5 Best Hospital Plans for Students and Young Adults

The 5 Best Hospital Plans for Students and Young Adults in South Africa revealed.

We tested them side by side and verified their hospital plans.

This is a complete guide to the best hospital plans for students and young adults in South Africa.

In this in-depth guide you’ll learn:

- What is a Hospital Plan?

- At what age do you stop qualifying as a student?

- What is the cheapest hospital plan in South Africa?

- Should you rather have a medical aid or hospital plan as a young adult?

- Do you have to study to qualify for student benefits on medical aid?

So if you’re ready to go “all in” with the best hospital plans for students and young adults in South Africa, this guide is for you.

Let’s dive right in…

Best Hospital Plans for Students and Young Adults (2024)

| 🩺 Medical Aid | ✔️ Offers Plans for Students/Young Adults? | ⚕️ Plan Offered | 👉 Sign Up |

| 1. Bonitas Medical Scheme | Yes | Boncap Student | 👉 Apply Now |

| 2. Discovery Health | Yes | Discovery KeyCare Plan | 👉 Apply Now |

| 3. Momentum Medical Aid | Yes | Ingwe Student Option | 👉 Apply Now |

| 4. BestMed | Yes | Network Plans | 👉 Apply Now |

| 5. Medihelp Medical Scheme | Yes | MedMove | 👉 Apply Now |

5 Best Hospital Plans for Students and Young Adults Summary

- Bonitas Medical Scheme – Overall, Best Hospital Plans for Students and Young Adults in South Africa

- Discovery Medical Scheme – Top Extensive Medical Protection in South Africa

- Momentum Medical Scheme – Broadest Range of Low-Cost Medical Aid Plans

- BestMed Medical Aid – Best Pay-As-You-Go Private Healthcare

- Medihelp Medical Scheme – Best Customer Service Medical Aid

Introduction to Hospital Plans for Students and Young Adults

Individuals who have reached an age where they are no longer eligible to remain on their parents’ health insurance policy but who are not yet permanently employed and are still enrolled in a tertiary educational programme are eligible to purchase coverage through medical aid plans for students at a cost that is reasonable.

You will be eligible for discounted fees if you can provide proof that you are enrolled in an educational programme.

Students who are generally healthy but would want the peace of mind that comes with knowing they are financially protected in the event that they require hospitalisation typically opt for a hospital plan that focuses primarily on covering the costs associated with being in the hospital.

Students who have a chronic ailment may still be eligible for an all-inclusive medical insurance plan, but this depends on whether or not sufficient money are available. There are other plans that may be tailored to your specific requirements that are affordable and provide coverage both inside and outside of hospitals.

If you are less than 21 years old, you are eligible to be listed as a dependent on your parent’s medical insurance plan and will be charged the child rate for your coverage. If you can produce confirmation that you are attending school full-time, you may be able to keep paying the child rate for a certain type of medical insurance up to the age of 26.

Quotes for medical aid may be compared online, an efficient approach to choose which alternative best meets your requirements and financial constraints. You will be able to choose from a diverse selection of Medical Aid providers.

READ also: Medical Aid for Young Adults

1. Bonitas Medical Scheme

Bonitas offers a wide variety of plans, including hospital plans, several of which are suitable for students and other young adults.

These plans are designed so that young members can get the most out of their benefits:

Hospital Plans

Young healthy adults can opt for basic hospital plans, that cover them for emergency and planned procedures in hospital and access to some additional benefits for wellness and preventative care.

These options include the Hospital Standard, BonEssential and BonEssential Select plans – the latter using a quality provider network that offers comprehensive hospital benefits and some value-added benefits.

Other plans suitable for students, if they can afford it:

Edge Plans

These plans cover day-to-day benefits including unlimited GP consultations, layers of virtual care, dental and optical consultations, a private hospital network and more. Options include the BonStart plan, designed for economically active singles, living in the larger metros, with a drive to succeed and BonStart Plus, designed for young, economically active adults, living in the larger metros.

Traditional Plans

The traditional plans are suitable for young adults who are already settled and financially independent. The give an overall day-to-day limit with sub-limits for GP and specialist consultations, acute and over-the-counter medicine, X-rays and blood tests and other out-of-hospital medical expenses. Options include a Standard, Standard Select, Primary and Primary Select plan.

This traditional options offers good day-to-day benefits and comprehensive hospital cover, with the Select plans using a network of quality providers to offer modest day-to-day benefits and hospital cover.

Savings Plans

Young adults can also consider one of Bonitas’ Saving plans that give a set amount that you can use however you want for out-of-hospital costs like doctor visits, optometry, and dentistry. They also cover you while you’re in the hospital and give you extra benefits for maternity, wellness, and preventative care.

The options are called BonFit Select, BonSave, BonComplete, BonClassic and BonComprehensive

This savings options offer sufficient savings to use for medical expenses and extensive hospital cover, with BonComprehensive being a first-class savings plan that offers ample savings, an above threshold benefit and the best hospital cover.

2. Discovery Medical Scheme

Students are eligible for all Discovery’s hospital plans and all-inclusive medical aid plans, depending on whether or not sufficient money are available. There are several plans that may be tailored to their specific requirements that are affordable and provide coverage both inside and outside of hospitals.

Core Series

The Core Series is a value-for-money series of hospital plans that provide unlimited private hospital cover and essential cover for chronic medicine to students who do not have a big income. The benefits do not include any day-to-day cover.

Keycare Series

Young adults who just start out with a career, may consider this basic series of plans to get a foot in the door. The Keycare Series offers affordable medical cover providing you use providers in a specified network for both in-hospital and out-of-hospital treatment.

Saver Series

The Saver series is economical, provides in-hospital cover, essential chronic medicine cover and day-to-day benefits through a Medical Savings Account. Its premiums are reasonable, therefore many young adults and students consider them.

Smart Series

The Smart series of plans provide the most cost-effective in-hospital cover, essential chronic medicine cover plus limited day-to-day cover for young adults if they use providers in a specified network.

Priority Series

The Priority Series Medical Aid Plans offer cost-effective in-hospital cover, essential chronic medicine cover and day-to-day benefits with a limited Above Threshold Benefit, which is ideal for young professionals.

3. Momentum Medical Scheme

Young adults in South Africa can find a wide range of medical insurance plans and benefits, including 6 medical aid plans from Momentum Medical Scheme. These plans are:

Evolve Option

This option gives cover for hospitalisation from the Evolve Network of private hospitals with no overall annual limit.

Young adults who choose this option get access to 2 virtual doctors’ consultations and any additional day-to-day benefits are subject to HealthSaver+.

Custom Option

This option gives young adult members comprehensive hospital and chronic cover from any or associated providers. They can choose to have access to treatment at any hospital or save further on their contributions by using a specific list of private hospitals.

Incentive Option

This top option is suitable for young adults who can afford a more expensive monthly premium. With this option young adults can get extensive hospital and chronic cover from any or associated providers. Their day-to-day expenses will be covered by a medical savings pocket that is being funded by 10% of their monthly contributions

Ingwe Option

This entry-level medical cover option is the most affordable and accessible to young adults who have just started their first job. They can get treatment from any hospital, the Ingwe Network of private hospitals, or State hospitals.

Young adults can choose between BestMed Hospital Plans, Network Plans, Savings Plans, and Comprehensive Plans.

READ more about The 5 Best Medical Aid Schemes under R1500 in South Africa reviewed

4. BestMed Medical Aid

Hospital Plans

These Hospital Plans are popular with students and young adults, because it covers treatment at a range of network hospitals for planned and unplanned hospital stays, no matter what age you are. There is also a choice between the Beat1 Plan and Beat1 Network Plan that gives unlimited cover for unplanned hospital stays in the network’s hospitals.

Network Plans

BestMed Network Plans include a little bit more benefits, which are appreciated by young adults who can afford slightly higher monthly premiums:

Both the Rhythm1 and Rhythm2 Network Plans offer unlimited in-hospital cover with either limited essential day-to-today benefits, or comprehensive savings for consultations with designated healthcare providers. The Rhythm2 Network Plan is dependent on income levels.

Savings Plans

BestMed Savings Plans are an even better option for young adults, since they include extensive hospital cover at private hospitals and a savings account out of which general day-to-day expenses are paid.

The following options are available:

- Beat2 Savings Plan

- Beat2 Network Savings Plan

- Beat3 Savings Plan

- Beat3 Network Savings Plan

The Network Savings plans are associated with certain Network hospitals and providers.

POLL: The 5 Best Medical Aids with No Late Joiner Penalty in South Africa reviewed and revealed

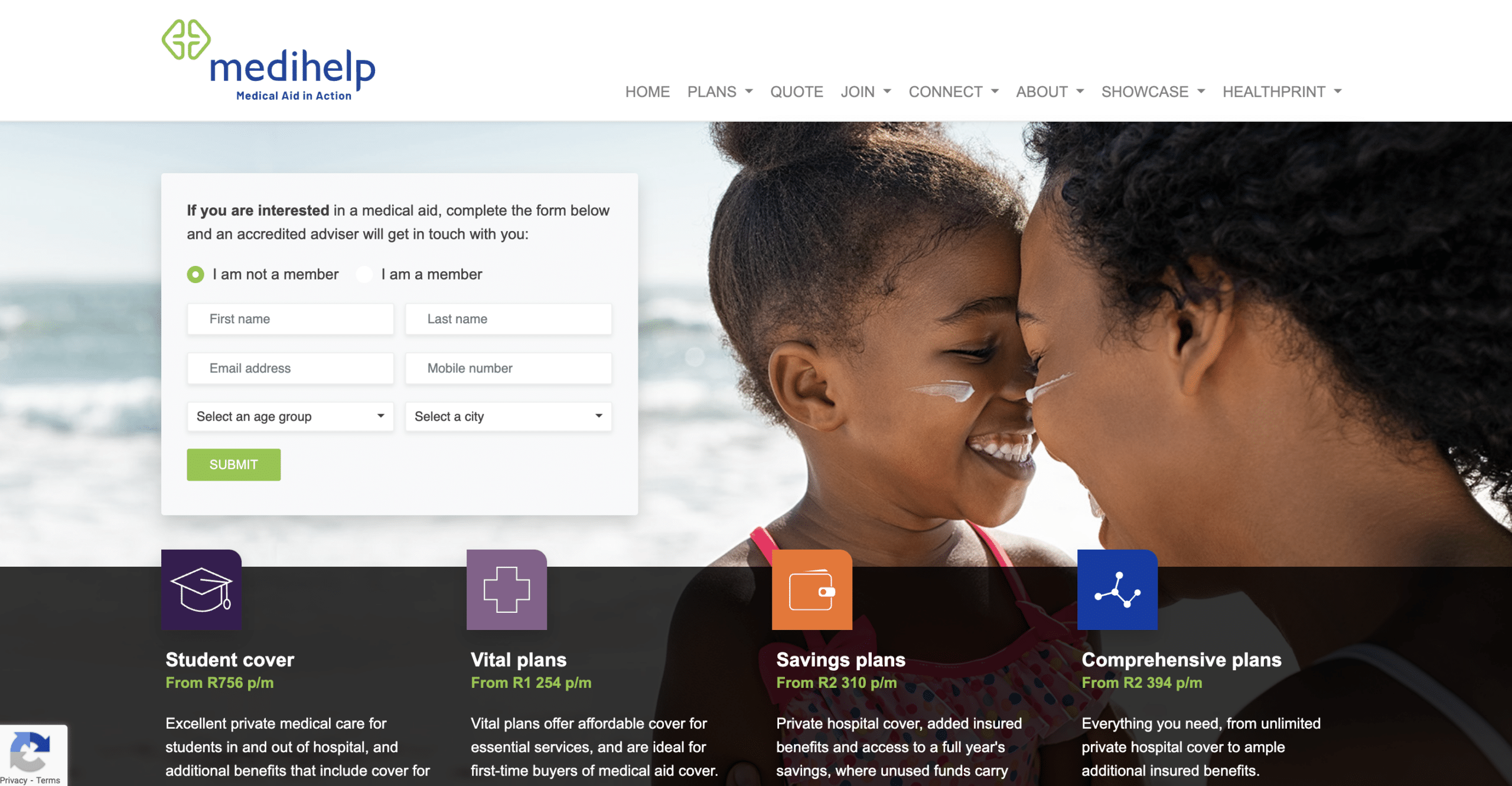

5. Medihelp Medical Scheme

Medihelp offers the following option plans that are ideally suited to students and young adults:

MedMove

Medmove provides essential cover such as private hospitalisation and emergency medical services through quality networks. Members also have access to virtual and in-person doctors’ consultations and medicine, as well as a selection of other medical services they may need.

MedElect Student

MedElect uses a quality network of service providers to provide comprehensive cover at an affordable premium for those who still have to concentrate on their studies. Among its benefits count extensive in-hospital cover, screenings and additional benefits.

MedVital

MedVital is another healthcare solution that offers affordable cover for minor medical expenses, private hospitalisation and emergency medical services.

MedAdd

MedAdd offers the flexibility of an added savings account, additional insured cover once savings are depleted, cover for dental and eye care, as well as pregnancy benefits, a definite plus for young families.

MedSaver

MedSaver provides cover for private hospitalisation at any hospital, while the 25% savings pocket covers medical expenses incurred out of hospital. Once savings are depleted, an additional out-of-hospital cover gets activated.

You might like 5 Best Gap covers under R200 per month

Frequently Asked Questions

Can students get hospital plans in South Africa?

Yes, students that can afford it, can get a hospital plan in South Africa. Even though you can only afford an entry-level medical aid plan, it can give you hospital cover, day-to-day, and chronic illness benefits, especially when you use network providers.

Is a hospital plan for students cheaper than medical aid?

Yes, in general, student hospital plans are less expensive than full-service medical aid plans.

How do students choose a suitable hospital plan?

Consider the coverage offered, cost, network of healthcare providers, extra perks, waiting periods, and overall flexibility of the plan when selecting a good hospital plan for students.

Which is better for young adults, a medical aid or hospital plan?

A medical aid has more benefits because it pays for medical costs in and out of hospital while a hospital plan does not cover other costs than those incurred in hospital.

Do hospital plans for young adults cover surgery?

Yes, depending on the specific plan you choose a hospital plan for young adults can cover you for any medical procedures that are performed in a private hospital, such as if you’re in an accident and need surgery.