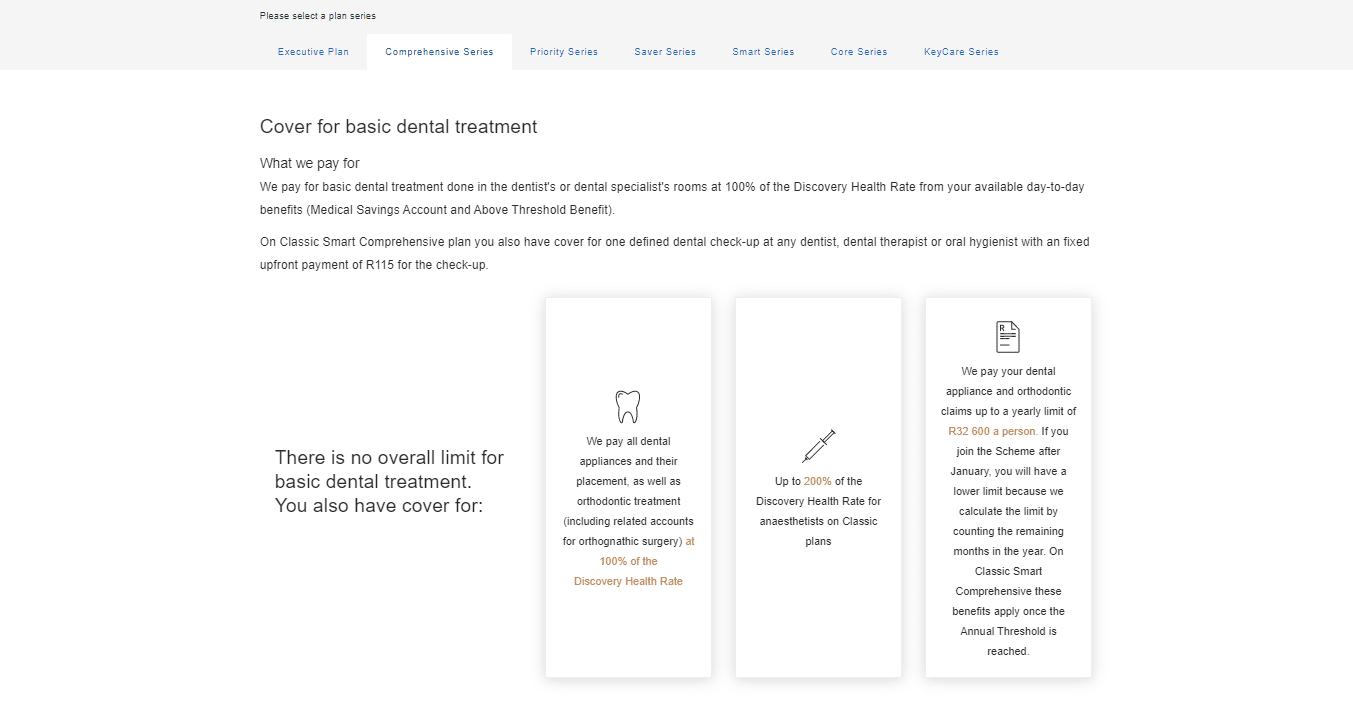

Principle Member

From R8381

Dependant Member

From R7927

Child Dependant

From R1671

Classic Comprehensive

The Classic Comprehensive plan is designed for those who are willing to pay a premium price for top-tier medical coverage.

★★★★★ 4.5/5

Chronic Cover:

Day-to-Day:

Preventative Care:

Cancer Cover:

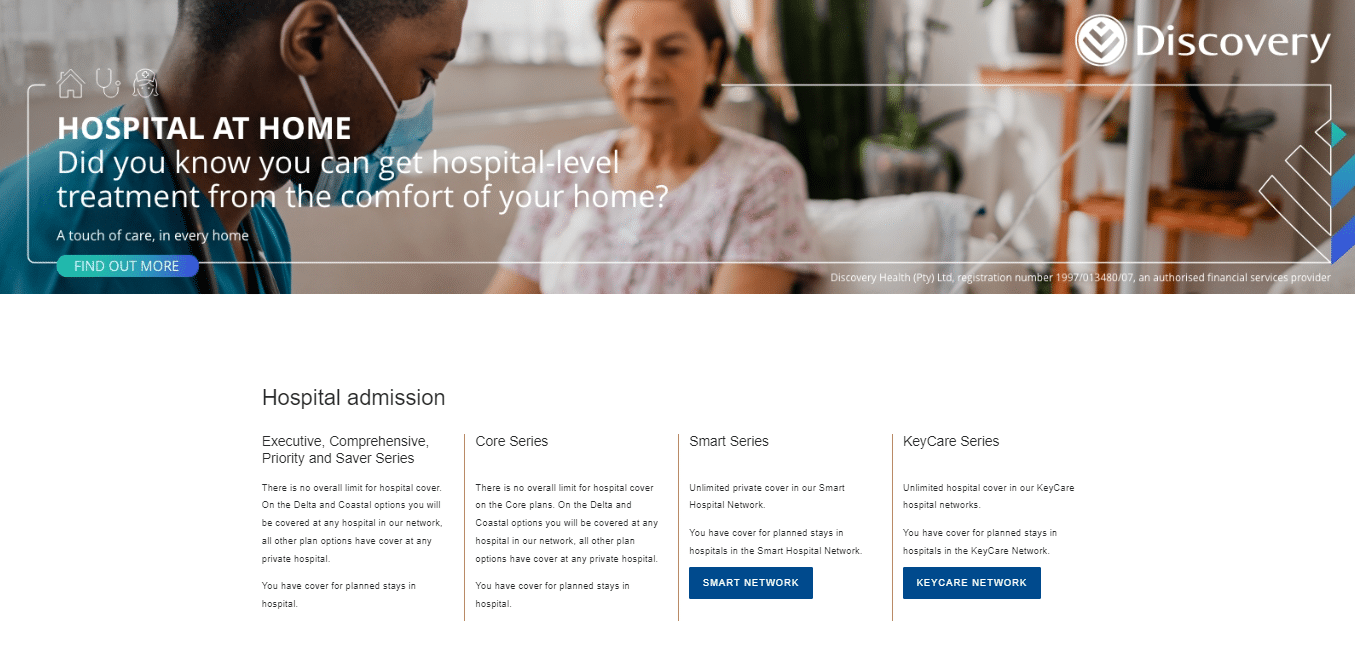

Hospitalisation:

Maternity Benefits:

The Classic Comprehensive plan is designed for those who are willing to pay a premium price for top-tier medical coverage.

Tax Deductible:

Travel Cover:

Classic Comprehensive

The Classic Comprehensive plan is designed for those who are willing to pay a premium price for top-tier medical coverage.

★★★★★ 4/5

Principle Member

From R8381

Dependant Member

From R7927

Child Dependant

From R1671

Chronic Cover:

Day-to-Day:

Preventative Care:

Cancer Cover:

Hospitalisation:

Maternity Benefits:

The Classic Comprehensive plan is designed for those who are willing to pay a premium price for top-tier medical coverage.

Tax Deductible:

Travel Cover: