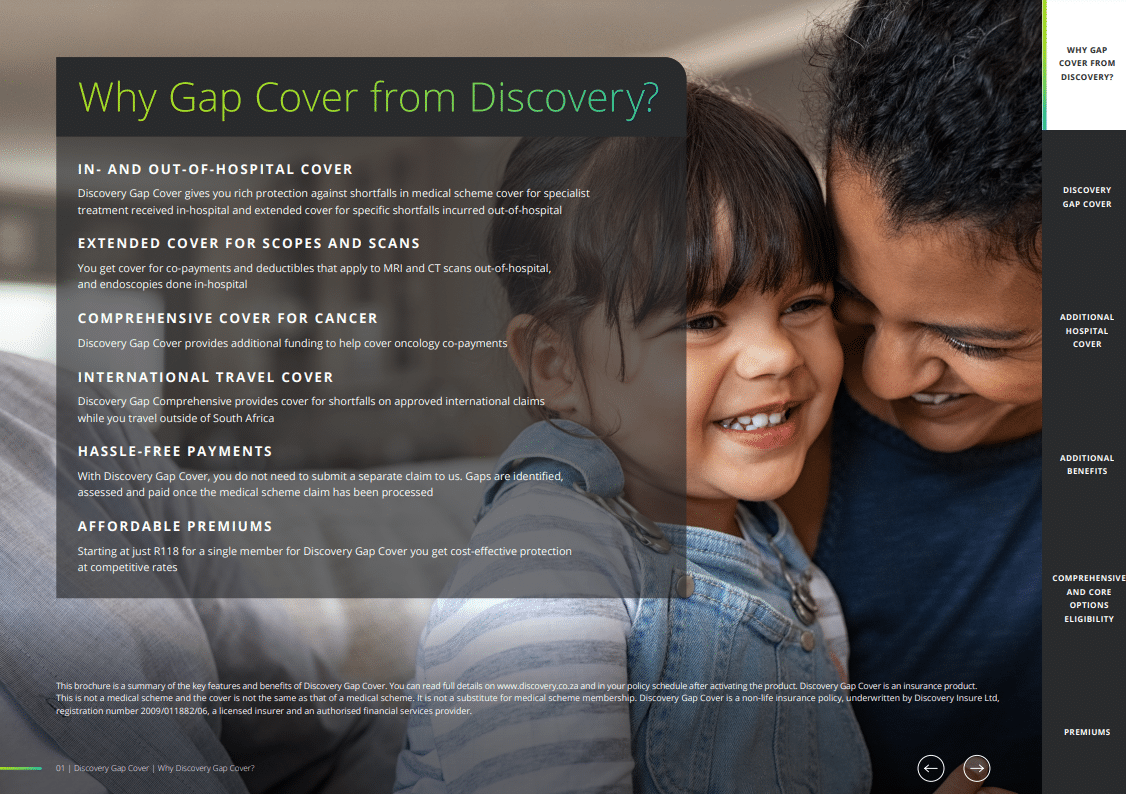

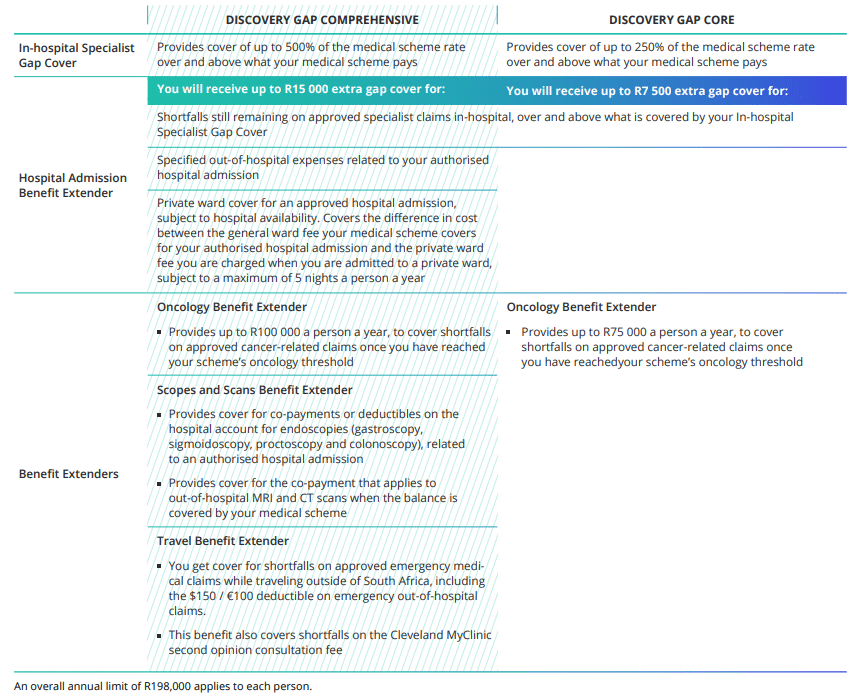

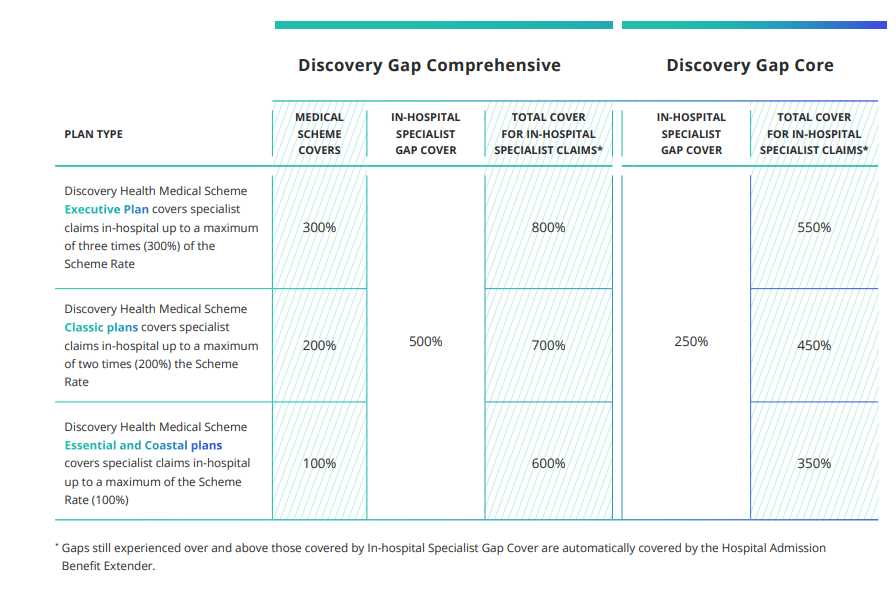

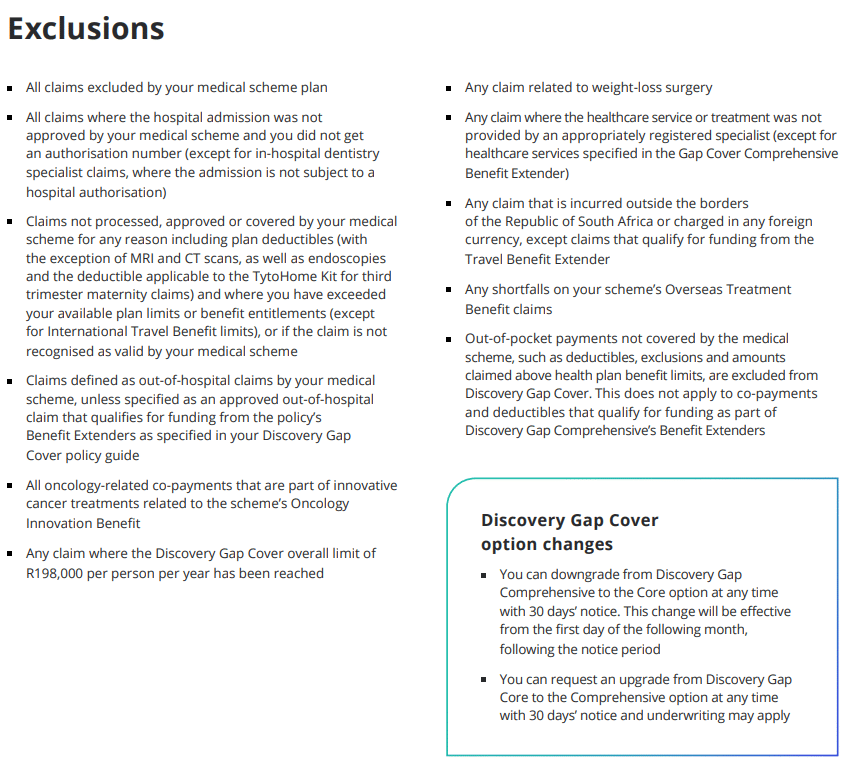

The Core Plan provides a range of benefits including coverage for oncology, both in and out-of-hospital services, scopes and scans, emergency room visits, and several other benefits.

★★★★★ 4.5/5

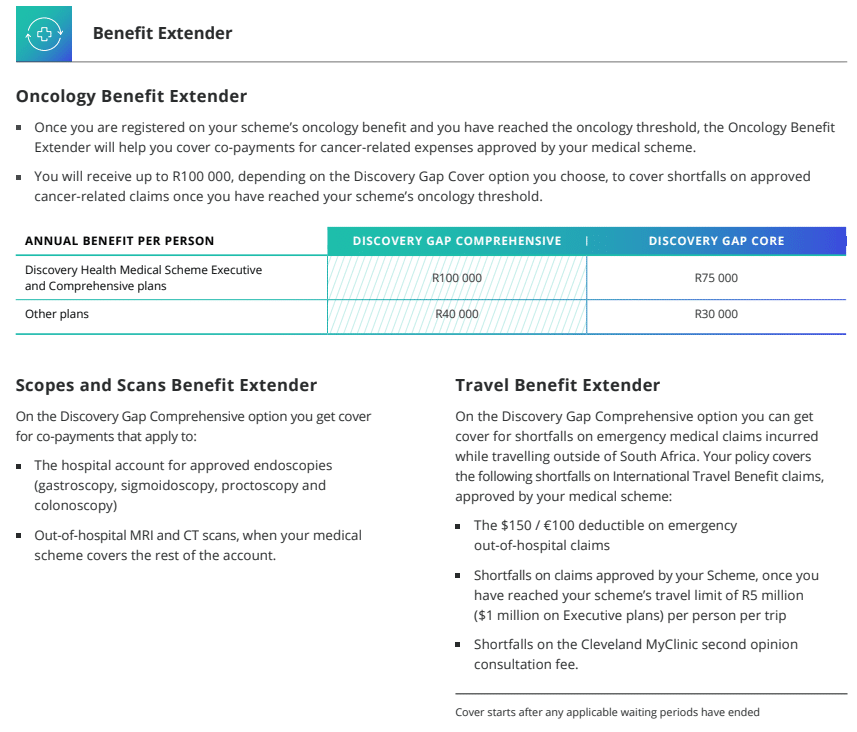

Oncology Benefits:

Scopes and Scans:

Accidental Cover:

Trauma Counseling:

Co-Payment Cover:

Maternity Benefits:

The Core Plan provides a range of benefits including coverage for oncology, both in and out-of-hospital services, scopes and scans, emergency room visits, and several other benefits.

In Hospital Benefits:

Out of Hospital Cover:

Tax Deductible:

Prostheses:

Core

The Core Plan provides a range of benefits including coverage for oncology, both in and out-of-hospital services, scopes and scans, emergency room visits, and several other benefits.

★★★★★ 4/5

Monthly Premium

From R143

Waiting Period

12 months

The Core Plan provides a range of benefits including coverage for oncology, both in and out-of-hospital services, scopes and scans, emergency room visits, and several other benefits.

In Hospital Benefits:

Out of Hospital Cover:

Tax Deductible:

Prostheses: