- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Sizwe Hosmed Gold Ascend EDO Medical Aid Plan

Overall, the Sizwe Hosmed Gold Ascend EDO Medical Aid Plan is a trustworthy and comprehensive medical aid plan that offers 24/7 medical emergency assistance and in-hospital procedures to up to 3 Family Members. The Sizwe Hosmed Gold Ascend EDO Medical Aid Plan starts from R3,250 ZAR.

| 👤 Main Member Contribution | R3,250 |

| 👥 Adult Dependent Contribution | R3,119 |

| 🍼 Child Dependent Contribution | R895 |

| 🔁 Gap Cover | None |

| 🌎 International Cover | Covered up to 100% of the scheme rates |

| 📉 Annual Limit | Unlimited Hospital Cover |

| 🏥 Hospital Cover | Unlimited for PMBs |

| 🏡 Home Care | None |

| 😷 Screening and Prevention | ✅ Yes |

| 💶 Medical Savings Account | None |

Sizwe Hosmed Gold Ascend EDO Plan – 7 Key Point Quick Overview

- ☑️ Sizwe Hosmed Gold Ascend EDO Plan Overview

- ☑️ Sizwe Hosmed Gold Ascend EDO Plan Contributions

- ☑️ Gold Ascend EDO Plan Benefits and Cover Comprehensive Breakdown

- ☑️ Gold Ascend EDO Plan Exclusions and Waiting Periods

- ☑️ Sizwe Hosmed Gold Ascend EDO Plan vs. Similar Plans from other Medical Schemes

- ☑️ Our Verdict on The Gold Ascend EDO Plan

- ☑️ Gold Ascend EDO Plan Frequently Asked Questions

Sizwe Hosmed Gold Ascend EDO Plan Overview

The Sizwe Hosmed Gold Ascend EDO Medical Aid Plan is one of 12, starting from R3,250 and includes cover for 26 Chronic Conditions, Wheelchair and hearing aid benefits, Auxiliary services, in and out-of-hospital cover, child immunizations, and more. Gap Cover is not available on the Sizwe Hosmed Gold Ascend EDO Plan. However, Sizwe Hosmed offers 24/7 medical emergency assistance. According to the Trust Index, Sizwe Hosmed has a trust rating of 3.9.

Sizwe Hosmed offers 12 medical aid plans

- ✅ Sizwe Hosmed Value Core

- ✅ Sizwe Hosmed Titanium Executive

- ✅ Sizwe Hosmed Silver Hospital

- ✅ Sizwe Hosmed Plus

- ✅ Sizwe Hosmed Platinum Enhanced

- ✅ Sizwe Hosmed Platinum Enhanced EDO

- ✅ Sizwe Hosmed Gold Ascend

- ✅ Sizwe Hosmed Gold Ascend EDO

- ✅ Sizwe Hosmed Value

- ✅ Sizwe Hosmed Essential Copper

- ✅ Sizwe Hosmed Access Saver 25

- ✅ Sizwe Hosmed Access Core

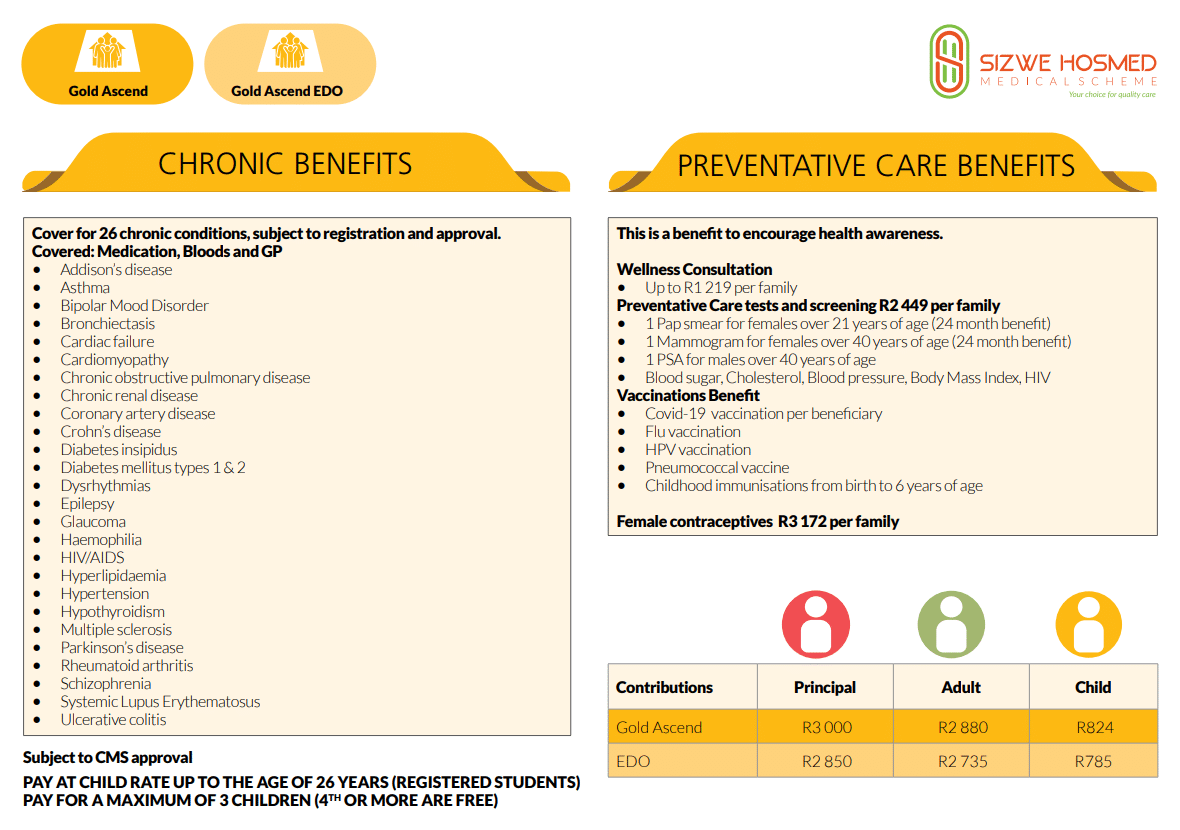

Sizwe Hosmed Gold Ascend EDO Plan Contributions

| 👤 Main Member | 👥 Adult Dependent | 🍼 Child Dependent |

| R3,250 | R3,119 | R895 |

Gold Ascend EDO Plan Benefits and Cover Comprehensive Breakdown

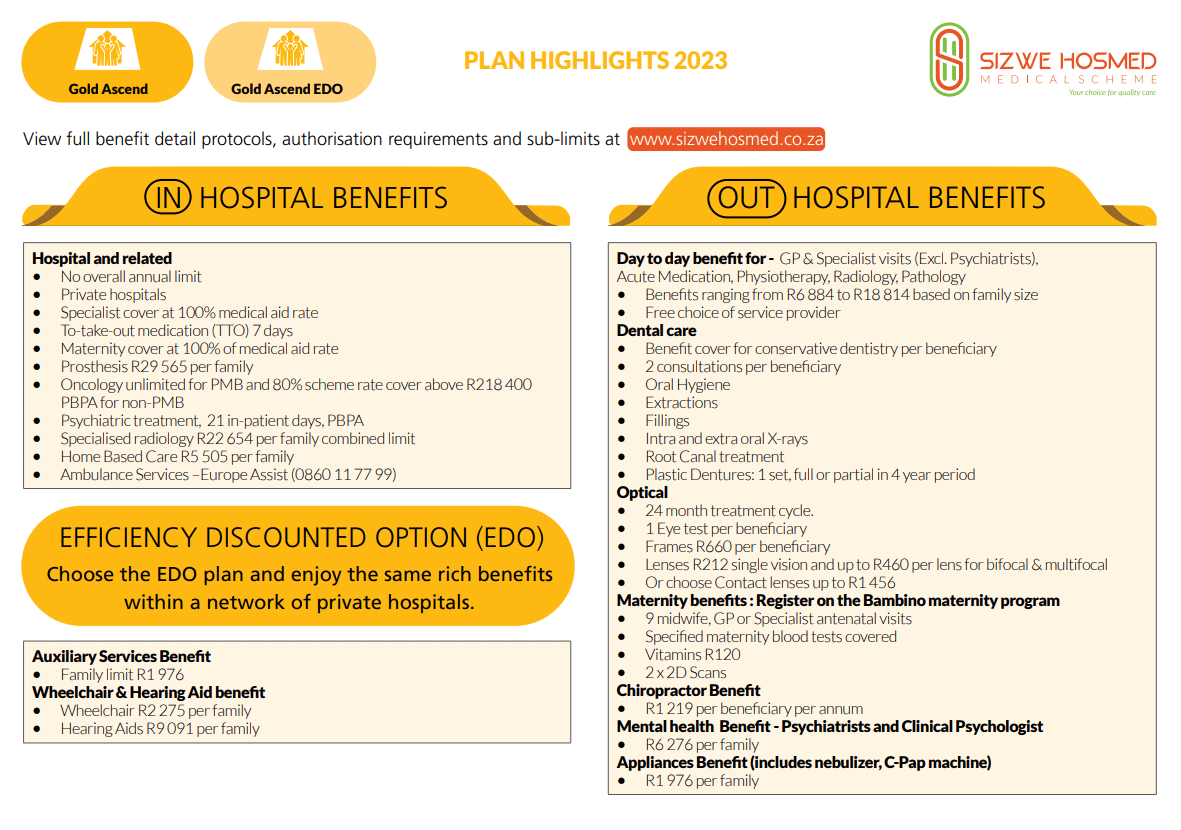

Gold Ascend EDO In-Hospital Benefits

- ☑️ Hospital admissions

- ☑️ Unlimited benefits for Specified Minimum Benefit circumstances.

- ☑️ Hospital admissions—including PMBs—require pre-authorization and case management.

- ☑️ Emergency admissions require 48-hour notification of the Scheme.

- ☑️ Claims will be denied if admissions are not pre-authorized or reported within 48 hours.

- ☑️ Gold Ascend EDO hospital benefits are only available at Authorized Service Providers.

- ☑️ There is a 10% co-payment for non-DSP hospital use.

- ☑️ In-hospital General Practitioner and Specialist services

- ☑️ PMB and case management protocols apply.

- ☑️ All procedures must be approved in advance.

Failing to pre-authorize or notify the scheme of admission within 48 hours will result in claim payments being withheld.

| 🏥 Hospital Admissions High Care Unit General Ward Theatre Recovery Room | Covered up to 100% of the Negotiated Tariff. |

| 🧪 Medicines and consumables used in hospital and theatre | Covered up to 100% of the negotiated tariff. |

| 💊 Medicine to take home after discharge | Paid from the hospital benefit. Limited to 7 days’ medicine. |

| 👩⚕️ Consultations and Procedures | Covered up to 100% of the negotiated tariff. |

| 1️⃣ Basic Radiology and Pathology | Covered up to 100% of the scheme tariff. Subject to pre-authorization and the following programs: Hospital Benefit Management Disease Management PMB Protocols |

| 2️⃣ Specialized Radiology | Limited to two scans per beneficiary yearly for MRI, CAT, and Angiogram scans. Subject to the overall combined in and out-of-hospital limit of R22,654 per family per year. Managed care protocols apply, and pre-approval is required. Interventional Radiology falls within the hospital limit and is subject to clinical protocols and pre-approval. |

| 3️⃣ Oncology | The benefit is limited to requirements set out in PMBs covered at a DSP. |

| 4️⃣ Renal Dialysis | Covered up to 100% of the Sizwe Hosmed tariff. |

| ❤️ Organ Transplants | Covered up to 100% of the scheme tariff. |

| 🦷 Dental Hospitalisation | Covered up to 100% of the scheme tariff. Limited to PMBs. Children under seven can receive general anesthesia benefits once per year for intensive dental treatment. Symptomatic wisdom tooth removal is covered solely as Day Case. Subject to pre-approval. Treatment protocols will apply. |

| 🥰 Maxillo-facial and Oral Surgery | Covered up to 100% of the Sizwe Hosmed tariff. Subject to managed care protocols. Benefits for Temporo-Mandibular Joint (TMJ) are limited to non-surgical interventions or treatments. |

| 💟 Drug and Alcohol Rehabilitation | Treatment Protocols and PMBs are subject to pre-approval. On pre-authorization, 3 days of withdrawal treatment + 21 days of rehabilitation at an appropriate facility |

| 🧠 Psychiatric Treatment Consultations Ward Fees Medicines Psychiatry/psychology therapy sessions | Each beneficiary is only allowed 21 days per year. This benefit provides six (6) in-hospital consultations with a clinical psychologist and six (6) psychiatrist consultations – subject to PMBs. Limited to 1,785 daily per beneficiary, with a maximum value of R37,485. Subject to managed care rules Four (4) additional out-of-hospital visits/consultations are permitted instead of hospitalization. |

| 🚑 Hospitalisation Alternatives | Subject to PMBs Pre-authorization required. Subject to relevant protocols |

| ⬇️ Step-down Facilities | Subject to the Management Program and Disease Management Program. Sizwe Hosmed prices apply to all services provided at registered step-down institutions and nursing homes. Hospice care is covered by up to 100% of the cost. 100% of the Sizwe Hosmed rates apply for Home Care services instead of Hospitalisation. |

| 🏡 Home-Based Care | Benefits are subject to Sizwe Hosmed Private Nurse fees and Pre-Authorisation. There is a limit of R5,505 per year per family. Frail care is not covered under this benefit. PMB is applicable. |

| 😮💨 Hyperbaric Oxygen Therapy | Covered up to 100% of the negotiated tariff. Pre-authorization required. Limited to PMBs. Public sector protocols will apply. |

| 🅰️ Male Sterilisation/Vasectomy | Covered up to 100% of the negotiated tariff. Sterilization is limited to R17,472 per beneficiary per year. Subject to pre-approval and PMBs. |

| 🅱️ Female Sterilisation/Tubal Ligation | Covered up to 100% of the negotiated tariff. Sterilization is limited to R17,472 per beneficiary per year. Subject to pre-approval and PMBs. |

| 🧬 Back and Neck Surgery | Spinal surgery authorization for treating chronic back or neck pain is subject to managed care guidelines. Before authorizing surgery, managed care may require adherence to conservative clinical treatment. |

| 🔴 Stereotactic Radiosurgery | Covered up to 100% of the scheme tariff. Only covers Primary Central Nervous System tumors. |

| 🟠 Age-related Muscular Degeneration Treatment | Covered up to 100% of the negotiated tariff. Pre-authorization required. |

| 🟡 Laparoscopic Hospitalisation and Associated Costs | Pre-authorization required. Subject to PMBs. |

| 🟢 PMB Laparoscopic Procedures | PMBs are covered in DSP facilities. Subject to clinical protocols. |

| 🔵 Internal and External Prostheses | Covered up to 100% of the negotiated tariff. Subject to PMBs and pre-approval. Overall prostheses limit of R31,043 per family per year within the hospital limit. |

| 🦾 Internal Prostheses | Subject to the benefit limit unless it is a PMB. The following are covered: Pacemakers Defibrillators Spinal Fusion – only one spine level per beneficiary, and if more is required, managed care protocols will apply. Grafts Joints – Hip and Knee (partial and total), limited to one joint per beneficiary yearly. Other clinically appropriate unspecified prosthetic items |

| 🦿 External Prostheses | Subject to the benefit limit unless it is a PMB. This benefit includes the following: Artificial Limbs Prosthetic Breasts Ocular Taylor Spatial Frame External Fixator Mesh Other clinically appropriate unspecified prosthetic items. |

| 🫀 Cardiac Stents | Cardiac Stents are limited to 3 unless it is a PMB. Vascular Stents are limited to 2 stents per family per year. |

| 🩸 Blood Transfusions | Covered up to 100% of the scheme tariff. |

| 🏈 Physiotherapy and Biokinetics | Covered up to 100% of the scheme tariff. |

| ❤️ Dietician and Occupational Therapy | Covered up to 100% of the scheme tariff. |

You might like the 5 Best Hospital Plans under R1500 in South Africa

Gold Ascend EDO Day-to-Day Benefits

Gold Ascend EDO offers the following Day-to-Day Limits:

- ☑️ Main Member – R7,228

- ☑️ Main Member + 1 Dependent – R10,704

- ☑️ Main Member + 2 Dependents – R12,526

- ☑️ Main Member + 3 Dependents – R14,325

- ☑️ Main Member + 4 Dependents – R16,146

- ☑️ Main Member + 5 Dependents – R17,956

- ☑️ Main Member + 6 Dependents – R19,755

| ☀️ Day Hospital Procedures using a DSP hospital Network | Covered up to 100% of the scheme tariff. |

| 🪙 Co-payments on day procedures | This will apply depending on the treatment. |

| 👨⚕️ Out-of-Hospital Consultations General Practitioners Specialists Outpatient Facilities | Subject to day-to-day benefit. One additional visit per member per year for preventative care. General Practitioner Consultations allowed per member per year: Main Member – 6 Main Member + 1 Dependent – 9 Main Member + 2 Dependents – 12 Main Member + 3 Dependents – 14 Main Member + 4 Dependents – 15 Main Member + 5 Dependents – 16 Main Member + 6 Dependents – 17 Specialists (Except Psychiatrists) – Visits: Referral to a specialist by a Physician is mandatory unless it is not practicable, such as in the case of an unavailable GP, an emergency, or a follow-up specialist appointment after an initial GP referral. Failing to obtain the appropriate GP referral will result in the Scheme paying the Scheme GP rate. The following visits are covered according to the family size: Main Member – 2 Main Member + 1 Dependent – 6 Main Member + 2 Dependents – 7 Main Member + 3 Dependents – 8 Main Member + 4 Dependents – 9 Main Member + 5 Dependents – 10 Main Member + 6 Dependents – 11 |

| 💊 Acute Medicine | Subject to the day-to-day benefits and limited to the following: Main Member – R2,149 Main Member + 1 Dependent – R3,873 Main Member + 2 Dependents – R4,310 Main Member + 3 Dependents – R4,885 Main Member + 4 Dependents – R5,022 Main Member + 5 Dependents – R5,298 Main Member + 6 Dependents – R5,735 |

| ✅ PMB Disease List Medicines | Covered up to 100% of the reference price. Unlimited cover provided. The beneficiary must be registered with the Chronic Disease Management Program. Medications prescribed are included in the formulary, and a reference price will be applied if the formulary is not followed. |

| ☑️ Other Chronic (non-CDL) medicines | Covered up to 100% of the scheme tariff. |

| 📌 Pharmacy Advised Treatment (PAT) | Subject to the acute medication and day-to-day limit. |

| 📍 Contraceptives | Covered up to 100% of the reference price |

| 💉 Oral and injectable | Limited to R3,172 per family per year. Subject to the managed care protocols and formulary. |

Gold Ascend EDO Optical Benefits

| 😎 Spectacle Lenses | Covered up to 100% of the DSP tariff. |

| 👁️ Contact Lenses | Limited to R1,456 per beneficiary. |

| 👓 Frames/Lens Enhancements | Frames are limited to R660. Single-vision lenses are limited to R212 per lens. Bi-focal lenses are limited to R460 per lens. Multi-focal lenses are limited to R460 per lens. |

| 🅰️ Eye Tests | Covered up to 100% of the DSP tariff. Limited to one comprehensive consultation per beneficiary every 2 years. |

Gold Ascend EDO Dentistry Benefits

| 🔴 Dentistry | – |

| 🟠 Basic/Conservative Dentistry | Covered up to 100% of the scheme tariff. Dental protocols apply, and pre-authorization is needed. Quantity limits will apply, and members must use a contracted network provider. |

| 🟡 Conscious Sedation | Inhalation sedation: 100% of the Sizwe Hosmed rate. Managed care rules apply. |

| 🟢 Consultations, Fillings, Extractions | Two (2) annual check-ups (once every six (6) months) per recipient. Fillings: once every 720 days. |

| 🔵 Root Canal | Managed care protocols apply. Except for wisdom teeth (3rd molars) and primary (milk) teeth |

| 🟣 Preventative Scale and Polish | Per beneficiary, two (2) annual scale and polish treatments are provided (once in 6 months) |

| 🔴 Infection Control | Covered up to 100% of the scheme tariff. |

| 🟠 Fluoride Treatment | Fissure sealants are only available to children under the age of 16. |

| 🟡 Dental X-Rays | Beneficiaries must be between the ages of 5 and 13 years old. Intra-oral: Managed care protocols apply. Panoramic radiographs are limited to one per 24 months per recipient. Extra-oral: one (1) scan every two (2) years for each beneficiary. |

| 🟢 Advanced Dentistry | – |

| 🔵 Crowns Bridgework Dentures Orthodontics Removal of Impacted Wisdom Teeth Non-Surgical Periodontics | Pre-authorization and managed care protocols apply to 100% of the Scheme Tariff. Partial metal frame dentures, crowns and bridges, implants, and orthodontics are not covered. |

| 🟣 Partial Metal Frame Dentures | Limited to beneficiaries 16> Periodontics: 100% of Scheme Tariff; subject to Periodontal Programme registration. Only conservative, non-surgical therapy (root planing) is available. |

| 🔴 Acrylic (Plastic) Dentures for beneficiaries 16> | Each beneficiary receives one pair of acrylic/plastic dentures every four years. Denture repairs, realignment, and repair can be done every 12 months Only PMBs are covered. |

| 🟠 Maxillo-Facial and Oral Dental Surgery | Subject to managed care protocols. Covered up to 100% of the Scheme Tariff. The benefits of TMJ therapy are confined to non-surgical interventions and treatments. Claims for oral pathology treatments (cysts and biopsies, surgical treatment of jaw and soft tissue tumors) will be covered only if accompanied by a laboratory report that verifies the diagnosis. |

Gold Ascend EDO Auxiliary Benefits

| 🅰️ Alternative Services Speech therapy Podiatry Occupational therapy Social worker Dietetics Audiology Naturopathy Educational psychologist Biokinetics Registered counselor, etc. | Covered up to 100% of the scheme tariff. The following limits will apply: Main Member R1,230. Main Member + Dependents – R1,976 Chiropractors are covered at the scheme tariff of up to R1,219 per beneficiary per year. |

| 🅱️ Physiotherapy Out-of-Hospital and Biokinetics | Covered up to 100% of the scheme tariff. Subject to PMB conditions and clinical protocols. |

Gold Ascend EDO Medical Appliances Benefits

| 🩺 Appliances | Covered up to 100% of the negotiated tariff, with the following limits: Main Member R1,230 Main Member + Dependents – R1,976 This benefit includes purchasing a Nebulizer, Glucometer, Insulin pump, Morphine pump, and C-PAP machine. Every appliance is only charged once per year, subject to the abovementioned limits. This benefit covers the cost of C-PAP machines. Subject to clinical requirements and procurement regulations being met. |

| 🦻 Hearing Aids | Covered up to 100% of Negotiated Rate Subject to an annual limit of R18,182 per family. One (1) hearing unit (one per ear) every four (4) years from the date of acquisition The benefit is subject to pre-authorization. |

| 👩🏻🦼 Wheelchairs | Non-motorized wheelchairs are limited to one per family per four years, with a family limit of R2,275. |

POLL: 5 Best Medical Aids under R500

Gold Ascend EDO Other Benefits

| ✈️ Air/Road Ambulance and Emergency Services | The contractual service provider authorizes 100% of the Negotiated Tariff*. Emergency transportation authorization should be obtained within 72 hours. Claims will not be paid if services are not pre-authorized through the selected provider. |

| 🧠 Psychology and Psychiatry Treatment | Covered up to 100% of the scheme tariff. The benefit is limited to psychiatrists and clinical and counseling psychologists as providers for mental health disorders. There is a limit of R6 276 for this benefit. |

| 💟 Infertility | All infertility investigations will be covered in a DSP hospital and compliance with the policies of the relevant Public Agencies. |

| 👩⚕️ Hospice and Private Nursing | Covered up to 100% of the Negotiated Tariff for all services provided in registered step-down facilities and nursing homes The Hospital Benefit Management Program and the Disease Management Program will apply. There is a limit of R5,505 for each family. |

Gold Ascend EDO Sizwe Hosmed Bambino Benefits

Sizwe Hosmed is concerned about its maternity mothers. This program offers information and advantages to help them during their pregnancy. In addition, pregnant women enrolled in the Bambino Programme are eligible for a complimentary maternity bag filled with baby goods at 24 weeks of pregnancy.

| ❤️ Sizwe Hosmed Bambino Program | Covered up to 100% of the scheme tariff. |

| 🧡 Hospital Confinement | Admissions can only be done to a DSP Hospital Network. Natural Delivery – Limited to 2 days Cesarean – Limited to 3 days. |

| 💛 Home Delivery | Covered up to 100% of the negotiated tariff. A registered Midwife, GP, or medical specialist can only do it. Materials included in benefit. |

| 💚 Maternity Ultrasounds | Limited to two 2D ultrasounds in and out-of-hospital. Covered up to 100% of the negotiated tariff. |

| 💙 Maternity Visits/Consultations | Covered up to 100% of the scheme tariff. Extra 9 GP maternity appointments and 3 specialist consultations each pregnancy at GP or Specialist. |

| 💜 Antenatal Pathology Screening Haemoglobin Syphilis Chlamydia Bacteriuria Hepatitis B Rhesus incompatibility | Two Hemoglobin Measurement Tests One Blood Grouping Test One VDRL Test for Syphilis Two HIV blood tests Twelve Urine Analysis Tests One Full Blood Count (FBC) test |

| ❤️ Child Immunisation Benefit | According to the Immunisation schedule of the Department of Health, only up to 6 years old. |

Read more about Best Medical Aids in South Africa Cover IVF

Gold Ascend EDO Preventative Care Benefits

| 👨⚕️ Wellness Consultations | Limited to R1,219 per family per year. |

| 🧬 Preventative care screening | Limited to one test per beneficiary per year. Limited to R2,449 per family and includes these tests: Blood Sugar Cholesterol Blood Pressure Body Mass Index HIV screening test One screening test per beneficiary in the doctor’s room. Limited to R310 per beneficiary per year using a preferred provider facility. |

| 💗 Female Beneficiaries | One mammogram every 2 years for women 40>. One pap smear every 2 years for women 21>. |

| 💙 Male Beneficiaries | Men 40> receive a PSA test once every year. |

| 💉 Immunisation/Vaccinations | Flu Vaccine Pneumococcal Vaccine HPV Vaccine Immunization for children aged six (6) years and under will be approved per those supplied by the Department of Health, subject to a family wellness screening and family limit. |

| ⚕️ HIV/AIDS Management Program | Covered up to 100% of the scheme tariff. HIV/AIDS is a PMB benefit, and infected beneficiaries are encouraged to enroll in the Disease Management Program. |

| ➡️ Chronic Disease Management Program (CDL) | Covered up to 100% of the scheme tariff. Benefits are restricted to PMB chronic illnesses and are subject to pre-approval, registration in the chronic disease program, formulary, and clinical protocols. |

| 😷 COVID-19 Screening, Diagnosis, and Treatment | This benefit includes the following: SAHPRA-approved COVID-19 vaccine. Pathology-approved COVID-19 test as approved by CMS. COVID-19 in-hospital treatment for COVID-19 pneumonia. |

Gold Ascend EDO Chronic Diseases Benefit

Sizwe Hosmed Gold Ascend EDO covers the following chronic conditions on the CDL list:

- ✅ Addison’s Disease

- ✅ Epilepsy

- ✅ Asthma

- ✅ Glaucoma

- ✅ Bipolar Mood Disorder

- ✅ Hemophilia

- ✅ Bronchiectasis

- ✅ HIV/AIDS

- ✅ Cardiac Failure

- ✅ Hyperlipidemia

and many more.

Gold Ascend EDO Plan Exclusions and Waiting Periods

Gold Ascend EDO Plan Exclusions

Sizwe Hosmed indicates that the following are excluded. However, these are only a few items; the complete list can be viewed on the Sizwe Hosmed website.

- Costs that exceed the annual or biennial maximum allowed for the category

- Operations, medicines, treatments, and procedures for cosmetic purposes or personal reasons

- Medical service not deemed necessary by the medical advisor for the management of the medical condition

- Treatment with no proven efficacy and safety

- Services rendered by unregistered persons or institutions not registered in terms of any law

- Abdominoplasties and repair of divarication of abdominal muscles

- Geriatric hospital, nursing home, frail care facility, or similar accommodations and services

- Alternative therapists, such as art therapists, aromatherapists, massage therapists, reflexologists, and Chinese medicine practitioners

- Anabolic steroids and immunostimulants, excluding immunoglobulins and growth hormones

- Ante- and postnatal exercises

- Ozone therapy

and many more.

Discover the 5 Best Gap Cover Options for Under R1 000

Gold Ascend EDO Plan Waiting Periods

When new members join the plan, they may be subject to a three-month general waiting period during which they cannot receive benefits. Except in the case of Specified Minimum Benefits, if the new member has a pre-existing ailment, they may be subject to a one-year condition-specific waiting period.

Medical Aid Comparisons : Sizwe Hosmed Gold Ascend EDO Plan vs. Similar Plans from other Medical Schemes

| 🔎 Medical Aid Plan | 🥇 Sizwe Hosmed Gold Ascend EDO | 🥈 Discovery Health Classic Smart | 🥉 Momentum Incentive |

| 🌎 International Cover | Covered up to 100% of the scheme rates | R5 million | R8 million |

| 👤 Main Member Contribution | R3,250 | R2,627 | R2,794 |

| 👥 Adult Dependent Contribution | R3,119 | R2,073 | R2,206 |

| 🍼 Child Dependent Contribution | R895 | R1,049 | R1,072 |

| ➡️ Annual Limit | Unlimited Hospital Cover | ✅ Yes | Unlimited Hospital Cover |

| 🚑 Hospital Cover | Unlimited for PMBs | Unlimited | Unlimited |

Our Verdict on The Gold Ascend EDO Plan

The Sizwe Hosmed Gold Ascend EDO plan is a medical aid plan offered by Sizwe Hosmed, a South African medical aid scheme. This plan provides the same rich benefits as the Gold Ascend Plan but with lower contributions. One of the main differences between the Sizwe Hosmed Gold Ascend EDO plan and the Gold Ascend Plan is the contribution amount. The EDO plan has lower contributions, making it an affordable option for individuals or families on a tight budget. However, despite the lower contributions, members still get access to private hospitals within the Sizwe Hosmed network. Another advantage of the Sizwe Hosmed Gold Ascend EDO plan is that it offers higher limits on additional benefits and appliances.

This includes cover for optometry, dentistry, hearing aids, and other medical appliances. As a result, members can enjoy peace of mind knowing that they have comprehensive coverage for their medical needs. One potential disadvantage of the Sizwe Hosmed Gold Ascend EDO plan is that it may not be suitable for individuals who require frequent visits to specialists or medical practitioners. The plan has limited visits to specialists and physiotherapists, which may not be enough for individuals with chronic conditions or ongoing medical needs. In conclusion, the Sizwe Hosmed Gold Ascend EDO plan is an excellent option for individuals or families looking for an affordable medical aid plan with comprehensive benefits.

- You might also like: Siswe Hosmed Review

- You might also like: Sizwe Hosmed Gold Ascend

- You might also like: Sizwe Hosmed Platinum Enhanced EDO

- You might also like: Sizwe Hosmed Platinum Enhanced

- You might also like: Sizwe Hosmed Plus

- You might also like: Sizwe Hosmed Silver Hospital

- You might also like: Sizwe Hosmed Titanium Executive

- You might also like: Sizwe Hosmed Value Core

- You might also like: Sizwe Hosmed Value

- You might also like: Sizwe Hosmed Access Saver 25

- You might also like: Sizwe Hosmed Access Core

- You might also like: Sizwe Hosmed Copper Essential

Gold Ascend EDO Plan Frequently Asked Questions

What is Gold Ascend EDO?

Gold Ascend EDO is a medical aid plan offered by Sizwe Hosmed that uses electronic communication and administration systems to manage members’ medical aid benefits.

How does Gold Ascend EDO differ from Gold Ascend?

Gold Ascend EDO has lower contributions than Gold Ascend. However, it offers the same rich benefits within a network of private hospitals and higher benefit limits on auxiliary benefits and appliances.

Can I visit any private hospital under the Gold Ascend EDO plan?

No, members can only visit private hospitals within the Sizwe Hosmed network.

Are there any limits to the number of specialist visits under the Gold Ascend EDO plan?

Yes, there are limits to the number of specialist visits allowed under the Gold Ascend EDO plan.

What are the advantages of the Gold Ascend EDO plan?

Sizwe Hosmed Gold Ascend EDO plan provides its members access to private hospitals within the Sizwe Hosmed network. Apart from this, it offers higher limits on additional benefits and appliances, such as optometry, dentistry, hearing aids, and other medical appliances. Therefore, members can have a sense of security as they have extensive coverage for their medical requirements.

You might also like

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans