- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

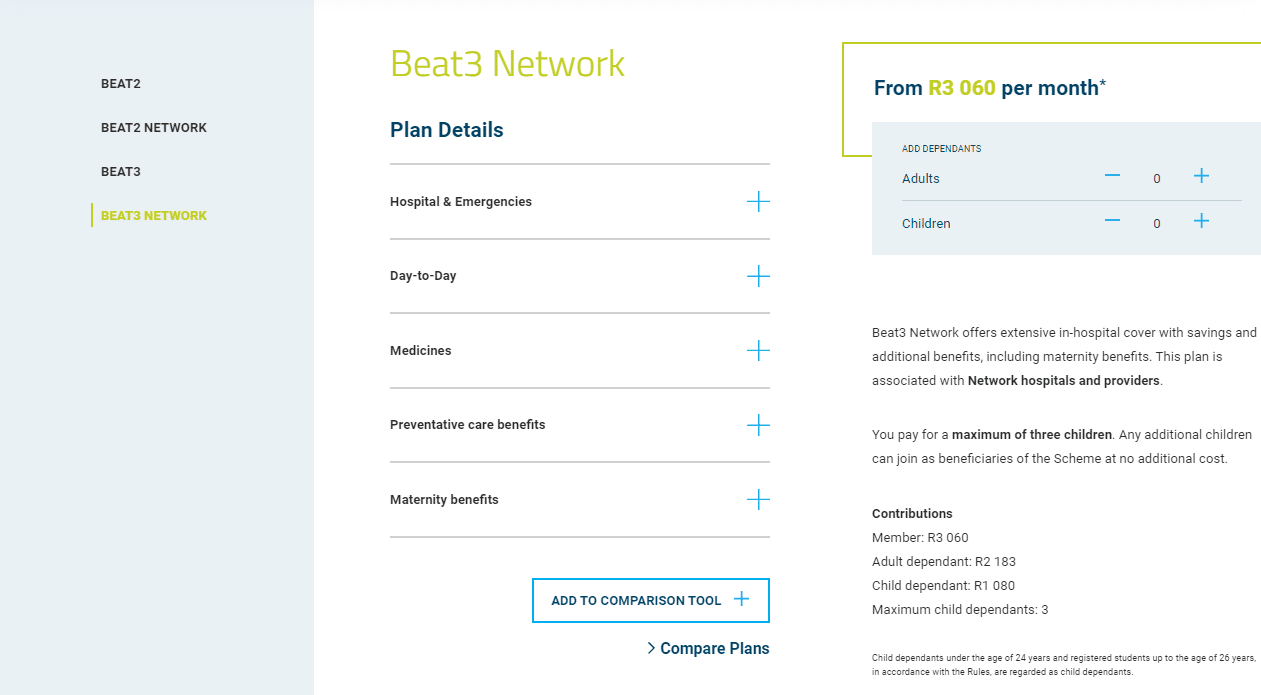

Bestmed Beat 3 Network Medical Aid Plan

Overall, the Bestmed Beat 3 Network Medical Aid Plan is a trustworthy and comprehensive medical aid plan that offers 24/7 medical emergency assistance and preventative care to up to 3 Family Members. The Bestmed Beat 3 Network Medical Aid Plan starts from R3,352 ZAR.

| 🔎 Medical Aid Plan | 🥇 Bestmed Beat 3 Network |

| 🌎 International Cover | R500,000 – R3 million |

| 👤 Main Member Contribution | R3,352 |

| 👥 Adult Dependent Contribution | R2,391 |

| 👶 Child Dependent Contribution | R1,183 |

| 🔁 Gap Cover | None |

| 🎗️ Oncology Cover | 100% of the scheme tariff |

| 💙 Hospital Cover | Subject to scheme rules |

| 💴 Medical Savings Account | ✅ Yes |

| 🍼 Maternity Benefits | ✅ Yes |

Bestmed Beat 3 Network Plan – 11 Key Point Quick Overview

- ✅ Bestmed Beat 3 Network Plan Overview

- ✅ Bestmed Beat 3 Network Plan Contributions and PMSA

- ✅ Bestmed Beat 3 Network Plan Benefits and Cover Comprehensive Breakdown

- ✅ Bestmed Beat 3 Network Chronic Condition List

- ✅ Bestmed Beat 3 Network Preventative Care

- ✅ Bestmed Tempo Wellness Program

- ✅ Bestmed Beat 3 Network Maternity Care Program

- ✅ Bestmed Beat 3 Network Plan Exclusions and Waiting Periods

- ✅ Bestmed Beat 3 Network Plan vs Similar Plans from Other Medical Schemes

- ✅ Our Verdict on The Bestmed Beat 3 Network Plan

- ✅ Bestmed Beat 3 Network Plan Frequently Asked Questions

Bestmed Beat 3 Network Plan Overview

The Bestmed Beat 3 Network medical aid plan is one of 10, starting from R3,352.

The Bestmed Beat 3 Network Plan can be a good choice for members who want a comprehensive medical scheme option with a large network of providers.

Gap Cover is not available on the Bestmed Beat 3 Network Plan. Bestmed offers 24/7 medical emergency assistance.

According to the Trust Index, Bestmed has a trust rating of 3.5.

Bestmed Beat 3 Network Plan Contributions and PMSA

Beat 3 Network Monthly Contributions

| 👤 Main Member | 👥 +1 Adult Dependent | 🍼 +1 Child Dependent |

| R3,352 | R2,391 | R1,183 |

Beat 3 Network Medical Savings Account Available at the start of the year

| 👤 Main Member | 👥 +1 Adult Dependent | 🍼 +1 Child Dependent |

| R503 x 12 Months | R359 x 12 Months | R177 x 12 Months |

Bestmed Beat 3 Network Plan Benefits and Cover Comprehensive Breakdown

Beat 3 Hospital Plan (With Savings and Limited Benefits)

| 🅰️ Savings Account / Day-to-day Benefits | There is a savings account available. There are limited day-to-day benefits offered. |

| 🅱️ Over-the-counter Medication | Covered from the available funds in the savings account. |

READ more: 5 Best Medical Aids for Babies in South Africa

Bestmed Beat 3 Network In-Hospital Benefits

✅ Method of Payment on Beat 3 Plan

- ✅ On the Beat 3 option, hospitalization benefits are covered by Scheme risk.

- ✅ The Scheme risk funds certain day-to-day benefits, while the savings account funds other services.

- ✅ The Scheme’s risk-benefit provides some preventative care advantages.

While using DSPs, any benefits related to conditions that meet the requirements for PMBs will be covered. However, this will have no impact on your medical savings account.

✅ Bestmed Beat 3 Network Scheme Benefits for Different Medical Events In-Hospital

- ✅ Members must get pre-approval for all planned operations at least fourteen (14) days before the event. In emergencies, however, the member, their authorized representative, or the hospital must notify Bestmed of the member’s hospitalization as soon as feasible or on the first business day after admission.

- ✅ Clinical procedures, preferred providers, designated service providers, formularies, funding rules, and the Mediscor Reference Price (MRP) could apply.

A maximum co-payment of R13,078 will apply if a member chooses not to utilize a hospital that is part of a hospital network for the Beat Network benefit option.

| 🟥 In-Hospital Accommodation and fees for the theatre | Covered up to 100% of the Bestmed tariff. |

| 🟧 Take-home medication after discharge | Covered up to 100% of the Bestmed tariff. Limited to a 7-day supply. |

| 🟨 Biological medicine (in-hospital) | Annually limited to R21,140 per family. Subject to pre-approval and financial restrictions. |

| 🟩 Treatment in Mental Health Clinics | Covered up to 100% of the Bestmed tariff. Limited to 21 days per beneficiary yearly. |

| 🟦 Chemical and Substance Abuse Treatment | Covered up to 100% of the Bestmed tariff. Limited to 21 days or R35,573 per beneficiary per year. Subject to members using network facilities. |

| 🟪 Consultations and procedures | Covered up to 100% of the Bestmed tariff. |

| 🟥 Surgical Procedures (including anesthetic) | Covered up to 100% of the Bestmed tariff. Subject to the medical savings account. |

| 🟧 Organ Transplants | Covered up to 100% of the Bestmed tariff. Only PMBs are covered under this benefit. |

| 🟨 Major medical maxillo-facial surgery (Only specified conditions) | Covered up to 100% of the Bestmed tariff. There is a limit of up to R14,256 per family. |

| 🟩 In- and Out-of-Hospital Dental and oral surgery | Covered up to 100% of the Bestmed tariff. The scheme risk funds the procedure if beneficiaries are 7 years and younger. There is a limit of R8,893 per family. |

| 🟦 Prostheses are subject to preferred providers or co-payments, and limits will apply | Covered up to 100% of the Bestmed tariff. There is a limit of p to R87,757 per family. |

| 🟪 Internal Prostheses (Preferred Providers or limits and co-payments will apply) Functional items used must be towards treating or supporting bodily functions | The following sub-limits apply per beneficiary Functional limited to – R32,000 Pacemakers (dual chamber) – R47,344 Vascular – R60,000 Spinal, including artificial discs – R34,789 Drug-eluting stents – only PMBs using DSP products Mesh – R12,227 Gynecology/Urology – R10,098 Lens Implants (per lens, per eye) – R7,585 |

| 🟥 External prostheses | Only PMBs are covered. |

| 🟧 Joint replacement surgery | The following prostheses limits apply to PMBs: Hip replacement and other major joints – R36,751 Knee replacement – R45,474 Other minor joints – R13,995 |

| 🟨 Orthopedic and Medical Appliances | Covered up to 100% of the Bestmed tariff. |

| 🟩 Pathology | Covered up to 100% of the Bestmed tariff. |

| 🟦 Radiology | Covered up to 100% of the Bestmed tariff. |

| 🟪 MRI, CT scans, and other specialized diagnostics | Covered up to 100% of the Bestmed tariff. |

| 🟥 Oncology | Covered up to 100% of the Bestmed tariff. The benefit is subject to pre-authorization and the use of DSP |

| 🟧 Peritoneal Dialysis and hemodialysis | Covered up to 100% of the Bestmed tariff. The benefit is subject to pre-authorization and the use of DSP |

| 🟨 Birthing Confinements | Covered up to 100% of the Bestmed tariff. |

| 🟩 HIV/AIDS | Covered up to 100% of the Bestmed tariff. The benefit is subject to pre-authorization and the use of DSP |

| 🟦 Refractive Surgery (and all other procedures that aim to improve or stabilize vision, excluding cataracts) | Covered up to 100% of the Bestmed tariff. Subject to pre-approval and other protocols. Covered up to a limit of R9,155 per eye. |

| 🟪 Midwife-assisted birth | Covered up to 100% of the Bestmed tariff. |

| 🟥 Supplementary Services | Covered up to 100% of the Bestmed tariff. |

| 🟧 Hospitalization Alternatives | Covered up to 100% of the Bestmed tariff. |

| 🟨 Palliative and Home-Based Care instead of hospitalization | Covered up to 100% of the Bestmed tariff. There is a limit of R63,420 per beneficiary yearly. Subject to benefit availability, pre-authorization, and treatment plan. |

| 🟩 Day Procedures performed at a day hospital | Funded at 100% of the Network or Scheme Tariffs if DSPs are used. There is a co-payment of R2,500 when voluntarily using a non-DSP specialist or hospital. |

| 🟦 International Travel Cover | Leisure Travel: Coverage is limited to 45 days and R500,000 for trips to the United States. All other nations are insured for up to 90 days, and a family (member and dependents) is protected for R3 million. Business Travel to the United States is limited to 45 days and covers up to R500,000. All other nations are insured for up to 45 days, and a family (member and dependents) is protected for R3 million. |

| 🟪 Co-Payments for using a non-network option | Co-payment for the voluntary use of a non-network hospital is R13,078 for the network option. |

You might consider reading the 5 Best Medical Aids in South Africa for Young Adults

Bestmed Beat 3 Network Out-of-Hospital Benefits

The following benefits may be governed by pre-authorization, clinical procedures, preferred providers (PPs), designated service providers (DSPs), formularies, funding standards, and the Mediscor Reference Pricing (MRP).

- ✅ All planned treatments or procedures must be pre-authorized for members.

- ✅ Most non-hospital expenses, such as visits to a primary care physician (PCP) or specialist, are paid from an individual’s savings account.

- ✅ Certain non-hospital benefits are paid up to 100% scheme tariff.

- ✅ Any remaining funds in your savings account will be transferred to your vested savings account at the beginning of the following fiscal year if you do not utilize them all.

- ✅ Members who select the network option must utilize contracted service providers, such as network hospitals, that the Scheme engages.

Non-network pharmacies and DSP specialists will be reimbursed at the Scheme’s standard rate, including for the treatment of PMBs.

Best Hospital Plans for Domestic Workers is something that might interest you.

| 🔴 FP and Specialist Consultations | These consultations are covered using available funds from the medical savings account. |

| 🟠 Diabetes Primary Care Consultation | Covered up to 100% of the Scheme price. Subject to HaloCare registration. Two consultations for primary care at Dis-Chem pharmacies. |

| 🟡 Basic and Specialized Dentistry | Basic Covered from the Preventative Benefit or the medical savings account. Specialized Covered from the savings account. Orthodontic treatment Subject to pre-approval. |

| 🟢 Medical devices/aids, apparatus, appliances (including wheelchairs, crutches, etc.) | Covered from funds in the savings account. |

| 🔵 Hearing Aids | Subject to pre-approval. Covered from available savings account funds. |

| 🟣 Supplementary Services | Covered from available funds in the savings account. |

| 🔴 Wound Care Benefit (Dressings, negative pressure wound therapy NPWT treatment, and other nursing services Out-of-hospital) | Covered up to 100% of the Bestmed tariff. Limited to R3,885 per family per year. |

| 🟠 Optometry | Covered from available funds in the savings account. |

| 🟡 Basic Radiology and Pathology | Covered from available funds in the savings account. |

| 🟢 Oncology | Oncology program at the full Scheme rate. Subject to pre-approval and DSP. |

| 🔵 Peritoneal Dialysis and Hemodialysis | Covered up to 100% of the Bestmed tariff. Subject to pre-approval and DSP. |

| 🟣 HIV/AIDS | Covered up to 100% of the Bestmed tariff. Subject to pre-approval and DSP. |

| 🔴 MRI scans, CT scans, and isotope studies | Covered up to 100% of the Bestmed tariff. Limited to R12,361 per family per year |

| 🟠 Rehabilitation after a traumatic event | Only PMBs are covered. Subject to pre-approval and DSP. |

Bestmed Beat 3 Network Medicine

The following benefits may be subject to pre-authorization, clinical protocols, preferred providers (PPs), designated service providers (DSPs), formularies, funding criteria, the Mediscor Reference Price (MRP), and the exclusions listed in Annexure C of the published Regulations.

- ✅ Members will not incur co-payments for PMB pharmaceuticals on the formulary for which no generic substitute exists.

Members selecting the network option are required to receive their medications from Scheme-contracted pharmacies.

| ❤️ CDL and PMB Chronic Conditions | Covered up to 100% of the Bestmed tariff. There is a co-payment of 30% for non-formulary medicine. |

| 🧡 Non-CDL Chronic medicine (First paid from the non-CDL limit. After that, approved CDL and PMB medicine is paid from the Scheme Risk) The following medicine is not subject to any chronic limits and is paid from scheme risk: Organ Transplants Chronic Renal Failure Multiple Sclerosis Hemophilia | Five conditions are covered. Covered up to 80% of the Bestmed tariff. There is a co-payment of 30% for non-formulary medicine. The following limits will apply: Main Member – R3,793 Main Member + Dependents – R7,716 |

| 💛 Biological medicine | Only PMBs are covered according to funding protocols. Subject to pre-approval. |

| 💚 Other high-cost medication | Only PMBs are covered according to funding protocols. Subject to pre-approval. |

| 💙 Acute Medicine | Covered from the available funds in the medical savings account |

| 💜 OTC Medication | Covered from the available funds in the medical savings account |

Bestmed Beat 3 Network Chronic Condition List

The Bestmed Beat 3 Network Chronic Condition List and Prescribed Minimum Benefits are as follows:

✅ Bestmed Beat 3 Network Chronic Condition List

- ✅ Addison’s disease

- ✅ Asthma

- ✅ Bipolar Mood Disorder

- ✅ Bronchiectasis

- ✅ Cardiac Failure

- ✅ Cardiomyopathy

- ✅ Chronic obstructive pulmonary disease (COPD)

- ✅ Chronic Renal Disease

- ✅ Coronary Artery Disease

- ✅ Crohn’s Disease

and many more.

and read more about the Best Medical Aids in South Africa Cover IVF

✅ Bestmed Beat 3 Network Prescribed Minimum Benefits

- ✅ Aplastic anemia

- ✅ Benign prostatic hypertrophy

- ✅ Cerebral palsy

- ✅ Chronic anemia

- ✅ COVID-19

- ✅ Cushing’s disease

- ✅ Cystic fibrosis

- ✅ Endometriosis

- ✅ Female menopause

- ✅ Fibrosing alveolitis

and many more.

Bestmed Beat 3 Network Preventative Care

The following benefits could be subject to pre-approval, clinical procedures, preferred providers (PPs), designated service providers (DSPs), formularies, funding guidelines, and the Mediscor Reference Pricing (MRP).

| 1️⃣ Benefit | 2️⃣ Gender and Age Group | 3️⃣ Quantity and Frequency | 4️⃣ Criteria |

| 🤧 Flu Vaccines | All | 1 per beneficiary yearly | Applies to all active participants and recipients. |

| 💉 Pneumonia Vaccines | Children <2 Years High-risk adult group | Children – according to the Department of Health Adults – Twice in a lifetime with a booster for beneficiaries 65> | Adults: The Scheme will identify high-risk adults who will be encouraged to receive vaccinations. |

| ✈️ Travel Vaccines | All | Amount and frequency vary by product up to the maximum quantity authorized. | Program risk benefits for mandatory typhoid, yellow fever, tetanus, meningitis, hepatitis, and cholera travel vaccinations. |

| 🍼 Pediatric Immunizations | Babies and Children | Funding for all pediatric immunizations per the state-recommended vaccine schedule. | Funding for all pediatric immunizations per the state-recommended vaccine schedule. |

| 👶 Baby Growth and Development Assessments | 0 – 2 Years | 3 Assessments per year | Pharmaceutical clinics under the Bestmed Network perform assessments. |

| 🚺 Female Contraceptives | All female beneficiaries of child-bearing age | Depends on the product according to the maximum allowed amount | Annually limited to R2,550 per beneficiary. Covers all items categorized under the female contraception category. |

| 📌 HPV Vaccinations | Female Beneficiaries 9 – 26 | 3 vaccines per beneficiary | Vaccinations are funded according to the MRP |

| 📍 Mammogram | All females 40 years> | Once every 2 years | Covered up to 100% of the Bankmed tariff |

| 🦷 Preventative Dentistry | Covered in the “Preventative Dentistry” Section below | Covered in the “Preventative Dentistry” Section below | Covered in the “Preventative Dentistry” Section below |

| ↪️ PSA Screening | Male Beneficiaries | Once every 2 years | It may be performed at a urologist, family practitioner, or network pharmacy clinic. The available savings account covers the consultation fee. |

| 🧬 Back and Neck Preventative Care Program | All | Subject to pre-authorization | Providers of choice (DBC/Workability Clinics). This is a prophylactic approach designed to avoid the need for back and neck surgery. The System could discover suitable volunteers. Based on the initial evaluation, a rehabilitation treatment plan is developed and implemented over a period indicated by the provider. This program is an alternative to surgery. |

| 🩺 Pap Smear | Female beneficiaries 18 and older | Once every 24 months | Possible at a gynecologist, family physician, or pharmacy clinic. The consultation will be at the member’s expense. |

Bestmed Beat 3 Network Preventative Dentistry

The following services may be subject to pre-approval, clinical protocols, and financial guidelines.

| 1️⃣ Service | 2️⃣ Age | 3️⃣ Frequency |

| 🟥 General full-mouth examination by a general dentist | 12 years> | Once yearly |

| 🟧 General full-mouth examination by a general dentist | <12 years | Twice yearly |

| 🟨 Full-mouth Intra-Oral Photos | All | Once every 3 years |

| 🟩 Intra-Oral Radiograph | All | 2 photos yearly |

| 🟦 Scaling or polishing | All | Twice yearly |

| 🟪 Fluoride treatment | All | Twice yearly |

| 🟥 Fissure Sealing | Up to and including beneficiaries 21 years old | According to the applicable and accepted protocol |

| 🟧 Space Maintainers | During the primary and mixed denture stage | Once per space |

POLL: 5 Best Medical Aids under R1500

Bestmed Tempo Wellness Program

The Bestmed Tempo wellness program is designed to assist you in enhancing your health and reaping the benefits that come with it. Therefore, members can access the following advantages:

| ❤️ Temporary Health Assessment (HA) for adults (16 years and older) that includes one of the following per adult beneficiary per year | The Tempo lifestyle questionnaire Blood pressure check Cholesterol check Glucose check Height, weight, and waist circumference These assessments must be conducted at a contracted pharmacy or on-site at employer groups participating in the program. |

| 🧡 Bestmed Tempo Fitness and Nutrition Programs (for those older than 16) | Fitness: 1 x (face-to-face) fitness assessment with a Tempo partner biokinetics. 1 x (virtual or face-to-face) follow-up discussion to receive a customized fitness/exercise plan from a Tempo partner biokinetics. These fitness benefits are designed to support your Tempo Get Active journey. Nutrition: 1 x (in-person) nutrition evaluation with a Tempo partner dietician 1 x follow-up (virtual or in-person) consultation with a Tempo partner dietician to receive your personalized healthy-eating plan. These nutritional benefits are designed to support your Tempo Nutritional Health Journey. |

| 💛 Emotional wellness journey | Licensed psychologists and healthcare professionals designed this to help you understand and manage your emotions and their impact on your mental health. In addition, this Adventure grants you access to the following: Lifestyle-related knowledge that will assist you in adapting to life’s alterations and surprises. Practical obstacles that will allow you to practice the new abilities you must acquire to evolve from your current emotional and mental state to the state you seek. |

| 💚 Maternity Benefits | Covered up to 100% of the Scheme tariff. Depending on the following benefits: Consultations Nine prenatal consultations with a general practitioner, gynecologist, or midwife. One postnatal consultation with a general practitioner, gynecologist, or midwife. Ultrasounds 1 x 2D ultrasound scan in the first trimester (between 10 and 12 weeks) performed by an FP OR gynecologist OR radiologist. 1 x 2D ultrasound scan in the second trimester (between 20 and 24 weeks) performed by an FP OR gynecologist OR radiologist. Supplements Any item classified as a pregnancy supplement may be claimed up to a monthly limit of R127 for a maximum of nine months. |

You might also like to compare Bestmed Tempo with Discovery Vitality

Bestmed Beat 3 Network Maternity Care Program

The Maternity care program is available to pregnant members and their dependents, providing comprehensive services and information.

It has been designed with expectant parents’ specific needs and support networks. It provides support, education, and advice throughout pregnancy, confinement, and the postnatal period.

To access these services, members must register for the Bestmed Maternity care program when they receive confirmation of their pregnancy through a pathology test or scan from their family practitioner or gynecologist.

Once registration is complete, a consultant will reach out to them.

Discover more: What are Maternity Benefits?

Bestmed Beat 3 Network Plan Exclusions and Waiting Periods

Bestmed Beat 3 Network Exclusions

Some of the following are excluded from Beat 3. The comprehensive list can be found on the official Bestmed website.

- ✅ Any fees associated with patient and medical staff travel.

- ✅ Medical aids, orthopedic, surgical, and medical appliances, excluding those described in Annexes B.1 to B.4 of the Scheme Regulations and those prescribed for treating specific PMB disorders and available in the public sector.

- ✅ Requested reports, examinations, tests for emigration, immigration, visas, insurance policies, employment, admission to schools and universities, court medical reports, muscle-function tests, fitness examinations and testing, adoption of children, and retirement due to ill health.

- ✅ Any non-functional or cosmetic procedures, operations, or treatments.

- ✅ Accounting for services performed by individuals not registered with the Health Professionals Council of South Africa, the Associated Health Service Professions Board, or a comparable healthcare organization in the nation where the service was rendered.

- ✅ Accounts pertaining to:

- ✅ The costs incurred for treating illness conditions or injuries received by a member or dependent for whom another party is responsible.

- ✅ Preventative devices and medications for sports and recreational activities.

- ✅ Injuries resulting from illegal actions in which the member or their dependents participated in a criminal crime, excluding those recommended in treating specific PMB conditions and available in the public sector.

Unkept appointments by members, and more.

Bestmed Beat 3 Network Waiting Periods

Depending on pre-existing or existing conditions, the following might apply when you register for medical cover with the Bestmed Beat 3 Network plan:

- ✅ A 3-month general waiting period in respect of all benefits.

- ✅ A 12-month exclusion in respect of a pre-existing condition.

A late-joiner contribution penalty fee will apply.

Medical Aid Comparisons : Bestmed Beat 3 Network Plan vs Similar Plans from Other Medical Schemes

| 🔎 Medical Aid Plan | 🥇 Bestmed Beat 3 Network | 🥈 Bonitas BonSave Plan | 🥉 Discovery Health Coastal Saver |

| 🌎 International Cover | R500,000 – R3 million | R10 million | R5 million |

| 👤 Main Member Contribution | R3,352 | R2,950 | R2,983 |

| 👥 Adult Dependent Contribution | R2,391 | R2,284 | R2,241 |

| 👶 Child Dependent Contribution | R1,183 | R883 | R1,205 |

| 🔁 Gap Cover | None | ✅ Yes | ✅ Yes |

| 🎗️ Oncology Cover | 100% of the scheme tariff | R200,000 | R250,000 |

| 💙 Hospital Cover | Subject to scheme rules | Unlimited | Unlimited |

| 💴 Medical Savings Account | ✅ Yes | ✅ Yes | ✅ Yes |

| 🍼 Maternity Benefits | ✅ Yes | ✅ Yes | ✅ Yes |

POLL: 5 Best Medical Aids Covering Glasses & Optometry

Our Verdict on The Bestmed Beat 3 Network Plan

The Bestmed Beat 3 Network is a comprehensive medical scheme option that offers a large network of providers, including hospitals, specialists, and pharmacies.

One of the key features of this plan is its focus on screening and prevention, with a range of preventative care benefits available to help members stay healthy and catch potential health issues early.

It is worth noting that several limits and sub-limits apply to benefits, so members should carefully review the plan’s terms and conditions.

You might also consider the following options BestMed has to offer:

- 💙 BestMed Beat 2 Network

- 💙 BestMed Beat 1 Network

- 💙 BestMed Tempo

- 💙 BestMed Pace 4

- 💙 BestMed Pace 3

- 💙 BestMed Pace 2

- 💙 BestMed Pace 1

- 💙 BestMed Rhythm 2

- 💙 BestMed Rhythm 1

- 💙 BestMed Beat 4

- 💙 BestMed Beat 3

- 💙 BestMed Beat 2

- 💙 BestMed Beat 1

Frequently Asked Questions

What is Bestmed Beat 3 Network?

Bestmed Beat 3 Network is a medical scheme offered by Bestmed Medical Scheme. It offers many benefits, including hospital coverage, chronic medication, and preventative care.

What are the benefits of Bestmed Beat 3 Network?

The benefits of Bestmed Beat 3 Network include comprehensive hospital cover, chronic medication, preventative care, and access to a network of healthcare providers.

How does Bestmed Beat 3 Network compare to other medical schemes?

Bestmed Beat 3 Network is known for its affordability and comprehensive benefits. It is also one of the largest medical schemes in South Africa, with a large network of healthcare providers.

Who is eligible to join Bestmed Beat 3 Network?

Anyone can join Bestmed Beat 3 Network, regardless of age or medical history. However, there may be waiting periods for certain benefits, depending on the individual’s health status.

How do I apply to join Bestmed Beat 3 Network?

You can apply to join Bestmed Beat 3 Network online or by calling their customer service department. First, you must provide basic information about yourself and your medical history.

What is the cost of Bestmed Beat 3 Network?

The cost of Bestmed Beat 3 Network varies depending on the level of coverage you choose and your individual health needs. However, Bestmed Beat 3 Network is known for being an affordable option compared to other medical schemes, starting from R3,352 per month for the main member.

How do I find healthcare providers in the Bestmed Beat 3 Network?

On their website, you can search for healthcare providers who are part of the Bestmed Beat 3 Network. They also provide a mobile app that makes finding healthcare providers in your area easy.

[xyz-ips snippet="KK-Star"]

You might also like

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans

Your compare list

Back

REMOVE ALL

0