- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Suremed Health Navigator Plan

Overall, the Suremed Health Navigator Medical Aid Plan is a trustworthy and comprehensive medical aid plan that offers 24/7 medical emergency assistance and a medical savings account for up to 3 Family Members. The Suremed Health Navigator Medical Aid Plan starts from R3,884 ZAR.

| 👤 Main Member Contribution | R3,884 |

| 👥 Adult Dependent Contribution | R3,040 |

| 🍼 Child Dependent Contribution | R1,148 |

| 🔁 Gap Cover | ✅ Yes |

| ↪️ Hospital Cover | Unlimited |

| ➡️ Oncology Cover | R250,000 |

| 💶 Prescribed Minimum Benefits | ✅ Yes |

| 📉 Screening and Prevention | ✅ Yes |

| 💙 Medical Savings Account | ✅ Yes |

| 🟦 Maternity Benefits | ✅ Yes |

Suremed Health Navigator Plan – 7 Key Point Quick Overview

- ✅ Suremed Health Navigator Plan Overview

- ✅ Suremed Health Navigator Plan Contributions and Medical Savings Account

- ✅ Suremed Health Navigator Plan Benefits and Cover Comprehensive Breakdown

- ✅ Suremed Health Navigator Plan Exclusions and Waiting Periods

- ✅ Suremed Health Navigator Plan vs Similar Plans from Other Medical Schemes

- ✅ Our Verdict on the Suremed Health Navigator Plan

- ✅ Suremed Health Navigator Plan Frequently Asked Questions

Suremed Health Navigator Plan Overview

The Suremed Health Navigator Medical Aid Plan is one of 4, starting from R3,884, and includes additional out-of-hospital benefits, a medical savings account, advanced dentistry, internal and external prostheses, and more. Gap Cover is available on the Suremed Health Navigator Plan, along with 24/7 medical emergency assistance. According to the Trust Index, Suremed Health has a trust rating of 2.1.

Suremed Health Medical Aid Scheme has the following plans:

- ✅ Suremed Health Challenger

- ✅ Suremed Health Explorer

- ✅ Suremed Health Navigator

- ✅ Suremed Health Shuttle

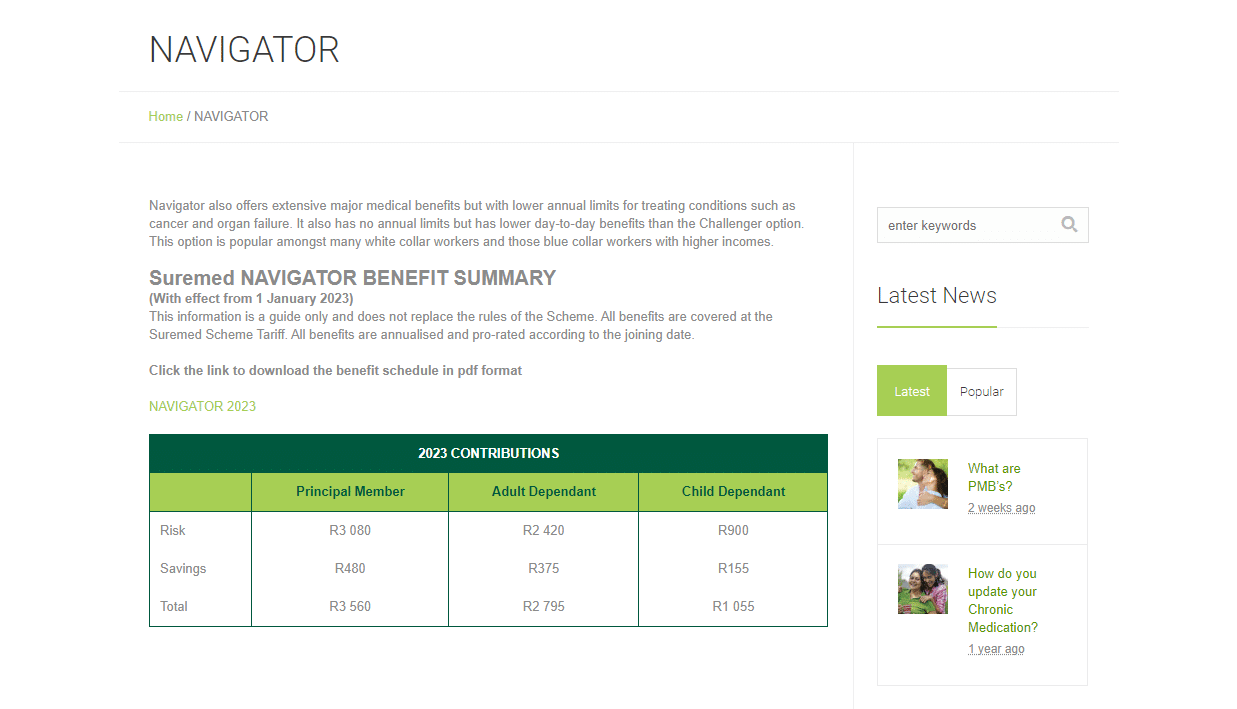

Suremed Health Navigator Plan Contributions and Medical Savings Account

| 💶 Amount | 👤 Main Member | 👥 Adult Dependent | 🍼 Child Dependent |

| 💵 Monthly Contribution | R3,884 | R3,040 | R1,148 |

| 💴 Savings per Month | R525 | R405 | R169 |

| 💷 Annual Savings Account | R6,300 | R4,860 | R2,028 |

Discover the 5 Best Medical Aids under R1500

Suremed Health Navigator Plan Benefits and Cover Comprehensive Breakdown

| 📌 Prescribed Minimum Benefits (PMB) | Unlimited cover provided. Covered up to 100% of the Suremed Scheme Tariff. Pre-authorization is required before admission, or an R1,000 co-payment is required. |

| 📍 Emergency Stabilisation and Transportation | Netcare 911 is the preferred provider for road or air transport and stabilization. Unlimited cover provided. |

| ☑️ Hospitalisation Alternatives | Limited to R20,000 per member family (PMF). Pre-authorization is required. |

| ✅ GP and Specialist Consultation | Unlimited cover provided. Covered up to 122% of the Suremed Scheme Tariff. |

| 🅰️ Maternity | Unlimited cover provided. Pre-approval is required. Cesarean Section is only covered if clinically necessary or will be paid up to natural delivery rates. The benefit includes the following: Accommodation Medication Materials Anaesthetist Gynaecologist Paediatrician |

| 🅱️ Mental Health | Limited to R16,000 PMF. This benefit includes all costs relating to hospitalization and doctors. |

| 💖 Organ Transplants | Limited to R150,000 PMF. Covered up to 100% of PMBs treated at a DSP. Pre-authorization required. All services are covered, including anti-rejection medication, and harvesting. |

| 🦾 Internal/Surgical Prostheses | Limited to R35,000 per beneficiary. Spinal fusions are limited to two levels per year and up to R25,000 per beneficiary. Intra-ocular lenses are limited to R2,500 per lens. Mesh is limited to R8,000 per beneficiary. Subject to Suremed protocols. |

| 🦿 Physiotherapy while in the hospital | Limited to R5,650 per beneficiary unless it is a PMB. |

| 📉 Basic Radiology and Pathology | Unlimited cover. |

| 📈 Dentistry | Limited to R10,700 PMF. The benefit covers general anesthetic for dental procedures on patients <12 years for impacted wisdom teeth. The benefit includes all hospital and doctor’s accounts. Subject to the Suremed protocol and requires pre-approval. |

| 📊 Compassionate Care | Limited to R20,000 PMF only for clinically appropriate medical care. PMBs are unlimited when using a DSP. Pre-approval is required. A doctor’s letter is required to confirm end-of-life treatment. |

| ➡️ Chronic Medication | Unlimited when using a Preferred Provider. Pre-authorization is required. Subject to preferred provider-managed care protocols. |

| ↪️ Dialysis | Unlimited PMF. PMBs are covered up to 100% when using a DSP. Pre-approval is required. Subject to case and treatment management. |

| 🎗️ HIV/AIDS | Unlimited cover but subject to LifeSense protocols. |

| 🟥 Oncology | Limited to R250,000 PMF. Benefits must be pre-approved via ICON. PMBs are covered up to 100% when using a DSP. Pre-authorization is required, and the benefit includes medication and chemicals used during active treatment periods. |

| 🟧 Specialized Radiology and Pathology | Limited to R16,900 PMF. Pre-approval is required, or cover is only up to 80%. |

| 🟨 Acute Medicine | Paid from available funds in the PMSA. Once funds are depleted, there is a sub-limit of R3,165 within the overall day-to-day limit. OTC medication is limited to R160 per prescription per month, up to a maximum of R1,425 per year. |

| 🟩 Alcoholism and Drug Dependency. | Paid from available funds in the PMSA. Once funds are depleted, there is a sub-limit of R1,550 within the overall day-to-day limit. Pre-approval is required before treatment. Treatment includes accommodation, medication, materials, and visits. |

| 🟦 Paramedical, Auxiliary, and Mental Health | Paid from available funds in the PMSA. Once funds are depleted, the benefit is subject to the day-to-day limit. This benefit includes the following: Audiology Dietetics Hearing Aid Acoustics Homoeopathy Podiatry Speech Therapy Social Workers Clinical and Counselling Psychology |

| 🟪 Ambulance Services | Unlimited cover if ER24 is used. |

| 🩺 Appliances | Paid from available funds in the PMSA. Once funds are depleted, there is a sub-limit of R2,500 within the overall day-to-day limit. There is a limit of R4,000 paid to PMF for Oxygen. The benefit is subject to Suremed protocols and must be pre-approved. The following additional limits apply: Hearing aids are limited to R5,000 per 3-year cycle. Nebulizers/Humidifiers are limited to R500. CPAP Machines are limited to R5,000 per 3-year cycle. Glucometers are limited to R500 per 3-year cycle. Back support/braces are limited to R2,500. Orthotics are limited to R1,000. |

| 🪥 Basic Dentistry | Paid from available funds in the PMSA. Once depleted, the benefit will be subject to the day-to-day limit. Basic dentistry includes fillings, extractions, etc. |

| 🦷 Advanced Dentistry | Paid from available funds in the PMSA. Once depleted, the benefit will be subject to a sub-limit of R4,800 per beneficiary within the day-to-day limit. This benefit includes crowns, bridges, orthodontics, inlays, dental technician fees, and Osseo-integrated implants. |

| 👩⚕️ GP Consultations | Paid from available funds in the PMSA. Once depleted, the benefit will be subject to the day-to-day limit. This benefit includes casualty or emergency room visits. |

| 🍼 Maternity | The benefit is included in the benefit parameters. Pregnant members must register for the Maternity Program on the Suremed Navigator App. The benefit includes the following: Nine antenatal consultations. R470 for antenatal classes. One postnatal consultation with a GP, midwife, or specialist. R65 for antenatal vitamins per month for 9 months. |

| 🤓 Optometry | Paid from available funds in the PMSA. Once depleted, the benefit will be subject to a sub-limit of R1,350 per beneficiary and R3,380 PMF within the day-to-day limit. The benefit covers one pair of glasses per beneficiary every two years or contact lenses yearly. |

| ⚽ Physiotherapy | Paid from available funds in the PMSA. Once depleted, the benefit will be subject to the day-to-day limit. This benefit includes physiotherapy, chiropractics, and biokinetics. |

| 🧪 Pathology and Basic Radiology | Paid from available funds in the PMSA. Once depleted, the benefit will be subject to the day-to-day limit. This benefit includes X-rays, blood tests, etc. |

| 💜 Preventative Care and Wellness | Paid from available funds in the PMSA. Once depleted, the benefit will be subject to a sub-limit of R1,110 per beneficiary and up to R2,100 PMF within the day-to-day limit. This benefit covers the following: Mammograms Pap Smears Prostate Check-ups (PSA) Tonometry |

Discover the 5 Best Hospital Plans for Babies

Suremed Health Navigator Plan Exclusions and Waiting Periods

Navigator Plan Exclusions

The Suremed Health Navigator Plan Exclusions include, but are not limited to, the following:

- Costs exceeding the annual or biennial maximums.

- Medical, surgical, and orthopedic appliances, devices, and products not specifically provided for.

- Operations, medicines, treatments, and procedures for cosmetic purposes or personal reasons.

- Medicines not included in a prescription from a legally entitled medical practitioner or healthcare professional (except schedule 0, 1, and 2 medicines supplied by a registered pharmacist).

- Healthcare services are not appropriate or necessary for symptoms, diagnosis, or treatment of a medical condition.

- Medicines not registered and approved by SAHPRA for clinical treatment of a condition.

- Treatment where efficacy and safety cannot be scientifically proven.

- MRI scans are ordered by a general practitioner (except in emergencies).

- Specialist referral for second opinions unless authorized by the scheme.

- Injuries sustained while participating voluntarily in certain activities or any injuries arising from professional sports or speed contests.

- Organ and tissue donations to anyone other than a member or dependent of a member.

- Treatment of a sickness condition directly attributable to the failure to carry out medical practitioner instructions (except if the sickness condition is a PMB).

and many more.

Navigator Plan Waiting Periods

Waiting periods prevent members from anti-selecting or joining a program solely when ill. There are two types of wait times:

- A 3-month General Waiting Period – The scheme will not fund any claims during this general waiting period.

- A 12-month Condition-Specific Waiting Period – A member is ineligible to claim benefits for a condition for which medical advice, diagnosis, care, or treatment was recommended or received within the 12 months ending on the date of the membership application.

Condition-specific waiting periods may not be imposed on related conditions unless a direct link between the conditions can be demonstrated. Furthermore, the waiting periods can also include prescribed minimum benefit (PMB) conditions for applicants who have never belonged to a medical plan before or for members who have had a break in coverage of more than 90 days.

Suremed Health Navigator Plan vs Similar Plans from Other Medical Schemes

| 🔎 Medical Aid Plans | 🥇 Suremed Health Navigator | 🥈 Fedhealth FlexiFED 3 | 🥉 Medimed Medisave Max |

| 👤 Main Member Contribution | R3,884 | R3,796 | R3,980 |

| 👥 Adult Dependent Contribution | R3,040 | R3,477 | R3,980 |

| 🍼 Child Dependent Contribution | R1,148 | R1,345 | R730 |

| ☑️ Hospital Cover | Unlimited | Unlimited | Unlimited |

| ✅ Oncology Cover | R250,000 | R311,900 | R400,000 |

You might like the 5 Best Gap Cover Options for Under R500

Our Verdict on the Suremed Health Navigator Plan

Suremed Navigator is a comprehensive medical aid plan designed to provide its members with access to quality healthcare services at an affordable cost. The plan offers a range of features and benefits catering to individuals’ and families’ diverse healthcare needs. One of the key benefits of the Suremed Navigator plan is that it provides members with unlimited private hospital coverage. This means that members can receive medical treatment in a private hospital of their choice without worrying about the cost of treatment. The plan also covers the chronic medication, an essential benefit for individuals with chronic conditions.

Another advantage of the Suremed Navigator plan is that it offers a wellness program that gives members access to various health and wellness services, such as preventative care, health assessments, and disease management programs. Furthermore, this program helps members stay healthy and manage their health conditions effectively. However, there are also some drawbacks to the Suremed Navigator plan. One of the drawbacks is that it does not cover certain medical procedures and treatments, such as cosmetic surgery and infertility treatments. Additionally, the plan has waiting periods for some benefits, which can disadvantage individuals needing immediate medical treatment.

You might also like: Suremed Health Challenger

You might also like: Suremed Health Explorer

You might also like: Suremed Health Shuttle

Suremed Health Navigator Plan Frequently Asked Questions

What is Suremed Navigator?

Suremed Navigator is a medical aid plan that provides affordable access to quality healthcare services, including private hospital cover, chronic medication, and a wellness program.

Does Suremed Navigator cover private hospital treatment?

Yes, Suremed Navigator provides unlimited private hospital cover, allowing members to receive medical treatment in a private hospital of their choice.

Does Suremed Navigator cover chronic medication?

Yes, Suremed Navigator covers the chronic medication, which is an essential benefit for individuals with chronic conditions.

What is the Suremed Navigator wellness program?

The Suremed Navigator wellness program provides members access to various health and wellness services, including preventative care, health assessments, and disease management programs.

Are there waiting periods for Suremed Navigator benefits?

Yes, there are waiting periods for some benefits under the Suremed Navigator plan. These waiting periods may vary depending on the specific benefit.

Does Suremed Navigator cover cosmetic surgery?

No, Suremed Navigator does not cover cosmetic surgery.

Does Suremed Navigator cover infertility treatments?

No, Suremed Navigator does not cover infertility treatments.

Are there any limitations to Suremed Navigator cover?

Yes, there may be limitations to Suremed Navigator cover, such as exclusions for certain medical procedures and treatments.

You might also like

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans