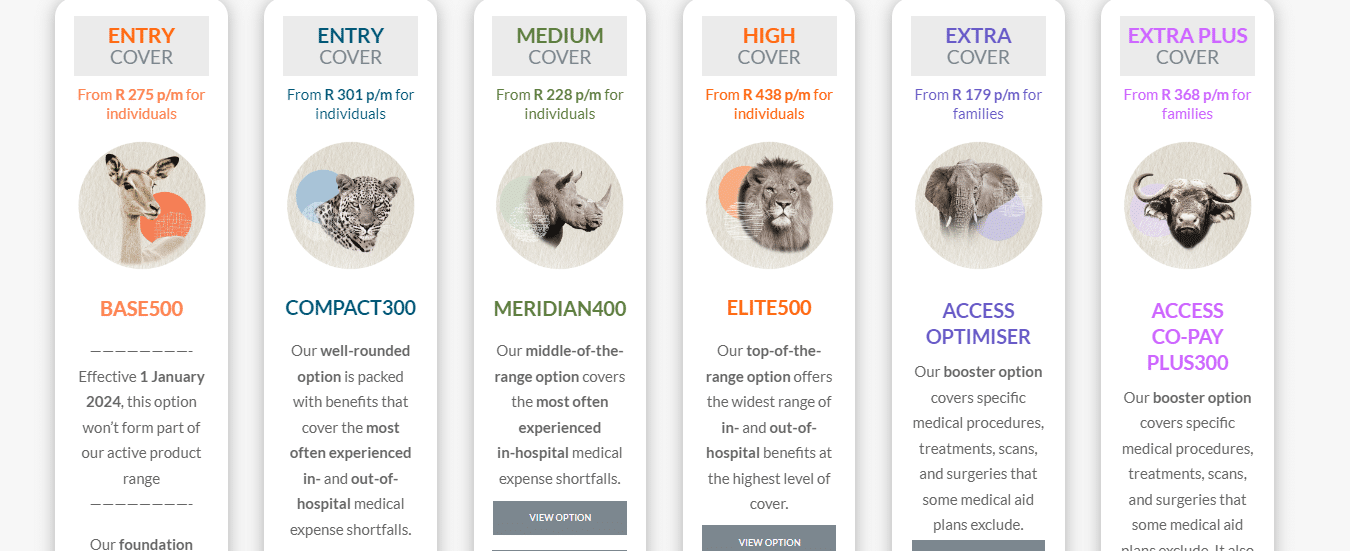

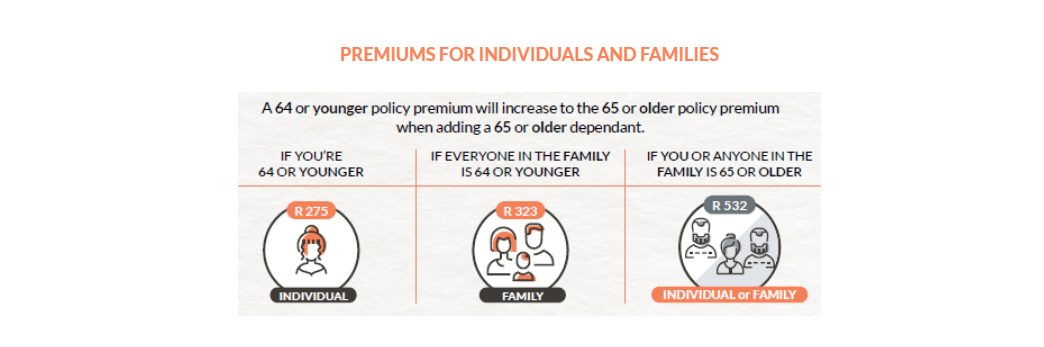

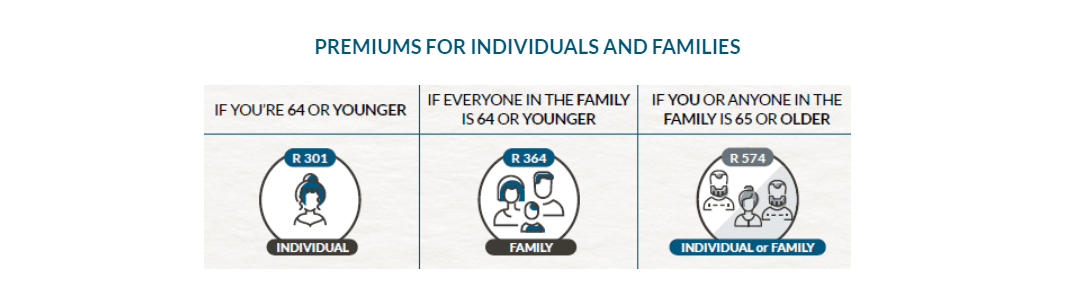

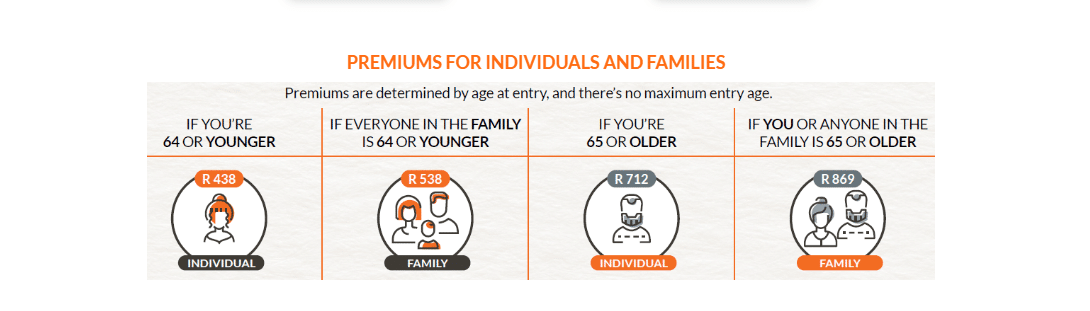

Monthly Premium

From R438

Waiting Period

3 months

Elite

The Elite plan provides benefits for maternity services, sub-limits, radiology, cancer treatments, MRI and other scans, physical rehabilitation, outpatient specialist consultations, casualties, and various other additional advantages.

★★★★★ 4.5/5

Oncology Benefits:

Scopes and Scans:

Accidental Cover:

Trauma Counseling:

Co-Payment Cover:

Maternity Benefits:

The Elite plan provides benefits for maternity services, sub-limits, radiology, cancer treatments, MRI and other scans, physical rehabilitation, outpatient specialist consultations, casualties, and various other additional advantages.

In Hospital Benefits:

Out of Hospital Cover:

Tax Deductible:

Prostheses:

Elite

The Elite plan provides benefits for maternity services, sub-limits, radiology, cancer treatments, MRI and other scans, physical rehabilitation, outpatient specialist consultations, casualties, and various other additional advantages.

★★★★★ 4/5

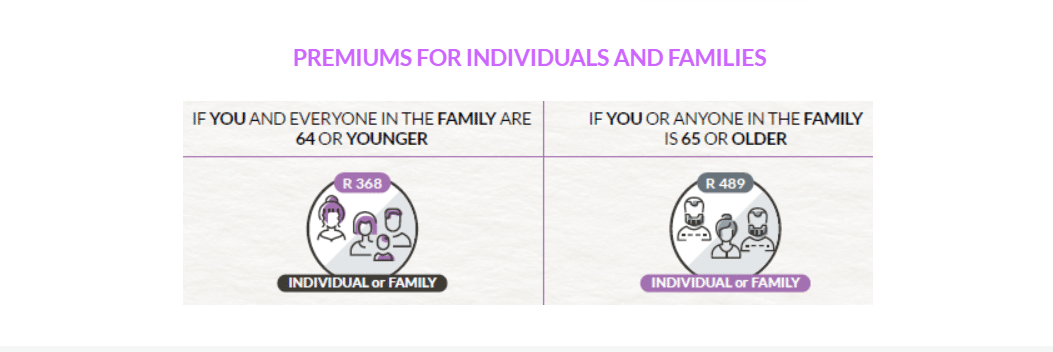

Monthly Premium

From R438

Waiting Period

3 months

The Elite plan provides benefits for maternity services, sub-limits, radiology, cancer treatments, MRI and other scans, physical rehabilitation, outpatient specialist consultations, casualties, and various other additional advantages.

In Hospital Benefits:

Out of Hospital Cover:

Tax Deductible:

Prostheses: