5 Best Hospital Plans under R2000 in South Africa

The 5 Best Hospital Plans Under R2000 in South Africa revealed.

We tested them side by side and verified their hospital plans.

This is a complete guide to the best hospital plans under Two Thousand Rand in South Africa.

In this in-depth guide you’ll learn:

- What is a Hospital Plan?

- How do you find affordable hospital plans in South Africa?

- How to choose the best affordable hospital plan for your needs?

- Which hospital plans are the cheapest under R2000?

- Hospital plan vs Medical Aid.

- Does Capitec have a hospital plan? Answer is NO.

- What are the cheapest hospital plans in South Africa in 2024 that suits your pocket?

So if you’re ready to go “all in” with the best hospital plans under R2000 in South Africa, this guide is for you.

Let’s dive right in…

Best Hospital Plans under R2000 in South Africa (2024)

| 🩺 Medical Aid | ✔️ Offers Plans Under R2000? | ⚕️ Plan Offered | 💵 Pricing | 👉 Sign Up |

| 1. FedHealth | Yes | FlexiFED 1 | R1 583 per month per member | 👉 Apply Now |

| 2. BestMed | Yes | Beat1 Network Plan | R1 873 per member per month | 👉 Apply Now |

| 3. Momentum | Yes | Evolve Plan | R1 424 per member per month | 👉 Apply Now |

| 4. Discovery Health | Yes | KeyCare Plus and KeyCare Start | R1,102 per member per month | 👉 Apply Now |

| 5. Genesis Medical Aid | Yes | Med 100 Hospital Plan | R1 465 per member per month | 👉 Apply Now |

5 Best Hospital Plans under R2000 (2024)

- Fedhealth – Overall, Best Hospital Plans Under R2000 in South Africa

- BestMed – Top Extensive Medical Protection in South Africa

- Momentum – Broadest Range of Low-Cost Medical Aid Plans

- Discovery Health – Best Pay-As-You-Go Private Healthcare

- Genesis Medical Scheme – Best Customer Service Medical Aid

How hospital plans work in South Africa

👉 When you have a hospital plan, it’s easier to pay for unexpected medical bills that may arise while you’re in the hospital. A percentage of your hospital bill, co-pay, and doctor’s fees will be covered by your plan.

👉 While some hospital plans may have more generous coverage and lower out-of-pocket costs, others may impose more stringent restrictions.

👉 Understand that hospital plans only pay for services received while you are actually in the hospital. All costs not incurred in a hospital, such as those for urgent care visits and prescriptions, are on you.

👉 However, the Medical Schemes Act mandates that all medical aid plans, including hospital plans, cover prescriptions for a list of 27 chronic diseases known as Prescribed Minimum Benefits, regardless of whether or not the insured person is hospitalised (PMBs).

👉 You must obtain pre-authorization from your provider before being admitted to the hospital, with the exception of emergency situations, in which the hospital will coordinate admittance with your provider.

👉 In addition to the standard 12-month waiting period for pre-existing conditions, all medical assistance might impose a 3-month general waiting period during which no claims would be reimbursed.

👉 In the event of an accident, hospitalisation is immediately available. If the first day of hospitalisation occurs during the waiting period, and the total length of hospitalisation exceeds the waiting period, no benefits will be paid.

Why a hospital plan is not a medical aid

👉 When compared to hospital insurance, medical aid provides much more comprehensive coverage. In contrast to a hospital plan, which only pays for care received within a hospital, a medical aid plan pays for care received outside of a hospital, including visits to specialists, general practitioners, and other diagnostic and therapeutic treatments.

👉 Due to its reduced cost compared to full medical aid, a hospital plan may be preferable for those with lower incomes or who are already in good health but still like to have access to private healthcare.

👉 Your decision should be influenced by whether you are willing to self-fund other general out-of-hospital expenses in lieu of paying the higher monthly premium for complete medical aid, as medical aid hospital plans cover the 25 needed minimum benefit chronic diseases.

The top reasons to opt for a hospital plan

👉 Hospital coverage can vary from medical scheme to medical scheme, and different schemes offer different packages. However, hospital plans vary significantly from medical aid in important ways.

👉 Surgery and other medical procedures conducted outside of a hospital are not covered by a hospital plan. That’s the determining aspect you need to know about while picking a plan.

👉 This plan could be ideal if you want to protect yourself financially in case of an emergency such as a car crash or a serious illness that requires hospitalisation.

👉 If you want full coverage for routine services, consultations with specialists, and annual check-ups with your primary care physician, a hospital plan is not the best choice. But there are times when more affordable hospital coverage is preferable.

👉 A hospital plan is an option to consider even if you are in good health, rarely require medical attention and don’t have any regular medical needs.

👉 A hospital plan may be your best bet for safety if you’re concerned about costs. Even the best medical aid plan is useless if you can’t afford to make your monthly premium payments on time.

👉 You might save money if you don’t spend a high percentage of your monthly income on medical expenses. In this manner, in the event of an emergency or illness, you can still visit a doctor. For the aforementioned reasons, hospital plans are quite common among the younger generation.

👉 Because both the need for and the ability to pay for medical care rise with age, it is imperative that retirees have access to medical aid.

👉 A hospital plan may require the retiree to pay for a certain proportion of their annual medical bills, but it will still be there for them when they need it most to pay for the astronomical costs associated with a hospital stay.

👉 You, as a pregnant woman on a hospital plan, are responsible for all costs incurred outside of the hospital. However, the cost of labour and delivery, including any necessary hospitalisation, will be covered. The majority of the costs associated with giving birth are covered by maternity hospital plans, which are relatively inexpensive.

👉 Gap cover, which pays the difference between medical aid rates and the higher hospital price, may be necessary if your hospital plan does not cover all of your expenses. Therefore, gap insurance is supplementary to pre-existing medical aid or hospitalisation coverage.

5 of the Best Known Hospital Plans in South Africa under R2000

👉 We have listed the 5 best hospital plans available to South Africans at less than R2000 a month.

1. Fedhealth

Overview

👉 Fedhealth was established in 1936 to provide for the medical needs of South Africans. Their dedication to offering excellent medical treatment at reasonable prices has not wavered throughout the years.

👉 As a cooperative run by and for its members, Fedhealth is always on the lookout for innovative ways to serve its customers in an ever-evolving industry.

👉 Since customization is a central tenet of Fedhealth, you, the member, may have some input over the specifics of your medical aid plan. As a membership organisation, Fedhealth is dedicated to serving the needs of its constituents first and foremost.

👉 The Scheme’s strong financial standing has allowed it to keep its AA- Global Credit Rating for the past 14 years and to set aside a greater than 25% reserve for the benefit of its members in the event of a financial emergency.

👉 The unique Risk-based rewards offered by Fedhealth help members’ benefits go even further.

👉 A few examples include no limits on the number of visits to a doctor inside the network and free upgrades at any time of year within 30 days of a major life change.

Fedhealth Hospital Plans Available at Under R2000

👉 Fedhealth offers a comprehensive hospital plan that costs less than R2000 per month.

flexiFED 1

👉 FlexiFED 1 is a low-cost hospital plan that provides excellent protection. Fedhealth Savings, made possible by the MediVault, can be used to assist cover the cost of routine medical bills that pop up unexpectedly, while the Threshold Benefit is activated after your claims reach a specified threshold. If you are young and healthy, this healthcare plan is for you.

➡️ flexiFED 1 is available at R1 583.00

How Much Are Fedhealth Medical Scheme Monthly Premiums?

👉 The monthly premiums for the salary-banded myFED option is from R 1 275 per month for the main member. The maxima PLUS extensive medical cover will cost 13 122 per month per the main member.

Comparisons between FedHealth and other Medical Aid Service providers

- Fedhealth versus Sizwe Hosmed Medical Fund

- Fedhealth versus Medihelp

- Fedhealth versus Momentum Medical Scheme

- Fedhealth versus Medshield

- Fedhealth versus KeyHealth

- Fedhealth versus Bonitas

- Fedhealth versus Medimed

What Is the Waiting Period for Fedhealth Benefits?

👉 The general waiting period for Fedhealth benefits is usually three months, depending on the medical aid scheme you join. The waiting period for pre-existing conditions is 12 months.

How to Claim Benefits from Fedhealth Medical Scheme

👉 Members can submit claims using one of the following:

➡️ In the Fedhealth Family Room,

➡️ Through a WhatsApp service

➡️ On the Fedhealth Member Phone App

➡️ You may also email, fax or post the claims to email: [email protected], fax: (011) 671 3842 or post to Private Bag X3045, Randburg, 2125.

Fedhealth Medical Scheme Contact Details

Flora Centre Shop 21 and 22

Corner Conrad street and Ontdekkers Rd

Florida Glen

Johannesburg

Phone: 0861 116 016

2. BestMed

Overview

👉 BestMed is a leading independent health assistance provider in South Africa, serving a member base of over a million people.

👉 BestMed is dedicated to keeping a company that is big enough to make a difference for the people they help, but small enough to know the names of everyone they help and to act quickly on customer input to improve their services.

👉 BestMed operates under the idea that healthcare requirements vary greatly across a wide range of individual characteristics, including age, marital status, family size, health, preferences, and financial resources. There are three primary care plans to choose from at BestMed, each with its own set of benefits and levels of coverage.

👉 This includes BestMed, which has options whether you need basic hospitalisation coverage or something much more thorough.

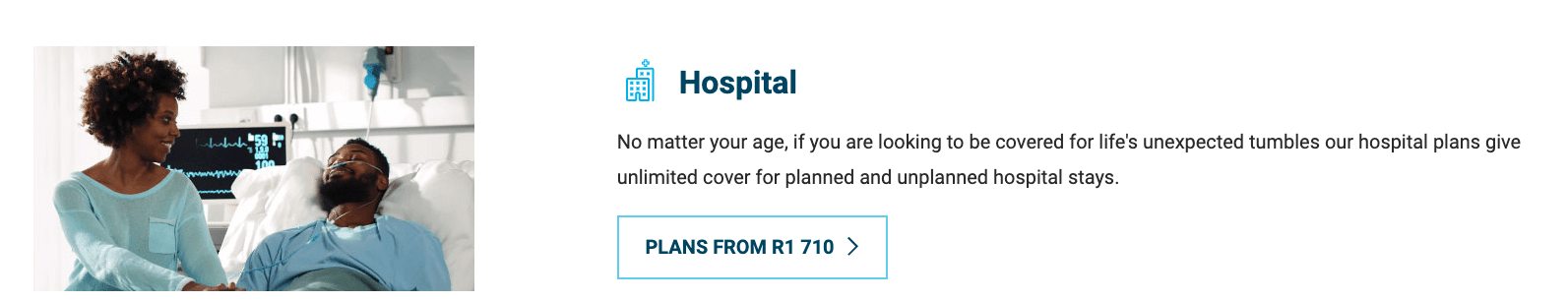

BestMed Hospital Plans Available at Under R2000

👉 BestMed offers a comprehensive hospital plan that costs less than R2000 per month.

BestMed Beat Hospital Plans

👉 The BestMed hospital plans are great for anyone of any age who wants to be ready for the unexpected because they provide unlimited coverage at any of their network hospitals for both planned and unplanned inpatient stays.

👉 All hospital plans cover no more than three children. There is no cost to add more children to the Scheme as beneficiaries.

➡️ The Beat1 Network plan is available from R1 873.00 per month

How Much Are BestMed Medical Aid Monthly Premiums?

👉 At the time of writing, monthly premiums for the cheapest BestMed Beat1 Network Hospital Plan started at R1 873 for a member, with an additional R1 456 for an adult dependant and R789 for a child dependant, to a maximum of 3 child dependants. Additional children join at no additional cost.

👉 The most expensive plan at the time was the Pace4 Comprehensive Plan, with monthly contributions of R10 343 per member and R10 343 per adult dependant. For a child dependant, the extra contribution was R2 423, up to 3 child dependants with additional children added as beneficiaries of the scheme at no extra cost.

What Is the Waiting Period for BestMed Medical Aid’s Benefits?

👉 There can be a general waiting period of three months or a specific waiting period of 12 months for a certain condition.

👉 BestMed Medical Scheme will sometimes only pay a claim if it is a PMB. This can happen if you are in a waiting period or if you are getting treatment for a condition that your plan doesn’t cover.

How to Claim Benefits from BestMed Medical Aid

👉 If your healthcare provider does not submit claims to BestMed, one must submit the original claim directly to the fund administrators.

👉 You can claim by means of the BestMed App, or by scanning and emailing your claim to them.

👉 Details that should appear on all claim documents include:

➡️ Member’s name and contact details

➡️ BestMed membership number

➡️ Patient’s details

➡️ Service provider’s name, contact details and practice number

➡️ Details of treatment, including applicable tariff and ICD-10 codes

➡️ Whether payment should be done to the service provider or the member

👉 You will receive an email confirmation when your claim is received and indexed.

BestMed Medical Aid Contact Details

Head Office:

BestMed Medical Scheme, Glenfield Office Park, 361 Oberon Avenue, Faerie Glen, Pretoria

PO Box 2297

Pretoria

Emails: [email protected]; [email protected],

Phone: +27 (0)86 000 2378

3. Momentum Health

Overview

👉 Momentum Medical Scheme is one of the top three open medical schemes in South Africa, and it is operated by one of the country’s largest and most reputable healthcare service providers.

👉 The primary objective of Momentum Health is to guarantee the scheme’s long-term viability while providing great value to members.

👉 If you join Momentum Health Solutions, you can take use of their extensive network of affordable doctors and hospitals.

👉 A number of options are available to members, including a 24/7 medical advice line operated by “Hello Doctor” and networks of doctors who have partnered with Momentum to get financial incentives for providing care.

👉 Incentives and reward programmes that motivate members to maintain a healthy lifestyle can be designed and priced with the help of Momentum’s actuarial services.

👉 By organising its members into care cohorts, Momentum is able to provide individualised assistance through its advocacy programmes, enabling its customers to make more educated healthcare decisions and reducing overall costs.

Momentum Hospital Plans are Available Under R2000

👉 Momentum Health offers a comprehensive hospital plan that costs less than R2000 per month.

Evolve

👉 The Evolve Option Hospital Plan includes two virtual visits with a doctor and coverage at any private hospital in the Evolve Network (no yearly cap). The HealthSaver+ programme applies to supplementary everyday benefits. A sports injury benefit of up to R1,000 per recipient per year for up to two visits to a physiotherapist or biokineticist has been added.

➡️ The Evolve Plan is available from R1 424.00 per month

Custom

👉 Hospitalization and long-term care expenses are fully covered by Any or Associated providers. The cost of your care may be reduced if you choose from among a network of private hospitals that are not included in the network’s standard contribution.

➡️ The Custom Plan is available from R1 808.00 per month

How Much Are Momentum Health Monthly Premiums?

👉 Momentum monthly premiums start at R1 539 for the main member on the Evolve Option and go up to R12 345 for the main member on the Summit Option.

What Is the Waiting Period for Momentum Health’s Benefits?

👉 The general waiting period is 3 months, but since pregnancy is considered a pre-existing condition, it is excluded from all benefits for the first 12 months of scheme membership.

How to Claim Momentum Health Benefits

👉 You can submit a claim in several ways:

➡️ Use the Momentum App

➡️ Use the web chat facility in the bottom left corner.

➡️ Send an email to [email protected] or send normal mail to PO Box 2338, Durban, 4000

👉 To make sure your claim is processed quickly and accurately, including the following information:

➡️ Membership number.

➡️ Principal member’s surname, initials, and first name.

➡️ Patient’s surname, initials, and first name.

➡️ Date of treatment.

➡️ Amount charged.

➡️ ICD–10 code (code to indicate what condition you’ve been diagnosed with), tariff code (product-specific code for procedures and claims), and NAPPI code (a unique identifier for a given ethical, surgical, or consumable product).

➡️ Service provider’s name and practice number.

➡️ Proof of payment if you’ve paid the claim out of your own pocket.

Momentum Health Contact Details

201 Umhlanga Ridge Blvd

Cornubia

Blackburn

PO Box 2338

Durban

Read more about GEMS Medical Aid Scheme

4. Discovery Health

Overview

👉 It has been reported that as of December 31, 2019, Discovery Health Medical Plan (DHMS) had 2,808,106 members, making it the largest open medical scheme in South Africa according to the Council for Medical Schemes Quarterly Report for the quarter that ended 30 June 2019.

👉 Discovery is under the jurisdiction of the Council for Medical Schemes, a non-profit organisation, and the Medical Schemes Act 131 of 1998, as amended. Since the System is a publicly funded healthcare programme, participation is open to anybody who fits the conditions.

👉 To aid Scheme participants is the Scheme’s principal objective, and this fact informs all policy decisions. Discovery finds a happy medium between the wants of its members and the needs of the Scheme as a whole by relying on their common principles.

👉 In South Africa, members of the Discovery Health Medical Scheme (DHMS or the Scheme) have access to a pooled fund that is administered with a focus on social solidarity rather than the commercial gain to pay medical expenditures.

Discovery Hospital Plans Available at Under R2000

👉 Discovery Health offers a comprehensive hospital plan that costs less than R2000 per month.

The KeyCare Series

👉 The hospital networks affiliated with KeyCare provide extensive medical protection. There is no out-of-pocket maximum for visits to specialists in the KeyCare network, and up to 100% of the Discovery Health Rate is reimbursed for visits to other doctors and hospitals (DHR).

👉 Expectant mothers and newborns receive attention both throughout and after pregnancy.

👉 Both KeyCare Plus and KeyCare Start include unlimited visits to your primary care physician within the KeyCare network, as well as coverage for lab work, X-rays, and medications.

👉 Coverage for all diseases on the KeyCare Chronic Disease List is provided when patients see a participating doctor for treatment of chronic conditions (DSP). Your level of protection depends on the policy you select.

➡️ The KeyCare plan is available at R1,102 per month

Discovery Health has the following plans to offer under the Discovery Health KeyCare series

✅ Discovery Health KeyCare Start Regional Medical Aid Plan

✅ Discovery Health KeyCare Start Medical Aid Plan

✅ Discovery Health KeyCare Plus Medical Aid Plan

✅ Discovery Health Key Care Core Medical Aid Plan

The Core Series

👉 The Essential and Coastal plans pay up to 100% of the DHR for additional healthcare professionals with whom Discovery has a payment arrangement, and the Core Series pays 100% of the DHR for hospitalisation costs.

👉 No matter how long a patient needs treatment for a Chronic Disease, the plan will cover it. Also included are any restrictions associated with using MedXpress or a pharmacy in the MedXpress network.

👉 All aspects of prenatal and postnatal treatment, including delivery and the first few years of a child’s life, are covered, as is emergency care abroad.

➡️ The Core Series is available at R1 923.00 per month

How Much Are Discovery Medical Aid Monthly Premiums?

👉 Monthly premiums start from R930 per member for the KeyCare Series with medical cover for both in-hospital and out-of-hospital treatment by providers in a specified network and go up to R8 298 per member for the Executive Plan with extensive cover for in-hospital and day-to-day benefits, extended chronic medicine cover, and unlimited Above Threshold Benefit.

What Is the Waiting Period for Discovery Medical Aid’s Benefits?

👉 Discovery Health Medical Scheme’s general waiting period is 3 consecutive months and the condition-specific waiting period is 12 consecutive months.

How to Claim for Discovery Medical Aid Benefits

👉 You can submit a claim fast and easily in the following ways:

➡️ Scan and upload your claims on the website.

➡️ Scan and email your claims to [email protected].

➡️ Use the Discovery app on your smartphone. If the claim has a QR code, scan the QR code or alternatively take a photo of the claim from within the app.

➡️ You can also submit your claims by post.

Discovery Medical Aid Contact Details

PO Box 784262,

Sandton,

2146

Phone: 0860 99 88 77

5. Genesis Medical Scheme

Overview

👉 Genesis has established itself as a premier medical scheme in South Africa by consistently offering members first-rate protection at competitive rates.

👉 Based on objective metrics including claims ratio, ability to pay claims, access to medical facilities, and benefits offered relative to contributions charged, Genesis was recently ranked as one of the most successful schemes in South Africa.

👉 Genesis provides its members with better financial protection, more value for their money, more benefits, and better service than the majority of South African medical aid schemes do, with benefits ranging from inexpensive hospital plans to more comprehensive medical aid cover with savings for everyday healthcare expenses.

👉 Due to the competent management and administration of the Scheme, Genesis has been at the forefront of minimal contribution increases coupled with enhanced benefits over the past few years.

👉 Genesis members continue to save with below-inflation contribution increases, with a 2014 average annual contribution rise of only 6.4%, significantly lower than all open schemes.

Genesis Hospital Plans Available at Under R2000

👉 Genesis offers a comprehensive hospital plan that costs less than R2000 per month.

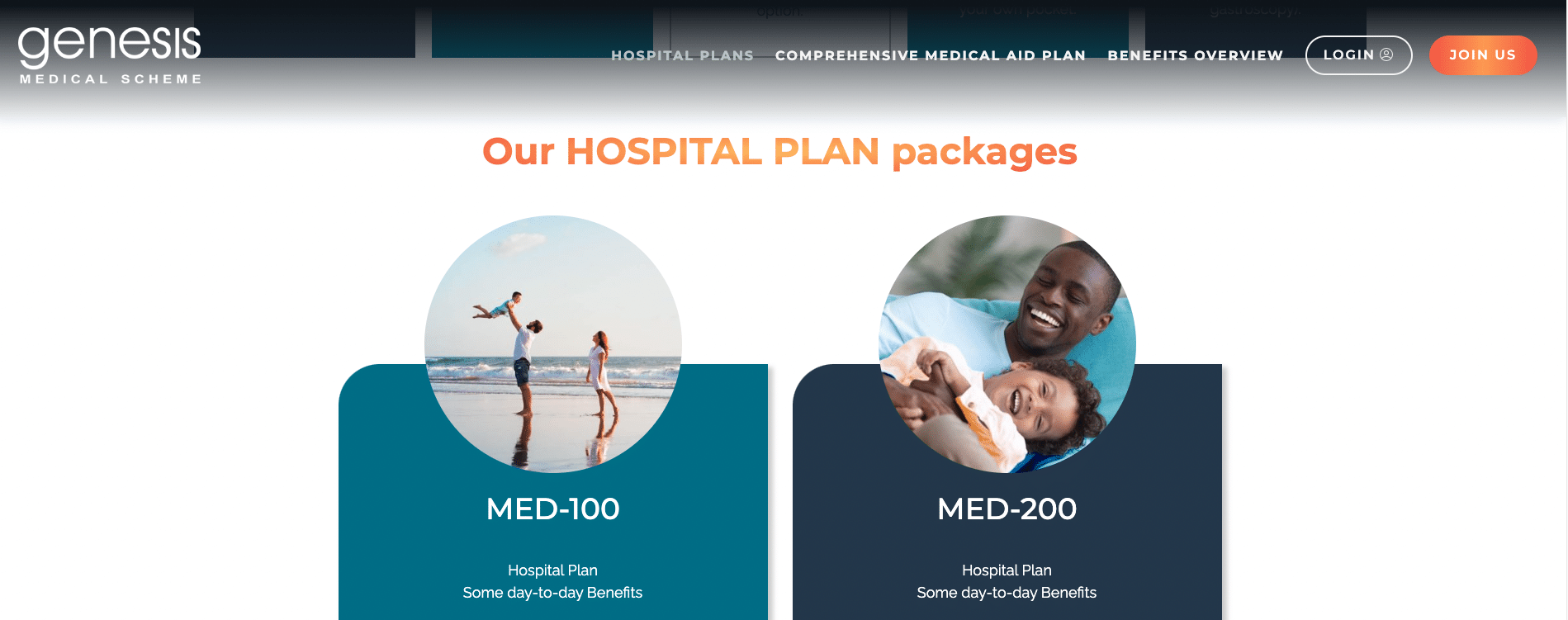

Med 100 Hospital Plan

👉 If you or your family members are young, you should enrol in this hospital plan. The plan covers hospital stays, both those that are anticipated and those that are unanticipated.

👉 All medical costs associated with seeing a physician or specialist are paid for by the Scheme Tariff. Additional benefits for basic dental care are provided by Genesis at no additional cost to you.

➡️ The Genesis Med 100 Hospital Plan is available at R1 465.00 a month

How Much Are Genesis Medical Aid Monthly Premiums?

👉 Genesis Medical Aid premiums are highly competitive and range from R1 465.00 to R2 815.00

What Is the Waiting Period for Genesis Medical Aid’s Benefits?

👉 Genesis Medical Scheme’s general waiting period is 3 consecutive months and the condition-specific waiting period is 12 consecutive months.

How to Claim for Genesis Medical Aid Benefits

➡️ Genesis will accept signed claims by the principal member via e-mail, fax, post or by hand.

➡️ Where a member has paid an account, please attach the receipt to the claim. Claims can be scanned and e-mailed to [email protected] or faxed to 021 447 4707.

➡️ Alternatively, a PDF document(s) or a good quality photo (image) of the claim, clearly indicating your membership details, may also be emailed to the Scheme directly from your Smartphone App.

➡️ Always ensure that you insert your membership number in the “Subject Line” of claims that are sent via email.

➡️ Monthly statements will be sent to each member that has claimed in that month. Alternatively, members can log in to the secured Member section on the website or mobile app to view the status of their claims.

➡️ Genesis encourages members to check that the services were in fact rendered to them or their dependents.

Genesis Medical Aid Contact Details

Email: [email protected]

Existing Members – 0860 10 20 10

New Members – 0861 56 46 66

Poll: 5 Best GP Network Plans on Medical Aid in South Africa revealed

Frequently Asked Questions

What is a Hospital Plan under R2000 in South Africa?

A hospital plan under R2000 is a reasonably priced medical insurance plan that pays for hospital-related medical costs up to R2000 a day in total. For people who want hospitalization coverage without having to pay for more extensive medical treatment, it is an appropriate option.

How does a Hospital Plan under R2000 in South Africa work?

You must pay your insurance company a monthly payment when you enroll in a Hospital Plan under R2000. In the event that you are hospitalized, the plan will pay your hospital-related medical costs, up to a daily maximum of R2000. Additionally, the plan’s coverage can be expanded to include specific procedures and therapies connected to your hospital stay.

What are the benefits of a Hospital Plan under R2000 in South Africa?

To cover pricey in-hospital medical costs that are otherwise prohibitive without insurance, obtaining a Hospital Plan under R2000 is a viable choice. By having this plan, you may rest easy knowing that you are protected from unforeseen healthcare costs without breaking the bank.

What types of medical expenses does a Hospital Plan under R2000 in South Africa typically cover?

In-hospital medical costs, such as hospital lodging, surgery, anesthesia, and other procedures connected to your hospital stay, are often covered by a Hospital Plan under R2000. But it’s important to remember that this plan might not cover particular operations, therapies, or medications. It is crucial to properly read the policy in order to comprehend what it covers.

How can I sign up for a Hospital Plan under R2000 in South Africa?

Contact an insurance company that offers this kind of coverage if you want to sign up for a Hospital Plan under R2000. You will receive the necessary information from the supplier, who will also assist you in submitting your application. To find one that meets your unique needs and budget, it is critical to examine several providers and plans.

Our you can just complete the online form and we will provide you with some options.