5 Best Medical Aid for Unemployed in South Africa

The 5 Best Medical Aids for the Unemployed in South Africa revealed.

We tested them side by side and verified their medical aid plans that are best for the unemployed.

This is a complete guide to the best medical aid for the unemployed in South Africa.

In this in-depth guide you’ll learn:

- What is a Medical Aid?

- How do you find affordable medical aid in South Africa?

- How to choose the best affordable medical aid for your needs?

- How to compare medical aids against each other?

- How do you choose the best medical aid when you are unemployed?

- How do you choose the best plan without generating any income?

So if you’re ready to go “all in” with the best medical aid for the Unemployed in South Africa, this guide is for you.

Let’s dive right in…

Best Medical Aid for Unemployed in South Africa (2024)

| 🩺 Medical Aid | ✔️ Offers Plans for the Unemployed? | ⚕️ Plan Offered | 💵 Pricing | 👉 Sign Up |

| 1. Momentum Medical Aid | Yes | Ingwe Option | R482 per member per month | 👉 Apply Now |

| 2. FedHealth | Yes | flexiFED 1 | R1 583 per month per member | 👉 Apply Now |

| 3. Discovery Health | Yes | KeyCare | R1,102 per member per month | 👉 Apply Now |

| 4. Bonitas | Yes | Edge Plan | R1 338 per member per month | 👉 Apply Now |

| 5. BestMed | Yes | Hospital Plans, Network Plans, Savings Plans, and Comprehensive Plans | R1 710 per member per month | 👉 Apply Now |

5 Best Medical Aid for Unemployed in South Africa (2024)

- Momentum Health – Overall, Best Medical Aid for the Unemployed in South Africa

- Fedhealth – Top Extensive Medical Protection in South Africa

- Discovery Health – Broadest Range of Low-Cost Medical Aid Plans

- Bonitas – Best Pay-As-You-Go Private Healthcare

- BestMed – Best Customer Service Medical Aid

Getting medical aid in South Africa if you are unemployed

👉 Not only is it tough to obtain work in South Africa these days but with the economy slowing, losing your job is a reality that every South African worker must face.

👉 When you, the employee, are at fault, you may be fired after numerous warnings. In any event, being unemployed is one of the most trying times in your life, especially if other members of your home do not have secure employment.

👉 Luckily, hospital programmes, whether medical aid or cash back, do not discriminate based on your job position. In other words, even if you are unemployed, you can have a hospital plan or medical aid.

Read more about The 5 Best Medical Aids for Young Adults in South Africa compared and revealed

Choosing medical aid when you are unemployed

👉 Although medical aid plans and insurance providers may inquire about your employment status, they will not deny you coverage if you can pay it. A medical aid hospital plan only or a hospital cash-back plan is not cheap, especially if you are not working, but they are necessary to some level.

👉 Nonetheless, if money is an issue, consider alternatives rather than foregoing coverage entirely. You may need to decrease your medical aid coverage or choose lesser daily payouts on your hospital cash insurance, resulting in lower monthly charges.

👉 Even though you have reduced coverage, you have maintained your coverage.

👉 Examine the situation thoroughly. Now that you have less money, you must consider what level of coverage you can afford.

👉 You may be receiving unemployment benefits, have income protection insurance, or your employer has given you a payment, which, along with your pension fund, provides you with enough money to last for a few months until you find new work.

👉 Now is the time to protect oneself through thorough planning. Go to a cheaper plan that provides at least some coverage, even if it is not as broad as you were used to until you have a steady income from a job.

Deciding whether to keep your medical coverage when you are unemployed

👉 Before you terminate your coverage, whether it’s medical aid or a hospital cash-back plan, consider whether this is a fair course of action.

👉 Talk with your medical scheme or insurance provider to see if they have any unemployment protection in place that will cover your premiums for a few months until you find work.

👉 Discuss your position with them and how you might be able to keep your coverage despite experiencing financial difficulties for a few months. No medical scheme or insurance provider likes to lose a client, and contingency preparations may be in place.

👉 But, if your supplier does provide such a service, it will only be for a limited time. If you do not pay your premiums, your coverage will be suspended after one month and revoked after three months.

👉 While you still have time to decide whether or not to maintain the cover, here are a few things to think about:

➡️ Can you afford to pay cash for medical treatments, or are you willing to go to a government hospital or clinic?

➡️ Even if you can live with public healthcare for your own needs, how will you feel if your spouse or child is forced to utilise it?

➡️ Is there any other monthly item you may cut to pay for your medical aid instead?

➡️ Have you looked into the cheapest coverage alternatives with your medical aid scheme and considered switching?

➡️ Is it possible to remove some individuals from medical aid in order to keep the most vulnerable and ill people covered?

👉 Remember that if you have coverage through your company, it will be removed after you are retrenched or fired. That might not happen right away. In some situations, there may be a grace period of a month or two.

👉 Yet, if you cannot afford the coverage on your own without your employer’s subsidies, you may have no choice. When you lose your employment, you may no longer be able to use limited medical aid options.

👉 Certain medical aids are only available to employees of specific companies or workers in a specific industry area. But, before you lose your coverage, you may be given the option to transfer to an open scheme and so continue your coverage with a different carrier.

You might like 10 things we listed to consider before cancelling your medical aid

5 of the Best Known Medical Aids for the Unemployed

👉 The unemployed in South Africa may have to reevaluate their medical aid coverage. To this end, we have listed the 5 best medical aid schemes that provide affordable coverage while you are unemployed.

1. Momentum Health

Overview

👉 The parent business of Momentum Medical Scheme, one of South Africa’s top three open medical plans, is largely regarded as a market leader.

👉 Momentum Health is committed to preserving the plan’s long-term stability and providing outstanding value to its subscribers.

👉 By choosing Momentum Health Solutions, you may connect with a group of doctors who are dedicated to providing you with low-cost, high-quality care.

👉 Momentum has partnered with commercially oriented physician networks to deliver for its clients. Also, by dialling the Hello Doctor number, customers can have their medical questions answered by a doctor at any time.

👉 Momentum’s actuarial services can be used to calculate the cost of incentive and reward programmes that can be utilised to attract and maintain healthy members.

👉 Momentum’s advocacy initiatives allow people to make educated healthcare decisions and decrease costs by utilising a ground-breaking health coaching methodology.

Momentum Medical Aid Plans Suitable for the Unemployed

👉 Momentum offers a wide range of options for members’ medical coverage, including some plans that cost less than R1000 per month for the unemployed.

Ingwe Option Plan

👉 The Ingwe plan allows you and your family to use any network hospital you desire, up to a certain annual limit. Only private Ingwe-affiliated hospitals are available. Participants must use public hospitals and clinics in order to qualify for the plan’s lowest premiums.

👉 In contrast to many other types of medical aid, the Ingwe option does not limit annual medical expenses. Depending on your financial situation, you can use either private Ingwe hospitals or state hospitals for a lower monthly fee.

👉 The only people you may turn to for both immediate medical assistance and continuous medical management, such as prescriptions and doctor’s appointments, are the Ingwe Active Network and the Ingwe Primary Care Network.

👉 Momentum has an outstanding reputation in the medical aid industry. It is South Africa’s third-largest medical aid scheme and fifth-largest medical aid provider in terms of membership. This represents 3.2% of the market and 5.8% of the open sector, or 284 400 people.

➡️ The Ingwe Option Plan is available at R482.00 per month

Ingwe Student Option

👉 The Ingwe Student Plan is the most affordable medical aid option in South Africa. This is your best option if you are a student with no money who needs a Visa and medical aid. For as little as R407 a month, you can get unlimited general medical, dental, optical, and speciality care services. You will also receive a free chest x-ray to meet visa requirements.

How Much Are Momentum Health Monthly Premiums?

👉 Momentum monthly premiums start at R1 539 for the main member on the Evolve Option and go up to R12 345 for the main member on the Summit Option.

What Is the Waiting Period for Momentum Health Benefits?

👉 The general waiting period is 3 months, but since pregnancy is considered a pre-existing condition, it is excluded from all benefits for the first 12 months of scheme membership.

How to Claim Momentum Health Benefits

👉 You can submit a claim in several ways:

➡️ Use the Momentum App

➡️ Use the web chat facility in the bottom left corner.

➡️ Send an email to [email protected] or send normal mail to PO Box 2338, Durban, 4000

👉 To make sure your claim is processed quickly and accurately, including the following information:

➡️ Membership number.

➡️ Principal member’s surname, initials, and first name.

➡️ Patient’s surname, initials, and first name.

➡️ Date of treatment.

➡️ Amount charged.

➡️ ICD–10 code (code to indicate what condition you’ve been diagnosed with), tariff code (product-specific code for procedures and claims), and NAPPI code (a unique identifier for a given ethical, surgical, or consumable product).

➡️ Service provider’s name and practice number.

➡️ Proof of payment if you’ve paid the claim out of your own pocket.

Momentum Health Contact Details

201 Umhlanga Ridge Blvd

Cornubia

Blackburn

PO Box 2338

Durban

Medimed versus Momentum Medical Scheme compared and revealed

2. Fedhealth

Overview

👉 Fedhealth was founded in 1936 in response to the need for medical treatment in South Africa. Several changes have occurred throughout the years, but one constant has been their commitment to providing quality service at reasonable prices.

👉 Fedhealth is continually looking for better ways to deliver healthcare to its members because it is still a cooperative run for the benefit of its members.

👉 Fedhealth allows you to participate in the construction of your own personalised health care plan, emphasising the importance of individualization. Fedhealth is dedicated to exceeding its members’ expectations by offering outstanding service.

👉 The Plan is in a good financial position to provide for its members, as indicated by its AA- Global Credit Rating, which it has maintained for the past 14 years, with a reserve greater than the minimum 25% required by law.

👉 Fedhealth is well-known not just for its standard benefits, but also for its innovative Risk-based awards, which greatly increase the value of such benefits for members.

👉 There are no restrictions on seeing doctors within the network of the plan, and you can obtain a free plan upgrade at any point during the year if your medical needs dramatically alter (within 30 days of a major life event).

Fedhealth Medical Aid Plans Suitable for the Unemployed

👉 Fedhealth offers a wide range of options for members’ medical coverage, including some plans that are affordable for the unemployed.

flexiFED 1

👉 You can use the Fedhealth Savings made available by the MediVault and the Threshold Benefit, which is triggered when your claims surpass a certain threshold, to cover the costs of routine medical care and any unforeseen emergencies that may happen.

➡️ flexiFED 1 is available at R1 583.00

How Much Are Fedhealth Medical Scheme Monthly Premiums?

➡️ The monthly premiums for the salary-banded myFED option is from R 1 275 per month for the main member.

👉 The maxima PLUS extensive medical cover will cost 13 122 per month per the main member.

Waiting Period for Fedhealth Medical Scheme Benefits?

👉 The general waiting period for Fedhealth benefits is usually three months, depending on the medical aid scheme you join. The waiting period for pre-existing conditions is 12 months.

How to Claim Benefits from Fedhealth Medical Scheme

👉 Members can submit claims using one of the following:

➡️ On the Fedhealth Family Room,

➡️ Through a WhatsApp service

➡️ On the Fedhealth Member Phone App

➡️ You may also email, fax or post the claims to email: [email protected], fax: (011) 671 3842 or post to Private Bag X3045, Randburg, 2125.

Fedhealth Medical Scheme Contact Details

Flora Centre Shop 21 and 22

Corner Conrad street and Ontdekkers Rd

Florida Glen

Johannesburg

Phone: 0861 116 016

Fedhealth versus Sizwe Hosmed Medical Fund compared and revealed

3. Discovery Health

Overview

👉 Discovery Medical Health is a non-profit organisation controlled by the Medical Schemes Act 131 of 1998, as amended, and the Medical Schemes Council (CMS). According to the Scheme guidelines, it is a recognised open medical scheme that anybody can join.

👉 Members own the Scheme, and its operations are controlled by an independent Board of Trustees (the Trustees or the Board). The Scheme outsources its administration and managed care functions to Discovery Health (Pty) Limited under a formal contractual relationship.

👉 One of the Scheme’s strategic priorities is value-based healthcare. Their strategy, which places their members at the centre of care, compensates providers based on health outcomes rather than the volume of services they deliver.

👉 It gives members access to programmes and providers committed to continuous quality improvement.

👉 Discovery Health strives to ensure that our members have access to the safest, most efficient, and most effective healthcare available in South Africa through a variety of quality care programmes and innovations that are regularly examined by the Scheme on an ongoing basis.

👉 The Scheme also provides its participants with information relevant to their needs.

Discovery Medical Aid Plans Suitable for the Unemployed

👉 Discovery offers a wide range of options for members’ medical coverage, including some plans that cost a bit more than R1000 for the unemployed.

Discovery KeyCare Plan

👉 The hospital networks with which KeyCare is affiliated provide extensive medical care. All KeyCare network hospitals, as well as up to 100% of the Discovery Health Rate for all other doctors and hospitals, are covered for the full cost of hospitalisation (DHR).

👉 Both KeyCare Plus and KeyCare Start include lab work, X-rays, and prescription medicine obtained from a participating pharmacy inside the KeyCare network, as well as unlimited primary care visits.

👉 When you visit a KeyCare participating provider, you will receive full coverage for any disease on the KeyCare Chronic Disease List (DSP). The policy you select determines the level of coverage you receive.

➡️ Discovery KeyCare Start is available at R1102.00 per month

How Much Are Discovery Medical Aid Monthly Premiums?

👉 Monthly premiums start from R1102 per member for the KeyCare Series with medical cover for both in-hospital and out-of-hospital treatment by providers in a specified network and go up to R10 303 per member for the Executive Plan with extensive cover for in-hospital and day-to-day benefits, extended chronic medicine cover, and unlimited Above Threshold Benefit.

What Is the Waiting Period for Discovery Medical Aid’s Benefits?

👉 Discovery Health Medical Scheme’s general waiting period is 3 consecutive months and the condition-specific waiting period is 12 consecutive months.

How to Claim for Discovery Medical Aid Benefits

👉 You can submit a claim fast and easily in the following ways:

➡️ Scan and upload your claims on the website.

➡️ Scan and email your claims to [email protected].

➡️ Use the Discovery app on your smartphone. If the claim has a QR code, scan the QR code or alternatively take a photo of the claim from within the app.

➡️ You can also submit your claims by post.

Discovery Medical Aid Contact Details

PO Box 784262,

Sandton,

2146

Phone: 0860 99 88 77

4. Bonitas

Overview

👉 Bonitas has an international financial stability rating of AA-. It has a solvency ratio of 30.7%.

👉 Because the average age of Bonitas members and beneficiaries is under 30, the average magnitude of annual contribution increases is necessarily smaller.

👉 Bonitas provides a variety of low-cost medical assistance programmes, including hospitalisation, long-term care, and medications. When it comes to medical coverage, this company is perfect for both single and family workers.

👉 Bonitas was not the first medical aid company in South Africa, but it swiftly grew to become the largest. It was established in 1982.

👉 The Bonitas network’s 4,500 medical experts are dedicated to providing their patients with high-quality care at reasonable prices.

👉 In order to tackle the ever-increasing costs of healthcare, Bonitas provides its clients with oncology management as well as hospital and medicine administration as independent solutions.

👉 Lasik eye surgery is one of several dental and vision procedures covered by Bonitas. Each participant’s unused sum earns interest and is available for use the following year.

Bonitas Medical Aid Plans Suitable for the Unemployed

👉 Bonitas offers excellent healthcare and medical aid plans suitable for the unemployed.

Bonitas Edge Plans

👉 Bonitas, like other medical aid providers, has a number of coverage plans from which to pick. The unemployed can now select the best plan for them, with the Edge plan starting at just R1338 per month. An unemployed individual should, in particular, maximise the benefits of the following coverage options:

➡️ Hospitalisation benefits from a private hospital

➡️ No deposits to pay upfront.

➡️ Chronic medications are ones that your doctor may prescribe for you.

➡️ Payment for both therapy that is life-threatening (such as an accident, stroke, or heart attack) and treatment that is life-sustaining (such as for cancer or renal disease).

➡️ Care when injured

➡️ Consultations and diagnostic procedures such as MRI scans and CT scans.

➡️ Radiography and pathology within the hospital

➡️ Diagnostic scopes – gastroscopy, colonoscopy, sigmoidoscopy and proctoscopy

➡️ Procedures such as biopsies and operations on the eye, ear, nose, and throat.

How Much Are Bonitas Medical Aid Monthly Premiums?

👉 Bonitas monthly contributions start at R 2 033 for a Principal Member, R 1 555 for a spouse/adult dependant and R 596 per child (max 3) on the BonEssential Hospital Plan and go up to R 8 217 for a main member, R7 749 for additional adult, and R 1 672 for a child for the BonComprehensive plan that offers abundant savings, an above threshold benefit and extensive hospital cover.

What Is the Waiting Period for Bonitas Medical Aid Benefits?

👉 The minimum general waiting period for Bonitas medical aid is three months for all benefits. Some plans, however, have a waiting period of 12 months, especially regarding a pre-existing condition.

How to Claim Breast Reduction Benefits from Bonitas

👉 You can send in your claim in the following ways:

➡️ Email your claims to [email protected].

➡️ Post your claims to Bonitas Claims Department, PO Box 74, Vereeniging, 1930.

➡️ Submit your claims in person at one of the walk-in centres.

👉 Follow these simple steps to get your claims paid quickly:

➡️ Ensure your banking details are correct for refunds by electronic transfer (EFT) into your bank account

➡️ Make sure that your account and receipt show your name and initials, membership number, treatment date, the name of the patient as shown on your membership card, the amount charged and the ICD-10 code.

Breast medical procedures in South Africa:

Breast Uplift Procedure (Mastopexy)

Breast Reconstruction with Latissimus Dorsi Flap

Breast Reconstruction with Implant or Tissue Expander

Breast Reconstruction with Abdominal Tissue Flap

Breast Augmentation (Breast Implants)

Excision Biopsy of a Breast Lump

Bonitas Contact Details

34 Melrose Blvd, Birnam

Johannesburg

2196

Phone for General Queries: 0860002108

Email: [email protected]

Email: [email protected]

5. BestMed

Overview

👉 BestMed has a long history of providing outstanding value for money, comprehensive coverage, and wellness benefits for people of all ages to its subscribers.

👉 BestMed promises to be South Africa’s largest open medical system and the world’s fourth largest.

👉 The company boasts about its annual raises being less than 10% for the last five years in a row, as well as its 13 choice plans that take retirees’ financial situation into mind.

👉 Illness prevention, including measures such as vaccination against communicable diseases such as influenza and pneumonia, benefits tremendously from all of the available possibilities.

👉 There is also access to over 4,300 primary care providers and specialists across South Africa.

👉 BestMed members elect trustees to serve on various committees to assist the management team, and the board hires trustees to serve in various capacities.

BestMed Medical Aid Plans Suitable for the Unemployed

👉 Unemployed individuals can choose between BestMed Hospital Plans, Network Plans, Savings Plans, and Comprehensive Plans.

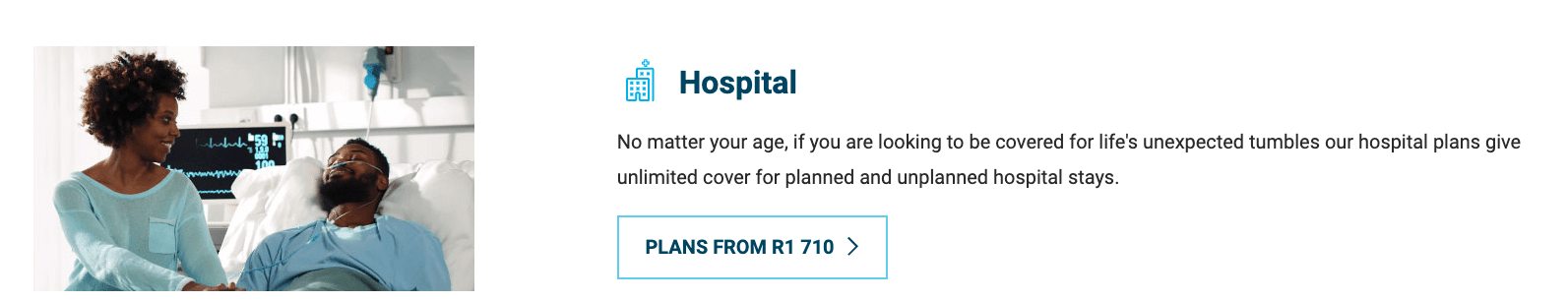

Hospital Plans

👉 Plan members of any age can use any hospital in the Hospital Plan’s network for both elective and emergency care.

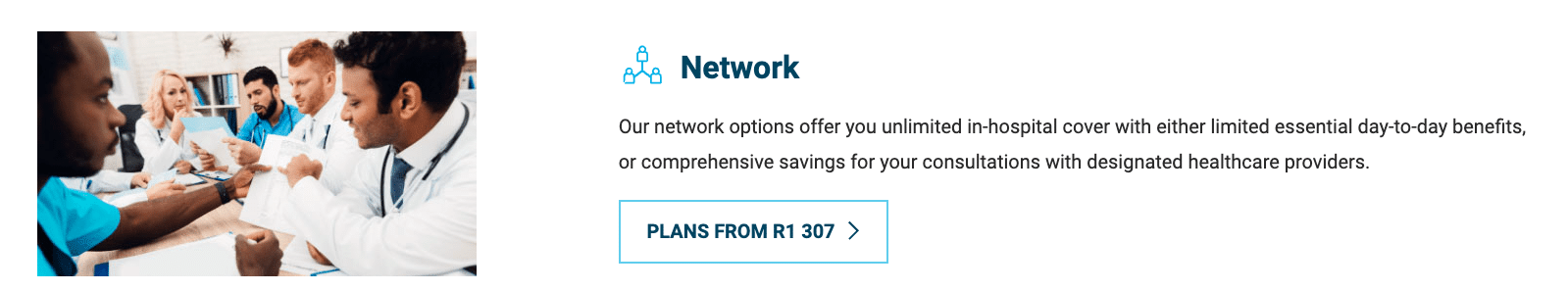

Network Plans

👉 The BestMed Network Plans are divided into two types: Rhythm1 and Rhythm2 Network Plans, which offer either considerable discounts for visits to recommended healthcare providers or unlimited in-hospital coverage with either limited important day-to-day benefits or no benefits at all. The Rhythm 2 programme has income requirements.

Savings Plans

👉 BestMed savings programmes are classified into three types: Beat2, Beat3, and Beat3 Network.

👉 All offer comprehensive medical coverage in private institutions, as well as a savings account to aid with normal monthly payments.

👉 The hospitals and doctors that will take part in the Network plans have already been identified.

Comprehensive Plans

👉 The various BestMed Comprehensive Plans are excellent options for SASSA seniors and the aged, as long as their budgets can support the hefty monthly costs.

👉 You’ll have access to excellent and comprehensive hospital benefits, including extensive day-to-day cover, chronic benefits, and a flexible spending account for medical expenses, whether you choose the Beat4 Comprehensive Plan, the Pace1 Comprehensive Plan, the Pace2 Comprehensive Plan, the Pace3 Comprehensive Plan, or the Pace4 Comprehensive Plan.

👉 The specifics of coverage differ slightly from one policy to the next.

How Much Are BestMed Medical Aid Monthly Premiums?

👉 At the time of writing, monthly premiums for the cheapest BestMed Beat1 Network Hospital Plan started at R1 710 for a member, with an additional R1 329 for an adult dependant and R720 for a child dependant, to a maximum of 3 child dependants. Additional children join at no additional cost.

👉 The most expensive plan at the time was the Pace4 Comprehensive Plan, with monthly contributions of R9 411 per member and R9 411 per adult dependant. For a child dependant, the extra contribution was R2 205, up to 3 child dependants with additional children added as beneficiaries of the scheme at no extra cost.

What Is the Waiting Period for BestMed Medical Aid’s Benefits?

👉 There can be a general waiting period of three months or a specific waiting period of 12 months for a certain condition.

👉 BestMed Medical Scheme will sometimes only pay a claim if it is a PMB. This can happen if you are in a waiting period or if you are getting treatment for a condition that your plan doesn’t cover.

How to Claim Benefits from BestMed Medical Aid

👉 If your healthcare provider does not submit claims to BestMed, one must submit the original claim directly to the fund administrators.

👉 You can claim by means of the BestMed App, or by scanning and emailing your claim to them.

👉 Details that should appear on all claim documents include:

➡️ Member’s name and contact details

➡️ BestMed membership number

➡️ Patient’s details

➡️ Service provider’s name, contact details and practice number

➡️ Details of treatment, including applicable tariff and ICD-10 codes

➡️ Whether payment should be done to the service provider or the member

👉 You will receive an email confirmation when your claim is received and indexed.

BestMed Medical Aid Contact Details

Head Office:

BestMed Medical Scheme,

Glenfield Office Park

361 Oberon Avenue

Faerie Glen

Pretoria

PO Box 2297

Pretoria

Emails: [email protected]; [email protected],

Phone: +27 (0)86 000 2378

Compare BestMed with other Medical Scheme Providers

- BestMed Medical Scheme versus Discovery Health

- BestMed Medical Scheme versus Medimed

- BestMed Medical Scheme versus Medihelp

- BestMed Medical Scheme versus Keyhealth

- BestMed Medical Scheme versus Fedhealth

- BestMed Medical Scheme versus Bonitas

- BestMed Medical Scheme versus Momentum Medical Scheme

- BestMed Medical Scheme versus Sizwe Medical Fund

- BestMed Medical Scheme versus Medshield

Frequently Asked Questions

Can an unemployed person get medical aid in South Africa?

Yes, medical schemes and insurance providers may ask about your employment, but they won’t deny you coverage if you can afford to pay for it, or if you are a dependent on a medical aid where someone else (e.g. a family member) pays the premiums.

Do you qualify for healthcare if you are unemployed and don’t have a medical aid or insurance?

Yes, the South African constitution ensures that everyone has access to healthcare. Expats, refugees, and asylum seekers are all included. As a result, foreigners can get public healthcare simply by residing in South Africa.

How can I make sure I keep my medical aid when unemployed?

You may receive unemployment benefits, income protection insurance or your employer gave you a payment that, together with your pension fund and your savings, will provide you with enough money to last you for a few more months before you find a new job.

What should I do with my medical aid if I lose my job?

If money is an issue, consider alternatives rather than foregoing coverage entirely. Being unemployed, you may need to decrease your medical aid coverage or choose lesser daily payouts on your hospital cash-back plan, resulting in lower monthly charges.

Can I keep my company medical aid if I am fired?

Remember that if you have coverage through your company, it will be removed after you are retrenched or fired. That might not happen right away. In some situations, there may be a grace period of a month or two.