Best Medical Aids for Small Businesses

Healthcare is a major concern for all employers. Selecting the appropriate medical aid can be challenging when operating a small business. This article simplifies your search by highlighting the top five medical aids designed specifically for small businesses.

In this article, you can expect the following topics:

- ✅ The Importance of Medical Aid for Small Businesses

- ✅ The 5 Best Medical Aids for Small Businesses

- ✅ The Criteria for Our Selection

- ✅ What Small Businesses Should Look for in a Medical Aid Plan

- ✅ Employee Benefits and Retention

- ✅ Our Final Thoughts on Medical Aid for Small Businesses

- ✅ Small Business Medical Aid FAQ

and much, MUCH more!

The 5 Best Medical Aid Schemes for Small Businesses – A Comparison

| 🔎 Provider | 💙 Specialized Cover for Small Businesses | ▶️ Cover Includes |

| 🥇 Discovery Health | ✅Yes | Dental and Vision Coverage |

| 🥈 Bonitas | ✅Yes | Remote Consultations |

| 🥉 Momentum | ✅Yes | In-Patient Treatments |

| 🏅 Bestmed | ✅Yes | Screenings and Vaccinations |

| 🎖️ Medimed | ✅Yes | Emergency Services |

The 5 Best Medical Aid Schemes for Small Businesses (2024)

- ☑️ Discovery Health – Overall, The Best Medical Aid for Small Businesses in South Africa

- ☑️ Bonitas – Various Customizable Plans

- ☑️ Momentum – Affordable Basic Medical Aid Cover

- ☑️ Bestmed – Personalized Healthcare Solutions

- ☑️ Medimed – Basic Dental and Vision coverage

The Importance of Medical Aid for Small Businesses

Below are several significant reasons why medical aid is crucial for small enterprises.

Financial Security

Having medical emergencies can be quite expensive. Nevertheless, having a thorough healthcare coverage plan for your employees is an excellent way to financially secure them against the hefty bills from hospital stays and treatments.

This will create more stability in the work environment since workers become less worried about their finances and can focus on performing better at what they do best.

Employee Well-being

By delivering medical aid, the primary advantage is enhancing employee well-being. An opportunity to avail healthcare facilities ensures that an organization’s team members’ medicinal requirements are met timely and crucial in sustaining a wholesome and prolific labor force.

Talent Attraction and Retention

Medical benefits can set you apart from other employers in today’s competitive job market. Offering quality healthcare packages can make your company more appealing to top talent.

Furthermore, employees are likelier to remain with a company that prioritizes their health, lowering turnover costs.

Productivity

Physically fit employees are more productive in general. They are less likely to miss work due to illness and are frequently more focused and engaged.

Preventative care options in medical aid plans can help maintain a high level of productivity by catching health issues before they become serious problems.

Employee Morale and Company Culture

Offering medical aid helps to foster a positive corporate culture. Employees believe they are valued and cared for, which boosts morale and fosters a more collaborative and engaged workforce.

Competitive Edge

Medical aid can help your company compete in industries where physical labor or high-stress environments are the norm.

Employees are more likely to be committed and efficient when they know their health is being cared for, which improves your company’s overall performance and reputation.

Legal Compliance

Depending on your jurisdiction, providing healthcare may be required by law. Failure to provide adequate medical aid may result in penalties and even legal action against your company.

Does medical aid impact employee performance?

Yes, providing medical aid can improve employee health, lower absenteeism, and boost overall performance.

Is medical aid tax-deductible for small businesses?

Yes, in many jurisdictions, the cost of providing medical aid to employees is tax-deductible, providing financial benefits to the company.

The Best Medical Aids for Small Businesses

Discovery Health

The pioneering healthcare company in South Africa, Discovery Health, is known for its advanced and innovative solutions.

Discovery creates customized preventative care plans tailored to small businesses with wellness programs worth mentioning due to the provision of mental health support, nutritional advice, and fitness tracking geared towards keeping staff healthy.

This approach aims at lowering long-term healthcare expenses while providing comprehensive medical coverage via an extensive hospital network, including day-to-day medical benefits – dental and vision inclusive, hence making it a perfect option for businesses operating on a lower scale.

Notable features of Discovery Health include:

- ✅ Dental and vision coverage are included, completing the healthcare package.

- ✅ Preventative care programs include fitness tracking and nutritional advice to keep employees healthy.

- ✅ For real-time health monitoring, health and fitness tracking integrates with wearable devices.

- ✅ A large hospital network ensures that high-quality in-patient care is always available.

- ✅ Day-to-day medical benefits include visits to the general practitioner, specialist consultations, and routine check-ups.

and much, MUCH more!

Pros and Cons of Discovery Health for Small Businesses

| ✅ Pros | ❎ Cons |

| Offers innovative wellness programs | Premiums can become costly for optimal cover |

| Advanced health and fitness tracking available | The number of plans makes it difficult to decide |

| Offers comprehensive cover to individuals and businesses | The wellness features offered might not be useful for all employees |

| Offers dental and vision cover | There are limited options available for budget-conscious small businesses |

Bonitas

As a top healthcare provider in South Africa, Bonitas Medical Fund offers various plans that cater to the needs of small businesses. These plans are known for their comprehensive coverage that includes basic hospital care, specialized treatments, and medication for chronic conditions.

Businesses can easily scale up their healthcare offerings with these customizable options provided by Bonitas.

Additionally, through its telehealth service, employees can consult health professionals remotely without booking physical appointments, which is particularly beneficial if they belong to remote teams or work across distributed locations.

With an extensive network of healthcare providers throughout the country, your employees have access to quality care no matter where they happen to be located, thanks to Bonita’s superior facilities

Notable Features of Bonitas include:

- ✅ Telehealth services enable remote consultations, ideal for businesses with dispersed teams.

- ✅ All in-patient treatments are covered by comprehensive hospital coverage.

- ✅ Chronic medication coverage addresses long-term medication requirements.

- ✅ Wellness programs emphasize prevention by providing screenings and vaccinations.

- ✅ Consultations with general practitioners and specialists are among the day-to-day benefits.

and much, MUCH more!

Pros and Cons of Bonitas for Small Businesses

| ✅ Pros | ❎ Cons |

| Bonitas offers flexible medical aid plans | Bonitas’ comprehensive plans are expensive |

| The plans offered are scalable | There is limited coverage internationally |

| There is an extensive and strong network of healthcare providers | Waiting periods might apply to some conditions and procedures |

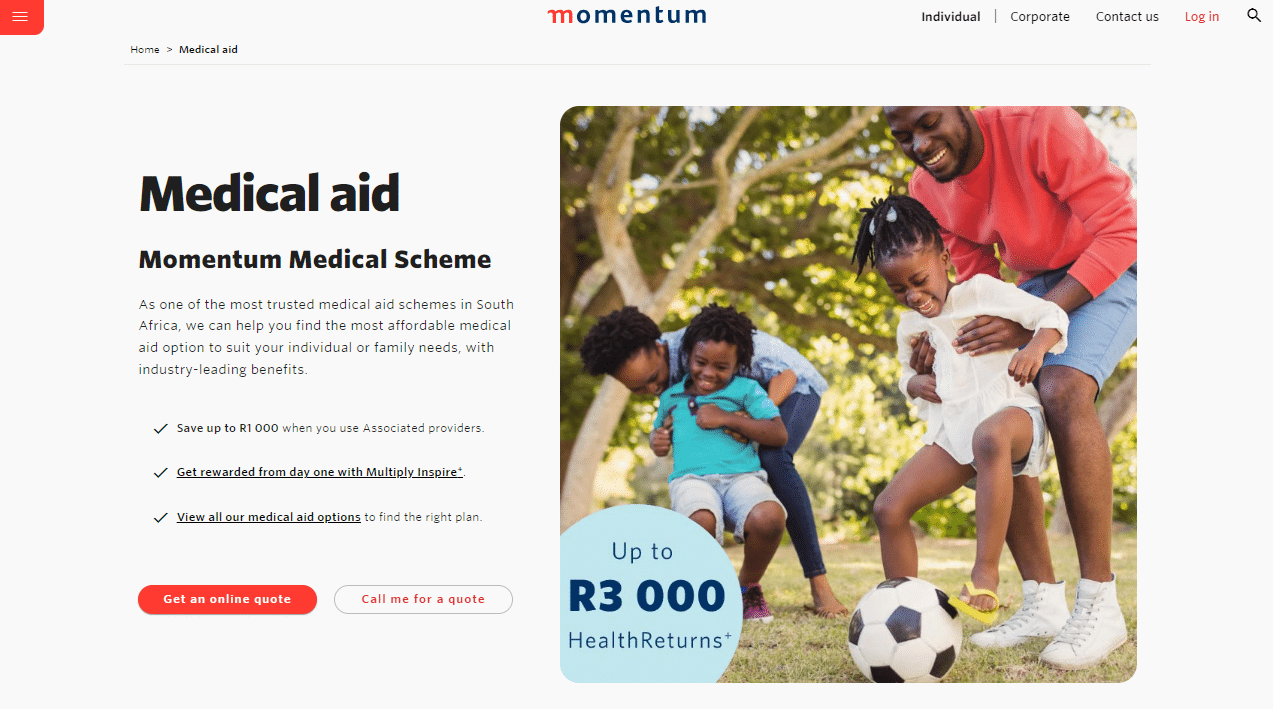

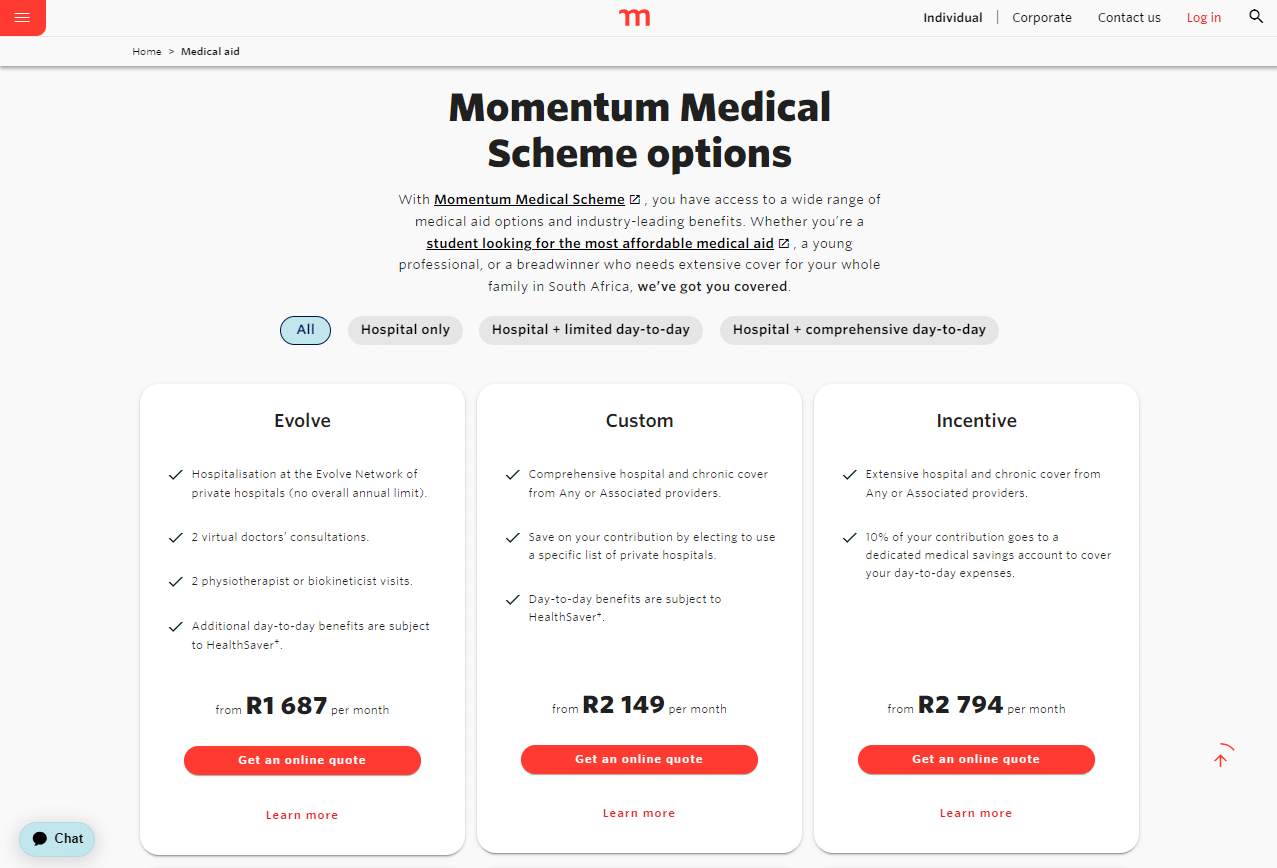

Momentum

Momentum Health is a great option for small businesses in South Africa as it provides an uncomplicated and balanced approach to healthcare.

Momentum is known for being affordable while still offering necessary coverage such as hospital care, emergency services, and basic dental care without unnecessary extras.

Unlike other companies that may have more advanced features, Momentum excels at creating simple plans that are easy to understand, which makes it the perfect fit for those who want essential coverage with less complexity.

Additionally, they offer telehealth consultations – providing remote medical advice from a distance – which gives added convenience, especially now when technology plays an increasingly important role in our lives today

Notable features of Momentum include:

- ✅ Telehealth services make it easy for virtual teams to have remote consultations.

- ✅ Hospital care coverage caters to all necessary in-patient treatments and surgeries.

- ✅ Prescription drug costs may be claimed under the medication service offered by providers.

- ✅ Quick response times are ensured during emergencies that require immediate intervention from emergency service personnel.

- ✅ Basic dental needs such as routine check-ups or essential procedures can also be addressed under basic dental care coverages.

and much, MUCH more!

Pros and Cons of Momentum for Small Businesses

| ✅ Pros | ❎ Cons |

| Momentum offers several affordable plans | There are limited advanced features |

| The cover options are straightforward | The network of providers is small |

| Momentum is often praised for its customer support | There is limited focus on preventative care |

Bestmed

Bestmed distinguishes itself by focusing on personalized healthcare solutions. Bestmed, as opposed to one-size-fits-all plans, provides customizable options that can be tailored to meet the specific needs of a small business.

With this level of customization, businesses can select from various services, such as standard hospital care, specialist consultations, and even alternative therapies, such as acupuncture and chiropractic care.

While this level of customization can be complicated, it provides a unique approach to medical aid, ensuring that businesses only pay for services they require. Bestmed also prioritizes customer service, providing 24/7 support and a dedicated account manager for each business client.

Notable Features of Bestmed include:

- ✅ Wellness checks provide preventive care, such as screenings and vaccinations.

- ✅ In-patient treatment options are extensive with standard hospital care.

- ✅ Businesses can tailor their healthcare offerings to meet specific needs with customizable plans.

- ✅ Acupuncture and chiropractic care are also included as alternative therapies.

- ✅ Specialist consultations are covered, giving you access to diverse medical experts.

and much, MUCH more!

Pros and Cons of Bestmed for Small Businesses

| ✅ Pros | ❎ Cons |

| Bestmed’s options are extremely customizable | The customization can be confusing |

| There are many services offered | Depending on the customization, premiums can be expensive |

| There is a client-centered focus | Several alternative therapies are not covered |

Medimed

Medimed is known for its simplicity and user-friendliness, making it an ideal choice for small companies searching for straightforward medical aid solutions.

While other providers may offer more features than Medimed, the latter meets essential needs very well – including emergency services, routine hospital care, and basic day-to-day benefits like doctor visits and prescription medication.

It offers reasonably priced plans that are favored by smaller businesses. Additionally, healthcare coverage offered by Medimed’s core business policies includes dental health coverage and vision protection on a simple basis.

Despite having limited provider networks, Medimed offers streamlined processes and basic procedures, ensuring essential medical treatment is provided whenever needed with minimal stress or complexity.

Notable Features of Medimed include:

- ✅ Basic dental and vision coverage are included, providing a comprehensive healthcare package.

- ✅ In critical situations, emergency services respond quickly and provide treatment.

- ✅ In-patient treatments and surgeries are included in hospital care coverage.

- ✅ Prescription drug coverage ensures that necessary medications are reasonably priced.

- ✅ Day-to-day benefits include doctor visits and prescription medications.

and much, MUCH more!

Read more comparisons:

- Medimed vs. Discovery Health

- Medimed vs. BestMed Medical Scheme

- Medimed vs Medshield

- Medimed vs. Medihelp

- Medimed vs Sizwe Hosmed Medical Fund

- Medimed vs Momentum Medical Scheme

Pros and Cons of Medimed for Small Businesses

| ✅ Pros | ❎ Cons |

| The plans are easy to understand, making choosing the right one easier | There are limited advanced features on the plans |

| Essential healthcare needs are covered | There is a smaller network of providers compared to other plans |

| There are no hidden fees | Limited focus on wellness and preventative care |

The Criteria for Our Selection

Selecting suitable medical aid for small businesses can be challenging, requiring careful deliberation of various aspects. Our selection process to determine the best healthcare coverage alternatives for small enterprises and their workers involved these criteria.

Legal Compliance and Accreditation

Verifying that the medical service provider complies with local and national healthcare laws is crucial. We ensured this by checking each medical aid scheme’s accreditation status and searching for any legal complications that could detriment small businesses.

Customer Reviews and Ratings

Medical aid organizations’ evaluation of service quality relies heavily on customer feedback.

We gathered authentic ratings and reviews from users to gauge their level of satisfaction, which involved examining the efficiency with which claims were dealt with, how promptly customer support responded, and whether the provider could be counted upon.

Coverage Options

When choosing a medical aid provider, it is crucial to consider the variety of coverage options offered. These options should include hospital care and regular benefits such as visits with general practitioners or specialists.

Additionally, optional dental and vision coverage services should be available for employees’ specific health requirements. A broad range of choices guarantees that all staff members’ diverse healthcare needs are catered to adequately.

Cost-Effectiveness

When assessing medical aid plans for small businesses, the focus revolves around understanding the services’ cost-effectiveness. This evaluation encompasses monthly premiums, co-pays, and potential incidental expenditures.

The aim is to discover solutions that deliver maximum value while meeting fundamental healthcare requirements.

Additional Benefits and Features

Certain medical aid providers offer supplementary perks, which include wellness initiatives, telemedical facilities, and fitness monitoring.

Though not obligatory components of the plan, they bring added benefits to healthcare services and enhance staff contentment by improving overall well-being.

Flexibility and Scalability

Small businesses frequently experience growth and change, which may necessitate changes to their medical aid plans.

We sought providers who provide flexible and scalable options, allowing businesses to upgrade or downgrade their plans as needed. This ensures that the healthcare needs of an expanding or contracting workforce are met adequately.

Network of Healthcare Providers

The network of providers affiliated with the medical aid plan directly impacts the accessibility and quality of healthcare services.

We looked at the size and reputation of these networks, specifically whether they provide a diverse range of specialists and healthcare facilities locally and nationally.

Were family plans part of the criteria?

Yes, family plans were considered, particularly regarding affordability and coverage options.

How important was affordability in the criteria?

Given the budget constraints of many small businesses, affordability was a critical criterion.

How to Choose the Right Plan for Your Business

Choosing the right medical aid plan for your small business is a critical decision affecting your employees’ well-being and your company’s bottom line.

The process entails more than just price comparison; it necessitates a thorough understanding of your team’s healthcare needs, legal requirements, and the ability to adapt as your business evolves. This section will walk you through the key factors to consider when making an informed decision.

Assessing Your Team’s Needs

Before delving into the various medical aid options, it is critical to understand your employees’ specific healthcare requirements. Consider your workforce’s average age, pre-existing conditions, and whether your team prefers specific healthcare providers.

Using surveys or consultations to conduct a needs assessment can provide valuable insights into what your employees value most in a healthcare plan.

Cost and Budget Considerations

Although opting for the least expensive plan might seem attractive, it is essential to factor in the long-term benefits.

Employees might be unhappy with a budget-friendly plan due to substantial co-payments or restricted coverage. To guarantee you are making the most of your investment, assess the expenses compared to the range of services provided.

Legal Requirements and Compliance

Depending on your jurisdiction, there may be legal requirements for providing healthcare benefits to your employees. Learn about local and national laws to ensure that your medical aid plan is legal.

This could include minimum coverage requirements or the inclusion of certain healthcare services as a requirement. Noncompliance can result in penalties and legal complications.

Flexibility and Futureproofing

Your healthcare requirements will most likely change as your company grows. Look for medical aid plans that allow you to adapt to these changes.

This could imply the ability to add or remove employees from the plan easily or the ability to upgrade to a more comprehensive package as your company grows. A flexible, scalable plan will save you the trouble of switching providers as your needs change.

Review and Compare Plans

Once you have established your requirements and financial constraints, the next step is to evaluate available medical aid schemes. Assess their offered services, healthcare provider network, and additional perks such as wellness initiatives or telehealth offerings.

In addition, reading reviews and customer feedback can provide useful information when it comes to judging the dependability and service quality of each option

Should I prioritize low premiums or low deductibles?

Your employees’ healthcare needs determine this because low premiums are less expensive but may result in higher out-of-pocket costs.

Should the plan include mental health services?

Yes, incorporating mental health services is becoming increasingly important for a well-rounded healthcare package.

Medical Aid and Employee Benefits and Retention

This section explores the idea that medical aid goes beyond healthcare. It is a strategic tool with immense power to influence employee satisfaction, retention and overall company culture.

Case studies are presented as evidence of how medical aid can be instrumental in transforming these areas for the better.

How Medical Aid Affects Employee Satisfaction

Employee satisfaction is frequently directly related to the benefits provided by an employer, and medical aid is usually near the top of the list. A comprehensive medical aid plan can make employees feel valued and cared for, increasing job satisfaction.

It also provides employees with peace of mind because they know they and their families are covered in the event of illness or an emergency.

Employees are more likely to be focused and productive when not concerned about healthcare costs, leading to a more engaged and motivated workforce.

The Role of Medical Aid in Employee Retention

High employee turnover is costly for businesses in terms of recruitment costs and knowledge loss. Offering a comprehensive medical aid plan can be a compelling reason for employees to stay with a company for the long term.

According to various studies, employees are more likely to stay with a company that offers comprehensive healthcare benefits. Retaining experienced employees saves money on recruitment and promotes a more stable and productive work environment.

Case Studies on Employee Benefits

Case Study 1: Tech Startup Without Medical Aid

A small tech startup decided to forego offering a medical aid plan to save on costs. Within a year, they experienced a high turnover rate, with employees citing the lack of healthcare benefits as a significant reason for leaving.

The cost of recruiting and training new staff far outweighed what the company would have spent on a basic medical aid plan.

Case Study 2: Retail Business with Comprehensive Medical Aid

A retail business with multiple locations offered a comprehensive medical aid plan with preventative care and wellness programs.

Employee surveys indicated high levels of job satisfaction, and the company saw a significant decrease in sick days taken. Over three years, employee retention rates improved by 25%.

Case Study 3: Manufacturing Company with Scalable Plans

A manufacturing company offered a basic medical aid plan with the option for employees to upgrade to more comprehensive packages at a discounted rate.

The workforce highly appreciated this flexibility, leading to increased job satisfaction and a lower turnover rate. The company also noted that employees who upgraded their plans were likelier to stay with the company longer.

Do employees expect medical aid as a standard benefit?

Yes, medical aid is a standard benefit in many industries, and its absence may make your company less competitive in attracting and retaining talent.

Can medical aid be used as a negotiating tool during hiring?

Yes, medical aid can be a strong incentive and give you an advantage in negotiating with potential hires.

In Conclusion

In our opinion, medical aid is more than just a budgetary or legal consideration; it is a strategic investment in your workforce. The right plan can significantly impact employee satisfaction, retention, and overall productivity.

While cost is an important consideration, it should not overshadow the value a comprehensive medical aid plan can bring your company. Flexibility and scalability are important features to look for because they allow your plan to adapt to the changing needs of your business.

Therefore, a well-chosen medical aid plan can provide significant returns on investment, benefiting your employees and your company.

Frequently Asked Questions

What is medical aid for small businesses?

Medical aid for small businesses is a type of health cover that covers small business employees.

Why is medical aid important for small businesses?

Medical aid is critical for small businesses because it can help attract and retain top talent, improve employee satisfaction and productivity, and lower healthcare costs through preventive care and early intervention.

What are the best medical aids for small businesses in South Africa?

Bonitas, Discovery Health, Momentum, Bestmed, and Medimed are some of the best medical aids for small businesses in South Africa.

How does medical aid affect employee satisfaction?

Employee satisfaction and loyalty can be increased by providing comprehensive medical aid plans. Access to quality healthcare services and preventive care can improve employee health and productivity, increasing job satisfaction.

How can small businesses choose the right medical aid plan?

Small businesses can select the best medical aid plan by assessing their workforce’s needs and comparing the features and benefits of various medical aid providers.