Best Medical Aids in South Africa For Young Adults

The 5 Best Medical Aids for Young Adults in South Africa revealed.

We tested them side by side and verified their medical aid plans.

This is a complete guide to the best medical aid for young adults in South Africa.

In this in-depth guide you’ll learn:

- What is a Medical Aid?

- How much is affordable medical aid for a young adult?

- Should you have medical aid when you are under 25?

- Should you rather have a hospital plan or medical aid as a young adult?

- Can you get a discount if you are still studying?

So if you’re ready to go “all in” with the best medical aid for young adults in South Africa, this guide is for you.

Let’s dive right in…

Best Medical Aids in South Africa For Young Adults

| 🩺 Medical Aid | ✔️ Offers Plans for Young Adults? | ⚕️ Plan Offered | 👉 Sign Up |

| 1. Bonitas Medical Aid | Yes | Edge Plans | 👉 Apply Now |

| 2. Discovery Medical Aid | Yes | Ingwe Student Option | 👉 Apply Now |

| 3. Momentum Health | Yes | Evolve Option | 👉 Apply Now |

| 4. BestMed Medical Aid | Yes | Hospital Plans | 👉 Apply Now |

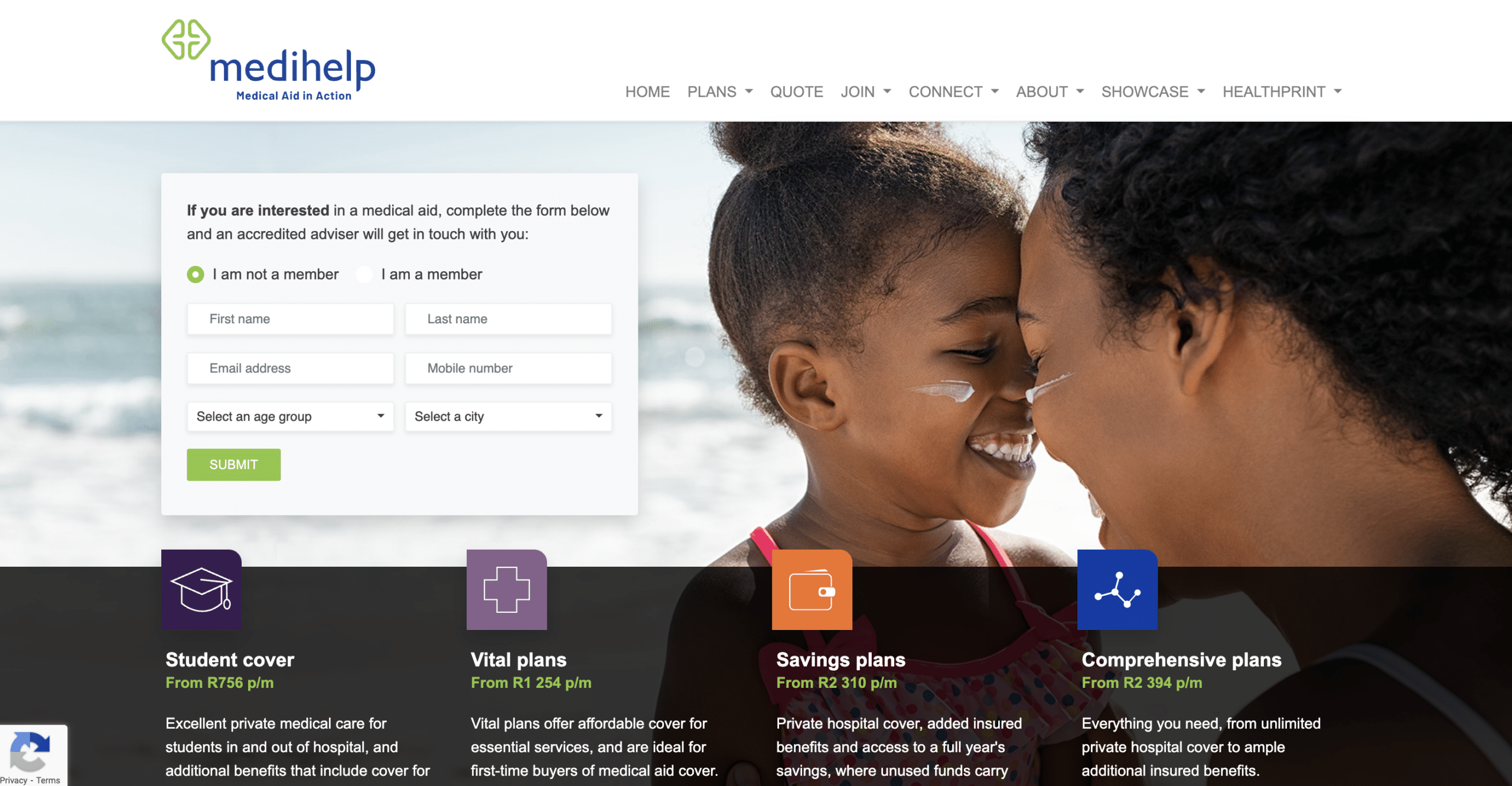

| 5. Medihelp Medical Aid | Yes | MedMove | 👉 Apply Now |

Best Medical Aids in South Africa For Young Adults

- Bonitas Medical Aid – Overall, Best Medical Aid for Young Adults in South Africa

- Discovery Medical Aid – Broadest Range of Low-Cost Medical Aid Plans

- Momentum Health – Best Pay-As-You-Go Private Healthcare

- BestMed Medical Aid – Top Extensive Medical Protection in South Africa

- Medihelp Medical Aid – Verified Medical Aid Options Specifically for Young Adults

Why Healthy Young Adults Also Need Medical Aid

After you have finished your secondary or postsecondary education and your parents have stopped financially supporting you, you enter the real world and the workforce, either as a young entrepreneur or perhaps as an employee of a company that does not offer medical aid membership as part of the employee’s remuneration package.

In either case, you will need to find a way to pay for your own health insurance. Then it is time to sign up for a medical aid programme that is within your price range.

Statements such as “I never get sick; I’m quite healthy; and I’m a young adult with a very powerful immune system, thus I don’t need medical treatment” are common among adolescents and young adults who have recently gained their independence.

The latter half of the statement is the one that raises concerns, despite the fact that the first part of the statement may very well be historically accurate. It also displays an inaccurate knowledge of just why people chose to get medical assistance protection, what medical aid membership is, or how it works to work to your favour.

Don’t Wait, Act as Soon as Possible

Young people in South Africa should investigate their alternatives for medical aid as soon as possible rather than waiting till later.

Accidents can occur when they are least expected, and the risk that young people could get chronic ailments or terrifying diseases is growing. These range from communicable diseases like HIV and TB to ailments like hypertension and diabetes that are linked to sedentary lifestyles.

In the event that you do not have health insurance, you may find that the expenditures of hospitalisation, surgery, treatment, consultations, and medication cause you to fall deeply into debt.

Additionally, the longer you go without receiving medical assistance, the higher the associated costs will be. Late joiner fees are automatically assessed to any adult South African who has not previously participated in a medical assistance programme and is at least 35 years old.

Anyone who has gone without health insurance for at least three months will be subject to the same penalty.

Learn more about the 5 Best Hospital Plans for Students / Learners and Young Adults in South Africa

5 of the Best Known Medical Aids in South Africa For Young Adults

What are the medical aid options for young adults in South Africa?

The best medical aid programmes in South Africa each offer a variety of items to choose from in order to meet the needs of young people in the country who have diverse levels of financial stability and different expectations regarding their health care.

Affordable income-based plans and hospital plans are both popular choices among young people looking for medical assistance.

Low Cost Income-Based Plans

Your monthly income is used to calculate the amount of the premium that you must pay for entry-level income-based medical aid plans. If you earn a low to middle-income and are looking for basic coverage, they’re perfect for you—as long as you’re willing to use only the specified service providers.

Income-based plans typically offer unlimited benefits in hospitals, frequently at 100% of the scheme rate. Co-payments are not required for the majority of the available options if you use network providers, as tariffs have already been pre-negotiated.

In addition, income-based plans often offer limited coverage for explicitly specified out-of-hospital charges, such as visits with network primary care physicians, prescribed drugs, as well as routine radiology and pathology services.

They might also include some form of maternity coverage, making them suited for young people in South Africa who are thinking about starting a family.

These income-based plans may also include a hospital plan that covers chronic medicine for specific illnesses but does not provide coverage for day-to-day medical expenses outside of the hospital.

Hospital plans

When a patient is admitted to the hospital, hospital plans will pay for any treatments, consultations, or medication that they get during their stay. Additionally, they typically offer benefits in the fields of radiography and pathology, as well as oncology, dialysis, and internal prosthesis, such as pacemakers.

Coverage is supplied at 100%, 200%, or 300% of the scheme rate and is proportional to the amount of your monthly contribution; in other words, the more you pay each month, the more coverage you’ll have when you’re in the hospital.

Some plans even provide some maternity benefits outside of the hospital setting.

More expensive hospital plans typically cover medical expenses at any private hospital or clinic, whereas budget choices typically only cover medical expenses at public hospitals or at a limited number of privately owned facilities that have been specifically designated.

Additionally, there are healthcare plans that provide cost-cutting benefits. These hybrid medical aid plans place a certain portion of your total annual contributions into a savings account, which can then be utilised to pay for day-to-day costs. After you have depleted your yearly savings, you will be required to pay for all of your medical expenses, including visits to your primary care physician and specialists, as well as the cost of your medicine, out of your own personal funds.

However, some plans do cover general practitioner visits at a network of general practitioners after the funds have been depleted.

Regardless of the kind of medical insurance policy you decide to purchase, you always have the option to upgrade to a package that offers a wider range of coverage if and when your needs evolve.

You can “level up” to a product that provides a higher level of benefits that are suitable for your particular situation if, for example, you are diagnosed with a terrible disease that requires sustained medical intervention outside of the hospital or if you are ready to start a family.

In the majority of circumstances, you won’t be able to upgrade your plan until a specific time of the year, and if you have a pre-existing condition, you might not be covered for the time being.

It is recommended that you, as a young South African, talk to experts in the field. Brokers of medical aid are educated to evaluate your level of risk and then advise you on the best medical insurance plan to purchase, taking into account your monthly budget as well as your specific needs.

They are also privy to confidential information regarding the beneficiary demographics and financial indices of each plan.

Most of the time, medical aid’s more expensive hospital plans cover medical costs at any private hospital or clinic. On the other hand, budget options usually only cover medical costs at public hospitals or a small number of privately owned facilities that have been designated.

Some of the large medical aids provide health care plans with benefits that help cut costs. Some of the money you pay into these hybrid medical aid plans is put into a savings account, which you can then use to pay for day-to-day costs. After you’ve used up your yearly savings, you’ll have to pay for all of your medical costs out of your own pocket.

This includes visits to your primary care doctor and specialists, as well as the cost of your medicine. But some plans, like Fedhealth’s Saver choices, cover visits to a general practitioner at a network of general practitioners even after the money has run out.

Students who are generally healthy but want the peace of mind that comes with knowing they are financially protected in case they need to go to the hospital usually choose a hospital plan that focuses mainly on covering the costs of being in the hospital.

Students with a long-term illness may still be able to get an all-inclusive health insurance plan, but this depends on whether or not there is enough money. There are also plans that can be made to fit your needs, are affordable, and cover you both inside and outside of hospitals.

If you are younger than 21, you can be listed as a dependent on your parents’ health insurance plan. This means that you will pay the child rate for your coverage. If you can prove that you are studying full-time, you may be able to pay the child rate for a certain type of health insurance until you are 26 years old.

It is advisable to know more about Gap Cover Options

1. Bonitas Medical Aid

Overview

Bonitas has been around for close to 40 years, which is enough time to have built up a rich tradition and a thorough understanding of the South African private healthcare sector.

Therefore, whether it’s keeping a finger on the technological pulse, managing your care so lifestyle diseases are identified before they become chronic, or negotiating better rates for you, its team of experts is constantly looking for innovative ways to ensure that members receive affordable, quality healthcare.

If you are one of more than 700 000 beneficiaries, you can share in the company’s lower prices and reliable service providers to keep you well while containing the cost of healthcare.

Bonitas’ extensive selection of plans guarantees that you and your family will find a perfect match for your unique requirements. The plans are designed to be simple to use while also maximising your benefits. Bonitas is there for you are a young adult looking for first time medical insurance.

The company has solid key indications of fiscal health, stable finances, and reserves of more than R6 billion.

Connecting with consumers is one of Bonitas’ strategy pillars since it helps them to be member-centric and committed to serving their best interests. Three distinct polls have rated Bonitas Medical Fund as having a high degree of customer satisfaction and service excellence:

In the 2021/2022 Ask Afrika Orange Index for service excellence in the Medical Aid industry, Bonitas was voted the best medical aid in South Africa.

It was also voted the no. 1 medical aid in South Africa in the 2019/2020 and in the 2017/2018 Index.

Since 2001 the Ask Afrika Orange Index measures services within and across 31 industries, using 10 of the most relevant service benchmarks of the service performance of an organisation while measuring customer and emotional satisfaction and loyalty.

Bonitas is run by a management team with a lot of experience and an independent Board of Trustees made up of professional non-members from the health, legal, financial, and business fields.

Bonitas Medical Aid Option Plans Suitable for Young Adults in South Africa

Bonitas offers a wide variety of plans, several of which are suitable for young adults.

The plans are easy to understand and use so that young members can get the most out of their benefits.

Edge Plans

This category gives access to day-to-day benefits including unlimited GP consultations, layers of virtual care, dental and optical consultations, a private hospital network and more. Options include the BonStart plan, designed for economically active singles, living in the larger metros, with a drive to succeed and BonStart Plus, designed for young, economically active couples, living in the larger metros, and looking to expand their family.

Traditional Plans

The traditional plans are suitable for young adults who are already more settled and financially independent. The give an overall day-to-day limit with sub-limits for GP and specialist consultations, acute and over-the-counter medicine, X-rays and blood tests and other out-of-hospital medical expenses. Options include a Standard, Standard Select, Primary and Primary Select plan.

This traditional options offers good day-to-day benefits and comprehensive hospital cover, with the Select plans using a network of quality providers to offer modest day-to-day benefits and hospital cover.

Savings Plans

Young adults can also consider one of Bonitas’ Saving plans that give a set amount that you can use however you want for out-of-hospital costs like doctor visits, optometry, and dentistry. They also cover you while you’re in the hospital and give you extra benefits for maternity, wellness, and preventative care.

The options are called BonFit Select, BonSave, BonComplete, BonClassic and BonComprehensive

This savings options offer sufficient savings to use for medical expenses and extensive hospital cover, with BonComprehensive being a first-class savings plan that offers ample savings, an above threshold benefit and the best hospital cover.

Hospital Plans

Young healthy adults can also opt for hospital plans, that cover them for emergency and planned procedures in hospital and access to some additional benefits for wellness and preventative care. These options include the Hospital Standard, BonEssential and BonEssential Select plans – the latter using a quality provider network that offers comprehensive hospital benefits and some value-added benefits.

Benefits for Young Adults under Bonitas Medical Aid

Most of the mentioned option plans offer basic benefits like hospital coverage and savings pockets from which other medical expenses may be covered.

How Much Are Bonitas Medical Aid Monthly Premiums?

Bonitas monthly contributions start at R 2 033 for a Principal Member, R 1 555 for a spouse/adult dependant and R 596 per child (max 3) on the BonEssential Hospital Plan and go up to R 8 217 for a main member, R7 749 for additional adult, and R 1 672 for a child for the BonComprehensive plan that offers abundant savings, an above threshold benefit and extensive hospital cover.

What Is the Waiting Period for Bonitas Medical Aid Benefits?

The minimum general waiting period for Bonitas medical aid is three months for all benefits. Some plans, however, have a waiting period of 12 months, especially regarding a pre-existing condition.

Pregnancy is considered a pre-existing condition; therefore it is excluded from all benefits for the first 12 months of scheme membership.

How to Claim for Breast Reduction Benefits from Bonitas

You can send in your claim in the following ways:

- Email your claims to [email protected].

- Post your claims to Bonitas Claims Department, PO Box 74, Vereeniging, 1930.

- Submit your claims in person at one of the walk-in centres.

Follow these simple steps to get your claims paid quickly:

- Ensure your banking details are correct for refunds by electronic transfer (EFT) into your bank account

- Make sure that your account and receipt show your name and initials, membership number, treatment date, the name of the patient as shown on your membership card, amount charged and ICD-10 code.

Bonitas Contact Details

34 Melrose Blvd, Birnam

Johannesburg

2196

Phone for General Queries: 0860002108

Email: [email protected]

Email: [email protected]

READ more about the comparisons between Bonitas Medical Aid and Medimed Medical Aid

2. Discovery Medical Aid

Overview

The largest open medical system in South Africa is most likely the Discovery Health Medical Scheme (DHMS). As long as they abide by the regulations of the Program, anyone, including young adults, may join this scheme.

The Discovery Health Medical Scheme offers more than 20 different health plan options, all of which are suitable for young adults because they include limitless private hospital coverage and a range of perks to suit everybody’s requirements and financial situation.

The plans give access to a variety of advantages, care plans, and services that guarantee any young adult will receive the best medical care when they need it.

According to Discovery, for the same level of coverage, rival South African medical schemes charge an average 14.9% more in contributions, a very attractive feature for young people who may not earn big salaries yet.

You also have the option to enrol in Vitality, its wellness programme, which rewards you for leading a healthy lifestyle by gym memberships and more.

An independent Board of Trustees oversees the management of the Scheme, which is owned by its participants. It is managed by a different organisation, an authorised financial services provider named Discovery Health (Pty) Ltd. The Medical Schemes Act and the Council for Medical Schemes both regulate Discovery Health Medical Scheme.

Discovery Medical Aid Option Plans Suitable for Young Adults in South Africa

Discovery option plans range from the most comprehensive but expensive private healthcare cover to basic and more affordable plans where you get cost-effective private healthcare cover through an extensive network of providers.

Young adults can choose from the following health plan options:

This series of plans provide comprehensive cover for in-hospital and day-to-day cover with extended chronic medicine cover and unlimited Above Threshold Benefit. With its fairly high premiums, only young adults already established in a secure job may consider this.

These plans offer cost-effective in-hospital cover, essential chronic medicine cover and day-to-day benefits with a limited Above Threshold Benefit, which is ideal for young professionals.

This series is economical, provides in-hospital cover, essential chronic medicine cover and day-to-day benefits through a Medical Savings Account. Its premiums are reasonable, therefore many young adults become members.

This is a value-for-money series of hospital plans that provide unlimited private hospital cover and essential cover for chronic medicine to young adults who do not have a big income. The benefits do not include any day-to-day cover.

This series of plans provide the most cost-effective in-hospital cover, essential chronic medicine cover plus limited day-to-day cover for young adults if they use providers in a specified network.

Young adults who just start out with a career, may consider this basic series of plans to get a foot in the door. It offers affordable medical cover providing you use providers in a specified network for both in-hospital and out-of-hospital treatment.

Benefits for Young Adults in South Africa under Discovery Medical Aid

Most of the mentioned option plans offer the needed basic benefits like hospital coverage. Some have the option of savings pockets from which other medical expenses and day to day expenses may be paid.

How Much Are Discovery Medical Aid Monthly Premiums?

Monthly premiums start from R1 102 per member for the Keycare Series with medical cover for both in-hospital and out-of-hospital treatment by providers in a specified network and goes up to R10 303 per member for the Executive Plan with extensive cover for in-hospital and day-to-day benefits, extended chronic medicine cover, and unlimited Above Threshold Benefit.

What Is the Waiting Period for Discovery Medical Aid’s Benefits?

Discovery Health Medical Scheme’s general waiting period is 3 consecutive months and the condition-specific waiting period is 12 consecutive months.

How to Claim for Discovery Medical Aid Benefits **

You can submit a claim fast and easy in the following ways:

- Scan and upload your claims on the website.

- Scan and email your claims to [email protected].

- Use the Discovery app on your smartphone. If the claim has a QR code, scan the QR code or alternatively take a photo of the claim from within the app.

- You can also submit your claims by post.

Discovery Medical Aid Contact Details

PO Box 784262,

Sandton,

2146

Phone: 0860 99 88 77

READ more about Easiest Ways to Get Cheaper Medical Aid in South Africa revealed.

3. Momentum Health

Overview

Momentum is one of the most effective open medical plans in South Africa, and it is managed by one of the largest and most respected healthcare solutions companies in the country. Momentum Health Solutions is wholly owned by its parent company, Momentum Metropolitan Life Limited.

Momentum Medical Scheme is a not-for-profit open medical scheme that operates in compliance with the Medical Schemes Act 131 of 1998, in its most recent updated form.

An Annual General Meeting is held each year to select new members for the organization’s Board of Trustees, which includes a large number of individuals who have substantial experience in the fields of medical, accounting, and law.

Momentum Health Option Plans Suitable for Young Adults in South Africa

Young adults in South Africa can find a wide range of medical insurance plans and benefits, including 6 medical aid plans from Momentum Medical Scheme. These plans are:

Evolve Option

The Evolve option gives cover for hospitalisation from the Evolve Network of private hospitals with no overall annual limit.

Young adults who choose this option get access to 2 virtual doctors’ consultations and any additional day-to-day benefits are subject to HealthSaver+.

Custom Option

The Custom option gives young adult members comprehensive hospital and chronic cover from any or associated providers. They can choose to have access to treatment at any hospital or save further on their contributions by using a specific list of private hospitals.

Incentive Option

The Incentive option is suitable for young adults who can afford a more expensive monthly premium. With this option young adults can get extensive hospital and chronic cover from any or associated providers. Their day-to-day expenses will be covered by a medical savings pocket that is being funded by 10% of their monthly contributions

Extender Option

The Extender option is more expensive option gives extensive hospital cover and additional chronic cover from any or associated providers, to those young people who just need an extra bit of coverage. 25% of their contributions go to a dedicated medical savings account from which any day-to-day expenses are paid. They will get the Extended Cover benefit once they have reached their set Threshold.

Summit Option

With the Summit option young adults can get unlimited private hospital cover from any provider. A chronic cover is available for 36 conditions and day-to-day benefits up to a certain amount per beneficiary per year are also covered.

Ingwe Option

The Ingwe option is an entry-level medical cover option is the most affordable and accessible to young adults who have just started their first job. They can get treatment from any hospital, the Ingwe Network of private hospitals, or State hospitals.

Benefits for Young Adults in South Africa under Momentum Health

Most of the mentioned option plans of Momentum Health will fulfil in the most basic needs for benefits like hospital coverage. With some, members have the option to contribute to savings pockets from which other medical expenses and day to day expenses may be paid.

How Much Are Momentum Health Monthly Premiums?

Momentum monthly premiums start at R1 539 for the main member on the Evolve Option and go up to R12 345 for the main member on the Summit Option.

What Is the Waiting Period for Momentum Health Benefits?

The general waiting period is 3 months, but since pregnancy is considered a pre-existing condition, it is excluded from all benefits for the first 12 months of scheme membership.

How to Claim for Momentum Health Benefits

You can submit a claim in several ways:

- Use the Momentum App

- Use the web chat facility in the bottom left corner.

- Send an email to [email protected] or send normal mail to PO Box 2338, Durban, 4000

To make sure your claim is processed quickly and accurately, include the following information:

- Membership number.

- Principal member’s surname, initials, and first name.

- Patient’s surname, initials, and first name.

- Date of treatment.

- Amount charged.

- ICD–10 code (code to indicate what condition you’ve been diagnosed with), tariff code (product-specific code for procedures and claims), and NAPPI code (unique identifier for a given ethical, surgical, or consumable product).

- Service provider’s name and practice number.

- Proof of payment if you’ve paid the claim out of your own pocket.

Momentum Health Contact Details

201 Umhlanga Ridge Blvd

Cornubia

Blackburn

PO Box 2338

Durban

You might like to read more about Health Insurance for Learners

4. BestMed Medical Aid

Overview

BestMed claims to be the largest self-administered medical plan in South Africa, as well as the fourth-largest open medical plan overall.

BestMed has a track record of providing young adult members with access to a network of healthcare specialists, wellness benefits, and cost-effective healthcare coverage options.

The aid is quite proud of its consistent single-digit growth over the recent years, as well as its 13 well-organized products that cover every possible life stage and financial need.

All of its alternatives offer young adults significant benefits for preventative healthcare, such as contraception for women, treatment for pneumonia, vaccinations against influenza, and a variety of other options.

With help and backup from this medical aid, young adults in South Africa have access to more than 4,300 primary care physicians, as well as networks of hospitals and specialists.

The Bestmed Maternity Care programme, which is accessible for all coverage plans, gives young expectant mothers and fathers access to a plethora of information and services pertaining to pregnancy and childbirth.

BestMed Medical Aid Option Plans Suitable for Young Adults in South Africa

Young adults can choose between BestMed Hospital Plans, Network Plans, Savings Plans, and Comprehensive Plans.

Hospital Plans

Hospital Plans are popular with young adults, because its coverage treatment at a range of network hospitals for planned and unplanned hospital stays, no matter what age you are. There is also a choice between the Beat1 Plan and Beat1 Network Plan that gives unlimited cover for unplanned hospital stays in the network’s hospitals.

Network Plans

BestMed Network Plans include a little bit more benefits, which are appreciated by young adults who can afford slightly higher monthly premiums:

Both the Rhythm1 and Rhythm2 Network Plans offer unlimited in-hospital cover with either limited essential day-to-today benefits, or comprehensive savings for consultations with designated healthcare providers. The Rhythm2 Network Plan is dependent on income levels.

Savings Plans

BestMed Savings Plans are an even better option for young adults, since they include extensive hospital cover at private hospitals and a savings account out of which general day-to-day expenses are paid.

The following options are available:

The Network Savings plans are associated with certain Network hospitals and providers.

Comprehensive Plans

BestMed Comprehensive Plans are the most expensive in terms of monthly premiums and may be out of reach of many first time members.

Those young adults who can afford it, may choose from the following:

- Pace1 Comprehensive Plan

- Beat4 Comprehensive Plan

- Pace2 Comprehensive Plan

- Pace3 Comprehensive Plan

- Pace4 Comprehensive Plan

Benefits for Young Adults in South Africa under BestMed Medical Aid

Most of the mentioned option plans of BestMed Medical Aid will fulfil in the basic needs for benefits like hospital coverage. With some, young adult members have the option to contribute to savings pockets from which other medical expenses and day to day expenses can be paid.

The comprehensive plans are suitable for young adults with specific healthcare needs, because they include chronic benefits and savings.

How Much Are BestMed Medical Aid Monthly Premiums?

At the time of writing, monthly premiums for the cheapest BestMed Beat1 Network Hospital Plan started at R1 710 for a member, with an additional R1 329 for an adult dependant and R720 for a child dependant, to a maximum of 3 child dependants. Additional children join at no additional cost.

The most expensive plan at the time was the Pace4 Comprehensive Plan, with monthly contributions of R9 411 per member and R9 411 per adult dependant. For a child dependant the extra contribution was R2 205, up to 3 child dependants with additional children added as beneficiaries of the scheme at no extra cost.

What Is the Waiting Period for BestMed Medical Aid’s Benefits?

There can be a general waiting period of three months or a specific waiting period of 12 months for a certain condition.

Bestmed Medical Scheme will sometimes only pay a claim if it is a PMB. This can happen if you are in a waiting period or if you are getting treatment for a condition that your plan doesn’t cover.

How to Claim for Benefits from BestMed Medical Aid

If your healthcare provider does not submit claims to BestMed, one must submit the original claim directly to the fund administrators.

You can claim by means of the BestMed App, or by scanning and emailing your claim to them.

Details that should appear on all claim documents include:

- Member’s name and contact details

- BestMed membership number

- Patient’s details

- Service provider’s name, contact details and practice number

- Details of treatment, including applicable tariff and ICD-10 codes

- Whether payment should be done to the service provider or the member

- You will receive an email confirmation when your claim is received and indexed.

BestMed Medical Aid Contact Details

Head Office:

Bestmed Medical Scheme,

Glenfield Office Park

361 Oberon Avenue

Faerie Glen

Pretoria

PO Box 2297

Pretoria

Emails: [email protected]; [email protected],

Phone: +27 (0)86 000 2378

READ: Compare Bestmed Medical Scheme with Momentum Medical Scheme

5. Medihelp Medical Aid

Overview

Medihelp is a reliable and consistent organisation that can help pay for medical care for young adults.

Since its start more than a hundred years ago, Medihelp has always put its members’ needs first. Medihelp is still one of the top five choices for medical aids in the industry because it can adapt to changing needs and improve the way it does business by using cutting-edge technology.

Medihelp is self-run, and the goal is to take care of its members and meet their needs for medical services. Young adults in South Africa should feel at home at Medihelp whether they are students, just got a new job and want to join a medical aid for the first time, are self-employed and looking for a reliable healthcare solution for your employees or are strating a family.

As a self-administered plan, Medihelp is owned by its members, who also take care of administrative tasks like processing and paying claims, getting pre-authorization, and talking with members. So, young adults can be sure that Medihelp employees will give them the best service possible.

Medihelp Medical Aid Option Plans Suitable for Young Adults in South Africa

Medihelp offers the following option plans that are ideally suited to young adults:

MedMove

Medmove provides health essentials cover such as private hospitalisation and emergency medical services through quality networks. Members also have access to virtual and in-person doctors’ consultations and medicine, as well as a selection of other medical services they may need.

MedElect Student

MedElect uses a quality network of service providers to provide comprehensive cover at an affordable premium for those who still have to concentrate on their studies. Among its benefits count extensive in-hospital cover, screenings and additional benefits.

MedVital

MedVital is another healthcare solution that offers affordable cover for minor medical expenses, private hospitalisation and emergency medical services.

MedAdd

MedAdd offers the flexibility of an added savings account, additional insured cover once savings are depleted, cover for dental and eye care, as well as pregnancy benefits, a definite plus for young families.

MedSaver

MedSaver provides cover for private hospitalisation at any hospital, while the 25% savings pocket covers medical expenses incurred out of hospital. Once savings are depleted, an additional out-of-hospital cover gets activated.

MedElect

MedElect offers comprehensive care at premium quality networks at an affordable rate.

MedPrime, MedElite, & MedPlus

These top of the range plans may not be applicable to young adults, due to the expensive monthly premiums.

They provide private hospitalisation, excellent cover for out-of-hospital services through a savings account, as well as comprehensive acute and chronic medicine, radiology, pathology, dental and optometry benefits.

Benefits under Medihelp Medical Aid’s Option Plans for Young Adults in South Africa

MedMove is Medihelp’s ideal solution for young adults in South Africa.

With premiums from R1 254 per month, MedMove provides cover for health essentials such as private hospitalisation and emergency medical services through quality networks.

Members also have access to virtual and in-person doctors’ consultations and medicine, as well as a selection of other medical services including:

In-hospital cover –

- Unlimited private hospitalisation at network hospitals and day procedure facilities

- Standard radiology, pathology and medical technologist services

- Access to mental health care

Out-of-hospital cover

- Unlimited nurse consultations (also virtual consultations) with no co-payment

- Network GP consultations (also virtual consultations) with a R120 co-payment

- Dental check-up at a DRC network dentist

- Eye test at a PPN network optometrist

- Physiotherapy

- Self-medication

MedElect Student offers

- Essential cover

- Emergency transport services in South Africa by Netcare 911

- Transport by road and air

- Major trauma that requires hospitalisation

- 271 listed PMB conditions and 26 chronic illnesses

- Post-hospital benefit to help you recover after hospitalisation

- Health tests and vaccines

- Available at Dis-Chem and Clicks

- Blood glucose, cholesterol, BMI & blood pressure

- Flu shots

- Health screening

- A Pap smear every 3 years

- HIV testing and counselling

- Contraceptives

- Injections, implants or pills – R100 per month, up to R1 300 per year

- Intra-uterine device – R1 785 every 60 months

How Much Are Medihelp Medical Aid Monthly Premiums?

Medihelp monthly premiums start with Medmove’s R1 254 per month per member for health essentials cover such as private hospitalisation and emergency medical services through networks and go up to R10 980 per month for the top-of-the-range MedElite plan that offers the most extensive cover for medical emergencies, private hospitalisation and preventive care, as well as extensive provision for acute and chronic medicine, radiology, pathology and other day-to-day medical expenses.

What Is the Waiting Period for Medihelp Medical Aid’s Benefits?

Medihelp may apply a general waiting period or a condition-specific waiting period.

A general waiting period of up to three months applies from the date that a member joined. During this period, a person is not entitled to any benefits except prescribed minimum benefits (PMB). Claims submitted during this waiting period, will not be paid by the scheme.

During a condition-specific waiting period of up to 12 months a member will not be entitled to benefits for a particular condition for which the person receive medical advice, a diagnosis, care or treatment (excluding PMB).

Upon joining Medihelp, members receive a document with the conditions under which they are enrolled as beneficiaries, indicating any waiting periods and/or late-joiner penalties.

How to Claim for Benefits from Medihelp Medical Aid

To submit a medical aid claim with Medihelp, a member can use one of the following options:

- Use Medihelp’s member app to upload the account and proof of payment and submit.

- Email the account and proof of payment to [email protected].

- Submit your claim by logging in to Medihelp’s Member Zone and clicking on “Claims” – “Submit a claim”.

To guarantee that your claim is valid according to the Medical Schemes Act and Medihelp’s Rules, ensure that you have provided the following details:

- Your membership number

- The member’s name and surname

- The name, surname and date of birth of the patient

- Medihelp Medical Scheme – not “Private” (this has tax implications)

- The healthcare practitioner’s name and practice code number

- The amount charged per item

- The amount you have paid

- Your proof of payment (attached)

- The relevant codes such as ICD-10, NAPPI and item code(s)

- The date on which the service/procedure was rendered/performed

The account should not be modified by hand in any way, as this will cause your claim to be invalid.

Your claims must reach Medihelp on or before the last workday of the fourth calendar month after the month in which the service was rendered.

Medihelp Medical Aid Contact Details

Medihelp Head Office

Postal address

PO Box 26004

Arcadia, 0007

Street address

189 Clark street,

Brooklyn, 0181

Customer care

General enquiries – 086 0100 678

International – +27 12 336 9000

Email: [email protected]

Claims submission: [email protected]

READ more about Medihelp Medical Aid compare to Medshield Medical Aid

Frequently Asked Questions

How Old Must You Be to Join a Medical Aid in South Africa?

In South Africa, you need to be 18 before you can join a medical aid scheme. Anyone younger than 18 can be included in a parent’s or guardian’s membership as a registered dependent.

How Long does a Young Adult have to be a member of a Medical Aid to get benefits?

The normal waiting periods of 3 months (12 months for pre-existing conditions) apply to young adults.

Can young adults stay on their parents’ medical aid plan?

Yes, young adults can often stay on their parents’ medical aid plan until a certain age or specific eligibility criteria are met.

Are there specialized medical aid plans for young adults?

Some medical aid providers offer specialized plans tailored for young adults, considering their unique healthcare requirements and budget constraints.

What benefits should young adults consider when choosing a medical aid plan?

Young adults should consider benefits such as coverage for general practitioner visits, preventive care, mental health services, and access to a network of healthcare providers. They should also evaluate affordability, coverage for emergencies or hospitalization, and any waiting periods or restrictions that may apply.

Is Medical Aid Based on Salary?

Only some medical aid options of open-plan capitated medical aid plans your premium depends on your income: the less you earn, the less you pay for the same benefits.