5 Best Medical Aids for Babies in South Africa

The 5 Best Medical Aids for Babies in South Africa revealed.

We tested them side by side and verified their medical aid plans for babies.

This is a complete guide to the best medical aid for babies in South Africa.

In this in-depth guide you’ll learn:

- What is a Medical Aid?

- How do you find affordable medical aid in South Africa?

- Which medical aids are best for mom and baby in South Africa?

- Which medical aid is best for a baby only?

- How do you choose the best medical aid for your family?

So if you’re ready to go “all in” with the best medical aid for babies in South Africa, this guide is for you.

Let’s dive right in…

Best Medical Aids for Babies (2024)

| 🩺 Medical Aid | ✔️ Offers Plans for Babies? | ⚕️ Plan Offered | 💵 Pricing | 👉 Sign Up |

| 1. BestMed | Yes | BestMed Beat1 Network Hospital Plan | R1 710 per member per month | 👉 Apply Now |

| 2. FedHealth | Yes | myFED Option | R1 275 per month per member | 👉 Apply Now |

| 3. Affinity Health | Yes | Hospital Plan | R1 170 per member per month | 👉 Apply Now |

| 4. Bonitas | Yes | BonComprehensive Plan | R2 033 per member per month | 👉 Apply Now |

| 5. Discovery Health | Yes | Discovery KeyCare Plan | R1,102 per member per month | 👉 Apply Now |

5 Best Medical Aids for Babies (2024)

- BestMed – Overall, Best Medical Aid for Babies

- Fedhealth – Top Extensive Medical Protection in South Africa

- Affinity Health – Broadest Range of Low-Cost Medical Aid Plans

- Bonitas – Best Pay-As-You-Go Private Healthcare

- Discovery Health – Best Customer Service Medical Aid

A closer look at medical aids for babies in South Africa

👉 Of course, you want the best for your baby. Part of this is prioritising their health and well-being.

👉 Healthcare options in South Africa are flexible. There are many options for medical aid for you and your family if you work for a company that provides it, but knowing which plan is best for your baby can be challenging.

👉 Whether you’re a single parent seeking for coverage or a multi-child household trying to figure out your options, or happily expecting your next bundle of joy, this article will help you make sense of the many plans that offer high-quality medical aid for babies.

👉 It’s unfortunate that many babies in South Africa don’t live with both of their parents, but instead with extended family. It’s a common query among South Africans to wonder if they can get their babies covered by medical aid despite the high expense of living in South Africa today.

👉 Presently, with a few exceptions, babies in South Africa can only be added as dependents to a medical scheme. If you want to be responsible for your own medical care, you must be at least 18 years old.

👉 In the event of the primary member’s death, the dependent baby may be permitted to become the sole member of the medical aid plan. Yet, the monthly cost is rarely reduced in this way.

Advice on choosing the best medical aid for babies

👉 In South Africa, minors under the age of 18 are not permitted to be primary members of a medical aid plan but are instead covered as dependents of an adult’s scheme.

👉 Unless there are adequate finances in the estate to maintain the membership after the death of a parent or legal guardian, the child’s membership often ceases.

👉 Having things in order before adding a baby to your Medical Aid coverage can provide a variety of benefits.

👉 You want to ensure that your family is cared for in the event of a medical emergency, which includes having access to hospital treatment around the clock, in addition to normal care like paediatrician visits, medications, and preventative care like regular dental and vision exams. Save money without compromising quality to get the best deal.

👉 If you tell your Medical Aid broker about your family’s specific health needs, they should be able to recommend the best plan for you.

👉 Comparing medical aid quotes from several companies will help you choose the most cost-effective option.

👉 Here are some things to think about as you shop around for paediatric medical aid.

Research the possibility of upgrading your current plan

👉 If your existing medical aid is insufficient to handle escalating expenses, as it may be if your baby has developed a chronic illness, upgrading to a more thorough plan will cover the expense of prescription medications, longer hospital stays, and prolonged treatment and care.

👉 Please be aware that there is typically a waiting period before benefits kick in for the majority of medical aid plans due to qualifying restrictions.

Weigh the options of a network-linked plan

👉 Low-cost medical aid typically only covers services from government-run clinics and hospitals. Customers who pay more for their policies have more freedom to choose their own healthcare providers, pharmacies, and medical facilities.

Shop around for plans that have baby-orientated benefits

👉 Consider your own medical history, your baby’s medical history, your current financial circumstances, and any other relevant aspects while making this determination.

👉 You can compare medical aid schemes, plans, benefits, and contributions to figure out which one is the best fit for your family’s budget and healthcare needs.

👉 The most comprehensive medical coverage would include not just emergency room visits but also primary care physician and paediatrician check-ups, as well as some dental and optical services.

5 of the Best Known Medical Aids in South Africa For Babies

👉 There are a variety of leading medical aid schemes that offer comprehensive plans suited to families with babies. We explore these options in more detail below.

1. BestMed

Overview

👉 As one of the largest private medical aid schemes in South Africa, BestMed serves about a million people.

👉 BestMed is dedicated to operating a company that is substantial enough to make an actual difference in the lives of the people they serve, but still small enough to know the names of those serviced and to react quickly to customer input.

👉 The principle around which BestMed is built is that individuals’ healthcare requirements vary widely depending on characteristics such as age, marital status, family size, health, preferences, and financial resources.

👉 There are a total of three primary care plans available from BestMed, and they all have their own distinct set of benefits and coverage choices.

👉 From comprehensive policies that cover all medical costs to more limited ones that solely pay for inpatient care, BestMed has you covered.

BestMed Medical Aid Option Plans Suitable for Babies

👉 A number of BestMed’s plans are well-suited to babies. For babies to get the most out of their benefits, these plans offer a variety of benefits.

BestMed Medical Aid Plans

👉 The BestMed Tempo wellness programme helps you lead a healthier life by providing you with expert advice and encouragement.

👉 Only one adult member of the family needs to get a health assessment at a BestMed Tempo pharmacy in order to sign up for the wellness benefits. The advantages, which your babies will have, include:

➡️ 3 nurse consultations for babies under 35 months old

👉 In addition to the aforementioned benefits, the wellness program’s nutritional assessment could be beneficial for babies.

How Much Are BestMed Medical Aid Monthly Premiums?

👉 At the time of writing, monthly premiums for the cheapest BestMed Beat1 Network Hospital Plan started at R1 710 for a member, with an additional R1 329 for an adult dependant and R720 for a child dependant, to a maximum of 3 child dependants. Additional children join at no additional cost.

👉 The most expensive plan at the time was the Pace4 Comprehensive Plan, with monthly contributions of R9 411 per member and R9 411 per adult dependant. For a child dependant, the extra contribution was R2 205, up to 3 child dependants with additional children added as beneficiaries of the scheme at no extra cost.

What Is the Waiting Period for BestMed Medical Aid’s Benefits?

👉 There can be a general waiting period of three months or a specific waiting period of 12 months for a certain condition.

👉 BestMed Medical Scheme will sometimes only pay a claim if it is a PMB. This can happen if you are in a waiting period or if you are getting treatment for a condition that your plan doesn’t cover.

👉 Read more about the Bestmed Medical Scheme Late Joiner Fees

How to Claim Benefits from BestMed Medical Aid

👉 If your healthcare provider does not submit claims to BestMed, one must submit the original claim directly to the fund administrators.

👉 You can claim by means of the BestMed App, or by scanning and emailing your claim to them.

👉 Details that should appear on all claim documents include:

➡️ Member’s name and contact details

➡️ BestMed membership number

➡️ Patient’s details

➡️ Service provider’s name, contact details and practice number

➡️ Details of treatment, including applicable tariff and ICD-10 codes

➡️ Whether payment should be done to the service provider or the member

👉 You will receive an email confirmation when your claim is received and indexed.

BestMed Medical Aid Contact Details

Head Office:

BestMed Medical Scheme,

Glenfield Office Park

361 Oberon Avenue

Faerie Glen

Pretoria

PO Box 2297

Pretoria

Emails: [email protected]; [email protected],

Phone: +27 (0)86 000 2378

2. Fedhealth

Overview

👉 Fedhealth was established in 1936 to provide for the health care needs of the South African populace. They have always intended to offer reasonably priced healthcare, and they have never wavered from that mission.

👉 Fedhealth is a cooperative owned by its customers that tries to address the ever-evolving demands of the healthcare industry.

👉 The individualised nature of Fedhealth means that you, the member, may have input over the specifics of your health coverage. Due to its membership structure, Fedhealth prioritises the needs of its constituents above all else.

👉 The Scheme’s stable financial position is shown in the fact that it has been able to save more than 25% as a reserve for its members for the past 14 years and maintain an AA- Global Credit Rating.

👉 The unique Risk-based rewards offered by Fedhealth maximise the benefits of membership.

👉 Visit any participating provider as frequently as you like without incurring any additional fees, and receive a complimentary upgrade once per year, within 30 days of a major life event.

Fedhealth Medical Aid Option Plans Suitable for Babies

👉 A number of Fedhealth’s plans are well-suited to babies. For babies to get the most out of their benefits, these plans offer a variety of benefits.

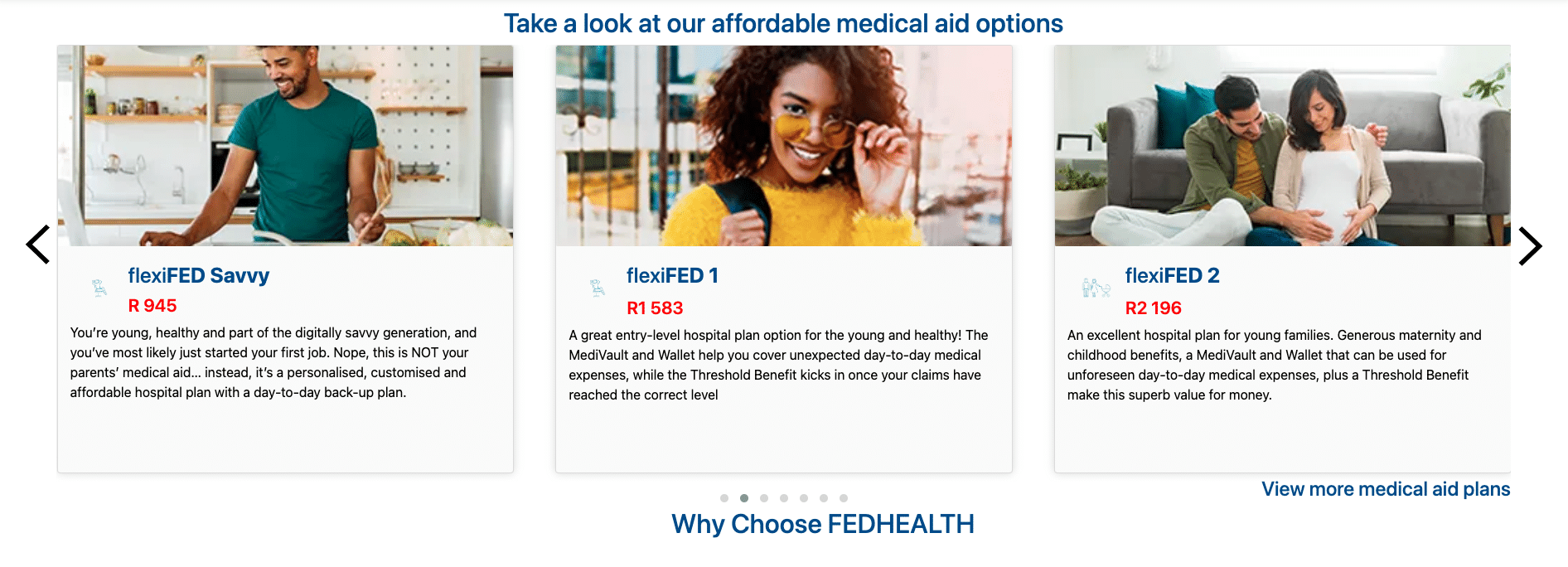

Fedhealth Medical Aid Plans

👉 Fedhealth offers three distinct plans, each one designed with families with children of varied ages in mind. The cost of the car every month ranges from R1,900 to R2,800.

👉 To be more specific, the FlexiFED 2 plan is aimed towards those who are just starting a family, while the FlexiFED 3 plan is created for those who already have babies. FlexiFED 4 was developed by Fedhealth for households with children in elementary school and beyond.

👉 All three choices offer equivalent benefits. While all FlexiFED plans include the MediVault for handling unexpected medical bills, the FlexiFED 3 and 4 plans provide you access to significantly more emergency funds. Moreover, FlexiFED 4 provides access to the Threshold Benefit.

👉 All of your family’s medical expenses at Fedhealth-affiliated hospitals and clinics will be covered by these plans. For the first twelve years of a child’s life, immunisations are provided at no cost. One free annual flu vaccination per person in the household.

How Much Are Fedhealth Medical Scheme Monthly Premiums?

👉 The monthly premiums for the salary-banded myFED option is from R 1 275 per month for the main member. The maxima PLUS extensive medical cover will cost 13 122 per month per the main member.

What Is the Waiting Period for Fedhealth Benefits?

👉 The general waiting period for Fedhealth benefits is usually three months, depending on the medical aid scheme you join. The waiting period for pre-existing conditions is 12 months.

How to Claim Benefits from Fedhealth Medical Scheme

👉 Members can submit claims using one of the following:

➡️ In the Fedhealth Family Room,

➡️ Through a WhatsApp service

➡️ On the Fedhealth Member phone App

➡️ You may also email, fax or post the claims to email: [email protected], fax: (011) 671 3842 or post to Private Bag X3045, Randburg, 2125.

Fedhealth Medical Scheme Contact Details

Flora Centre Shop 21 and 22

Corner Conrad street and Ontdekkers Rd

Florida Glen

Johannesburg

Phone: 0861 116 016

3. Affinity Health

Overview

👉 When Affinity Health was founded in 2011, its primary goal was to ensure that all citizens of South Africa had access to high-quality private healthcare at a price they could afford. Long-term medical coverage is what Affinity Health has focused on delivering since its inception.

👉 Affinity Health’s revolutionary approach to the medical aid market is the result of its unparalleled expertise, dedication, and knowledge.

👉 Everyone in South Africa should have access to affordable private healthcare. To ensure that all South Africans have access to affordable, high-quality healthcare, Affinity Health is working to expand its network of private medical assistance providers.

👉 Thanks to its extensive network of partners, Affinity Health is able to provide its market with a formidable team of specialists.

👉 Affinity Health is investing heavily in both its staff and cutting-edge technologies to speed up the product development process and assure the delivery of unique goods to market.

Affinity Health Medical Aid Option Plans Suitable for Babies

👉 A number of Affinity Health’s plans are well-suited to babies. For babies to get the most out of their benefits, these plans offer a variety of benefits.

Affinity Health Medical Aid Plans

👉 Affinity Health is one of the few companies in South Africa that caters exclusively to babies when it comes to medical aid. Whether you’re looking for everyday, hospital, or mixed insurance, Affinity Junior gives you the choice of covering only your children and babies.

👉 The Junior Day-to-Day plan covers any and all imaging and testing that is recommended by your primary care physician. Moreover, routine dental and eye care is included. The first child costs around R600 a month, and each additional child adds another R300.

👉 The Junior Hospital plan is a good deal for the money, costing roughly R900 per month for the first child and an additional R300 for each additional child. The cost of your hospital stay and any necessary medical procedures are covered in full by this policy.

👉 The Junior Combination plan provides comprehensive medical coverage, including routine doctor visits and hospital stays, for a monthly premium of R1,400 for the first kid and R500 for each additional child.

How Much Are Affinity Health’s Monthly Premiums?

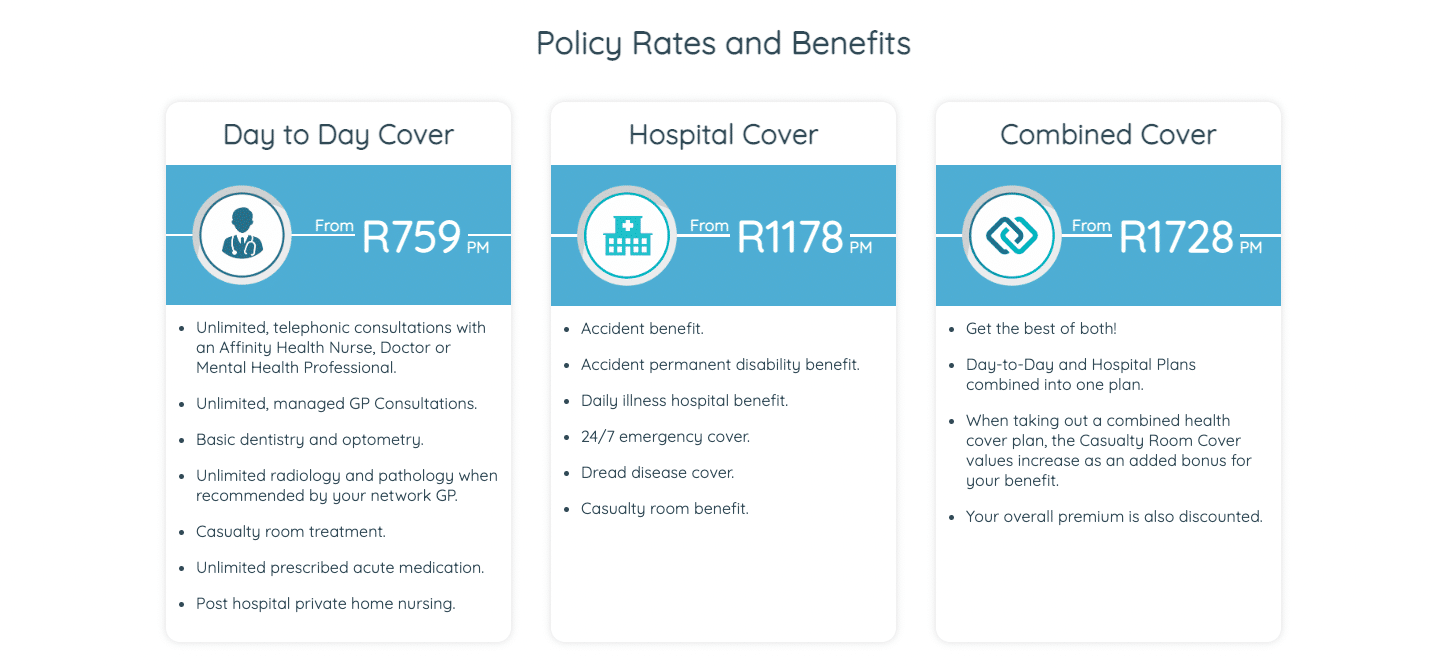

👉 Affinity Health offers a comprehensive hospital plan from R1170.00 per month. The Day-to-Day Plan is available from R759.00 per month. The Combined Plan is available from R1 728.00 per month.

What Is the Waiting Period for Affinity Health Benefits?

👉 Depending on the medical aid scheme you join, the average waiting period for Affinity Health benefits is three months. Pre-existing conditions have a 12-month waiting period.

How to Claim for Benefits from Affinity Health

➡️ General practitioner visits also need pre-authorisation. In the event of visiting a doctor who may not be on the Affinity Health network, you will need to pay the full consultation fee upfront. You can then claim up to R250.00 back from Affinity Health.

➡️ For assistance with reimbursement, please email the detailed account and a signed Affinity Health reimbursement form to [email protected].

➡️ Network doctors can claim directly from Affinity Health. The practice may charge additional administration fees, which cannot be recovered from Affinity Health. These will be for the member’s account.

➡️ Procedures conducted in the rooms of Affinity Health network doctors are also covered, provided you have obtained pre-authorisation.

➡️ If you need to consult a specialist, you will have to get a referral letter from your GP, for the consultation to be eligible for cover by Affinity Health. Once you have your referral letter, you will need to call to get pre-authorisation before the actual consultation.

➡️ With hospital cover, the insurer will pay a set portion of the cost. The patient is still fully liable for the bill and will need to claim from the insurance to pay the hospital.

➡️ As always, pre-authorisation is required before going into the hospital. Affinity Health has a 24-hour hospital pre-authorisation line.

Affinity Health Contact Details

1 Dingler Street, Rynfield, Benoni 1501

Call Centre: 0861 11 00 33

WhatsApp: 079 479 3230

Email: [email protected]

4. Bonitas

Overview

👉 Bonitas has been in operation for about 40 years, and during that time it has established itself as a forerunner in the private healthcare sector in South Africa.

👉 As a result, its employees are consistently hunting for fresh methods to save money without lowering the quality of service customers receive. To do so entails, among other things, keeping an eye on new advancements in the area, monitoring care to prevent the chronicity of lifestyle diseases, and negotiating for reduced expenses.

👉 By taking advantage of the organization’s low-priced services and extensive network of qualified medical specialists, you and the other 700,000 people it helps may be able to maintain your health with less financial strain.

👉 One of Bonita’s various plans is perfect for you and your family. The programmes aim to be as simple to use as possible without sacrificing the quality of the services they provide. Bonitas is a great option for people looking for their first medical aid policy.

👉 The company appears to be solvent, with about R6 billion stashed away in the bank.

Bonitas understands the need of fostering meaningful connections with its clientele in order to continue putting the needs of its members first and behaving in a member-centric manner. In three independent polls, Bonitas Medical Fund has been praised for its high levels of client satisfaction and stellar service.

👉 Bonitas is rated as the top South African medical aid provider in the next 2021–2022.

👉 The finest medical coverage in South Africa, according to both the 2019/2020 and 2017/2018 indices.

👉 Since 2001, the service industry has relied on Ask Afrika’s Orange Index to evaluate client retention and satisfaction.

👉 The leaders of Bonitas all have extensive experience in their fields, and the non-profit is overseen by an independent Board of Trustees made up of experts in medicine, law, finance, and business.

👉 The index considers 31 different industries when ranking businesses and evaluates them according to 10 crucial service qualities.

Bonitas Medical Aid Option Plans Suitable for Babies

👉 A number of Bonitas’ plans are well-suited to babies. For babies to get the most of their benefits, the programmes must are simple to grasp and use.

Bonitas Medical Aid Plans

👉 Bonitas offers several different series, each with its own set of benefits and cost structure. Go no farther than the Traditional series if you want a great read for the whole family, including babies. Price for Basic Select begins at about R2 200, while Premium Select is around R3 600.

👉 Your loved ones can receive unlimited inpatient care coverage at any network hospital. Your medical aid plan will pay for non-hospital medical care, such as regular doctor visits and expert consultations. The cost of routine dental work and eye exams is subject to set restrictions.

👉 Immunizations for babies are covered by both programmes. While the Standard plan allows for two doctor’s visits each year, the Primary plan only covers one. One annual flu shot is sufficient protection for an entire household against the virus.

How Much Are Bonitas Medical Aid Monthly Premiums?

👉 Bonitas monthly contributions start at R 2 033 for a Principal Member, R 1 555 for a spouse/adult dependant and R 596 per child (max 3) on the BonEssential Hospital Plan and go up to R 8 217 for a main member, R7 749 for additional adult, and R 1 672 for a child for the BonComprehensive plan that offers abundant savings, an above threshold benefit and extensive hospital cover.

What Is the Waiting Period for Bonitas Medical Aid Benefits?

👉 The minimum general waiting period for Bonitas medical aid is three months for all benefits. Some plans, however, have a waiting period of 12 months, especially regarding a pre-existing condition.

👉 Pregnancy is considered a pre-existing condition; therefore it is excluded from all benefits for the first 12 months of scheme membership.

👉 Read more about Bonitas Late Joiner Fees

How to Claim for Breast Reduction Benefits from Bonitas

👉 You can send in your claim in the following ways:

➡️ Email your claims to [email protected].

➡️ Post your claims to Bonitas Claims Department, PO Box 74, Vereeniging, 1930.

➡️ Submit your claims in person at one of the walk-in centres.

👉 Follow these simple steps to get your claims paid quickly:

➡️ Ensure your banking details are correct for refunds by electronic transfer (EFT) into your bank account

➡️ Make sure that your account and receipt show your name and initials, membership number, treatment date, the name of the patient as shown on your membership card, the amount charged and ICD-10 code.

Bonitas Contact Details

34 Melrose Blvd, Birnam

Johannesburg

2196

Phone for General Queries: 0860002108

Email: [email protected]

Email: [email protected]

5. Discovery Health

Overview

👉 In terms of medical coverage, Discovery Health Medical Scheme is among the best options in South Africa. Everyone, including babies, can be added to the Program as long as they play by the rules.

👉 All of Discovery Health Medical Scheme’s over twenty plans are great for families because they provide limited coverage for private hospitals and a large range of additional perks.

👉 With such a wide variety of options for treatment and care, families can get the attention they need whenever it’s needed thanks to these plans.

👉 Discovery’s rates are 14.9% higher than the average South African medical aid plan, but provide the same level of coverage.

👉 The Vitality wellness programme is also available, rewarding participants for adopting a healthy lifestyle with perks like discounted gym memberships and healthy meals.

👉 The fund is administered on behalf of the members by a Board of Trustees who are separate from the Scheme.

👉 The corporation is managed by Discovery Health (Pty) Ltd., a separate financial services organisation. To be clear, the Medical Schemes Act and the Council for Medical Schemes are the authoritative sources for all of Discovery Health Medical Scheme’s rules and regulations.

Discovery Medical Aid Option Plans Suitable for Babies

👉 The Discovery option gives you a choice between high-priced, all-inclusive private medical aid and lower-priced, all-inclusive private medical aid through a more limited network of providers.

👉 As a result, families can choose from a variety of medical aid plans.

Discovery Health Plans

👉 There are seven distinct packages available from Discovery. The Smart Series plans to offer the best value and comprehensive coverage for your baby’s immediate healthcare needs.

👉 The Smart Series’ Classic and Essential packages offer nearly identical benefits with various levels of information. The initial instalment is only R1,500, with higher monthly instalments available.

👉 You and your family’s appointments with the doctor and private hospitalisations are completely covered by Discovery’s network of providers. Both common sports injuries and over-the-counter treatments are included.

👉 Discovery offers a wide variety of Vitality programmes through which you may earn points and exchange them for merchandise.

👉 The benefits of the Vitality Babies, Vitality Kids, and Vitality Teens programmes are distinct from one another because they are designed for children, adolescents, and young adults of varying ages.

How Much Are Discovery Medical Aid Monthly Premiums?

👉 Monthly premiums start from R1,102 per member for the KeyCare Series with medical cover for both in-hospital and out-of-hospital treatment by providers in a specified network and go up to R10,303 per member for the Executive Plan with extensive cover for in-hospital and day-to-day benefits, extended chronic medicine cover, and unlimited Above Threshold Benefit.

What Is the Waiting Period for Discovery Medical Aid’s Benefits?

👉 Discovery Health Medical Scheme’s general waiting period is 3 consecutive months and the condition-specific waiting period is 12 consecutive months.

👉 Read more about Discovery Health late joiner fee

How to Claim for Discovery Medical Aid Benefits

👉 You can submit a claim fast and easily in the following ways:

➡️ Scan and upload your claims on the website.

➡️ Scan and email your claims to [email protected].

➡️ Use the Discovery app on your smartphone. If the claim has a QR code, scan the QR code or alternatively take a photo of the claim from within the app.

➡️ You can also submit your claims by post.

Discovery Medical Aid Contact Details

PO Box 784262,

Sandton,

2146

Phone: 0860 99 88 77

Frequently Asked Questions

When should I put my baby on medical aid?

It is advised that you complete the Application for Newborn Baby Registration and send it to your medical aid provider no later than 30 days following the birth of your baby. This ensures that your child is protected for any medical care that they may require.

Does medical aid cover a new-born?

If you are a member of a recognized medical aid program, your newborn baby will be immediately covered for medical care. Notifying your medical assistance provider as soon as possible after the birth will guarantee that your newborn is fully covered and not disqualified from coverage.

How much are medical expenses for a baby?

The cost of having a baby can sometimes be very high. The average cost of the pregnancy, delivery in a hospital, and postpartum care is close to R100,000.

How do I add my baby to a medical aid?

You can get the most recent copies of all necessary application forms from the website of your medical aid. Update any required certificates and other documents. When completing the form, make sure to use black ink or clear digital printing. All relevant elements must be signed by the key member. The primary member must sign and date any changes.

Why do hospitals charge for babies?

Hospitals charge for newborns because they provide specialized medical services, facilities, equipment, staffing, administrative support, and incur overhead costs to ensure the safety and well-being of babies.