- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Medihelp MedPrime Elect Medical Aid Plan

Overall, the Medihelp MedPrime Elect Medical Aid Plan is a trustworthy and comprehensive medical aid plan that offers 24/7 medical emergency assistance to up to 3 Family Members. The Medihelp MedAdd Medical Aid Plan starts from R3,918 ZAR.

| 👤 Main Member Contribution | R3,918 |

| 👥 Adult Dependent Contribution | R3,306 |

| 💙 Child Dependent Contribution | R1,140 |

| 🌎 International Cover | None |

| 🔁 Gap Cover | None |

| ➡️ Annual Limit | Unlimited Hospital Cover |

| 🏥 Hospital Cover | Unlimited |

| 💶 Prescribed Minimum Benefits | ✅ Yes |

| 💳 Medical Savings Account | ✅ Yes |

| 🍼 Maternity Benefits | ✅ Yes |

Medihelp MedPrime Elect Plan – 11 Key Point Quick Overview

- ☑️ Medihelp MedPrime Elect Plan Overview

- ☑️ Medihelp MedPrime Elect Plan Contributions and Medical Savings

- ☑️ MedPrime Elect Plan Benefits and Cover Comprehensive Breakdown

- ☑️ MediHelp MedPrime Elect Benefit Table

- ☑️ MedPrime Elect Hospitalization and Advanced Treatment

- ☑️ MedPrime Elect Hospitalization

- ☑️ MedPrime Elect Added Insured Benefits

- ☑️ Medihelp MedPrime Elect Plan Exclusions and Waiting Periods

- ☑️ Medihelp MedPrime Elect Plan vs. Similar Plans from other Medical Schemes

- ☑️ Our Verdict on The Medihelp MedPrime Elect Plan

- ☑️ Medihelp MedPrime Elect Plan Frequently Asked Questions

Medihelp MedPrime Elect Plan Overview

The Medihelp MedPrime Elect medical aid plan is one of 11, starting from R3,918 and includes physiotherapy, consultations, basic radiology, medicine, care extender, and more. Gap Cover is not available on the Medihelp MedPrime Elect Plan. However, Medihelp offers 24/7 medical emergency assistance. According to the Trust Index, Medihelp has a trust rating of 4.2.

MediHelp has the following 11 plans to choose from

- ✅ MediHelp Medprime

- ✅ MediHelp MedPrime Elect

- ✅ MediHelp MedPlus

- ✅ MediHelp MedElite

- ✅ MediHelp MedVital

- ✅ MediHelp MedVital Elect

- ✅ MediHelp MedSaver

- ✅ MediHelp MedMove

- ✅ MediHelp MedElect

- ✅ MediHelpMedAdd

- ✅ MediHelp MedAdd Elect

Medihelp MedPrime Elect Plan Contributions and Medical Savings

MedPrime Elect Contributions

| 👤 Main Member | 👥 +1 Adult Dependent | 💙 +1 Child Dependent |

| R3,918 | R3,306 | R1,140 |

MedPrime Elect Medical Savings Account

| 👤 Main Member | 👥 +1 Adult Dependent | 💙 +1 Child Dependent |

| R390 per month | R330 per month | R114 per month |

| R4,680 per year | R3,960 per year | R1,368 per year |

Discover the 5 Best Medical Aids under R1500

MedPrime Elect Plan Benefits and Cover Comprehensive Breakdown

MedPrime Elect Accumulative Unused Savings Contributions

MedPrime Elect’s flexible credit facility provides instantaneous access to all your HSA balance for the year. Any remaining balance is carried over to the following year and earns interest.

- 10% of your annual premium is accessible as a lump payment through the credit facility once yearly.

- The accumulative savings account is a separate account from which surplus funds from the previous year can be withdrawn in one payment beginning on January 1.

How Medihelp pays claims on MedPrime Elect:

- The day-to-day benefits listed below are paid from the credit facility of the savings account until it is emptied, except for PMB services.

- Then, Medihelp pays your insured daily benefits until they are exhausted.

- The payment for PMB services is limited to day-to-day benefits until they are depleted, after which payment is unlimited from core benefits.

- Finally, once this is exhausted, payments will be made from the cumulative savings account.

- Co-payments that Medihelp does not cover from the credit facility, such as co-payments during hospitalization or day-to-day benefits, can be paid from your available savings account balance.

MedPrime Elect Day-to-Day Benefits

Benefits are first paid from the available Medical Savings Account. Once funds are depleted, the following savings per year are available:

- Main Member – R4,680 per year.

- Adult Dependent – R3,960 per year.

- Child Dependent – R1,368 per year.

Once savings have been depleted, Medihelp pays medical expenses as follows:

- Up to 100% of the Medihelp Tariff (MT), with the following limits:

- Up to R6,600 for the main member.

- Up to R12,100 for the main member and dependents.

Day-to-day benefits cover the following:

Consultations:

- GP appointments and follow-up appointments.

- Specialists

- Telemedicine, virtual consultations, and visits from nurses at network pharmacies.

- Pharmacies providing primary care and emergency units, including primary care drug therapists, in terms of consultations and follow-ups.

- Out-of-hospital

- Treatment and Materia

Clinical psychology and psychiatric nursing:

- Covered in and out of the hospital.

- Other medical services: Occupational and speech therapy, dietitian services, audiometry, podiatry, massage, orthoptic, chiropractic, homeopathic, herbal, naturopathic, osteopathic, and biokinetic services

Standard radiology:

- Covered out-of-hospital

- Subject to clinical protocols

- Must be requested by a medical doctor

- Only standard black and white X-rays are covered if a chiropractor requests them.

Pathology and medical technologist services (With Ampath as the Pathology DSP):

- Covered out-of-hospital

- Subject to clinical protocols and must be requested by a medical doctor

- Must use Ampath as the Pathology DSP

Medicine:

- The medication obtained through the Medihelp Preferred Pharmacy Network and prescribed or given by a physician

- Acute and non-PMB chronic medication and self-medication, including emergency room drugs and immunizations.

- Generic medicine – 100% of the MMAP

- Original medicine if no generic equivalent is available – 80% of the MT

- Original medicine used voluntarily when a generic equivalent is available – 70% of the MMAP

- Homeopathic, naturopathic, and osteopathic medicine – 25% of the available day-to-day benefit

MediHelp MedPrime Elect Benefit Table

| 🅰️ Care Extender: Additional GP Consultation | A beneficiary’s Pap smear, mammography, prostate test, FOBT, or bone mineral density test activates a family consultation benefit. |

| 🅱️ Care Extender: R475 for Self-Medication | After a beneficiary claims the combo health screening (blood glucose, cholesterol, BMI, and blood pressure measurement) at a preferred pharmacy clinic, the family will receive R475 for non-prescribed medicine. |

| 📌 PMB Chronic Medicine | Pre-approval and registration on Medihelp’s PMB drug management program are required. Covered up to 100% of the MHRP. The unlimited cover is provided. Formulary and DSPs will apply. A 60% co-payment applies if there is non-compliance with the protocols. |

| 📍 DSPs PMB Chronic – Medipost and Elect Oncology – Dis-Chem/Medipost HIV/AIDS – Dis-Chem/Medipost | Pre-approval and registration on Medihelp’s PMB drug management program are required. Covered up to 100% of the MHRP. The unlimited cover is provided. Formulary and DSPs will apply. A 60% co-payment applies if there is non-compliance with the protocols. |

| 💙 Oxygen | Covered out-of-hospital. Subject to pre-approval and clinical protocols and must be prescribed by a medical doctor. Covered up to 100% of the MT. Unlimited cover. 20% co-payment if this benefit is not pre-approved before treatment. |

| 🤓 Optometry | Subject to pre-authorization by a PPN. Services must be via a PPN provider. There is a limit of 1 composite consultation, including refraction test, tonometry, and visual field test per 2-year cycle. Covered up to 100% of the MT. |

| 👓 Spectacles or Contact Lenses | Spectacles – Frames or lens enhancement Limited to R825 per beneficiary/2 years. Lenses (1 x clear pair) Limited to single-vision or bifocal lenses per beneficiary/2 years. Multifocal lenses are covered at the cost of bifocal lenses. Contact lenses Limited to R1,235 per beneficiary/2 years. |

| 🪥 Conservative Dental Services | Benefits are subject to Dental Risk Company (DRC) protocols, contracted to Medihelp as a DSP. Benefits are subject to protocols and are limited to certain item codes. |

| 🦷 Dentistry: Routine Check-ups | Covered up to 100% of the MT. Limited to two check-ups per beneficiary per year or per 6-month cycle. |

| ☑️ Oral Hygiene | Scale and Polish Treatments: Covered up to 100% of the MT. Limited to two treatments per beneficiary per year or per 6-month cycle. Fluoride Treatment for children between 5 and 13: Covered up to 100% of the MT. Limited to two treatments per beneficiary per year or per 6-month cycle. Fissure sealants for children between 5 and 16 (permanent teeth): Covered up to 100% of the MT. |

| ✅ Fillings | Treatment plans and x-rays might be requested where multiple fillings are necessary. Pre-approval is required for 4> fillings per year and 2 fillings on front teeth per visit. Covered up to 100% of the MT. Limited to 1 filling per tooth per year for beneficiaries <18. Fillings for beneficiaries 18> are paid from the available medical savings. |

| 📊 Tooth Extractions and Root Canals on permanent teeth in the Dentist’s chair | Pre-authorization for 4> extractions in a single visit. Covered up to 100% of the MT. |

| 🙂 Laughing Gas (Dentist’s Chair) | Covered up to 100% of the MT. |

| 😴 Dentistry under conscious sedation (Dentist’s chair) | The benefit is only available for removing impacted teeth (3rd molars) Covered up to 100% of the MT Extensive dental treatment is only offered for children <12 years. 20% co-payment for no authorization. |

| 💤 Dentistry under general anesthesia in a day procedure facility, including the removal of impacted teeth | Covered up to 100% of the MT Removal of impacted teeth (3rd molars) Extensive dental treatment for children <7 (only once per beneficiary yearly) 35% co-payment for procedures not performed in a day procedure network. 20% co-payment for no authorization. |

| 🤍 Special Needs Patients – dentistry under general anesthesia in a day procedure | Covered up to 100% of the MT Unlimited cover provided. 35% co-payment for procedures not performed in a day procedure network. 20% co-payment for no authorization. |

| ➡️ Plastic Dentures | Covered up to 100% of the MT. Limited to one set per beneficiary/4 years. |

| ❌ X-Rays | Intra-Oral X-Rays Covered up to 100% of the MT. Extra-Oral X-Rays Covered up to 100% of the MT. One per beneficiary every three years. |

| 🦷 Specialized Dentistry | Subject to pre-authorization and DRC protocols. |

| 🚩 Partial Metal Frame Dentures | Covered up to 100% of the MT. One partial frame (upper or lower) per beneficiary every 5 years. 20% co-payment for no authorization. |

| 🙂 Maxillofacial Surgery and Oral Pathology | Benefits for temporomandibular joint (TMJ) benefit limited to non-surgical treatment or interventions. Covered up to 100% of the MT. |

| 👑 Crowns and Bridges | Covered up to 100% of the MT. One crown per family yearly, once per tooth every five years. 20% co-payment for no authorization. |

| 🪥 Orthodontic Treatment | Covered up to 100% of the MT. Limited to R10,120 per beneficiary. Limited to once per beneficiary <18. Payment is made from the authorization date until the patient turns 18. |

| 🔁 Periodontal Treatment | Covered up to 100% of the MT. 20% co-payment for no authorization. |

| 🦾 External Prostheses and Medical Appliances Services in and out of the hospital, including fitting, cost of repairs, maintenance, spares, accessories, and adjustments on the following: Artificial Eyes, Speech and Hearing Aids, Artificial Limbs, Wheelchairs, External Breath Prostheses, Medical Appliances, and CPAP Apparatus | Covered up to 100% of the MT. Limited to R5,200 per family every three years. |

| 🦵 Medical Appliances (back, leg, neck, and arm supports, crutches, orthopedic footwear, nebulizers, etc. | Covered up to 100% of the MT. Limited to R1,500 per family per year. |

| 📌 Glucometers (every 5 years) | Covered up to 100% of the MT. Limited to R1,500 per family per year. |

| 📍 Stoma Components Incontinence Products or Supplies | Covered up to 100% of the MT. Unlimited cover provided. |

| ❎ CPAP Apparatus | A doctor must prescribe it. Covered up to 100% of the MT. Limited to R10,900 per beneficiary every 2 years. |

You might also like to learn more about Medical Aid Schemes that cover Diabetes in South Africa

MedPrime Elect Hospitalization and Advanced Treatment

| 1️⃣ Chronic Illness and PMB | Subject to protocols, pre-authorization, DSPs, and the specialist network. Covered up to 100% of the cost or the contracted tariff. Unlimited cover provided. Co-payments can apply if not using a DSP or deviating from the code. |

| 2️⃣ Trauma Benefits This applies to major trauma requiring hospitalization, for example: Motor Vehicle Accidents Stab Wounds Gunshot Wounds Head Trauma Burns Near-drowning | Subject to authorization, PMB protocols, and case management. Covered up to 100% of the cost or the contracted tariff. Unlimited cover provided. |

| 3️⃣ Post-Exposure Prophylaxis (HIV/AIDS) | Subject to authorization, PMB protocols, and case management. Covered up to 100% of the cost or the contracted tariff. Unlimited cover provided. |

You might like 5 Best Hospital Plans under R1500 in South Africa

Emergency Transport Services via Netcare 911

The Beneficiary’s Country of Residence (RSA, Lesotho, Eswatini, Mozambique, Namibia, Zimbabwe, Botswana) includes road and air transport.

- Unlimited Cover.

- Covered up to 100% of the MT.

- If not pre-approved, a 50% co-payment applies.

Outside the beneficiary’s Country of Residence

Road Transport

- Covered up to 100% of the MT.

- If not pre-approved, a 50% co-payment applies.

- Limited to R2,320 per case.

Air Transport

- Covered up to 100% of the MT.

- If not pre-approved, a 50% co-payment applies.

- Limited to R15,400 per case.

MedPrime Elect Hospitalization

(Only MedPrime Elect hospital and day procedure network can be used)

| 🏥 Hospitalization Intensive Care and high-care wards Ward Accommodation Theatre fees Treatment and medicine in the ward In-hospital consultation with GPs and specialists Surgery Anesthesia | Unlimited Cover. Covered up to 100% of the MT. If not pre-approved, a 20% co-payment applies. 35% co-payment applies if members use non-network facilities for treatment. Additional co-payments on certain procedures may apply. |

| 🔎 Day Procedures (Including Ophthalmological, endoscopic, ear, nose, and throat procedures, dental procedures, removal of skin lesions, circumcisions, and procedures as pre-authorized) | Unlimited Cover. Covered up to 100% of the MT. If not admitted to a hospital/day procedure facility in the network, a 35% co-payment applies. Additional co-payments on certain procedures may apply. |

| 💊 Hospital Medicine upon Discharge | Covered up to 100% of the MT. There is an R500 limit per admission. |

| 🍼 Childbirth Subject to pre-authorization, protocols, and case management Unlimited Cover. | Covered up to 100% of the MT. If not pre-approved, a 20% co-payment applies. |

| 🏠 Home Delivery Includes the following: Professional Nursing Fee Equipment Material and Medicine | Covered up to 100% of the MT. Limited to R14,900 per event. If not pre-approved, a 20% co-payment applies. |

| 📈 Radiology, Pathology, and Medical Technologist Services In-Hospital cover only. Subject to clinical protocols and approved hospital admission. | Members must use Ampath as the contracted Pathology DSP. Covered up to 100% of the MT. Unlimited cover provided. |

| 📉 Radiography | Covered up to 100% of the MT. Limited to R1,210 per family yearly. |

| 📊 Specialized Radiography | MRI and CT scans Subject to pre-authorization. Covered up to 100% of the MT. Unlimited Cover. Member pays the first R2,400 per examination and R1,900 out of the hospital. Angiography Covered up to 100% of the MT. Unlimited Cover. |

| 📌 Clinical Technologist Services | Covered up to 100% of the MT. Unlimited Cover. |

| ❤️ Organ Transplants | Covered up to 100% of the MT. Unlimited Cover. Subject to pre-authorization and clinical protocols. Cornea implants Covered up to 100% of the MT. Limited to R32,600 per implant yearly. |

| ⚕️ In-hospital Oxygen | Covered up to 100% of the MT. Unlimited Cover. |

| ✳️ Neurostimulators (Includes device and components) | Covered up to 100% of the MT. Limited to R65,600 per beneficiary per year. |

| 🅰️ Renal Dialysis Acute Renal Dialysis Chronic/Peritoneal Renal Dialysis | Covered up to 100% of the MT. Unlimited Cover. Subject to pre-authorization and clinical protocols. 20% co-payment if not pre-approved. |

| 🅱️ Post-Hospital Care Speech therapy, occupational therapy, and physiotherapy 30 days after discharge | Accessible day-to-day benefits cover prescription medication and medical equipment. Covered up to 100% of the MT. Limited to the following: Main Member – R2,100 per year. Main Member + Dependents – R3,000 per year. |

| 💟 Other Medical Services Dietitian services, physiotherapy, and occupational therapy Speech therapy Audiometry and orthoptic services Podiatry | In-hospital protocols might apply. Covered up to 100% of the MT. Unlimited Cover. |

| 🧠 Psychiatry Psychiatrist-provided hospital and outpatient treatments General ward accommodations Institution-supplied medication Outpatient consultations | Covered up to 100% of the MT. Limited to R33,100 per beneficiary per year, with a limit of R44,600 per family per year. If not pre-approved, a 20% co-payment applies. |

| 📌 Oncology: PMB Cases | Pre-authorization and Medihelp Oncology Program registration are required. Protocols, a DSP, and the MORP apply. Covered up to 100% of the MT. Unlimited Cover. 10% co-payment on non-DSP treatment. 20% co-payment for deviating from protocol. |

| 📍 Oncology: Non-PMB Cases | Covered up to 100% of the MT. Limited to R299,000 per family per year. 10% co-payment on non-DSP treatment. 20% co-payment for deviating from protocol. |

| ☑️ Hospice Services and Subacute Care Facilities | Covered up to 100% of the MT. 20% co-payment if not pre-authorized Unlimited cover. |

| ✅ Palliative Care | Covered up to 100% of the MT. 20% co-payment if not pre-authorized Limited to R26,000 per family per year. |

| 👩⚕️ Private Nursing | Covered up to 100% of the MT. 20% co-payment if not pre-authorized Unlimited cover. |

| 🩺 Appendectomy Conventional or Laparoscopic Procedure | Unlimited cover. Covered up to 100% of the MT. |

| 🤖 Robotic Laparoscopy | Covered up to 100% of the MT Hospitalization is covered up to R126,100 per beneficiary. |

| 🧪 Refractive Surgery | Subject to pre-authorization and clinical protocols. Covered up to 100% of the MT. Hospitalization is covered up to R13,100 per family for beneficiaries between 18 and 50. A 20% co-payment applies if there is no pre-authorization. |

MedPrime Elect Emergency Benefits

A medical emergency is a sudden and unexpected occurrence that necessitates quick medical or surgical treatment to safeguard a patient’s health. Failure to offer medical or surgical treatment would result in severe impairment of bodily functioning or severe dysfunction of a bodily organ or portion or jeopardize the individual’s life. Netcare 911 is the designated service provider for Medihelp’s emergency transport services, and you must contact them in an emergency. Phone 082 911. Furthermore, you may also seek assistance at the nearby hospital’s emergency room. However, the following conditions apply:

- Emergency admissions must be reported to Medihelp on the following business day by calling 086 0200 678.

- If you visit an emergency facility but are not hospitalized, the care you receive will be covered by your regular plans.

- Facilities costs are not included.

Emergency Transport Services via Netcare 911

The Beneficiary’s Country of Residence (RSA, Lesotho, Eswatini, Mozambique, Namibia, Zimbabwe, Botswana) includes road and air transport.

- Unlimited Cover.

- Covered up to 100% of the MT.

- If not pre-approved, a 50% co-payment applies.

Outside the beneficiary’s Country of Residence

Road Transport

- Covered up to 100% of the MT.

- If not pre-approved, a 50% co-payment applies.

- Limited to R2,320 per case.

Air Transport

- Covered up to 100% of the MT.

- If not pre-approved, a 50% co-payment applies.

- Limited to R15,400 per case.

READ more about 5 Best Travel Medical Insurances

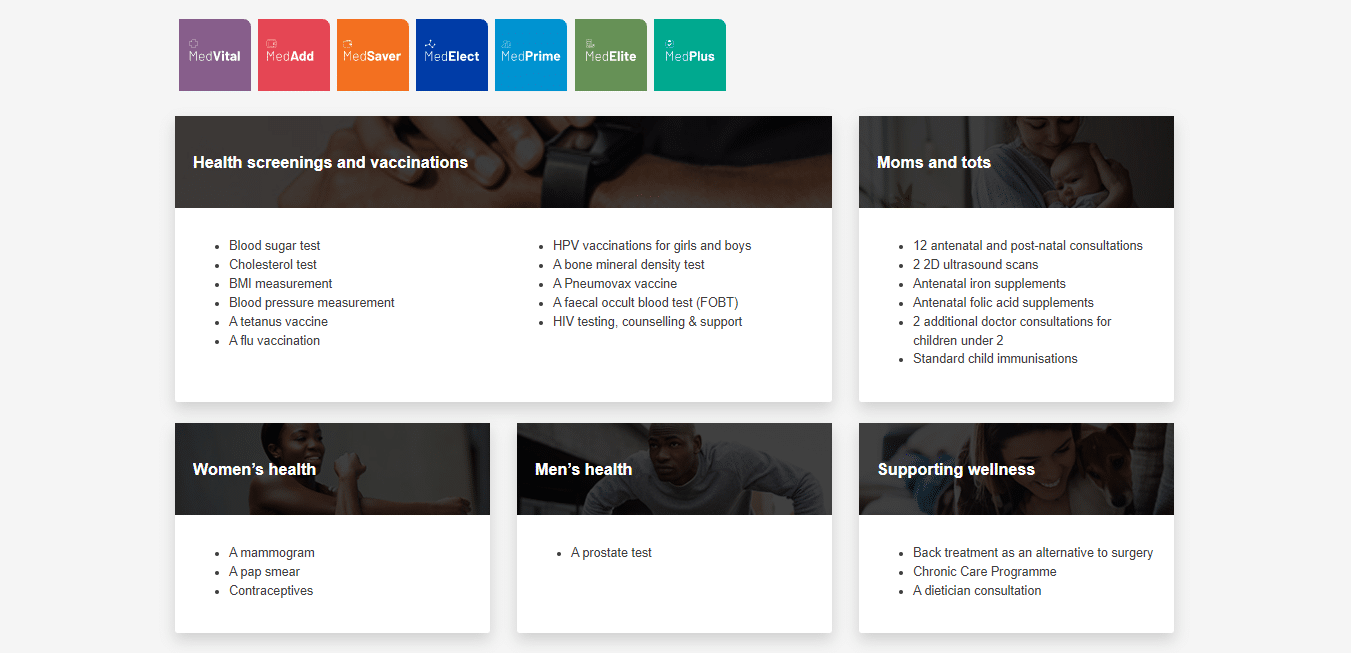

MedPrime Elect Added Insured Benefits

- With a strong emphasis on preventative care, early diagnosis of potential health problems, and maternity benefits and childcare, these benefits are offered annually in addition to your insured benefits unless otherwise specified.

- Protocols and item codes may be applicable.

- Members can look for network provider information on Medihelp’s website or app using the provider search option.

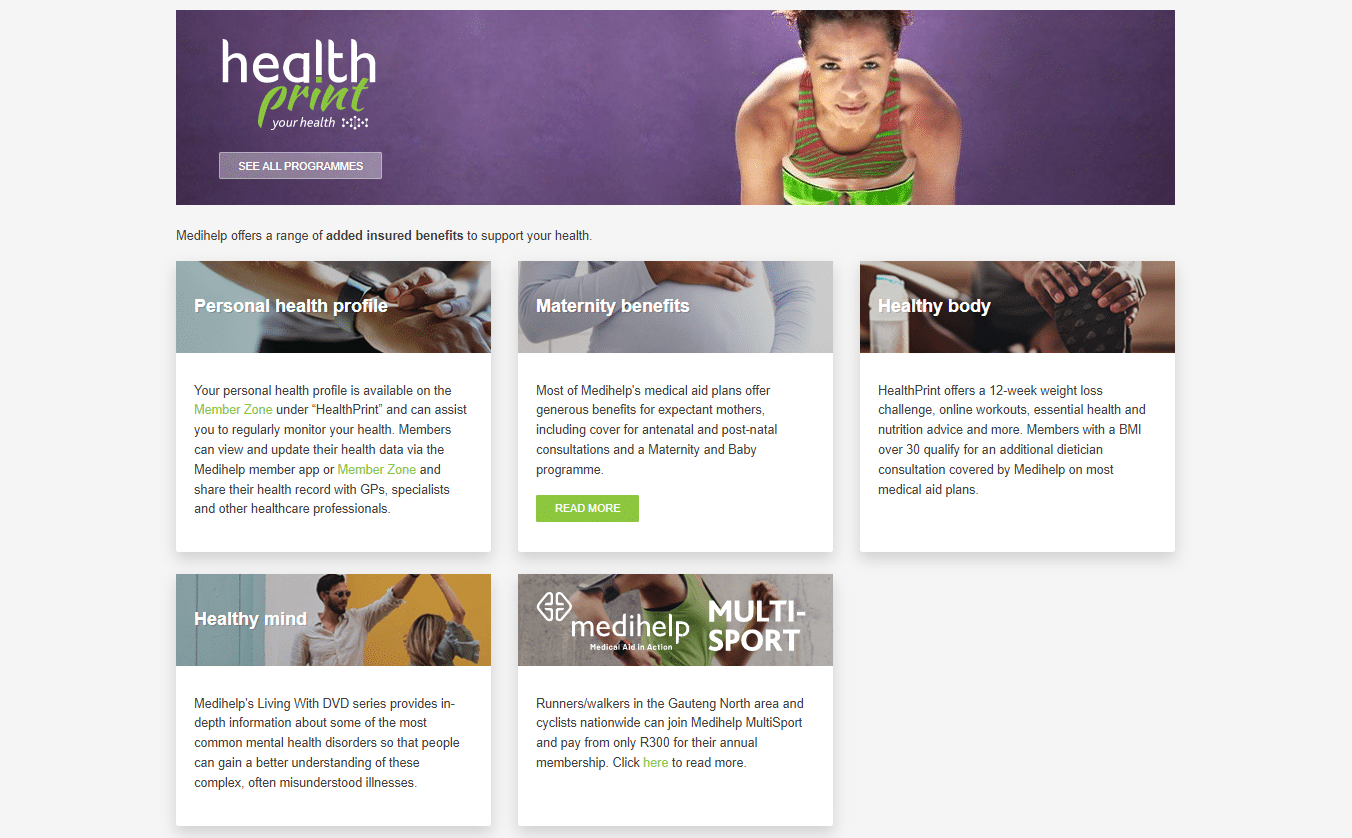

- You can also sign up for HealthPrint, a free online health and fitness program offered by Medihelp, to activate the specified benefits.

| 📌 Mammogram | For women 40 – 75 years old. Every two years. A medical doctor must request it. |

| 📍 Pap Smear | For women 21 – 65 years old. Every three years. A medical doctor must request it. |

| 💉 Flu Vaccines | Once yearly. It must be done at network pharmacy clinics. |

| 💊 Contraceptives | Oral, injectable, or implantable contraceptives Female beneficiaries up to 50 years. Covered up to R165 per month and up to R2,145 per beneficiary. Intra-uterine devices for women up to 50 years Every 60 months. Covered up to R2,520 per beneficiary. |

| ✅ Enhanced Maternity Benefits HealthPrint’s Maternity and Infant program registration will activate these additional benefits per family per year. | Ten prenatal and postnatal consultations with a midwife, general practitioner, or gynecologist. However, a recommendation from a network GP to the gynecologist is not required. Two prenatal and postnatal visits to a lactation consultant, dietician, or antenatal classes. Two 2D ultrasound imaging. Antenatal supplements: Nine months’ iron supplements. Nine months’ folic acid supplements. |

| ☑️ Child Benefits | Babies <2 years receive two additional visits to a general practitioner, pediatrician, or ear, nose, and throat specialist. However, a network Physician reference is not required to see these specialists. In network pharmacy clinics, the full series of regular child immunizations are covered for up to seven years. Vaccination of children against influenza at network pharmacy clinics. |

| 📈 Routine Screening and Immunization | A combo test, including blood glucose, cholesterol, BMI & blood pressure measurement. Individual tests, including blood glucose or cholesterol. HIV testing, counseling & support A tetanus vaccine A flu vaccination Two HPV vaccinations for girls and boys between 10 – 14 years or three between 15 – 26 years |

| 📉 Men’s Health | A prostate test (PSA level) was requested by a physician for men aged 40 to 75. Flu vaccination is administered at network pharmacies. |

| 📊 Screening and Immunization for beneficiaries 45> | An FOBT test for recipients 45-75 years Women aged 65 and older can access one bone mineral density test every two years if requested by a physician. A Pneumovax vaccine on a 5-year cycle for each 55-year-old with asthma or COPD who is registered. |

| 💛 Wellness Support | Back Treatment – this benefit covers back therapy at a DBC facility as an alternative to surgery for eligible patients. Moreover, treatment is a precondition for spinal surgery. One dietitian consultation with each registered HealthPrint member whose BMI is greater than 30 and whose BMI was determined by a BMI test. An oncology schedule is provided in conjunction with Independent Clinical Oncology Network oncologists (ICON) HIV program – Presented in partnership with LifeSense Disease Management |

| 🧡 Care Extender Benefit | Additional GP visit Once your increased insured benefits pay for a Pap smear, mammography, prostate test, FOBT, or bone mineral density test, the family will receive a one-time GP visit benefit. Test protocols will apply to this benefit. Self-Medication (R475) Once your enhanced insured benefits pay for a combo health screening (blood glucose, cholesterol, BMI, and blood pressure), the family will receive a one-time R475 for self-medication. |

Medihelp MedPrime Elect Plan Exclusions and Waiting Periods

Medihelp MedPrime Elect Exclusions

As medical research advances, new medical services are introduced each year. However, Medihelp covers life-saving medical treatment first. The Medical Schemes Act requires medical schemes to cover the diagnostic, treatment, and care costs of the mandated minimum benefits (PMB) without co-payments or limits. Furthermore, services must follow legislation’s PMB treatment algorithms and Medihelp’s managed healthcare guidelines, which may include pharmaceutical formularies. Medihelp will cover the cost of a substitute treatment if a protocol or formulary drug is ineffective or hazardous. However, the Medihelp MedPrime Elect plan excludes several items, including but not limited to the following:

- The treatment of infertility other than that specified in the Medical Schemes Act of 1998 Regulations

- The artificial insemination of a human, as defined in section 61 of the National Health Act of 2003

- Immunizations (including immunization processes and materials) required by an employer, excluding flu vaccinations and routine childhood immunizations

- Workout, coaching, and rehabilitation regimens

- The cost of extracting or conserving human tissues, including but not limited to stem cells, for future use in the treatment of an undiagnosed medical ailment in a beneficiary

- Pathology services requested by someone other than a physician

- Non-registered substances with the South African Health Products Regulatory Authority (SAHPRA).

- This does not apply to medicines exempted by section 21 of the Medicines and Related Substances Control Act (101 of 1965, as amended)

- Bandages, cotton wool, bandages, plasters, and similar items not utilized by a service provider during a treatment or procedure

- Food substitutes, food supplements, and prescription food, including infant food.

- Multivitamin and multimineral supplements alone or with stimulants (tonics)

- Appetite suppressants

- Cost of metal-based complete dentures, including laboratory fees

- Impact-resistant acrylic

- The expense of gold, precious metal, semi-precious metal, and platinum foil

- Laboratory delivery fees

- Blood pressure apparatus

- Commode

- Toilet seat raiser

- Home-use hospital beds

- Devices to improve vision, other than the stated eyeglass and contact lens benefits

Read our Study: Unhealth habits where South Africa ranks 10th in the world

Medihelp MedPrime Elect Waiting Periods

During waiting periods, members are eligible for membership but not for benefits. For example, Medihelp could implement either a general or condition-specific waiting period as follows:

- The general waiting period is up to three months from the date of membership. During this time, you will not be eligible for benefits other than the minimum prescribed benefits (PMB). During this waiting period, the Scheme will not pay any claims you file.

- From the day you join, a condition-specific waiting period of up to 12 months applies. During this period, you will not be eligible for benefits related to a specific ailment for which you get medical advice, a diagnosis, care, or treatment (this excludes PMB).

Medihelp MedPrime Elect Plan vs. Similar Plans from other Medical Schemes

| 🔎 Medical Aid Plan | 🥇 Medihelp MedPrime Elect | 🥈 Discovery Classic Saver | 🥉 Bonitas BonSave Plan |

| 🌎 International Cover | None | R5 million | R10 million |

| 👤 Main Member Contribution | R3,918 | R4,182 | R3,447 |

| 👥 Adult Dependent Contribution | R3,306 | R3,299 | R2,671 |

| 🍼 Child Dependent Contribution | R1,140 | R1,676 | R1,032 |

| 🏥 Hospital Cover | Unlimited | Unlimited | Unlimited |

| 📌 Oncology Cover | R299,000 | R250,000 | R200,000 |

| 💶 Prescribed Minimum Benefits | ☑️ Yes | ☑️ Yes | ☑️ Yes |

| 📉 Screening and Prevention | ✅ Yes | ✅ Yes | ✅ Yes |

| ➡️ Medical Savings Account | ☑️ Yes | ☑️ Yes | ☑️ Yes |

Our Verdict on The Medihelp MedPrime Elect Plan

Medihelp’s MedPrime Elect is a comprehensive medical aid plan offering its members a range of benefits. One of the standout features of this plan is its unlimited hospital cover, which means that members are covered for all hospital-related expenses, including accommodation, theatre, and specialist fees. In addition, the plan offers generous benefits for chronic medication. It covers day-to-day medical expenses such as GP consultations, dentistry, and optometry. One of the advantages of the MedPrime Elect plan is that it is more affordable than the MedElect plan while still offering comprehensive coverage. Additionally, the plan allows for some customization, with members able to choose between different levels of chronic medication coverage and dental and optical benefits.

The plan also offers various value-added benefits, such as a wellness program, health assessments, and chronic disease management. However, the plan has a few drawbacks, including certain exclusions and limitations, such as limited coverage for certain procedures, waiting periods for pre-existing conditions, and a maximum limit on some benefits. Overall, the MedPrime Elect plan is a great choice for individuals or families who are looking for comprehensive medical aid coverage at an affordable price.

You might also consider the following options of MediHelp:

- MediHelp HealthPrint

- MediHelp Medprime

- MediHelp MedPlus

- MediHelp MedElite

- MediHelp MedVital

- MediHelp MedVital Elect

- MediHelp MedSaver

- MediHelp MedMove

- MediHelp MedElect

- MediHelpMedAdd

- MediHelp MedAdd Elect

Medihelp MedPrime Elect Plan Frequently Asked Questions

Does MedPrime Elect cover blood tests?

Yes, MedPrime Elect covers blood tests that are medically necessary, subject to the scheme’s rules and protocols. The scheme may limit the number of blood tests covered, depending on the member’s benefit option and specific needs.

Does MedPrime Elect pay for MRI scans?

Yes, MedPrime Elect covers MRI (Magnetic Resonance Imaging) scans as part of its hospitalization and radiology benefits, subject to pre-authorization by the scheme. However, the amount of cover may depend on the member’s benefit option, and any co-payments or deductibles may apply.

How much is MedPrime Elect monthly?

MedPrime Elect is R3,918 for the main member, R3,306 per adult, and R1,140 per child dependent.

Does MedPrime Elect pay for hip replacement?

Yes, MedPrime Elect covers hip replacement surgery as part of its hospitalization benefits, subject to pre-authorization and scheme protocols.

What is MedPrime Elect?

MedPrime Elect is a healthcare technology company that provides healthcare providers with electronic health records, telemedicine, and practice management software. The company’s services are designed to help providers deliver high-quality patient care and improve operational efficiency.

Does MedPrime Elect cover maternity benefits?

Yes, MedPrime Elect covers maternity benefits, including antenatal consultations, childbirth, and postnatal care. The plan also covers certain tests and scans related to pregnancy.

Does MedPrime Elect cover chronic medication?

Yes, MedPrime Elect covers chronic medication for a defined list of chronic conditions. The plan has a Chronic Disease List (CDL) that specifies the chronic conditions covered and the medication and treatment options available.

Does MedPrime Elect cover refractive eye surgery?

Yes, MedPrime Elect covers refractive eye surgery, a surgical procedure that corrects vision problems such as nearsightedness, farsightedness, and astigmatism. The plan covers a limited amount of refractive eye surgery every two years.

Does MedPrime Elect cover internal and external prostheses?

Yes, MedPrime Elect covers internal and external prostheses, which are devices that replace missing body parts or functions. This includes artificial limbs, hearing aids, and pacemakers, among others.

Does MedPrime Elect have a waiting period for certain benefits?

Yes, MedPrime Elect has waiting periods for certain benefits. For example, there is a 12-month waiting period for maternity benefits and a three-month waiting period for chronic medication benefits. Furthermore, the waiting periods ensure that members cannot claim certain benefits immediately after joining the plan.

How do I join Medihelp’s MedPrime Elect medical aid plan?

To join MedPrime Elect, visit the Medihelp website or contact their call center to request a quote. You will need to provide personal and medical information. The scheme will assess your application and determine your premium based on age, health status, and other factors.

What is the co-payment for hospitalization on MedPrime Elect?

MedPrime Elect has a co-payment of 20% – 50% for unauthorized hospitalization, meaning you will need to pay 20 to 50% of your hospitalization out of pocket. However, depending on the hospital and the treatment received, this co-payment is capped at a maximum amount.

You might also like

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans