Principle Member

From R1405

Dependant Member

From R1245

Child Dependant

From R649

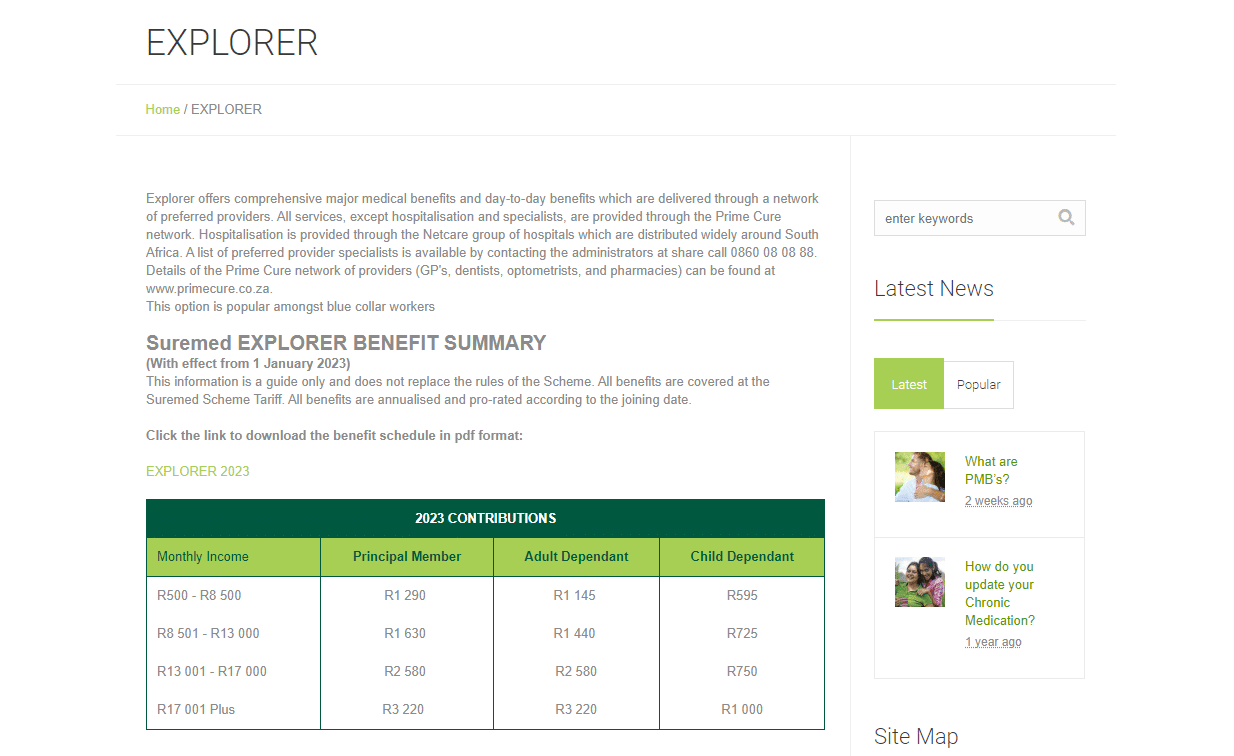

Explorer

The Explorer plan provides unlimited hospitalization in Netcare hospitals, a comprehensive network of medical professionals such as General Practitioners, Dentists, Optometrists, and Pharmacies, extended day-to-day benefits, and more.

★★★★★ 4.5/5

Chronic Cover:

Day-to-Day:

Preventative Care:

Cancer Cover:

Hospitalisation:

Maternity Benefits:

The Explorer plan provides unlimited hospitalization in Netcare hospitals, a comprehensive network of medical professionals such as General Practitioners, Dentists, Optometrists, and Pharmacies, extended day-to-day benefits, and more.

Tax Deductible:

Travel Cover:

Explorer

The Explorer plan provides unlimited hospitalization in Netcare hospitals, a comprehensive network of medical professionals such as General Practitioners, Dentists, Optometrists, and Pharmacies, extended day-to-day benefits, and more.

★★★★★ 4/5

Principle Member

From R1405

Dependant Member

From R1245

Child Dependant

From R649

Chronic Cover:

Day-to-Day:

Preventative Care:

Cancer Cover:

Hospitalisation:

Maternity Benefits:

The Explorer plan provides unlimited hospitalization in Netcare hospitals, a comprehensive network of medical professionals such as General Practitioners, Dentists, Optometrists, and Pharmacies, extended day-to-day benefits, and more.

Tax Deductible:

Travel Cover: