Best Medical Aids for Professionals

Being healthy is equivalent to being wealthy, and professionals prioritize receiving the most superior medical care for themselves. Explore the top five tailored healthcare plans that cater precisely to the specific needs of individuals in your profession. In this article, you will come across the following topics:

- ☑️ Why Professionals Need Specialised Medical Aid

- ☑️ The 5 Best Medical Aids for Professionals

- ☑️ The Criteria for Our Selection

- ☑️ What to Look for in a Medical Aid Plan

- ☑️ The Future of Medical Aid for Professionals

- ☑️ Our Final Thoughts on Medical Aid for Professionals

- ☑️ Medical Aid for Professionals FAQ

and much, MUCH more!

The Best Medical Aids for Professionals – A Comparison

| 🔎 Provider | ❤️ Specialized Cover For Professionals | ☑️ Cover Includes |

| 🥇 Discovery Health | ✅Yes | 23 Plan Options Selection of Healthcare Providers |

| 🥈 Bonitas | ✅Yes | Managed Care Program Comprehensive Hospital Cover |

| 🥉 Momentum | ✅Yes | Unlimited private hospital coverage Essential chronic medicine coverage |

| 🏅 Medihelp | ✅Yes | Several flexible plans |

| 🎖️ Profmed | ✅Yes | Comprehensive healthcare |

The Best Medical Aids for Professionals (2024)

- ☑️ Discovery Health – Overall, the Best Medical Aid for Professionals in South Africa

- ☑️ Bonitas – Comprehensive Hospital Coverage for Specialized Treatments

- ☑️ Momentum – Essential Chronic Medicine Coverage

- ☑️ Medihelp – Several Flexible Plans

- ☑️ Profmed – Comprehensive Coverage at Competitive Prices

Why Professionals Need Specialised Medical Aid

Professionals in today’s fast-paced work environment face unique challenges that extend beyond the boardroom and into their well-being.

The demands of a professional life can have serious consequences for one’s health, from the stress of meeting deadlines to the physical toll of working long hours.

While general medical aid plans provide some protection, they frequently fall short of meeting the specific healthcare needs of working professionals.

This section will examine why professionals should consider specialized medical aid plans tailored to their specific lifestyle and health risks.

Unique Health Risks and Challenges

Professionals frequently face distinct health risks related to their work environment and lifestyle.

Long work hours, high-stress situations, and frequent travel can all contribute to various health problems, ranging from musculoskeletal issues to cardiovascular disease.

Specialized medical aid plans, such as chiropractic care or stress management programs, can address these specific challenges.

Time Constraints

Professionals typically have demanding schedules, making navigating the complexities of healthcare difficult.

Concierge services, which can help schedule appointments, find specialists, and even arrange home-based care, are frequently included in specialized medical aid plans. This saves time and ensures that healthcare does not suffer because of work obligations.

Competitive Edge in the Job Market

Employers with specialized medical aid as part of their compensation package may have an advantage in attracting top talent. Professionals are more likely to be drawn to job offers that include comprehensive medical benefits, creating a win-win situation for both parties.

Access to a Network of Specialists

Professionals frequently prefer direct access to medical specialists over going through a general practitioner first. Specialized medical aid plans can provide a network of specialists who are easily accessible for consultations, speeding up the diagnosis and treatment process.

Financial Stability

Medical emergencies can be financially draining, especially concerning for professionals with significant financial responsibilities.

Specialized medical aid plans frequently provide higher coverage limits and additional benefits such as income protection, ensuring that a medical crisis does not become financial.

Tailored Coverage Options

The one-size-fits-all approach is ineffective for professionals who may have unique healthcare requirements. Professionals can customize their medical aid plans by selecting add-ons or specific coverage options most relevant to them.

This could include everything from maternity benefits for those thinking about starting a family to international coverage for those who travel frequently for work.

Tax Benefits

If you are a self-employed professional or run your own business, opting for specialized medical aid plans can offer tax advantages.

By choosing more inclusive coverage options, the premiums paid towards these plans can often be claimed as tax deductions – a financial incentive to consider such schemes.

READ more about our Guide to Medical Aid Tax Explained

Is mental health coverage important for professionals?

Yes, mental health coverage is a crucial component of specialized medical aid due to the high-stress nature of many professional roles.

What role does flexibility play in specialized medical aid for professionals?

Flexibility is essential for professionals who may experience job changes or relocations, necessitating an adaptable medical aid plan.

The Best Medical Aids for Professionals

Discovery Health Medical Scheme

Discovery Health is South Africa’s largest open medical aid scheme, covering approximately 2.8 million people. Premiums for a single member range from R1,003 to R9,122, with 23 medical aid options. The following factors make Discovery Health the Best Option For Professionals:

- ✅ Discovery Health offers professionals the flexibility to choose a plan that best suits their healthcare needs and financial situation by offering 23 different medical aid plans.

- ✅ The absence of an overall limit for hospital coverage ensures that professionals can access the best healthcare services without fear of exhausting their benefits.

- ✅ Most plans allow members to visit any private hospital, allowing them to select healthcare providers with whom they are most comfortable.

- ✅ As South Africa’s largest open medical aid scheme, Discovery Health provides the sense of dependability and stability that professionals seek.

and much, MUCH more!

Discovery Health Pros and Cons

| ✅ Pros | ❎ Cons |

| Most plans let you choose any private hospital, giving you more healthcare options | High premiums that may not be affordable for all |

| Discovery Health is South Africa’s largest open medical aid scheme that provides stability | 23 plans make choosing one difficult |

| Offers virtual consultations, ideal for professionals with busy schedules | Some plans have limited day-to-day medical benefits, resulting in out-of-pocket expenses |

| With 23 plans, professionals can find one that meets their needs | There are network restrictions that limit the choice of healthcare providers |

Bonitas Medical Aid

Bonitas is a leading managed care program in South Africa, providing various medical aid options. The BonEssential Hospital Plan is particularly popular, with monthly premiums starting at R2,135.

The following notable factors make Bonitas the best option for Professionals:

- ✅ Bonitas offers a managed care program that provides professionals with the support and guidance they need to navigate the healthcare system.

- ✅ The BonEssential Hospital Plan provides comprehensive hospital coverage, which is important for professionals needing specialized treatments or surgeries.

- ✅ With monthly premiums starting at R2,135, Bonitas balances comprehensive coverage and affordability.

and much, MUCH more!

Bonitas Pros and Cons

| ✅ Pros | ❎ Cons |

| The BonEssential Hospital Plan provides comprehensive hospital coverage for specialized treatments | Some plans have limited coverage for chronic illness |

| Provides robust emergency medical services | There are several waiting periods for certain conditions and treatments |

| Bonitas is one of the most affordable medical aid schemes in South Africa | Basic plans may not cover specialized treatments |

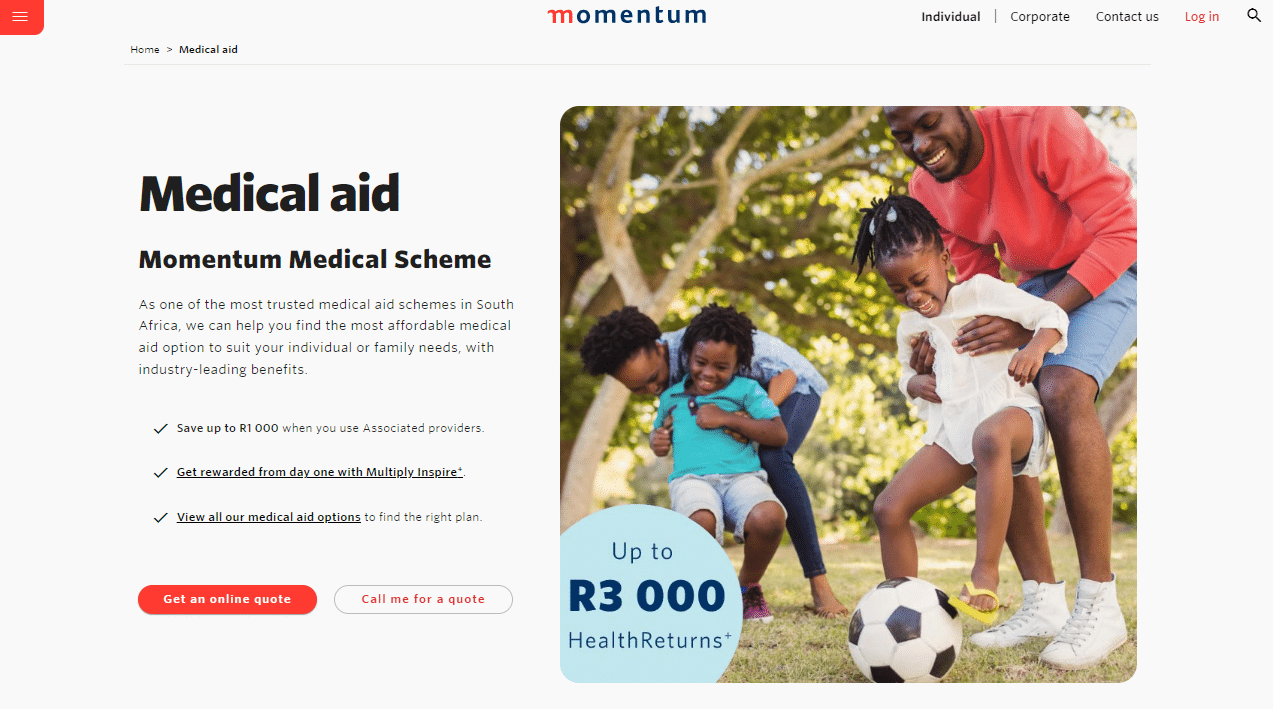

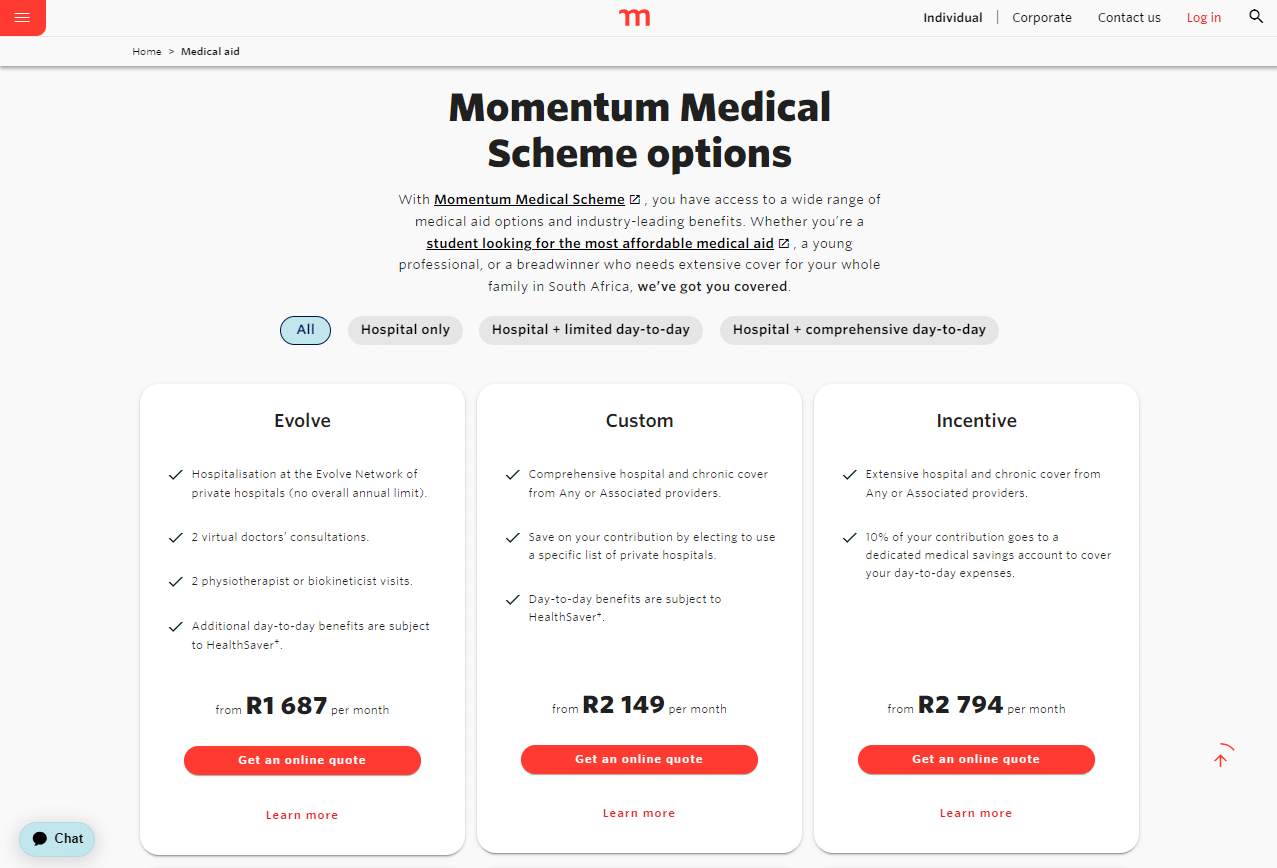

Momentum Medical Aid

Momentum is South Africa’s third-largest medical aid provider. Its Evolve Option is popular, providing comprehensive coverage at a reasonable price.

The following Notable factors make Momentum the best option for Professionals:

- ✅ The Evolve Option includes unlimited private hospital coverage, ensuring that professionals do not have to sacrifice healthcare quality.

- ✅ Chronic Medicine Coverage includes essential chronic medicine coverage, useful for professionals managing long-term health conditions.

- ✅ Including a Medical Savings Account allows professionals to manage their day-to-day healthcare expenses effectively.

and MUCH, much more!

Momentum Pros and Cons

| ✅ Pros | ❎ Cons |

| Offers rewards for maintaining a healthy lifestyle | Comprehensive plans can be costly |

| Offers chronic medicine cover, essential for professionals managing long-term chronic conditions | Fewer options than other providers |

| There are travel benefits available to professionals, including international travel insurance | The wellness programs are limited compared to other medical aids |

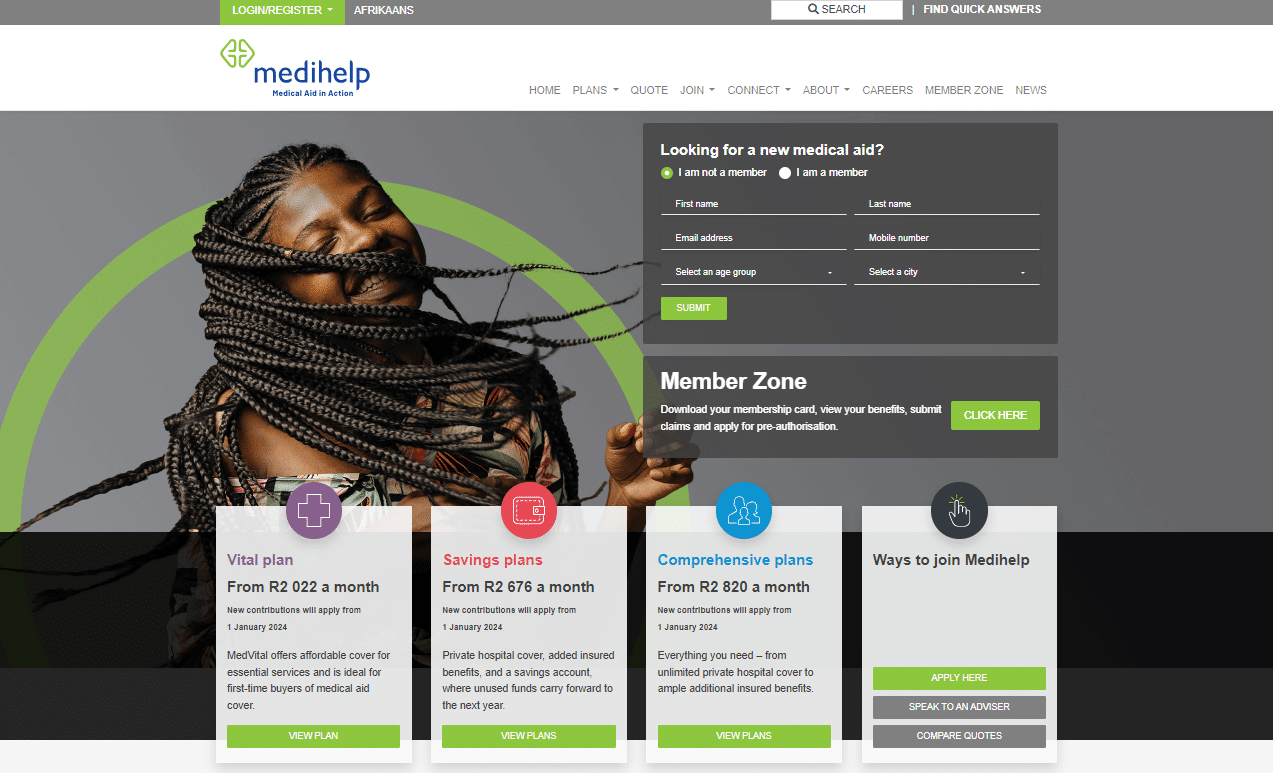

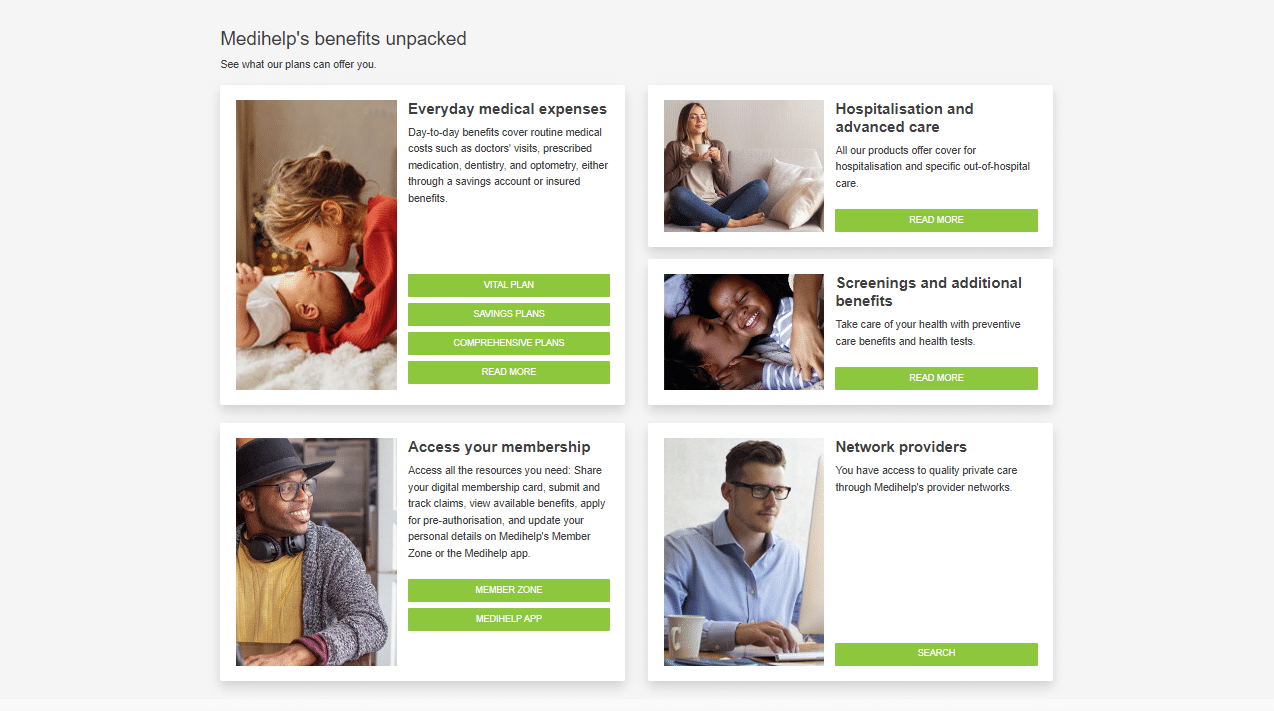

Medihelp Medical Aid

Medihelp is one of South Africa’s five largest medical schemes, covering approximately 200,000 people. The scheme has ten options, with premiums ranging from R756 on MedElect Student to R10,980 on MedPlus for single members.

The Following factors make Medihelp the best option for Professionals:

- ✅ Medihelp offers several flexible plans, allowing professionals to select a plan that meets their healthcare needs while remaining within budget constraints.

- ✅ Maternity and preventative care Benefits ensure that professionals have comprehensive coverage beyond their immediate medical needs.

- ✅ With approximately 200,000 people covered, Medihelp provides a sense of community and dependability.

and much, MUCH more!

Medihelp Pros and Cons

| ✅ Pros | ❎ Cons |

| Customised options across medical aid plans | There are restrictions on the network of hospitals that members can access |

| Offers maternity and preventative care | Out-of-network costs are high |

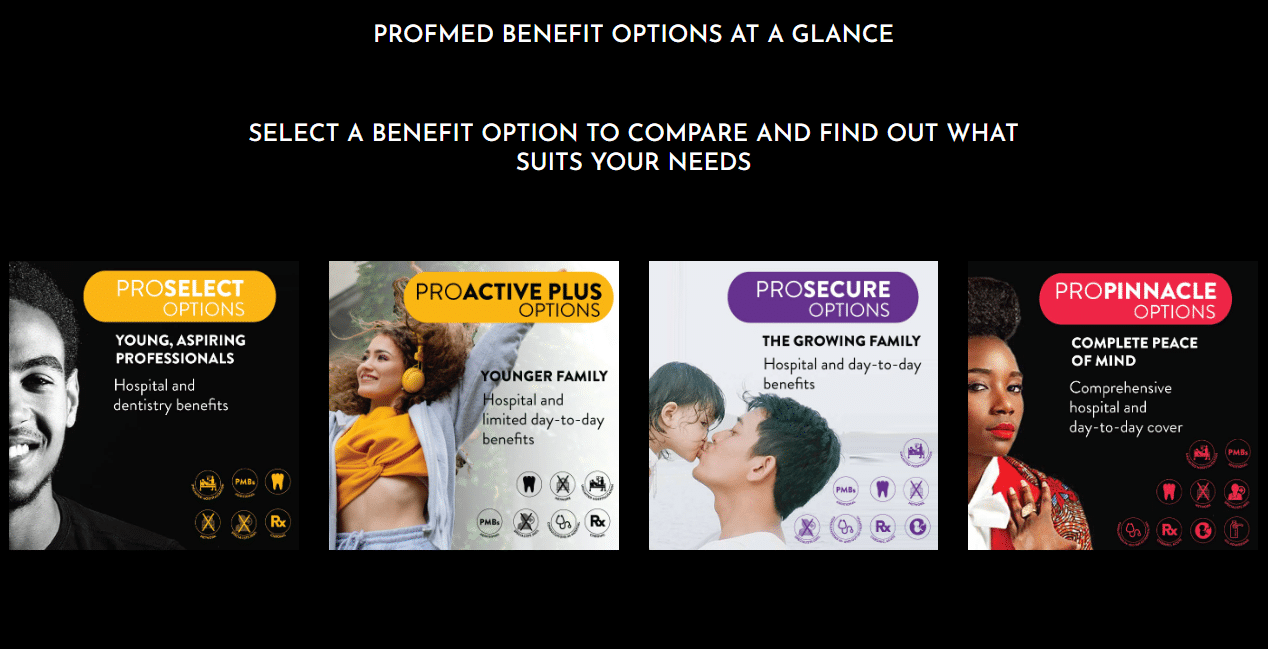

Profmed

Profmed is a medical aid scheme designed specifically for professionals. Its ProSelect option is popular, with monthly premiums starting at R2,285.

Profmed’s ProSelect option is designed with the unique healthcare needs of professionals in mind. It provides comprehensive coverage at competitive prices, ensuring access to the required healthcare services while controlling costs.

The following factors make Profmed the best option for Professionals:

- ✅ As a scheme designed specifically for professionals, Profmed understands the unique healthcare needs of this group.

- ✅ Profmed offers an affordable yet comprehensive healthcare solution for professionals, with premiums starting at R2,285 per month.

- ✅ The ProSelect option provides professionals access to a wide range of healthcare services, allowing them to manage their healthcare effectively while maintaining quality.

and much, MUCH more!

Profmed Pros and Cons

| ✅ Pros | ❎ Cons |

| Profmed offers specialized customer service to professionals | There are limited family plan options |

| There are no late-joiner penalties, which is ideal for professionals who want to switch their medical cover | There is limited preventative care |

The Criteria for Our Selection

Clearly defined criteria are essential for identifying the most suitable medical aid schemes catering to professionals.

These standards serve as a benchmark, ensuring that only plans of superior quality are chosen to meet their distinct requirements and overcome any challenges they may face. Our selection criteria shall be elaborated on in this section.

You might like Best Medical Aid for small business

Flexibility and Customisation

Customizing a medical aid plan is a major benefit, especially for professionals with special healthcare needs. Flexibility in adding add-ons, scaling coverage, or switching plans without penalties makes a scheme appealing.

Coverage Options

The foundation of any medical aid program is coverage. Professionals receive hospital coverage, daily medical benefits, chronic disease management, and emergency medical services.

We rank plans with more coverage options higher. Unlimited hospital coverage and a wide range of specialists and treatments are prioritized.

Cost-Effectiveness

Comprehensive coverage is crucial, but affordability is too. Professionals prefer a balance. We compare premiums to service range and quality for each plan to determine cost-effectiveness. High-value plans at competitive prices are preferred.

Customer Reviews and Ratings

Real-world customer reviews and ratings reveal medical aid scheme performance. These reviews can show claim processing efficiency, customer service quality, and member satisfaction.

Medical aid schemes with high ratings and positive reviews are more reliable and likely to provide a better experience.

Additional Benefits and Perks

Medical aid schemes can be significantly improved by adding benefits. Wellness programs, health incentives, and international travel insurance are examples. Plans with these extras offer a more holistic healthcare solution and are preferred in our selection process.

READ more about:

Why is comprehensive coverage a key criterion?

Comprehensive coverage ensures professionals access to many healthcare services, including hospitalization and day-to-day benefits.

How do you evaluate the range of healthcare services offered?

The scope of healthcare services is evaluated according to how well they satisfy the diverse healthcare needs of professionals.

What to Look for in a Medical Aid Plan

Choosing the right medical aid plan can affect your quality of life and finances. Busy schedules, healthcare needs, and the desire for premium services complicate professionals’ choices.

This section discusses the most important factors professionals should consider when choosing a medical aid plan.

Cost and Affordability

While choosing the most comprehensive plan might be tempting, professionals must consider premium affordability. Cost-effective plans with good coverage should be considered. If you work for an organization, look for plans with flexible payment options or corporate discounts.

Additional Perks and Benefits

Many professionals appreciate fitness programs, telehealth services, and lifestyle rewards as they enhance their quality of life and promote a work-life balance. Insurance plans offering such benefits and incentives to maintain good health are highly valued.

Customer Service and Support

Professionals are time-pressed. Managing your medical aid plan requires efficient and responsive customer service. Search for plans with 24/7 customer service, online portals, and a dedicated account manager.

Comprehensive Coverage

Professionals need comprehensive coverage, not a luxury. Plans with extensive mental health services and coverage for specialized treatments and surgeries should be prioritized due to the high stress of many professional roles.

Look for plans with unlimited hospital coverage and a large specialist network for the best care.

Flexibility and Portability

The dynamic nature of professional life, including job changes and relocations, requires medical aid plan flexibility. Plans that offer international coverage or allow easy coverage switching are beneficial. Portability is crucial if you are switching jobs or becoming self-employed.

How does cost factor into choosing a medical aid plan for professionals?

Cost is important for professionals who must balance affordable coverage with comprehensive coverage.

Why should professionals consider telehealth services?

Telehealth services provide convenience and adaptability, making it easier for busy professionals to consult with healthcare providers.

The Future of Medical Aid for Professionals

In an era of rapid technological advancements and changing healthcare needs, medical aid for professionals will change.

As professionals balance work and personal life, future medical aid schemes will better meet their needs. This section discusses the trends and innovations that will change medical aid for professionals.

Personalized Healthcare Plans

With the aid of data analytics and AI, medical care is rapidly moving towards personalization. Future healthcare might be customized to suit an individual’s genetics, lifestyle choices, and health risks.

Such a highly personalized approach empowers professionals with options that better cater to their specific healthcare requirements rather than relying on standardized plans that may not meet everyone’s needs equally well.

IoT and Wearable Technology

The amalgamation of wearable technology and IoT is set to bring about a significant impact on healthcare administration. The forthcoming medical aid schemes could comprise gadgets that offer instantaneous health monitoring, paving the way for tailored healthcare alternatives.

The data from these devices can be leveraged to provide useful perspectives into proactive management approaches for enhancing patients’ well-being while granting clinicians valuable insights.

Sustainability and Eco-Friendly Initiatives

Medical aid schemes could implement environmentally friendly practices because of the increasing significance of sustainability worldwide.

These initiatives may involve reducing paper usage or supporting healthcare providers prioritizing ecological concerns – a decision that could benefit individuals who value environmental health.

Telehealth and Virtual Consultations

The emergence of telehealth has become a tangible concept, gaining significance in recent times. Virtual meetings with healthcare professionals have proven invaluable for individuals who struggle to take time out for medical appointments.

Future health insurance policies will probably cover a wider range of telehealth services, including but not limited to general medicine and mental well-being consultations.

Blockchain and Secure Data Management

Blockchain technology could transform medical record storage and sharing. Future medical aid schemes could use blockchain to provide secure, immutable records for professionals concerned about data privacy. This technology can also improve claims efficiency and transparency.

Mental Health and Well-being Focus

The increasing acknowledgment of mental health, particularly in demanding occupations, will likely impact forthcoming medical aid schemes.

Furthermore, enhanced coverage for mental well-being will encompass support from therapists and counselors, stress-handling initiatives, and training focusing on mindfulness.

Will personalized healthcare plans become more common?

Yes, data analytics and AI are enabling more personalized healthcare plans that are tailored to the health risks and needs of everyone.

How will blockchain technology impact medical aid for professionals?

Blockchain promises secure and transparent data management, indispensable for privacy-conscious professionals.

In Conclusion

In our experience, technological advances and evolving healthcare requirements are bringing about substantial changes in the medical aid offered to professionals.

The inclusion of telehealth, customized healthcare plans, and comprehensive coverage for mental health is becoming more important.

Adapting to these developments requires a proactive approach by individuals who should select aid programs that offer an ideal balance between affordability, benefits, and coverage options.

According to our research, a concentration on personalized data-driven solutions efficiency and professional medical care looks promising per future predictions. Thus, making informed choices today can lead to better financial security and well-being prospects.

Frequently Asked Questions

What is medical aid?

Medical aid is a form of coverage that assists individuals in paying for medical expenses, such as doctor visits, hospital stays, and prescription drugs.

Why do professionals need medical aid?

Professionals require medical aid to ensure access to quality healthcare services and financial protection against unanticipated medical costs.

Which medical aid offers the most comprehensive coverage for professionals?

Discovery Health Medical Scheme provides the most extensive coverage, including unlimited hospital coverage and a vast selection of medical aid options.

What additional perks should professionals look for?

Additional benefits like wellness programs and telehealth services can provide professionals with added value and convenience.

What are the different types of medical aid plans?

Hospital, comprehensive, network, and savings plans are among the various medical aid plans. Each plan provides varying levels of protection and benefits.

Can professionals add dependents to their medical aid plans?

Yes, in most cases, professionals can include their spouses and children in their medical aid plans. Depending on the plan, the cost and protection for dependents may vary.

Can professionals choose their healthcare providers with medical aid?

Depending on their medical aid plan, professionals could choose their healthcare providers, including doctors and hospitals. Some plans may have a network of preferred providers, whereas others offer greater flexibility.