- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Sirago Gov Gap Cover

Overall, Sirago Gov Gap Cover is a trustworthy short-term insurance product designed to provide extra protection for those who already have medical aid. The Sirago Gov Gap Gap Cover Plan starts from R350 ZAR. Sirago has a trust score of 4.4.

| 🔎 Provider | 🥇 Sirago Gov Gap Cover |

| 🟥 Years in Operation | 30 years |

| 🟧 Underwriters | GENRIC Insurance Company Limited (FSP: 43638) |

| 🟨 Market Share in South Africa | >10% |

| 🟩 Gap Cover Waiting Period | From 3 months (up to 12) |

| 🟦 Do Exclusions Apply | ✅ Yes |

| 🟪 Average Monthly Premium | R350 |

| 🟥 Oncology Benefit | ✅ Yes |

| 🟧 In-Hospital Benefit | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes |

Sirago Gov Gap Cover – 7 Key Point Quick Overview

- ✅ Sirago Gov Gap Cover Overview

- ✅ Sirago Gov Gap Cover Premiums

- ✅ Sirago Gov Gap Cover Benefits and Cover Breakdown

- ✅ Sirago Gov Gap Cover Exclusions and Waiting Periods

- ✅ Sirago Gov Gap Cover vs Other Gap Cover Plans

- ✅ Our Verdict on Sirago Gov Gap Cover

- ✅ Sirago Gov Gap Cover Frequently Asked Questions

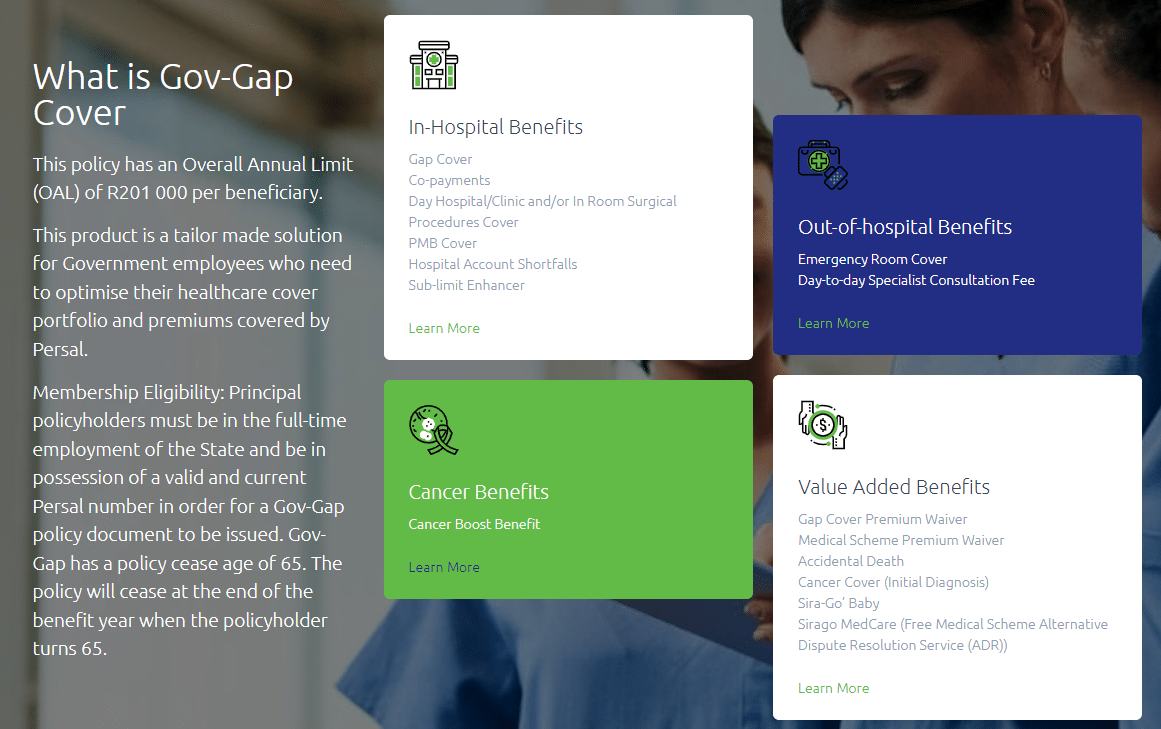

Sirago Gov Gap Cover Overview

The Sirago Gov Gap Cover is one of eight plans that starts from R350 per month. Sirago’s Gov Gap Cover has benefits for co-payments, day hospitals, PMBs, illness, day-to-day medical consults, cancer, and more.

Sirago Gap Cover has eight plans to choose from:

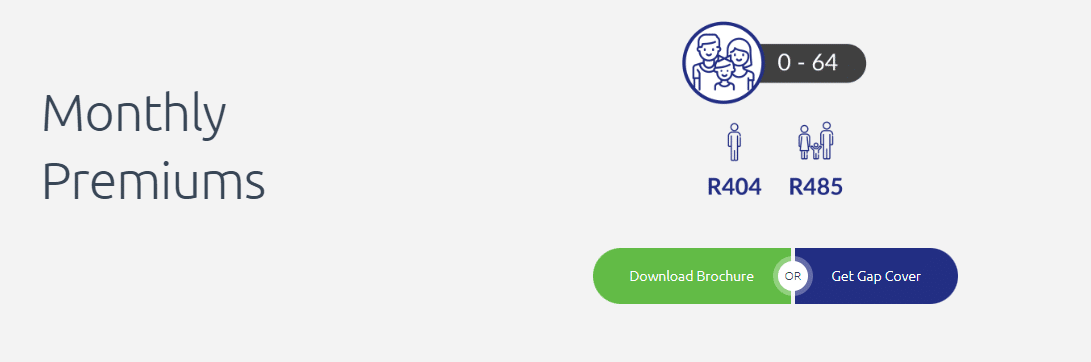

Sirago Gov Gap Cover Premiums

| 🟥 Age Limit | 🟩 Monthly Contribution |

| 🟧 Price per Individual who is between 0 – 64 years old | 🟦 R350 |

| 🟨 Price per Family with beneficiaries from 0 – 64 years old | 🟪 R405 |

Sirago Gov Gap Cover Benefits and Cover Breakdown

The intended recipients of this policy are exclusively employees working for the State. Moreover, individuals who meet the criteria must possess a valid and up-to-date Persal number. The cover provided by this policy will cease automatically when the policyholder reaches the age of 65, marking the end of the year.

| 🟥 In-Hospital Benefits | 🟥 Description |

| 🟧 Gap Cover | The policy covers up to 500% of the medical scheme rates or the stated benefit value, with a maximum cover of 600%. |

| 🟨 Day Hospital, Clinic, In-Room | If the medical scheme pre-authorizes or you choose to have treatment at a day hospital, clinic, or doctor’s room, the policy will pay for the gap portion of the claims. |

| 🟩 Sub-Limit Enhancer | This benefit is subject to a sublimit of R26,500 per claim. The sub-limit enhancer benefit is applicable when you have exceeded your medical plan’s benefit limit for MRI and CT scans and internal prostheses. The OAL governs this benefit. |

| 🟦 Prescribed Minimum Benefits | The sub-limit enhancer benefit has a sub-limit of R45,000 per policy and R16,000 per claim, limited to 3 per policy and 2 per beneficiary. This benefit applies when the medical scheme’s benefit limit has been exceeded for MRI and CT scans, intraocular lenses, and internal prostheses. |

| 🟪 Out-of-Hospital Benefits | 🟪 Description |

| 🟥 Emergency Room Cover | Covers emergency costs at registered emergency facilities, hospitals, or casualty centers. There is a sub-limit of R8,000. |

| 🟧 Accidental and Trauma | Covers all costs associated with accidents or traumatic events. |

| 🟨 Illness | All costs associated with the emergency illness event will be covered and paid up to the sub-limit of R2,000 if you are responsible for paying the costs out of pocket or if paid from your medical scheme savings. |

| 🟩 Illness | In the event of a visit to an emergency room due to a medical emergency caused by illness, the policy will cover the gap portion or the amount above the medical scheme rate when the medical scheme pays a portion. The cover is up to the sub-limit of R8 000. |

| 🟦 Day-to-Day Specialist Consultations | This benefit covers the difference between the medical scheme rate and the specialist’s consultation rate only if your medical aid pays a portion of the fee from your savings. Sub-limits of R4,000 per policy, R800 per claim, and three claims per beneficiary apply. The benefit is subject to the OAL. |

| 🟪 Value-Added Benefits | 🟪 Description |

| 🟥 Sira’GO Baby | This benefit has a sub-limit of R2 000 for each newborn baby and covers midwife consultations, pathology, ultrasounds, audiology for the newborn, and more. |

| 🟧 Premium Waiver (Gap Cover) | If the Sirago policyholder dies or becomes totally and permanently disabled, the surviving spouse or adult dependent may file a claim for a Premium Waiver benefit. Sirago will hold your policy’s premiums as a credit for six months. |

| 🟨 Premium Waiver (Medical Aid) | Sirago will pay the medical scheme premium, up to R3,000 monthly over 4 months in the event of the death or total and permanent disability of the Sirago policyholder and where all beneficiaries are linked to a single medical scheme. |

| 🟩 Initial Cancer Diagnosis | This benefit will pay a lump sum of R7,500 upon the initial diagnosis of stage 1 cancer. Before the policy is started, any cancer or pre-cancer is excluded, including skin cancer. |

| 🟦 Accidental Death | This benefit will be paid out in the event of accidental death at the following rates: R6,000 for the Sirago policyholder, R5,000 for adult dependents, and R3,000 for child dependents. |

| 🟪 Cancer Benefits | 🟪 Description |

| 🟥 Cancer Boost | If your medical scheme for cancer has a set dollar amount, you may be eligible for this benefit. After the initial rand limit is met, Sirago will cover ongoing treatment costs according to the medical scheme’s registered treatment plan. |

Sirago Gov Gap Cover Exclusions and Waiting Periods

Gov Gap Exclusions

The following are excluded from the cover by Sirago Gap Cover:

- ✅ Any pre-existing disease, disorder, or condition for six months.

- ✅ Any pre-existing cancer condition, disease, disorder, or illness for one year.

- ✅ Claims for routine or recurring diagnostic medical treatment.

- ✅ Diseases or injuries caused by alcohol or drug abuse.

- ✅ Any psychological or psychiatric disorder.

Suicide or attempted suicide, etc.

Gov Gap Waiting Periods

Sirago Gap Cover applies the following waiting periods:

- ✅ General Waiting Period of 3 months for new policies and 10 months for pre-existing conditions.

- ✅ Policy-Specific Waiting Periods apply within the first 6 months of a new policy. After this, 50% of benefits are paid from months 7 – 10, with all benefits accessible after month 11.

- ✅ Waiting Periods for Specific Benefits include a 10-month pregnancy and delivery waiting period, a 3-month waiting period for death and disability (on plans that include this benefit) and new cancer diagnosis, and 12 months for pre-existing cancer conditions.

Cover Upgrades of 3 months apply when existing policyholders with a previous 12-month consecutive cover upgrade to a higher plan. Those with <12 months of existing cover will wait for the difference between the remaining period and a 3-month waiting period.

Discover more about Health Insurance for Adventure Explorer Travellers

Sirago Gov Gap Cover vs Other Gap Cover Plans

| 🔎 Provider | 🥇 Sirago Gov Gap Cover | 🥈 Kaelo Gap Core | 🥉 Elixi Executive Single Plus |

| 🟥 Years in Operation | 30 years | 19 years | 6 years |

| 🟧 Underwriters | GENRIC Insurance Company Limited (FSP: 43638) | Centriq Insurance Company Limited | Unity Health |

| 🟨 Market Share in South Africa | >10% | <1% | <5% |

| 🟩 Gap Cover Waiting Period | From 3 months (up to 12) | 12 months | 3 – 12 months |

| 🟦 Do Exclusions Apply | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Average Monthly Premium | R350 | R255 | R403 |

| 🟥 Oncology Benefit | ✅ Yes | None | ✅ Yes |

| 🟧 In-Hospital Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes | None | None |

| 🟩 Maternity Benefit | ✅ Yes | None | None |

| 🟦 Scopes and Scans | ✅ Yes | None | ✅ Yes |

| 🟪 Co-payment Cover | ✅ Yes | None | ✅ Yes |

| 🟥 Emergency Room | ✅ Yes | None | ✅ Yes |

| 🟧 Accidental Cover | ✅ Yes | ✅ Yes | None |

| 🟨 Trauma Counseling | None | None | None |

| 🟩 Premium Waiver | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟦 Non-DSP Co-Payment | None | None | None |

| 🟪 Prostheses | ✅ Yes | None | ✅ Yes |

| 🟥 Travel Cover Extender | None | None | None |

| 🟧 Accidental Death/ Permanent Disability | ✅ Yes | ✅ Yes | ✅ Yes |

Our Verdict on Sirago Gov Gap Cover

According to our research, Sirago Gov Gap Cover appears to be a robust and comprehensive policy, especially suited to employees working for the state. In addition, it provides a wide range of benefits at a competitive monthly premium.

However, like all insurance products, we urge potential policyholders to read and understand the terms and conditions, including exclusions and waiting periods, to ensure it meets their specific needs.

Sirago Gov Gap Cover Frequently Asked Questions

Who is eligible for the Sirago Gov Gap Cover?

The Sirago Gov Gap Cover is primarily designed for state employees. Individuals who meet the criteria must possess a valid and up-to-date Persal number.

What are the premium rates for the Sirago Gov Gap Cover?

The monthly premium for an individual between 0 and 64 years old is R350. For a family with beneficiaries from 0 to 64 years old, the premium is R405 per month.

What happens to the Sirago Gov Gap Cover when the policyholder reaches the age of 65?

The cover provided by the Sirago Gov Gap Cover will automatically cease when the policyholder reaches the age of 65.

What are the waiting periods for Sirago Gov Gap Cover?

The waiting period for Sirago Gov Gap ranges from 3 to 12 months.

Are there any exclusions in the Sirago Gov Gap Cover?

Yes, the policy does not cover pre-existing diseases for six months, pre-existing cancer conditions for one year, routine or recurring diagnostic medical treatment, diseases or injuries caused by alcohol or drug abuse, psychological or psychiatric disorders, suicide or attempted suicide, etc.

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans