- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Dis-Chem Health Accident Cover Plan

Overall, the Dis-Chem Health Accident Cover Plan is a trustworthy and comprehensive medical aid plan that offers 24/7 medical emergency assistance and access to medical advice to up to 3 Family Members. The Dis-Chem Health Accident Cover Plan starts from R206 ZAR.

| 🔎 Medical Health Plan | 🥇 Dis-Chem Health Accident Cover |

| 🌎 International Cover | None |

| 👤 Main Member Contribution | R206– R301 |

| 👥 Adult Dependent Contribution | R206 – R301 |

| 👶🏻 Child Dependent Contribution | R114 – R164 |

| 🔁 Gap Cover | ✅ Yes |

| 📈 Annual Limit | ✅ Yes |

| 😷 Screening and Prevention | ✅ Yes |

| 💶 Medical Savings Account | None |

| 🍼 Maternity Benefits | ✅ Yes |

Dis-Chem Health Accident Cover Plan – 8 Key Point Quick Overview

- ✅ Dis-Chem Health Accident Cover Plan Overview

- ✅ Dis-Chem Health Accident Cover Plan Premiums

- ✅ Dis-Chem Health Accident Cover Plan Benefits and Cover Comprehensive Breakdown

- ✅ Dis-Chem Medical Emergency Illness Buy-Up

- ✅ Dis-Chem Health Accident Cover Plan Exclusions and Waiting Periods

- ✅ Dis-Chem Health Accident Cover Plan vs Other Providers

- ✅ Our Verdict on the Dis-Chem Health Accident Cover Plan

- ✅ Dis-Chem Health Accident Cover Plan Frequently Asked Questions

Dis-Chem Health Accident Cover Plan Overview

The Dis-Chem Health Accident Cover Plan is one of 4, starting from R206, and includes day-to-day and accident cover, with the option of Value-Added Services at an additional cost. Dis-Chem Health Accident Cover is a decent insurance policy for those seeking cover for accidental injuries or death. Its 24/7 emergency medical transportation and access to medical advice are useful features.

Gap Cover is available on the Dis-Chem Health Accident Cover Plan, along with 24/7 medical emergency assistance. According to the Trust Index, Dis-Chem Health has a trust rating of 3.2.

Dis-Chem Health Insurance offers the following plans

Dis-Chem Health Accident Cover

Dis-Chem Health MyHealth Core

Dis-Chem Health MyHealth Plus

Private Health Insurance – Dis-Chem Health Accident Cover Plan Premiums

Medical coverage that is affordable :

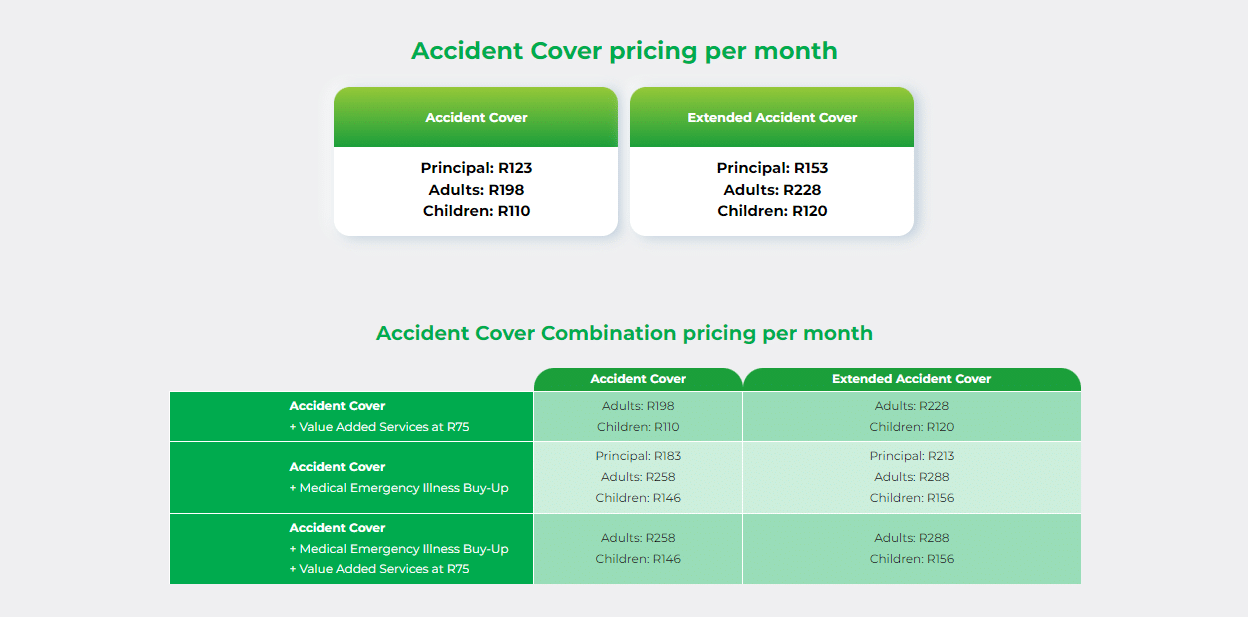

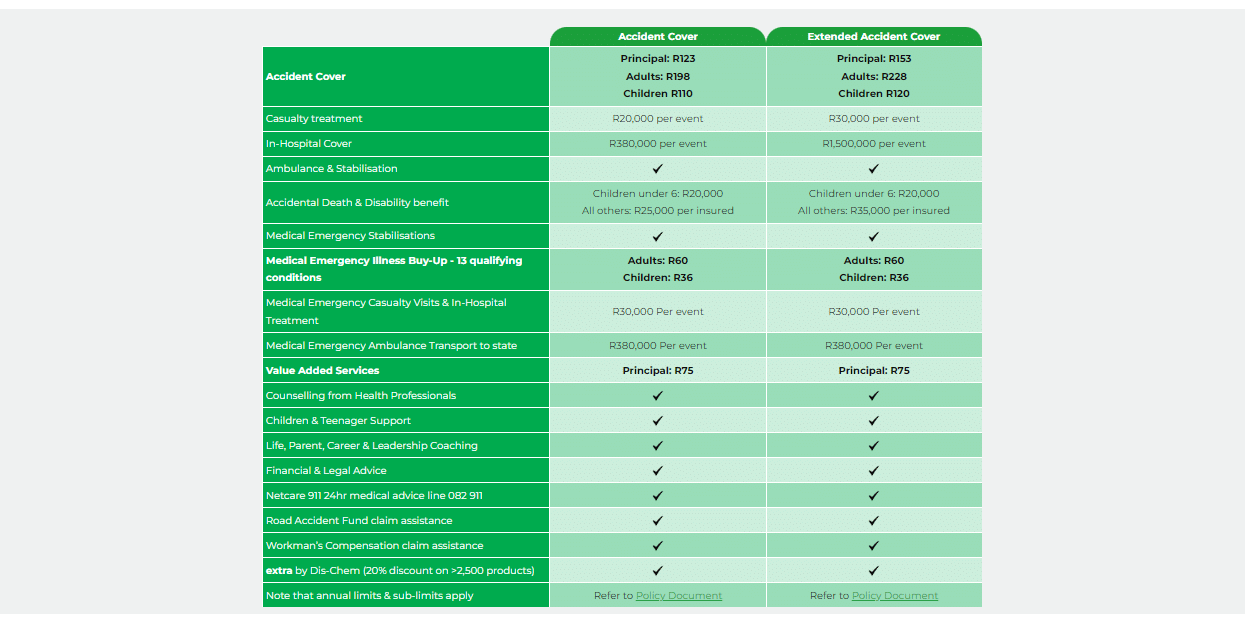

| 🟥 Option | 👤 Principal Member | 👥 Adults | 🍼 Children |

| 🟧 Accident Cover | R151 | R206 | R114 |

| 🟨 Extended Accident Cover | R182 | R237 | R125 |

| 🟩 Accident Cover Value-Added Services (R75) | – | R206 | R114 |

| 🟦 Accident Cover Medical Emergency Illness Buy-Up | R215 | R270 | R153 |

| 🟪 Accident Cover Medical Emergency Buy-Up Value-Added Services (R75) | R270 | R270 | R153 |

| 🟥 Extended Accident Cover Value-Added Services (R75) | – | R237 | R125 |

| 🟧 Extended Accident Cover Medical Emergency Illness Buy-Up | R246 | R301 | R164 |

| 🟨 Extended Accident Cover Medical Emergency Buy-Up Value-Added Services (R75) | R301 | R301 | R164 |

| 🟩 Medical Emergency Illness Buy-Up | – | R64 | R39 |

POLL: 3 Best Private Hospital Plans Under R1000

Dis-Chem Health Accident Cover Plan Benefits and Cover Comprehensive Breakdown

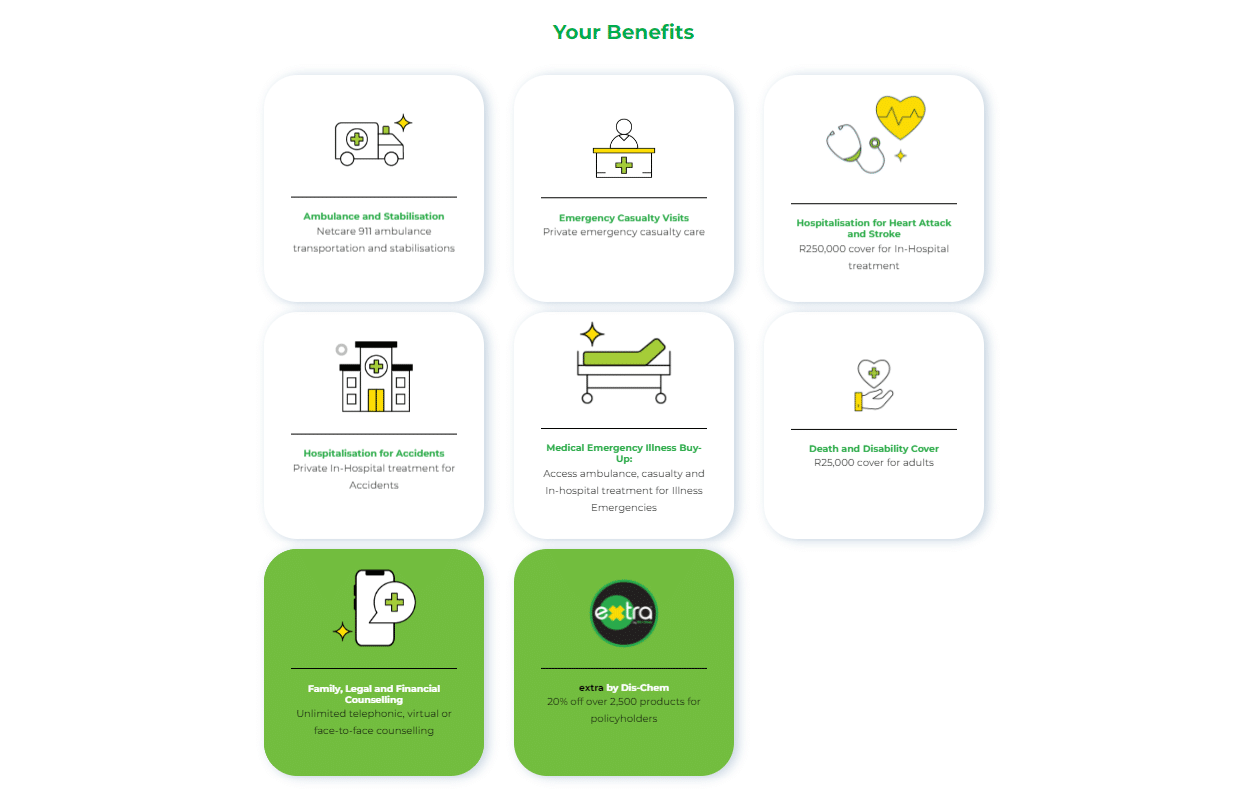

Casualty and In-Hospital Cover for Accidental Harm

Casualty Treatment

- ☑️ Cover for emergency services in the event of Accidental Harm resulting from an Accidental Event in a Hospital Casualty.

- ☑️ Post-Accident Discharge, specialist, or follow-up visits or treatment are not covered.

- ☑️ Limited to R20,000 per event per insured person.

In-Hospital Treatment

- ✅ Includes Accidental Injury hospitalization cover resulting from an Accidental Occurrence.

- ✅ Includes cover for emergency surgery following an accident, any required specialist visits and associated blood tests, radiology, and Allied Healthcare Provider services, such as physiotherapy, while hospitalized.

- ✅ Cover expires upon hospital discharge or when the event or annual limits are met, whichever occurs first.

- ✅ If the limit has been reached and the Insured Party continues to require Hospital Treatment, they will be transferred to a state facility.

- ✅ All transfer-related expenses will be covered.

- ✅ No Benefit is payable for services received after hospital discharge or for illnesses other than a heart attack or stroke.

- ✅ The Benefit pays up to R380,000 per event per Insured Party, with an annual maximum per Insured Party of R1,500,000.

- ✅ Hospital Allied Healthcare Professional services are subject to a sub-limit of R20,000.

Casualty and In-Hospital Cover for Heart Attacks and Strokes

| 🔴 Casualty Treatment | Includes cover for hospital emergency services in the event of a heart attack or stroke. Post-Accident Discharge, specialist, or follow-up visits or treatment are not covered. The Benefit pays up to R20,000 per occurrence per Insured Party. |

| 🟠 In-Hospital Treatment | Includes cover for In-Hospital Medical Emergencies due to heart attack or stroke. Cover expires upon hospital discharge or when the event or annual limits are met, whichever occurs first. If the limit has been reached and the Insured Party continues to require Hospital Treatment, they will be transferred to a state facility. All transfer-related expenses will be covered. There is no Benefit payable for services rendered after hospital discharge. The Benefit pays a maximum of R250,000 per event per Insured Party, with an annual maximum of R500,000. Sublimit of R20,000 for Hospital Allied Healthcare Professional services. |

| 🟡 Emergency stabilization and ambulance services | Netcare 911 will stabilize the scene and transport the person to a suitable hospital. If needed, Netcare 911 will issue a Guarantee of Payment and Authorisation for admission. If the emergency is due to accidental harm or a suspected heart attack/stroke, the person will be taken to a Prime Cure Network Hospital. If it is an illness unrelated to stroke or heart attack, the person will be taken to a state facility unless they have purchased the Medical Emergency Illness Cover Buy-Up for qualifying conditions. If the casualty or in-hospital benefit limit is exceeded, the person will be taken to a state facility. |

| 🟢 Total Permanent Disability of an insured party because of accidental harm | In the event of Total Permanent Disability resulting from Accidental Harm, the Insured Party will receive a lump sum. Total Permanent Disability is restricted to insured parties 18 years>. Limited to R25,000. |

| 🔵 Death of an insured party because of accidental harm | In the event of the accidental death of an Insured Party, a lump sum payment will be made to either of the following: The surviving Eligible Spouse or Policyholder. Eligible Children (or their legal guardians if they are minors) or an Eligible Special Dependent The deceased Insured Party’s estate if none of the aforementioned is applicable. The cover is restricted to: Children younger than six years – R20,000 All other insureds: R25,000 Death or disability claim payout due to the same injury is limited to a single payment if the Permanent Disability benefit has already been paid. No payment will be made under the Death benefit if the Insured Party dies due to the same injury. |

READ more about the Hospital Plans

Medical Emergency Illness Buy-Up

Casualty and In-Hospital Cover for Accidental Harm

| ⚠️ Casualty Treatment | Cover for emergency services in the event of Accidental Harm resulting from an Accidental Event in a Hospital Casualty. Post-Accident Discharge, specialist, or follow-up visits and treatment are not covered. Limited to R30,000 per event per insured person. |

| 🏥 In-Hospital Treatment | Includes Accidental Injury hospitalization cover resulting from an Accidental Occurrence. Includes cover for emergency surgery following an accident, any required specialist visits and associated blood tests, radiology, and Allied Healthcare Provider services, such as physiotherapy, while hospitalized. Cover expires upon hospital discharge or when the event or annual limits are met, whichever occurs first. If the limit has been reached and the Insured Party continues to require Hospital Treatment, they will be transferred to a state facility. All transfer-related expenses will be covered. No Benefit is payable for services received after hospital discharge or for illnesses other than a heart attack or stroke. The Benefit pays up to R380,000 per event per Insured Party, with an annual maximum per Insured Party of R1,500,000. Hospital Allied Healthcare Professional services are subject to a sub-limit of R20,000. |

| 🚑 Emergency stabilization and ambulance services | Netcare 911 will stabilize the scene and transport the person to a suitable hospital. If needed, Netcare 911 will issue a Guarantee of Payment and Authorisation for admission. If the emergency is due to accidental harm or a suspected heart attack/stroke, the person will be taken to a Prime Cure Network Hospital. If it is an illness unrelated to stroke or heart attack, the person will be taken to a state facility unless they have purchased the Medical Emergency Illness Cover Buy-Up for qualifying conditions. If the casualty or in-hospital benefit limit is exceeded, the person will be taken to a state facility. |

| 💙 Qualifying conditions | Aortic aneurism Acute appendicitis Acute asthma attack/allergic reaction Acute inflammation of the gall bladder (cholecystitis) Acute pancreatitis Acute renal failure Acute respiratory distress syndrome and many more. |

You might like the Medical Aid Calculator

Dis-Chem Health Accident Cover Plan Exclusions and Waiting Periods

Dis-Chem Health Accident Cover Plan Exclusions

The following are Exclusions for claims or benefits:

- ✅ Suicide, attempted suicide, or willful injury to oneself.

- ✅ Use of drugs or narcotics, legal or illegal, unless prescribed by a healthcare provider.

- ✅ Failure to follow medical advice from a healthcare provider.

- ✅ The blood alcohol content is over 30mg per 100 ml of blood.

- ✅ Participation in the defense force, police force, medical rescue service, hazardous sports, etc.

- ✅ War, civil commotion, terrorism, etc.

- ✅ Claims for services not included in the policy, cosmetic surgery, external prosthesis, rehabilitation, etc.

- ✅ Transport expenses, fraudulent acts, treatment unrelated to accidental harm or medical emergencies, etc.

The following are Benefit exclusions:

- ☑️ Treatment for illnesses unrelated to heart attack or stroke unless the Medical Emergency Illness Buy-Up is purchased.

- ☑️ Services related to pregnancy, except for ectopic pregnancy with Medical Emergency Illness Buy-Up.

- ☑️ Specialist or follow-up visits and treatment after hospital or casualty discharge.

- ☑️ Medication and appliances like wheelchairs, crutches, and beds.

However, Emergency stabilization and ambulance services are exceptions to some exclusions.

Dis-Chem Health Accident Cover Plan Waiting Periods

Dis-Chem Health provides the following information regarding waiting periods in their policy:

- ✅ General and Condition-Specific Waiting Periods are outlined in the Policy Schedule.

- ✅ Waiting periods are served concurrently.

- ✅ Newborns, Eligible Children/Spouses will not have waiting periods applied if registered within 90 days of birth/marriage date or Policy Start Date.

- ✅ Waiting periods may be waived for Policyholders/Dependents with proof of previous medical insurance for at least 12 months with less than 3 months break in cover.

- ✅ Failure to provide proof of previous cover within the first three months of policy inception may affect claim eligibility.

If Policyholder/Dependent served less than 12 months with the previous insurer or less than 3 months since the resignation, a Condition-Specific Waiting Period will apply. If the Insured Party served less than three months on their previous policy, a General Waiting Period would also apply. The insurer may change the application of waiting periods with 31 days’ notice.

5 Best Medical Aids for Babies in South Africa is something you might be interested in

Dis-Chem Health Accident Cover Plan vs Other Providers

| 🔎 Medical Health Plan | 🥇 Dis-Chem Health Accident Cover | 🥈 Oneplan Health Core | 🥉 Affinity Health Day-to-Day |

| 🌎 International Cover | None | None | None |

| 👤 Main Member Contribution | R206 – R301 | R450 – R1,555 | R759 |

| 👥 Adult Dependent Contribution | R206 – R301 | R870 for a couple | R689 |

| 👶🏻 Child Dependent Contribution | R114 – R164 | R765 (Single adult + 1 Child) – R1,175 (Couple + 1 child) | R359 |

| 🔁 Gap Cover | ✅ Yes | None | None |

| 📈 Annual Limit | ✅ Yes | R7,675 – R319,300 | Unlimited |

| 😷 Screening and Prevention | ✅ Yes | None | ✅ Yes |

| 💶 Medical Savings Account | None | None | None |

| 🍼 Maternity Benefits | ✅ Yes | ✅ Yes | ✅ Yes |

Our Verdict on the Dis-Chem Health Accident Cover Plan

Dis-Chem Health Accident Cover is an insurance policy that covers accidental injury or death resulting from an accident. The policy offers a range of benefits, including emergency medical transportation, accidental death and disability benefits, and funeral benefits.

The policy has a few noteworthy features, such as 24/7 emergency medical transportation and access to the Dis-Chem benefit line for medical advice. Additionally, no medical underwriting is required to obtain cover, and the policy covers individuals up to the age of 75. However, there are some drawbacks to the policy. For one, it only covers accidental injuries or death, which means that illnesses are not covered.

Additionally, the policy only provides a fixed amount of cover for each benefit, which may not be sufficient for all cases. The policy also has a waiting period of 3 months before benefits become active.

- You might also like: Dis-Chem Health Insurance Review

- You might also like: Dis-Chem Health MyHealth Core

- You might also like: Dis-Chem Health MyHealth Plus

Dis-Chem Health Accident Cover Plan Frequently Asked Questions

What is Dis-Chem Health Accident Plan, and what does it cover?

Dis-Chem Health Accident Plan is an insurance policy that provides financial protection in case of accidental injury. It covers emergency medical expenses, hospitalization, and other related costs, such as transportation and accommodation.

What are the benefits of the Dis-Chem Health Accident Plan?

The benefits of the Dis-Chem Health Accident Plan include financial protection in case of accidental injury, emergency medical expenses cover, hospitalization cover, transportation and accommodation expenses cover, and accidental death and disability cover.

How much does Dis-Chem Health Accident Plan cost?

The cost of the Dis-Chem Health Accident Plan depends on various factors, such as the insured person’s cover amount, age, and health status. You can get a quote by visiting the Dis-Chem website or contacting customer service.

What do customers say about Dis-Chem Health Accident Plan?

Customers who have used Dis-Chem Health Accident Plan have generally given positive reviews, highlighting the ease of application, affordable premiums, and excellent customer service.

How do I apply for Dis-Chem Health Accident Plan?

You can apply for Dis-Chem Health Accident Plan online by visiting the Dis-Chem website or contacting customer service. The application process is straightforward.

What are the exclusions of the Dis-Chem Health Accident Plan?

The Dis-Chem Health Accident Plan may not cover injuries resulting from self-inflicted harm, participation in illegal activities, war, terrorism, or natural disasters. Therefore, reading the policy documents carefully is essential to understand the exclusions.

How do I make a claim under Dis-Chem Health Accident Plan?

To claim the Dis-Chem Health Accident Plan, notify the insurance company within a specified time frame and provide the necessary documents, such as medical reports and bills. The claims process is generally quick and hassle-free.

Is Dis-Chem Health Accident Plan a comprehensive health insurance policy?

No, the Dis-Chem Health Accident Plan is not a comprehensive health insurance policy. It only provides cover for accidental injuries and related expenses.

Table of Contents

Free Health Insurance Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans