5 Best Hospital Plans under R1500 in South Africa

The 5 Best Hospital Plans under R1500 in South Africa revealed.

We tested them side by side and verified their hospital plans.

This is a complete guide to the best hospital plans under One Thousand Five Hundred in South Africa.

In this in-depth guide you’ll learn:

- What is a Medical Aid?

- How do you find affordable hospital plans in South Africa under R1500?

- How to choose the best affordable hospital plans for your needs?

- How to compare hospital plans against each other? (Rates and Prices)

So if you’re ready to go “all in” with the best hospital plans under R1500 in South Africa, this guide is for you.

Let’s dive right in…

Best Hospital Plans under R1500 (2024)

| 🩺 Medical Aid | ✔️ Offers Hospital Plans Under R1500? | ⚕️ Plan Offered | 💵 Pricing | 👉 Sign Up |

| 1. Genesis Medical Aid | Yes | Med 100 Hospital Plan | R1 530 per member per month | 👉 Apply Now |

| 2. Momentum | Yes | Evolve Plan | R1 687 per month per member | 👉 Apply Now |

| 3. Discovery Health | Yes | KeyCare Core and KeyCare Start | R1 239 per member per month | 👉 Apply Now |

| 4. NetCare | Yes | NetCare Accident and Trauma Cover | R280 per member per month | 👉 Apply Now |

| 5. Affinity Health | Yes | Affinity Health Hospital Plan | R1 258 per member per month | 👉 Apply Now |

Other Affordable Hospital Plans to consider in South Africa:

✅ Profmed ProSelect Savvy plan is a medical options that require the use of hospital networks. This means reduced contributions to better suit your pocket. ProSelect Savvy is the ideal solution for young members choosing medical aid for the first time. The Main Member can get cover from R956 per month subject to income category.

✅ The SureMed Shuttle option provides extensive private hospital cover for both planned procedures and emergencies, as well as comprehensive day-to-day benefits including medicine, dentistry, optometry and doctor visits. The Main Member can get cover from R1,150 per month subject to income category.

5 Best Hospital Plans under R1500 (2024)

- Genesis Medical Scheme – Overall, Best Hospital Plans Under R1500

- Momentum Health – Top Extensive Medical Protection in South Africa

- Discovery Health – Broadest Range of Low-Cost Medical Aid Plans

- NetCare – Best Pay-As-You-Go Private Healthcare

- Affinity Health – Best Customer Service Medical Aid

Why more South Africans need affordable hospital plans

👉 This article compares and contrasts the prices of five different South African medical aid policies for the year 2024.

👉 Recent data from the South African Customer Satisfaction Index for medical schemes suggests that many members will have switched to plans with cheaper benefits. Participating members seek a happy medium between cost and other factors.

👉 A hospital stay might cost hundreds of thousands, if not millions, of Rands. As a result, it is crucial that you have adequate risk coverage (i.e. hospital and related costs).

👉 More people are thinking about purchasing good value-for-money hospital insurance now that they can handle their regular expenses on an as-needed basis.

👉 There may be more member departures from the medical schemes business in 2024 as a result of the harsh economic climate. Consumers can no longer afford the high costs of medical aid. Many people who have medical aid are trying to find plans with lower premiums.

👉 Towards the end of 2021, the CMS suggested that medical plans think about capping their increases for at 4.2%. Contribution hikes have been declared by the majority of medical plans.

👉 In an effort to reduce members’ financial burdens, some plans have delayed contribution hikes for a period of a few months. A number of other plans held their yearly cost of living adjustments down to levels below the recommended rise.

READ more about Medical Insurance for women that are pregnant

How to choose a hospital plan

👉 A hospital plan, like comprehensive medical aid, is a type of risk-based insurance that, in exchange for a monthly premium, covers all of your medical expenses.

👉 The main difference is that medical aid pays for both emergency and routine care outside of the hospital, and frequently includes other value-added services like preventative care programmes and discounts at the dentist and eye doctor.

👉 A hospital plan may be less expensive overall, but it will not cover your out-of-hospital medical bills or prescription medication. Even if you go to the ER and are not hospitalised, you will still have to pay for your care out of pocket.

👉 Nevertheless, not all medical aid schemes are the same. The cost of staying in a hospital might be covered by either medical aid or insurance.

READ more about Hospital Plan vs Medical Aid – A Beginners Guide

Hospital plans offered by medical aid schemes

👉 Medical schemes that include hospitalisation are protected by the Medical Schemes Act, which means that you cannot be denied membership and that the scheme is required to pay for your hospitalisation fees and other specified benefits (or PMBs).

👉 Additional coverage, such as limited day-to-day benefits, may be included in some of these hospital plans. If your medical aid policy covers medical expenses outside of a hospital, you may be compelled to see a specific doctor or visit a specific clinic for routine care, known as a “designated service provider” (DSP).

👉 You may be responsible for paying for expensive medical care out of pocket if you don’t utilise a DSP. If you don’t have convenient access to a doctor or hospital on the approved list, this could be an issue.

Cash-back hospital plans

👉 In this case, the insured receives a single payment from the insurance company regardless of the number of days he or she actually spends in the hospital.

👉 Instead of using a cash-back plan as your sole form of medical protection, you should consider supplementing it with another type of health insurance.

👉 If this is your sole form of insurance, medical professionals may be hesitant to treat you because there is no assurance you will actually pay for your care.

Hospital plans offered by insurance companies

👉 Hospital insurance plans sold by insurance companies are considered financial products and are not subject to the Medical Schemes Act’s oversight.

👉 As a result, your insurance coverage may be cancelled if you make too many claims or outright denied if the insurance company evaluates you as too great a risk.

👉 On the other hand, medical aids are required by law to pay for the diagnosis and treatment of a long list of chronic diseases and ailments known as “prescribed minimum benefits” (PMBs).

You might also like the best medical aid under R1000 per month in South Africa

What do hospital plans cover?

👉 In recent years, consumers have had a wider variety of options in the insurance market because of industry developments. Full medical aid used to be the only choice for health coverage.

👉 There appear to be a variety of programmes available now that can be adapted to meet a wide range of financial constraints. These days, a household can decide between medical aid, hospital plans, hospital cover, and medical help.

👉 Basic medical care expenses incurred while hospitalised are covered by a hospital plan. This medical scheme is provided by a non-profit organisation and will help pay for your medical care while you are hospitalised, but it is not comprehensive medical aid.

👉 Many schemes charge different prices for hospital plans since they negotiate coverage individually and set their own restrictions and exceptions. The plan you have will determine whether or not you will be responsible for any out-of-pocket costs associated with medical services.

👉 Whether you need to go to the hospital in South Africa for any reason—a procedure, an accident, or an illness—the best hospital plan will cover all of your expenses. When committing to a hospital plan provider, it’s important to learn what services will be covered. You should be ready to make a co-payment for some procedures.

👉 Daily costs are not covered by hospital plans, but all medical aid plans are required to cover at least 27 chronic diseases.

👉 If you are just starting out in your profession and require reasonably priced cover in case of an emergency, a hospital plan is a good choice. When compared to a comprehensive medical aid policy, the cost is far more manageable.

👉 Most people, according to statistics, begin their medical coverage journey with a hospital plan and progress to other types of medical aids as their needs evolve. Most people don’t switch to medical aid coverage until they’re older or have started a family.

👉 In conclusion, selecting a medical plan is a personal decision, but given the rising cost of healthcare, a hospital plan is preferable to going without any protection at all.

1. Genesis Medical Scheme

Overview

👉 Genesis has been the go-to medical aid provider in South Africa by continually providing its members with superior coverage at affordable prices.

👉 Genesis has lately been regarded as one of the most successful schemes in South Africa, based on objective indicators including claims ratio, ability to pay claims, access to medical facilities, and benefits delivered relative to contributions charged.

👉 In comparison to other South African medical aid schemes, Genesis offers its members superior financial security, greater value for their money, a wider range of benefits, and higher quality service.

👉 Genesis has been at the forefront of minimal contribution increases coupled with enhanced benefits over the past few years thanks to the excellent management and administration of the Plan.

👉 The average annual growth in Genesis members’ contributions was only 6.4% in 2014, much lower than the average increase across all open schemes.

Genesis Hospital Plans are Available Under R1500

👉 Genesis offers a comprehensive hospital plan that costs less than R1500 per month in 2023. This plan cost now R1,530 per month for 2024.

Med 100 Hospital Plan

👉 You and your family should enrol in this hospital plan while still young. Any and all hospitalisations, planned or otherwise, are covered by the policy.

👉 The Scheme Tariff covers the full cost of any doctor’s visit, no matter who you see. Genesis provides additional benefits for essential dental care at no extra cost to you.

➡️ The Med 100 Hospital Plan is available at R1 530.00 a month

How Much Are Genesis Medical Aid Monthly Premiums?

👉 Genesis Medical Aid premiums are highly competitive and range from R1,530.00 to R3,000.00

What Is the Waiting Period for Genesis Medical Aid’s Benefits?

👉 Genesis Medical Scheme’s general waiting period is 3 consecutive months and the condition-specific waiting period is 12 consecutive months.

How to Claim for Genesis Medical Aid Benefits

➡️ Genesis will accept signed claims by the principal member via e-mail, fax, post or by hand.

➡️ Where a member has paid an account, please attach the receipt to the claim. Claims can be scanned and e-mailed to [email protected] or faxed to 021 447 4707.

➡️ Alternatively, a PDF document(s) or a good-quality photo (image) of the claim, clearly indicating your membership details, may also be emailed to the Scheme directly from your Smartphone App.

➡️ Always ensure that you insert your membership number in the “Subject Line” of claims that are sent via email.

➡️ Monthly statements will be sent to each member that has claimed in that month. Alternatively, members can log in to the secured Member section on the website or mobile app to view the status of their claims.

➡️ Genesis encourages members to check that the services were in fact rendered to them or their dependents.

Genesis Medical Aid Contact Details

Email: [email protected]

Existing Members – 0860 10 20 10

New Members – 0861 56 46 66

Read more about Genesis MED 200 Plus

2. Momentum Health

Overview

👉 Momentum Health is run by one of South Africa’s largest and most respected healthcare service companies, making it one of the top three open medical schemes in the country.

👉 Momentum Health’s key goal is to ensure the scheme’s long-term stability while also providing exceptional value to members.

👉 Momentum Health Solutions is a large, low-cost medical provider network that members can use.

👉 Members can choose from many choices, such as a 24/7 medical advice line run by “Hello Doctor” and networks of doctors who have joined Momentum to get financial incentives for providing care.

👉 Momentum’s actuarial services can be used to design and price incentive and reward programmes that encourage members to maintain a healthy lifestyle.

👉 Momentum is able to help its clients save money and make better healthcare decisions by grouping them into care cohorts and then offering individualised support through its advocacy programmes.

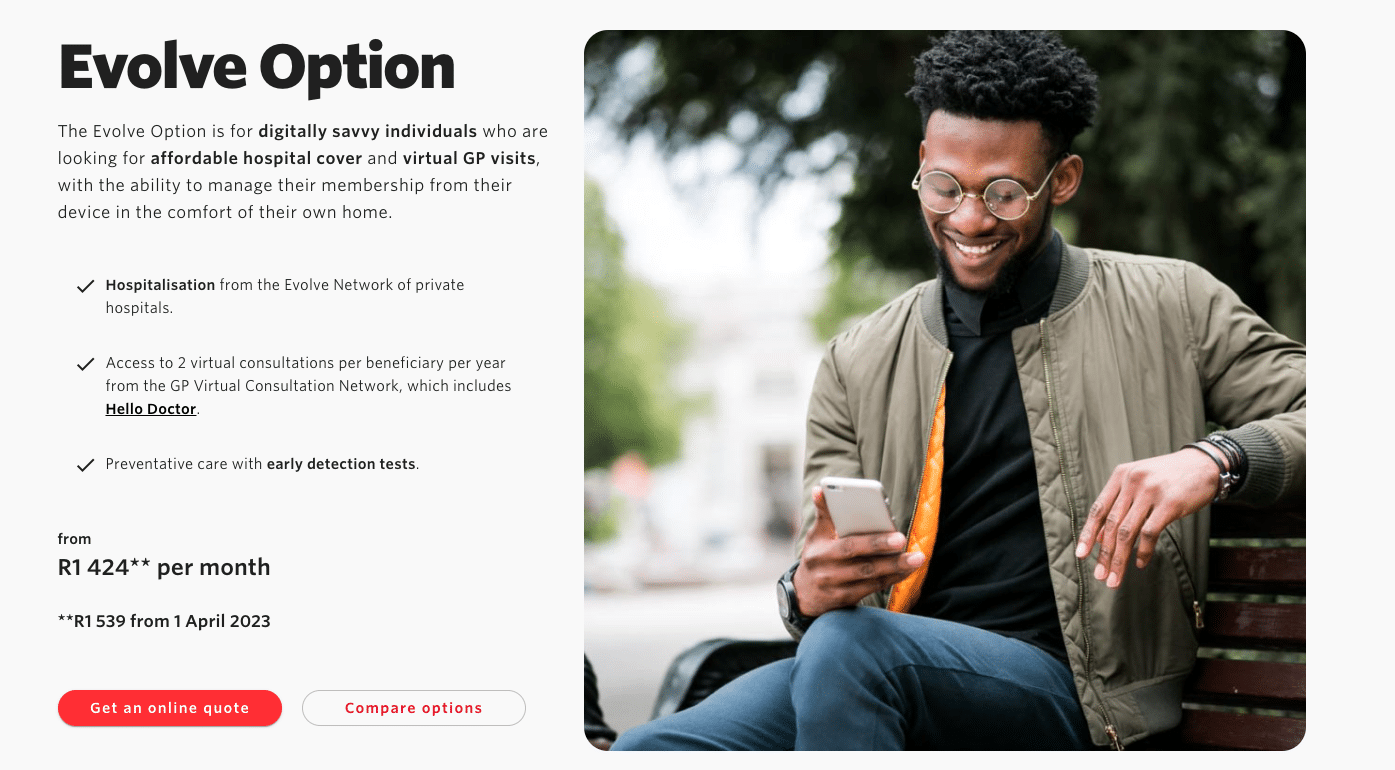

Momentum Hospital Plans are Available Under R1500

👉 Momentum Health offers a comprehensive hospital plan that costs less than R1500 per month in 2023. With the increase for 2024 the same plan cost R1,687

Evolve

👉 Using the Evolve plan, you can visit any private hospital in the Evolve Network and receive coverage for two virtual doctor appointments (no yearly cap). The HealthSaver+ plan is for supplemental benefits used frequently. There is now a sports injury benefit of up to R1,000 per beneficiary per year, good for up to two visits to a physiotherapist or biokineticist.

➡️ The Evolve Plan is available from R1 687.00 per month

How Much Are Momentum Health Monthly Premiums?

👉 Momentum monthly premiums start at R1 687 for the main member on the Evolve Option and go up to R13 573 for the main member on the Summit Option.

What Is the Waiting Period for Momentum Health’s Benefits?

👉 The general waiting period is 3 months, but since pregnancy is considered a pre-existing condition, it is excluded from all benefits for the first 12 months of scheme membership.

How to Claim Momentum Health Benefits

👉 You can submit a claim in several ways:

➡️ Use the Momentum App

➡️ Use the web chat facility in the bottom left corner.

➡️ Send an email to [email protected] or send normal mail to PO Box 2338, Durban, 4000

👉 To make sure your claim is processed quickly and accurately, including the following information:

➡️ Membership number.

➡️ Principal member’s surname, initials, and first name.

➡️ Patient’s surname, initials, and first name.

➡️ Date of treatment.

➡️ Amount charged.

➡️ ICD–10 code (code to indicate what condition you’ve been diagnosed with), tariff code (product-specific code for procedures and claims), and NAPPI code (unique identifier for a given ethical, surgical, or consumable product).

➡️ Service provider’s name and practice number.

➡️ Proof of payment if you’ve paid the claim out of your own pocket.

Momentum Health Contact Details

201 Umhlanga Ridge Blvd

Cornubia

Blackburn

PO Box 2338

Durban

You might like 5 Best Gap Cover Options for Under R300 in South Africa reviewed

3. Discovery Health

Overview

👉 According to the Commission for Medical Schemes Quarterly Report for the quarter ended 30 June 2019, Discovery Health Medical Plan (DHMS) had 2,808,106 members as of December 31, 2019, making it the largest open medical scheme in South Africa.

👉 The Commission for Medical Schemes is a non-profit organisation with authority over discovery under the Medical Schemes Act 131 of 1998, as modified. Because it is a publicly funded healthcare service, anyone who meets the criteria can sign up to use the System.

👉 Because helping Scheme members is the Scheme’s top priority, that reality guides all policy choices. Discovery relies on shared values to strike a balance between the desires of its individuals and the requirements of the Scheme as a whole.

👉 Discovery Health Medical Scheme (DHMS or the Scheme) provides its members in South Africa with a pooled fund that is managed with a priority on social solidarity rather than commercial gain in order to cover members’ medical expenses.

Discovery Hospital Plans are Available Under R1500

👉 Discovery Health offers a comprehensive hospital plan that costs less than R1500 per month.

The KeyCare Series

👉 KeyCare’s substantial medical coverage is provided by its connected hospital networks. Specialist visits within the KeyCare network have no out-of-pocket maximum, while trips to other doctors and hospitals are reimbursed at up to 100% of the Discovery Health Rate (DHR).

👉 New-borns and their mothers are for all the way through and beyond pregnancy.

👉 KeyCare Plus and KeyCare Start both provide unlimited office visits to a primary care physician within the KeyCare network, along with other benefits like coverage for diagnostic tests, prescription medication, and more.

👉 When patients see an in-network provider for treatment of a chronic condition, they are covered for all diseases on the KeyCare Chronic Disease List (DSP). The extent of your safety is in the hands of the policy you pick.

➡️ The KeyCare Start plan is available at R1,239 per month

How Much Are Discovery Medical Aid Monthly Premiums?

👉 Monthly premiums start from R1,102 per member for the KeyCare Series with medical cover for both in-hospital and out-of-hospital treatment by providers in a specified network and go up to R10,303 per member for the Executive Plan with extensive cover for in-hospital and day-to-day benefits, extended chronic medicine cover, and unlimited Above Threshold Benefit.

What Is the Waiting Period for Discovery Medical Aid’s Benefits?

👉 Discovery Health Medical Scheme’s general waiting period is 3 consecutive months and the condition-specific waiting period is 12 consecutive months.

How to Claim for Discovery Medical Aid Benefits

👉 You can submit a claim fast and easily in the following ways:

➡️ Scan and upload your claims on the website.

➡️ Scan and email your claims to [email protected].

➡️ Use the Discovery app on your smartphone. If the claim has a QR code, scan the QR code or alternatively take a photo of the claim from within the app.

➡️ You can also submit your claims by post.

Discovery Medical Aid Contact Details

PO Box 784262,

Sandton,

2146

Phone: 0860 99 88 77

4. NetCare

Overview

👉 Formed as an investment holding company, Netcare Limited now employs around 29,000 people through its many divisions.

👉 The Netcare Group is committed to enhancing the efficiency of the national healthcare systems in which it operates through a combination of investment in expanding and enhancing capabilities and capacities and collaboration with the public sector.

👉 Netcare is a leading healthcare provider due to the company’s commitment to innovation, high standards of professional excellence, and concern for each individual patient.

👉 With to NetCare’s innovative product options and extensive network of providers, you may now pay as you go for top-notch private healthcare when you really need it.

👉 Some of the new products available from NetCare can be donated to those in need, while others are designed to help you and your loved ones meet your own healthcare needs.

👉 These prepaid plans cover unexpected medical expenses and help you budget for regular doctor visits.

👉 NetCare operates South Africa’s most extensive system of private hospitals, primary care clinics, emergency rooms, and dialysis centres.

👉 The Group also offers emergency medical treatment through Netcare 911, kidney dialysis through National Renal Care, mental health and psychiatric care through Akeso, and primary healthcare, subacute care, day surgery, occupational health, and employee wellness services through Medicross.

👉 NetCare is also the most well-known private institution for training emergency medical and nursing personnel in the country.

NetCare Hospital Plans Available at Under R1500

👉 NetCare Medical Aid offers a wide range of hospital plans including some plans that cost less than R1500 per month.

👉 NetCare offers also a GAP Cover

NetCare Accident and Trauma Cover

👉 In the case of an accident or trauma, NetcarePlus Accident and Trauma Insurance pay for treatment at a wide variety of private hospitals and contractual facilities.

👉 Patients without medical aid can rest easy knowing that their physical impact injuries (from things like car accidents, assaults, and falls) are covered by this medical aid.

➡️ NetCare Accident and Trauma Cover is available from R280.00 per month

How Much Are Netcare Medical Scheme’s Monthly Premiums?

👉 NetCare Accident and Trauma Cover are available from R280.00 per month.

What Is the Waiting Period for NetCare Benefits?

👉 Depending on the medical aid scheme you join, the average waiting period for NetCare benefits is three months. Pre-existing conditions have a 12-month waiting period.

How to Claim Benefits from NetCare Medical Scheme

👉 Members can submit claims using one of the following:

➡️ Select a product you would like to submit a claim for

➡️ Email NetCare at [email protected]

NetCare Medical Scheme Contact Details

76 Maude Street,

Corner West Street,

Sandton,

2196

Phone: 0860 638 2273

Email: [email protected]

5. Affinity Health

Overview

👉 In 2011, Affinity Health was founded to provide all South Africans with access to high-quality, low-cost private healthcare. Affinity Health focuses solely on offering long-term medical aid solutions.

👉 Affinity Health’s deep knowledge, dedication, and expertise have led to a revolution in the medical aid business.

👉 All South Africans should be able to afford basic private medical care. In order to ensure that all citizens of South Africa have access to quality medical care at a price they can afford, Affinity Health is working to expand private medical aid options.

👉 Because of its extensive network of partners, Affinity Health is able to present a formidable team of specialists to its market.

👉 Affinity Health is investing heavily in its personnel and cutting-edge technology in order to speed up the product development process and ensure that they deliver innovative goods to market.

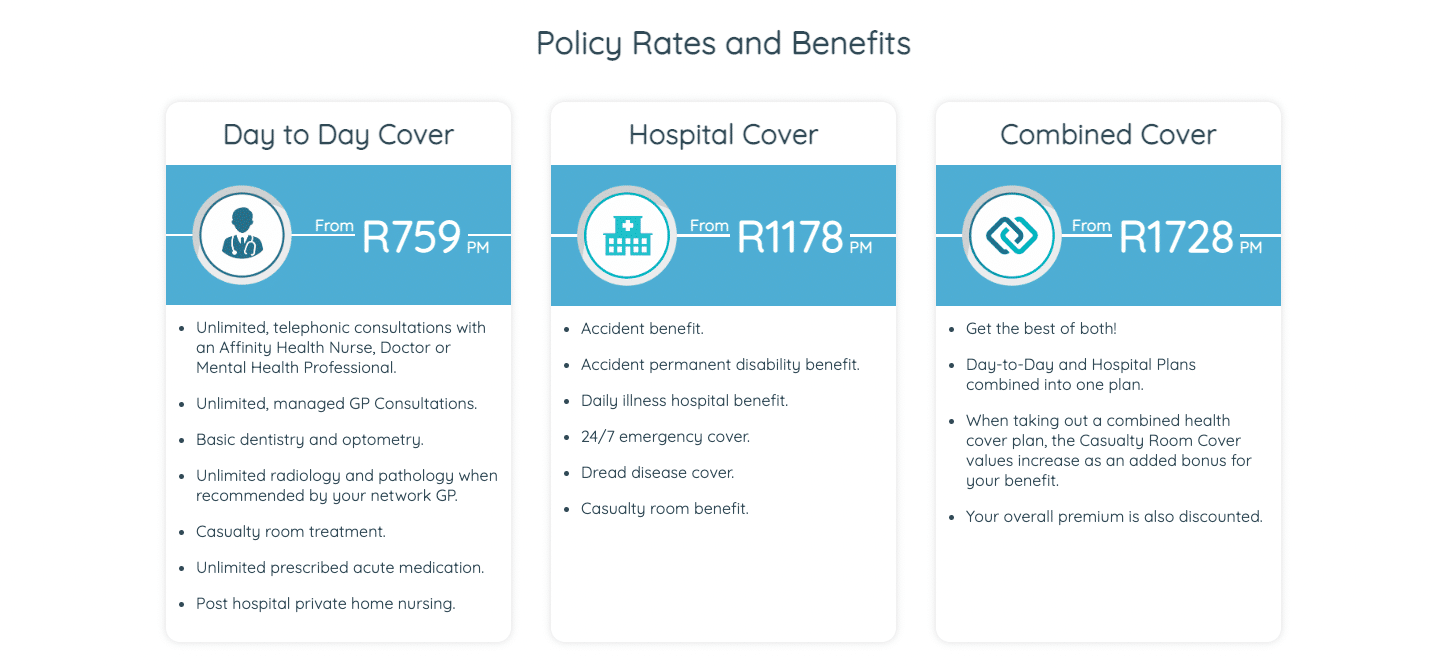

Affinity Health Hospital Plans are Available at Under R1500

👉 Affinity Health offers a wide range of hospital plans including some plans that cost less than R1500 per month.

Affinity Health Hospital Plan

👉 With this hospital plan, you’ll have access to a comprehensive range of benefits in the case of an unexpected hospitalisation due to an accident, illness, or medical emergency.

👉 Affinity Health, one of the most rapidly expanding Hospital Plan and Health Cover providers in South Africa, allows you access to a comprehensive set of features and benefits within your budget whenever you need them.

👉 As a member of the Affinity Health Hospital Plan, you get access to a wider network of hospitals and physicians than you would with public medical aid.

👉 The plan will pay for the majority of your hospital bills, including room and board, all of your meals, and any necessary medical procedures. In the event that you require hospitalisation, these expenses will mount daily.

👉 Specialist fees, such as those for surgeons, radiologist, and anaesthesiologists, are also covered by the plan.

➡️ The Affinity Health Hospital Plan is available from R1258.00 per month

How Much Are Affinity Health’s Monthly Premiums?

👉 Affinity Health offers a comprehensive hospital plan from R1258.00 per month. The Day-to-Day Plan is available from R809.00 per month. The Combined Plan is available from R1 838.00 per month.

What Is the Waiting Period for Affinity Health Benefits?

👉 Depending on the medical aid scheme you join, the average waiting period for Affinity Health benefits is three months. Pre-existing conditions have a 12-month waiting period.

How to Claim for Benefits from Affinity Health

➡️ General practitioner visits also need pre-authorisation. In the event of visiting a doctor who may not be on the Affinity Health network, you will need to pay the full consultation fee upfront. You can then claim up to R250.00 back from Affinity Health.

➡️ For assistance with reimbursement, please email the detailed account and a signed Affinity Health reimbursement form to [email protected].

➡️ Network doctors can claim directly from Affinity Health. The practice may charge additional administration fees, which cannot be recovered from Affinity Health. These will be for the member’s account.

➡️ Procedures conducted in the rooms of Affinity Health network doctors are also covered, provided you have obtained pre-authorisation.

➡️ If you need to consult a specialist, you will have to get a referral letter from your GP, for the consultation to be eligible for cover by Affinity Health. Once you have your referral letter, you will need to call to get pre-authorisation before the actual consultation.

➡️ With hospital coverage, the insurer will pay a set portion of the cost. The patient is still fully liable for the bill and will need to claim from the insurance to pay the hospital.

➡️ As always, pre-authorisation is required before going into the hospital. Affinity Health has a 24-hour hospital pre-authorisation line.

Affinity Health Contact Details

1 Dingler Street, Rynfield, Benoni 1501

Call Centre: 0861 11 00 33

WhatsApp: 079 479 3230

Email: [email protected]

You might also consider Platinum Health Medical Aid

Frequently Asked Questions

What is a hospital plan for less than R1500 in South Africa?

A medical insurance policy that covers hospital-related medical costs up to a daily maximum of R1500 is known as a hospital plan in South Africa. For those who desire hospitalization coverage without paying for more extensive medical assistance, it is a cost-effective solution.

What does a hospital plan under R1500 cover?

Hospitalization-related medical costs, including hospital lodging, surgery, anesthesia, and other treatments, are normally covered by hospital plans under R1500. However, it is crucial to keep in mind that it might not cover specific surgeries, treatments, or medications, thus it is crucial to thoroughly study the policy.

How do I sign up for a hospital plan under R1500 in South Africa?

You can get in touch with an insurance company that provides this kind of coverage to enroll in a hospital plan for less than R1500 in South Africa. They will help you with the application procedure and give you the information you need. To select one that fits your demands and budget, it is critical to examine several providers and plans.

What are the benefits of having a hospital plan under R1500?

Knowing that you are financially protected for in-hospital medical costs when you have a hospital plan under R1500 gives you piece of mind. For people who wish to make sure they are covered for unplanned hospitalization without paying for more extensive medical help, it is also a cost-effective choice.

Can I add additional coverage to a hospital plan under R1500?

A hospital plan under R1500 may be supplemented with additional coverage, depending on the insurance company and the policy. However, as this could incur additional costs, it is crucial to carefully weigh your options and make sure the extra coverage is required and affordable for your particular circumstances.