Principle Member

From R546

Dependant Member

From R546

Child Dependant

From R546

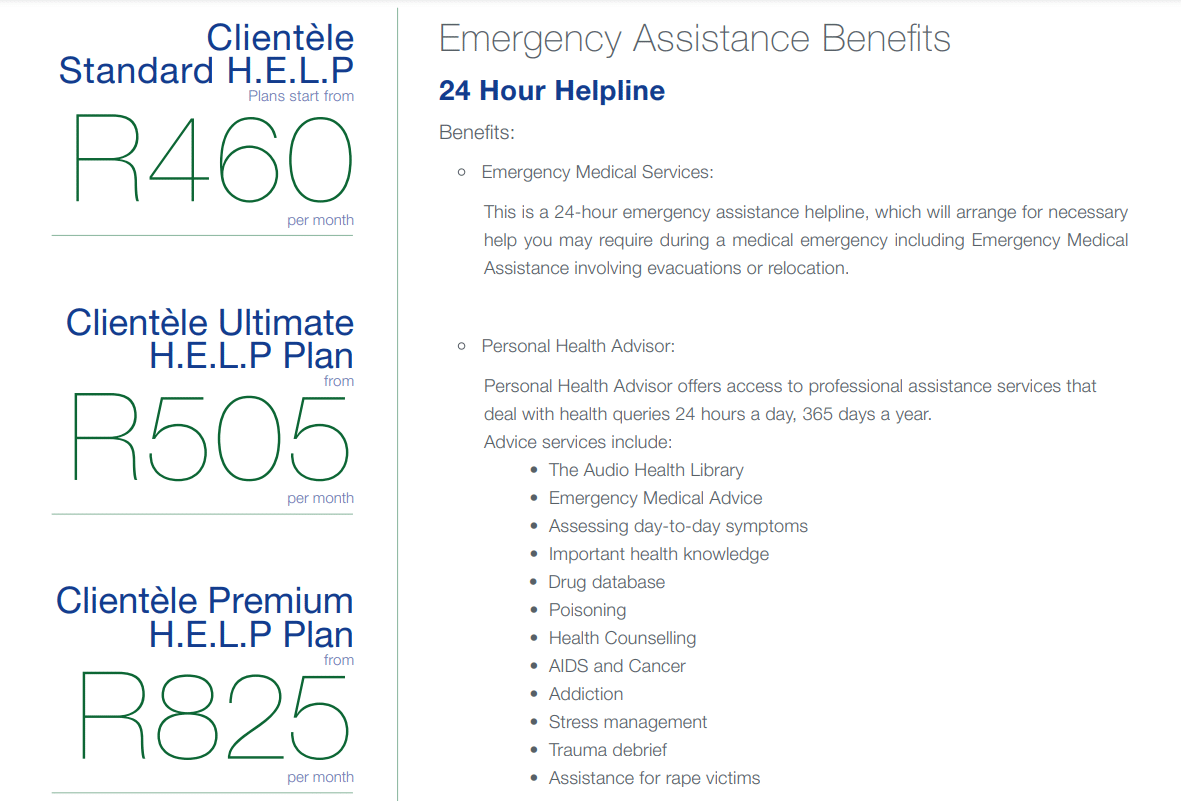

Ultimate H.E.L.P

The Ultimate H.E.L.P plan provides policyholders with a variety of benefits, including the Premium Payback Benefit, Cover for Children, Premium Guarantee, and other perks.

★★★★★ 4.5/5

Chronic Cover:

Day-to-Day:

Preventative Care:

Cancer Cover:

Hospitalisation:

Maternity Benefits:

The Ultimate H.E.L.P plan provides policyholders with a variety of benefits, including the Premium Payback Benefit, Cover for Children, Premium Guarantee, and other perks.

Tax Deductible:

Travel Cover:

Ultimate H.E.L.P

The Ultimate H.E.L.P plan provides policyholders with a variety of benefits, including the Premium Payback Benefit, Cover for Children, Premium Guarantee, and other perks.

★★★★★ 4/5

Principle Member

From R546

Dependant Member

From R546

Child Dependant

From R546

Chronic Cover:

Day-to-Day:

Preventative Care:

Cancer Cover:

Hospitalisation:

Maternity Benefits:

The Ultimate H.E.L.P plan provides policyholders with a variety of benefits, including the Premium Payback Benefit, Cover for Children, Premium Guarantee, and other perks.

Tax Deductible:

Travel Cover: