- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

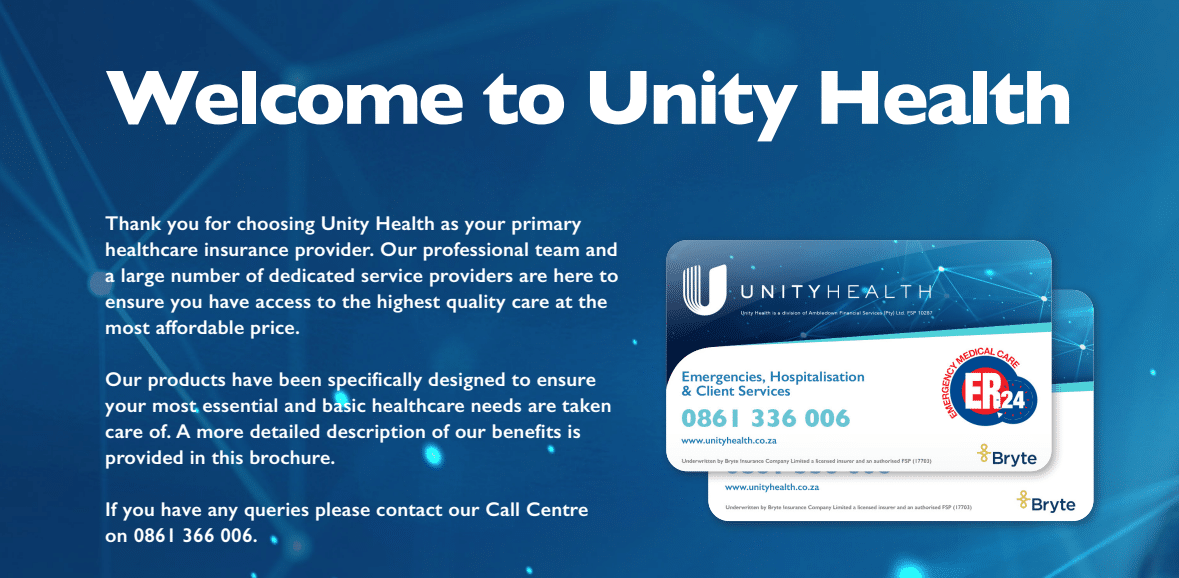

Unity Health Individual Hospital Plan

Overall, the Unity Health Individual Hospital Plan is a trustworthy and comprehensive medical health plan that offers 24/7 medical emergency assistance and in-hospital procedures to up to 3 Family Members. The Unity Health Individual Hospital Plan starts from R192 ZAR. Unity Health has a trust score of 2.8.

| 🔎 Medical Health Plan | 🥇 Unity Health Individual Hospital |

| 🌎 International Cover | None |

| 👤 Main Member Contribution | From R192 |

| 👥 Adult Dependent Contribution | From R107 |

| 😊 Child Dependent Contribution | From R44 |

| 🔁 Gap Cover | None |

| 😷 Screening and Prevention | None |

| 💵 Medical Savings Account | None |

| 🍼 Maternity Benefits | None |

| 💙 Pre and Postnatal Care | None |

Unity Health Individual Hospital Plan – 7 Key Point Quick Overview

- ✅ Unity Health Individual Hospital Plan Overview

- ✅ Unity Health Individual Hospital Plan Premiums 2023

- ✅ Unity Health Individual Hospital Plan Benefits and Cover Comprehensive Breakdown

- ✅ Unity Health Individual Hospital Plan Exclusions and Waiting Periods

- ✅ Unity Health Individual Hospital Plan vs Plans Offered by Other Providers

- ✅ Our Verdict on the Unity Health Individual Hospital Plan

- ✅ Unity Health Individual Hospital Plan Frequently Asked Questions

Unity Health Individual Hospital Plan Overview

The Unity Health Individual Hospital Plan is one of 4, starting from R192, and includes comprehensive cover for in-hospital procedures, treatments, and services. Furthermore, South Africans on this plan can access several hospitals nationwide and over 4,000 doctors and specialists.

Gap Cover is not available on the Unity Health Individual Hospital Plan. However, Unity Health offers 24/7 medical emergency assistance.

Unity Health has the following four plans to choose from:

- ✅ Unity Health Group Hospital Plan

- ✅ Unity Health Group Primary Care

- ✅ Unity Health Individual Hospital Plan

- ✅ Unity Health Individual Primary Care

Unity Health Individual Hospital Plan Premiums 2024

The premiums for Unity Health’s Individual Hospital are adjustable. They are based on certain factors, such as the policyholder’s age and family structure, which determine the number of insured individuals under the policy.

It is worth noting that the premiums usually start from R192, which we found to be competitive compared to other health insurance providers in South Africa.

POLL: 5 Best Hospital Plans for Unemployed

Unity Health Individual Hospital Plan Benefits and Cover Comprehensive Breakdown

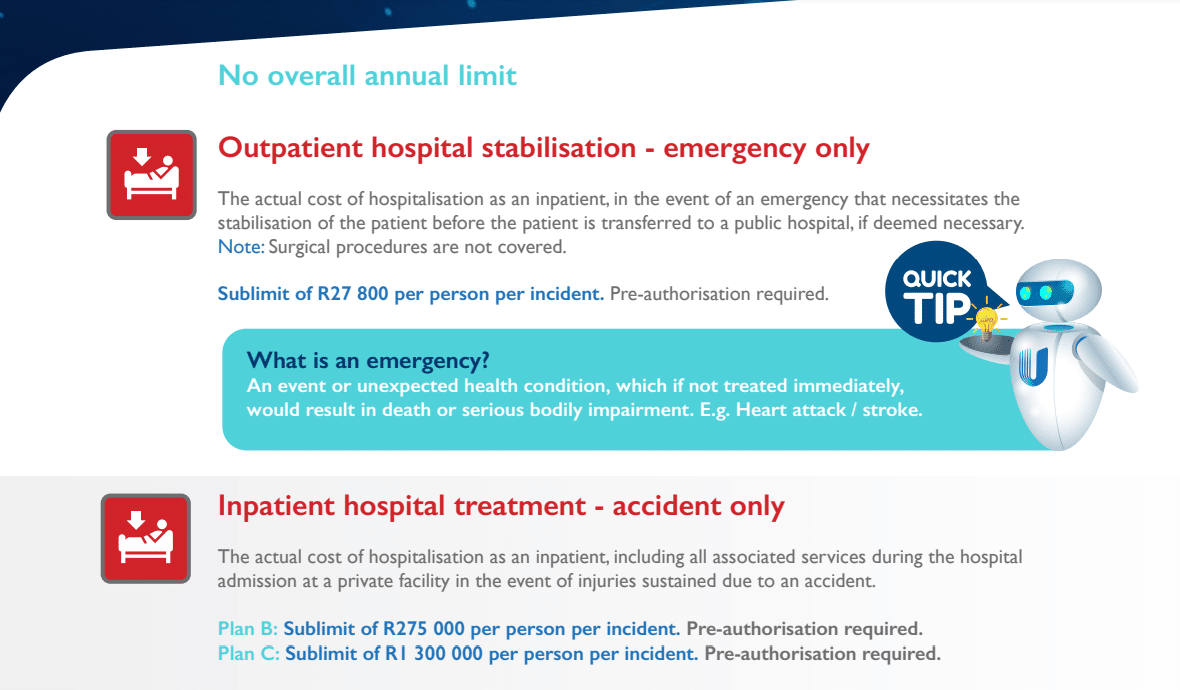

| 🟥 Overall Limit | There is no overall annual limit. |

| 🟧 Hospital Access | Unity Health offers service and treatment in the following Private Hospitals across South Africa: Mediclinic Netcare National Hospital Network (NHN) Life Healthcare Clinix Health Group |

| 🟨 In-Patient Hospital | Accident only – limited to R300 000 per incident |

| 🟩 In-Patient Hospital Stabilisation | Only emergencies are covered under this benefit. The actual cost of hospitalization as an in-patient in an emergency requires the patient to be stabilized before being transferred to a public hospital. Surgical procedures are not covered. The maximum amount per incident is R30,000 per person. Pre-approval is required. |

| 🟦 In-Patient Hospital Treatment | Only accidents are covered under this benefit. In the event of injuries sustained in an accident, the actual cost of hospitalization as an in-patient, including all associated services during the hospitalization, at any private facility. Limited to R300,000 on Option B and R1,500,000 per person per incident on Option C. Pre-approval is required. |

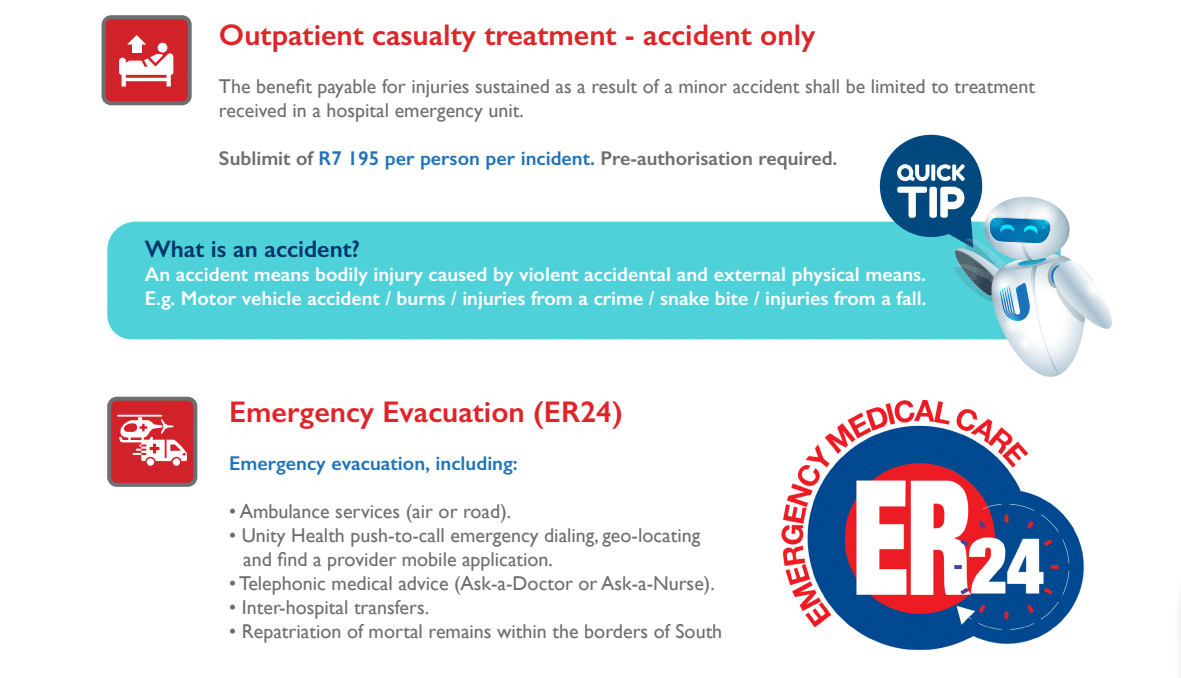

| 🟪 Outpatient Casualty Treatment | The benefit is payable for injuries sustained in an accident and is limited to treatment in a hospital emergency unit. The maximum amount per incident is R7,600. Pre-approval is required. |

| 🟥 Emergency Evacuation | This includes the following: Air or ground ambulance services. Transfers between hospitals. Return of mortal remains. Medical advice over the phone (Ask a Doctor or a Nurse). “Push to activate” emergency dialing and “find a provider” app. Pre-authorization for hospitalization and payment guarantee to the treating facility in the event of an emergency/accident. |

| 🟧 MRI and CT scans | The actual cost of an MRI or CT scan required as a result of an accident-related injury. The annual limit is R20,000 per person. Pre-approval is required. |

| 🟨 Physiotherapy and Occupational Therapy | Physiotherapy and occupational therapy were provided after an in-patient hospitalization due to an accident. Limited to 3 months following discharge from an in-patient hospitalization incident and R3,800 per person per year. Pre-approval is required. |

| 🟩 Accidental Death | The cover is limited to the following: R25,000 maximum per principal insured and first spouse dependent. R5,000 for each child dependent (only in motor vehicle accidents). |

READ more about Top 100 Medical Aid Questions

Unity Health Individual Hospital Plan Exclusions and Waiting Periods

Unity Health Individual Hospital Plan Exclusions

Outlined below are the exclusions from the cover which pertain to the services, conditions, or events not covered:

- ✅ Incidents related to nuclear weapons or nuclear material, ionizing radiation, or contamination by radioactivity from any nuclear fuel or nuclear waste arising from the combustion of nuclear fuel, which includes any self-sustaining nuclear fission process.

- ✅ Surgery or treatment for obesity or its sequel, cosmetic surgery, or surgery directly or indirectly caused by or related to cosmetic surgery, except as a result of an Insured Incident.

- ✅ Suicide, attempted suicide, or self-inflicted injuries, except if done to save another human life.

- ✅ Routine physical or purely diagnostic procedures, any other examination without objective indications of impairment in normal health, and laboratory diagnostic or x-ray examinations, except in the course of a medical condition or disability established by a prior call or attendance of a Medical Practitioner.

- ✅ All expenses are determined by the clinical review team of the Underwriting Manager.

- ✅ Expenses that are not medically necessary or clinically appropriate or do not meet the Insured Person’s healthcare needs, are inconsistent in type, frequency, and duration of treatment.

- ✅ Procedures performed in doctors’ offices not described in the tariff code list

and many more. A full list of exclusions will be made available by Unity Health.

Unity Health Individual Hospital Plan Waiting Periods

The waiting periods for Unity Health insurance policies vary and depend on the cover type and policy. Please see below for the standard Unity Health waiting periods:

- ✅ General medical services, such as doctor visits, prescription drugs, and diagnostic tests, usually require a waiting period of three months.

- ✅ Specialist consultations and procedures usually have a waiting period of six months.

- ✅ For maternity benefits, including prenatal care, delivery, and postnatal care, the standard waiting period is typically 12 months.

A waiting period of 12 months is typically required for pre-existing conditions.

Discover some GAP cover options with the 5 Best Gap Cover Options for Under R2000

Unity Health Individual Hospital Plan vs Plans Offered by Other Providers

| 🔎 Medical Health Plan | 🥇 Unity Health Individual Hospital | 🥈 EssentialMED Hospital | 🥉 UbuntuMed Hospital |

| 🌎 International Cover | None | None | None |

| 👤 Main Member Contribution | From R192 | R699 | From R192 |

| 👥 Adult Dependent Contribution | From R107 | R699 | From R192 |

| 😊 Child Dependent Contribution | From R44 | R272,50 | From R192 |

| 🔁 Gap Cover | None | None | None |

| 😷 Screening and Prevention | None | ✅ Yes | None |

| 💵 Medical Savings Account | None | None | None |

| 🍼 Maternity Benefits | None | ✅ Yes | None |

| 💙 Pre and Postnatal Care | None | None | None |

POLL: 5 Best Medical Aids under R200

Our Verdict on the Unity Health Individual Hospital Plan

Unity Health Hospital Plan is a private hospitalization cover in South Africa that offers emergency and accident-related cover. It includes a range of benefits that cover in-patient hospitalization, outpatient casualty treatment, MRI and CT scans, physiotherapy, and occupational therapy. Additionally, accidental death is covered, and the plan offers 24-hour medical emergency services through ER24.

As we evaluate the Unity Health Hospital Plan, we find it a suitable option for individuals who prioritize unexpected emergencies and accidents but lack comprehensive cover for other medical expenses. Furthermore, Unity Health Hospital Plan is an excellent choice for those who require extensive cover for accidents and emergencies and are otherwise healthy and active.

However, one major drawback of the Unity Health Hospital Plan is the limited coverage for various services such as GP consultations, medicine, and chronic medication.

- You might also like: Unity Health Group Hospital Plan

- You might also like: Unity Health Group Primary Care

- You might also like: Unity Health Individual Primary Care

- You might also like: Unity Health – Health Insurance Review

Unity Health Individual Hospital Plan Frequently Asked Questions

What is the Unity Health Individual Hospital Plan?

The Unity Health Individual Hospital Plan is a comprehensive health insurance plan covering hospitalization expenses for South African individuals. It includes in-hospital benefits such as surgery, scopes and scans, physiotherapy, accidental death benefits, and more.

What are the benefits of the Unity Health Individual Hospital Plan?

The Unity Health Individual Hospital Plan provides affordable hospital cover for individuals, with a range of benefits that include hospitalization, specialist consultations, and emergency medical care.

What is the waiting period for the Unity Health Individual Hospital Plan?

According to Unity Health, the hospital care plan has no waiting periods, and coverage is available immediately.

Does the Unity Health Individual Hospital Plan cover pre-existing conditions?

Pre-existing conditions are covered under the hospital plan when the member is involved in an accident or they have a medical emergency.

How can I join the Unity Health Individual Hospital Plan?

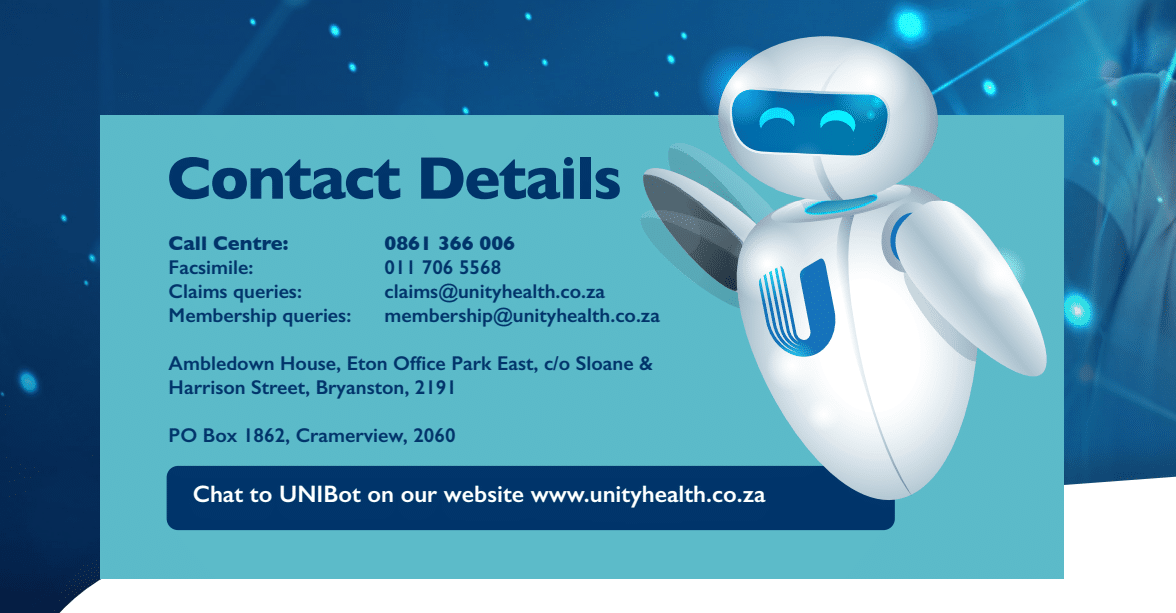

You can join the Unity Health Individual Hospital Plan by completing an online application form on their website or contacting their customer service center.

Can I choose my own hospital with the Unity Health Individual Hospital Plan?

Yes, you can choose your own hospital with the Unity Health Individual Hospital Plan, including Mediclinic, Netcare, National Hospital Network, Life Healthcare, and Clinix Health Group.

How much does the Unity Health Individual Hospital Plan cost?

The Unity Health Individual Hospital Plan starts from R192. The monthly premium will depend on the number of dependents you add to your policy.

Does the Unity Health Individual Hospital Plan cover emergency medical care?

Yes, the Unity Health Individual Hospital Plan covers emergency medical care, including ambulance transportation, emergency room treatment, and emergency surgery.

Table of Contents

Free Health Insurance Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans