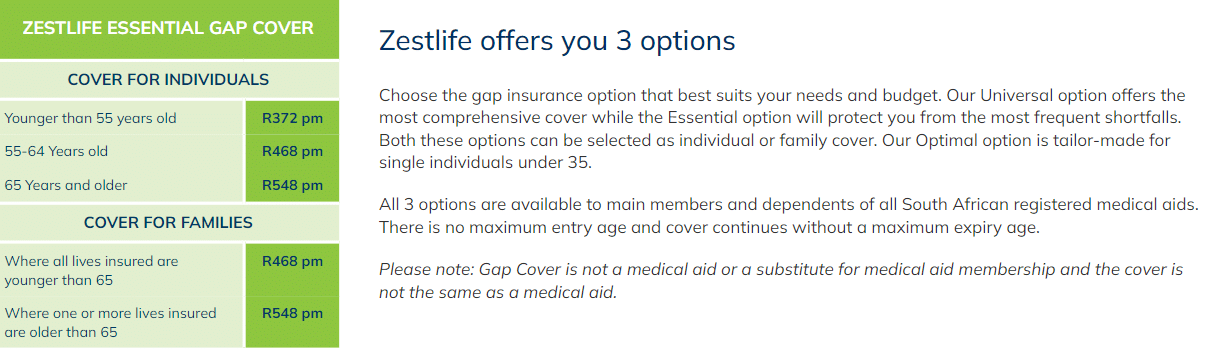

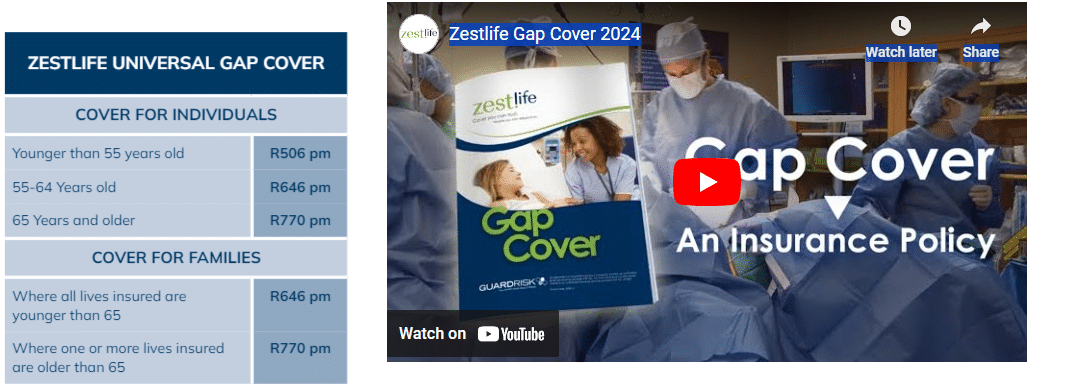

Monthly Premium

From R506

Waiting Period

3 - 12 months

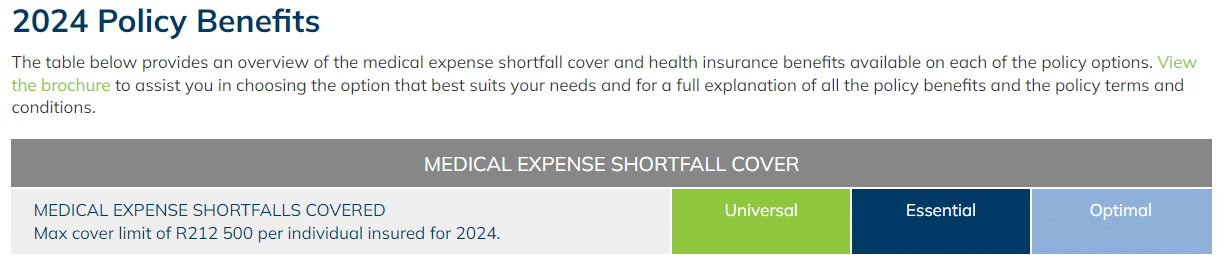

Universal

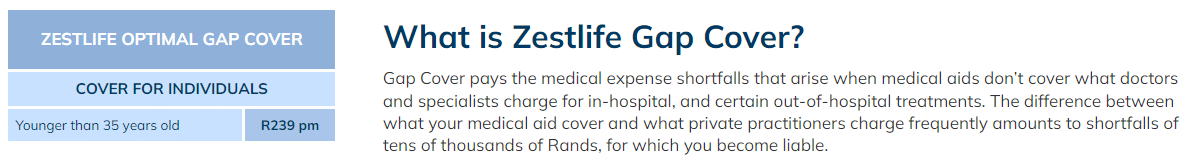

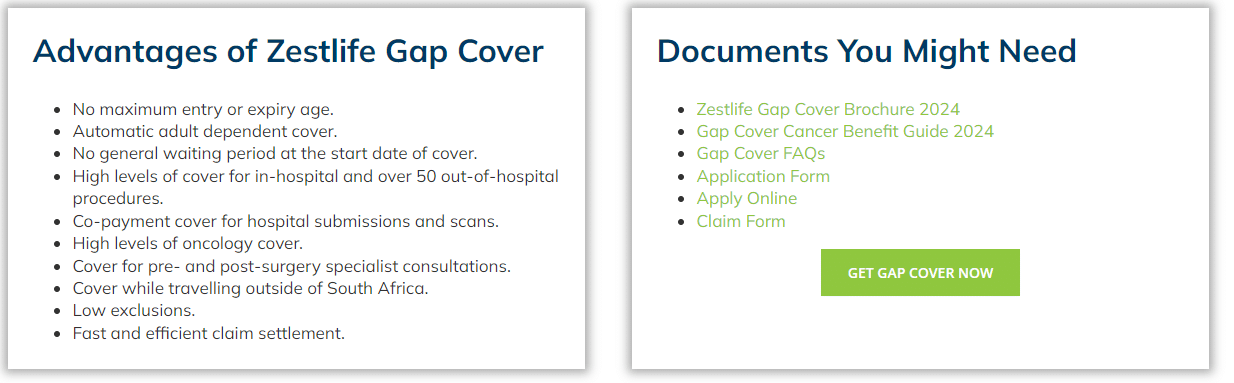

The Universal Gap Cover is a reliable short-term insurance product specifically crafted to offer additional protection for individuals who already possess medical aid.

★★★★★ 4.5/5

Oncology Benefits:

Scopes and Scans:

Accidental Cover:

Trauma Counseling:

Co-Payment Cover:

Maternity Benefits:

The Universal Gap Cover is a reliable short-term insurance product specifically crafted to offer additional protection for individuals who already possess medical aid.

In Hospital Benefits:

Out of Hospital Cover:

Tax Deductible:

Prostheses:

Universal

The Universal Gap Cover is a reliable short-term insurance product specifically crafted to offer additional protection for individuals who already possess medical aid.

★★★★★ 4/5

Monthly Premium

From R506

Waiting Period

3 - 12 months

The Universal Gap Cover is a reliable short-term insurance product specifically crafted to offer additional protection for individuals who already possess medical aid.

In Hospital Benefits:

Out of Hospital Cover:

Tax Deductible:

Prostheses: