- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Sizwe Hosmed Access Saver 25 Medical Aid Plan

Overall, the Sizwe Hosmed Access Saver 25 Medical Aid Plan is a trustworthy and comprehensive medical aid plan that offers 24/7 medical emergency assistance and in-hospital procedures to up to 3 Family Members. The Sizwe Hosmed Access Saver 25 Medical Aid Plan starts from R3,092 ZAR.

| 👤 Main Member Contribution | R3,092 |

| 👥 Adult Dependent Contribution | R2,669 |

| 🍼 Child Dependent Contribution | R619 |

| ↪️ Gap Cover | None |

| 🏥 Hospital Cover | Unlimited for PMBs |

| 💙 Oncology Cover | R546,000 |

| 💶 Medical Savings Account | ☑️ Yes |

| 📉 Screening and Prevention | ☑️ Yes |

| ➡️ Prescribed Minimum Benefits | ☑️ Yes |

| 🟦 Maternity Benefits | ☑️ Yes |

Sizwe Hosmed Access Saver 25 Plan – 7 Key Point Quick Overview

- ☑️ Sizwe Hosmed Access Saver 25 Plan Overview

- ☑️ Sizwe Hosmed Access Saver 25 Plan Contributions and Medical Savings Account

- ☑️ Access Saver 25 Plan Benefits and Cover Comprehensive Breakdown

- ☑️ Access Saver 25 Plan Exclusions and Waiting Periods

- ☑️ Sizwe Hosmed Access Saver 25 Plan vs. Similar Plans from other Medical Schemes

- ☑️ Our Verdict on The Access Saver 25 Plan

- ☑️ Access Saver 25 Plan Frequently Asked Questions

Sizwe Hosmed Access Saver 25 Plan Overview

The Sizwe Hosmed Access Saver 25 medical aid plan is one of 12, starting from R3,092 and includes a savings account containing 25% of monthly contributions pooled together and presented at the start of every year. This plan also covers chronic conditions, 8 additional non-PMB conditions, and more. Gap Cover is not available on the Sizwe Hosmed Access Saver 25 Plan. However, Sizwe Hosmed offers 24/7 medical emergency assistance. According to the Trust Index, Sizwe Hosmed has a trust rating of 3.9.

Sizwe Hosmed offers 12 medical aid plans

- ✅ Sizwe Hosmed Value Core

- ✅ Sizwe Hosmed Titanium Executive

- ✅ Sizwe Hosmed Silver Hospital

- ✅ Sizwe Hosmed Plus

- ✅ Sizwe Hosmed Platinum Enhanced

- ✅ Sizwe Hosmed Platinum Enhanced EDO

- ✅ Sizwe Hosmed Gold Ascend

- ✅ Sizwe Hosmed Gold Ascend EDO

- ✅ Sizwe Hosmed Value

- ✅ Sizwe Hosmed Essential Copper

- ✅ Sizwe Hosmed Access Saver 25

- ✅ Sizwe Hosmed Access Core

Sizwe Hosmed Access Saver 25 Plan Contributions and Medical Savings Account

Sizwe Hosmed Access Saver 25 Plan Contributions

| 👤 Main Member | 👥 Adult Dependent | 🍼 Child Dependent |

| R3,092 | R2,669 | R619 |

Sizwe Hosmed Access Saver 25 Plan Medical Savings Account (MSA)

| 👤 Main Member | 👥 Adult Dependent | 🍼 Child Dependent |

| R9,277 per year | R8,007 per year | R1,855 per year |

POLL: 5 Best Medical Aids for Foreigners Living in South Africa

Access Saver 25 Plan Benefits and Cover Comprehensive Breakdown

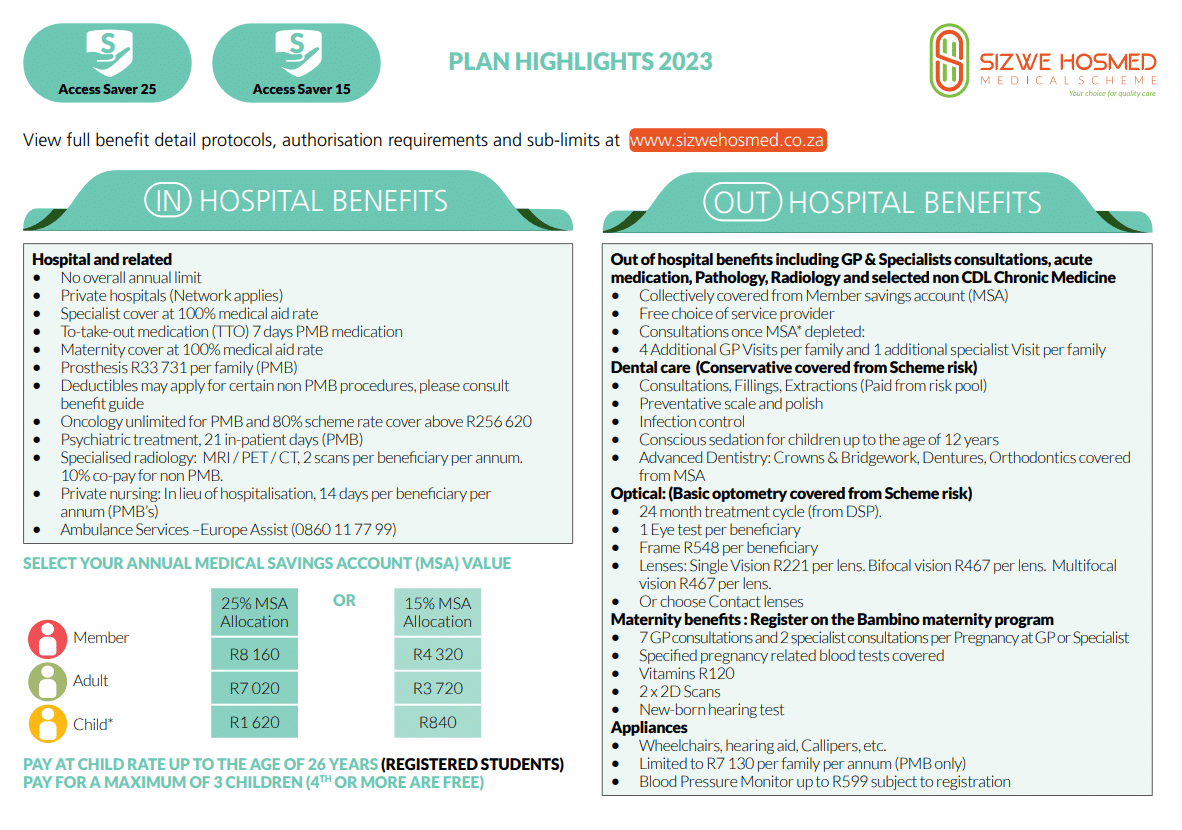

Access Saver 25 In-Hospital Benefits

- ✅ Hospital admissions

- ✅ Unlimited benefits for Specified Minimum Benefit circumstances.

- ✅ Hospital admissions—including PMBs—require pre-authorization and case management.

- ✅ Emergency admissions require 48-hour notification of the Scheme.

- ✅ Claims will be denied if admissions are not pre-authorized or reported within 48 hours.

- ✅ Access Saver 25 hospital benefits are only available at Authorized Service Providers.

- ✅ There is a 10% co-payment for non-DSP hospital use.

- In-hospital General Practitioner and Specialist services

- ✅ PMB and case management protocols apply.

- ✅ All procedures must be approved in advance.

- ✅ Failing to pre-authorize or notify the scheme of admission within 48 hours will result in claim payments being withheld.

| 🔎 Hospital Admissions High Care Unit General Ward Theatre Recovery Room | Covered up to 100% of the DSP Tariff. Non-PMB benefits are subject to benefit availability. |

| 💉 Medicines and consumables used in hospital and theatre | Covered up to 100% of the negotiated tariff. |

| 💊 Medicine to take home after discharge | Paid from the hospital benefit. Limited to 7 days’ medicine. |

| 👩⚕️ Consultations and Procedures | Covered up to 100% of the negotiated tariff. |

| 1️⃣ Basic Radiology and Pathology | Covered up to 100% of the scheme tariff. The unlimited cover is in-hospital. |

| 2️⃣ Specialized Radiology | Limited to two scans per beneficiary yearly for MRI, PET, and CT scans. There is a 10% co-payment for non-PMB CT, MRI, or PET scans. Mutual benefit in and out-of-hospital. Subject to pre-approval and specialist referral. |

| 3️⃣ Oncology | Covered up to 100% of the DSP tariff. Unlimited treatment. Benefits that exceed R256,620 are subject to a 20% co-payment for non-PMBs. Subject to using a DSP. Member must register on the Disease Management Program. Standard oncology DSP protocols will apply. |

| 4️⃣ Renal Dialysis | Covered up to 100% of the negotiated tariff. Peritoneal and hemodialysis are included. Department of Health Protocols apply Subject to pre-approval. PMBs have unlimited benefits. Pre-authorization, clinical recommendations, drug formulary, and registration on the Disease management program are all subject to approval. |

| ❤️ Organ Transplants | Covered up to 100% of the scheme tariff. Unlimited PMB benefits. Clinical guidelines, pre-authorization, and DMP registration are required. Medical protocols apply. Donations to non-Sizwe Hosmed members are not covered. |

| 🦷 Dental Hospitalisation | Covered up to 100% of the scheme tariff. Limited to PMBs. Children under seven can receive general anesthesia benefits once per year for intensive dental treatment. Symptomatic wisdom tooth removal is covered solely as Day Case. Subject to pre-approval. Treatment protocols will apply. |

| 😊 Maxillo-facial and Oral Surgery | Only PMBs are covered. Subject to pre-approval and treatment protocols. |

| 🎗️ Drug and Alcohol Rehabilitation | Limited to R13,498 per family yearly. Covered up to 100% of the scheme tariff. |

| 🧠 Psychiatric Treatment Consultations Ward Fees Medicines Psychiatry/psychology therapy sessions | Covered up to 100% of the scheme tariff. Limited to 21 days per beneficiary or 15 outpatient consultations per year. Pre-authorization is needed. Managed care protocols apply. |

| ➡️ Hospitalisation Alternatives | Subject to PMBs Pre-authorization required. Subject to relevant protocols |

| ⬇️ Step-down Facilities | Covered up to 100% of the negotiated tariff. Limited to 14 days per year per beneficiary. |

| 🏠 Home-Based Care | Covered up to 100% of the negotiated tariff. Limited to 14 days per year per beneficiary. |

| 🩹 Negative Pressure Wound Therapy | Covered up to 100% of the negotiated tariff. Pre-authorization required. Subject to PMBs. Relevant protocols will apply. |

| 😮💨 Hyperbaric Oxygen Therapy | Covered up to 100% of the negotiated tariff. Pre-authorization required. Subject to PMBs. Relevant protocols will apply. |

| 🅰️ Male Sterilisation/Vasectomy | Limited to R17,472 per beneficiary yearly. Covered up to 100% of the negotiated tariff. Pre-authorization required. Relevant protocols will apply. |

| 🅱️ Female Sterilisation/Tubal Ligation | Limited to R17,472 per beneficiary yearly. Covered up to 100% of the negotiated tariff. Pre-authorization required. Relevant protocols will apply. |

| ⚕️ Back and Neck Surgery | Covered up to 100% of the scheme tariff. Pre-authorization required. Subject to PMBs. Subject to the conservative back and neck treatment protocol. Spinal surgery authorization for treating chronic back or neck pain is subject to managed care guidelines. Before authorizing surgery, managed care may require adherence to conservative clinical treatment. |

| 📈 Stereotactic Radiosurgery | Pre-authorization required. Only PMBs are covered. |

| 📉 Age-related Muscular Degeneration Treatment | Covered up to 100% of the negotiated tariff. Pre-authorization required. |

| 📊 Laparoscopic Hospitalisation and Associated Costs | Pre-authorization required. Subject to PMBs. |

| 🧪 PMB Laparoscopic Procedures | Covered up to 100% of the scheme tariff. There is no co-payment if the procedures are performed at a day hospital or treated as a day case. |

| 🔍 Non-PMB Laparoscopic Procedures | In-hospital procedures will attract an R5,250 co-payment except for diagnostic laparoscopies done on the following: Aspiration/excision of ovarian cyst Lap-appendicectomy Repair of recurring or bilateral inguinal hernias |

| 🦵 Internal and External Prostheses | Covered up to 100% of the negotiated tariff. Subject to PMBs and pre-approval. Overall prostheses limit of R33,731 per family per year. |

| 🦾 Instrumentation and Disc Prostheses Components Fixation Devices for back/spine | Limited to 1 event per beneficiary yearly. Limited to PMBs. |

| 🦿 Internal Prostheses | Limited to the equivalent in the state. This benefit does not include cement. |

| External Prostheses | Limited to PMBs. |

| 🟥 Aphakic Lenses | Limited to R5,628 per lens. |

| 🟧 Cardiac Stents | Limited to PMBs. Limited to 1 lesion and a maximum of 3. Public sector protocols for STEMI will apply. There is no benefit for unstable angina or NSTEMI unless evidence can be provided that conservative treatment failed. |

| 🟨 Internal Sphincters and Stimulators | Subject to the overall prostheses limit. Only PMBs are treated. |

| 🟩 Unlisted Prostheses such as artificial limbs, artificial eyes, etc. | There is a limit of R12,731, which is subject to the overall prostheses limit. |

| 🟦 Blood Transfusions | Covered up to 100% of the scheme tariff. Only PMBs are treated. |

| 🟪 Physiotherapy and Biokinetics | Covered up to 100% of the scheme tariff. |

| 🍎 Dietician and Occupational Therapy | Only PMBs are treated. |

| ✔️ Deductible for in-hospital procedures | Skin disorders Arthroscopy Bunionectomy Removal of varicose veins Refractive eye surgery, Aphakic lenses Infertility treatment Non-cancerous breast conditions |

You might consider the 5 Best Hospital Plans for Foreigners

Access Saver 25 Day-to-Day Benefits

| ☀️ Day Procedures | – |

| 🏥 Day Hospital Procedures using a DSP hospital Network | There is an R1,662 deductible unless there is a PMB: Colonoscopy Facet joint injections Myringotomy There is an R3,323 deductible on the following unless it is a PMB: Gastroscopy Cystoscopy Hysteroscopy Flexible Sigmoidoscopy Percutaneous radiofrequency ablations Percutaneous rhizotomies There is an R5,539 deductible for the following unless it is a PMB: Elective cesarean delivery Joint replacements Back surgery, including spinal fusion Umbilical hernia repair Hysterectomy Functional nasal surgery |

| 📌 Out-of-Hospital Consultations General Practitioners Specialists Outpatient Facilities | Covered up to 100% of the scheme tariff. General Practitioner Consultations: Paid from the medical savings account. Consultations once the MSA is depleted: Additional Doctor visits per family are limited to one per beneficiary. If the specialist consultation benefit is used after the MSA has been depleted, the additional GP visits are limited to three per family and one per beneficiary. Specialist Consultations: Paid from MSA. Specialist Consultations once the MSA is depleted: One additional specialist visit with either of the following: Paediatrician Gynecologists |

| 💴 Co-payments on day procedures | This will apply depending on the treatment. |

| 💊 Medicine | – |

| 💉 Acute Medicine | Covered up to 100% of the reference price. Paid from the MSA. If medication is obtained from a pharmacy, it is subject to available medical savings funds. |

| 🩺 PMB Disease List Medicines | Covered up to 100% of the reference price. Subject to pre-approval by DSP. Treatment protocols apply. Medicine formulary applies. Member must register chronic medicine. |

| 🧪 Pharmacy Advised Treatment (PAT) | Covered up to 100% of the reference price. Paid from the MSA. |

| 🅰️ Contraceptives | Covered up to 100% of the reference price |

| 🅱️ Oral and injectable | Paid from the MSA. Subject to the contraceptive formulary. |

| 🚩 Mirena Device | Subject to a sub-limit of R2,100 per beneficiary every 5 years for abnormal uterine bleeding. Paid from the MSA. |

Access Saver 25 Optical Benefits

| 🤓 Spectacle Lenses | Covered up to 100% of the DSP tariff. Limited to R221 per lens (clear – single vision), R467 per lens (clear bifocal), or R467 per lens (base multifocal) There will not be a benefit for contact lenses if spectacle lenses are obtained. Subject to the Optical Protocols. |

| 👁️🗨️ Contact Lenses | Covered up to 100% of the DSP tariff. Limited to R1,045 per beneficiary every 2 years. There is no cover if a beneficiary has already obtained spectacles. Subject to optical protocol. |

| 👓 Frames/Lens Enhancements | Covered up to 100% of the DSP tariff. Limited to R575 per beneficiary. |

| 👁️ Eye Tests | Covered up to 100% of the DSP tariff. Limited to one comprehensive consultation per beneficiary every 2 years. |

Discover more: 5 Best Medical Aids Covering Glasses & Optometry

Access Saver 25 Dentistry Benefits

| 🦷 Dentistry | – |

| 🔴 Basic/Conservative Dentistry | Covered up to 100% of the scheme tariff. Dental protocols apply, and pre-authorization is needed. Quantity limits will apply, and members must use a contracted network provider. |

| 🟠 Conscious Sedation | Conscious sedation: Intensive dental treatment (more than four fillings or extractions) subject to dental treatment protocols and pre-approval. |

| 🟡 Consultations, Fillings, Extractions | Paid from the Risk pool. |

| 🟢 Preventative Scale and Polish | Cover provided. |

| 🔵 Infection Control | Cover provided. |

| 🟣 Fluoride Treatment | Cover provided. |

| 🔴 Dental X-Rays | Cover provided but only for intra-oral x-rays. |

| 🦷 Advanced Dentistry | – |

| 🟠 Crowns Bridgework Dentures Orthodontics Removal of Impacted Wisdom Teeth Non-Surgical Periodontics | Non-PMBs are covered by MSA. Clinically valid specialized dental treatment is paid from the MSA. |

| 🟡 Acrylic (Plastic) Dentures for beneficiaries 16> | Each beneficiary receives one pair of acrylic/plastic dentures every four years. Denture repairs, realignment, and repair can be done every 12 months Only PMBs are covered. |

| 🟢 Maxillo-Facial and Oral Dental Surgery | Covered up to 100% of the scheme tariff. Only PMBs are covered. |

Access Saver 25 Auxiliary Benefits

| 🟥 Alternative Services For example: Speech therapy Podiatry Occupational therapy Social worker Dietetics | Covered up to 100% of the scheme tariff. Non-PMBs are paid from the MSA. Medicine dispensed is subject to the Acute Medicine Limit. Homeopathic medicine is not covered. |

| 🟧 Remedial and Other Therapies For example: Audiology Speech therapy Dieticians Hearing Aid Acousticians | Covered up to 100% of the scheme tariff. Limited to R2,730 per family per year. |

| 🟨 Physiotherapy Out-of-Hospital and Biokinetics | Covered up to 100% of the scheme tariff. Subject to PMB conditions and clinical protocols. Non-PMBs are covered by the MSA. Heart and respiratory conditions: A treatment plan and therapeutic goals must be provided. Maximum of six sessions per recipient, additional sessions contingent on progress reports and proof of response. |

Access Saver 25 Medical Appliances Benefits

- ✅ Appliances: Hearing Aids. Wheelchairs, Calipers, etc.

- ✅ Covered up to 100% of the negotiated tariff in and out-of-hospital.

- ✅ Only PMBs are covered.

- ✅ Limited to R7,130 per family per year.

- ✅ Paid from the Risk Pool and subject to limits.

- ✅ Blood Pressure Monitors are subject to a sub-limit of R599 for beneficiaries registered for hypertension.

Access Saver 25 Other Benefits

| ✈️ Air/Road Ambulance and Emergency Services | Covered up to 100% of Negotiated Tariff 24-hour Contact Center Access, including Telephonic Nurse Advice Line. Emergency: Subject to pre-approval within 72 hours of the emergency. Only a preferred provider can perform inter-hospital transfers. Emergency response by road or air to the scene of the occurrence, as well as transfer from the scene to the nearest, most appropriate facility Escort repatriation of stranded children is possible. Non-emergency: Subject to pre-authorization. Medically justifiable inter-facility transfers. Medical repatriation. |

| 🧠 Psychology and Psychiatry Treatment | Covered up to 100% of the negotiated tariff. Only PMB conditions are covered. Non-PMBs are paid from the MSA. |

| 💟 Infertility | Covered up to 100% of the negotiated tariff. Non-PMBs are paid from the MSA. |

| 👩⚕️ Hospice and Private Nursing | Covered up to 100% of the negotiated tariff. Only PMB conditions are covered. Non-PMBs are paid from the MSA. |

Access Saver 25 Sizwe Hosmed Bambino Benefits

Sizwe Hosmed is concerned about its maternity mothers. This program offers information and advantages to help them during their pregnancy. In addition, pregnant women enrolled in the Bambino Programme are eligible for a complimentary maternity bag filled with baby goods at 24 weeks of pregnancy.

| ❤️ Sizwe Hosmed Bambino Program | Covered up to 100% of the scheme tariff. |

| 🧡 Hospital Confinement | Admissions can only be done to a DSP Hospital Network. Natural Delivery – Limited to 2 days Cesarean – Limited to 3 days. |

| 💛 Home Delivery | Covered up to 100% of the negotiated tariff. Can only be done by a registered Midwife |

| 💚 Maternity Ultrasounds | Limited to 3 2D ultrasounds in and out-of-hospital. Covered up to 100% of the negotiated tariff. |

| 💜 Maternity Visits/Consultations | Covered up to 100% of the scheme tariff. Extra 7 GP maternity appointments and 2 specialist consultations each pregnancy at GP or Specialist. More ante-natal consultations will be covered from the day-to-day benefit once these limits have been achieved. |

| 💙 Antenatal Pathology Screening Haemoglobin Syphilis Chlamydia Bacteriuria Hepatitis B Rhesus incompatibility | Covered up to 100% of the scheme tariff. |

| 🤍 Child Immunisation Benefit | According to the Immunisation schedule of the Department of Health, only up to 6 years old. |

Read more about 5 Best Day Hospitals in South Africa

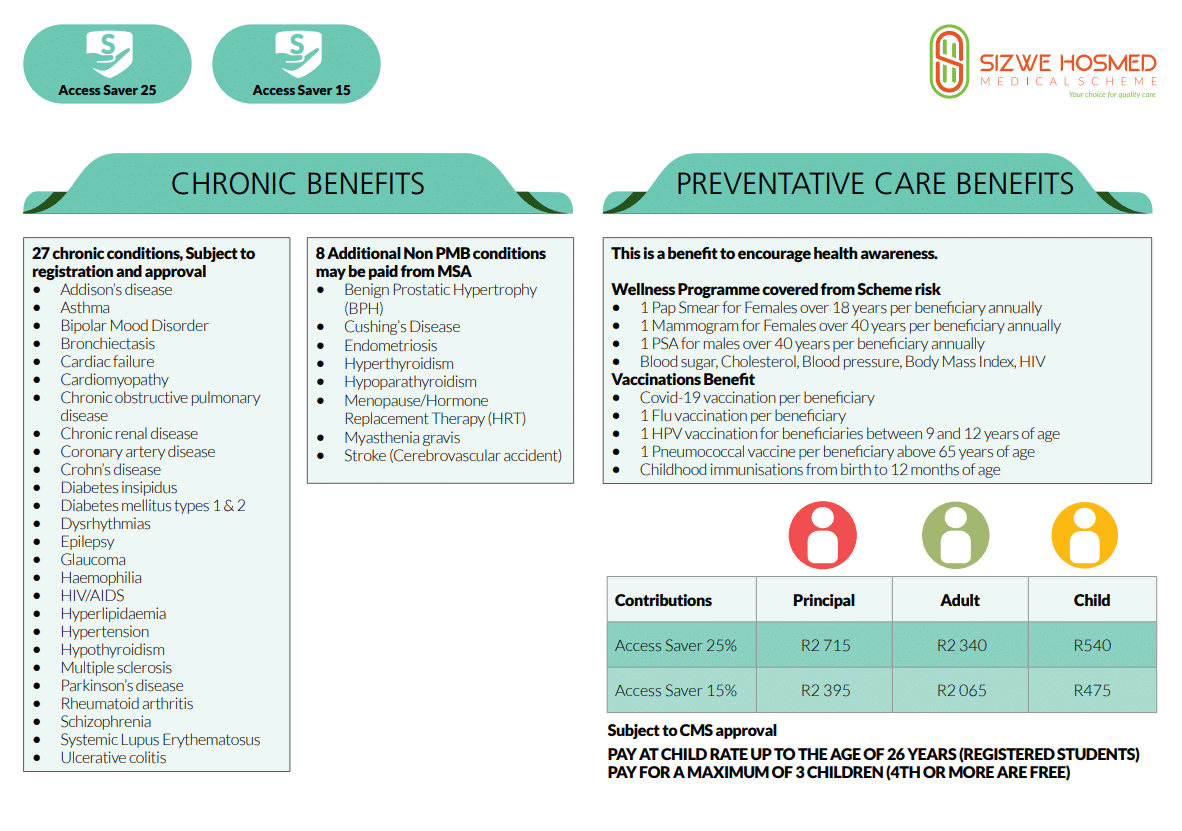

Access Saver 25 Preventative Care Benefits

| 💖 Wellness Consultations | Limited to R1,219 per family per year. |

| 😷 COVID-19 Vaccination | Covered according to guidelines. |

| ✅ Pap Smear for female beneficiaries 18> | One per qualifying beneficiary yearly. |

| ☑️ Mammogram for female beneficiaries 40> | One per qualifying beneficiary yearly. |

| 📌 PSA for Male Beneficiaries 40> | One per qualifying beneficiary yearly. |

| 📍 Cholesterol Test for beneficiaries 20> | One per qualifying beneficiary yearly. |

| 💉 Flu Vaccine for all beneficiaries | One per beneficiary yearly. |

| 🩸 Colon Cancer Blood Test for beneficiaries 50> | One per qualifying beneficiary yearly. |

| 🩸 Blood Pressure test for all beneficiaries. | One per beneficiary yearly. |

| 🎗️ HIV test for all beneficiaries | One per beneficiary yearly. |

| ✳️ HPV Vaccines for beneficiaries between 9 and 12. | One per qualifying beneficiary. |

| 🤒 Pneumococcal Vaccines for beneficiaries 65> | One per qualifying beneficiary yearly. |

| 🦴 Bone density testing for female beneficiaries between 50 and 69 and male beneficiaries 65 years old. | One per qualifying beneficiary yearly. |

| 🟦 HIV/AIDS Management Program | Covered up to 100% of the scheme tariff. Treatment is subject to the treatment care plan. Clinical protocols per CDL apply. |

| 🟪 Chronic Disease Management Program (CDL) | Covered up to 100% of the scheme tariff. Treatment is subject to the treatment care plan. Clinical protocols per CDL apply. |

| 😷 COVID-19 Screening, Diagnosis, and Treatment | Covered up to 100% of the scheme tariff. |

Access Saver 25 Chronic Diseases Benefit

Sizwe Hosmed Access Saver 25 covers the following chronic conditions on the CDL list:

- ✅ Addison’s Disease

- ✅ Epilepsy

- ✅ Asthma

- ✅ Glaucoma

- ✅ Bipolar Mood Disorder

- ✅ Hemophilia

- ✅ Bronchiectasis

- ✅ HIV/AIDS

- ✅ Cardiac Failure

- ✅ Hyperlipidemia

- ✅ Hypertension

- ✅ High Cholesterol

and many more!

Sizwe Hosmed Access Saver 25 also covers the following eight additional Non-PMB conditions, paid from available funds in the MSA:

- ✅ Benign Prostatic Hypertrophy (BPH)

- ✅ Cushing’s Disease

- ✅ Endometriosis

- ✅ Hyperthyroidism

- ✅ Hypoparathyroidism

- ✅ Menopause/Hormone Replacement Therapy (HRT)

- ✅ Myasthenia gravis

- ✅ Stroke (Cerebrovascular accident)

Access Saver 25 Plan Exclusions and Waiting Periods

Access Saver 25 Plan Exclusions

Sizwe Hosmed indicates that the following are excluded. However, these are only a few items; the complete list can be viewed on the Sizwe Hosmed website.

- ✅ Costs that exceed the annual or biennial maximum allowed for the category

- ✅ Operations, medicines, treatments, and procedures for cosmetic purposes or personal reasons

- ✅ Medical service not deemed necessary by the medical advisor for the management of the medical condition

- ✅ Treatment with no proven efficacy and safety

- ✅ Services rendered by unregistered persons or institutions not registered in terms of any law

- ✅ Abdominoplasties and repair of divarication of abdominal muscles

- ✅ Geriatric hospital, nursing home, frail care facility, or similar accommodations and services

- ✅ Alternative therapists, such as art therapists, aromatherapists, massage therapists, reflexologists, and Chinese medicine practitioners

- ✅ Anabolic steroids and immunostimulants, excluding immunoglobulins and growth hormones

- ✅ Ante- and postnatal exercises

- ✅ Ozone therapy

- ✅ Polishing of restorations

and more.

Access Saver 25 Plan Waiting Periods

When new members join the plan, they may be subject to a three-month general waiting period during which they cannot receive benefits. Except in the case of Specified Minimum Benefits, if the new member has a pre-existing ailment, they may be subject to a one-year condition-specific waiting period.

Sizwe Hosmed Access Saver 25 Plan vs. Similar Plans from other Medical Schemes

| 🔎 Medical Aid Plan | 🥇 Sizwe Hosmed Access Saver 25 | 🥈 Fedhealth MyFED | 🥉 Medshield MediSwift |

| 👤 Main Member Contribution | R3,092 | R1,590 – R4,676 | R2,037 |

| 👥 Adult Dependent Contribution | R2,669 | R1,590 – R4,260 | R1,986 |

| 🍼 Child Dependent Contribution | R619 | R677 – R1,782 | R522 |

| 📊 Annual Limit | Unlimited Hospital Cover | No Overall Annual Limit | Unlimited Hospital Cover |

| 🏥 Hospital Cover | Unlimited for PMBs | Unlimited | Unlimited |

| 📈 Oncology Cover | R546,000 | Unlimited for PMBs | Unlimited, subject to PMBs |

| 💶 Medical Savings Account | ☑️ Yes | ☑️ Yes | None |

Our Verdict on The Access Saver 25 Plan

Sizwe Hosmed Access Saver 25 is a medical aid plan that offers comprehensive healthcare coverage with a savings component. The Sizwe Hosmed Access Saver 25 includes unlimited in-hospital benefits, chronic medication coverage, maternity benefits, and a savings account. Members can use the savings account to cover their day-to-day medical expenses such as doctor consultations, medications, and pathology tests. In addition to these features, the Access Saver 25 plan offers dental benefits, optical benefits, and travel insurance coverage. The advantages of the Sizwe Hosmed Access Saver 25 plan include access to private hospitals and doctors, specialist consultations, preventative healthcare services, a network of healthcare providers, and additional benefits such as dental and optical coverage.

This plan also covers emergency medical and ambulance services and provides travel insurance coverage. As a result, members can manage their healthcare expenses and have peace of mind knowing they are covered for various healthcare needs. The drawbacks of the Sizwe Hosmed Access Saver 25 plan include a higher premium than the Access Core plan and a limited savings amount, which may not cover all day-to-day medical expenses. This plan also has a waiting period for certain benefits, which may be inconvenient for members who need immediate medical attention.

- ✅ You might also like: Siswe Hosmed Review

- ✅ You might also like: Sizwe Hosmed Gold Ascend

- ✅ You might also like: Sizwe Hosmed Platinum Enhanced EDO

- ✅ You might also like: Sizwe Hosmed Platinum Enhanced

- ✅ You might also like: Sizwe Hosmed Plus

- ✅ You might also like: Sizwe Hosmed Silver Hospital

- ✅ You might also like: Sizwe Hosmed Titanium Executive

- ✅ You might also like: Sizwe Hosmed Value Core

- ✅ You might also like: Sizwe Hosmed Value

- ✅ You might also like: Sizwe Hosmed Access Saver 15

- ✅ You might also like: Sizwe Hosmed Copper Essential

- ✅ You might also like: Sizwe Hosmed Gold Ascend EDO

Access Saver 25 Plan Frequently Asked Questions

How much are the premiums for Access Saver 25?

Access Saver 25 offers more savings. Therefore, its contributions are higher than Access Saver 15. The main member pays R2,850, while there is an R2,460 contribution for adult dependents and R570 for kids.

What is Access Saver 25?

Access Saver 25 is a medical aid plan offered by Sizwe Hosmed in South Africa that offers generous savings for out-of-hospital medical expenses such as GP and specialist consults, medication, and non-PMB treatment.

Does Access Saver 25 cover chronic medication?

Yes, chronic medication is covered under Access Saver 25.

What can I use the savings account of Access Saver 25 for?

The savings account can be utilized by members to pay for their routine medical costs, such as doctor visits, medications, and pathology tests.

What are the advantages of Access Saver 25?

The Sizwe Hosmed Access Saver 25 plan offers various benefits, such as access to private hospitals and doctors, specialist consultations, preventative healthcare services, a network of healthcare providers, and extra coverage for dental and optical services.

What are the disadvantages of Access Saver 25?

Some disadvantages of the Sizwe Hosmed Access Saver 25 plan are that it comes with a higher premium compared to the Access Saver 15 plan, and a limited savings amount which may not suffice for all day-to-day medical expenses. Additionally, this plan has a waiting period for specific benefits, which could be inconvenient for members in urgent need of medical attention.

You might also like

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans