- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Sizwe Hosmed Platinum Enhanced EDO Medical Aid Plan

Overall, the Sizwe Hosmed Platinum Enhanced EDO Medical Aid Plan is a trustworthy and comprehensive medical aid plan that offers 24/7 medical emergency assistance and home-based care to up to 3 Family Members. The Sizwe Hosmed Platinum Enhanced EDO Medical Aid Plan starts from R4,511 ZAR.

| 👤 Main Member Contribution | R4,511 |

| 👥 Adult Dependent Contribution | R4,320 |

| 🍼 Child Dependent Contribution | R1,150 |

| ↪️ Gap Cover | ❎ None |

| 🌎 International Cover | Covered up to 100% of the scheme rates |

| 🏥 Hospital Cover | Unlimited for PMBs |

| 🟦 Oncology Cover | R546,000 |

| 😷 Screening and Prevention | ☑️ Yes |

| 💶 Medical Savings Account | ☑️ Yes |

| 🩺 Disease Prevention Program | ❎ None |

Sizwe Hosmed Platinum Enhanced EDO Plan – 7 Key Point Quick Overview

- ☑️ Sizwe Hosmed Platinum Enhanced EDO Plan Overview

- ☑️ Sizwe Hosmed Platinum Enhanced EDO Plan Contributions, MSA, and Self-Payment Gap

- ☑️ Platinum Enhanced EDO Plan Benefits and Cover Comprehensive Breakdown

- ☑️ Platinum Enhanced EDO Plan Exclusions and Waiting Periods

- ☑️ Sizwe Hosmed Platinum Enhanced EDO Plan vs. Similar Plans from other Medical Schemes

- ☑️ Our Verdict on The Platinum Enhanced EDO Plan

- ☑️ Platinum Enhanced EDO Plan Frequently Asked Questions

Sizwe Hosmed Platinum Enhanced EDO Plan Overview

The Sizwe Hosmed Platinum Enhanced EDO medical aid plan is one of 12, starting from R4,511 and includes no overall annual limit, maternity cover up to 100% of the scheme rate, specialized and basic radiology, home-based care for 14 days, and more. Gap Cover is not available on the Sizwe Hosmed Platinum Enhanced EDO Plan. However, Sizwe Hosmed offers 24/7 medical emergency assistance. According to the Trust Index, Sizwe Hosmed has a trust rating of 3.9.

Sizwe Hosmed offers 12 medical aid plans

- 🥇 Sizwe Hosmed Value Core

- 🥇 Sizwe Hosmed Titanium Executive

- 🥇 Sizwe Hosmed Silver Hospital

- 🥇 Sizwe Hosmed Plus

- 🥇 Sizwe Hosmed Platinum Enhanced

- 🥇 Sizwe Hosmed Platinum Enhanced EDO

- 🥇 Sizwe Hosmed Gold Ascend

- 🥇 Sizwe Hosmed Gold Ascend EDO

- 🥇 Sizwe Hosmed Value

- 🥇 Sizwe Hosmed Essential Copper

- 🥇 Sizwe Hosmed Access Saver 25

- 🥇 Sizwe Hosmed Access Core

Sizwe Hosmed Platinum Enhanced EDO Plan Contributions, MSA, and Self-Payment Gap

Sizwe Hosmed Platinum Enhanced EDO Plan Contributions

| 👤 Main Member | 👥 Adult Dependent | 🍼 Child Dependent |

| R4,511 | R4,320 | R1,150 |

Discover more: 5 Best Medical Aids for Students

Sizwe Hosmed Platinum Enhanced EDO Plan Medical Savings Account (MSA)

| 👤 Main Member | 👥 Adult Dependent | 🍼 Child Dependent |

| R12,181 | R11,663 | R3,104 |

Sizwe Hosmed Platinum Enhanced EDO Plan Self-Payment Gap (SPG)

| 👤 Main Member | 👥 Adult Dependent | 🍼 Child Dependent |

| R2,075 | R1,759 | R453 |

You might like the 5 Best Gap Cover Options for Under R2000

Platinum Enhanced EDO Plan Benefits and Cover Comprehensive Breakdown

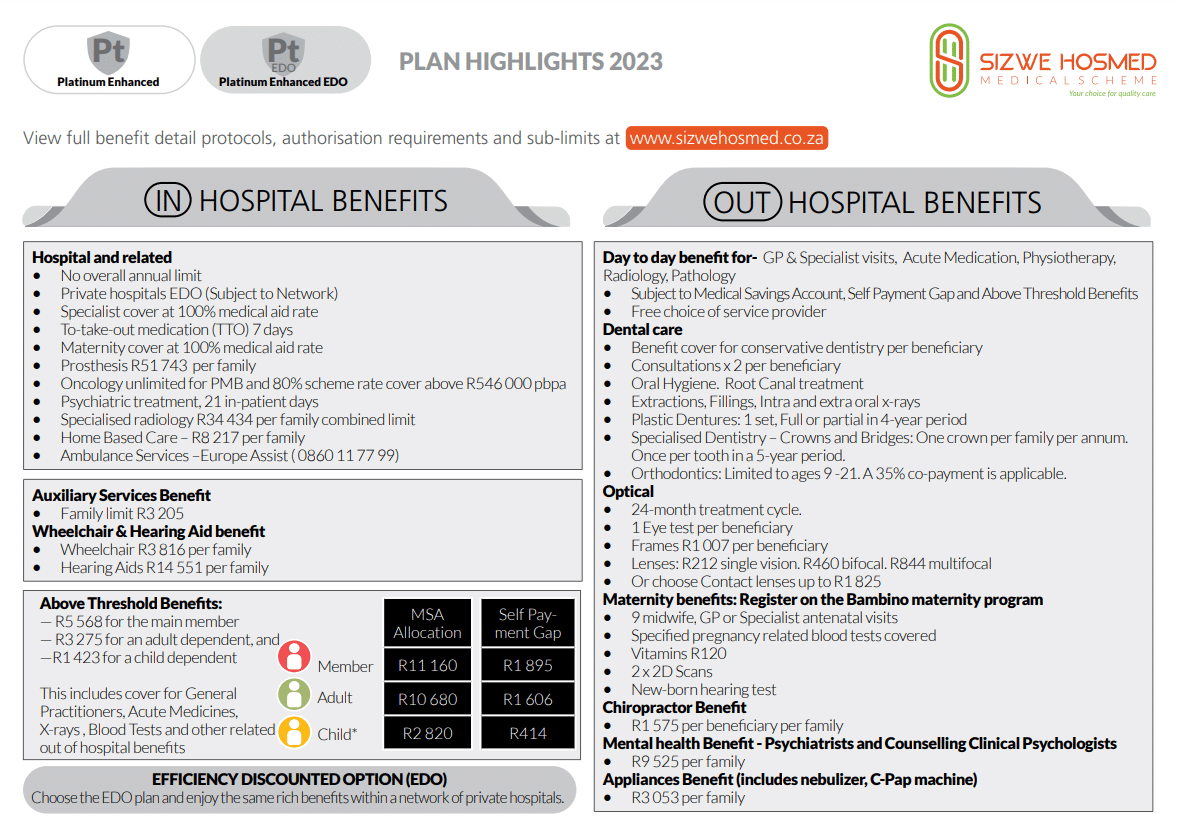

Platinum Enhanced EDO In-Hospital Benefits

- ️✅ Hospital admissions

- ✅ Unlimited benefits for Specified Minimum Benefit circumstances.

- ✅ Hospital admissions—including PMBs—require pre-authorization and case management.

- ✅ Emergency admissions require 48-hour notification of the Scheme.

- ✅ Claims will be denied if admissions are not pre-authorized or reported within 48 hours.

- ✅ Platinum Enhanced EDO hospital benefits are only available at Authorized Service Providers.

- ✅ There is a 10% co-payment for non-DSP hospital use.

Discover the 5 Best Hospital Plans for Farm Workers

- ✅️ In-hospital General Practitioner and Specialist services

- ✅ PMB and case management protocols apply.

- ✅ All procedures must be approved in advance.

Failing to pre-authorize or notify the scheme of admission within 48 hours will result in claim payments being withheld.

| 🔎 Hospital Admissions High Care Unit General Ward Theatre Recovery Room | Covered up to 100% of the Negotiated Tariff. |

| ☑️ Medicines and consumables used in hospital and theatre | Covered up to 100% of the negotiated tariff. |

| 💊 Medicine to take home after discharge | Paid from the hospital benefit. Limited to 7 days’ medicine. |

| 👨⚕️ Consultations and Procedures | Covered up to 100% of the negotiated tariff. |

| 1️⃣ Basic Radiology and Pathology | Covered up to 100% of the scheme tariff. Subject to pre-approval and the following programs: Hospital Benefit Management Disease Management PMB Protocols |

| 2️⃣ Specialized Radiology | Limited to R34,434 per family per year. Pre-approval and managed care protocols apply. |

| 3️⃣ Oncology | Covered up to 100% of the Sizwe Hosmed tariff. Unlimited Oncology treatment is available. Subject to pre-approval. Subject to managed care protocols and registration on the Hospital Benefit Management Program. Benefits over R546,000 are subject to a 20% co-payment on non-PMBs. |

| 4️⃣ Renal Dialysis | The benefit is limited to the standards outlined in PMBs at a Preferred Provider. |

| ❤️ Organ Transplants | Covered up to 100% of the negotiated tariff. |

| 🦷 Dental Hospitalisation | Children under seven (7) years old can receive general anesthesia benefits for comprehensive dental treatment once every 365 days. Removing symptomatic impacted wisdom teeth is only covered as a Day case at a Day Hospital. |

| 😊 Maxillo-facial and Oral Surgery | Subject to managed care rules, 100% of the Sizwe Hosmed rate The benefits of TMJ therapy are restricted to non-surgical interventions/treatments. |

| ✅ Drug and Alcohol Rehabilitation | Treatment Protocols and PMBs are subject to pre-approval. Subject to pre-approval. Limited to 3 days of withdrawal treatment + 21 days of rehabilitation at an approved facility |

| 🧠 Psychiatric Treatment (PMB) Consultations Ward Fees Medicines Psychiatry/psychology therapy sessions | Each beneficiary is only allowed 21 days per year. This benefit covers six (6) in-hospital consultations with a psychiatrist and six (6) consultations with a clinical psychologist – subject to PMBs. Limited to R2,100 each day, up to a maximum of R44,100 |

| ➡️ Non-PMB Psychiatric Treatment | Subject to managed care rules, four (4) additional out-of-hospital consultations in place of hospitalization are permitted. |

| ⬇️ Step-down Facilities | The Hospital Benefit Management Program and the Disease Management Program apply. Sizwe Hosmed prices apply to all services provided at registered step-down institutions and nursing homes. Hospice care is provided at no cost. Covered up to 100% of the Sizwe Hosmed rate for Home Care services performed instead of Hospitalization |

| 🏡 Home-Based Care | Covered up to 100% of the negotiated tariff. Limited to 14 days per beneficiary per year. |

| 😮💨 Hyperbaric Oxygen Therapy | Covered up to 100% of the negotiated tariff. Limited to PMBs and public sector protocols. |

| 🅰️ Male Sterilisation/Vasectomy | Covered up to 100% of the negotiated tariff. Sterilization is limited to R17,472 per beneficiary per year. Subject to pre-approval and PMBs. |

| 🅱️ Female Sterilisation/Tubal Ligation | Covered up to 100% of the negotiated tariff. Sterilization is limited to R17,472 per beneficiary per year. Subject to pre-approval and PMBs. |

| 🟥 Back and Neck Surgery | Spinal surgery authorization for treating chronic back or neck pain is subject to managed care guidelines. Before authorizing surgery, managed care may require adherence to conservative clinical treatment. |

| 🟧 Stereotactic Radiosurgery | Covered up to 100% of the negotiated tariff. Only covers Primary Central Nervous System tumors. |

| 🟨 Age-related Muscular Degeneration Treatment | Covered up to 100% of the negotiated tariff. Pre-authorization required. |

| 🟩 Laparoscopic Hospitalisation and Associated Costs | Pre-authorization required. Subject to PMBs. |

| 🟦 PMB Laparoscopic Procedures | PMBs are covered in DSP facilities. Subject to clinical protocols. |

| 🦾 Internal and External Prostheses | Covered up to 100% of the negotiated tariff. Subject to PMBs and pre-approval. Overall prostheses limit of R51,743 per family per year within the hospital limit. |

| 🦿 Internal Prostheses | Hip and knee (partial and total), only one prosthesis, and one joint every year. Spine – two (2) levels per year performed in a single surgery. Heart procedures (pacemakers, internal defibrillators, grafts, and valves). |

| 📌 Cardiac Stents | Vascular Stents are limited to 2 stents per family per year. Cardiac stents are limited to 3 stents per family per year. Overall external prostheses limits apply. |

| 📍 Internal sphincters and stimulators | Limited to PMBs. Subject to the benefit limit. |

| 🩸 Blood Transfusions | Covered up to 100% of the scheme tariff. |

| ✔️ Physiotherapy and Biokinetics | Covered up to 100% of the scheme tariff. |

| 🍎 Dietician and Occupational Therapy | Covered up to 100% of the scheme tariff. |

Platinum Enhanced EDO Day-to-Day Benefits

| ☀️ Day Hospital Procedures using a DSP hospital Network | Covered up to 100% of the scheme tariff. |

| 💴 Co-payments on day procedures | This will apply depending on the treatment. |

| 👩⚕️ Out-of-Hospital Consultations General Practitioners Specialists Outpatient Facilities | Covered up to 100% of the scheme tariff. Paid from the available savings or Above Threshold Benefit when savings are depleted. |

| 💊 Acute Medicine | Covered up to 100% of the scheme tariff. Paid from MSA. No accumulation towards the SPG or Above Threshold Benefit (ATB) exists. |

| ➡️ PMB Disease List Medicines | Covered up to 100% of the reference price. Unlimited cover provided. The beneficiary must be registered with the Chronic Disease Management Program. Medications prescribed are included in the formulary, and a reference price will be applied if the formulary is not followed. |

| 📌 Other Chronic (non-CDL) medicines | Limited to R15,246 per family per year. Limited to R7,560 per beneficiary per year. Paid from risk. |

| 📍 Pharmacy Advised Treatment (PAT) | Covered up to 100% of the scheme tariff. Paid from the MSA. Does not accumulate towards the SPG or ATB. |

| 🔍 Contraceptives | Limited to R3,172 per family per year. Paid from the available MSA funds or the ATB. |

Platinum Enhanced EDO Optical Benefits

| 😎 Spectacle Lenses | Covered up to 100% of the DSP tariff. The following is covered: R212 per lens for clear single-vision lenses. R460 per lens for clear bifocal lenses. R844 per lens for multifocal lenses. |

| 👁️ Contact Lenses | Covered up to 100% of the DST tariff. Limited to R1,825 per beneficiary every 2 years. |

| 👓 Frames/Lens Enhancements | Covered up to 100% of the DSP tariff. Limited to R1,007 per beneficiary. |

| 🤓 Eye Tests | Covered up to 100% of the scheme tariff. Limited to one comprehensive consultation per beneficiary every 2 years. |

| 👁️🗨️ Refractive Surgery (including Radial Keratotomy) | Limited to R7,644 per family per year. |

Platinum Enhanced EDO Dentistry Benefits

| 🦷 Basic/Conservative Dentistry | Covered up to 100% of the scheme tariff. Pre-authorization and managed care protocols apply |

| 👑 Crowns Bridgework Dentures Orthodontics Removal of Impacted Wisdom Teeth Non-Surgical Periodontics | Pre-authorization is required for crowns and bridges. 1 crown per year per household Once every five years, per tooth. |

| 🪥 Orthodontics | Pre-approval is necessary. A 35% co-payment is required. Individuals between the ages of nine and twenty-one are eligible for fixed comprehensive therapy. |

| ↪️ Partial Metal Frame Dentures | Limited to beneficiaries 16> Subject to Periodontal Programme registration Only conservative, non-surgical therapy (root planing) is available. |

| ➡️ Acrylic (Plastic) Dentures for beneficiaries 16> | One set of plastic dentures, full or partial (an upper and a lower) per beneficiary in 4 years, subject to pre-authorization Every 5 years, each beneficiary can receive two partial frames (an upper and a lower). |

| 😊 Partial Chrome Cobalt Dentures | Limited to two partial frames (upper and lower) per beneficiary every 5 years. |

| 🥰 Maxillo-Facial and Oral Dental Surgery | Covered up to 100% of the Scheme Tariff. Subject to managed care protocols The benefit of Temporomandibular Joint (TMJ) therapy is restricted to non-surgical interventions or treatments. Claims for oral pathology treatments (cysts and biopsies, surgical treatment of jaw and soft tissue tumors) will be covered only if accompanied by a laboratory report that verifies the diagnosis. |

Platinum Enhanced EDO Auxiliary Benefits

| 🟥 Alternative Services Speech therapy Podiatry Occupational therapy Social worker and more. | Covered up to 100% of the scheme tariff. Paid from available savings and the ATB, limited to: Main Member – R1,827 Main Member and Dependents – R3,205 |

| 🟧 Chiropractic and Homeopathy Treatment | Covered up to 100% of the scheme tariff. Paid from available savings or above-the-threshold benefit R1,575 per recipient per year |

| 🟨 Remedial and Other Therapies | Covered up to 100% of the scheme tariff. Subject to pre-approval and limited to PMBs. Including, but not Limited to the following: Speech therapy Podiatry Occupational therapy Social workers |

| 🟩 Clinical and Medical Technologists | Covered up to 100% of the scheme tariff. Paid from available MSA or ATB. |

| 🟦 Physiotherapy Out-of-Hospital and Biokinetics | Covered up to 100% of the scheme tariff. Paid from available savings. |

Platinum Enhanced EDO Medical Appliances Benefits

| ➡️ Appliances Procurement of Nebulizer Glucometer Insulin pump Morphine pump C-PAP machine | Covered up to 100% of the negotiated tariff. Paid from available savings or ATB. Appliances are payable once per year and are subject to limits. Limited to the following: Main Member – R1,827 Main Member and Dependents – R3,206 |

| ↪️ C-PAP Machine | The cost of C-PAP machines is covered by this benefit, subject to clinical requirements and procurement regulations being met. |

| 🦻 Hearing Aids | Risk pays for 100% of the negotiated tariff. Subject to an R29,102 yearly limit per household. Every three (3) years from the date of acquisition, one (1) pair of hearing units (one per ear) is provided to each beneficiary. |

| 🔁 Non-motorized Wheelchair | Limited to one per family every four years. Paid from risk and limited to R3,816 per family. |

Read more: Health Insurance for Kids

Platinum Enhanced EDO Other Benefits

| ✈️ Air/Road Ambulance and Emergency Services | Covered up to 100% of Negotiated Tariff 24-hour Contact Center Access, including Telephonic Nurse Advice Line. Emergency: Subject to pre-approval within 72 hours of the emergency. Only a preferred provider can perform inter-hospital transfers. Emergency response by road or air to the scene of the occurrence, as well as transfer from the scene to the nearest, most appropriate facility Escort repatriation of stranded children is possible. Non-emergency: Subject to pre-authorization. Medically justifiable inter-facility transfers. Medical repatriation. |

| 🧠 Psychology and Psychiatry Treatment | Covered up to 100% of the scheme tariff. Limited to R10,001 per family. Limited to Psychiatrists, Clinical and Counselling Psychologists – mental health disorders. |

| 💛 Infertility | Covered according to the relevant code of the PMB regulations. Investigations for infertility conditions are covered in a DSP hospital according to the policies of relevant Public Authorities. |

| 👩⚕️ Hospice and Private Nursing | 100% of the Negotiated Rate for all services performed in certified step-down and nursing facilities. The Hospital Benefit Management Programme and the Disease Management Programme apply. Annual limit per family – R8,217 PMB applicable |

Platinum Enhanced EDO Sizwe Hosmed Bambino Benefits

Sizwe Hosmed is concerned about its maternity mothers. This program offers information and advantages to help them during their pregnancy. In addition, pregnant women enrolled in the Bambino Programme are eligible for a complimentary maternity bag filled with baby goods at 24 weeks of pregnancy.

| ❤️ Sizwe Hosmed Bambino Program | Covered up to 100% of the scheme tariff. |

| 🧡 Hospital Confinement | Admissions can only be done to a DSP Hospital Network. Natural Delivery – Limited to 2 days Cesarean – Limited to 3 days. |

| 💛 Home Delivery | Covered up to 100% of the negotiated tariff. A registered Midwife, GP, or medical specialist can only do it. Materials included in benefit. |

| 💚 Maternity Ultrasounds | Limited to two 2D ultrasounds in and out-of-hospital. |

| 💙 Maternity Visits/Consultations | Covered up to 100% of the scheme tariff. Extra 9 GP maternity appointments, of which 6 are for a GP or Midwife, and three are for a Specialist Obstetrician visit. |

| 💜 Antenatal Pathology Screening Haemoglobin Syphilis Chlamydia Bacteriuria Hepatitis B Rhesus incompatibility | Two Haemoglobin Measurement Tests One Blood Grouping Test One VDRL Test for Syphilis Two HIV blood tests Twelve urine Analysis Tests One complete blood count FBC test |

| 🤍 Vitamins | R120, subject to the day-to-day limit. |

| 🖤 Child Immunisation Benefit | According to the Immunisation schedule of the Department of Health, only up to 6 years old. |

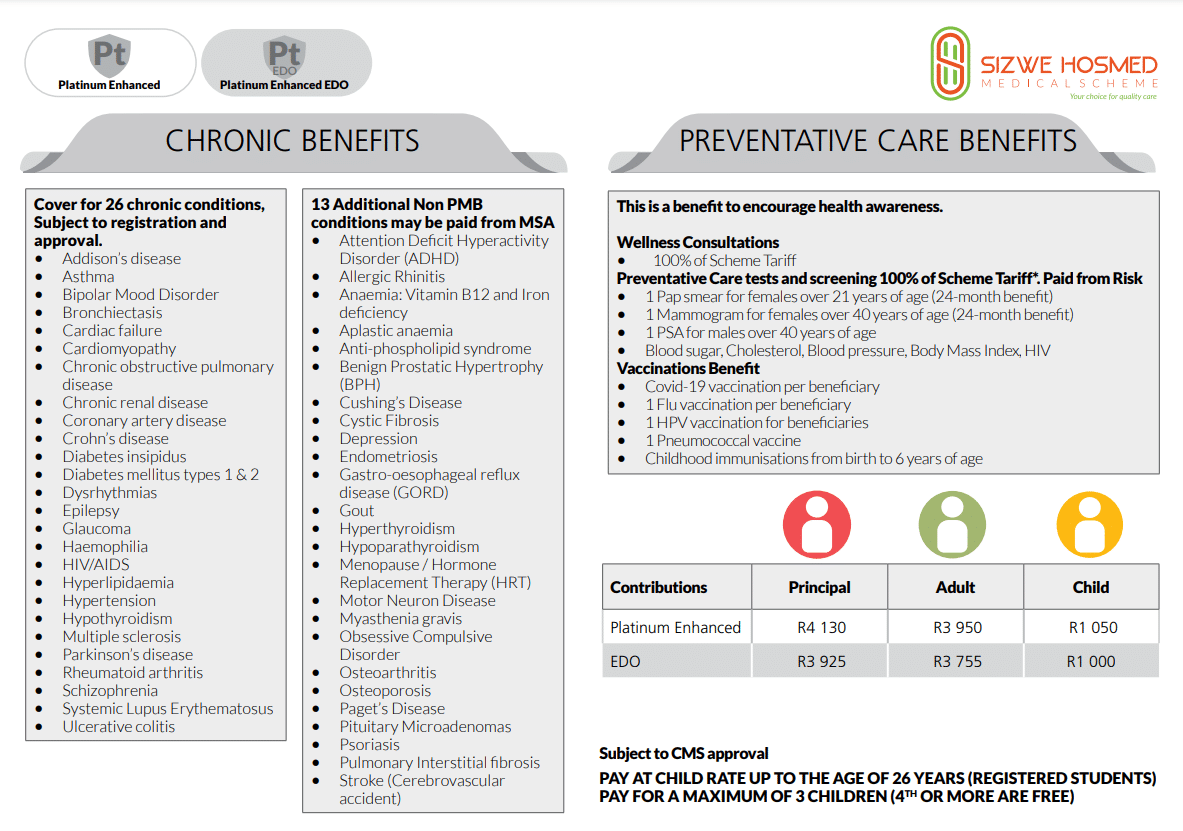

Platinum Enhanced EDO Preventative Care Benefits

| 🔴 Wellness Consultations | Limited to R1,219 per family per year. |

| 🟠 COVID-19 Vaccination | Covered according to guidelines. |

| 🟡 Diabetic eye care | Covered |

| 🟢 Pap Smear for female beneficiaries 18> | One per qualifying beneficiary yearly. |

| 🔵 Mammogram for female beneficiaries 40> | One per qualifying beneficiary yearly. |

| 🟣 PSA for Male Beneficiaries 40> | One per qualifying beneficiary yearly. |

| 🔴 Cholesterol Test for beneficiaries 20> | One per qualifying beneficiary yearly. |

| 🟠 Flu Vaccine for all beneficiaries | One per beneficiary yearly. |

| 🟡 Blood Sugar | Test for those 15> – one test per qualifying beneficiary. |

| 🟢 Colon Cancer Blood Test for beneficiaries 50> | One per qualifying beneficiary yearly. |

| 🔵 Blood Pressure test for all beneficiaries. | One per beneficiary yearly. |

| 🟣 HIV test for all beneficiaries | One per beneficiary yearly. |

| 🔴 HPV Vaccines for beneficiaries between 9 and 12. | One per qualifying beneficiary. |

| 🟠 Pneumococcal Vaccines for beneficiaries 65> | One per qualifying beneficiary yearly. |

| 🟡 Bone density testing for female beneficiaries between 50 and 69 and male beneficiaries 65 years old. | One per qualifying beneficiary yearly. |

| 🟢 HIV/AIDS Management Program | Covered up to 100% of the scheme tariff. Treatment is subject to the treatment care plan. Clinical protocols per CDL apply. |

| 🔵 COVID-19 Screening, Diagnosis, and Treatment | Covered up to 100% of the scheme tariff. Subject to PMB. |

Platinum Enhanced EDO Chronic Diseases Benefit

Sizwe Hosmed Platinum Enhanced EDO covers the following chronic conditions on the CDL list:

- ☑️ Addison’s Disease

- ☑️ Epilepsy

- ☑️ Tuberculosis

- ☑️ Asthma

- ☑️ Glaucoma

- ☑️ Bipolar Mood Disorder

- ☑️ Hemophilia

- ☑️ Bronchiectasis

- ☑️ HIV/AIDS

- ☑️ Cardiac Failure

- ☑️ Hyperlipidemia

- ☑️ Multiple Sclerosis

and more.

Sizwe Hosmed Platinum Enhanced EDO covers the following 25 additional non-PMB conditions:

- ☑️ Attention Deficit Hyperactivity Disorder (ADHD)

- ☑️ Allergic Rhinitis

- ☑️ Anaemia: Vitamin B12 and Iron deficiency

- ☑️ Aplastic anemia

- ☑️ Anti-phospholipid syndrome

- ☑️ Benign Prostatic Hypertrophy (BPH)

- ☑️ Cushing’s Disease

- ☑️ Cystic Fibrosis

- ☑️ Depression

- ☑️ Endometriosis

and more.

Poll: 5 Best Medical Aids under R200

Platinum Enhanced EDO Plan Exclusions and Waiting Periods

Sizwe Hosmed Platinum Enhanced EDO Plan Exclusions

Sizwe Hosmed indicates that the following are excluded. However, these are only a few items; the complete list can be viewed on the Sizwe Hosmed website.

- Costs that exceed the annual or biennial maximum allowed for the category

- Operations, medicines, treatments, and procedures for cosmetic purposes or personal reasons

- Medical service not deemed necessary by the medical advisor for the management of the medical condition

- Treatment with no proven efficacy and safety

- Services rendered by unregistered persons or institutions not registered in terms of any law

- Abdominoplasties and repair of divarication of abdominal muscles

- Geriatric hospital, nursing home, frail care facility, or similar accommodations and services

- Alternative therapists, such as art therapists, aromatherapists, massage therapists, reflexologists, and Chinese medicine practitioners

- Anabolic steroids and immunostimulants, excluding immunoglobulins and growth hormones

and many more.

Sizwe Hosmed Platinum Enhanced EDO Plan Waiting Periods

When new members join the plan, they may be subject to a three-month general waiting period during which they cannot receive benefits. Except in the case of Specified Minimum Benefits, if the new member has a pre-existing ailment, they may be subject to a one-year condition-specific waiting period.

Sizwe Hosmed Platinum Enhanced EDO Plan vs. Similar Plans from other Medical Schemes

| 🔎 Medical Aid Plan | 🥇 Sizwe Hosmed Platinum Enhanced EDO | 🥈 Discovery Essential Priority Series | 🥉 Momentum Extender |

| 🌎 International Cover | Covered up to 100% of the scheme rates | Up to R5 million | R9.01 million |

| 👤 Main Member Contribution | R4,511 | R4,531 | R6,589 |

| 👥 Adult Dependent Contribution | R4,320 | R3,562 | R4,997 |

| 🍼 Child Dependent Contribution | R1,150 | R1,809 | R1,937 |

| 📉 Annual Limit | Unlimited Hospital Cover | None | Unlimited Hospital Cover |

| 💙 Hospital Cover | Unlimited for PMBs | Unlimited | Unlimited |

| ➡️ Oncology Cover | R546,000 | R250,000 | R500,000 |

Our Verdict on The Platinum Enhanced EDO Plan

Platinum Enhanced EDO savings plan offers the best of both worlds by combining traditional and new-generation savings plans. Platinum Enhanced EDO provides a sense of security by offering additional benefits, such as an Above Threshold Benefit, if the Medical Savings Account (MSA) is depleted. Moreover, any unused member savings can be carried forward each year and refunded if the member resigns from the savings type plan after four months. This plan is ideal for large families who desire comprehensive coverage in and out of the hospital while maintaining flexibility and peace of mind that an above-threshold benefit (ATB) is available when needed. Furthermore, Sizwe Hosmed’s comprehensive plans offer out-of-hospital benefits covered by the scheme, extending the value of benefits available to the family. Whether in or out of the hospital, Platinum Enhanced EDO has you covered.

- You might also 💙: Siswe Hosmed Review

- You might also 💙: Sizwe Hosmed Gold Ascend

- You might also 💙: Sizwe Hosmed Platinum Enhanced

- You might also 💙: Sizwe Hosmed Plus

- You might also 💙: Sizwe Hosmed Silver Hospital

- You might also 💙: Sizwe Hosmed Titanium Executive

- You might also 💙: Sizwe Hosmed Value Core

- You might also 💙: Sizwe Hosmed Value

- You might also 💙: Sizwe Hosmed Access Saver 25

- You might also 💙: Sizwe Hosmed Access Saver 15

- You might also 💙: Sizwe Hosmed Copper Essential

- You might also 💙: Sizwe Hosmed Gold Ascend EDO

Platinum Enhanced EDO Plan Frequently Asked Questions

What is a Medical Savings Account (MSA) in the Platinum Enhanced EDO savings plan offered by Sizwe Hosmed?

A Medical Savings Account (MSA) is a portion of your premium that is allocated to you to use for your day-to-day medical expenses. It is a savings account that allows you to control your healthcare spending and helps you manage your medical expenses throughout the year.

What are out-of-hospital benefits covered by Sizwe Hosmed with their Platinum Enhanced EDO plan?

The Platinum Enhanced EDO savings plan offered by Sizwe Hosmed covers a range of out-of-hospital benefits such as specialist consultations, prescribed medication, radiology and pathology, physiotherapy, and more. Furthermore, these benefits are covered by the scheme and do not come out of your own Medical Savings Account (MSA).

Can I carry forward my unused member savings in the Platinum Enhanced EDO savings plan?

Yes, any unused member savings in the Platinum Enhanced EDO savings plan can be carried forward to the following year. This means that if you do not use all your MSA in one year, the remaining balance is carried over to the following year, and you can use it for your medical expenses in that year.

What is the refund policy for unused MSA in the Platinum Enhanced EDO savings plan if I resign from the plan?

Any unused MSA will be refunded if you resign from the Platinum Enhanced EDO savings plan after four months. This means you will not lose any money in your MSA if you leave the plan.

Is the Platinum Enhanced EDO savings plan suitable for large families?

Yes, the Platinum Enhanced EDO savings plan is well-suited to large families looking for comprehensive coverage in and out of the hospital while keeping flexibility and peace of mind that an above-threshold benefit (ATB) is available in times of need. With the added benefit of an above-threshold benefit, members can rest assured that they can access additional benefits if needed, making it an excellent choice for large families.

You might also like

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans