- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Day1 Health Value Plus Hospital Plan

Overall, the Day1 Health Value Plus Hospital Plan is a trustworthy and comprehensive medical aid plan that offers medical emergency assistance and in-hospital benefits to up to 5 Family Members. The Day1 Health Value Plus Hospital Plan starts from R345 ZAR. Day1 Health has a trust rating of 3.1.

| 🔎 Medical Health Plan | 🥇 Day1 Health Value Plus Hospital |

| 📊 Annual Limit | None |

| 📈 Above Threshold Benefit (ATB) | None |

| 🌎 International Cover | None |

| 👤 Main Member Contribution | R345 |

| 👥 Adult Dependent Contribution | R345 – R569 |

| 🍼 Child Dependent Contribution | R552 – R1,397 |

| 🔁 Gap Cover | None |

| 💙 Hospital Cover | Illness Benefit |

| 💚 Screening and Prevention | None |

Day1 Health Value Plus Hospital Plan – Key Point Quick Overview

- ✅ Day1 Health Value Plus Hospital Plan Overview

- ✅ Day1 Health Value Plus Hospital Plan Premiums

- ✅ Day1 Health Value Plus Hospital Plan Benefits and Cover Comprehensive Breakdown

- ✅ Day1 Health Value Plus Hospital Plan Exclusions and Waiting Periods

- ✅ Day1 Health Value Plus Hospital Plan vs Plans Offered by Other Providers

- ✅ Our Verdict on the Day1 Health Value Plus Hospital Plan

- ✅ Day1 Health Value Plus Hospital Plan Frequently Asked Questions

Day1 Health Value Plus Hospital Plan Overview

The Day1 Health Value Plus Hospital Plan is one of 10, starting from R345. It includes an in-hospital illness benefit, accident/trauma benefit, funeral benefit, and 24-hour emergency services.

The Day1 Health Value Plus Hospital Plan may be a good option for individuals seeking basic hospitalization coverage and protection against accident and trauma-related expenses. Gap Cover is not available on the Day1 Health Platinum Comprehensive Plan. However, Day1 Health offers 24/7 medical emergency assistance.

Day1Health has the following health insurance plans to choose from:

Day1 Health Day-to-Day Plan

Day1 Health Day-to-Day Senior Plan

Day1 Health Executive Comprehensive Plan

Day1 Health Executive Hospital Plan

Day1 Health Platinum Comprehensive Plan

Day1 Health Platinum Hospital Plan

Day1 Health Value Plus Comprehensive Plan

Day1 Health Value Plus Comprehensive Senior Plan

Day1 Health Value Plus Hospital Plan

Day1 Health Value Plus Hospital Senior Plan

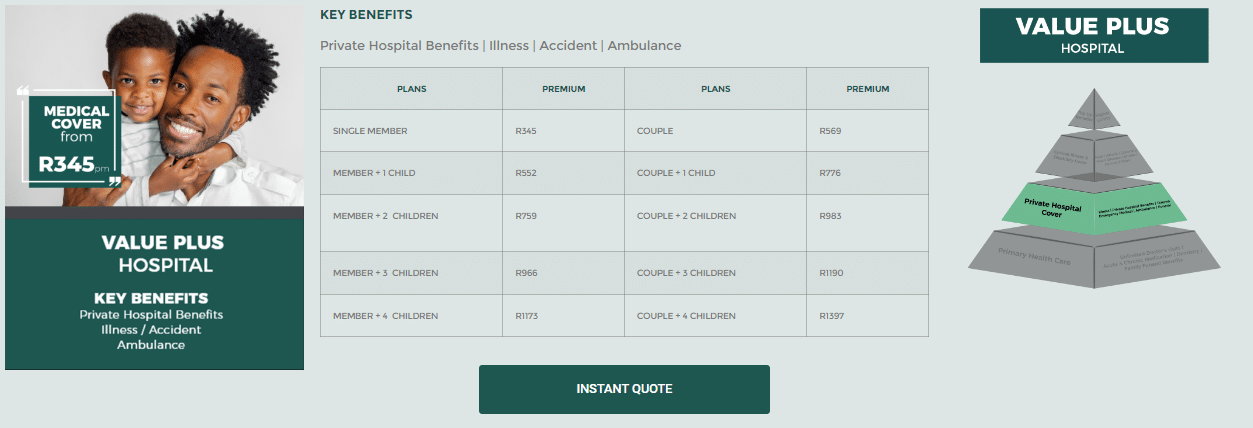

Day1 Health Value Plus Hospital Plan Premiums

| 🅰️ Family Dynamic | 🅱️ Premium | 🅰️ Family Dynamic | 🅱️ Premium |

| 🟧 Single Member | R345 | 🟧 Couple | R569 |

| 🟨 Member + 1 Child | R552 | 🟨 Couple + 1 Child | R776 |

| 🟩 Member + 2 Children | R759 | 🟩 Couple + 2 Children | R983 |

| 🟦 Member + 3 Children | R966 | 🟦 Couple + 3 Children | R1,190 |

| 🟪 Member + 4 Children | R1,173 | 🟪 Couple + 4 Children | R1,397 |

You might like the 5 Best Hospital Plans Under R3000 in South Africa

Day1 Health Value Plus Hospital Plan Benefits and Cover Comprehensive Breakdown

| 1️⃣ In-Hospital Illness | Covers up to R10,000 after 24 hours in the hospital, R10,000 for the second day, and R10,000 for the third day. Following that, R1,500 per day for a maximum of 21 days. |

| 2️⃣ Accident/Trauma | Limited to R150,000 per event. Sports injuries are excluded from this benefit. |

| 3️⃣ Family Funeral Benefit | The Family Funeral Benefit is as follows: Principal Member – R20,000 Spouse and Child >14 years – R10,000 Children >6 years – R5,000 Children >0 – R2,500 Children >28 weeks – R1,250 |

| 4️⃣ 24-Hour Emergency Services Ambulance and Pre-Authorisation | Africa Assist offers 24-Hour Emergency Services, Medical Assistance, and Pre-Authorization. Guaranteed private hospital admission with a preference for all hospitals operated by Life Healthcare and Mediclinic. |

Consider adding GAP Cover ? You might like 5 Best Gap Cover Options for Under R500

Day1 Health Value Plus Hospital Plan Exclusions and Waiting Periods

Day1 Health Value Plus Hospital Plan Exclusions

Typical exclusions with Day1 Health could include:

- Treatment for pre-existing conditions unless otherwise specified in the policy.

- Cosmetic or elective procedures, unless medically necessary.

- Treatment received outside of the designated network of healthcare providers.

- Experimental or investigational treatments.

- Fertility treatments or assisted reproductive technologies.

- Infertility testing or treatment.

- Weight loss or weight management programs.

- Substance abuse treatment or counseling.

- Mental health treatment or counseling.

Finally, Long-term care or hospice care is not included in the Value Plus Hospital Plan.

Day1 Health Value Plus Hospital Plan Waiting Periods

Day1 Health applies the following waiting periods on the Value Comprehensive Plan:

| 🅰️ Benefit | 🅱️ Waiting Period |

| 🧡 In-Hospital Illness | 3 – 12 Months |

| 💛 Accident/Trauma | 1 month |

| 💚 Family Funeral Benefit | 3 Months |

| 💙 24-Hour Emergency Services Ambulance and Pre-Authorisation | Immediate |

Day1 Health Value Plus Hospital Plan vs Plans Offered by Other Providers

| 🔎 Medical Health Plan | 🥇 Day1 Health Value Plus Hospital | 🥈 Momentum Custom Plan | 🥉 Bonitas Hospital Standard Plan |

| 📊 Annual Limit | None | None | Unlimited |

| 📈 Above Threshold Benefit (ATB) | None | None | None |

| 🌎 International Cover | None | Up to R9.01 million | R10 million |

| 👤 Main Member Contribution | R345 | R2,580 | R2,592 |

| 👥 Adult Dependent Contribution | R345 – R569 | R3,176 | R2,184 |

| 🍼 Child Dependent Contribution | R552 – R1,397 | R2,449 – R6,573 | R986 |

| 🔁 Gap Cover | None | ✅ Yes | ✅ Yes |

| 💙 Hospital Cover | Illness Benefit | Unlimited | Unlimited |

| 💚 Screening and Prevention | None | ✅ Yes | ✅ Yes |

Women might consider making use of our free Ovulation Calculator

Our Verdict on the Day1 Health Value Plus Hospital Plan

The Day1 Health Value Plus Hospital Plan is a health insurance plan that covers in-hospital benefits, accident and trauma-related expenses, and family funeral benefits. The plan is designed to provide financial protection for individuals who may require hospitalization or need to cover medical expenses related to an accident or trauma.

However, it is important to note that the Value Plus Hospital Plan only provides cover for hospitalization and does not offer day-to-day cover for things like doctor visits or medication. This may not be suitable for individuals who require ongoing medical care or treatment.

You might also like: Day1 Health Day-to-Day Plan

You might also like: Day1 Health Day-to-Day Senior Plan

You might also like: Day1 Health Executive Comprehensive Plan

You might also like: Day1 Health Executive Hospital Plan

You might also like: Day1 Health Platinum Comprehensive Plan

You might also like: Day1 Health Platinum Hospital Plan

You might also like: Day1 Health Value Plus Comprehensive Plan

You might also like: Day1 Health Value Plus Comprehensive Senior Plan

You might also like: Day1 Health Value Plus Hospital Senior Plan

Day1 Health Value Plus Hospital Plan Frequently Asked Questions

What is the Day1 Health Value Plus Hospital Plan?

The Value Plus Hospital Plan is a health insurance plan offered by Day1 Health in South Africa. It covers in-hospital benefits, accident and trauma-related expenses, and family funeral benefits.

What is covered under the Value Plus Hospital Plan?

The plan covers hospitalization expenses, including in-hospital medical expenses, accident and trauma-related expenses, and family funeral benefits.

Can I choose my own hospital with the Value Plus Hospital Plan?

Yes, you can choose the hospital where you want to receive treatment. However, it is important to make sure that the hospital is included in the Day1 Health network to ensure that you receive maximum benefits.

Does the Value Plus Hospital Plan provide cover for day-to-day medical expenses?

No, the plan only provides cover for hospitalization expenses. It does not cover day-to-day medical expenses such as doctor visits or medication.

Is there a waiting period for coverage under the Value Plus Hospital Plan?

Yes, there is a waiting period of 3 months for hospitalization-related benefits and a waiting period of 6 months for accident and trauma-related benefits.

Is the Value Plus Hospital Plan suitable for individuals with pre-existing conditions?

Yes, the plan is available for individuals with pre-existing conditions. However, there is a waiting period of 12 months for pre-existing conditions.

How much does the Value Plus Hospital Plan cost?

The plan’s cost varies depending on the individual’s age and cover options.

Can I add additional cover to the Value Plus Hospital Plan?

Yes, Day1 Health offers additional top-up options for certain benefits, such as increased accident and trauma-related benefits.

Does the Value Plus Hospital Plan provide cover for international travel?

No, the plan only covers medical expenses incurred within South Africa.

How do I enroll in the Value Plus Hospital Plan?

You can enroll in the plan by visiting the Day1 Health website and completing the online enrollment process. Alternatively, you can contact Day1 Health directly for assistance with enrollment.

Table of Contents

Free Health Insurance Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans