Monthly Premium

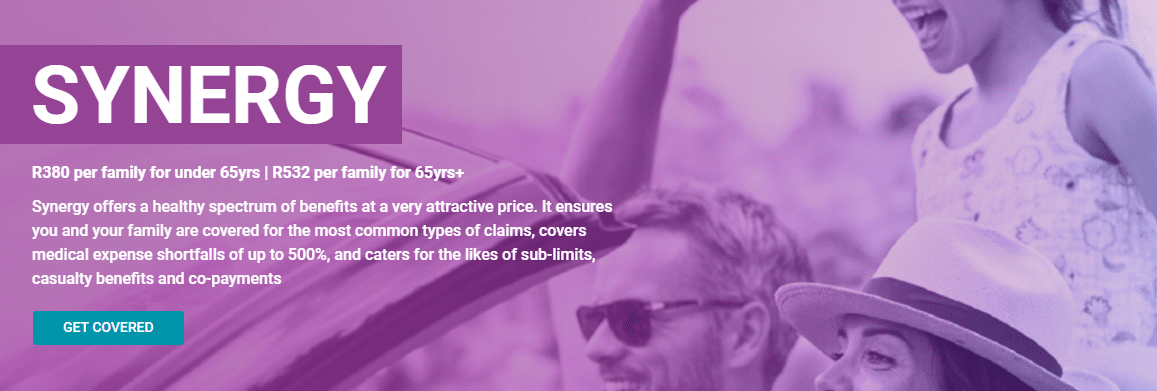

From R380

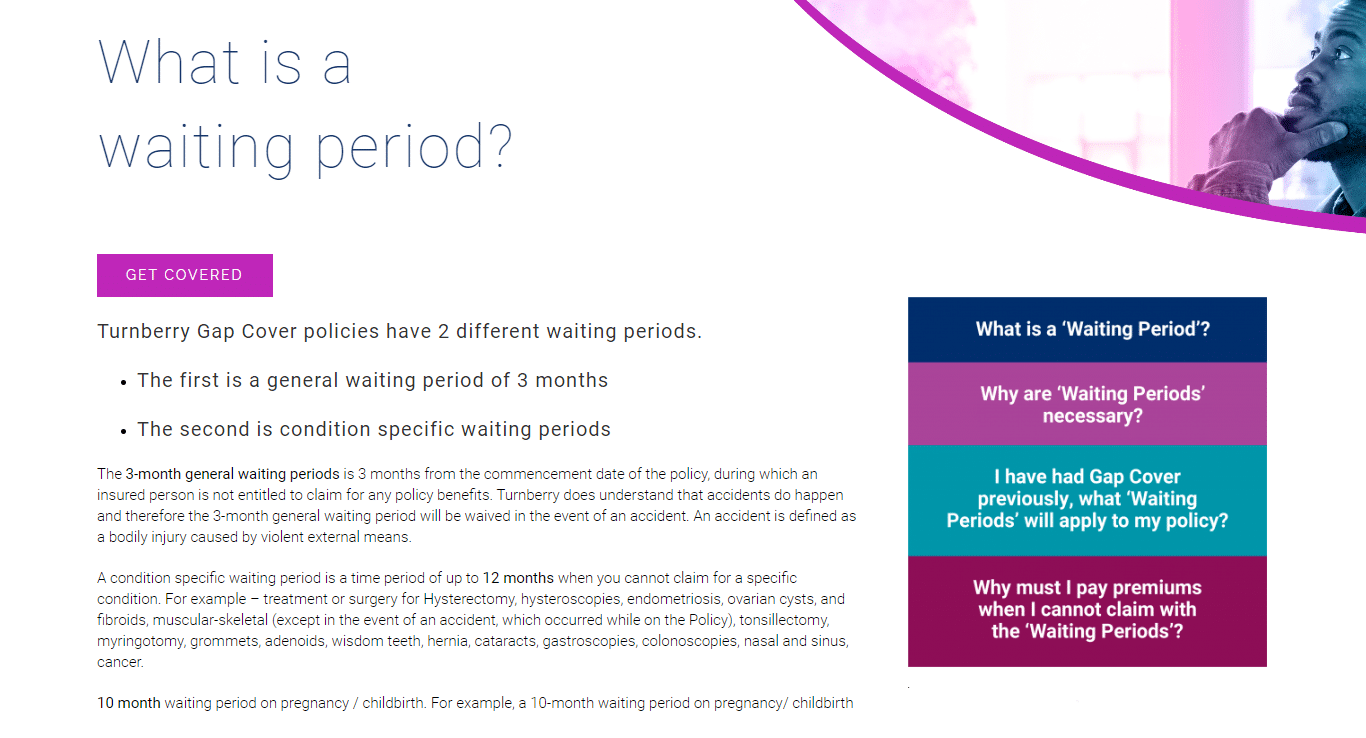

Waiting Period

3 - 12 months

Synergy

The Synergy Plan offers benefits for non-DSP hospital penalties, sub-limits, co-payments, reconstructive maxillofacial surgery, and various other additional advantages.

★★★★★ 4.5/5

Oncology Benefits:

Scopes and Scans:

Accidental Cover:

Trauma Counseling:

Co-Payment Cover:

Maternity Benefits:

The Synergy Plan offers benefits for non-DSP hospital penalties, sub-limits, co-payments, reconstructive maxillofacial surgery, and various other additional advantages.

In Hospital Benefits:

Out of Hospital Cover:

Tax Deductible:

Prostheses:

Synergy

The Synergy Plan offers benefits for non-DSP hospital penalties, sub-limits, co-payments, reconstructive maxillofacial surgery, and various other additional advantages.

★★★★★ 4/5

Monthly Premium

From R380

Waiting Period

3 - 12 months

The Synergy Plan offers benefits for non-DSP hospital penalties, sub-limits, co-payments, reconstructive maxillofacial surgery, and various other additional advantages.

In Hospital Benefits:

Out of Hospital Cover:

Tax Deductible:

Prostheses: