- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Discovery Health Essential Smart Medical Aid Plan

Overall, the Discovery Health Essential Smart Medical Aid Plan is a trustworthy and comprehensive medical aid plan that offers 24/7 medical emergency assistance and chronic medication to up to 3 Family Members. The Discovery Health Essential Smart Medical Aid Plan starts from R1,881 ZAR.

| 🔎 Medical Aid Plan | 🥇 Discovery Health Essential Smart |

| 👤 Main Member Contribution | R1,881 |

| 👥 Adult Dependent Contribution | R1,881 |

| 🍼 Child Dependent Contribution | R1,881 |

| 🔁 Gap Cover | ✅ Yes |

| 💙 Hospital Cover | Unlimited |

| ✔️ Screening and Prevention | ✅ Yes |

| 💶 Medical Savings Account | None |

| 👶 Maternity Benefits | ✅ Yes |

| 🏠 Home Care | ✅ Yes |

Discovery Health Essential Smart – 22 Key Point Quick Overview

- ✅ Discovery Health Essential Smart Overview

- ✅ Discovery Health Essential Smart Contributions

- ✅ Discovery Health Essential Smart Benefits at a Glance

- ✅ Discovery Health Essential Smart Benefits and Cover Comprehensive Breakdown

- ✅ Discovery Health WELLTH Fund

- ✅ Discovery Health WHO Outbreak Benefit

- ✅ Discovery Health Connected Care

- ✅ Discovery Health Hospital At Home

- ✅ Discovery Health Day-To-Day Benefits and Cover

- ✅ Discovery Maternity and Early Childhood Benefits

- ✅ Discovery Health Chronic Benefits

- ✅ Discovery Health Care Programs

- ✅ Discovery Health Comprehensive Cancer Cover

- ✅ Discovery Health Hospital Benefit

- ✅ Discovery Health Annual Limits

- ✅ Discovery Health Smart Cover for Day Surgery Network Procedures

- ✅ Discovery Health Smart Additional Benefits

- ✅ Discovery Essential Smart Value-Added Offers

- ✅ Discovery Health Essential Smart Exclusions and Waiting Periods

- ✅ Discovery Health Essential Smart Plan vs Similar Plans from Other Medical Schemes

- ✅ Our Verdict on Discovery Health Essential Smart

- ✅ Discovery Health Essential Smart Frequently Asked Questions

Discovery Health Essential Smart Overview

The Discovery Health Essential Smart starts from R1,881 and is part of a series of comprehensive medical insurance plans offered by Discovery Health. Discovery Essential Smart is a good option for those who require comprehensive coverage for essential healthcare needs but are on a tighter budget. While it does have some limitations compared to the more comprehensive Classic Smart Plan, it still provides essential cover for hospital stays, chronic medication, and day-to-day healthcare needs. Gap Cover is available on the Discovery Health Essential Smart, along with 24/7 medical emergency assistance. According to the Trust Index, Discovery Health has a trust rating of 4.8.

The Discovery Health Smart Series consist out of the following plans:

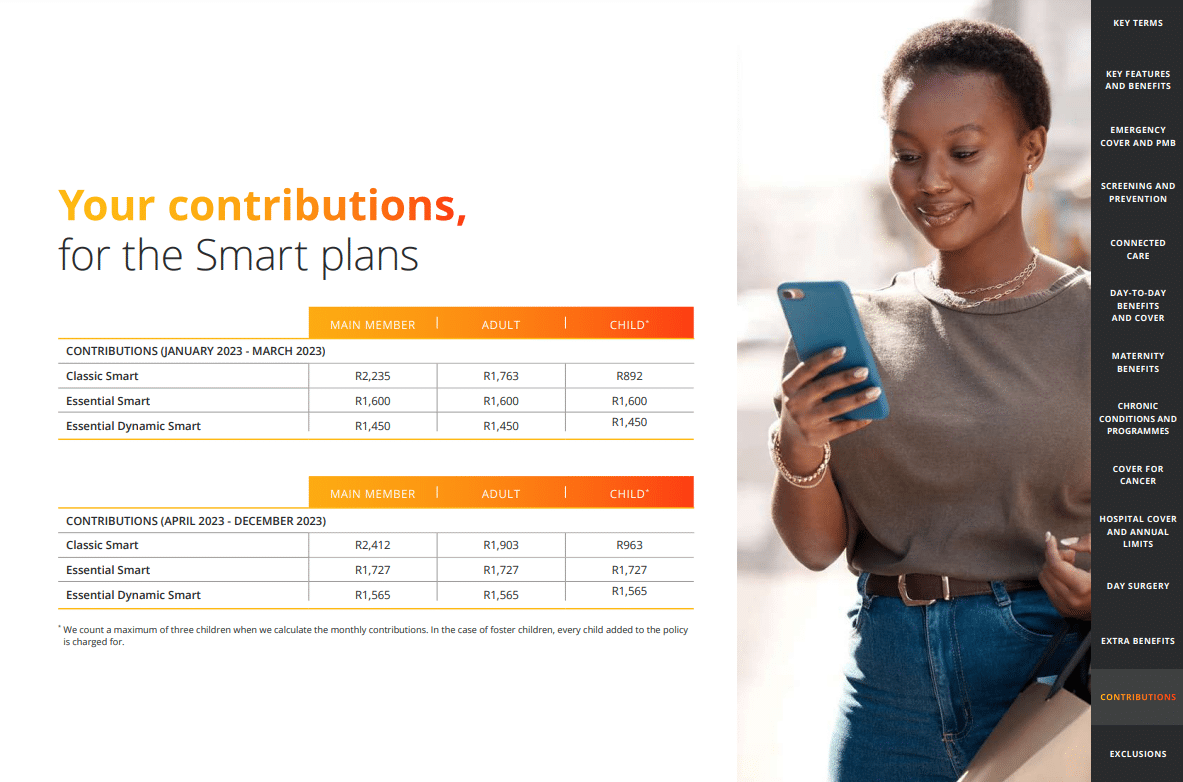

Discovery Health Essential Smart Contributions

| 👤 Main Member | 👥 +1 Adult Dependent | 🍼 +1 Child Dependent |

| R1,881 | R1,881 | R1,881 |

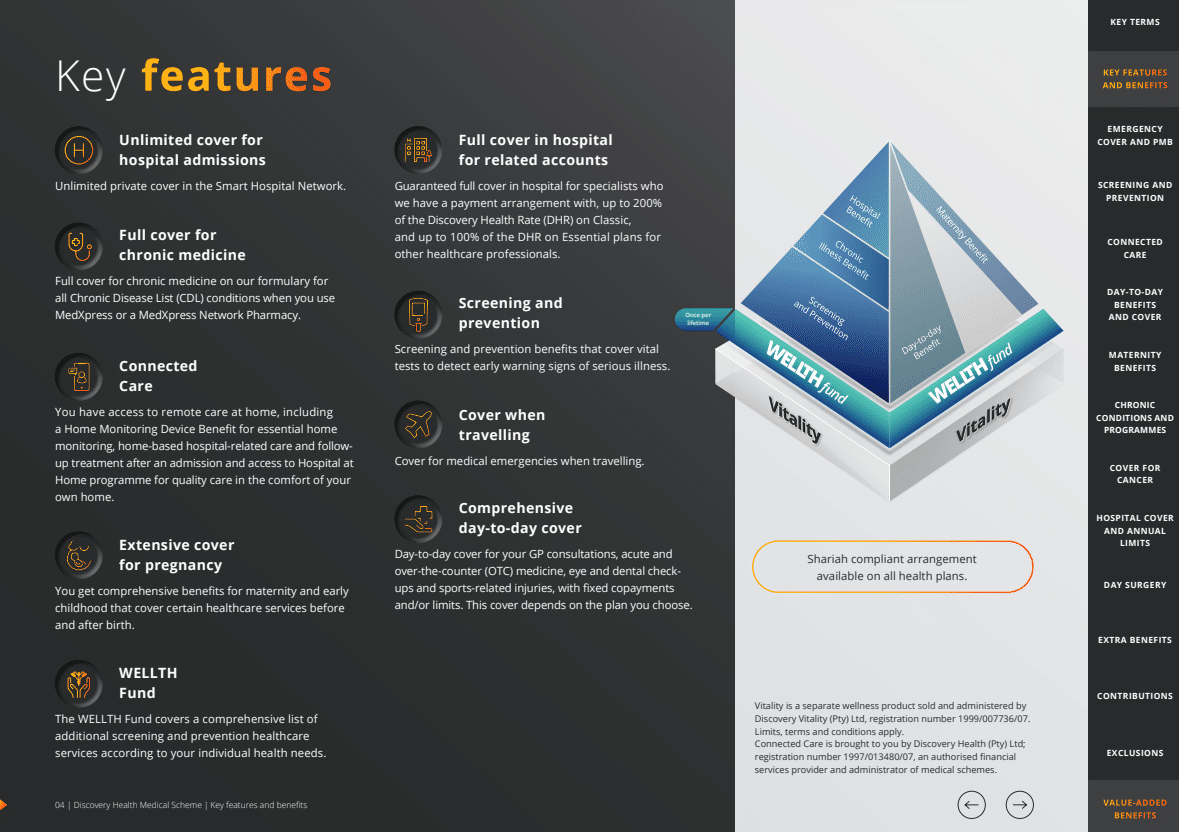

Discovery Health Essential Smart Benefits at a Glance

| 🔴 Day-to-Day Cover | Unlimited Smart Network GP consultations with R120 co-payments. Network optometrist eye test with R120 co-payment. One dental check-up at a dentist, dental therapist, or oral hygienist with an R180 co-payment. Covered up to 100% of the Discovery Health Rate cover (DHR) OTC medicine from network pharmacies up to R560 per family per year. |

| 🟠 Chronic Dialysis | State facilities cover you. |

| 🟡 Cancer | Discovery Health will assign a network provider |

| 🟢 Hospital Cover – Hospitals you can go to | Private Smart Hospital Network hospitals |

| 🔵 Cover for Healthcare Professionals in-hospital | Covered up to 100% of the Discovery Health Rate (DHR). |

| 🟣 MRI and CT scans | You must pay for non-admission-related or conservative back and neck treatment. |

Discovery Health Essential Smart Benefits and Cover Comprehensive Breakdown

Emergency Cover

In case of a traumatic incident or after a traumatic event, you can get help from a trained professional. Calling Emergency Assist will help you and your loved ones in need. Furthermore, family members can get help after a traumatic event at any time. The survivors of gender-based violence can receive counseling and other support as part of this service.

Discovery Health Emergency Cover covers the following medical services:

- ✅ The emergency vehicle (or other medical transport).

- ✅ The hospital’s account of the incident.

- ✅ The observations of the physician who admitted you to the hospital.

- ✅ The anesthesiologist.

Any additional approved healthcare provider.

Prescribed Minimum Benefits

All medical schemes are required by the Prescribed Minimum Benefit (PMB) provisions of the Medical Schemes Act 131 of 1998 and its Regulations to cover the costs associated with the diagnosis, treatment, and care of:

- ✅ A life-threatening medical condition

- ✅ A defined listing of 271 conditions

- ✅ A list of 27 chronic illnesses.

To qualify for coverage, your medical condition must be on the Prescribed Minimum Benefit (PMB) conditions list. Furthermore, the necessary treatment must correspond to the treatments listed in the benefits. In addition, you are required to utilize designated service providers (DSPs) within the Discovery Health network. Once your condition has stabilized, you will be transferred to a hospital or other service providers in the Discovery Health network, if necessary, according to the scheme’s rules. Discovery Health will cover up to 80% of the Discovery Health Rate if you do not use a DSP (DHR). Your responsibility will be to determine the difference between what Discovery Health will pay and the actual cost of your treatment.

Furthermore, Discovery Health will pay according to your plan’s benefits if these criteria are unmet.

Screening and Prevention

This benefit covers certain diagnostic procedures that detect early warning signs of serious diseases. The Discovery Health wellness providers cover a variety of screening tests, including blood glucose, cholesterol, HIV, Pap smear or HPV test for cervical screening, mammograms or ultrasounds, and prostate screenings. After all your membership members have completed their health check, you can access additional screening and preventive healthcare services through the WELLTH Fund.

The Discovery Health Screening and Prevention covers the following:

- ✅ Screening for kids will assess the child’s growth and development, including weight, height and body mass index measurements, blood pressure, and more.

- ✅ Screening for Adults includes blood pressure, blood glucose, HIV, and more. Discovery also covers mammograms, breast ultrasounds, pap smears, and more.

Screening for Seniors (65>) includes risk screening assessments and referrals to Premier Plus GPs according to the screening results.

POLL: 5 Best Medical Aids under R2000

Discovery Health WELLTH Fund

The WELLTH Fund covers a comprehensive list of screening and prevention healthcare services to empower you to act based on your individual health requirements. This benefit is distinct from and in addition to the Screening and Prevention Benefit; it is available once per lifetime to all members and dependents who have completed their health checks. Your WELLTH Fund can be used up to its maximum for screening and prevention services. However, the cover is subject to the Scheme’s clinical entry requirements, treatment protocols, and guidelines.

The Discovery Health WELLTH Fund for Essential Smart covers the following:

| 🩺 General Health | You can access screenings for vision, hearing, dental, and skin conditions as part of your primary care. Additionally, you are eligible for one GP screening consultation |

| 🏈 Physical Health | Dieticians, biokinetics, or physiotherapists are available for physical well-being evaluations. |

| 🧠 Mental Health | You have access to a mental health evaluation to promote mental health. |

| 🚺 Women and Men’s Health | You have access to various screening and prevention services for women and men. These include, for instance: Consultation with your doctor for gynecological, prostate, or cardiac issues Bone density analysis |

| 🍼 Children’s Health | A pediatrician, speech pathologist, or physiotherapist can evaluate your child’s progress toward important developmental milestones as part of a well-child check-up. |

| ✔️ Medical Monitoring Devices | You have access to medical monitoring devices that assist in measuring, for instance, blood pressure, cholesterol, and blood sugar. |

The WELLTH Fund is available for two benefit years after all beneficiaries over two complete an age-appropriate health check with a Wellness Network provider. Furthermore, the benefit is available to new members in the joining year and subsequent years. The benefit is available once per lifetime per beneficiary. Cover for eligible healthcare services is limited to the Discovery Health Rate (DHR), subject to the overall benefit maximum.

Your WELLTH Fund maximum is based on the size and composition of your family as stated in your policy:

- ✅ Limited to R2,500 per adult dependent.

- ✅ Limited to R1,250 per two-year-old or older child dependent.

- ✅ Limited to R10,000 per family.

Furthermore, the WELLTH Fund is available to all registered membership beneficiaries and will not cover healthcare services already covered by other defined benefits.

Discovery Health WHO Outbreak Benefit

The basket of care includes the following:

- ✅ COVID-19 vaccines and their administration according to the COVID-19 guidelines of the National Department of Health.

- ✅ Screening consultations with a network general practitioner (virtual, telephone, or in-person).

- ✅ COVID-19 PCR and Rapid Antigen screening tests if referred by a qualified medical practitioner.

- ✅ A set of defined pathology tests for COVID-19-positive individuals.

- ✅ A predetermined assortment of x-rays and scans for COVID-19-positive individuals.

- ✅ Members at risk who meet the clinical entry criteria will receive supportive care, including medication and a home monitoring device to track oxygen saturation levels.

- ✅ When you are admitted to the hospital because of symptoms of COVID-19, you will be covered by the Hospital Benefit of the Essential Smart and, if necessary, the PMBs.

- ✅ Access to the Long COVID Recovery Program.

How members of the Discovery Health Essential Smart are covered in terms of Monkeypox:

- ✅ The treatment protocol for confirmed cases consists of a diagnostic PCR screening test

- ✅ Two visits to a dermatologist or general practitioner.

Formulary of supportive medications for pain management.

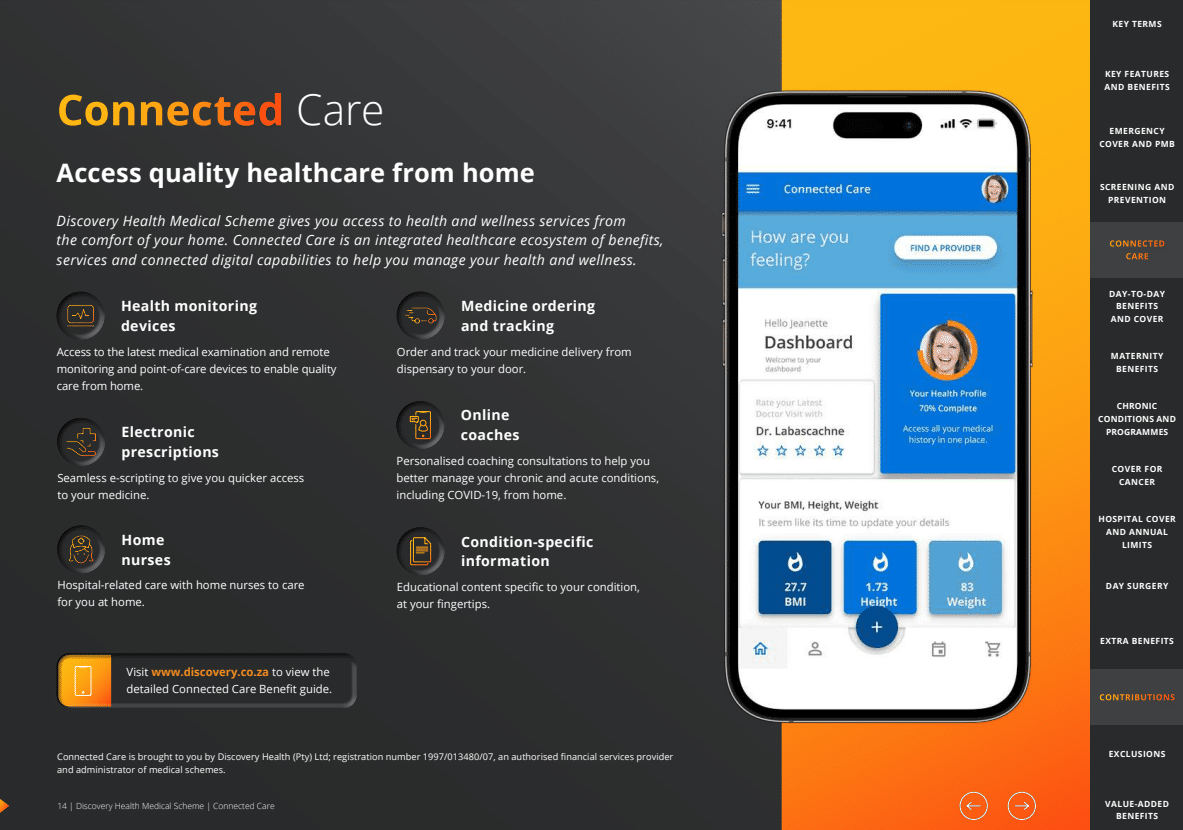

Discovery Health Connected Care

Discovery Health Medical Scheme provides home-based access to health and wellness services. Connected Care is an integrated ecosystem of benefits, services, and digitally connected capabilities designed to assist you in managing your health and wellness.

| ❤️ Health Monitoring Devices | Access to the most up-to-date medical examination, remote monitoring, and point-of-care devices to facilitate the delivery of quality care at home. |

| 🧡 Electronic Prescriptions | Electronic prescribing for expedited access to medications. |

| 💛 Home Nurses | Hospital-related care is provided at home by registered nurses. |

| 💚 Medicine Ordering and Tracking | Order and track the delivery of your medication from the dispensary to your door. |

| 💙 Online Coaches | At-home consultations with a coach to help you better manage your chronic and acute conditions, including COVID-19. |

| 💜 Condition-Specific Information | Educational content pertinent to your condition is readily accessible. |

✅ Connected care for members at home:

Previously unimaginable access to medical professionals is now at your fingertips, thanks to the advent of online consultations.

Thanks to the Home Monitoring Device Benefit, you can get various approved home monitoring devices for chronic and acute conditions. You will not see any changes to your regular benefits because of having cover approved for these gadgets.

✅ Connected care for those with chronic conditions:

Through Connected Care, you and your doctor can work together to keep your chronic condition under control while you are at home. Eligible members can use various digital services connected to smart remote monitoring, point-of-care devices, and individualized coaching consultations to monitor and control their chronic condition in the comfort of their homes.

READ more: 5 Best Medical Aids Covering Glasses & Optometry

Discovery Health Hospital At Home

Hospital at Home patients receive specialized care from a dedicated medical staff in the comfort of their own homes. Each of these benefits and services contributes to your overall health and well-being. They all work together to make your healthcare more efficient and your life safer. Suppose you have a valid pre-authorization for hospitalization. In that case, Discovery Health will use your Hospital Benefit to cover any services provided as part of Discovery’s Hospital at Home program. For those who meet the program’s clinical and benefit criteria, this unlocks cover for approved medical devices and services.

✅ Discovery Health covers the following:

- 24/7 clinical oversight from a care team virtually, including nurses, doctors, and allied healthcare professionals.

- 24/7 real-time remote monitoring, which is supported by innovative healthcare technology.

- Hospital-level diagnostics and intervention to manage post-surgical or medical care at home.

✅ Acute Care at home

This includes cover and treatment for COVID-19, as well as post-discharge care. In addition, you are eligible for the Home Monitoring Device Benefit.

✅ Home Monitoring Devices

- Suppose you meet the Scheme’s clinical entry criteria. In that case, you have healthcare coverage up to a limit of R4,250 per person per year at 100% of the Discovery Health Rate (DHR) for monitoring certain conditions like chronic obstructive pulmonary disease, congestive heart failure, diabetes, pneumonia, and COVID-19.

- If you meet the clinical entry criteria, the scheme covers up to 75% of the Discovery Health Rate (DHR) for defined point-of-care medical devices. You are responsible for 25% of the total cost of these devices. In addition, you have access to the most advanced remote medical examination device, known as TytoHome.

- TytoHome enables you to conduct a medical examination by transmitting throat, ear images, and heart and lung sound to your doctor in real time.

✅ Home Care Cover

- Discovery Home Care is a service that provides you with high-quality care in the comfort of your own home if your doctor recommends it as an alternative to hospitalization. Postnatal care, end-of-life care, intravenous infusions (drips), and wound care are provided. These services are covered by the Hospital Benefit, pending authorization.

- Discovery Home Care is the designated service provider (DSP) for intravenous infusion administration. Use Discovery Home Care for these infusions to avoid a 20% co-payment.

✅ Home-based care for follow-up treatment after hospital admission

- Once discharged from the hospital, patients with clinically appropriate conditions such as chronic obstructive pulmonary disease, chronic cardiac failure, ischemic heart disease, and pneumonia have access to enhanced home-based care.

If you meet the clinical entry criteria, you are covered for bedside medicine reconciliation before admission discharge, a follow-up consultation with a GP or specialist, and a defined basket of supportive care at home, including in-person and virtual consultations with a Discovery Home Care nurse.

You might like the 5 Best Hospital Plans under R1500 in South Africa

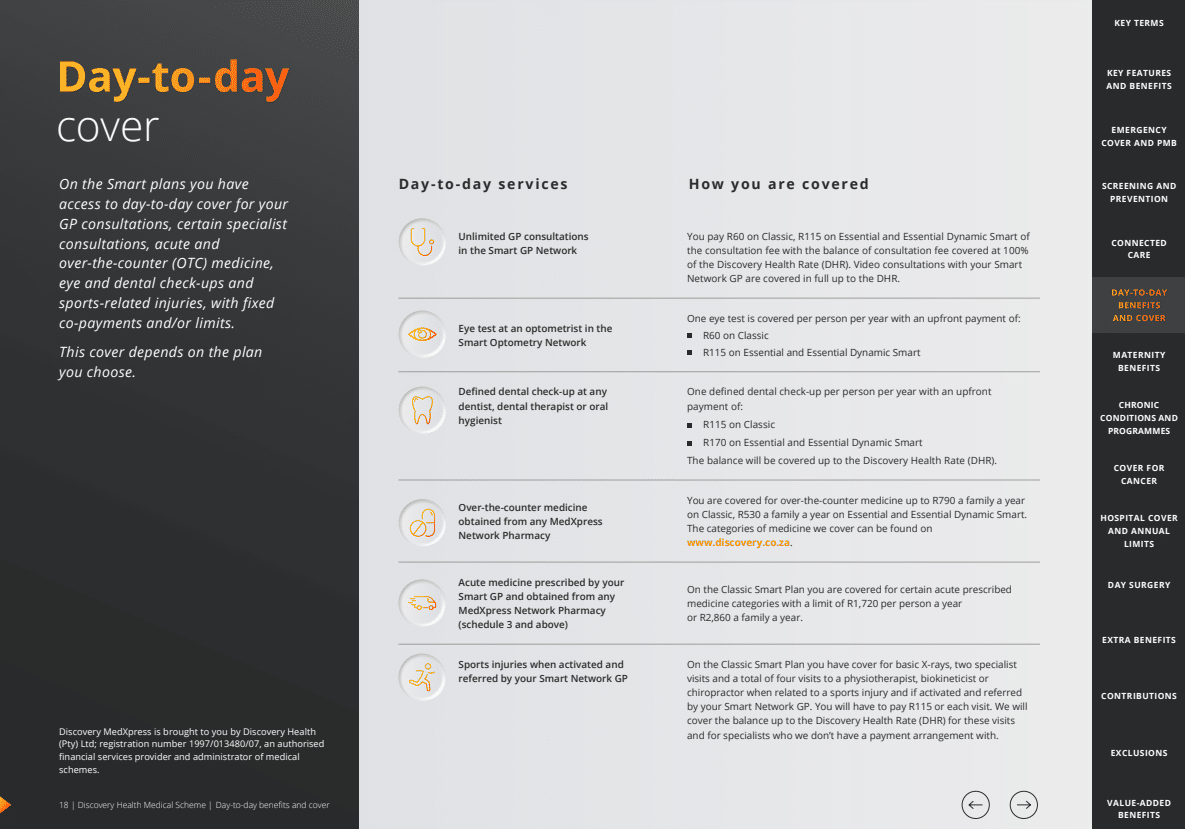

Discovery Health Day-To-Day Benefits and Cover

| 🟥 Unlimited GP Consultations in the Smart GP Network | There is an R120 fee applied. The remaining consultation fee is covered at 100% of the Discovery Health Rate (DHR). Up to the DHR, video consultations with your Smart Network GP are fully covered. |

| 🟧 Eye tests at an optometrist within the Smart Optometry Network | One eye exam per person per year is covered for a one-time fee of R120. |

| 🟨 Defined dental check-ups at any dentist, dental therapist, or oral hygienist | One defined dental examination per person per year with an upfront payment of R180. The balance up to the Discovery Health Rate will be covered (DHR). |

| 🟩 Over-the-counter (OTC) medicine obtained from any pharmacy in the MedXpress Network | Up to R560 per family per year is covered for over-the-counter medications. |

| 🟦 Acute Medicine prescribed by a Smart GP and obtained from a pharmacy in the MedXpress Network (Schedule 3>) | Not available on these plans |

| 🟪 Sports injury cover when activated, referred by a Smart Network GP | Not available on these plans |

Discovery Maternity and Early Childhood Benefit

With the Discovery Health Essential Smart, you get coverage for healthcare services related to your pregnancy and treatment for the first two years of your baby’s life. This applies from the date of activation of the benefit for each pregnancy and each child from birth until they are two years old. Discovery Health Maternity Benefit covers the following:

✅ During Pregnancy:

- Scans and Screenings

- Eight antenatal consultations with a midwife, GP, or gynecologist.

- 2 x 2D ultrasound scans

- Nuchal translucency test

- 3D and 4D scans up to the 2D scan rate.

- Non-invasive Prenatal Test (NIPT)

- One flu vaccination during pregnancy.

- Discovery Health will cover predetermined blood tests to confirm your pregnancy.

✅ After giving birth:

- GP and Specialist help for up to 2 years.

- Postnatal care, including complications during delivery, nutritional assessment, etc.

Discovery Health’s prenatal and postnatal care includes Five antenatal or postnatal classes and One Breastfeeding consultation.

You might consider Health Insurance for Pregnancy

Discovery Health Chronic Benefits

The Chronic Disease List lists 27 conditions for which the Chronic Illness Benefit (CIB) provides cover (CDL).

✅ Discovery Health Chronic Benefit Cover Summarized

| 🅰️ Prescribed Minimum Benefit (PMB) Conditions | Under the Prescribed Minimum Benefits, you can receive treatment for a set of medical conditions (PMBs). The PMBs cover the 27 chronic conditions in the Chronic Disease List (CDL). |

| 🅱️ Medicine Cover for the Chronic Disease List | Discovery Health will pay for medications up to the Discovery Health Rate maximum (DHR). The DHR for medication consists of the price of the medication and the dispensing fee. The scheme will cover up to the cost of the cheapest equivalent drug on the formulary for medications not on the list. |

✅ Discovery Health Essential Smart List of conditions covered:

- Addison’s disease

- Asthma

- Bipolar mood disorder

- Bronchiectasis

- Cardiac failure

- Cardiomyopathy

- Chronic obstructive pulmonary disease

- Chronic renal disease

- Coronary artery disease

- Crohn’s disease

- Diabetes insipidus

- Diabetes Type 1

- Diabetes Type 2

- Dysrhythmia

and many more.

Discover: 5 Best Medical Aids for Chronic Illness Cover

Chronic Medicine

Members should utilize designated service providers (DSPs), MedXpress, and MedXpress Network Pharmacies to avoid paying a 20% co-payment on their chronic medication. Through MedXpress, you can order or reorder your medication online and have it delivered to your place of business or residence.

Alternatively, you can:

- You can order your medication online and pick it up at a MedXpress Network Pharmacy or

- Fill a prescription as usual at any pharmacy in the MedXpress Network.

✅ Medicine Tracker

You can set reminders and prompts to help you take your medication as prescribed and on time. For example, your approved chronic medication will be displayed automatically. You will be prompted to take your medication and confirm each dose.

Discovery Health Care Programs

Discovery Health will cover preventative and condition-specific care programs that assist with managing diabetes, mental health, HIV, and heart-related conditions. You must be registered with these condition-specific care programs to access additional benefits and services. On a personalized dashboard, you and your Premier Plus GP can identify the next steps to manage your condition and optimally maintain your health over time.

| 🔴 Discovery Health Disease Prevention Program | Smart Premier Plus GPs can enroll you in the Disease Prevention Program if you have cardiometabolic risk syndrome. GPs, dietitians, and health coaches coordinate care. Consultations, pathology tests, and medicine are covered for enrolled members. Health coaching will help you manage your condition daily. |

| 🟠 Discovery Health Mental Health Care Program | Once enrolled by your network psychologist or Smart Premier Plus GP, you have defined major depression cover. The program provides medication coverage, virtual and in-person psychotherapy, and additional GP visits for treatment evaluation, tracking, and monitoring. Relapse prevention programs cover psychiatry consultations, counseling, and care coordination for qualifying members. |

| 🟡 Discovery Health Diabetes Care Program | Your Smart Premier Plus GP can enroll you in the Diabetes Care Program if you receive the Chronic Illness Benefit (CIB) for diabetes. The program covers extra glucometer strips and dietitian and biokinetics visits. A nurse educator can help you manage your condition. |

| 🟢 Discovery Health HIV Care Program | Your Smart Premier Plus GP registers you on the HIV program, which includes social worker cover. Confidentiality is guaranteed. Avoid a 20% co-payment by getting your medicine from a DSP. |

| 🔵 Discovery Health Cardio Care Program | If referred by your Smart Premier Plus GP and enrolled in the Cardio Care Program, you can receive a defined basket of care and an annual cardiovascular assessment for hypertension, hyperlipidemia, or ischemic heart disease on the Chronic Illness Benefit (CIB). |

The cover is subject to the Scheme’s clinical entry requirements, treatment protocols, and guidelines.

READ more about Discovery Vitality Program

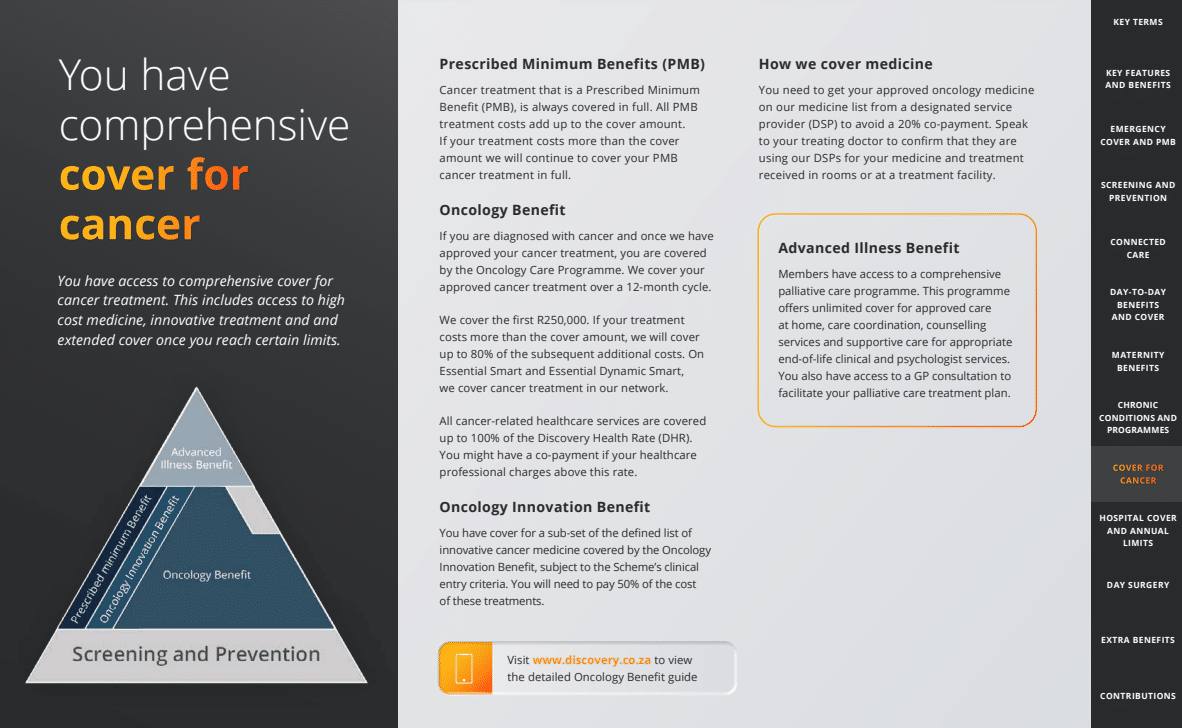

Discovery Health Comprehensive Cancer Cover

You have access to comprehensive cancer treatment coverage. This includes access to expensive medications, innovative treatments, and extended coverage once certain thresholds are reached.

| 🎗️ Discovery Health Prescribed Minimum Benefits (PMB) | PMB cancer treatment is always covered. PMB treatment costs total the cover. Discovery Health will fully cover PMB cancer treatment if it exceeds the cover amount. |

| 💛 Discovery Health Oncology Benefit | After Discovery Health approves your cancer treatment, the Oncology Care Program covers you. Discovery Health will cover approved cancer treatment for 12 months. The First R250,000 is covered. Discovery Health will cover up to 80% of your treatment costs if they exceed the coverage amount. Discovery Health’s network covers cancer treatment. Discovery Health Rate covers 100% of cancer-related healthcare services (DHR). If your doctor charges more, you may have a co-payment. |

| 🟨 Discovery Health Oncology Innovation Benefit | Subject to the Scheme’s clinical entry criteria, the Oncology Innovation Benefit covers a subset of innovative cancer medicine. The member must cover 50% of these treatments. |

| 🟡 Discovery Health – Covering Medicine | To avoid a 20% co-payment, get your approved oncology medicine from a DSP on the Scheme’s medicine list. Ask your doctor if they use the Scheme’s DSPs for your in-room or facility treatment. |

| 🥰 Discovery Health Advanced Illness Benefit | Members receive comprehensive palliative care. This program covers unlimited home care, care coordination, counseling, and supportive care for appropriate end-of-life clinical and psychologist services. Your palliative care treatment plan includes GP consultations. |

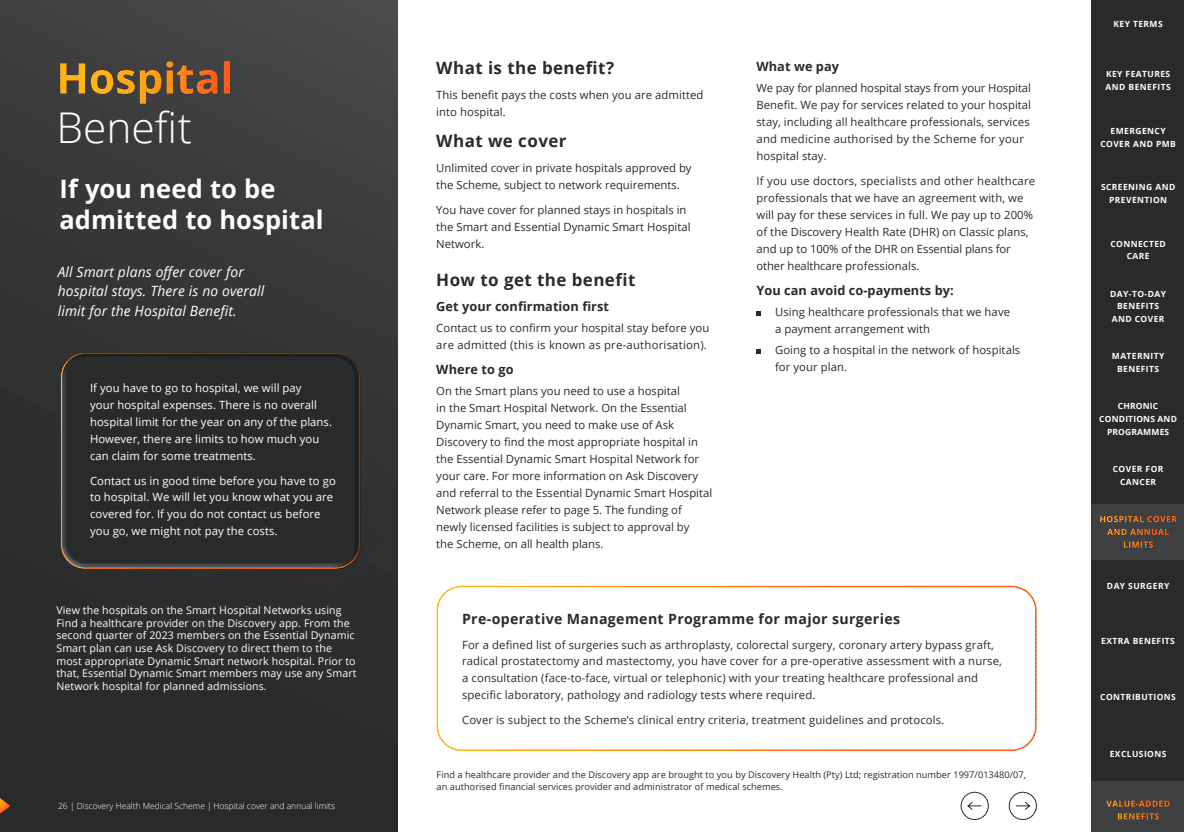

Discovery Health Hospital Benefit

The Essential Smart includes hospitalization coverage. Furthermore, there is no limit on the total amount covered by the Hospital Benefit.

- ✅ If you require hospitalization, Discovery Health will cover your hospital bills.

- ✅ There is no annual overall hospital limit on any of the plans. However, there are maximum reimbursement amounts for certain treatments.

- ✅ Discovery Health may not cover the expenses if you do not contact the scheme before being discharged.

The following table summarises how Discovery Health pays for approved hospital admissions within Essential Smart.

| 🔴 Healthcare Providers and Services | What Discovery Health pays on the Essential Smart |

| 🟠 The Hospital Account | The full hospital-agreed account is settled. For planned admissions to non-Smart Plan Hospital Network hospitals, there is an R11,000 upfront charge. |

| 🟡 Upfront Payment for a defined list of procedures that are performed outside the Day Surgery Network | R11,650 upfront charge. |

| 🟢 A defined list of procedures that are performed in a specialist’s room | Covered according to the Scheme-approved rate. |

| 🔵 Specialists with whom Discovery Health has an arrangement | The entire account will be paid according to the agreed-upon rate. |

| 🟣 Specialists with whom Discovery Health does not have an arrangement | Covered up to 200% Discovery Health Rate (DHR). |

| ⚪ Radiology and Pathology | Covered up to 100% of the Discovery Health Rate (DHR). |

| ⚫ MRI and CT scans | Discovery Health will cover your scan up to the Discovery Health Rate (DHR) (100%) from your Hospital Benefit if related to your admission. If your treatment is not related to your admission or for conservative back and neck treatment, you will be required to pay . Conservative spine and neck scans are limited to one per region. |

✅ Essential Smart Scopes

You are responsible for the following amount depending on where your scope is performed. Your Hospital Benefit will cover the remaining hospital and related charges.

| 🟥 Medical Aid Plan | 🟧 Day Clinic Account | 🟨 Hospital Account |

| 🟩 Essential | R4,300 | This co-payment will be reduced from R7,350 to R6,100 if performed by a doctor in the Scheme’s value-based network. |

| 🟦 If a gastroscopy and colonoscopy are performed during the same admission | – | – |

| 🟪 Essential | R5,250 | This co-payment will be reduced from R9,150 to R7,600 if performed by a doctor in the Scheme’s value-based network. |

Furthermore, the following will apply to the scopes of the Essential Smart:

- When a scope is performed outside of the Smart Day Surgery Network, a one-time payment of R11,650 is required.

If scopes are performed in the doctor’s office as part of a confirmed Prescribed Minimum Benefits (PMB) condition or if the patient is under 12 years old, no upfront payment is required. Furthermore, the Hospital Benefit covers the bill.

Discover what is hospital plans

Discovery Health Annual Limits

| 🦻 Cochlear Implants, Auditory Brain Implants, and processors | R244,000 per person per benefit |

| 🧬 Internal Nerve Stimulators | R185,550 per person |

| 🩹 Major Joint Surgery | No limit for planned hip and knee joint replacements if you use a provider in the network, or up to 80% of the Discovery Health Rate (DHR) if you use a provider outside the network, up to R30,900 per prosthesis per admission. Emergency and trauma surgeries are excluded from the network. |

| 🦾 Shoulder Joint Surgery | If you use a provider outside the network, you can pay up to R45,550 for your prosthesis. |

| 🍹 Alcohol and Drug Rehabilitation | Discovery Health will cover 21 days of rehabilitation per person per year. Three days for detoxification per approved admission. |

| 🧠 Mental health | Twenty-one days for admissions or 15 out-of-hospital consultations per person for major affective disorders, anorexia, and bulimia, and 12 for acute stress disorder with recent significant trauma. Three days for attempted suicide admissions. Other mental health admissions are 21 days. Network facilities cover all mental health admissions. If you go elsewhere, the Scheme will pay up to 80% of the Discovery Health Rate (DHR) for the hospital account. |

| ✅ Prosthetic Devices used during Spinal Surgery | The preferred prosthesis suppliers have no limit. If you do not use a preferred supplier, the first level is R17,500, and two or more levels are R35,000, limited to one procedure per person per year. The spinal surgery network covers approved spinal surgery admissions. The hospital account will receive up to 80% of the Discovery Health Rate (DHR) for planned admissions outside the Scheme’s network. |

| 🦷 Dental Treatment in the hospital | Dental Limit: No overall dental limit. However, you must pay for all dental appliances, prostheses, orthodontic treatment, and orthognathic surgery accounts. Severe Dental and Oral Surgery In-Hospital: The Severe Dental and Oral Surgery Benefit covers procedures without upfront payment or limit. This benefit requires authorization and Scheme Rules. Basic Dental Trauma: The Basic Dental Trauma Benefit covers unexpected dental injuries requiring emergency treatment after an accident. Dental appliances, prostheses, and placement are covered up to R65,150 per person per year if clinical entry criteria are met. Dental Treatment In-Hospital: Dental admissions require prepaying your hospital or day clinic bill, except for severe dental and oral surgery. Age and treatment location determine this amount. Your Hospital Benefit pays the hospital bill up to 100% of the Discovery Health Rate (DHR). In addition, your Hospital Benefit covers related bills, including the dentist’s, up to 100% of the Discovery Health Rate (DHR). Anesthetists receive 200% of the Discovery Health Rate (DHR). Members 13 and older must pay for routine conservative dentistry like preventive care, fillings, and root canals. Upfront Payments for Dental Admission: Hospital Account – R8,250 for members 13> and R3,200 for members <13 Day Clinic Account – R5,300 for members 12> and R1,450 for members <13 |

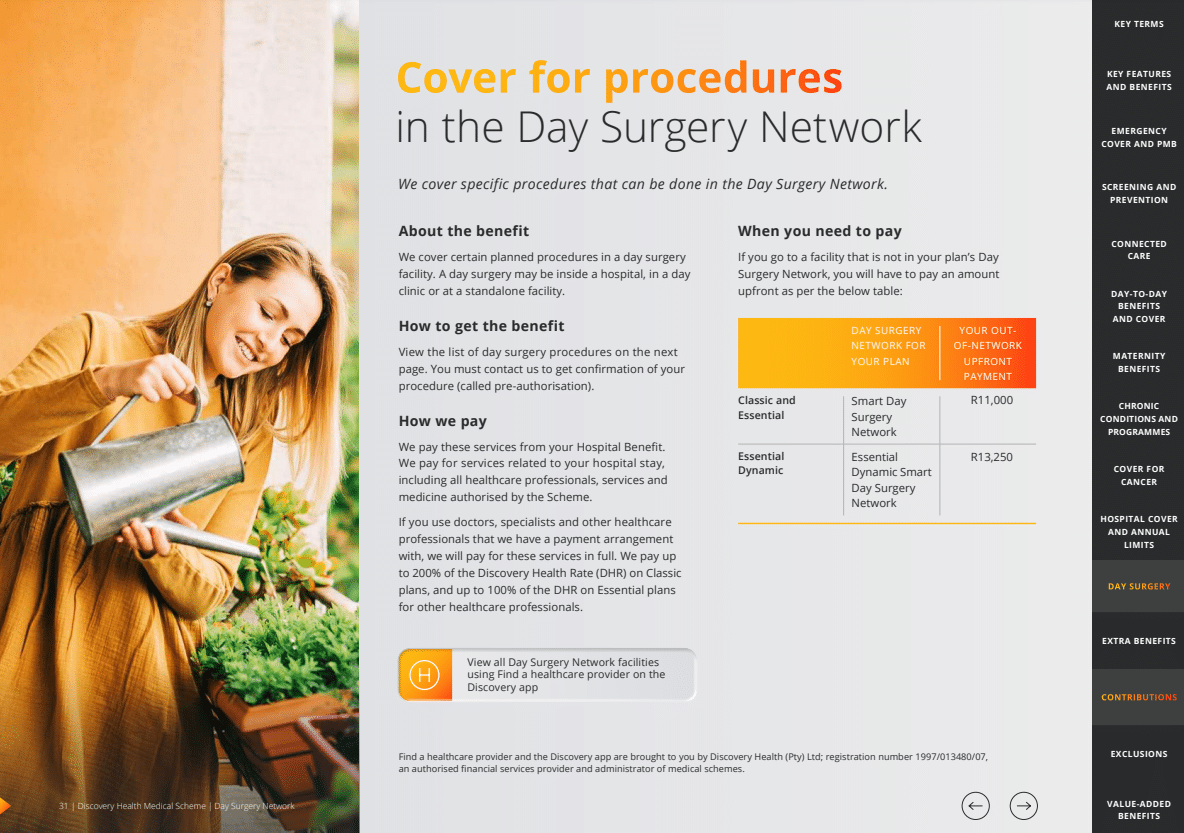

Discovery Health Smart Cover for Day Surgery Network Procedures

Discovery Health will provide cover for certain day surgery procedures. A day surgery may take place in a hospital, a day clinic, or an independent facility. Furthermore, these services are covered by your Hospital Benefit. Discovery Health will pay for hospitalization-related services, including all authorized healthcare professionals, services, and medications. Utilise physicians, specialists, and other healthcare professionals with whom Discovery Health will have a payment arrangement. Discovery Health will cover the full cost of these services.

- ✅ On Essential Smart plans, Discovery Health will pay up to 100% of the Discovery Health Rate (DHR).

If you visit a facility not in your plan’s Day Surgery Network, you must pay a co-payment according to the table below.

| 1️⃣ Medical Aid Plan | 2️⃣ Day Surgery Network for Your Plan | 3️⃣ Your Out-of-Network Upfront Payment |

| Essential Smart | Smart Day Surgery Network | R11,650 |

The following list provides the procedures that can be performed in a Discovery Health Day Surgery Network:

- ✅ Biopsies

- ✅ Breast Procedures

- ✅ Ear, nose, and throat procedures

- ✅ Eye Procedures

- ✅ Ganglionectomy

- ✅ Gastrointestinal scopes and procedures

- ✅ Gynecological Procedures

- ✅ Orthopedic Procedures

and many more.

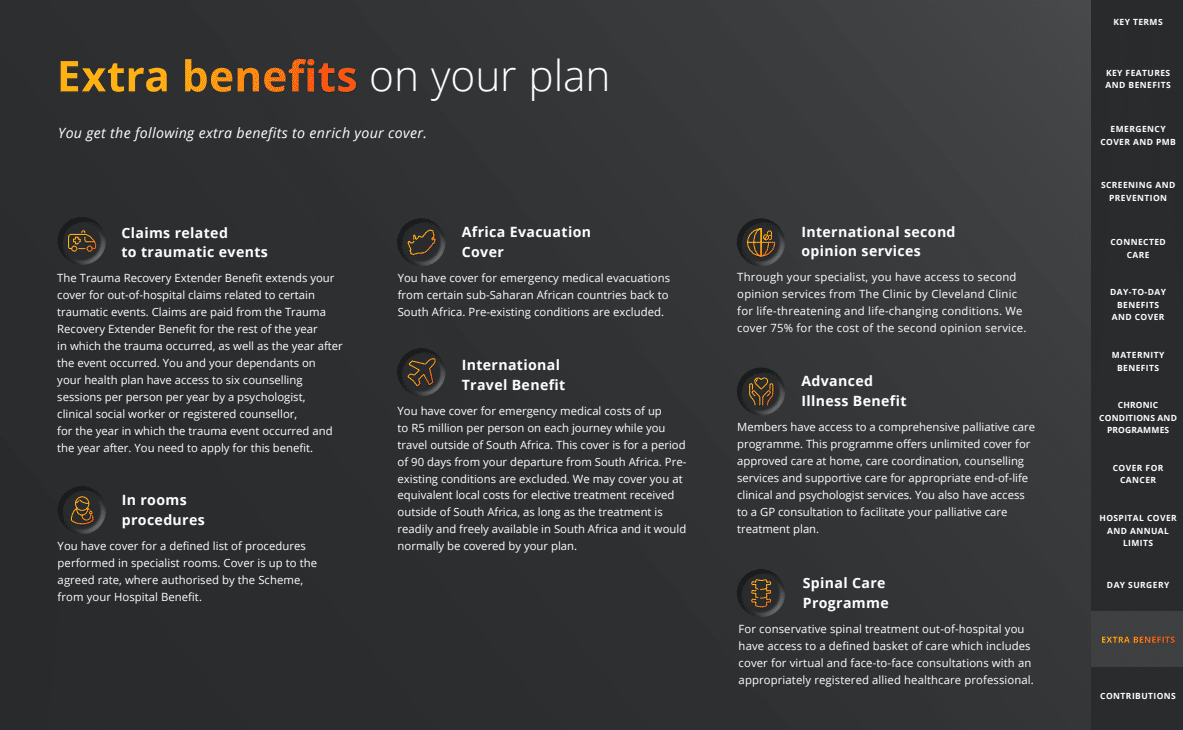

Discovery Health Smart Additional Benefits

✅ Claims Relating to Traumatic Events

- Trauma Recovery Extender Benefit covers out-of-hospital trauma claims.

- The Trauma Recovery Extender Benefit pays claims for the rest of the year and the year after.

- For the year when the trauma occurred and the year after, you and your dependents on your health plan can receive six counseling sessions per person per year from a psychologist, clinical social worker, or registered counselor.

- To qualify, members must apply for this benefit.

✅ Africa Evacuation Cover

- Emergency medical evacuations from sub-Saharan African countries to South Africa are covered.

- Excludes pre-existing conditions.

✅ International Travel Benefit

- While traveling outside South Africa, you are covered for emergency medical costs up to R5 million per person.

- The cover lasts 90 days after leaving South Africa.

- This benefit excludes pre-existing conditions.

- Suppose the elective treatment is freely available in South Africa and covered by your plan. In that case, Discovery Health might cover it at equivalent local costs.

✅ International Second Opinion Services

- The Clinic by Cleveland Clinic provides second opinions for life-threatening and life-changing conditions through your specialist.

- Discovery Health will pay 75% for second opinions.

✅ Spinal Care Program

- Conservative spinal treatment out-of-hospital includes virtual and face-to-face consultations with an appropriately registered allied healthcare professional.

✅ In-Room Procedures

- The cover is limited to specialist room procedures.

- Hospital Benefit covers up to the Scheme-authorised rate.

✅ Advanced Illness Benefit

- Members receive comprehensive palliative care.

- This program covers unlimited home care, care coordination, counseling, and supportive care for appropriate end-of-life clinical and psychologist services.

Your palliative care treatment plan includes GP consultations.

Discovery Essential Smart Value-Added Offers

- ✅ Healthy Care at Clicks or Dis-Chem offers discounts on personal and family products. Healthy Care includes baby care, dental care, eye care, foot care, sun care, hand care, first aid, and over-the-counter medicine.

- ✅ Your plan’s optometrists offer 20% off frames and lenses when you pay immediately.

- ✅ Expectant parents can cryogenically store their newborn baby’s umbilical cord blood and tissue stem cells at a discounted rate with Netcells’ exclusive offer.

- ✅ Vitality, the world’s leading science-based wellness program, rewards healthy living. As a result, Discovery Vitality members live longer and healthier lives.

Discovery Health collaborates with myHealthTeam, a global leader in online patient communities. This gives members with diabetes, heart disease, and long-term COVID access to a digital community of patients to manage their conditions.

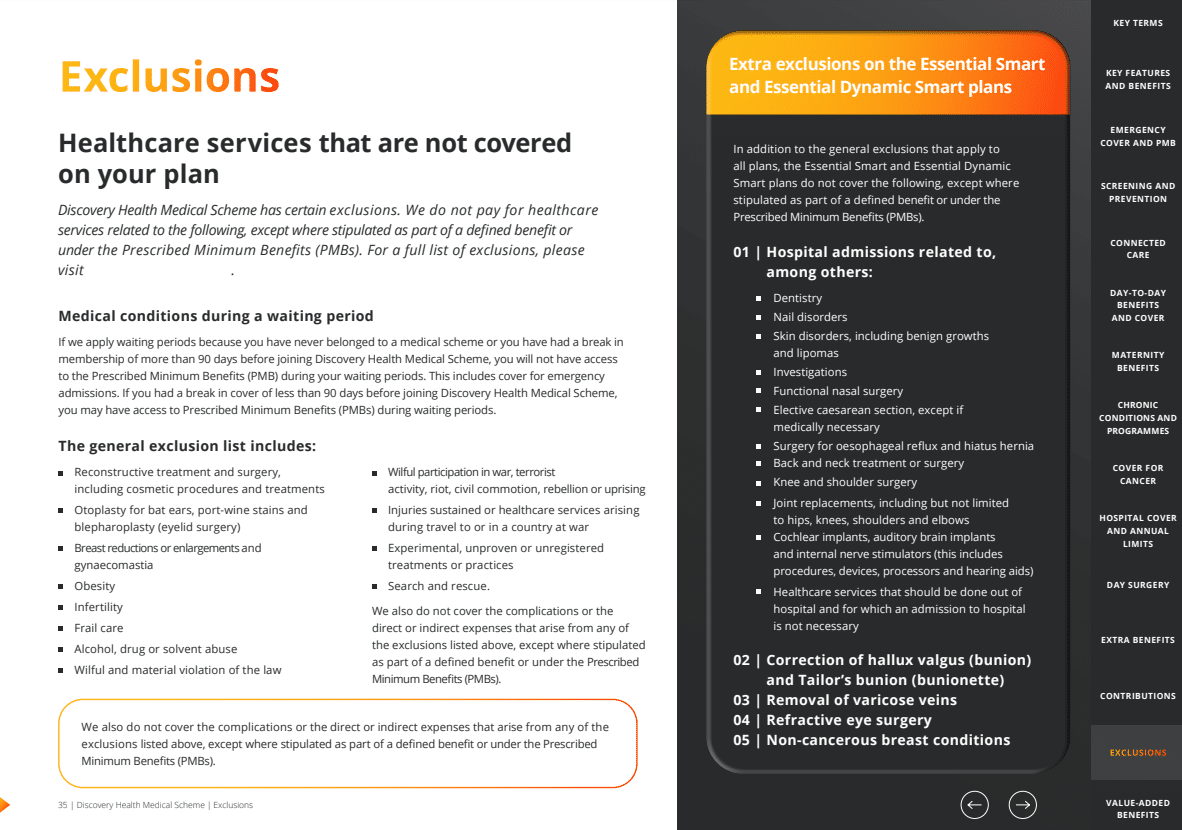

Discovery Health Essential Smart Exclusions and Waiting Periods

Discovery Health Essential Smart Exclusions

- Reconstructive surgical procedures and treatments, including cosmetic procedures and treatments.

- Otoplasty for bat ears, blepharoplasty, and port-wine stains (eyelid surgery).

- Breast reductions or augmentations and gynecomastia are considered cosmetic procedures.

- Obesity

- Unless included in Prescribed Minimum Benefits (PMBs) or Assisted Reproductive Therapy, infertility is not covered (ART) Benefit.

- Frail care

- Abuse of alcohol, drugs, or solvents.

- Willful and significant infraction of the law.

- Willful participation in a war, a terrorist act, a riot, a civil disturbance, a revolt, or an uprising.

- Injuries incurred or medical care rendered during travel to or within a country at war.

- Experimental, unproven, or unregistered treatments or practices.

- Rescue and search.

Additional exclusions that only apply to the Essential Smart include hospitalizations caused by the following, among other things:

- Dentistry

- Nail disorders

- Skin conditions, such as benign growths and lipomas

- Investigations

- Functional nasal surgery

- Elective cesarean section, unless medically required

- Hiatus hernia and esophageal reflux surgery.

- Back and neck surgery or treatment

- Knee and shoulder operations

- Arthroscopy

and many more.

Discovery Health Essential Smart Waiting Periods

The waiting periods are as follows:

- During your waiting periods, you will not have access to the Prescribed Minimum Benefits (PMBs) if you are subject to waiting periods due to never having belonged to a medical scheme or a break in membership of more than 90 days before joining Discovery Health Medical Scheme, including emergency admission cover.

If you had less than a 90-day break in cover before enrolling in Discovery Health Medical Scheme, you might be eligible for Prescribed Minimum Benefits (PMBs) during waiting periods.

Discovery Health Essential Smart Plan vs Similar Plans from Other Medical Schemes

| 🔎 Medical Aid Plan | 🥇 Discovery Health Essential Smart | 🥈 Medihelp MedVital Elect | 🥉 Bankmed Basic |

| 👤 Main Member Contribution | R1,881 | R2,022 | R1,320 – R2,538 |

| 👥 Adult Dependent Contribution | R1,881 | R1,470 | R987 – R1,902 |

| 🍼 Child Dependent Contribution | R1,881 | R852 | R332 – R636 |

| 🔁 Gap Cover | ✅ Yes | None | None |

| 💙 Hospital Cover | Unlimited | Unlimited | Unlimited |

| ✔️ Screening and Prevention | ✅ Yes | ✅ Yes | ✅ Yes |

| 💶 Medical Savings Account | None | None | None |

| 👶 Maternity Benefits | ✅ Yes | ✅ Yes | ✅ Yes |

| 🏠 Home Care | ✅ Yes | None | ✅ Yes |

Our Verdict on Discovery Health Essential Smart

The Discovery Health Essential Smart plan is good for those who want a more affordable medical aid plan that still provides comprehensive coverage for essential healthcare needs. The plan offers unlimited hospital coverage, chronic medication coverage, and day-to-day benefits such as GP visits, specialist consultations, and basic dentistry. One of the key benefits of the Essential Smart Plan is its affordability, with a lower monthly premium compared to the more comprehensive Classic Smart Plan. This makes it a good option for those on a tighter budget who still require comprehensive coverage.

Other Discovery Health Smart Series plans:

You might also like: Discovery Health Classic Smart

You might also like: Discovery Health Essential Dynamic Smart

Discovery Health Essential Smart Frequently Asked Questions

What is the Discovery Health Essential Smart plan?

The Discovery Health Essential Smart plan is a medical aid plan that provides comprehensive coverage for essential healthcare needs, including unlimited hospital coverage, chronic medication coverage, and day-to-day benefits such as GP visits, specialist consultations, and basic dentistry.

How does the Essential Smart plan differ from other Discovery Health plans?

The Essential Smart plan is more affordable than other Discovery Health plans, offering comprehensive coverage for essential healthcare needs while keeping costs low.

Does the Essential Smart plan cover chronic medication?

Yes, the Essential Smart plan covers the chronic medication, ensuring members can manage their chronic conditions without worrying about the cost.

Does the Essential Smart plan cover basic dentistry?

Yes, the Essential Smart plan includes basic dentistry coverage, providing members with essential dental care such as check-ups, fillings, and extractions.

What is the monthly premium for the Essential Smart plan?

The monthly premium for the Essential Smart plan starts from R1,881 for the main member per adult and child dependent.

Does the Essential Smart plan cover maternity benefits?

Yes, the Essential Smart plan includes several maternity benefits in and out-of-hospital. Furthermore, Discovery Health also offers a maternity program to existing members when they declare their pregnancy.

Does the Essential Smart plan include a wellness program?

Yes, the Essential Smart plan, like all other Discovery Health medical aid plans, includes a wellness program.

Does the Essential Smart plan cover major dental procedures such as orthodontics or implants?

No, the Essential Smart plan does not cover major dental procedures such as orthodontics or implants. However, Discovery Health offers other plans that provide more comprehensive dental coverage.

You might also like

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans