- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Sizwe Hosmed Late Joiner Fee

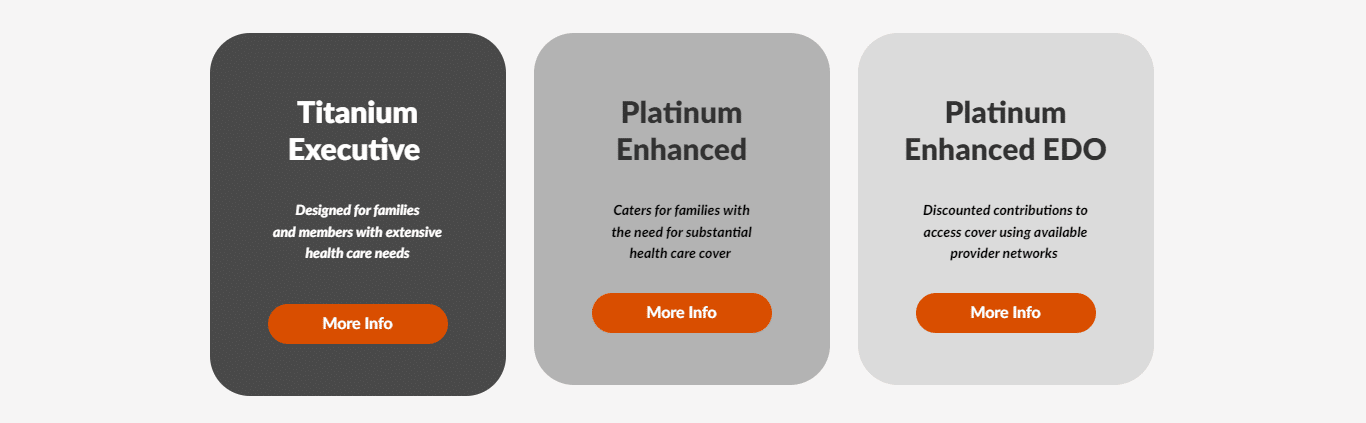

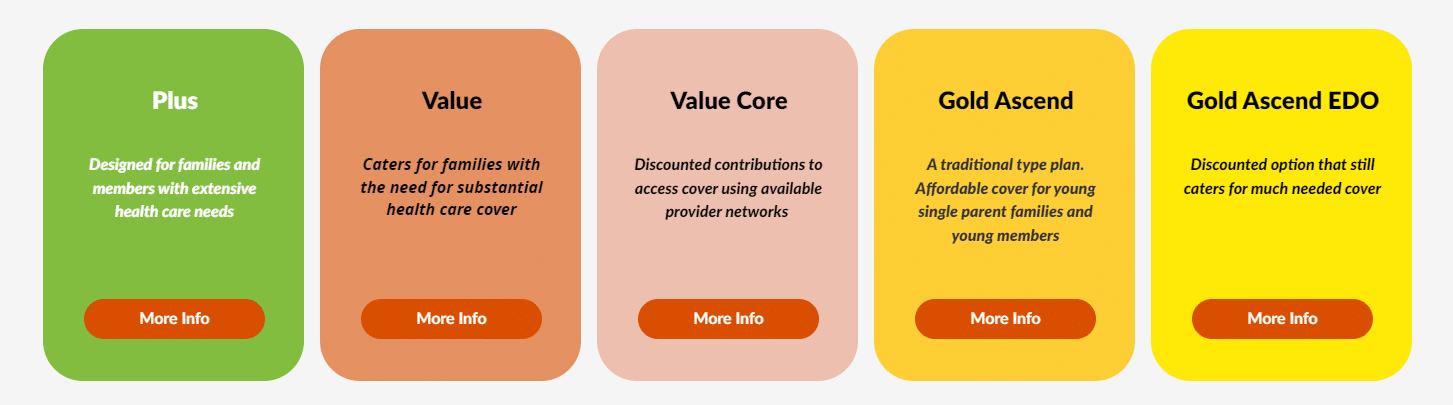

Overall, Sizwe Hosmed is a trustworthy and comprehensive medical aid provider. New Members 35 years or older may be subject to late-joiner penalties on Sizwe Hosmed Medical Aid Plans. The Sizwe Hosmed Medical Aid Plans start from R636 ZAR per month. Bestmed Medical Scheme has a trust rating of 3.9.

| 🟥 Medical Aid | 🔎 Sizwe Hosmed |

| 🟧 Waiting Period | Possible |

| 🟨 Late Joiner Fee | Possible |

| 🟩 Plans (from) | R636 ZAR |

| 🟦 Trust Rating | 3.9 |

Sizwe Hosmed Late Joiner Fees – 9 Key Point Quick Overview

- ✅ Sizwe Hosmed Late Joiner Fees – What to know before Joining

- ✅ Sizwe Hosmed Waiting Periods

- ✅ Sizwe Hosmed Exclusions

- ✅ Sizwe Hosmed and Pre-existing Conditions

- ✅ Late Joiner Fees vs. Waiting Periods – What is the Difference

- ✅ What Happens if You Do Not Pay Late Joiner Fees

- ✅ National Health Insurance (NHI) Bill South Africa

- ✅ Our Verdict on Sizwe Hosmed Late Joiner Fees

- ✅ Sizwe Hosmed Late Joiner Fees Frequently Asked Questions

Sizwe Hosmed Late Joiner Fees – What to know before Joining

If you are considering joining Sizwe Hosmed medical scheme after turning 35 and have never been a member of a medical scheme before, or if you have had a break in your membership, you may face late-joiner penalties. These penalties can range from 5% to 75% of your contributions and may be applicable for the rest of your life. Therefore, it is essential to consider these penalties before joining or taking a break from your membership.

Late-joiner penalties protect medical schemes like Sizwe Hosmed from people who only join when sick and need to claim. As a result, medical schemes rely on younger and healthier members to help balance the costs for older and sicker members.

Furthermore, the penalties ensure that everyone contributes fairly. The penalties for Sizwe Hosmed are calculated using a formula that considers the number of years you have not been a scheme member after turning 35. This involves adding up the number of years you have been a scheme member since turning 35, adding 35, and subtracting this answer from your age when you join the scheme.

Therefore, it is important to note that years spent out of the country or with health insurance do not count as years of coverage when calculating late-joiner penalties.

Sizwe Hosmed Waiting Periods

When new members join Sizwe Hosmed, they could be subject to a three-month general waiting period during which they cannot receive benefits. Except in the case of Prescribed Minimum Benefits, if the new member has a pre-existing ailment, they could be subject to a one-year condition-specific waiting period.

Sizwe Hosmed Exclusions

Sizwe Hosmed indicates that the following are excluded. However, these are only a few items; the complete list can be viewed on the Sizwe Hosmed website.

- ✅ Costs that exceed the annual or biennial maximum allowed for the category

- ✅ Operations, medicines, treatments, and procedures for cosmetic purposes or personal reasons

- ✅ Medical service not deemed necessary by the medical advisor for the management of the medical condition

- ✅ Treatment with no proven efficacy and safety

- ✅ Services rendered by unregistered persons or institutions not registered in terms of any law

- ✅ Abdominoplasties and repair of divarication of abdominal muscles

- ✅ Geriatric hospital, nursing home, frail care facility, or similar accommodations and services

- ✅ Alternative therapists, such as art therapists, aromatherapists, massage therapists, reflexologists, and Chinese medicine practitioners

- ✅ Anabolic steroids and immunostimulants, excluding immunoglobulins and growth hormones

- ✅ Ante- and postnatal exercises

- ✅ Ozone therapy

- ✅ Polishing of restorations

- ✅ Pulp capping (direct and indirect)

- ✅ Root canal treatment and laboratory fabricated crowns on primary teeth

- ✅ Fissure sealants on patients older than 16 years

and many more. A full list of exclusions will be made available by Sizwe Hosmed.

Sizwe Hosmed and Pre-existing Conditions

When joining a medical aid scheme, it is essential to note that there is usually a waiting period of 12 months before any pre-existing conditions are covered. Therefore, joining a medical aid scheme earlier in life is advisable, rather than waiting until old age when the risk of developing chronic health conditions is higher.

Additionally, it is important to note that some medical aid schemes, such as Sizwe Hosmed, have specific policies regarding pre-existing conditions.

Therefore, it is important to research and understands the policies of a medical aid scheme before joining to ensure that you are fully aware of any waiting periods or limitations regarding pre-existing conditions.

Late Joiner Fees vs. Waiting Periods – What is the Difference

Late Joiner Fees are a one-time penalty fee charged by medical aid if you join after a certain age or have never been a member of a medical aid program. Waiting periods, on the other hand, are periods during which you are not covered for certain medical aid benefits.

These waiting periods apply to all new members, regardless of whether they are charged Late Joiner Fees. Depending on the benefit, waiting periods can range from three to twelve months.

What Happens if You Do Not Pay Late Joiner Fees

Your medical aid membership may be suspended or terminated if you fail to pay the Late Joiner Fees. The scheme may also pursue legal action to collect overdue fees. If your membership is suspended, you cannot access medical aid benefits until you have paid any outstanding fees.

If your membership is terminated, you must reapply for membership and may be subject to even higher Late Joiner Fees. Therefore, paying your Late Joiner Fees on time is crucial to prevent interruptions in your medical aid coverage.

National Health Insurance (NHI) Bill South Africa

In South Africa, the NHI is a proposed universal health coverage system. It is still in the planning stages, but it could affect Late Joiner Fees and other facets of medical aid.

Our Verdict on Sizwe Hosmed Late Joiner Fees

Overall, South Africans who join the Sizwe Hosmed medical scheme after turning 35 and who have not been members of a registered medical scheme or had active cover for the preceding 24 months are subject to late joiner penalties.

Depending on how long you went without health insurance after turning 35, the penalty could be anywhere from 5%to 75% of your contribution. The one-time membership fee is in addition to the regular monthly administration fee.

Furthermore, Sizwe’s benefits for members range from preventative care to hospitalization to chronic medicine. The plan also supports members’ wellness and disease management. Despite the costs involved, late joiner fees and other costs at Sizwe Hosmed are comparable to those in the industry overall. Furthermore, generous benefits and services counterbalance them.

Sizwe Hosmed Late Joiner Fees Frequently Asked Questions

What is Sizwe Hosmed’s late joiner penalty?

People who join the Sizwe Hosmed medical scheme after turning 35 and who have never belonged to a medical scheme before or who have had a break in their medical scheme cover are subject to a late joiner penalty.

How is the waiting period determined for late joiners at Sizwe Hosmed?

Late joiners at Sizwe Hosmed have different wait times based on their medical history and any pre-existing conditions.

Are there any exclusion periods for late joiners at Sizwe Hosmed?

Depending on the patient’s medical history, Sizwe Hosmed could impose waiting periods before covering treatment for a late-arriving patient’s pre-existing condition.

Can a late joiner at Sizwe Hosmed apply for membership during an open enrollment period?

During open enrollment, a late joiner can apply for membership at Sizwe Hosmed, but they may still be charged a fee.

Is there a late application fee for late joiners at Sizwe Hosmed?

Late applicants to Sizwe Hosmed will not incur a late application fee. However, they may still be subject to late joiner penalties.

You might also like

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans