5 Best Student Medical Aids for Foreigners

The 5 Best Student Medical Aids for Foreigners in South Africa revealed.

We tested them side by side and verified their medical aid plans.

This is a complete guide to the best student medical aids for foreigners in South Africa.

In this in-depth guide you’ll learn:

- What is a Medical Aid?

- Can a foreigner join a medical aid in South Africa?

- How do you find affordable medical aid in South Africa?

- How to choose the best affordable medical aid for your needs?

- How to compare medical aids against each other side by side?

- The process to apply for cover if you are a foreign national.

So if you’re ready to sign up for the best student medical aid for a foreigner, this guide is for you.

Let’s dive right in…

Best Student Medical Aids for Foreigners (2024)

| 🩺 Medical Aid | ✔️ Student Medical Aid for Foreigners? | ⚕️ Plan Offered | 👉 Sign Up |

| 1. Momentum Health | Yes | Ingwe Student Option, Evolve Option, Custom Offer, Incentive Option, Extender Option, Summit Option | 👉 Apply Now |

| 2. Compcare | Yes | Compcare Student Plan | 👉 Apply Now |

| 3. Bonitas | Yes | BonCap Plans, BonEssential Select Plan, Savings Plan | 👉 Apply Now |

| 4. Discovery Health | Yes | Saver Series, Core Series, Smart Series | 👉 Apply Now |

| 5. BestMed Medical Aid | Yes | Hospital Plan, Network Plan, Savings Plan | 👉 Apply Now |

5 Best Student Medical Aids for Foreigners (2024)

- Momentum Health – Overall, Best Student Medical Aid for Foreigners in South Africa

- CompCare – Top Healthcare Funding Medical Aid

- Bonitas – Best Customer Service Student Medical Aid for Foreigners

- Discovery Health – Most Extensive Medical Aid Options

- BestMed Medical Aid – Largest Privately Operated Medical Aid

Why international students need medical aid in South Africa

👉 Regulation in South Africa require all international students to have valid medical cover through a list of South African medical scheme for the duration of their studies there.

👉 The Medical Schemes Act mandates this least basic coverage, which be provided through relatively reasonable medical scheme solutions that cater to the demands of international students and reduce the risk of financial responsibility on the part of the university or the student.

Applying for medical aid in South Africa as an international student

👉 As of the commencement date specified in the membership confirmation letter, medical coverage will be provided. Changes to the student’s planned course of study must be communicated to the scheme one month prior to the program’s scheduled start date.

👉 Requests to terminate membership or move the date the membership begins that were received late by the scheme cannot be retroactively granted. Coverage under your membership plan is tied instead to the length of your study visa, rather than the date you arrive in South Africa to begin classes.

👉 All international students are required to register with their school’s International Office before they can enrol in classes.

👉 Proof of a valid study permit, proof of payment of fees for the academic year, and proof of full medical aid coverage with a South African registered medical aid scheme for the academic calendar year (beginning on the first day of the month of registration and ending on the last day of December) are all typically required documents for universities to process pre-registration.

👉 Because of this, it is strongly recommended that overseas students secure medical aid coverage prior to arriving in South Africa. If a student needs sponsorship, he or she should let the sponsor know about this condition right away.

👉 No cash payments are permitted for the necessary medical aid protection; all payments must be made directly to the medical aid scheme.

👉 Modular programme students are exempt from providing proof of medical aid during the preregistration process with the International Office; however, should they choose to extend their stay in South Africa for the remainder of the academic year, they will be required to purchase medical cover in accordance with the requirements outlined above.

👉 Students pursuing a bachelor’s degree in South Africa are required to have comprehensive medical aid for the duration of their stay in the country.

5 of the Best-Known Medical Aids in South Africa For International Students

👉 South Africa’s best medical aid programmes offer flexible coverage to meet the demands of students with diverse budgets, health care choices, and other factors.

👉 Hospital plans and income-based policies are common choices among students shopping for medical aid plans due to their reduced premiums.

👉 Here, we explore the 5 best medical aids for international students in South Africa.

1. Momentum Health

Overview

👉 If you’re looking for reliable medical cover in South Africa, go no further than the Momentum open medical plan, provided by one of the country’s largest and most trusted healthcare solution providers. Momentum Health Solutions is wholly owned by Momentum Metropolitan Life Ltd, the parent company.

👉 Momentum Medical Scheme is an open, not-for-profit medical aid scheme that complies with the Medical Schemes Act 131 of 1998.

👉 Members of the organization’s Board of Trustees are elected annually at the Annual General Meeting and come from a wide variety of professional backgrounds, including medical, finance, and the law.

Momentum Health Option Plans Suitable for International Students in South Africa

👉 Momentum Medical Aid offers a comprehensive selection of health care coverage options for international students in South Africa across five different medical aid plans. Such schemes include:

Ingwe Student Plan

👉 South Africa’s most cost-effective medical aid plan is the Ingwe Student Plan. This is the ideal alternative for students who are on a budget but who need a Visa and medical aid. From as low as R407 per month, you can receive unlimited primary, dental, optical, and specialty medical care. To help you get your visa, we’ll throw in a free chest x-ray.

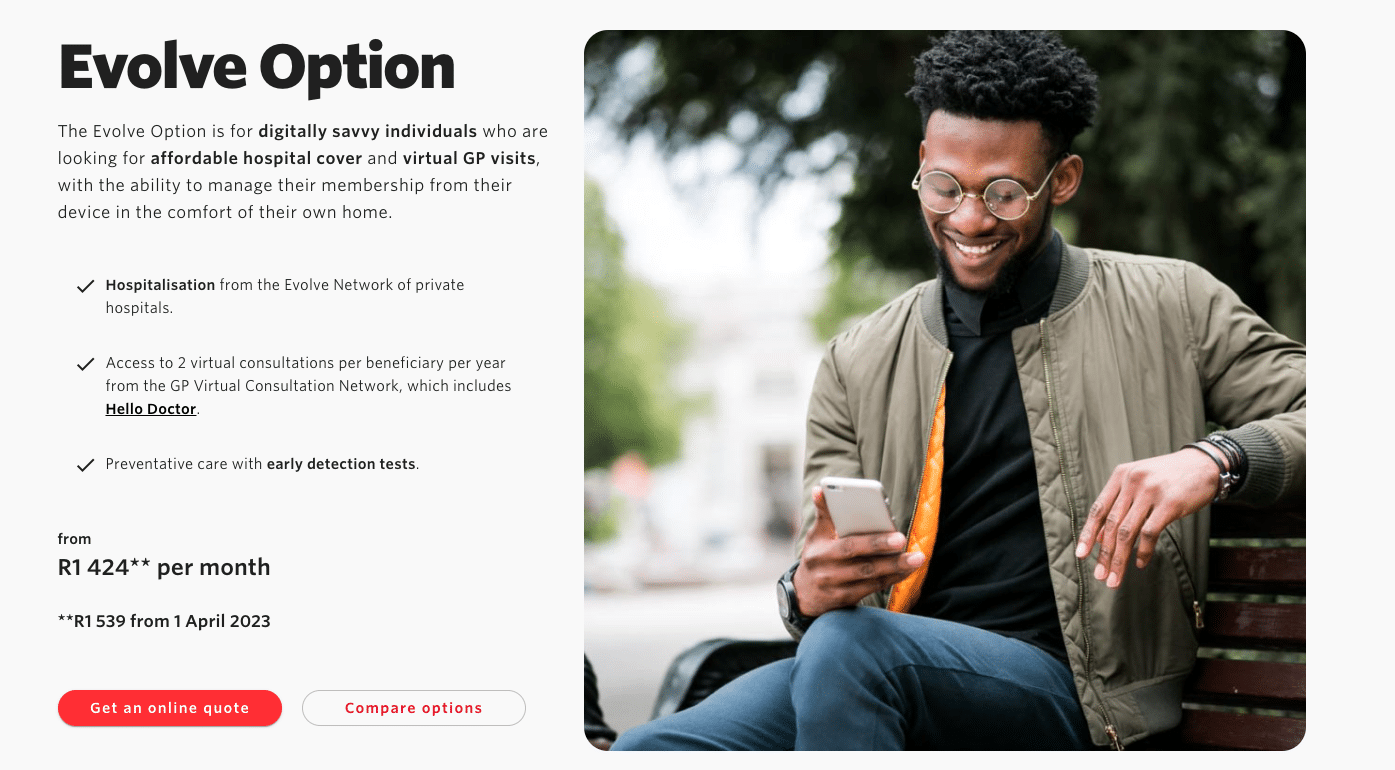

Evolve Option

👉 Unlike other similar plans, there are no yearly limits on this one, and it covers private hospital stays at any Evolve Network hospital.

👉 This plan includes two telehealth visits per year with a licenced physician, and HealthSaver+ applies to any additional daily benefits beyond those two.

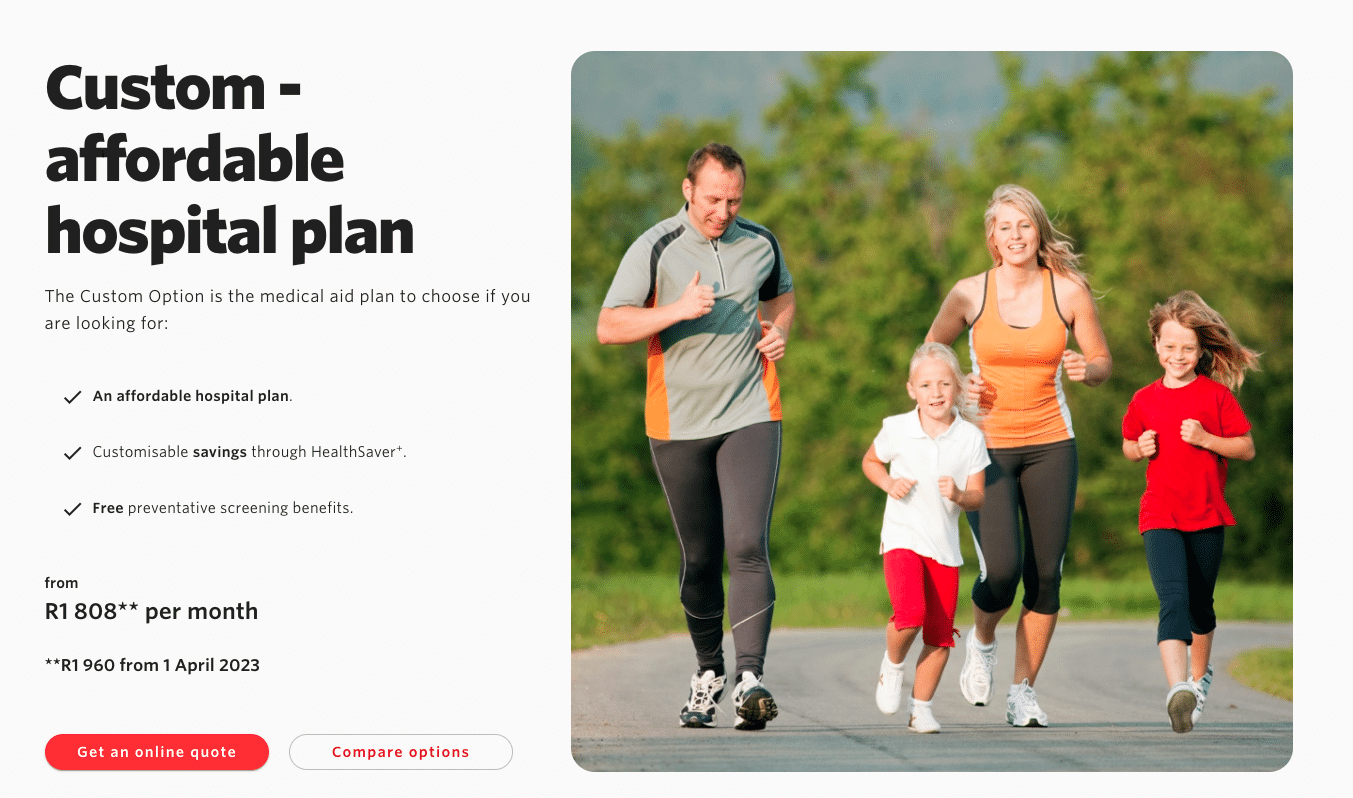

Custom Option

👉 Students who opt for this membership type will have access to full hospital and chronic cover from any or all affiliated providers.

👉 Members can use any hospital they like, or they can restrict their out-of-pocket expenses by using only a select group of private hospitals that have been pre-approved by their medical aid provider.

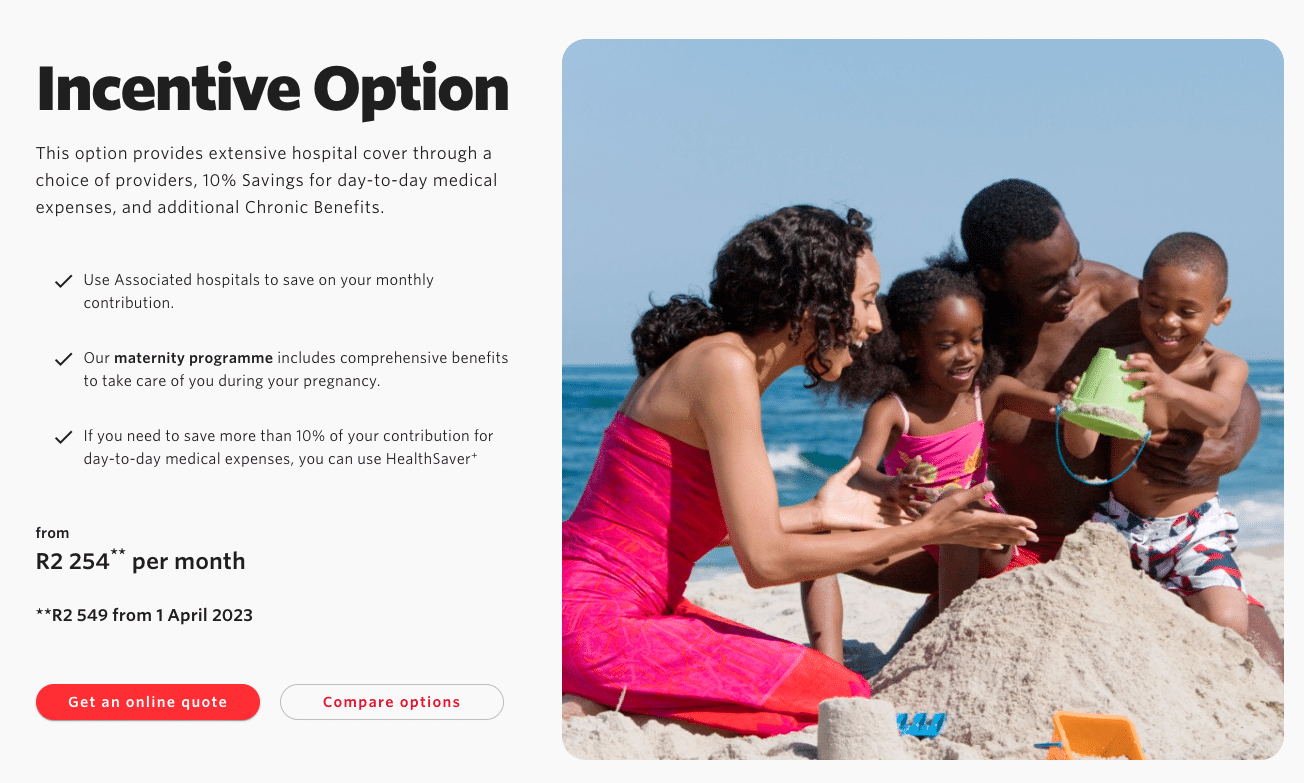

Incentive Option

👉 This is the best option for students who can afford a larger monthly cost. By selecting this option, students will have coverage from all or some of the hospitals and doctors in the network for both acute and ongoing medical needs. Ten percent of their regular monthly salary is deposited into a health savings account.

Extender Option

👉 This more expensive plan offers comprehensive hospital insurance and additional chronic cover from any or allied doctors, making it ideal for students who need a little extra protection.

👉 Twenty-five percent of their income is deposited into a health savings account from which they can withdraw money for recurring expenses. To receive the Extended Coverage benefit, they must first meet the specified Threshold.

Summit Option

👉 In this scenario, students can choose from an almost infinite number of different kinds of supplemental medical aid plans that cover hospitalisation costs. Chronic coverage for 36 diseases is included, as well as daily payments up to a fixed sum per recipient per year.

How Much Are Momentum Health Monthly Premiums?

👉 Momentum monthly premiums start at R1 539 for the main member on the Evolve Option and go up to R12 345 for the main member on the Summit Option.

👉 Compare Medical Aid Plans with Prices

What Is the Waiting Period for Momentum Health Benefits?

👉 The general waiting period is 3 months, but since pregnancy is considered a pre-existing condition, it is excluded from all benefits for the first 12 months of scheme membership.

How to Claim for Momentum Health Benefits

👉 You can submit a claim in several ways:

➡️ Use the Momentum App

➡️ Use the web chat facility in the bottom left corner.

➡️ Send an email to [email protected] or send normal mail to PO Box 2338, Durban, 4000

👉 To make sure your claim is processed quickly and accurately, include the following information:

➡️ Membership number.

➡️ Principal member’s surname, initials, and first name.

➡️ Patient’s surname, initials, and first name.

➡️ Date of treatment.

➡️ Amount charged.

➡️ ICD–10 code (code to indicate what condition you’ve been diagnosed with), tariff code (product-specific code for procedures and claims), and NAPPI code (unique identifier for a given ethical, surgical, or consumable product).

➡️ Service provider’s name and practice number.

➡️ Proof of payment if you’ve paid the claim out of your own pocket.

Momentum Health Contact Details

201 Umhlanga Ridge Blvd

Cornubia

Blackburn

PO Box 2338

Durban

2. CompCare

Overview

👉 CompCare has been in the healthcare funding game for a long time—over 43 years—so you can trust that they know what they’re doing.

👉 CompCare has a deep understanding of what is effective, and they are continually honing their service to provide you with the greatest and most pertinent medical cover possible.

👉 As a company, CompCare doesn’t respond to market fluctuations. Because CompCare is so dedicated to improving your quality of life, they are constantly coming up with new and exciting products and services.

👉 CompCare collaborates closely with its administrator, Universal Healthcare, to guarantee the highest quality of treatment and medical science for their valued members.

CompCare Plans Suitable for International Students in South Africa

👉 CompCare offers a comprehensive selection of healthcare coverage options for international students in South Africa. Such schemes include

CompCare Student Plan

👉 The CompCare Student Plan is designed specifically for international students in South Africa. Student-focused and providing necessary coverage through a contracted provider network, the NetworX option is a great choice for those who need medical attention outside of the hospital.

👉 In addition, it is the most cost-effective student choice among the various South African medical schemes available.

How Much Are CompCare Monthly Premiums?

👉 The NetworX Student Plan from CompCare is available at R454.00 per month. The Day-To-Day Plan is available from R3600 per beneficiary per year.

What Is the Waiting Period for CompCare Benefits?

👉 The general waiting period is 3 months, but since pregnancy is considered a pre-existing condition, it is excluded from all benefits for the first 12 months of scheme membership.

How to Claim for CompCare Health Benefits

👉 You can complete an online form directly on the CompCare website

👉 You can e-mail your claim to [email protected]

👉 You can submit your claims via the Member Mobi App (Download Member App)

CompCare Contact Details

Customer Support: 0861 222 777

Email: [email protected]

3. Bonitas

Overview

👉 Bonitas has been operating for almost four decades, during which time it has gained extensive knowledge and expertise in the South African private healthcare industry.

👉 Hence, its experts are constantly on the lookout for new ways to reduce costs without sacrificing quality of care provided to members. This includes keeping an eye on emerging technologies, managing your care to prevent lifestyle diseases from becoming chronic, and negotiating better rates.

👉 By taking use of the organization’s affordable services and extensive network of trusted medical specialists, you and the other 700,000 people the company serves might maintain your health at a lower out-of-pocket expense.

👉 Bonitas offers such a wide range of plans that you and your family are bound to discover one that works for you. The programmes are made to be as simple to operate as feasible while still giving the best possible benefits. Bonitas is a great resource for students looking for their first medical aid plan.

👉 The company appears to be financially stable, with over R6 billion in reserves.

👉 Bonitas knows they must cultivate meaningful connections with their customers if they are to maintain their commitment to putting their members’ needs first and being member-centric. In three independent polls, Bonitas Medical Fund has been praised for its high levels of client satisfaction and stellar service.

👉 According to the 2021-2022 Ask Afrika Orange Index, Bonitas is the best medical aid company in South Africa.

👉 It is the finest medical aid in South Africa, according to both the 2019/2020 Index and the 2017/2018 Index.

👉 Since 2001, the service industry’s level of customer satisfaction and loyalty has been measured by the Ask Afrika Orange Index.

👉 Those in charge at Bonitas have extensive experience in their fields, and the organisation is overseen by a Board of Trustees made up of experts in medicine, law, finance, and business who are not employed by Bonitas. The index considers 31 different industries and uses 10 key service criteria to evaluate an organization’s overall performance.

Best Bonitas Medical Aid Plans for International Students

👉 A number of Bonitas’ plans are well-suited to international students. For students to get the most out of their benefits, the programmes must be simple to grasp and use.

BonCap Plans

👉 Those who meet the program’s income requirements can enrol in a low-cost medical aid plan that will pay for hospitalisation and other essential medical care.

BonEssential Select Plan

👉 This plan gives you access to a wide variety of hospital benefits, as well as certain value-added bonuses, through a reputable network of medical professionals.

Savings Plans

👉 Benefits including maternity care, preventative medicine, and wellness checks are all part of these packages. Dental care, vision care, and doctor’s visits all have zero out-of-pocket charges.

How Much Are Bonitas Medical Aid Monthly Premiums?

👉 Bonitas monthly contributions start at R 2 033 for a Principal Member, R 1 555 for a spouse/adult dependant and R 596 per child (max 3) on the BonEssential Hospital Plan and go up to R 8 217 for a main member, R7 749 for additional adult, and R 1 672 for a child for the BonComprehensive plan that offers abundant savings, an above threshold benefit and extensive hospital cover.

What Is the Waiting Period for Bonitas Medical Aid Benefits?

👉 The minimum general waiting period for Bonitas medical aid is three months for all benefits. Some plans, however, have a waiting period of 12 months, especially regarding a pre-existing condition.

👉 Pregnancy is considered a pre-existing condition; therefore it is excluded from all benefits for the first 12 months of scheme membership.

👉 New Members 36 years or older may be subject to late-joiner penalties on Bonitas Medical Aid Plans.

How to Claim for Breast Reduction Benefits from Bonitas

👉 You can send in your claim in the following ways:

➡️ Email your claims to [email protected].

➡️ Post your claims to Bonitas Claims Department, PO Box 74, Vereeniging, 1930.

➡️ Submit your claims in person at one of the walk-in centres.

👉 Follow these simple steps to get your claims paid quickly:

➡️ Ensure your banking details are correct for refunds by electronic transfer (EFT) into your bank account

➡️ Make sure that your account and receipt show your name and initials, membership number, treatment date, the name of the patient as shown on your membership card, amount charged and ICD-10 code.

Bonitas Contact Details

34 Melrose Blvd, Birnam

Johannesburg

2196

Phone for General Queries: 0860002108

Email: [email protected]

Email: [email protected]

4. Discovery Health

Overview

👉 When it comes to medical aid in South Africa, Discovery Health Medical Scheme is likely your best bet. In accordance with the guidelines, anyone, including students, may join the Program.

👉 Discovery Health Medical Scheme offers more than twenty various plans, all of which are excellent for students due to their restricted private hospital coverage and extensive range of additional advantages.

👉 Because of the comprehensive nature of the benefits, care plans, and services provided by the plans, students may rest easy knowing that they will always have access to the highest quality medical care possible, whenever they need it.

👉 Discovery asserts that, in comparison to other South African health plans, its plan is more cheap for students because its premiums are just 14.9% higher for the same level of coverage.

👉 You can also participate in the Vitality wellness programme, which rewards you for adopting a healthy lifestyle with perks like discounted gym memberships and healthy meals.

👉 A Board of Trustees, who are not themselves Scheme participants, manages the fund on behalf of the members.

👉 The business is managed by Discovery Health (Pty) Ltd., a separate regulated financial services organisation. The Medical Schemes Act and the Council for Medical Schemes set the rules for the Discovery Health Medical Scheme.

Discovery Medical Aid Option Plans Suitable for International Students in South Africa

👉 The Discovery option gives you a choice between high-priced, all-inclusive private medical aid and lower-priced, all-inclusive private medical aid through a more limited network of providers.

👉 As a result, students can choose from a variety of medical aid plans.

Saver Series

👉 Plans in this category are moderately priced and cover the costs of hospitalisation, chronic medications, and other essentials of daily life through a Medical Savings Account. A big number of students join because membership is reasonably priced.

Core Series

👉 Students on a tight budget might benefit greatly from these hospital plans, as they provide both unlimited private hospital care and basic coverage for chronic medicine. The benefits do not include any sort of covering for routine costs.

Smart Series

👉 These plans provide students the lowest out-of-pocket costs for hospitalisation, the most comprehensive coverage for expensive long-term medications, and the barest minimum of coverage for everyday medical needs, provided they stick to a specific provider network.

How Much Are Discovery Medical Aid Monthly Premiums?

👉 Monthly premiums start from R1,102 per member for the KeyCare Series with medical cover for both in-hospital and out-of-hospital treatment by providers in a specified network and goes up to R10,303 per member for the Executive Plan with extensive cover for in-hospital and day-to-day benefits, extended chronic medicine cover, and unlimited Above Threshold Benefit.

What Is the Waiting Period for Discovery Medical Aid’s Benefits?

👉 Discovery Health Medical Scheme’s general waiting period is 3 consecutive months and the condition-specific waiting period is 12 consecutive months.

👉 New Members 35 years or older may be subject to late-joiner penalties on Discovery Health Medical Aid Plans.

How to Claim for Discovery Medical Aid Benefits

👉 You can submit a claim fast and easily in the following ways:

➡️ Scan and upload your claims on the website.

➡️ Scan and email your claims to [email protected].

➡️ Use the Discovery app on your smartphone. If the claim has a QR code, scan the QR code or alternatively take a photo of the claim from within the app.

➡️ You can also submit your claims by post.

Discovery Medical Aid Contact Details

PO Box 784262,

Sandton,

2146

Phone: 0860 99 88 77

5. BestMed Medical Aid

Overview

👉 BestMed is the largest privately operated medical aid scheme and the fourth largest open medical aid provider in the country, according to the company’s own statistics.

👉 BestMed has a history of providing its young adult members with convenient, low-cost access to a wide variety of doctors, health screenings, and other preventative care services.

👉 The company is pleased with its single-digit annualised growth rate over the past few years and the 13 simplified products it has developed to serve customers at every life stage and economic level.

👉 In terms of students’ preventative health care, all of the alternatives offer significant benefits. This includes, among many other things, contraception for women, treatment for pneumonia, and vaccinations against influenza.

👉 More than 4,300 primary care physicians, hospital and specialist networks, and other medical resources are made available to young people in South Africa as a result of this programme.

👉 BestMed’s Pregnancy Care programme is available to expectant parents with any type of coverage plan, and it’s stocked with helpful materials and advice for the new parents.

BestMed Medical Aid Option Plans Suitable for International Students in South Africa

👉 BestMed offers a variety of options for international students, including hospital plans, network plans, savings plans, and complete plans.

Hospital Plans

👉 Students frequently choose hospital plans due to the convenience of being able to access care at any of the participating hospitals for both planned and unplanned hospitalisations.

👉 Emergency room visits and inpatient stays at any network hospital are covered in full, without limits, by both the Beat1 Network Plan and the Beat1 Plan.

Network Plans

👉 The additional benefits offered by a BestMed Network Plan are well worth the slightly higher monthly costs for those students who can afford them.

👉 In addition to unlimited in-hospital coverage, members of the Rhythm1 and Rhythm2 Network Plans receive either a minimal set of essential daily benefits or a cornucopia of discounts at certain healthcare providers’ offices. Prices for the Rhythm2 Network Plan can be adjusted on a scale.

Savings Plans

👉 The BestMed Savings Plan is the best option for students searching for medical aid because it includes both complete coverage at private hospitals and a savings account for usage in situations other than medical ones.

How Much Are BestMed Medical Aid Monthly Premiums?

👉 At the time of writing, monthly premiums for the cheapest BestMed Beat1 Network Hospital Plan started at R1 710 for a member, with an additional R1 329 for an adult dependant and R720 for a child dependant, to a maximum of 3 child dependants. Additional children join at no additional cost.

👉 The most expensive plan at the time was the Pace4 Comprehensive Plan, with monthly contributions of R9 411 per member and R9 411 per adult dependant. For a child dependant the extra contribution was R2 205, up to 3 child dependants with additional children added as beneficiaries of the scheme at no extra cost.

What Is the Waiting Period for BestMed Medical Aid’s Benefits?

👉 There can be a general waiting period of three months or a specific waiting period of 12 months for a certain condition.

👉 BestMed Medical Scheme will sometimes only pay a claim if it is a PMB. This can happen if you are in a waiting period or if you are getting treatment for a condition that your plan doesn’t cover.

👉 New Members 35 years or older may be subject to late-joiner penalties on Bestmed Medical Aid Plans.

How to Claim Benefits from BestMed Medical Aid

👉 If your healthcare provider does not submit claims to BestMed, one must submit the original claim directly to the fund administrators.

👉 You can claim by means of the BestMed App, or by scanning and emailing your claim to them.

👉 Details that should appear on all claim documents include:

➡️ Member’s name and contact details

➡️ BestMed membership number

➡️ Patient’s details

➡️ Service provider’s name, contact details and practice number

➡️ Details of treatment, including applicable tariff and ICD-10 codes

➡️ Whether payment should be done to the service provider or the member

👉 You will receive an email confirmation when your claim is received and indexed.

BestMed Medical Aid Contact Details

Head Office:

BestMed Medical Scheme,

Glenfield Office Park

361 Oberon Avenue

Faerie Glen

Pretoria

PO Box 2297

Pretoria

Emails: [email protected]; [email protected],

Phone: +27 (0)86 000 2378

Frequently Asked Questions

Why do international students need medical aid in South Africa?

Regulation in South Africa require all international students to have valid medical cover through a South African medical scheme for the duration of their studies there. The Medical Schemes Act mandates this least basic coverage, which be provided through relatively reasonable medical scheme solutions that cater to the demands of international students and reduce the risk of financial responsibility on the part of the university or the student.

When will medical aid kick in for international students in South Africa?

As of the commencement date specified in the membership confirmation letter, medical coverage will be provided.

Do I need medical aid to enrol in a South African university as a foreigner?

Yes. Proof of a valid study permit, proof of payment of fees for the academic year, and proof of full medical aid coverage with a South African registered medical aid scheme for the academic calendar year (beginning on the first day of the month of registration and ending on the last day of December) are all typically required documents for universities to process pre-registration.

Why am I legally required to have medical aid to study in South Africa as a foreigner?

The Medical Schemes Act mandates this least basic coverage, which be provided through relatively reasonable medical scheme solutions that cater to the demands of international students and reduce the risk of financial responsibility on the part of the university or the student.

Can I pay for my medical aid with cash as an international student?

No cash payments are permitted for the necessary medical aid protection; all payments must be made directly to the medical aid scheme.