5 Best Medical Aids under R1500 in South Africa

The 5 Best Medical Aid Schemes under R1500 in South Africa revealed.

We tested them side by side and verified their medical aid plans.

This is a complete guide to the best medical aid under One Thousand Five Hundred Rand in South Africa.

In this in-depth guide you’ll learn:

- What is a Medical Aid?

- How do you find affordable medical aid in South Africa?

- How to choose the best affordable medical aid for your needs under R1500?

- How to compare medical aids against each other?

- What is the best way to sign up for medical aid for the first time?

So if you’re ready to go “all in” with the best medical aid under R1500 in South Africa, this guide is for you.

Let’s dive right in…

5 Best Medical Aids under R1500 (2024)

- Momentum Health – Overall, Best Medical Aid Under R1500 in South Africa

- Discovery Health – Top Extensive Medical Protection in South Africa

- Bonitas – Broadest Range of Low-Cost Medical Aid Plans

- Fedhealth – Best Pay-As-You-Go Private Healthcare

- BestMed – Best Customer Service Medical Aid

Why more South Africans are looking for affordable medical aid

👉 Coverage for prescription medication, in-office procedures, and visits to a private physician or specialist is all part of what you may expect to receive when you sign up for medical aid.

👉 Having medical aid or membership in a medical aid programme is normally a personal choice, but in today’s South Africa, it has become a necessity. Membership fees are no longer considered a luxury or convenience, but many people have trouble affording them.

👉 South Africa’s medical costs have not only climbed enormously but have spiralled astronomically, for both those with and without medical aid membership. The cost of healthcare products and services is fixed and never goes down. Even though they seem to level off for a while, they actually never go down.

👉 Government-funded clinics and hospitals, their patients, and members of medical aid schemes are all adversely affected by the ever-increasing prices. The majority of South Africans are aware that they require medical aid coverage in order to access quality medical treatment without breaking the bank.

👉 Very few South Africans would be able to afford a wide range of extremely pricey treatments, operations, surgeries, and general hospital bills without the assistance of medical aid.

👉 The state’s already strained healthcare infrastructure cannot take in any more patients. Depending on your income level, you can take advantage of their services at no cost. But when it comes to healthcare, the state typically falls short due to a lack of funding.

👉 Sometimes unexpected life events necessitate spending over what you had originally planned. We rarely budget for the unexpected cost of illness or a medical emergency, but it is inevitable. Any unexpected expense is a financial burden at the worst possible time.

You might like 5 Best Gap Cover Options for Under R500 per month

What to consider when choosing a medical aid

Check whether you can afford the specific plan

👉 It’s best to start by doing some serious budgeting to figure out what you can actually afford. Although medical aid is a costly line item, monthly premium payments shouldn’t consume more than 10% of your income.

👉 However, you will need to factor in your future ability to pay, as medical inflation is expected to outpace consumer inflation by 3%–4% annually. To determine which medical aid plan is right for you, first determine how much money you can put towards premiums.

👉 Be wary of simply selecting the cheapest premium because you get what you pay for; all medical aids are thoroughly priced by teams of actuaries and healthcare specialists.

👉 Read the fine print and be wary of low sub-limits, hefty co-payments, and strictly managed care that restricts access to specialists if the premium seems significantly lower than similar schemes.

Evaluate your health status

👉 You should take stock of your current health status and that of your dependents, even though your past health is no predictor of the future.

👉 In particular, you should document the existence of any chronic medical illnesses in your family, as well as the medications and treatments used to manage them. If you do this, you can compare the offered benefits to your own family’s needs.

👉 If you don’t currently have any children but hope to create a family soon, it’s important to find a medical aid plan that covers prenatal, delivery, and postpartum needs.

👉 It is not possible to change your plan during the benefit year, so if you know you will become pregnant in 2024, you should choose a plan that meets your needs.

Look for in-hospital coverage

👉 The average individual cannot pay the sky-high prices of private hospitals, so it is crucial that they find a suitable healthcare plan. Bear in mind that not all healthcare plans are created equal.

👉 Although it may sound appealing, entry-level plans typically only cover 100% of the medical aid tariff for in-hospital care provided by a small selection of institutions.

👉 In contrast, hospitalised doctors and specialists are free to charge you many times the medical aid tariff for their services, with the additional cost falling on your shoulders.

👉 Hospitalization, imaging, pathology, endoscopy, scanning, and specialised dental care are all examples of services for which you may be responsible for out-of-pocket costs.

Find a reputable scheme

👉 Choose a healthcare plan based on its proven track record, as well as the trustworthiness of its name. In particular, it is important to look into the medical plan’s claims payment history to ensure prompt and reliable payments.

👉 Members and service providers alike experience frustration with the delayed claims processing and payment capabilities of some poorly managed medical aids; as a result, many service providers avoid working with these medical schemes.

Make sure they offer competent managed care

👉 It’s not uncommon for medical aid organisations to contract out their managed care operations to independent businesses.

👉 Provider networks, provider oversight, medication formularies, chronic disease programmes, and pre-authorisation systems are all examples of managed care strategies employed by medical schemes to save costs without compromising the quality of care.

👉 In spite of the fact that the goal of managed care programmes is to provide their participants with high-quality medical attention, poorly run programmes can be a source of frustration.

👉 Learn more about the medical scheme’s managed care program’s administration, service quality, and patient access. To see a specialist, do you need a recommendation from your primary care physician, or is that not necessary under your plan?

Check whether you fall within the demographics of the scheme

👉 The premiums paid by younger, healthier members are used to offset the costs of providing medical treatment to those who are older and sicker. Therefore, it is critical to learn the demographics and size of the medical plan, bearing in mind that size matters.

👉 Larger risk pools have claims that are more reliably predictable. The financial risks increase proportionally as the average age of the group rises. Furthermore, over the past three years, examine the scheme’s membership to ascertain if there has been a significant drop in participation and, if so, the reasons behind this.

Read more about the 5 Best Hospital Plans for Students and Young Adults in SA revealed.

5 of the Best Known Medical Aids in South Africa under R1500

👉 An affordable and suitable medical aid plan is crucial for you and your family’s peace of mind in the face of potentially ruinous medical expenditures.

👉 Medical costs can quickly pile up, from the cost of a check-up to the cost of an emergency appendectomy. Without proper planning, you or your loved ones could be put in a serious financial bind if anything unforeseen were to happen.

👉 Here we review five of South Africa’s best medical aid plans that each cost less than R1500 per month.

1. Momentum Health

Overview

👉 The company behind Momentum Medical Scheme, one of South Africa’s top three open medical schemes, is widely recognised as a frontrunner in the industry.

👉 One of Momentum Health’s primary goals is to ensure the long-term viability of the plan by providing its members with unparalleled value.

👉 If you sign up with Momentum Health Solutions, you’ll have access to a group of medical professionals that are committed to providing you with low-cost, high-quality treatment.

👉 To provide for its members, Momentum has teamed with financially incentivized doctor networks. In addition, Hello Doctor’s medical advice line is open around the clock for members to call in with any questions they may have.

👉 By utilising Momentum’s actuarial services, wellness-focused incentive and reward programmes can be designed and priced to attract and retain healthy members.

👉 By using a novel health coaching approach, Momentum is able to provide individualised assistance through its advocacy activities, enabling members to make educated healthcare decisions and reducing costs.

Momentum Medical Aid Plans are Available at Under R1500 per month

👉 Some of the health aid plans offered by Momentum have monthly rates of less than R1500. We explore these in further detail below.

Momentum Ingwe

👉 The Ingwe Plan provides affordable healthcare coverage for newcomers. Choose between the State-run hospitals, the private hospitals in the Ingwe Network, or Any facility for your medical care.

👉 Those just starting out in their careers or studying in South Africa who cannot afford more comprehensive medical coverage will benefit from this plan. Even though it’s a minimal health aid plan, it nonetheless covers hospitalisation, outpatient, and long-term care services.

➡️ Momentum Ingwe A is available at R455.00 per month

➡️ Momentum Ingwe Network A is available at R455.00 per month

➡️ Momentum Ingwe State A is available at R455.00 per month

How Much Are Momentum Health Monthly Premiums?

👉 Momentum monthly premiums start at R1 539 for the main member on the Evolve Option and go up to R12 345 for the main member on the Summit Option.

What Is the Waiting Period for Momentum Health’s Benefits?

👉 The general waiting period is 3 months, but since pregnancy is considered a pre-existing condition, it is excluded from all benefits for the first 12 months of scheme membership.

How to Claim Momentum Health Benefits

👉 You can submit a claim in several ways:

➡️ Use the Momentum App

➡️ Use the web chat facility in the bottom left corner.

➡️ Send an email to [email protected] or send normal mail to PO Box 2338, Durban, 4000

👉 To make sure your claim is processed quickly and accurately, including the following information:

➡️ Membership number.

➡️ Principal member’s surname, initials, and first name.

➡️ Patient’s surname, initials, and first name.

➡️ Date of treatment.

➡️ Amount charged.

➡️ ICD–10 code (code to indicate what condition you’ve been diagnosed with), tariff code (product-specific code for procedures and claims), and NAPPI code (unique identifier for a given ethical, surgical, or consumable product).

➡️ Service provider’s name and practice number.

➡️ Proof of payment if you’ve paid the claim out of your own pocket.

Momentum Health Contact Details

201 Umhlanga Ridge Blvd

Cornubia

Blackburn

PO Box 2338

Durban

2. Discovery Health

Overview

👉 According to the Council for Medical Schemes Quarterly Report for the quarter ended 30 June 2019, Discovery Health Medical Scheme (DHMS) had 2,808,106 beneficiaries as of 31 December 2019, making it South Africa’s largest open medical scheme.

👉 The Medical Schemes Act 131 of 1998, as amended, and the Council for Medical Schemes, a non-profit organisation, serve as the framework for Discovery. As an open medical plan, any member of the public who meets the eligibility requirements can join the System.

👉 Every decision is guided by the knowledge that the Scheme’s sole objective is to assist its members. Discovery leverages the notions of social solidarity to establish a balance between member interests and the interests of the Scheme as a whole.

👉 When it comes to paying healthcare for its members, South Africa’s Discovery Health Medical Scheme (DHMS or the Scheme) pools payments from its members and manages this money in accordance with social solidarity values rather than profit.

Discovery Medical Aid Plans are Available Under R1500

👉 Discovery provides its customers with a variety of healthcare plans to choose from, some of which have monthly premiums of less than R1500.

Discovery KeyCare Plan

👉 KeyCare’s hospital networks offer comprehensive medical coverage. Hospitalization expenses for KeyCare network specialists are always fully covered, and expenses for other doctors and hospitals are paid at up to 100% of the Discovery Health Rate (DHR).

👉 Prenatal and postnatal care for expectant moms and infants is also included.

👉 Within the KeyCare network, KeyCare Plus and KeyCare Start cover an unlimited number of visits to your primary care physician, as well as any necessary lab work, X-rays, or prescriptions.

👉 When using a participating physician for chronic medicine from the KeyCare medicine list, KeyCare provides comprehensive coverage for all Chronic Disease List diseases (DSP). What you are protected for is determined by the medical aid plan you choose.

➡️ Discovery KeyCare Start is available at R1 239.00 per month

How Much Are Discovery Medical Aid Monthly Premiums?

👉 Monthly premiums start from R1,102 per member for the KeyCare Series with medical cover for both in-hospital and out-of-hospital treatment by providers in a specified network and go up to R10,303 per member for the Executive Plan with extensive cover for in-hospital and day-to-day benefits, extended chronic medicine cover, and unlimited Above Threshold Benefit.

What Is the Waiting Period for Discovery Medical Aid’s Benefits?

👉 Discovery Health Medical Scheme’s general waiting period is 3 consecutive months and the condition-specific waiting period is 12 consecutive months.

How to Claim for Discovery Medical Aid Benefits

👉 You can submit a claim fast and easy in the following ways:

➡️ Scan and upload your claims on the website.

➡️ Scan and email your claims to [email protected].

➡️ Use the Discovery app on your smartphone. If the claim has a QR code, scan the QR code or alternatively take a photo of the claim from within the app.

➡️ You can also submit your claims by post.

Discovery Medical Aid Contact Details

PO Box 784262,

Sandton,

2146

Phone: 0860 99 88 77

READ more about the Discovery Health Smart Series in South Africa reviewed.

3. Bonitas

Overview

👉 Over the course of 2014, it helped 649,032 young people in South Africa. This includes people working for major corporations like Nestlé, BHP Billiton, and Eskom. Bonitas has a solvency ratio of 30.7% and an international credit rating of AA-.

👉 Since the average age of a Bonitas member is under 30, the magnitude of annual contribution increases is smaller and the average age of a Bonitas beneficiary is under 30.

👉 Bonitas offers a variety of cost-effective medical aid plans that cover hospitalisation, long-term care, and pharmaceutical coverage. When it comes to medical aid, this company is ideal for both young workers and families.

👉 Bonitas was founded in 1982, but its quick growth has allowed it to overtake the previous market leader and become the largest medical aid scheme in South Africa.

👉 Bonitas’ network of 4,500 doctors is committed to providing patients with excellent care at predetermined costs.

👉 Bonitas offers its members two unique solutions to aid them and rein in rising healthcare costs: oncology management and hospital and medicine management.

👉 Several Bonitas plans offer coverage for dental and vision care services, including Lasik eye surgery. Unused funds accrue interest for the following year and are carried over from year to year by each member.

Bonitas Medical Aid Plans are Available Under R1500

👉 Bonitas offers a wide range of options for members’ medical coverage, including some plans that cost less than R1500 per month.

BonCap Plan

👉 Members can get cheap medical aid that is tied to their salary with the BonCap plan. Members’ dependents who are also full-time students can join Bonitas Boncap at the child rate up to the age of 24 with the Student option.

👉 You can visit your primary care physician as often as you like, and if you need hospital care, Bonitas will pay 100% of the cost, no questions asked. Out-of-network and specialist care are not fully covered either.

➡️ The BonCap plan is available from R1 274.00 per month

How Much Are Bonitas Medical Aid Monthly Premiums?

👉 Bonitas monthly contributions start at R 2 033 for a Principal Member, R 1 555 for a spouse/adult dependant and R 596 per child (max 3) on the BonEssential Hospital Plan and go up to R 8 217 for a main member, R7 749 for additional adult, and R 1 672 for a child for the BonComprehensive plan that offers abundant savings, an above threshold benefit and comprehensive hospital cover.

What Is the Waiting Period for Bonitas Medical Aid Benefits?

👉 The minimum general waiting period for Bonitas medical aid is three months for all benefits. Some plans, however, have a waiting period of 12 months, especially regarding a pre-existing condition.

How to Claim Breast Reduction Benefits from Bonitas

👉 You can send in your claim in the following ways:

➡️ Email your claims to [email protected].

➡️ Post your claims to Bonitas Claims Department, PO Box 74, Vereeniging, 1930.

➡️ Submit your claims in person at one of the walk-in centres.

👉 Follow these simple steps to get your claims paid quickly:

➡️ Ensure your banking details are correct for refunds by electronic transfer (EFT) into your bank account

➡️ Make sure that your account and receipt show your name and initials, membership number, treatment date, the name of the patient as shown on your membership card, the amount charged and ICD-10 code.

Bonitas Contact Details

34 Melrose Blvd, Birnam

Johannesburg

2196

Phone for General Queries: 0860002108

Email: [email protected]

Email: [email protected]

4. Fedhealth

Overview

👉 Fedhealth was founded in 1936 to meet the growing demand for medical care in South Africa. A lot has changed over the years, but not their dedication to providing excellent medical care at reasonable prices.

👉 Since Fedhealth is still a cooperative managed for the benefit of its members, it is always exploring new approaches to healthcare delivery in order to keep up with the evolving needs of its clientele.

👉 Fedhealth prioritises individualization so that you, the member, can have a hand in designing your own healthcare strategy. Because of its membership structure, Fedhealth is committed to serving the needs of its customers.

👉 The Scheme has more than the statutory 25% reserve for the benefit of its members, and it has maintained an AA- Global Credit Rating for the past 14 years thanks to its strong financial position.

👉 Fedhealth is well-known not just for its normal benefits but also for its novel Risk-based awards, which allow members to get even more out of those advantages.

👉 There are no caps on network doctor visits, and you can acquire a free upgrade at any time of the year (within 30 days of a major life event) if your health needs change significantly.

Fedhealth Medical Aid Plans Available at Under R1500

👉 Fedhealth provides a number of comprehensive and affordable medical aid plans that are available at under R1500, which provide members with various options to suit their diverse medical needs.

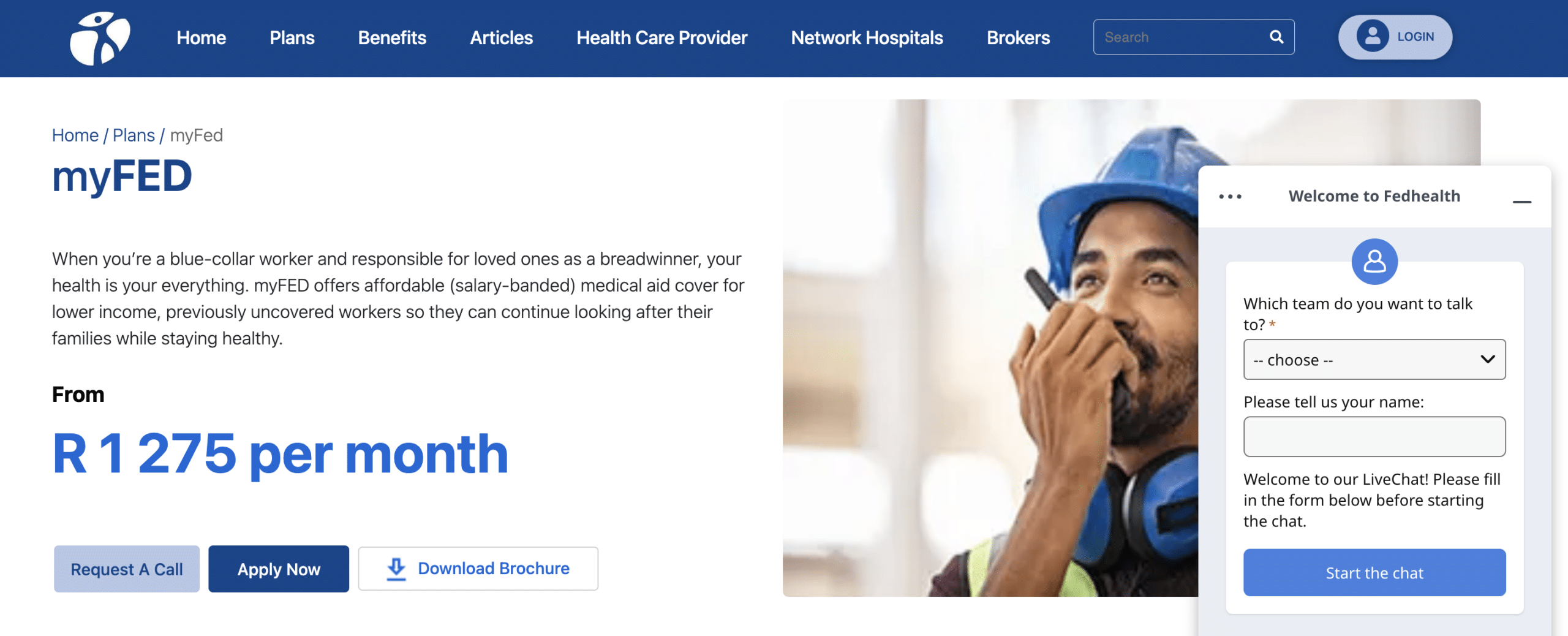

myFED

👉 To continue providing for their families, low-income workers who were previously uninsured can now obtain cheap (salary-banded) medical aid coverage through myFED.

👉 You should put your health first if you are the sole or primary breadwinner in your family and work in the blue collar sector.

➡️ myFED is available at R1 275.00

flexiFED 1

👉 You can use the Fedhealth Savings made available by the MediVault and the Threshold Benefit, which is triggered when your claims surpass a certain threshold, to cover the costs of routine medical care and any unforeseen emergencies that may happen. Assuming you are young and healthy, there is no better hospital plan available to you.

➡️ flexiFED 1 is available at R1 583.00

flexiFED Savvy

👉 You are a young professional, likely in your early twenties, who is fit and familiar with modern technology. No major hip or knee replacements are in your future.

👉 Individuals and businesses who want to provide their employees with high-quality, low-cost medical coverage should choose flexiFED Savvy, one of the most cost-effective hospital plans available, which can also be utilised as a supercharged savings plan or a supercharged flexible savings plan.

👉 It’s a daily backup solution to your standard hospital plan and is made to fit your needs and budget.

➡️ flexiFED Savvy is available at R945.00 per month

How Much Are Fedhealth Medical Scheme Monthly Premiums?

👉 The monthly premiums for the salary-banded myFED option is from R 1 275 per month for the main member. The maxima PLUS extensive medical cover will cost 13 122 per month per main member.

What Is the Waiting Period for Fedhealth Benefits?

👉 The general waiting period for Fedhealth benefits is usually three months, depending on the medical aid scheme you join. The waiting period for pre-existing conditions is 12 months.

How to Claim Benefits from Fedhealth Medical Scheme

👉 Members can submit claims using one of the following:

➡️ On the Fedhealth Family Room,

➡️ Through a WhatsApp service

➡️ On the Fedhealth Member phone App

➡️ You may also email, fax or post the claims to email: [email protected], fax: (011) 671 3842 or post to Private Bag X3045, Randburg, 2125.

Fedhealth Medical Scheme Contact Details

Flora Centre Shop 21 and 22

Corner Conrad street and Ontdekkers Rd

Florida Glen

Johannesburg

Phone: 0861 116 016

Read more about the 5 Best Hospital Plans under R2000 in South Africa

5. BestMed

Overview

👉 With over a million customers, BestMed is one of South Africa’s most successful private medical aid providers.

👉 BestMed is dedicated to keeping a company that is big enough to make a difference in people’s lives, but still small enough to know the names of the people they help and act on their suggestions for improvement quickly.

👉 BestMed is built on the idea that people have different medical requirements depending on characteristics including their age, marital status, family size, health, preferences, and financial resources.

👉 BestMed provides a choice between three primary care plan tiers, each with unique benefits and costs. BestMed’s hospitalisation coverage options fall under this broader heading and range from the bare minimum to a full suite of services.

BestMed Medical Aid Plans Available at Under R1500

👉 BestMed provides a number of comprehensive and affordable medical aid plans that are available at under R1500, which provide members with a variety of different options to suit their diverse medical needs.

Network Plans

👉 Health care and private hospital coverage at participating service providers is included in the BestMed network plans. These plans, depending on the details, can provide limitless hospitalisation coverage and steep discounts on visits to pre-approved doctors.

➡️ BestMed network plans are available from R1 307.00 per month

How Much Are BestMed Medical Aid Monthly Premiums?

👉 At the time of writing, monthly premiums for the cheapest BestMed Beat1 Network Hospital Plan started at R1 710 for a member, with an additional R1 329 for an adult dependant and R720 for a child dependant, to a maximum of 3 child dependants. Additional children join at no additional cost.

👉 The most expensive plan at the time was the Pace4 Comprehensive Plan, with monthly contributions of R9 411 per member and R9 411 per adult dependant. For a child dependant, the extra contribution was R2 205, up to 3 child dependants with additional children added as beneficiaries of the scheme at no extra cost.

What Is the Waiting Period for BestMed Medical Aid’s Benefits?

👉 There can be a general waiting period of three months or a specific waiting period of 12 months for a certain condition.

👉 BestMed Medical Scheme will sometimes only pay a claim if it is a PMB. This can happen if you are in a waiting period or if you are getting treatment for a condition that your plan doesn’t cover.

How to Claim for Benefits from BestMed Medical Aid

👉 If your healthcare provider does not submit claims to BestMed, one must submit the original claim directly to the fund administrators.

👉 You can claim by means of the BestMed App, or by scanning and emailing your claim to them.

👉 Details that should appear on all claim documents include:

➡️ Member’s name and contact details

➡️ BestMed membership number

➡️ Patient’s details

➡️ Service provider’s name, contact details and practice number

➡️ Details of treatment, including applicable tariff and ICD-10 codes

➡️ Whether payment should be done to the service provider or the member

👉 You will receive an email confirmation when your claim is received and indexed.

BestMed Medical Aid Contact Details

Head Office:

BestMed Medical Scheme, Glenfield Office Park, 361 Oberon Avenue, Faerie Glen, Pretoria

PO Box 2297

Pretoria

Emails: [email protected]; [email protected],

Phone: +27 (0)86 000 2378

Read more about 5 Best Medical Aids under R1500 per month

Frequently Asked Questions

Are there medical aids in South Africa for under R1500 per month?

Yes, there are medical aids in South Africa for less than R1500 per month.

Will I be able to get medical aid under R1500 without a permanent job?

It may be difficult to obtain medical aid under R1500 in South Africa without a stable job, as most medical aid systems require proof of income or work. However, certain medical aid providers may provide solutions for people who are unemployed or have inconsistent income.

Can I add my family as dependents on a medical aid under R1500 per month?

Yes, depending on the plan and provider you choose, you can add family members as dependents on a medical aid plan for less than R1500 per month. Adding dependents to your medical aid plan, on the other hand, may raise the overall cost of your monthly payments.

Will I be able to upgrade a medical aid plan for under R1500 ?

Depending on the exact plan and provider, you may be able to upgrade a medical aid plan for less than R1500 per month.

Will a medical aid for less than R1500 cover me in case of hospitalization?

Yes, some medical aid plans costing less than R1500 per month can cover hospitalization.