- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Medihelp MedSaver Medical Aid Plan

Overall, the Medihelp MedSaver Medical Aid Plan is a trustworthy and comprehensive medical aid plan that offers emergency cover in and outside South Africa to up to 3 Family Members. The Medihelp MedSaver Medical Aid Plan starts from R3,516 ZAR.

| 👤 Main Member Contribution | R3,516 |

| 👥 Adult Dependent Contribution | R2,892 |

| 💙 Child Dependent Contribution | R1,080 |

| 📉 Annual Limit | Unlimited Hospital Cover |

| ⚕️ Hospital Cover | Unlimited |

| 💶 Prescribed Minimum Benefits | ☑️ Yes |

| ✔️ Screening and Prevention | ✅ Yes |

| ☑️ Medical Savings Account | ☑️ Yes |

| ✅ Home Care | ✅ Yes |

| 🧠 Mental Healthcare Program | ☑️ Yes |

Medihelp MedSaver Plan – 12 Key Point Quick Overview

- ☑️ Medihelp MedSaver Plan Overview

- ☑️ Medihelp MedSaver Plan Contributions and Medical Savings

- ☑️ MedSaver Plan Benefits and Cover Comprehensive Breakdown

- ☑️ MedSaver Day-to-Day Benefits

- ☑️ Medihelp MedSaver Benefit Table

- ☑️ MedSaver Hospitalization and Advanced Treatment

- ☑️ MedSaver Emergency Benefits

- ☑️ MedSaver Added Insured Benefits

- ☑️ Medihelp MedSaver Plan Exclusions and Waiting Periods

- ☑️ Medihelp MedSaver Plan vs. Similar Plans from other Medical Schemes

- ☑️ Our Verdict on The MedSaver Plan

- ☑️ MedSaver Plan Frequently Asked Questions

Medihelp MedSaver Plan Overview

The Medihelp MedSaver medical aid plan is one of 11, starting from R3,516 and includes emergency cover in and outside South Africa, advanced treatment benefits, basic and advanced dentistry, optometry, maternity, HIV/AIDS, diabetes care, and more. Gap Cover is not available on the Medihelp MedSaver Plan. However, Medihelp offers 24/7 medical emergency assistance. According to the Trust Index, Medihelp has a trust rating of 4.2.

MediHelp has the following 11 plans to choose from:

- ✅ MediHelp Medprime

- ✅ MediHelp MedPrime Elect

- ✅ MediHelp MedPlus

- ✅ MediHelp MedElite

- ✅ MediHelp MedVital

- ✅ MediHelp MedVital Elect

- ✅ MediHelp MedSaver

- ✅ MediHelp MedMove

- ✅ MediHelp MedElect

- ✅ MediHelpMedAdd

- ✅ MediHelp MedAdd Elect

Medihelp MedSaver Plan Contributions and Medical Savings

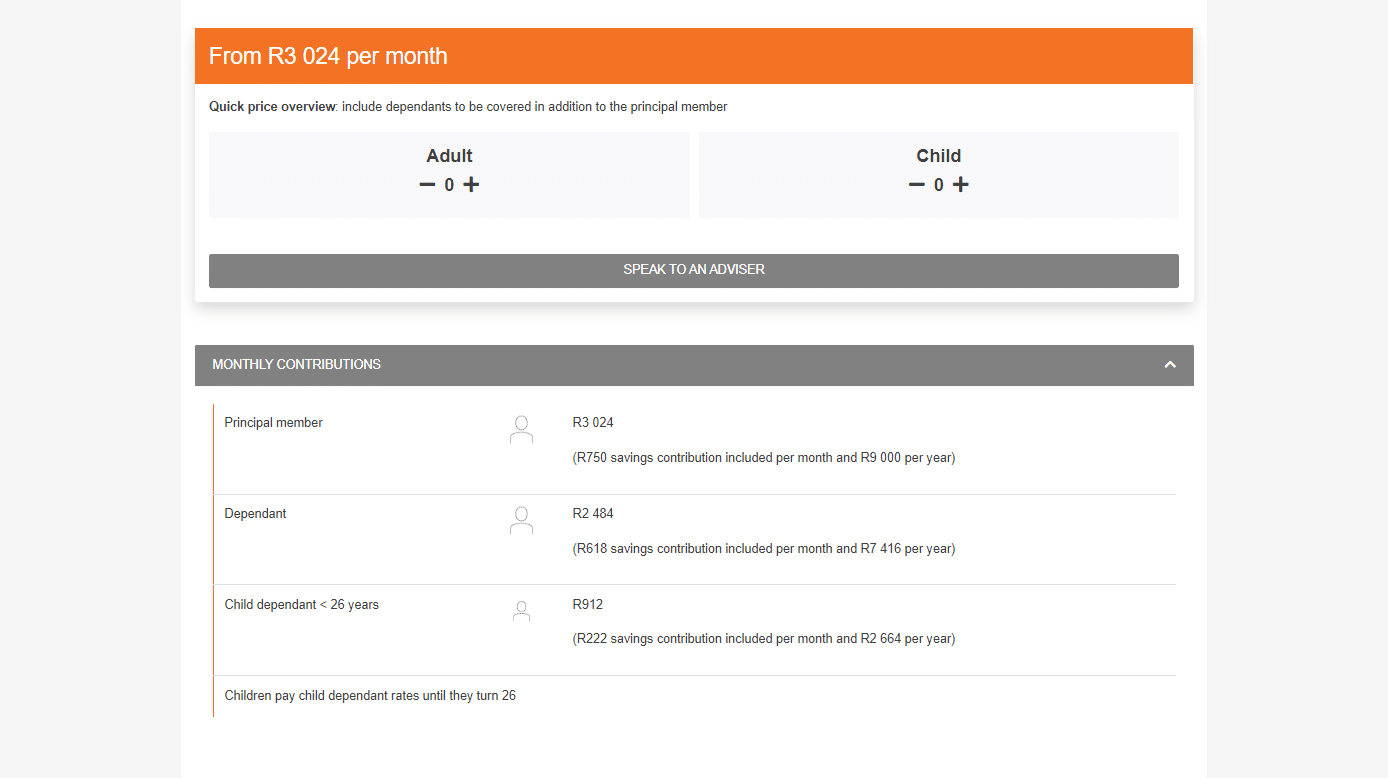

Contributions

| 👤 Main Member | 👥 +1 Adult Dependent | 🍼 +1 Child Dependent |

| R3,516 | R2,892 | R1,080 |

Discover the 5 Best Medical Aids under R500

Medical Savings Account

| 👤 Main Member | 👥 +1 Adult Dependent | 🍼 +1 Child Dependent |

| R876 per month / R10,512 per year | R720 per month / R8,640 per year | R270 per month / R3,240 per year |

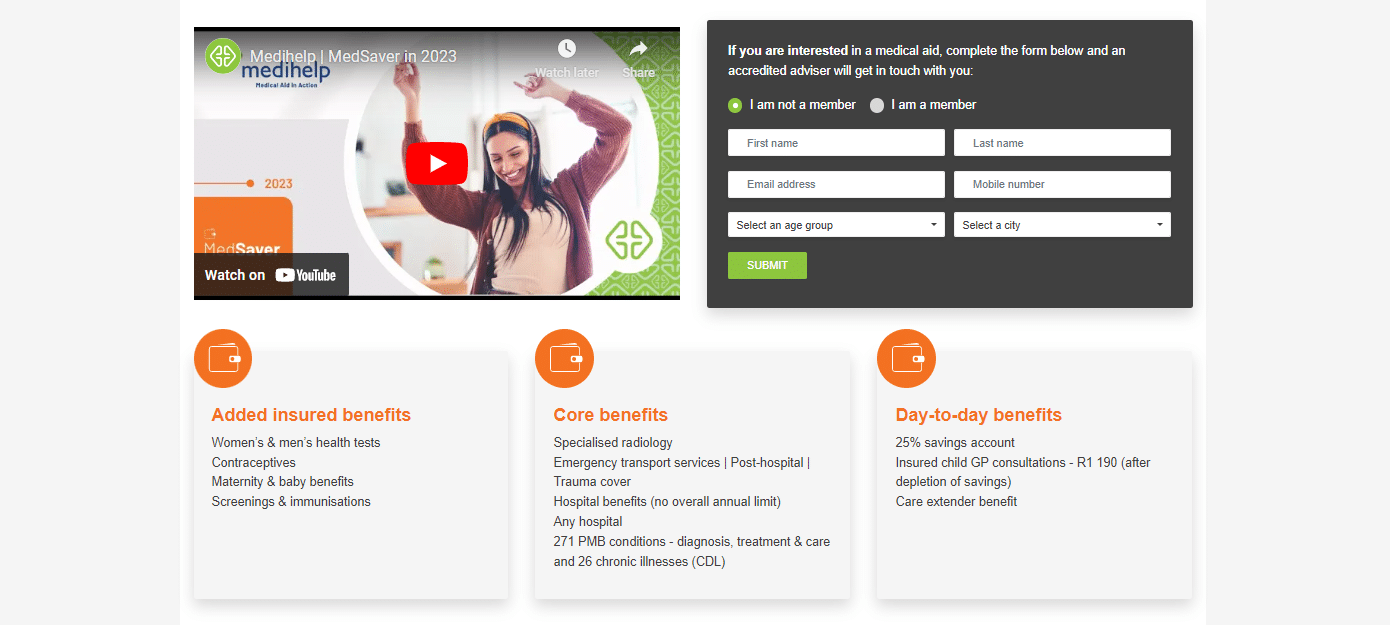

MedSaver Plan Benefits and Cover Comprehensive Breakdown

MedSaver Accumulative Unused Savings Contributions

MedSaver is a handy credit option that allows you to immediately access the cash in your medical savings account for the current year. In addition, any unused money is carried forward and earns interest the next year. Each month, a portion of your contributions equal to 25% is allocated to a savings account as follows:

- This amounts to R876 per month or R10,512 per year for the principal member.

- Adult dependents receive R720 per month or R8,640 per year.

- Child dependents receive R270 per month or R3,240 per year.

- These savings are intended to cover daily medical expenses.

- At the start of each year, the entire year’s contributions to the savings account become available as a credit facility.

- Any funds that are not used are carried forward to the following year.

- The remaining portion of your monthly contributions is used to fund your comprehensive core and insured benefits.

How Medihelp pays claims on MedSaver

- Except for services relating to prescribed minimum benefits (PMB), qualifying claims are paid from the savings account first until the account is empty.

- Claims are then reimbursed until the insured’s daily benefits are exhausted. PMB services are paid from day-to-day benefits until depleted, then from core benefits without limitation.

Discover the 5 Best Hospital Plans under R2000 in South Africa

MedSaver Day-to-Day Benefits

Benefits are first paid from the available Medical Savings Account. Once funds are depleted, the following limits apply to day-to-day benefits:

- All claims are paid up to 100% of the Medihelp Tariff (MT).

- Main Members – limited to R1,700 per year.

- Main Member and Dependents – limited to R2,700 per year.

MedSaver Consultations

- GP appointments and follow-up appointments.

- Specialists

- Telemedicine, virtual consultations, and visits from nurses at network pharmacies.

- Pharmacies providing primary care and emergency units, including primary care drug therapists, in terms of consultations and follow-ups.

- Physiotherapy

- Hyperbaric oxygen treatment

- Clinical psychology and psychiatric nursing

- Other medical services

- Occupational and speech therapy, dietitian services, audiometry, podiatry, massage, orthoptic, chiropractic, homeopathic, herbal, naturopathic, osteopathic, and biokinetic services

- Standard radiology

- Pathology and medical technologist services (With Ampath as the Pathology DSP)

- Optometry

- Medicine (including acute and non-PMB chronic medicine, self-medication, and homeopathic medicine)

Medihelp MedSaver Benefit Table

| 📌 Care Extender: Additional GP Consultation | A beneficiary’s Pap smear, mammography, prostate test, FOBT, or bone mineral density test activates a family consultation benefit. |

| 📍 Care Extender: R475 for Self-Medication | After a beneficiary claims the combo health screening (blood glucose, cholesterol, BMI, and blood pressure measurement) at a preferred pharmacy clinic, the family will receive R475 for non-prescribed medicine. |

| 💊 PMB Chronic Medicine | Pre-approval and registration on Medihelp’s PMB drug management program are required. Covered up to 100% of the MHRP. The unlimited cover is provided. |

| 🅰️ Oxygen | Covered out-of-hospital. Subject to pre-approval and clinical protocols and must be prescribed by a medical doctor. Covered up to 100% of the MT. Unlimited cover. 20% co-payment if this benefit is not pre-approved before treatment. |

| 🅱️ Dentistry: Conservative Dental Services | Benefits are subject to Dental Risk Company (DRC) protocols, contracted to Medihelp as a DSP. Benefits are subject to protocols and are limited to certain item codes. |

| ☑️ Dentistry: Routine Check-ups | Covered up to 100% of the MT. Covered from available savings. Limited to two check-ups per beneficiary per year or per 6-month cycle. |

| ✅ Oral Hygiene | Scale and Polish Treatments: Covered up to 100% of the MT. Covered from available savings. Limited to two treatments per beneficiary per year or per 6-month cycle. Fluoride Treatment for children between 5 and 13: Covered up to 100% of the MT. Paid from the medical savings account. Limited to two treatments per beneficiary per year or per 6-month cycle. Fissure sealants for children between 5 and 16 (permanent teeth): Covered up to 100% of the MT. Paid from the medical savings account. |

| 🦷 Fillings | Treatment plans and x-rays might be requested where multiple fillings are necessary. Pre-approval is required for 4> fillings per year and 2 fillings on front teeth per visit. Covered up to 100% of the MT. Limited to 1 filling per tooth per year for beneficiaries <18. Fillings for beneficiaries 18> are paid from the available medical savings. |

| ➡️ Tooth Extractions and Root Canals on permanent teeth in the Dentist’s chair | Pre-authorization for 4> extractions in a single visit. Covered up to 100% of the MT. Covered from available savings. |

| ⚕️ Laughing Gas (Dentist’s Chair) | Covered up to 100% of the MT. Paid from the medical savings account. |

| 📈 Dentistry under conscious sedation (Dentist’s chair) | The benefit is only available for removing impacted teeth (3rd molars) Covered up to 100% of the MT 20% co-payment for no authorization. |

| 📉 Dentistry under general anesthesia in a day procedure facility, including the removal of impacted teeth | Covered up to 100% of the MT 35% co-payment for procedures not performed in a day procedure network. 20% co-payment for no authorization. |

| 📊 Extensive dental treatment for children <7 (only once per beneficiary yearly) | Covered up to 100% of the MT 20% co-payment for no authorization. Covered from the savings account. |

| 🔎 Special Needs Patients – dentistry under general anesthesia in a day procedure | Covered up to 100% of the MT 35% co-payment for procedures not performed in a day procedure network. 20% co-payment for no authorization. |

| 📌 Plastic Dentures | Covered up to 100% of the MT. Paid from the medical savings account. Limited to one set per beneficiary/4 years. |

| 📍 X-Rays | Intra-Oral X-Rays Covered up to 100% of the MT. Paid from available savings. Extra-Oral X-Rays Covered up to 100% of the MT. Paid from available savings. |

| ✳️ Specialized Dentistry | Subject to pre-authorization and DRC protocols. |

| 📊 Partial Metal Frame Dentures | Covered up to 100% of the MT. Paid from the savings account. 20% co-payment for no authorization. |

| 😊 Maxillofacial Surgery and Oral Pathology | Benefits for temporomandibular joint (TMJ) benefit limited to non-surgical treatment or interventions. Covered up to 100% of the MT. Paid from the savings account. 20% co-payment for no authorization. |

| 👑 Crowns and Bridges | Covered up to 100% of the MT. Paid from the savings account. 20% co-payment for no authorization. |

| ➡️ Dental Implants | Covered up to 100% of the MT. Paid from the savings account. 20% co-payment for no authorization. |

| 🔁 Orthodontic Treatment | Covered up to 100% of the MT. Paid from the savings account. Limited to once per beneficiary <18. Payment is made from the authorization date until the patient turns 18. |

| 📌 Periodontal Treatment | Covered up to 100% of the MT. Paid from the savings account. 20% co-payment for no authorization. |

| 🔎 Stoma Components Incontinence Products or Supplies | Covered up to 100% of the MT. |

MedSaver Hospitalization and Advanced Treatment

| ☑️ Chronic Illness and PMB | Subject to protocols, pre-authorization, DSPs, and the specialist network. Covered up to 100% of the cost or the contracted tariff. Unlimited cover provided. Co-payments can apply if not using a DSP or deviating from the code. |

| ☑️ Trauma Benefits This applies to major trauma requiring hospitalization, for example: Motor Vehicle Accidents Stab Wounds Gunshot Wounds Head Trauma Burns Near-drowning | Subject to authorization, PMB protocols, and case management. Covered up to 100% of the cost or the contracted tariff. |

| ☑️ Post-Exposure Prophylaxis (HIV/AIDS) | Subject to authorization, PMB protocols, and case management. Covered up to 100% of the cost or the contracted tariff. |

Emergency Transport Services via Netcare 911

In the Beneficiary’s Country of Residence (RSA, Lesotho, Eswatini, Mozambique, Namibia, Zimbabwe, Botswana), including road and air transport:

- Unlimited Cover.

- Covered up to 100% of the MT.

- If not pre-approved, a 50% co-payment applies.

Outside the beneficiary’s Country of Residence:

Road Transport

· Covered up to 100% of the MT.

· If not pre-approved, a 50% co-payment applies.

· Limited to R2,320 per case.

Air Transport

· Covered up to 100% of the MT.

· If not pre-approved, a 50% co-payment applies.

· Limited to R15,400 per case.

MedSaver Hospitalization

(Only MedSaver hospital and day procedure network can be used)

| ✅ Intensive Care and high-care wards Ward Accommodation Theatre fees Treatment and medicine in the ward In-hospital consultation with GPs and specialists Surgery Anesthesia | Unlimited Cover. Covered up to 100% of the MT. If not pre-approved, a 20% co-payment applies. Additional co-payments on certain procedures may apply. |

| ✅ Day Procedures (Including Ophthalmological, endoscopic, ear, nose, and throat procedures, dental procedures, removal of skin lesions, circumcisions, and procedures as pre-authorized) | Unlimited Cover. Covered up to 100% of the MT. If not admitted to a hospital/day procedure facility in the network, a 35% co-payment applies. Additional co-payments on certain procedures may apply. |

| ✅ Hospital Medicine upon Discharge | Covered up to 100% of the MT. There is an R390 limit per admission. |

MedSaver Childbirth Benefit

Subject to pre-authorization, protocols, and case management

- Unlimited Cover.

- Covered up to 100% of the MT.

- If not pre-approved, a 20% co-payment applies.

Radiology, Pathology, and Medical Technologist Services

- In-Hospital cover only.

- Subject to clinical protocols and approved hospital admission.

- Members must use Ampath as the contracted Pathology DSP.

| 📈 Radiography | Covered up to 100% of the MT. Limited to R1,210 per family yearly. |

| 📊 Clinical Technologist Services | Covered up to 100% of the MT. Unlimited Cover. |

| 🏥 In-hospital Oxygen | Covered up to 100% of the MT. Unlimited Cover. |

| ➡️ Hyperbaric Oxygen Treatment in the hospital | Limited to R800 per family per year. |

| ✅ Renal Dialysis Acute Renal Dialysis Chronic/Peritoneal Renal Dialysis | Covered up to 100% of the MT. Unlimited Cover. Subject to pre-authorization and clinical protocols. 20% co-payment if not pre-approved. |

| ☑️ Post-Hospital Care Speech therapy, occupational therapy, and physiotherapy 30 days after discharge | Accessible day-to-day benefits cover prescription medication and medical equipment. Covered up to 100% of the MT. Limited to the following: Main Member – R2,100 per year. Main Member + Dependents – R3,000 per year. |

| 🔁 Other Medical Services Dietitian services, physiotherapy, and occupational therapy Speech therapy Audiometry and orthoptic services Podiatry | In-hospital protocols might apply. Covered up to 100% of the MT. Unlimited Cover. |

| 📌 Psychiatry Psychiatrist-provided hospital and outpatient treatments General ward accommodations Institution-supplied medication Outpatient consultations | Covered up to 100% of the MT. Limited to R27,600 per beneficiary per year, with a limit of R38,000 per family per year. If not pre-approved, a 20% co-payment applies. |

| ✔️ Oncology: Non-PMB Cases | Covered up to 100% of the MT. Limited to R262,000 per family per year. 10% co-payment on non-DSP treatment. 20% co-payment for deviating from protocol. |

| ✳️ Hospice Services and Subacute Care Facilities | Covered up to 100% of the MT. 20% co-payment if not pre-authorized Unlimited cover. |

| 🅰️ Palliative Care | Covered up to 100% of the MT. 20% co-payment if not pre-authorized Limited to R24,000 per family per year. |

| 🅱️ Private Nursing | Covered up to 100% of the MT. 20% co-payment if not pre-authorized Unlimited cover. |

| 🩺 Appendectomy: Conventional or Laparoscopic Procedure | Unlimited cover. Covered up to 100% of the MT. |

| 🧪 Prostatectomy: Conventional or Laparoscopic Procedure | Member pays the first R6,600 per admission. Covered up to 100% of the MT. |

MedSaver Emergency Benefits

A medical emergency is a sudden and unexpected occurrence that necessitates quick medical or surgical treatment to safeguard a patient’s health. Failure to offer medical or surgical treatment would result in severe impairment of bodily functioning or severe dysfunction of a bodily organ or portion or jeopardize the individual’s life. Netcare 911 is the designated service provider for Medihelp’s emergency transport services, and you must contact them in an emergency. Phone 082 911. Furthermore, you may also seek assistance at the nearby hospital’s emergency room. However, the following conditions apply:

- Emergency admissions must be reported to Medihelp on the following business day by calling 086 0200 678.

- If you visit an emergency facility but are not hospitalized, the care you receive will be covered by your regular plans.

- Facilities costs are not included.

Emergency Transport Services via Netcare 911

In the Beneficiary’s Country of Residence (RSA, Lesotho, Eswatini, Mozambique, Namibia, Zimbabwe, Botswana), including road and air transport:

- Unlimited Cover.

- Covered up to 100% of the MT.

- If not pre-approved, a 50% co-payment applies.

Outside the beneficiary’s Country of Residence:

Road Transport

- Covered up to 100% of the MT.

- If not pre-approved, a 50% co-payment applies.

- Limited to R2,320 per case.

Air Transport

- Covered up to 100% of the MT.

- If not pre-approved, a 50% co-payment applies.

- Limited to R15,400 per case.

MedSaver Added Insured Benefits

- With a strong emphasis on preventative care, early diagnosis of potential health problems, and maternity benefits and childcare, these benefits are offered annually in addition to your insured benefits unless otherwise specified.

- Protocols and item codes may be applicable.

- Members can look for network provider information on Medihelp’s website or app using the provider search option.

- You can also sign up for HealthPrint, a free online health and fitness program offered by Medihelp, to activate the specified benefits.

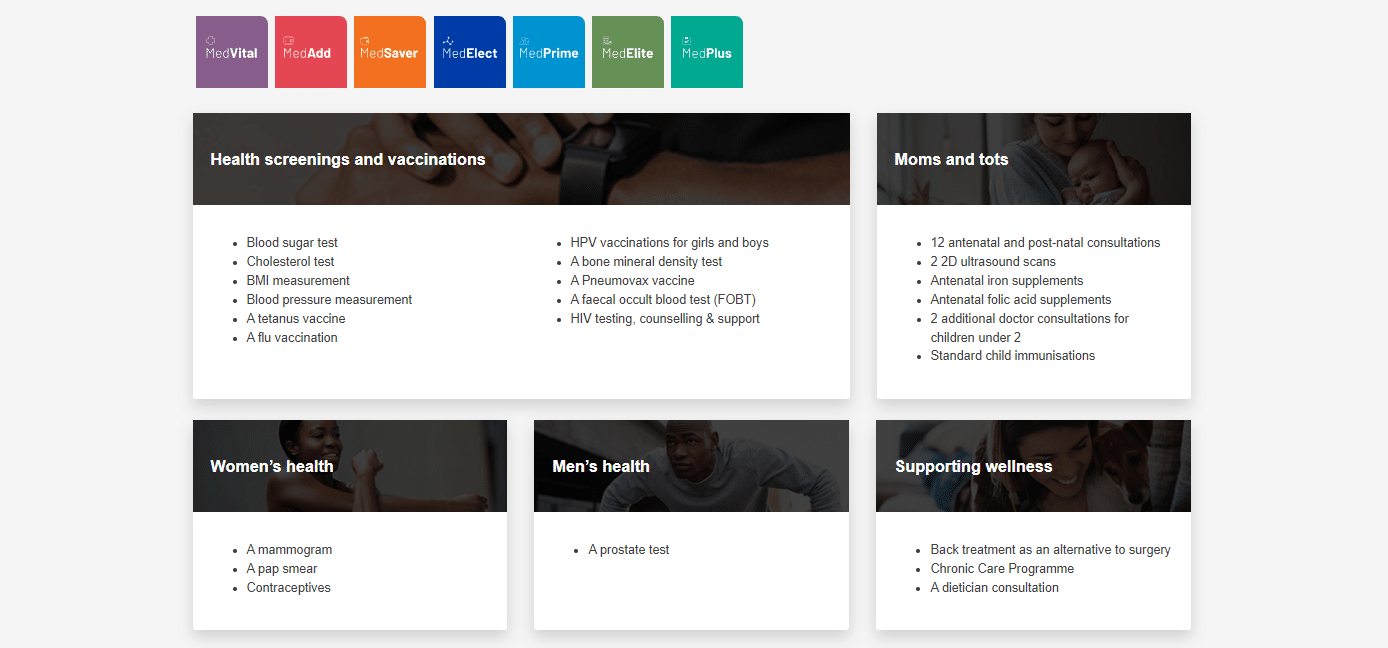

MedSaver Women’s Health

Mammogram

- For women 40 – 75 years old.

- Every two years.

- A medical doctor must request it.

Pap Smear

- For women 21 – 65 years old.

- Every three years.

- A medical doctor must request it.

Flu Vaccines

- Once yearly.

- It must be done at network pharmacy clinics.

Contraceptives

Oral, injectable, or implantable contraceptives

- Female beneficiaries up to 50 years.

- Covered up to R155 per month and up to R2,015 per beneficiary.

Intra-uterine devices for women up to 50 years

- Every 60 months.

- Covered up to R2,420 per beneficiary.

Enhanced Maternity Benefits

HealthPrint’s Maternity and Infant program registration will activate these additional benefits per family per year.

- Ten prenatal and postnatal consultations with a midwife, general practitioner, or gynecologist. However, a recommendation from a network GP to the gynecologist is not required.

- Two prenatal and postnatal visits to a lactation consultant, dietician, or antenatal classes.

- Two 2D ultrasound imaging.

Child Benefits

- Babies <2 years receive two additional visits to a general practitioner, pediatrician, or ear, nose, and throat specialist. However, a network Physician reference is not required to see these specialists.

- In network pharmacy clinics, the full series of regular child immunizations are covered for up to seven years.

- Vaccination of children against influenza at network pharmacy clinics.

Routine Screening and Immunization

- A combo test, including blood glucose, cholesterol, BMI & blood pressure measurement.

- Individual tests, including blood glucose or cholesterol.

- HIV testing, counseling & support

- A tetanus vaccine

- A flu vaccination

- Two HPV vaccinations for girls and boys between 10 – 14 years or three between 15 – 26 years

Men’s Health

- A prostate test (PSA level) was requested by a physician for men aged 40 to 75.

- Flu vaccination is administered at network pharmacies.

Screening and Immunization for beneficiaries 45>

- An FOBT test for recipients 45-75 years

- Women aged 65 and older can access one bone mineral density test every two years if requested by a physician.

- A Pneumovax vaccine on a 5-year cycle for each 55-year-old with asthma or COPD who is registered.

Wellness Support

- Back Treatment – this benefit covers back therapy at a DBC facility as an alternative to surgery for eligible patients. Moreover, treatment is a precondition for spinal surgery.

- One dietitian consultation with each registered HealthPrint member whose BMI is greater than 30 and whose BMI was determined by a BMI test.

- An oncology schedule is provided in conjunction with Independent Clinical Oncology Network oncologists (ICON)

- HIV program – Presented in partnership with LifeSense Disease Management

Care Extender Benefit

- Additional GP visit

- Once your increased insured benefits pay for a Pap smear, mammography, prostate test, FOBT, or bone mineral density test, the family will receive a one-time GP visit benefit.

- Test protocols will apply to this benefit.

- Self-Medication (R475)

- Once your enhanced insured benefits pay for a combo health screening (blood glucose, cholesterol, BMI, and blood pressure), the family will receive a one-time R475 for self-medication.

Medihelp MedSaver Plan Exclusions and Waiting Periods

Medihelp MedSaver Exclusions

As medical research advances, new medical services are introduced each year. However, Medihelp covers life-saving medical treatment first. The Medical Schemes Act requires medical schemes to cover the diagnostic, treatment, and care costs of the mandated minimum benefits (PMB) without co-payments or limits. Furthermore, services must follow legislation’s PMB treatment algorithms and Medihelp’s managed healthcare guidelines, which may include pharmaceutical formularies. Medihelp will cover the cost of a substitute treatment if a protocol or formulary drug is ineffective or hazardous. However, the Medihelp MedSaver plan excludes several items, including but not limited to the following.

- The treatment of infertility other than that specified in the Medical Schemes Act of 1998 Regulations

- The artificial insemination of a human, as defined in section 61 of the National Health Act of 2003

- Immunizations (including immunization processes and materials) required by an employer, excluding flu vaccinations and routine childhood immunizations

- Workout, coaching, and rehabilitation regimens

- The cost of extracting or conserving human tissues, including but not limited to stem cells, for future use in the treatment of an undiagnosed medical ailment in a beneficiary

- Pathology services requested by someone other than a physician

- Non-registered substances with the South African Health Products Regulatory Authority (SAHPRA).

- This does not apply to medicines exempted by section 21 of the Medicines and Related Substances Control Act (101 of 1965, as amended)

- Bandages, cotton wool, bandages, plasters, and similar items not utilized by a service provider during a treatment or procedure

- Food substitutes, food supplements, and prescription food, including infant food.

- Multivitamin and multimineral supplements alone or with stimulants (tonics)

- Appetite suppressants

- Cost of metal-based complete dentures, including laboratory fees

- Impact-resistant acrylic

- The expense of gold, precious metal, semi-precious metal, and platinum foil

- Laboratory delivery fees

- Blood pressure apparatus

- Commode

- Toilet seat raiser

- Home-use hospital beds

- Devices to improve vision, other than the stated eyeglass and contact lens benefits

Medihelp MedSaver Waiting Periods

During waiting periods, members are eligible for membership but not for benefits. For example, Medihelp could implement either a general or condition-specific waiting period as follows:

- The general waiting period is up to three months from the date of membership. During this time, you will not be eligible for benefits other than the minimum prescribed benefits (PMB). During this waiting period, the Scheme will not pay any claims you file.

- From the day you join, a condition-specific waiting period of up to 12 months applies. During this period, you will not be eligible for benefits related to a specific ailment for which you get medical advice, a diagnosis, care, or treatment (this excludes PMB).

Medihelp MedSaver Plan vs. Similar Plans from other Medical Schemes

| 🔎 Medical Aid Plan | 🥇 Medihelp MedSaver | 🥈 Momentum Incentive Plan | 🥉 Discovery Classic Delta Saver |

| 👤 Main Member Contribution | R3,516 | R2,794 | R3,342 |

| 👥 Adult Dependent Contribution | R2,892 | R2,206 | R2,640 |

| 💙 Child Dependent Contribution | R1,080 | R1,072 | R1,342 |

| 🌎 International Cover | None | Up to R8 million | R5 million |

| 📊 Annual Limit | Unlimited Hospital Cover | None | ☑️ Yes |

| 🏠 Home Care | ☑️ Yes | ☑️ Yes | ☑️ Yes |

| 🚑 Hospital Cover | Unlimited | Unlimited | Unlimited |

| 📉 Chronic Conditions | ☑️ Yes | ☑️ Yes | ☑️ Yes |

| 💳 Medical Savings Account | ☑️ Yes | ☑️ Yes | ☑️ Yes |

Our Verdict on The MedSaver Plan

Medihelp MedSaver is a medical aid savings plan offered by the Medihelp Medical Scheme in South Africa. It provides members with a savings account that can be used to pay for various medical expenses, including day-to-day healthcare costs and co-payments or deductibles. One of the key advantages of Medihelp MedSaver is that it can help members save money on their healthcare expenses and offers flexibility in how the savings account funds can be used. However, additional fees or charges may be associated with the plan, and the specific benefits and limitations may vary depending on the member’s medical aid plan.

You might also consider the following options of MediHelp:

- MediHelp HealthPrint

- MediHelp Medprime

- Medihelp MedPrime Elect

- MediHelp MedPlus

- MediHelp MedElite

- MediHelp MedVital

- MediHelp MedVital Elect

- MediHelp MedMove

- MediHelp MedElect

- MediHelpMedAdd

- MediHelp MedAdd Elect

MedSaver Plan Frequently Asked Questions

What is Medihelp MedSaver?

Medihelp MedSaver is a medical aid savings plan offered by the Medihelp Medical Scheme in South Africa. It is designed to help members save money on healthcare expenses by providing them with a savings account that can be used to pay for medical bills and services.

How does Medihelp MedSaver work?

Medihelp MedSaver works by providing members with a savings account that is used to pay for medical expenses. Furthermore, members can contribute to this account each month. The funds can be used to pay for day-to-day medical expenses or cover any co-payments or deductibles that may apply to their medical aid plan.

What are the benefits of Medihelp MedSaver?

The benefits of Medihelp MedSaver include saving money on healthcare expenses, access to a range of medical aid benefits, and the flexibility to choose how to use the savings account funds.

How do I become a member of Medihelp and enroll in MedSaver?

To become a member of Medihelp and enroll in MedSaver, you can visit the Medihelp website and follow the enrollment process. You will need to provide personal and contact information and information about your healthcare needs and preferences.

Can I use Medihelp MedSaver to pay for any medical expenses?

Medihelp MedSaver can pay for various medical expenses, including day-to-day medical expenses, co-payments, and deductibles. However, certain exclusions or limitations might apply depending on your specific medical aid plan.

You might also like

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans