- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

KeyHealth Essence Medical Aid Plan

Overall, the KeyHealth Essence Medical Aid Plan is a trustworthy and comprehensive medical aid plan that offers 24/7 medical emergency assistance and unlimited cover in private and state hospitals to up to 3 Family Members. The KeyHealth Essence Medical Aid Plan starts from R1,990 ZAR.

| 👤 Main Member Contribution | R1,990 |

| 👥 Adult Dependent Contribution | R1,595 |

| 🍼 Child Dependent Contribution | R717 |

| 🌎 International Cover | None |

| 🔁 Gap Cover | ☑️ Yes |

| 💶 Prescribed Minimum Benefits | ☑️ Yes |

| 📉 Screening and Prevention | ☑️ Yes |

| 💙 Medical Savings Account | None |

| 🏥 Hospital Cover | Unlimited |

| 👶 Pre- and Postnatal Care | Antenatal |

KeyHealth Essence Plan – 8 Key Point Quick Overview

- ☑️ KeyHealth Essence Plan Overview

- ☑️ KeyHealth Essence Plan Contributions

- ☑️ Essence Plan Benefits and Cover Comprehensive Breakdown

- ☑️ Essence Smart Baby Program

- ☑️ Essence Plan Exclusions and Waiting Periods

- ☑️ KeyHealth Essence Plan vs. Similar Plans from other Medical Schemes

- ☑️ Our Verdict on The Essence Plan

- ☑️ Essence Plan Frequently Asked Questions

KeyHealth Essence Plan Overview

The KeyHealth Essence medical aid plan is one of 6, starting from R1,814, and includes unlimited cover in private and state hospitals, organ transplants, oncology, palliative care, and more. Gap Cover is available on the KeyHealth Essence Plan, along with 24/7 medical emergency assistance. According to the Trust Index, KeyHealth has a trust rating of 4.1.

KeyHealth offers 6 medical aid plans:

- 📌 KeyHealth Essence Medical Aid Plan

- 📌 KeyHealth Origin Medical Aid Plan

- 📌 Keyhealth Equilibrium Medical Aid Plan

- 📌 Keyhealth Silver Medical Aid Plan

- 📌 Keyhealth Gold Medical Aid Plan

- 📌 Keyhealth Platinum Medical Aid Plan

KeyHealth Essence Plan Contributions

| 👤 Main Member | 👥 Adult Dependent | 🍼 Child Dependent |

| R1,990 | R1,595 | R717 |

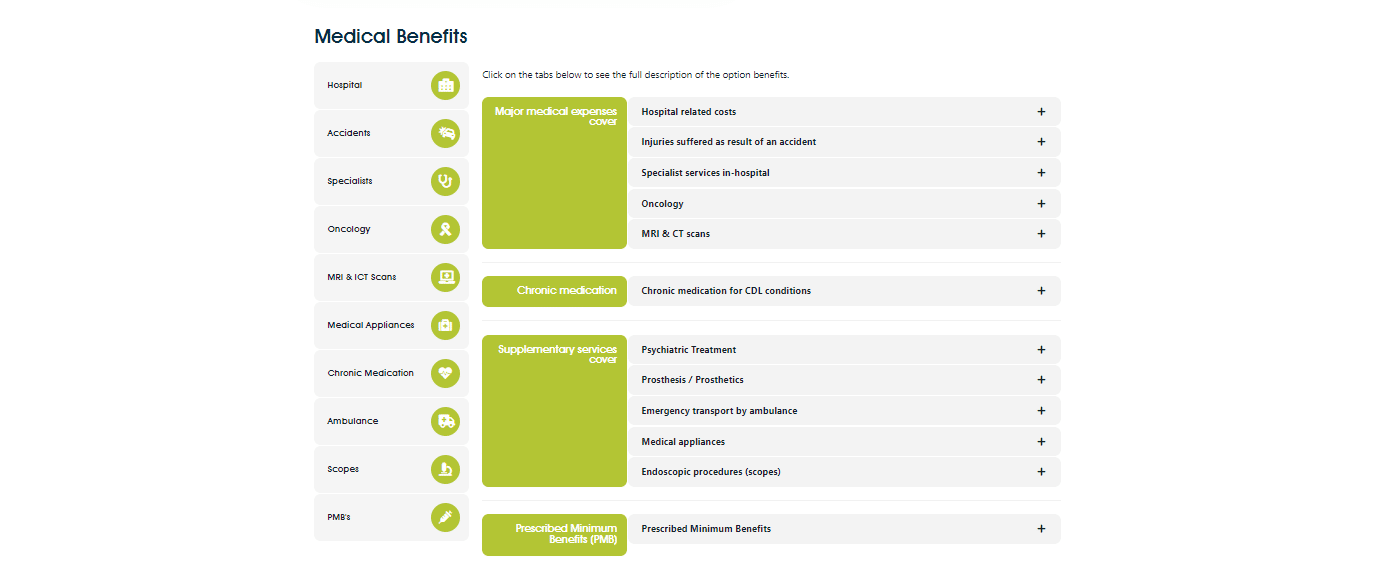

Essence Plan Benefits and Cover Comprehensive Breakdown

Essence Plan Major Medical Benefits

| 🔍 Hospitalization Varicose vein surgery Facet joint injections Rhizotomy Reflux surgery Back and neck surgery (incl. spinal fusion) Joint replacement | Only PMB. Case management and Scheme protocols cover all other procedures at 100% of the agreed rate. |

| 🏥 Private Hospital Admissions | Unlimited cover. Covered up to 100% of the agreed tariff. Subject to using DSP hospitals. A 30% co-payment will apply when using a non-DSP hospital. |

| 🚑 State Hospital Admissions | Unlimited covers up to 100% of the agreed tariff. |

| ⚕️ Specialist and Anesthetist Services | Covered up to 100% of the medical scheme tariff. Unlimited cover, subject to using a DSP. |

| 💊 Medication upon discharge | Covered up to 100% of the medical scheme tariff. Limited to R610 per admission. |

| ➡️ Sub-acute facilities and wound care Hospice Private Nursing Rehabilitation Step-down Facilities Wound Care | Covered up to 100% of the medical scheme tariff. Pre-approval needed. Subject to case management and scheme protocols. Only PMBs are covered. |

| 💖 Organ Transplants (Solid Organs, Tissue, and Corneas) Hospitalization Harvesting Drugs for Immuno-Suppressive Therapy | Covered up to 100% of the medical scheme tariff. Pre-approval is needed. Subject to case management. Only PMBs are covered in DSP hospitals. |

| ☑️ Renal Dialysis | Covered up to 100% of the medical scheme tariff. Pre-approval is needed. Subject to case management and scheme protocols. Only PMBs are covered. |

| ✅ Oncology | Covered up to 100% of the medical scheme tariff. Covered up to R180,000 per family per year. Pre-approval is needed. Subject to case management and scheme protocols. Must use a DSP for treatment. |

| 📌 Palliative Care | Covered up to 100% of the medical scheme tariff. Available instead of hospitalization. Pre-approval is needed. Subject to case management and scheme protocols. |

| 📈 Radiology | Covered up to 100% of the medical scheme tariff. Not covered if hospitalization admission is for investigative purposes. |

| 📉 MRI and CT scans | Limited to R19,000 per family per year. Combined in and out-of-hospital cover. |

| ❎ X-Rays | Unlimited cover. |

| 🩺 Pathology | Covered up to 100% of the medical scheme tariff. Unlimited cover. Not covered if admission is for investigative purposes. |

Essence Plan Out-of-Hospital Benefits

| 🅰️ Day-to-Day Benefits: Routine Medical Expenses | Covered up to 100% of the medical scheme tariff. Unlimited cover but only for PMB. |

| 🅱️ Day-to-Day Benefits: Pathology | Covered up to 100% of the medical scheme tariff. Only PMBs are covered. |

| 👨⚕️ Antenatal Visits to a GP, Gynaecologist, or midwife and a Urine Test | Covered up to 100% of the medical scheme tariff. Pre-notification and pre-approval are needed. Twelve visits were covered. |

| 📈 Ultrasounds – one before the 24th week and one after | Covered up to 100% of the medical scheme tariff. Pre-notification and pre-approval are needed. Limited to two scans per pregnancy. |

| 💶 Short Payments / Co-payments for services rendered and birthing fees | Covered up to R1,370 per pregnancy. |

| 🍼 Paediatrician Visits | Covered up to 100% of the medical scheme tariff. The baby must be registered on the scheme. Limited to 2 visits (one within the first and one in the second year) |

| 💊 Antenatal Vitamins | Covered up to 100% of the medical scheme tariff. Limited to R2,320 per pregnancy. |

| 📍 Antenatal Classes | Covered up to 100% of the medical scheme tariff. Limited to R2,320 for the first pregnancy. |

| 🦷 Conservative Dentistry: Consultations | Covered up to 100% of the medical scheme tariff. One check-up per beneficiary yearly. Two infection control treatments. One sterilized instrumentation benefit per beneficiary yearly. |

| ❎ Conservative Dentistry: Intra-oral X-Rays | Covered up to 100% of the medical scheme tariff. Limited to four intra-oral radiographs (periapical or bitewing) |

| ⬇️ Pap Smear (Pathology) | Once per year. Female beneficiaries 15> |

| ➡️ Pap Smear Consultation Pelvic Organs Ultrasound | Once per year. Female beneficiaries 15> |

| 📉 Mammogram | Once per year. Female beneficiaries 40> |

| 📊 Prostate Specific Antigen (PSA) | Once per year. Male beneficiaries 40> |

| 💗 HIV/AID Tests | Once per year. All beneficiaries are covered. |

| 🩸 Health Assessment Body Mass Index (BMI) Blood Pressure Measurement Cholesterol Test (Finger prick) Blood Sugar Test (Finger prick) PSA (Finger Prick) | Once per year. All beneficiaries are covered. |

| 👶 Baby Immunisation | Child dependents <6 years. According to the Department of Health schedule. |

| 💉 Flu Vaccination | All beneficiaries are covered. |

| 😷 COVID-19 Vaccination | All beneficiaries are covered. |

| ✔️ Pneumococcal Vaccination | All beneficiaries are covered. |

| 🦟 Malaria Medication | All beneficiaries are covered. Limited to R440 per year. |

| 🚼 Baby Growth Assessment | Three yearly assessments at a pharmacy or baby clinic for babies <35 months. |

| 🚸 Contraceptive Medication – Tablets and Patches | Limited to R175 every 20 days. Female beneficiaries 16> |

| 🚸 Contraceptive Medication – Injectables | Limited to R270 every 20 days. Female beneficiaries 16> |

| ⚖️ Weight Loss Program | Beneficiaries with a BM of 30> will receive the following: Three dietician consultations (one per week) One biokinetics consultation. Three additional dietician consultations per week if a weight loss chart was received, proving weight loss after the first three weeks. One follow-up with biokinetics. |

Essence Plan Chronic Benefits

| 🅰️ Category A CDL | Covered up to 100% of the medical scheme tariff. Unlimited cover. Subject to reference pricing and protocols. Beneficiaries must register on the Disease Risk Program. |

Discover more: 5 Best Medical Aids under R300

Essence Plan falls within Category A of the CDL of KeyHealth and covers a selection of conditions, including:

- ✅ Addison’s Disease

- ✅ Asthma

- ✅Bipolar Mood Disorder

- ✅ Bronchiectasis

- ✅ Cardiac Failure

- ✅ Cardiomyopathy Disease

- ✅ Chronic Renal Disease

- ✅ Coronary Artery Disease

- ✅ Crohn’s Disease

- ✅ Chronic Obstructive Pulmonary Disorder

Essence Plan Supplementary Benefits

| 📌 Psychiatric Treatment | Limited to R22,900 per family per year. Covered up to 100% of the medical scheme tariff. Pre-approval is required. Subject to case management. Out-of-hospital is only covered for PMB. |

| 🩸 Blood Transfusions | Covered up to 100% of the medical scheme tariff. Unlimited cover. Pre-approval required. |

| 🦵 Prostheses Internal External Fixation Devices Implanted Devices | Only PMBs are covered. Covered up to 100% of the medical scheme tariff. Pre-approval is required, and it is subject to case management. Covered according to reference pricing. Scheme protocols will apply, and beneficiaries must use a preferred provider. |

| 😷 HIV/AIDS | Unlimited cover. Covered up to 100% of the medical scheme tariff. Must be registered with the Chronic Disease Risk Program (LifeSense) |

| 🚑 Ambulance Services | Subject to protocols. |

| 👩🏻🦼 Wheelchairs Orthopaedic Appliances Incontinence Equipment | Covered up to 100% of the medical scheme tariff. Limited to R8,400 per family per year. Combined benefits for in and out-of-hospital. Subject to quantities and protocols. |

| 🫁 Oxygen Nebulizers Glucometer Blood Pressure Monitor | Pre-approval is required and will be subject to approval. |

| ☑️ Colonoscopy or gastroscopy | Covered up to 100% of the medical scheme tariff. Pre-approval is required. Co-payments do not apply when using a DSP hospital and specialist for out-of-hospital services for PMB. |

| ✅ Endoscopic Procedures (Scopes): All other procedures | Covered up to 100% of the medical scheme tariff. Pre-approval is required. Co-payments do not apply when using a DSP hospital and specialist for out-of-hospital services for PMB. |

Read also about Medical Aid plans that cover Motor Neurone Disease

Essence Smart Baby Program

The Smart Baby Programme by KeyHealth provides expecting mothers and fathers with general guidance and support on health and well-being throughout the pregnancy while ensuring peace of mind.

Smart Baby Program Features

- Coverage under Health Booster for antenatal visits (GP, gynecologist, or midwife), scans, and birthing fees that require short/co-payments.

- Provision of KeyHealth’s maternity benefits and instructions on how to access them.

- The New Baby and Childcare Handbook, authored by Marina Petropulos, is specifically for first-time parents.

- Information on the initial year of the baby’s life, including vaccinations, Easy-ER, and other details.

- Availability of Netcare 911’s 24-hour Health-on-Line service at 082 911 for medical advice and insights from a registered nurse.

READ more: 5 Best Medical Aids for Babies in South Africa

Smart Baby Program Benefits

The Smart Baby Programme benefits accessible to women (and babies) are distinct from day-to-day benefits and medical savings accounts.

| 🩺 Antenatal visits | Twelve visits, one of which is after the birth. |

| 🍼 Ultrasounds | Limited to two pregnancy ultrasounds. |

| 👩⚕️ Paediatrician Visits (after the baby is a registered beneficiary) | Limited to two visits in the baby’s first year. |

| 💊 Antenatal vitamins | Limited to R2,320 per pregnancy. |

| ☑️ Antenatal classes | Limited to R2,320 per pregnancy. |

Essence Plan Exclusions and Waiting Periods

Exclusions

The KeyHealth Essence Plan has the following specific exclusions:

Hospitalization benefits for the following procedures:

- Varicose vein

- Facet joint injections

- Rhizotomy

- Back surgery (including spinal fusion)

- Joint replacements (e.g., hip and knee)

- Hernia procedures requiring a prosthesis / internal fixation device

- Specialized Dentistry

- Prosthesis benefits

Waiting Periods

If a Principal Member or their dependent is diagnosed with a specific illness, the Scheme reserves the right to exclude benefits for this condition for 12 months. Subject to the regulations, KeyHealth can impose waiting periods on an individual who applies for membership or admission as a dependent and has not been a beneficiary of a medical scheme for a minimum of 90 days before the application date. Such waiting periods may include the following:

- A general waiting period of up to 3 months also encompasses PMB conditions.

- A condition-specific waiting period of up to 12 months, including PMB conditions.

If an individual who applies for membership or admission as a dependent was previously a beneficiary of a medical scheme for a continuous period of up to 24 months, which ended less than 90 days before the application date, Keyhealth could impose the following:

- A condition-specific waiting period of up to 12 months, except for any treatment or diagnostic procedures covered within PMB conditions.

If the previous medical scheme had imposed a general or condition-specific waiting period on such an individual, and the waiting period had not expired at the time of termination, Keyhealth could impose a waiting period for the remaining duration as imposed by the previous medical scheme. However, any child born into the Scheme during membership will not be subject to waiting periods. Furthermore, Keyhealth can impose the following:

- A general waiting period of up to 3 months, except for any treatment or diagnostic procedures covered within PMB conditions, on any person who applies for membership or admission as a dependent and was previously a beneficiary of a medical scheme for a continuous period of more than 24 months, which ended less than 90 days before the application date.

You might consider Health Insurance for Travel

KeyHealth Essence Plan vs. Similar Plans from other Medical Schemes

| 🔎 Medical Aid Plan | 🥇 KeyHealth Essence | 🥈 Fedhealth FlexiFED 1 | 🥉 Bestmed Beat 1 |

| 👤 Main Member Contribution | R1,990 | R1,716 | R2,082 |

| 👥 Adult Dependent Contribution | R1,595 | R1,341 | R1,616 |

| 🍼 Child Dependent Contribution | R717 | R625 | R875 |

| 🌎 International Cover | None | None | R10 million |

| 🚑 Hospital Cover | Unlimited | Unlimited | Subject to scheme rules |

| 💶 Prescribed Minimum Benefits | ☑️ Yes | ☑️ Yes | ☑️ Yes |

| 📉 Screening and Prevention | ✅ Yes | ✅ Yes | ✅ Yes |

| 💳 Medical Savings Account | None | ☑️ Yes | ☑️ Yes |

| 👶 Maternity Benefits | ✅ Yes | ✅ Yes | ✅ Yes |

Our Verdict on The Essence Plan

KeyHealth Essence is a medical aid plan offered by KeyHealth, a registered medical aid scheme in South Africa. The plan is one of six available and starts at a monthly contribution of R1,814 for the main member, with unlimited cover in private and state hospitals, organ transplants, oncology, palliative care, and more. The plan offers additional benefits through the Smart Baby Program, which provides expecting mothers and fathers with general guidance and support on health and well-being throughout the pregnancy while ensuring peace of mind. The plan has specific exclusions, such as hospitalization benefits for specific procedures and waiting periods for new members. Overall, KeyHealth Essence offers comprehensive medical coverage for individuals and families at competitive prices.

You might also like: KeyHealth Equilibrium

You might also like: KeyHealth Gold

You might also like: KeyHealth Origin

You might also like: KeyHealth Platinum

You might also like: KeyHealth Silver

Essence Plan Frequently Asked Questions

What is KeyHealth Essence?

KeyHealth Essence is a low-cost medical aid option offering members essential healthcare coverage.

What benefits are covered under the Keyhealth Essence medical aid plan?

The Keyhealth Essence medical aid plan offers a range of benefits including hospitalization, chronic medication, day-to-day medical expenses, and preventative care services such as child immunizations and cancer screenings.

Can I choose my own healthcare providers under the Keyhealth Essence medical aid plan?

Yes, you have the flexibility to choose your own healthcare providers under the Keyhealth Essence medical aid plan. However, using in-network providers may result in lower out-of-pocket costs.

Does the Keyhealth Essence medical aid plan cover pre-existing medical conditions?

Yes, pre-existing medical conditions are covered under the Keyhealth Essence medical aid plan, subject to waiting periods and other policy terms and conditions.

What is the claims process for the Keyhealth Essence medical aid plan?

To make a claim under the Keyhealth Essence medical aid plan, you can submit a claim online, via email, or by mail. Claims will be processed within a specified timeframe and reimbursed according to the plan benefits.

Are there any exclusions or limitations to the Keyhealth Essence medical aid plan benefits?

Yes, there are certain exclusions and limitations to the Keyhealth Essence medical aid plan benefits, such as cosmetic surgery, experimental treatments, and non-essential medical procedures. It is important to review the policy terms and conditions carefully to understand the full scope of coverage.

How does Keyhealth Esscence plan hospitalization work?

The Keyhealth Essence plan provides unlimited hospitalization cover for up to three family members in both private and state hospitals.

You might also like

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans