5 Best Hospital Plans for Unemployed

The 5 Best Hospital Plans for Unemployed in South Africa revealed.

We tested them side by side and verified their hospital plans.

This is a complete guide to the best hospital plans for unemployed in South Africa.

In this in-depth guide you’ll learn:

- What is a hospital plan?

- When do you qualify as unemployed in South Africa?

- Is a hospital plan or medical aid more affordable?

- Do hospital plans cover emergencies?

- What benefits do you get out of a hospital plan?

So if you’re ready to go “all in” with the best hospital plans for unemployed in South Africa, this guide is for you.

Let’s dive right in…

Best Hospital Plans for Unemployed (2024)

| 🩺 Medical Aid | ✔️ Offers Plans/Options for Unemployed? | ⚕️ Plan Offered | 👉 Sign Up |

| 1. Discovery Health | Yes | Discovery KeyCare Plan | 👉 Apply Now |

| 2. Momentum Medical Aid | Yes | Ingwe Student Option | 👉 Apply Now |

| 3. FedHealth | Yes | flexiFED Savvy | 👉 Apply Now |

| 4. Momentum | Yes | Boncap Student | 👉 Apply Now |

| 5. Medihelp Medical Scheme | Yes | Network Plans | 👉 Apply Now |

5 Best Hospital Plans for Unemployed Summary

- Discovery Medical Scheme – Overall, Best Hospital Plans for Unemployed in South Africa

- Momentum Health – Top Extensive Medical Protection in South Africa

- Fedhealth Medical Scheme – Broadest Range of Low-Cost Hospital Plans

- Momentum Medical Scheme – Best Pay-As-You-Go Private Healthcare

- Medihelp Medical Scheme – Best Customer Service Medical Aid

Introduction

The possibility of being laid off is a stressful situation for anybody to be in, especially when taking into account the multitude of economic challenges that will invariably crop up as a direct result of the loss of a job.

In order to make their money last longer each month, the majority of individuals decide to cut back on needless expenditures. As a result, insurance coverage and medical aid are frequently dropped.

If you do not have medical aid coverage or the funds on hand to pay for your medical costs, however, you may find yourself in a difficult financial situation due to the high cost of private healthcare in South Africa.

If you are now working or will shortly be laid off, what should you do regarding medical aid coverage?

If the medical aid programme offered by your employer is a restricted plan, it is possible that you will not be permitted to continue participating in the programme. This kind of medical aid is only available to workers who are employed by a certain firm or in a particular industry sector.

If you find another employment within the same industrial sector, it is possible that you may be able to preserve your coverage; but, if it is a corporate medical aid, it is more probable that you will lose your coverage.

At this time, you are going to want to think about getting an open medical aid. If you are jobless, you will not receive a reduction on the monthly costs for medical aids. Your monthly payment is calculated using the total number of people covered by the medical aid as well as the kind of coverage you choose.

On the other hand, if you lose your work, many medical aids in South Africa now provide a protection plan that will pay your medical aid charges for three to six months in the event that you become unemployed.

It is strongly recommended that you discuss these choices with your medical aid, particularly open medical aids. It is possible that those few months in which you do not have to pay medical aid payments while you look for a job and get your life back on track might mean the difference between having coverage and being at the whim of the public health system.

In the event that your previous employer contributed to the payment of a portion of the cost of your medical aid, you should be prepared to pay a larger premium once you have been laid off. Once the retrenchment is implemented, medical aid subsidies will no longer be applicable; therefore, you should speak with your medical aid about the total cost of the plan. It is possible that it might be prudent to consider downgrading your coverage in order to move to a cheaper plan.

This will ensure that you continue to be covered for urgent medical care until you find a new job and are able to upgrade to a more expensive plan that provides full coverage.

It is important to keep in mind that you will be subject to a late joiner’s charge if you sign up for medical aid coverage at a later stage if you have gone more than 90 days without having coverage and if you are older than 35 years of age.

It is preferable to maintain coverage under a more affordable plan as opposed to completely giving up your medical aid coverage. Your medical aid will be suspended if the premiums are not paid on time, and this means that your medical expenses will not be reimbursed.

It is also a good idea to talk to the people providing your medical aid and explain your situation to them. If you can provide evidence that you have been laid off from your job, your medical aid might be able to provide you a one-month break from paying the premiums if you have been a participant in the programme for a significant amount of time and if you have a lengthy history of doing so.

You might also ask your medical aid provider about cheaper rates if you pay for six to twelve months’ worth of premiums in advance out of your savings or your compensation from being laid off.

Be careful about diverting to hospital cash plans in a hurry, since these plans are NOT medical assistance. All too frequently, individuals will sign up for a hospital cash plan, only to later learn that their particular insurance would not allow them to access private hospital services.

A hospital cash plan is a type of insurance that protects your finances by paying you cash for each day that you spend in the hospital. The vast majority of private hospital groups in South Africa do not believe these plans to be sufficient guarantees when deciding whether or not to admit patients.

Plans that are affordable for unemployed persons

If you have limited financial resources available, and if you don’t have an employer who contribute a significant amount towards your monthly premium, medical aid may be completely out of reach for you financially.

There are, on the other hand, more affordable plans available via the majority of medical aid organisations. These plans offer fundamental medical services via certain clinic and hospital groups or chosen providers.

These standard, more affordable plans are not exclusive to any one particular medical aid provider. It is perhaps possible that it will provide outpatient benefits in addition to inpatient benefits and benefits for chronic medicine.

It is essential to keep in mind that these less costly medical aid plans could not cover the same comprehensive array of medical services as more expensive medical aid policies. On the other hand, in most cases, it offers at the very least the most fundamental medical services.

POLL: 5 Best Medical Aid Schemes under R1500 in South Africa

Choosing an Appropriate Medical Aid

The price tag of a medical aid is always the first thing that may deter you from becoming a member. If a person is required to cover the entirety of their monthly contribution on their own, the choice of plans may be restricted as a result.

In such a case, medical aid hospital plans are usually more affordable than full medical aid plans and become the obvious choice for unemployed people.

A cheap hospital plan should enable the member to only consult with a physician or go to a clinic that is included in a network of preferred providers that is covered by a medical aid. Although this may be restrictive in some ways, the member will still have access to private healthcare despite these restrictions.

The majority of programmes strongly recommend to potential members that they do not sign up for a hospital plan that has to be abandoned after a while owing to financial concerns associated with maintaining it.

READ more about Best Medical Aids for the Unemployed in South Africa

1. Discovery Medical Scheme

Core Series

The Core Series is a value-for-money series of hospital plans that provide unlimited private hospital cover and essential cover for chronic medicine but no day-to-day cover.

Keycare Series

The Keycare Series offers affordable medical cover providing you use providers in a specified network for both in-hospital and out-of-hospital treatment.

2. Momentum Health

Momentum Health offers three hospital plans. They are the Momentum Ingwe, Momentum Custom and Momentum Incentive plans.

Ingwe offers entry level cover at a list of private hospitals or State hospitals while Momentum Extender offers private hospitalisation.

3. Fedhealth Medical Scheme

Fedhealth hospital plans include the following:

flexiFED 1

flexiFED 1 is an affordable hospital plan that gives solid medical aid cover at a great price. Get access to Fedhealth Savings powered by the MediVault to help cover unexpected day-to-day medical bills and enjoy a valuable Threshold Benefit that kicks in once claims have reached a certain level.

READ more: Discover the Difference Between Medical Aid and Medical Insurance

4. Momentum Medical Scheme

Momentum Medical Scheme offers the Evolve Option, which gives cover for hospitalisation from the Evolve Network of private hospitals with no overall annual limit.

The Ingwe Option is the most affordable and accessible and covers treatment from any hospital, the Ingwe Network of private hospitals, or State hospitals.

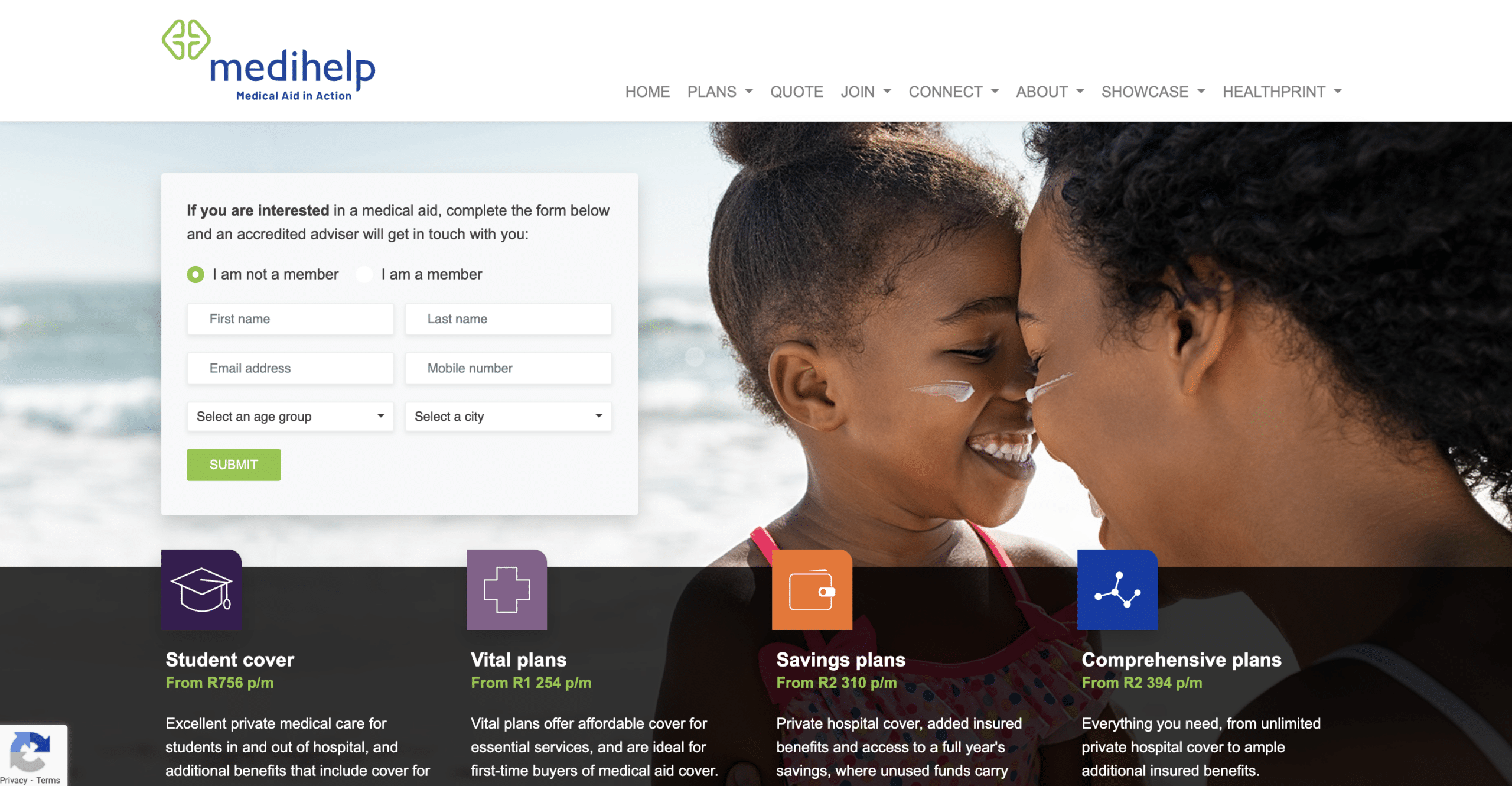

5. Medihelp Medical Scheme

Medihelp offers the Medmove option that provides essential hospitalisation cover and emergency medical services through networks. MedVital offers affordable cover for minor medical expenses, private hospitalisation and emergency medical services.

Our review: Fedhealth versus Medhihelp compared and revealed.

Frequently Asked Questions

Can an unemployed person get medical aid in South Africa?

Although medical schemes and insurance providers will ask you about your employment details, they will not refuse you cover if you can afford it.

Who qualifies for free health care in South Africa?

South Africa’s constitution guarantees that everyone has access to healthcare services in public hospitals.

Is there a waiting period for a hospital plan?

The waiting period may vary but usually ranges between 3 and 12 months. This means you will still have to pay your premiums, but you are unable to claim benefits for that period.

Are hospital plans cheaper than medical aid?

Yes, hospital plans are generally cheaper than comprehensive medical aid options. A hospital plan however provides excellent in-hospital cover.

How do I choose a hospital plan?

When Choosing a Medical Scheme you should consider the list of network hospitals, potential annual limits, your future plans and affordability.

Do hospital plans cover surgery?

Yes, a hospital plan covers you for any medical procedures that are performed in a private hospital, such as if you’re in an accident and need surgery.