Principle Member

From R5667

Dependant Member

From R5352

Child Dependant

From R1134

Essential Delta Comprehensive

The Essential Delta Comprehensive plan may be a suitable choice for individuals seeking a comprehensive medical aid plan with unique features.

★★★★★ 4.5/5

Chronic Cover:

Day-to-Day:

Preventative Care:

Cancer Cover:

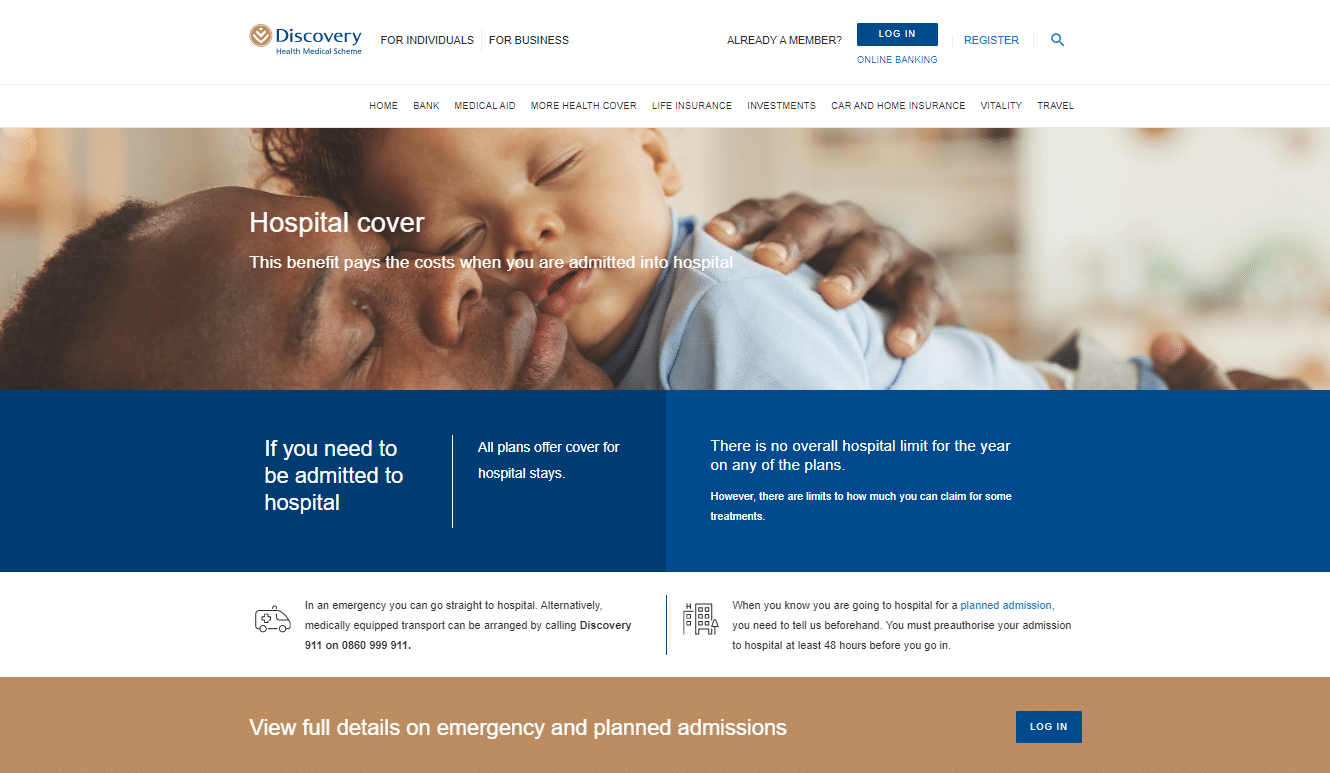

Hospitalisation:

Maternity Benefits:

The Essential Delta Comprehensive plan may be a suitable choice for individuals seeking a comprehensive medical aid plan with unique features.

Tax Deductible:

Travel Cover:

Essential Delta Comprehensive

The Essential Delta Comprehensive plan may be a suitable choice for individuals seeking a comprehensive medical aid plan with unique features.

★★★★★ 4/5

Principle Member

From R5667

Dependant Member

From R5352

Child Dependant

From R1134

Chronic Cover:

Day-to-Day:

Preventative Care:

Cancer Cover:

Hospitalisation:

Maternity Benefits:

The Essential Delta Comprehensive plan may be a suitable choice for individuals seeking a comprehensive medical aid plan with unique features.

Tax Deductible:

Travel Cover: