- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Suremed Health Explorer Plan

Overall, the Suremed Health Explorer Medical Aid Plan is a trustworthy and comprehensive medical aid plan that offers 24/7 medical emergency assistance and gap cover to up to 3 Family Members. The Suremed Health Explorer Medical Aid Plan starts from R1,405 ZAR.

| 👤 Main Member Contribution | R1,405 – R3,510 |

| 👥 Adult Dependent Contribution | R1,405 – R3,510 |

| 🍼 Child Dependent Contribution | R649 – R1,090 |

| 🔁 Gap Cover | ✅ Yes |

| 🦾 Internal Prosthesis | Only PMBs are covered |

| 🦿 External Prosthesis | Only PMBs are covered |

| 💙 Hospital Cover | Unlimited |

| 💶 Prescribed Minimum Benefits | ✅ Yes |

| 📉 Screening and Prevention | ✅ Yes |

| ➡️ Medical Savings Account | None |

Suremed Health Explorer Plan – 7 Key Point Quick Overview

- ✅ Suremed Health Explorer Plan Overview

- ✅ Suremed Health Explorer Plan Contributions

- ✅ Suremed Health Explorer Plan Benefits and Cover Comprehensive Breakdown

- ✅ Suremed Health Explorer Plan Exclusions and Waiting Periods

- ✅ Suremed Health Explorer Plan vs Similar Plans from Other Medical Schemes

- ✅ Our Verdict on the Suremed Health Explorer Plan

- ✅ Suremed Health Explorer Plan Frequently Asked Questions

Suremed Health Explorer Plan Overview

The Suremed Health Explorer Medical Aid Plan is one of 4, starting from R1,405 and includes unlimited hospitalization in Netcare hospitals, a comprehensive network of GPs, Dentists, Optometrists, and Pharmacies, extended day-to-day benefits, and more. Gap Cover is available on the Suremed Health Explorer Plan, along with 24/7 medical emergency assistance. According to the Trust Index, Suremed Health has a trust rating of 2.1.

Suremed Health Medical Aid Scheme has the following plans:

- ✅ Suremed Health Challenger

- ✅ Suremed Health Explorer

- ✅ Suremed Health Navigator

- ✅ Suremed Health Shuttle

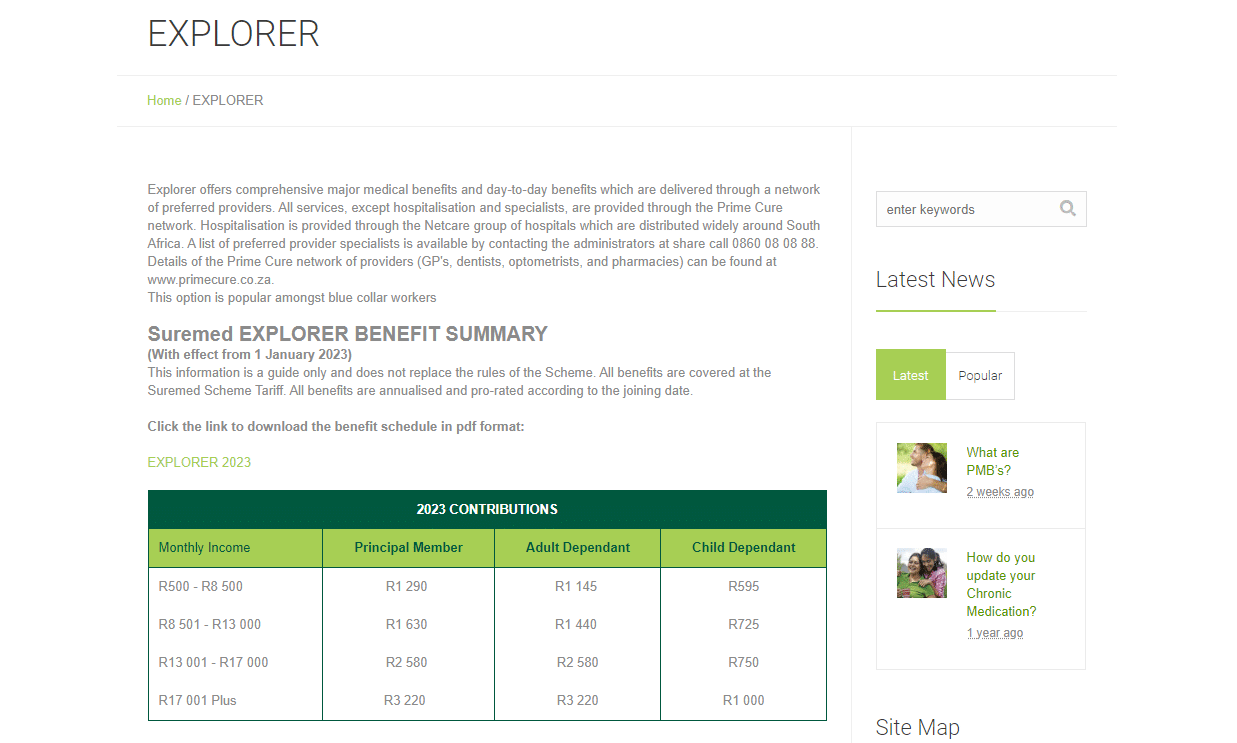

Suremed Health Explorer Plan Contributions

| 💴 Income Bracket | 👤 Main Member | 👥 Adult Dependent | 🍼 Child Dependent |

| 💵 R500 – R8,500 | R1,405 | R1,245 | R649 |

| 💶 R8,501 – R13,000 | R1,775 | R1,570 | R790 |

| 💷 R13,001 – R17,000 | R2,815 | R2,815 | R820 |

| 💴 R17,001> | R3,510 | R3,510 | R1,090 |

Discover the 5 Best Medical Aids under R1000

Suremed Health Explorer Plan Benefits and Cover Comprehensive Breakdown

| 📌 Prescribed Minimum Benefits (PMB) | A Preferred Provider provides unlimited coverage. PMBs are unlimited when using a scheme DSP. |

| 📍 Emergency Stabilisation and Transportation | Netcare 911 is the preferred provider for road or air transport and stabilization. Unlimited cover provided. |

| ☑️ Hospitalisation Alternatives | Limited to R12,500 per member family (PMF). Pre-authorization is required. |

| ✅ GP and Specialist Consultation | The unlimited cover is provided by a Preferred Provider. Specialists are limited to R20,000 PMF unless it involves a PMB. |

| 🅰️ Maternity | Unlimited only when using a Preferred Provider. Pre-approval is required. |

| 🅱️ Basic Radiology and Pathology | Unlimited only when using a Preferred Provider. Pathology is limited to R21,500 PMF unless PMBs apply. |

| 📉 Physiotherapy | Members must use a Preferred Provider. Limited to R3,550 PMF unless PMBs apply. Only covers in-hospital treatment. |

| 📈 Prostheses | Limited to PMBs. Pre-approval is required before admission. Unlimited when using a DSP, but scheme protocols will apply. |

| 📊 Take-home Medication | Limited to R300 per beneficiary per event. Subject to the formulary. |

| ❤️ Compassionate Care | Limited to R20,000 PMF only for clinically appropriate medical care. PMBs are unlimited when using a DSP. Pre-approval is required. A doctor’s letter is required to confirm end-of-life treatment. |

| 🩺 Medical Equipment | Limited to R4,000 PMF when using a Preferred Provider. Includes wheelchairs, oxygen, and cylinders. Pre-approval is required. |

| 💊 Chronic Medication | Unlimited when using a Preferred Provider. Pre-authorization is required via the Prime Cure formulary. Subject to preferred provider-managed care protocols. |

| ➡️ Dialysis | Unlimited when using a Preferred Provider and only for PMBs. Pre-approval is required. Subject to case and treatment management. |

| 🎗️ HIV/AIDS | Unlimited cover but subject to managed care protocols. |

| ↪️ Oncology | Unlimited when using a Preferred Provider and for PMBs. Pre-approval and registration with the necessary program are required. |

| 🔁 Specialized Radiology and Pathology | Limited to two scans PMF. |

| 🤕 Acute Medicine | Unlimited acute (prescribed) medicine from a nominated provider. Limited to R328 per beneficiary per year and up to R390 PMF. Maximum R105 per event via Prime Cure. |

| 🤧 Chronic Medicine | Unlimited coverage is provided if prescribed by a nominated provider. Subject to registration through Prime Cure. Subject to the Prime Cure medication formulary. |

| 🪥 Basic Dentistry | Unlimited when treatment is obtained from a Prime Cure provider. Only covers approved dental codes. Limited to one preventative consultation per beneficiary per year. |

| 🦷 Dentures | Covers one set of acrylic dentures PMF per 2 years, with a limit of R4,030 per family. Covered up to 80% at cost. Pre-authorization required. The benefit is only covered for beneficiaries older than 21 years. |

| 👩⚕️ GP Consultations | Limited to 12 consultations per beneficiary. Authorization is required for the twelfth consultation to activate the PMB benefit. Members may only change doctors twice a year. |

| 👨⚕️ Out-of-Network and After-Hour GP Consultations | Limited to one visit per beneficiary or two per family. Limited to R1,145 per event. Authorization is required within 72 hours of the visit. |

| 💉 Immunizations | Limited to one per beneficiary per year and only for high-risk patients. This only covers flu injections. |

| 🤓 Optometry | Unlimited when using a network optometrist. Limited to one eye test per beneficiary per year. One pair of glasses per beneficiary every two years. |

| ⚠️ Radiology and Pathology | Unlimited cover when referred by a nominated doctor. Subject to the approved Radiology and Pathology codes. |

| 🍼 Maternity | Pregnant members must register for the Maternity Program on the Suremed Explorer App. Limited to 2 visits to a gynecologist, midwife, or GP. Antenatal vitamins are covered up to R68 for 9 months. Limited to 2 2D ultrasound scans per pregnancy. Includes one pediatrician visit. |

You might like to read more about the different Hospital plans in South Africa

Suremed Health Explorer Plan Exclusions and Waiting Periods

Explorer Plan Exclusions

The Suremed Health Explorer Plan Exclusions include, but are not limited to, the following:

- Costs exceeding the annual or biennial maximums.

- Medical, surgical, and orthopedic appliances, devices, and products not specifically provided for.

- Operations, medicines, treatments, and procedures for cosmetic purposes or personal reasons.

- Medicines not included in a prescription from a legally entitled medical practitioner or healthcare professional (except schedule 0, 1, and 2 medicines supplied by a registered pharmacist).

- Healthcare services are not appropriate or necessary for symptoms, diagnosis, or treatment of a medical condition.

- Medicines not registered and approved by SAHPRA for clinical treatment of a condition.

- Treatment where efficacy and safety cannot be scientifically proven.

- MRI scans are ordered by a general practitioner (except in emergencies).

- Specialist referral for second opinions unless authorized by the scheme.

- Injuries sustained while participating voluntarily in certain activities or any injuries arising from professional sports or speed contests.

- Organ and tissue donations to anyone other than a member or dependent of a member.

- Treatment of a sickness condition directly attributable to the failure to carry out medical practitioner instructions (except if the sickness condition is a PMB).

- Medical examinations for employers, insurance, school readiness, or legal purposes.

- Non-disclosure of conditions.

and many more.

POLL: 5 Best Gap Cover Options for Under R300

Explorer Plan Waiting Periods

Waiting periods prevent members from anti-selecting or joining a program solely when ill. There are two types of wait times:

- A 3-month General Waiting Period – The scheme will not fund any claims during this general waiting period.

- A 12-month Condition-Specific Waiting Period – A member is ineligible to claim benefits for a condition for which medical advice, diagnosis, care, or treatment was recommended or received within the 12 months ending on the date of the membership application.

Condition-specific waiting periods may not be imposed on related conditions unless a direct link between the conditions can be demonstrated. Furthermore, the waiting periods can also include prescribed minimum benefit (PMB) conditions for applicants who have never belonged to a medical plan before or for members who have had a break in coverage of more than 90 days.

Suremed Health Explorer Plan vs Similar Plans from Other Medical Schemes

| 🔎 Medical Aid Plan | 🥇 Suremed Health Explorer | 🥈 Medimed Alpha | 🥉 Discovery Health Essential Delta Core |

| 👤 Main Member Contribution | R1,405 – R3,510 | R1,680 | R2,281 |

| 👥 Adult Dependent Contribution | R1,245 – R3,510 | R1,680 | R1,716 |

| 🍼 Child Dependent Contribution | R649 – R1,090 | R660 | R915 |

| ➡️ Hospital Cover | Unlimited | Unlimited | Unlimited |

| ↪️ Oncology Cover | Unlimited for PMBs at a Preferred Provider | R200,000 | R250,000 |

Our Verdict on the Suremed Health Explorer Plan

The Suremed Explorer plan offers comprehensive medical aid coverage at an affordable price. With this plan, members can access a wide range of benefits, including unlimited hospitalization, chronic medication coverage, and maternity benefits. The plan also covers out-of-hospital treatments such as consultations, diagnostic tests, and procedures. One of the main advantages of this plan is access to a large network of hospitals and medical practitioners, ensuring that members receive quality healthcare services. However, the plan has some drawbacks, such as limitations on certain treatments and procedures, co-payments, and waiting periods for certain benefits. Despite these limitations, the Suremed Explorer plan offers an attractive option for those looking for comprehensive medical aid coverage at an affordable price.

You might also like: Suremed Health Challenger

You might also like: Suremed Health Navigator

You might also like: Suremed Health Shuttle

Suremed Health Explorer Plan Frequently Asked Questions

What is the Suremed Explorer medical aid plan?

The Suremed Explorer is a medical aid plan offered by Suremed Health that provides comprehensive healthcare coverage at an affordable price.

What are the benefits of the Suremed Explorer plan?

The Suremed Explorer plan offers unlimited hospitalization, chronic medication coverage, maternity benefits, and coverage for out-of-hospital treatments such as consultations, diagnostic tests, and procedures.

Which hospitals and medical practitioners are included in the Suremed Explorer network?

The Suremed Explorer plan provides access to a large network of hospitals within the Netcare Group and medical practitioners to ensure that members receive quality healthcare services.

Is there a waiting period for benefits under the Suremed Explorer plan?

Yes, there is a waiting period for certain benefits under the Suremed Explorer plan. The waiting period may vary depending on the benefit.

Does the Suremed Explorer plan cover chronic medication?

Yes, the Suremed Explorer plan provides coverage for chronic medication.

Are maternity benefits included in the Suremed Explorer plan?

Yes, the Suremed Explorer plan provides maternity benefits.

Ladies can make use of our free Ovulation Calculator

Does the Suremed Explorer plan cover hospitalization?

Yes, the Suremed Explorer plan provides unlimited hospitalization coverage.

Are there co-payments required under the Suremed Explorer plan?

Yes, some benefits under the Suremed Explorer plan may require co-payments.

Does the Suremed Explorer plan cover out-of-hospital treatments?

Yes, the Suremed Explorer plan covers out-of-hospital treatments such as consultations, diagnostic tests, and procedures.

Can members choose their medical practitioners under the Suremed Explorer plan?

Yes, members can choose their medical practitioners, subject to the plan’s limitations.

What are the limitations of the Suremed Explorer plan?

The Suremed Explorer plan may have limitations on certain treatments and procedures and waiting periods for certain benefits.

Are pre-existing conditions covered under the Suremed Explorer plan?

Pre-existing conditions may be covered under the Suremed Explorer plan, subject to certain limitations and waiting periods.

How are premiums calculated for the Suremed Explorer plan?

Premiums for the Suremed Explorer plan are based on the level of cover selected and the income bracket of the main member, starting from R1,290 for the main member, R1,145 per adult, and R595 per child dependent.

What is the claims process for the Suremed Explorer plan?

Members can submit claims for healthcare services through the online portal or by completing and submitting a claims form.

Is emergency medical care covered under the Suremed Explorer plan?

Yes, emergency medical care is covered under the Suremed Explorer plan, subject to the limitations and conditions of the plan.

You might also like

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans