5 Best Medical Aids Covering "Pre-Existing Pregnancies"

Do medical aids cover pre-existing pregnancies revealed?

The straight answer is NO.

However, this doesn’t mean it’s not important to go ahead and secure medical aid cover, for yourself and the soon-to-be new member of your family.

Should you be pregnant before joining a medical aid, you will have to find the funds to cover the cost of the birth which can be anywhere around R60 000 and more for a normal birth in a private facility. Should there be any complications, this cost could be much higher.

The good news is, that if you join a medical scheme at least 30 days prior the birth, the baby will be covered from their first breath and have the protection they deserve.

This is a complete guide to maternity cover on medical aids in South Africa.

In this in-depth guide you’ll learn:

- What is a Medical Aid?

- How to compare medical aids against each other?

- Can you sign up for a new medical aid while pregnant?

So if you’re ready to go “all in” with the best medical aids and their maternity cover in South Africa, this guide is for you.

Let’s dive right in…

Top Medical Aids for Maternity Cover (2024)

- BestMed – Overall, Best Medical Aid Cover for Pregnancy in South Africa

- Discovery Health Medical Scheme – Best Customer Service Medical Aid

- Bonitas Medical Aid – Broadest Range of Low-Cost Medical Aid Plans

- Momentum Medical Aid – Top Extensive Medical Protection in South Africa

- FedHealth – Broadest Range of Low-Cost Medical Aid Plans

Introduction to Medical Aid Pregnancy Cover

👉 Most medical aids don’t pay for procedures or treatments for pre-existing conditions in the first year after you join. This apply to first-time joiners with no medical aid membership more than 90 days prior joining.

👉 This also applies to pregnancy, and no medical aid will pay for a new member’s pregnancy and delivery costs anymore if she joins the medical aid while she is pregnant.

👉 Some people think that medical aids are unfair to pregnant women since pregnancy is a human function and not a disease, but medical aids have to weigh the risks of covering a person against their potential cost.

👉 In South Africa, there has been a trend for pregnant women to join a medical aid, stay on it during their pregnancy, and then leave the medical aid soon after giving birth. This is seen as anti-selection.

👉 In such a case there’s a chance that the total expense for the medical aid will be far more than the contributions received from the member.

👉 This means that, in the end, the cost of this practice is mostly paid for by the other long-term and loyal medical aid members.

👉 Most medical aids in South Africa therefore no longer cover the costs of pregnancy and giving birth for women who are already pregnant when they join a medical aid.

👉 The Medical Schemes Act allows medical aids to impose a three-month general waiting period and 12-month condition-specific exclusions for any pre-existing medical condition, including pregnancy.

👉 If you join the medical aid after finding out you are pregnant, you will still be accepted, but your current pregnancy and delivery costs will not be covered.

👉 There used to be a small number of medical aids that might have covered pregnant women and paid for the costs of giving birth, but this has now changed, and even they are now turning away pregnant women.

👉 Most of those are restricted medical aids (Employer Group Medical Aids), which means that they are not open to everyone. For example Bankmed – covering all employees working in the Banking Industry.

👉 Even if you are already pregnant, there are still many reasons to join a medical aid as soon as possible.

👉 Firstly, the medical aid will still pay for medical costs other than your pregnancy.

👉 Secondly, even if the mother’s pregnancy is not covered, the medical aid coverage will still apply to the new-born. Lastly, pregnant women can be sure that future pregnancy costs will be covered if they join a medical aid right away.

👉 Should you switch medical aids, your new medical aid may cover all of the costs of giving birth, no matter how far along you are in your pregnancy. Provided that you belonged to your previous medical aid for 24 months or longer and did not have a break of more than 90 days prior joining the new medical aid.

👉 Therefor, make sure that there is NO break in between, to avoid not having cover in case of an emergency.

👉 Knowing now that medical aids do not cover pre-existing pregnancies for new members, let’s see what they do cover.

5 of the Best Known Medical Aids in South Africa & Their Pregnancy Coverage

👉 When you talk about medical aids in South Africa, Bestmed, Discovery, Bonitas, Momentum and FedHealth come to mind.

1. BestMed

👉 BestMed has a proven track record of offering members access to an extensive network of healthcare providers, value for money, and wellness benefits.

👉 BestMed claims to be South Africa’s largest self-administered scheme and the country’s fourth-largest open medical scheme.

👉 Bestmed prides itself on single-digit increases for 5 years in a row and 13 structured plans for every stage of life and budget.

👉 All its options come with great benefits for preventive health care, like female contraceptives, pneumonia, flu vaccines and more.

👉 Bestmed have options that gives access to any hospital or doctor, and also have more affordable network options with a network of specialists and hospitals all over South Africa.

👉 The Bestmed Maternity Care programme is available on all their options and gives expectant parents comprehensive benefits and services.

Who Manages BestMed?

👉 The Executive Leadership of BestMed consists of Leo Dlamini as CEO/Principal Officer, Pieter Van Zyl as COO, Ntando Ndonga as Executive: Legal, Risk & Corporate Governance, Elmarie Jooste as executive: Corporate Relations & Wellness, Jessogan Chetty as CFO, Dr Dion Kapp as Executive: Managed Healthcare and Service Providers, and Madelein Barkhuizen as Executive: Sales & Marketing. They are supported by teams of Member Elected Trustees and Board Appointed Trustees.

BestMed Options

👉 BestMed members can choose between Hospital options, Network options, Savings options, and Comprehensive options.

Hospital Options

👉 Hospital options include the Beat1 Network option that covers you at a range of NETWORK hospitals.

👉 Beat1 provides cover for hospitalisation at ANY hospital.

Network Options

👉 BestMed Network options include:

Rhythm1 Network option –

👉 Rhythm 1 offers unlimited in-hospital cover with either limited essential day-to-today benefits, or comprehensive savings for consultations with designated healthcare providers.

Rhythm2 Network option –

👉 Rhythm 2 offers unlimited in-hospital cover with either limited essential day-to-today benefits, or comprehensive savings for consultations with designated healthcare providers. This option is however dependent on income levels.

Savings Options

👉 BestMed Savings Options include the following:

Beat2 Savings option –

👉 The Beat 2 Savings plan offers extensive hospital cover at ANY private hospital and savings account out of which general day-to-day expenses are paid.

Beat2 Network Savings Option –

👉 The Beat2 Network Savings option offers extensive hospital cover at a NETWORK of private hospitals as well as access to a savings account for general day-to-day expenses.

Beat3 Savings option –

👉 Beat3 Savings option offers extensive in-hospital cover at ANY private Hospital, as well as a savings for day-to-day expenses and cover for additional chronic conditions over and above the 26 conditions covered on all medical aid options.

Beat3 Network Savings option –

👉 Beat3 Network Savings option offers extensive in-hospital cover with savings and cover for additional chronic conditions over and above the 26 conditions covered on all medical aid options. This plan is associated with a NETWORK of hospitals and providers.

Comprehensive Options

👉 BestMed Comprehensive options include the following:

Pace1 Comprehensive Option –

👉 The Pace 1 plan provides excellent hospital benefits with extensive day-to-day cover. It is ideal for those who want quality benefits but at an affordable price.

Beat4 Comprehensive Option –

👉 The Beat 4 comprehensive plan is suitable for people with specific healthcare needs because it includes additional chronic conditions and a savings portion with day-to-day expenses.

Pace2 Comprehensive Option –

👉 Pace 2 offers comprehensive cover with in- and out-of-hospital benefits is provided with this option. This option includes additional chronic conditions.

Pace3 Comprehensive Option –

👉 Pace3 Comprehensive Option offers comprehensive coverage for members that have varied medical needs. It includes comprehensive chronic benefits and provides excellent cover in case of hospitalisation.

Pace4 Comprehensive Option –

👉 The Pace 4 option is for those that need the comfort of extensive benefits and cover for hospital expenses because they have above-average medical costs or would just like the maximum available cover.

👉 It has the added benefit of an individual medical savings account which offers extra payment flexibility.

Benefits under BestMed’s Maternity Programme

👉 Maternity benefits are offered across all BestMed’s options. As a BestMed member, you can access the following benefits under the specific plans – paid at 100% scheme tariff and not from your savings account:

👉 Rhythm1:

➡️ 6 antenatal consultations with a Family Practitioner or gynaecologist or midwife

➡️ 1 x 2D ultrasound scan at first trimester (between 10 to 12 weeks) at a Family Practitioner or gynaecologist or radiologist

➡️ 1 x 2D ultrasound scan at second trimester (between 20 to 24 weeks) at a Family Practitioner or gynaecologist or radiologist

👉 Beat1 & Beat2

➡️ 6 antenatal consultations at a Family Practitioner or gynaecologist or midwife

➡️ 1 x 2D ultrasound scan at first trimester (between 10 to 12 weeks) at a Family Practitioner or gynaecologist or radiologist

➡️ 1 x 2D ultrasound scan at second trimester (between 20 to 24 weeks) at a Family Practitioner or gynaecologist or radiologist

👉 Beat3, Beat4, Pace1, Pace2, Pace3, Pace4 & Rhythm2

➡️ 9 antenatal consultations at a Family Practitioner or gynaecologist or midwife

➡️ 1 post-natal consultation at a Family Practitioner or gynaecologist or midwife

➡️ 1 x 2D ultrasound scan at first trimester (between 10 to 12 weeks) at a Family Practitioner or gynaecologist or radiologist

➡️ 1 x 2D ultrasound scan at second trimester (between 20 to 24 weeks) at a Family Practitioner or gynaecologist or radiologist

➡️ Any item considered as a maternity supplement, up to a maximum of R100 per claim, once a month, for a maximum of 9 months

👉 BestMed’s supporting maternity programmes include comprehensive information on every phase, monitoring for possible high-risks, weekly emails with helpful tips on your baby’s development and dealing with unpleasant pregnancy symptoms.

👉 In the unfortunate event of an unsuccessful pregnancy, you will get access to a nurse line and psychologists or counselling if necessary.

Quick Comparison of BestMed Options Pregnancy Benefits

| 💵 Benefit | 🤝 Consultations | 💻 Ultrasounds | 💊 Supplements |

| Hospital Plans | Up to 6 | 2 | – |

| Network Plans | Up to 6 | 2 | – |

| Savings Plans | 6 to 9 | 2 | – |

| Comprehensive Plans | 6 to 9 | 2 | Once a month |

How Much Are BestMed’s Monthly Premiums?

👉 At the time of writing, monthly premiums for the cheapest BestMed Beat1 Network Hospital Plan started at R1 873 for a member, with an additional R1 456 for an adult dependant and R789 for a child dependant, to a maximum of 3 child dependants. Additional children join at no additional cost.

👉 The most expensive plan at the time was the Pace4 Comprehensive Plan, with monthly contributions of R10,343 per member and R10,343 per adult dependant. For a child dependant the extra contribution was R2,423 up to 3 child dependants with additional children added as beneficiaries of the scheme at no extra cost.

How to Join BestMed’s Maternity Programme

👉 To benefit from the Maternity programme you need to sign up for it as soon as your family doctor or gynaecologist confirms your pregnancy with a pathology test and/or scan.

👉 After you fill out the form, a consultant will get in touch with you.

👉 If your pregnancy poses risks, the information will be sent to BestMed’s case managers, who will get in touch with you to help keep track of how things are going.

👉 Send an email to [email protected] or call +27 (0)12 472 6797 to register. Remember to provide the expectant member’s contact number and email address, membership number and expected delivery date.

👉 Upon successful registration you will receive the following:

➡️ A welcome pack with an informative book about the stages of pregnancy

➡️ Access to the 24-hour medical advice line

➡️ The relevant benefits through each phase of your pregnancy

➡️ A maternity/baby gift will be sent to you after the 12th week of your pregnancy

What Is the Waiting Period for BestMed Maternity Benefits?

👉 There can be a general waiting period of three months or a specific waiting period of 12 months.

👉 Bestmed Medical Scheme will sometimes only pay a claim if it is a PMB. This can happen if you are in a waiting period or if you are getting treatment for a condition that your plan doesn’t cover. Pregnancy is considered a PMB.

How to Claim Maternity Benefits from BestMed

👉 If your healthcare provider does not submit claims to BestMed, the member must submit the original claim directly to Bestmed.

👉 You can claim by means of the BestMed App, or by scanning and emailing your claim to [email protected].

👉 Details that should appear on all claim documents include:

➡️ Member’s name and contact details

➡️ BestMed membership number

➡️ Patient’s details

➡️ Service provider’s name, contact details and practice number

➡️ Details of treatment, including applicable tariff and ICD-10 codes

➡️ Whether payment should be done to the service provider or the member

👉 You will receive an email confirmation when your claim is received and indexed.

BestMed Contact Details

Head Office:

Bestmed Medical Scheme,

Glenfield Office Park

361 Oberon Avenue

Faerie Glen

Pretoria

PO Box 2297

Pretoria

Emails: [email protected]; [email protected],

Phone: +27 (0)86 000 2378

Compare BestMed with other Medical Scheme Providers

- ⚕️ BestMed Medical Scheme versus Discovery Health

- ⚕️ BestMed Medical Scheme versus Medimed

- ⚕️ BestMed Medical Scheme versus Medihelp

- ⚕️ BestMed Medical Scheme versus Keyhealth

- ⚕️ BestMed Medical Scheme versus Fedhealth

- ⚕️ BestMed Medical Scheme versus Bonitas

- ⚕️ BestMed Medical Scheme versus Momentum Medical Scheme

- ⚕️ BestMed Medical Scheme versus Sizwe Medical Fund

- ⚕️ BestMed Medical Scheme versus Medshield

2. Discovery Health Medical Scheme

👉 Discovery Health Medical Scheme (DHMS) is the largest open medical scheme in South Africa. It is a registered open medical scheme that anyone can join, as long as they follow the rules of the Scheme.

👉 The Discovery Health Medical Scheme gives more than 20 options to choose from, each with unlimited private hospital coverage and a variety of benefits to fit your needs and your budget.

👉 Access to a wide range of benefits, care programmes, and services that make sure you can get the best healthcare when you need it.

👉 Discovery claims that its contributions are on average 14.9% less than what other South African medical schemes charge for the same level of coverage.

👉 Vitality, Discovery’s wellness programme, rewards you for living a healthy life. You have to join Vitality at an extra cost.

Who Manages Discovery?

👉 The Discovery Health Medical Scheme is an independent non-profit entity governed by the Medical Schemes Act and regulated by the Council for Medical Schemes.

👉 The Scheme is owned by its members, and it is run by an independent Board of Trustees. It is administered by a separate company, Discovery Health (Pty) Ltd, an authorised financial services provider.

Discovery Options

👉 Discovery options range from the most comprehensive private healthcare cover to basic plans where you get cost-effective private healthcare cover through an extensive network of providers.

👉 Choose from the following options:

Executive Plan

👉 The Executive Plan offers customers the most extensive cover for in-hospital and day-to-day benefits, as well as extended chronic medicine cover and an unlimited Above Threshold Benefit.

Comprehensive Series

👉 The Comprehensive series provide comprehensive cover for in-hospital and day-to-day cover with extended chronic medicine cover and Above Threshold Benefits.

Priority Series

👉 The Priority series offer cost-effective in-hospital cover, essential chronic medicine cover and day-to-day benefits with more limited Above Threshold Benefits.

Saver Series

👉 The Saver series is economical, provides in-hospital cover, essential chronic medicine cover and day-to-day benefits through a Medical Savings Account.

Core Series

👉 The Core Series is a value-for-money series of hospital options that provide unlimited private hospital cover and essential cover for chronic medicine but with no day-to-day cover.

Smart Series

👉 The Smart Series provide the most cost-effective in-hospital cover, essential chronic medicine cover plus limited day-to-day cover if you use providers in a specified network.

Keycare Series

👉 The Keycare series offers affordable medical cover providing you use providers in a specified network for both in-hospital and out-of-hospital treatment.

Benefits under Discovery’s Maternity Programme

👉 Discovery’s Maternity Programme gives comprehensive benefits for maternity and early childhood.

👉 The My Pregnancy and My Baby programmes on the Discovery app and website offer support, advice, and guidance 24 hours a day, 7 days a week.

👉 The My Pregnancy programme can be activated on the Discovery app and gives access to immediate support, advice, and tools. You can track your pregnancy, get weekly milestones, and see personalised checklists on your mobile device or online.

👉 Through the My Pregnancy programme, it’s also easy to plan ahead for your hospital stay when you give birth. You can preauthorise your hospital stay or change the date of your stay.

👉 By getting your pregnancy and delivery approved ahead of time, you will always know how your healthcare services related to your pregnancy are covered.

👉 While you are pregnant the Maternity Benefit pay for the following:

➡️ Depending on the plan you choose, you are covered for up to 12 antenatal consultations with your gynaecologist, general practitioner, or midwife.

➡️ Up to two ultrasounds and one nuchal translucency scan

➡️ One Non-Invasive Prenatal Test (NIPT), as long as you meet the clinical entry criteria.

➡️ A set number of blood tests for each pregnancy.

➡️ On the Executive and Comprehensive plans, you are covered for up to R1,880 per day in a private ward while you are giving birth in the hospital.

➡️ On the Executive and Comprehensive plans, you can get up to R5,000 in coverage for essential registered devices, like breast pumps and smart thermometers, with a 25% co-payment.

➡️ Ante-natal Classes or visits with a nurse

Quick Comparison of Discovery Option Plans’ Pregnancy Benefits

| 💵 Benefit | 🤝 Consultations | 💻 Ultrasounds | 💊 Supplements |

| Executive and Comprehensive plans | Up to 12 | Up to 2 | Blood tests 1x NIPT if you qualify A private ward R5,000 in coverage for essential registered devices |

| Other plans | Up to 12 | Up to 2 | Blood tests 1x NIPT if you qualify |

How Much Are Discovery Monthly Premiums?

👉 Monthly premiums start from R1,102 per member for the Keycare Series with medical cover for both in-hospital and out-of-hospital treatment by providers in a specified network and go up to R10,303 per member for the Executive Plan with extensive cover for in-hospital and day-to-day benefits, extended chronic medicine cover, and unlimited Above Threshold Benefit.

How to Join Discovery’s Maternity Programme

👉 You can activate the My Pregnancy and My Baby programmes on the Discovery app or website (www.discovery.co.za) to gain access to immediate support, advice and personalised tools.

👉 Alternatively, you can activate it by calling 0860 99 88 77 and following the voice prompts.

👉 The maternity and early childhood benefits will be effective from the date of activation.

What Is the Waiting Period for Discovery Benefits?

👉 Discovery Health Medical Scheme’s general waiting period is 3 consecutive months, and the condition-specific waiting period is 12 consecutive months. This applies to new members joining who had a break of more than three months in medical aid membership and/or did not belong to any medical aid for 24 consecutive months prior joining.

How to Claim from Discovery

👉 You can submit a claim fast and easy in the following ways:

➡️ Scan and upload your claims on the website.

➡️ Scan and email your claims to [email protected].

➡️ Use the Discovery app on your smartphone. If the claim has a QR code, scan the QR code or alternatively take a photo of the claim from within the app.

➡️ You can also submit your claims by post.

Discovery Contact Details

PO Box 784262,

Sandton,

2146

Phone: 0860 99 88 77

3. Bonitas Medical Aid

👉 Bonitas has been around for a few decades, with a rich history and a good understanding of the South African private healthcare industry.

👉 Its team of experts is always looking for new ways to make sure that members get affordable, high-quality health care. This means keeping up with technology, managing care so that lifestyle diseases are detected before they become chronic, or negotiating better rates with healthcare providers.

👉 Moreover, the company’s finances are stable, its key indicators of fiscal health are strong, and it has enough funds in reserve.

Who Manages Bonitas?

👉 Bonitas is run by a management team with a lot of experience and an independent Board of Trustees made up of professionals from the health, legal, financial, and business fields – and who are not members.

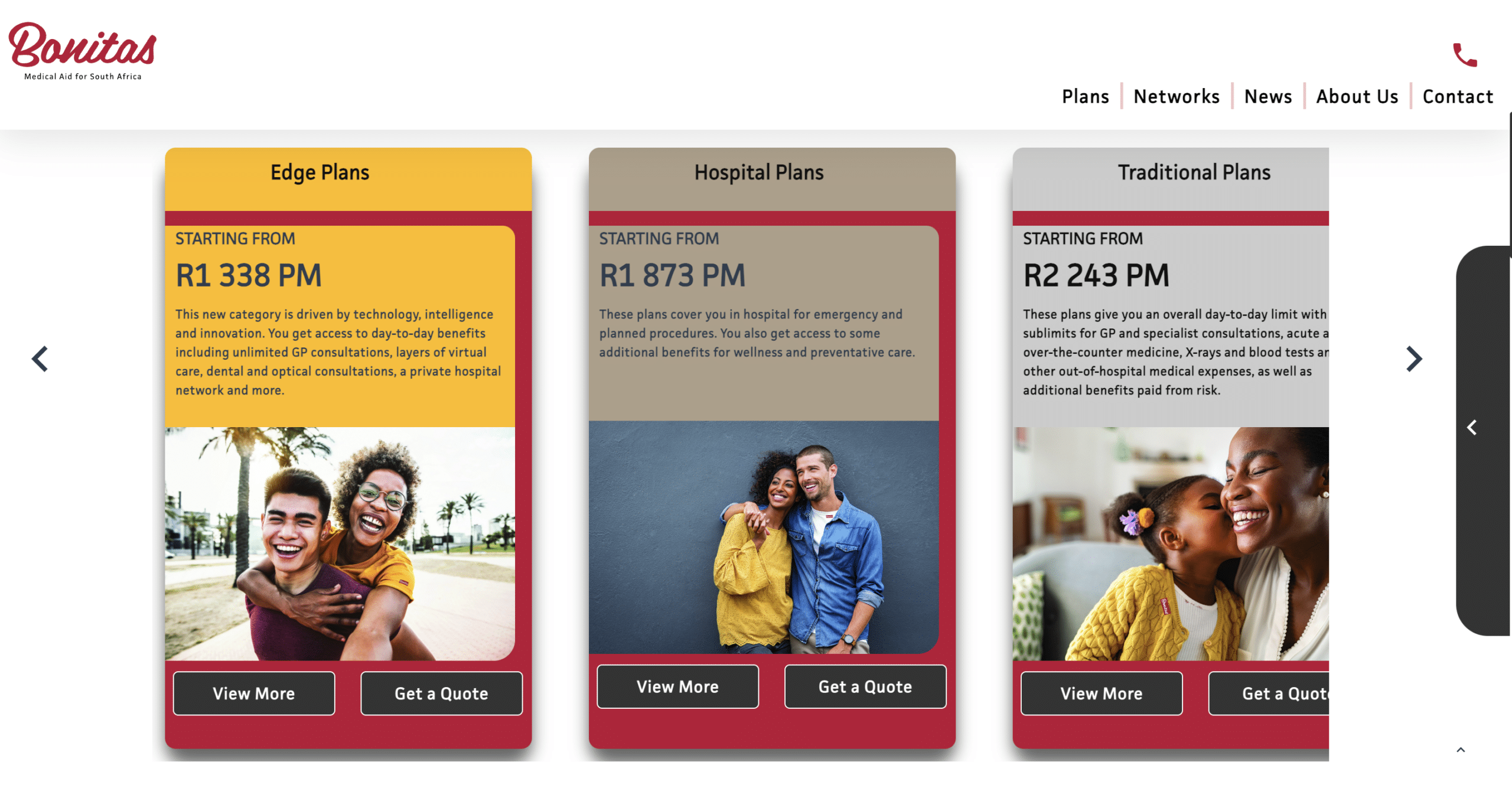

Bonitas Options

👉 Knowing that one size doesn’t fit all, Bonitas offers a wide variety of options so that any family can find one that fits their needs perfectly.

👉 The options are easy to understand and helps the member to get the most out of their benefits.

Edge

👉 This category gives access to day-to-day benefits including unlimited GP consultations, layers of virtual care, dental and optical consultations, a private hospital network and more. Options include:

BonStart

👉 The BonStart option is designed for economically active singles, living in the larger metros, with a drive to succeed.

BonStart Plus

👉 The BonStart Plus option is designed for young, economically active couples, living in the larger metros, and looking to expand their family.

Traditional

👉 These options give an overall day-to-day limit with sub-limits for GP and specialist consultations, acute and over-the-counter medicine, X-rays and blood tests and other out-of-hospital medical expenses.

Standard

👉 The Standard traditional option offers rich day-to-day benefits and comprehensive hospital cover.

Standard Select

👉 This Standard Select traditional option uses a network of quality providers that offers rich day-to-day benefits and hospital cover.

Primary

👉 The Primary traditional option offers simple day-to-day benefits and hospital cover.

Primary Select

👉 The Primary Select traditional option uses a network of quality providers to offer modest day-to-day benefits and hospital cover.

Savings

👉 These options give you a set amount that you can use however you want for out-of-hospital costs like doctor visits, optometry, and dentistry. They also cover you while you’re in the hospital and give you extra benefits for maternity, wellness, and preventative care.

BonFit Select

👉 The BonFit Select savings option offers essential hospital cover and basic cover for day-to-day medical needs.

BonSave

👉 The BonSave savings option offers sufficient savings to use for medical expenses and extensive hospital cover.

BonComplete

👉 The BonComplete savings option offers generous savings, an above-threshold benefit and rich hospital cover.

BonClassic

👉 The BonClassic savings option offers a wide range of medical benefits, in and out of the hospital.

BonComprehensive

👉 The BonComprehensive first-class option offers ample savings, an above threshold benefit and extensive hospital cover.

Hospital

👉 These options cover you for emergency and planned procedures in hospital and you get access to some additional benefits for wellness and preventative care.

Hospital Standard

👉 The Hospital Standard hospital option offers general hospital benefits with some value-added benefits.

BonEssential

👉 The BonEssential hospital option offers comprehensive hospital benefits with some value-added benefits.

BonEssential Select

👉 The BonEssential Select hospital option uses a quality provider network that offers comprehensive hospital benefits and some value-added benefits.

Income-based

👉 The BonCap income based entry-level option offers basic day-to-day benefits and hospital cover when using the set network of doctors, providers and hospitals.

Benefits under Bonitas’ Maternity Programme

👉 Bonitas’ maternity programme gives specific assistance during each trimester, information about pregnancy, and puts you in touch with other people who can help you.

👉 During your pregnancy, you can call the Maternity Health Advice line at 087 056 9888 if you have any questions about your health. The line is open 24 hours a day, 7 days a week and is run by a nurse. It’s just a medical advice line; you won’t get a diagnosis or a prescription.

👉 A maternity nurse or midwife will call you at certain important times to give advice on how to take care of your health while you’re pregnant. You will be reminded to take supplements, eat right, and come back for follow-up appointments.

👉 You’ll be able to take online classes to help you get ready for the birth, your stay in the hospital, and what to expect when you go home. You can sign up for these classes twice a month on the Bonitas website with your membership number.

👉 You will get an SMS every week that is right for your stage of pregnancy. This will help you keep track of how your baby is growing and help you understand how and why your body is changing during your pregnancy.

👉 Other maternity benefits include:

➡️ Up to 12 consultations during pregnancy

➡️ 2 ultrasounds in 2D

➡️ 1 amniocentesis

➡️ 4 visits with a midwife after giving birth (1 of these can be with a lactation specialist)

➡️ Newborn hearing screening (Excludes BonCap)

Quick Comparison of Bonitas Option Plans’ Pregnancy Benefits

| 💵 Benefit | 🤝 Consultations | 💻 Ultrasounds | 💊 Supplements |

| BonStart | None | None | None |

| Standard | 12 | 2 | 4 Postnatal consultations |

| BonComprehensive | 12 | 2 | 4 Postnatal consultations |

How Much Are Bonitas Monthly Premiums?

| 🔎 Plan | 💴 Contributions Range (Main) ZAR | 💵 Contributions Range (+ Adult) ZAR | 💶 Contributions Range (+ Child) ZAR | 💷 Medical Savings (Up to) | 📌 Chronic Conditions |

| 🥇 BonStart | 1,378 | 1,378 | 1,378 | None | 27 |

| 🥈 BonStart Plus | 1,754 | 1,668 | 773 | None | 27 |

| 🥉 Standard | 4,922 | 4,267 | 1,444 | None | 45 |

| 🏅 Standard Select | 4,448 | 3,849 | 1,302 | None | 45 |

| 🥇 Primary | 2,993 | 2,341 | 952 | None | 27 |

| 🥈 Primary Select | 2,619 | 2,048 | 832 | None | 27 |

| 🥉 BonFit Select | 2,295 | 1,719 | 772 | R4,128 (Main) R3,096 (+1 Adult) R1,392 (+1 Child) | 27 |

| 🏅 BonSave | 3,447 | 2,671 | 1,032 | R10,344 (Main) R8,016 (+1 Adult) R3,096 (+1 Child) | 27 |

| 🥇 BonComplete | 5,359 | 4,293 | 1,455 | R9,624 (Main) R7,716 (+1 Adult) R2,616 (+1 Child) | 31 |

| 🥈 BonClassic | 6,732 | 5,780 | 1,662 | R11,412 (Main) R9,804 (+1 Adult) R2,820 (+1 Child) | 47 |

| 🥉 BonComprehensive | 9,853 | 9,292 | 2,006 | R22,308 (Main) R21,036 (+1 Adult) R4,536 (+1 Child) | 60 |

| 🏅 Hospital Standard | 2,964 | 2,497 | 1,127 | None | 27 |

| 🥇 BonEssential | 2,287 | 1,690 | 739 | None | 27 |

| 🥈 BonEssential Select | 1,998 | 1,464 | 659 | None | 27 |

| 🥉 BonCap | 1,430 – 3,453 | 1,430 – 3,453 | 673 – 1,310 | None | 27 |

How to Join Bonitas’ Maternity Programme

👉 The Bonitas Maternity Programme is available to all Bonitas members. You can register for the programme by calling 087 056 9888.

What Is the Waiting Period for Bonitas Benefits?

👉 The minimum general waiting period for new members on Bonitas medical aid is three months for all benefits. However, pre-existing conditions may be excluded for 12 months where a new member had a break of more than 90 day medical aid membership prior joining.

👉 Pregnancy is considered a pre-existing condition; therefore, it is excluded from all benefits for the first 12 months of scheme membership. This only apply to new members who did not belong to any medical scheme more than 90 days prior joining.

How to Claim from Bonitas

👉 You can send in your claim in the following ways:

➡️ Email your claims to [email protected].

➡️ Post your claims to Bonitas Claims Department, PO Box 74, Vereeniging, 1930.

➡️ Submit your claims in person at one of the walk-in centres.

👉 Follow these simple steps to get your claims paid quickly:

➡️ Ensure your banking details are correct for refunds by electronic transfer (EFT) into your bank account

➡️ Make sure that your account and receipt show your name and initials, membership number, treatment date, the name of the patient as shown on your membership card, amount charged and ICD-10 code.

Bonitas Contact Details

34 Melrose Blvd, Birnam

Johannesburg

2196

Phone for General Queries: 0860002108

Email: [email protected]

Email: [email protected]

4. Momentum Medical Aid

👉 Momentum is one of the top open medical schemes and is run by one of South Africa’s largest and most trustworthy healthcare solutions companies.

👉 Momentum Medical Scheme is a non-profit open medical scheme registered under the Medical Schemes Act 131 of 1998, as amended.

Who Manages Momentum?

👉 Momentum Health Solutions is a wholly owned subsidiary of Momentum Metropolitan Life Limited.

👉 Each year its Board of Trustees is elected at an Annual General Meetings and includes several individuals with substantial experience and skills in a variety of medical, accounting and legal fields.

Momentum Options

👉 Momentum Medical Scheme gives access to a wide range of medical insurance plans and benefits, including 6 medical aid options.

Evolve Option

👉 The Evolve option gives cover for hospitalisation from the Evolve Network of private hospitals with no overall annual limit.

👉 You get access to 2 virtual doctors’ consultations and all day-to-day benefits are subject to an optional HealthSaver at an additional monthly cost. Minimum of R100 per month to a maximum of R6 000 per month.

Custom Option

👉 The Custom option gives comprehensive hospital and chronic cover between any or associated providers. You can choose to have access to treatment at any hospital or save on your contribution by using a specific list of associated private hospitals.

Incentive Option

👉 With the Incentive option you get extensive hospital and chronic cover from any or associated providers. Day-to-day expenses is covered by a dedicated medical savings account funded by 10% of your monthly contributions.

Extender Option

👉 The Extender option gives extensive hospital cover and additional chronic condition cover from any or associated providers. 25% of your contributions go to your dedicated medical savings account from which your day-to-day expenses are paid. You qualify for the Extended Cover benefit once you have reached your annual Threshold.

Summit Option

👉 The Summit option gives unlimited private hospital cover from any provider. Chronic cover is available for an additional 36 conditions and day-to-day benefits up to R29 700 per beneficiary per year.

Ingwe Option

👉 The Ingwe option gives affordable and accessible entry-level medical cover. You can get treatment from any hospital, the Ingwe Network of private hospitals, or State hospitals. Contributions according to various income scales.

Benefits under Momentum’s Maternity Programme

👉 Momentum Health Solutions works with South Africa’s leading parenting website, BabyYumYum, to offer new moms benefits like nurse visits at home, relevant and up-to-date parenting information, a meal delivered to the family on their first night home from the hospital, and a designer nappy bag with pampering products.

👉 Members qualify for up to 12 prenatal visits with a GP, gynaecologist, or registered midwife, as well as 2 pregnancy or growth scans, one before the 24th week and one after.

👉 The scheme pays for two visits to a paediatrician in a child’s first year, except for the Ingwe option. It’s important to remember that you have to be a member of the Scheme before you get pregnant to get the full value and benefits of the maternity programme. The benefits will also vary depending on which option a member chooses.

👉 Momentum Health members also have the option of getting their vaccinations done at home, and they can get advice 24 hours a day, seven days a week.

👉 Depending on which choice the member makes, the maternity programme offers the following benefits:

➡️ A midwife can come to your home to help with bathing, swaddling, latching on, and feeding your baby. The EPI schedule calls for visits to homes two days, two weeks, and six weeks after vaccinations.

➡️ Access to reliable, up-to-date information on all topics related to be a parent

➡️ A designer nappy bag that is full of things that mom and baby need.

➡️ A meal delivery voucher for the family’s first night at home, so they can settle in and focus on their family.

Quick Comparison of Momentum Option Plans’ Pregnancy Benefits

| 💵 Benefit | 🤝 Consultations | 💻 Ultrasounds | 💊 Supplements |

| All Options | 12 | 2 | – |

| Ingwe Option | None | None | – |

How Much Are Momentum Monthly Premiums?

| 🔎 Plan | 💴 Contributions Range (Main) | 💵 Contributions Range (2x Adult) | 💶 Contributions Range (1 Adult + 1 Child) | 💷 Contributions Range (2 Adults + 1 Child) | 💴 Contributions Range (2 Adults + 2 Children) | 💵 Contributions Range (2 Adult + 2 Children) | 💶 Medical Savings (% of contribution or ZAR) |

| 1️⃣ Ingwe | 541– 3,760 ZAR | 1,082 – 7,520 ZAR | 1,007– 4,851 ZAR | 1,548 – 8,611 ZAR | 2,014 – 9,702 ZAR | 2,480 – 10,793 ZAR | None |

| 2️⃣ Evolve | 1,687 ZAR | 3,374 ZAR | 3,374 ZAR | 5,061 ZAR | 6,748 ZAR | 8,435 ZAR | None |

| 3️⃣ Custom | 2,149 – 3,685 ZAR | 3,775 – 6,642 ZAR | 2,911 – 5,000 ZAR | 4,537– 7,957 ZAR | 5,299 – 9,272 ZAR | 6,061 – 10,587 ZAR | None |

| 4️⃣ Incentive | 2,794 – 4,970 ZAR | 5,000 – 9,009 ZAR | 3,866 – 6,908 ZAR | 6,072 – 10,947 ZAR | 7,144 – 12,885 ZAR | 8,216 – 14,823 ZAR | 10% |

| 5️⃣ Extender | 6,589 – 9,456 ZAR | 11,586 – 17,072 ZAR | 8,526 – 12,168 ZAR | 13,523 – 19,784 ZAR | 15,460 – 22,496 ZAR | 17,397 – 25,208 ZAR | 25% |

| 6️⃣ Summit | 13,573 ZAR | 24,428 ZAR | 16,691 ZAR | 27,546 ZAR | 30,664 ZAR | 33,782 ZAR | 31,300 ZAR |

How to Join Momentum’s Maternity Programme

👉 From the eighth week of your pregnancy you can register via the Momentum app, on momentum health.co.za or calling the call centre on 0860 11 78 59.

What Is the Waiting Period for Momentum Benefits?

👉 The general waiting period is 3 months, but since pregnancy is considered a pre-existing condition, it is excluded from all benefits for the first 12 months of scheme membership. This is only applicable to new members joining who had a break of more than 90 days medical aid membership prior joining.

How to Claim from Momentum

👉 You can submit a claim in several ways:

➡️ Use the Momentum App

➡️ Use the web chat facility in the bottom left corner.

➡️ Send an email to [email protected] or send normal mail to PO Box 2338, Durban, 4000

👉 To make sure your claim is processed quickly and accurately, include the following information:

➡️ Membership number.

➡️ Principal member’s surname, initials, and first name.

➡️ Patient’s surname, initials, and first name.

➡️ Date of treatment.

➡️ Amount charged.

➡️ ICD–10 code (code to indicate what condition you’ve been diagnosed with), tariff code (product-specific code for procedures and claims), and NAPPI code (unique identifier for a given ethical, surgical, or consumable product).

➡️ Service provider’s name and practice number.

➡️ Proof of payment if you’ve paid the claim out of your own pocket.

Momentum Contact Details

201 Umhlanga Ridge Blvd

Cornubia

Blackburn

PO Box 2338

Durban

5. FedHealth

👉 Fedhealth has been taking care of South Africans’ health Since 1936. Over the years, they were committed to providing quality health care that is also affordable.

👉 It gives its members access to medical care that they can manage themselves.

👉 The fund had a Global Credit Rating of AA- for 14 years in a row, and the scheme’s reserves are well over the required 25%.

👉 Fedhealth is also known for its unique benefits paid from Risk, which help members get more out of their regular benefits.

Who Manages FedHealth?

👉 The company is still run by members for members and is always coming up with new ideas to meet the needs of people who want to take care of their health in a changing world.

FedHealth Option

👉 The options offered by Fedhealth are tailor made to fit your needs, budget, and stage of life. You can choose from a variety of options, including coverage if you’ve never had medical aid before, the innovative flexiFED options that allow you to “design” your own medical aid, and the maxiFED options that offer the most comprehensive medical aid coverage.

myFED

👉 myFED offers affordable (income-based) cover for lower income, previously uncovered members.

flexiFED Savvy

👉 You’re young, healthy and just started your first job the flexiFED Savvy is a very affordable personalised, customised hospital option with an optional, voluntary day-to-day element.

flexiFED 1

👉 flexiFED 1 is an affordable hospital option that gives solid medical aid cover at a great price. Members can get access to Fedhealth Savings to help cover unexpected day-to-day medical bills and a Threshold Benefit that kicks in once your claims have reached a certain level.

flexiFED 2

👉 flexiFED 2 is a suitable family hospital option for young families, with generous maternity and childhood benefits, access to Fedhealth Savings (at additional cost) for unexpected day-to-day medical bills, and a Threshold Benefit that kicks in once your claims have reached a certain level.

flexiFED 3

👉 flexiFED 3 is ideal for young, growing families.

👉 It supports them with generous maternity and childhood benefits for pregnancy, birth and the busy early childhood years. Members also have access to Fedhealth Savings for unforeseen medical expenses, and a Threshold Benefit that kicks in once claims have reached the stated level.

flexiFED 4

👉 The flexiFED 4 option provides solid cover for mature families whose kids are older. Apart from comprehensive in-hospital cover, it also offers Fedhealth Savings for unplanned medical expenses and a Threshold benefit once claims have accumulated to a stated level.

maxima EXEC

👉 maxima EXEC offers comprehensive all-round cover for more mature members. Apart from in-hospital, chronic medicine, screening and additional benefits, it has a day-to-day savings portion and Threshold benefit.

maxima PLUS

👉 maxima PLUS offers extensive medical cover for every aspect of your healthcare, like generous in-hospital cover, chronic medicine, screening and additional benefits, a day-to-day savings portion, a Threshold benefit, and an optional hospital expense benefit.

Benefits under FedHealth’s Maternity Programme

👉 The FedHealth Birth and Baby Benefit gives vouchers, discounts, gifts, and advice to parents-to-be.

👉 You can sign up for our free Fedhealth Baby Programme once you have been pregnant for 12 weeks.

👉 Digital newsletters keep you up-to-date on news and education. They include health profiles for each trimester, monthly callouts for members who are at high risk, and access to a 24-hour Baby Advice Line for any questions.

👉 The following costs are covered:

➡️ 2x antenatal scans

➡️ 12 ante- and postnatal consults with midwife, network GP and gynea

➡️ Doula benefit

➡️ Postnatal midwifery benefit

➡️ Private ward cover (depending on plan)

Quick Comparison of FedHealth Option Plans’ Pregnancy Benefits

| 💵 Benefit | 🤝 Consultations | 💻 Ultrasounds | 💊 Supplements |

| flexiFED 1 | None | None | None |

| flexiFED 2 | 8 | 2 | Doula benefit Postnatal midwifery benefit |

| flexiFED 3 | 12 | 2 | Doula benefit Postnatal midwifery benefit Private ward cover |

How Much Are FedHealth Monthly Premiums?

👉 The monthly premiums for the salary-banded myFED option is from R1,590 per month for the main member.

👉 The maxima PLUS extensive medical cover will cost from R14,289 per month per main member.

How to Join FedHealth’s Maternity Programme

👉 You can register for the free Fedhealth Baby Programme once you’re 12 weeks into your pregnancy, by calling 0861 116 016 or emailing [email protected].

What Is the Waiting Period for FedHealth Benefits?

👉 The general waiting period for FedHealth benefits are usually three months. The waiting period for pre-existing conditions is 12 months.

This is only applicable to new members who did not belong to any medical aid more than 90 days prior joining.

How to Claim from FedHealth

👉 Members can submit claims using one of the following:

➡️ On the Fedhealth Family Room,

➡️ Through a WhatsApp service

➡️ On the Fedhealth Member phone App

➡️ You may also email, fax or post the claims to email: [email protected], fax: (011) 671 3842 or post to Private Bag X3045, Randburg, 2125.

FedHealth Contact Details

Flora Centre Shop 21 and 22

Corner Conrad street and Ontdekkers Rd

Florida Glen

Johannesburg

Phone: 0861 116 016

Frequently Asked Questions

Can you join a medical aid in South Africa if you are already pregnant?

Yes, you can join a medical aid in South Africa if you are already pregnant but will not be able to share in the aid’s pregnancy benefits.

Are there South African medical aids that cover pre-existing pregnancy?

No, there are no medical aids in South Africa that cover pre-existing pregnancy. Some used to but stopped.

Does medical insurance cover the cost of a pregnancy?

Medical insurance cover may not cover the cost of a pregnancy. Most health insurance plans come with a waiting period.

Can you have medical aid & medical insurance at the same time to cover pregnancy?

Yes, you can have a medical aid and medical insurance at the same time but should note that medical insurance only ensures you receive a pay-out if you are hospitalized and cannot work or earn a living.

How long do you have to be a member of a medical aid to get a pregnancy covered?

You usually have to be a member of a medical aid for longer than 12 months to get a pregnancy covered. A medical scheme cannot refuse to accept you as member if you are already, but you won’t have cover immediately.