- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Sirago Gap Assist

Overall, Sirago Gap Assist is a trustworthy short-term insurance product designed to provide extra protection for those who already have medical aid. The Sirago Gap Assist Plan starts from R366 ZAR. Admed has a trust score of 4.4.

| 🔎 Provider | 🥇 Sirago Gap Assist |

| 🟥 Years in Operation | 30 years |

| 🟧 Underwriters | GENRIC Insurance Company Limited (FSP: 43638) |

| 🟨 Market Share in South Africa | >10% |

| 🟩 Gap Cover Waiting Period | From 3 months (up to 12) |

| 🟦 Do Exclusions Apply | ✅ Yes |

| 🟪 Average Monthly Premium | R366 |

| 🟥 Oncology Benefit | ✅ Yes |

| 🟧 In-Hospital Benefit | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes |

Sirago Gap Assist – 7 Key Point Quick Overview

- ✅ Sirago Gap Assist Overview

- ✅ Sirago Gap Assist Premiums

- ✅ Sirago Gap Assist Benefits and Cover Breakdown

- ✅ Sirago Gap Assist Exclusions and Waiting Periods

- ✅ Sirago Gap Assist vs Other Gap Cover Plans

- ✅ Our Verdict on Sirago Gap Assist

- ✅ Sirago Gap Assist Frequently Asked Questions

Sirago Gap Assist Overview

The Sirago Gap Assist is one of eight plans that starts from R366 per month. Sirago’s Gap Assist has benefits for cancer, accidents, trauma, appliances/prostheses, premium waivers, and more.

Sirago Gap Cover has eight plans to choose from:

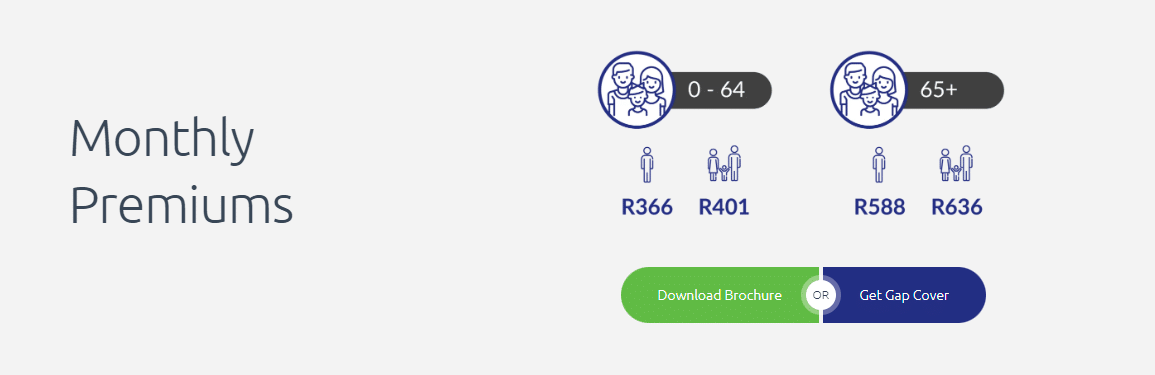

Sirago Gap Assist Premiums

| 🅰️ Age Limit | 🅱️ Monthly Contribution |

| 🟧 Overall Annual Limit per Beneficiary | R191,000 |

| 🟨 Price per Individual who is between 0 – 64 years old | R366 |

| 🟩 Price per Family with beneficiaries from 0 – 64 years old | R401 |

| 🟦 Price per Individual who is >65 years old | R588 |

| 🟪 Price per Family with a beneficiary of >65 years old | R636 |

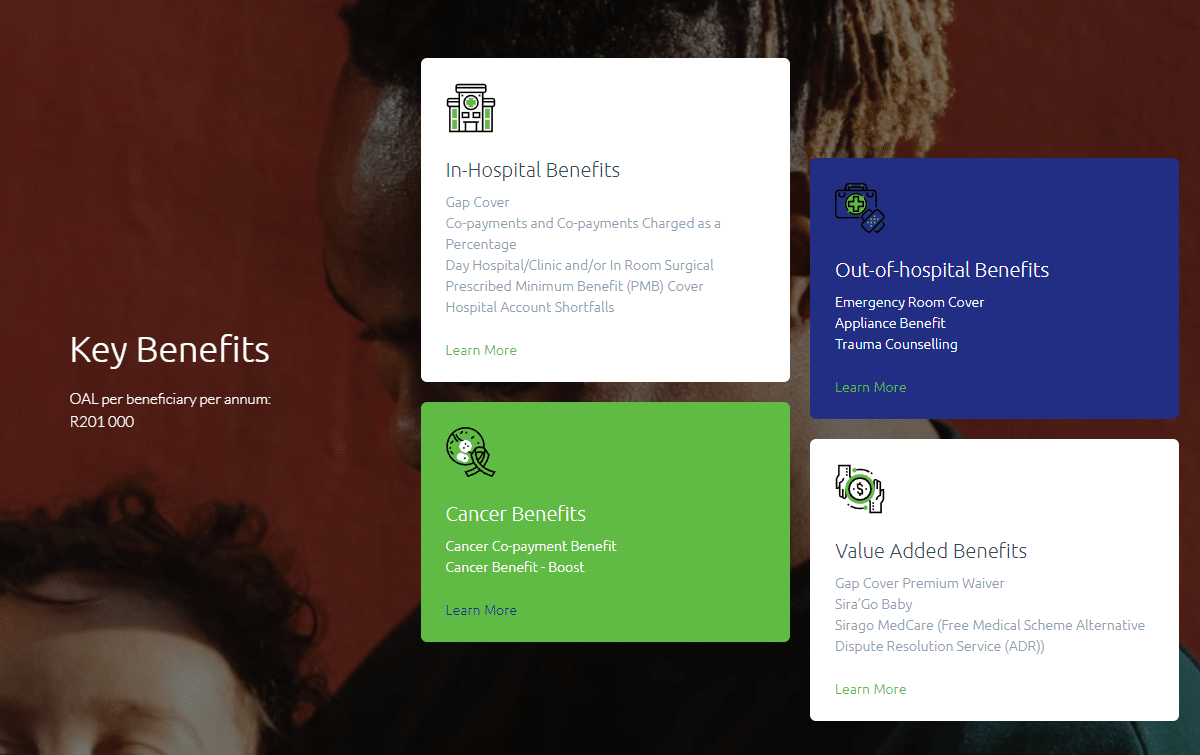

Sirago Gap Assist Benefits and Cover Breakdown

| 🅰️ In-Hospital Benefits | 🅱️ Description |

| 🟧 Gap Cover | Gap Cover pays the difference between the medical scheme rate and the rate service providers charge, i.e., doctors and specialists. Covers up to 500% above medical scheme rates or at the stated benefit value, to a maximum of 600%. subject to the OAL. |

| 🟨 Hospital Account Shortfall | This benefit will cover hospital account charges not covered by the medical plan, such as consumables and take-home medication. Sirago will pay up to R3,000 per policy, R500 per claim, and a maximum of three claims per beneficiary. A sub-limit of R1,000 applies to private room upgrades, and the OAL governs the benefit. |

| 🟩 Day Hospital, Clinic, In-Room | Covers the shortfall on any day hospital/clinic or in-room procedures if you elect to have the treatment normally performed in-hospital as an out-patient. Subject to the OAL. |

| 🟦 Co-Payments | Provides cover for co-payments, excesses, or deductibles imposed by a medical scheme for specific procedures. Sub-limit of R42,000 per policy and R11,00 per claim. Subject to the OAL. |

| 🟪 Penalty Fee Co-Payments | Covers penalty fees imposed by a medical scheme for using a non-designated service provider or network hospital. Sub-limit of R6,000 per claim, per policy. Governed by the OAL. |

| 🟩 Prescribed Minimum Benefits | All scheme members are entitled to the PMB, which covers diagnosis and treatment for predetermined conditions. Covers costs incurred from using an unapproved medical professional for scheduled PMB procedures. This applies if you meet the OAL. |

| 🅰️ Out-of-Hospital Benefits | 🅱️ Description |

| 🟧 Emergency Room Cover | Covers emergency costs at registered emergency facilities, hospitals, or casualty centers. There is a sub-limit of R6,500. |

| 🟨 Appliances | Covers up to R3,600 per policy and R1,200 per claim. Covers the difference between the tariff of the medical scheme and the service provider on hearing aids, wheelchairs, humidifiers, etc. |

| 🟩 Accidental and Trauma | Covers all costs associated with accidents or traumatic events. |

| 🟦 Child Emergency Illness | Covers emergency treatment for children 8 and younger outside normal consultation hours. Covers all costs related to the event. Subject to the OAL. |

| 🅰️ Value-Added Benefits | 🅱️ Description |

| 🟧 Sira’GO Baby | A lump sum of R1,500 for a newborn child is paid if the birth certificate is submitted within 90 days of birth. |

| 🟨 Sirago Medcare – Free ADR Service | Offers free alternative dispute resolution (ADR) service for PMB claims over R9,000 not considered valid. Provides discounted rates (60%, 20%, or 15%) for claims under R9,000, including non-scheme disputes. |

| 🟩 Premium Waiver | In the event of the death or total permanent disability of the Sirago policyholder, the surviving spouse or adult dependent on the policy can claim a Premium Waiver benefit. The premiums for the policy will be kept as a credit for 6 months. |

| 🅰️ Cancer Benefits | 🅱️ Description |

| 🟧 Cancer Co-Payments | This applies if your medical plan’s cancer benefit has been exhausted and a co-payment is required. Includes co-payments for ongoing cancer treatments and biological medications. Ongoing treatment must comply with your medical plan’s registered treatment plan to be eligible for this benefit of up to R20,000 per claim. The Overall Annual Limit (OAL) governs this benefit. |

| 🟨 Cancer Boost | This applies if your medical plan’s cancer cover option has a predetermined Rand limit. Once the limit is reached, Sirago will cover ongoing treatment costs per the medical scheme’s registered treatment plan. All claims are subject to a sub-limit of R50,000 per beneficiary. The OAL governs this benefit. |

Sirago Gap Assist Exclusions and Waiting Periods

Gap Assist Exclusions

The following are excluded from the cover by Sirago Gap Cover:

- ✅ Any pre-existing disease, disorder, or condition for six months.

- ✅ Any pre-existing cancer condition, disease, disorder, or illness for one year.

- ✅ Claims for routine or recurring diagnostic medical treatment.

- ✅ Diseases or injuries caused by alcohol or drug abuse.

- ✅ Any psychological or psychiatric disorder.

- ✅ Suicide or attempted suicide.

- ✅ Used medication, drugs, prescriptions, consumables, and equipment unless covered under this policy’s benefit provisions.

- ✅ Cosmetic surgery unless defined as a covered benefit under this policy.

- ✅ Optional procedures.

- ✅ Diagnostic procedures, therapy, and surgery regarding eating disorders, obesity, and weight management.

- ✅ Investigations, treatment, medication, or surgery related to any condition for which the policyholder seeks advice, diagnosis, or treatment outside South African borders.

- ✅ Body Mass Index (BMI), unless defined as a benefit under this policy.

- ✅ Diagnostic procedures, treatments, or surgical procedures on assisted reproduction.

Participation in any race or speed test involving Mechanically propelled vehicles or crafts, as a professional athlete, or in any hobby is defined as dangerous in the Policy Terms and Conditions will be excluded.

Women might consider making use of our free Ovulation Calculator

Gap Assist Waiting Periods

Sirago Gap Cover applies the following waiting periods:

- ✅ General Waiting Period of 3 months for new policies and 10 months for pre-existing conditions.

- ✅ Policy-Specific Waiting Periods apply within the first 6 months of a new policy. After this, 50% of benefits are paid from months 7 – 10, with all benefits accessible after month 11.

- ✅ Waiting Periods for Specific Benefits include a 10-month pregnancy and delivery waiting period, a 3-month waiting period for death and disability (on plans that include this benefit) and new cancer diagnosis, and 12 months for pre-existing cancer conditions.

Cover Upgrades of 3 months apply when existing policyholders with a previous 12-month consecutive cover upgrade to a higher plan. Those with <12 months of existing cover will wait for the difference between the remaining period and a 3-month waiting period.

Discover the Best Gap Cover with No Waiting Period

Sirago Gap Assist vs Other Gap Cover Plans

| 🔎 Provider | 🥇 Sirago Gap Assist | 🥈 Cura Administrators Gap Advanced Plus | 🥉 Auto & General Comprehensive Gap Cover |

| 🟥 Years in Operation | 30 years | 26 years | 38 years |

| 🟧 Underwriters | GENRIC Insurance Company Limited (FSP: 43638) | GENRIC Insurance Company Limited | 1Life Insurance Limited |

| 🟨 Market Share in South Africa | >10% | <5% | <5% |

| 🟩 Gap Cover Waiting Period | From 3 months (up to 12) | 3 – 12 months | 10 months |

| 🟦 Do Exclusions Apply | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Average Monthly Premium | R366 | R437 | R280 |

| 🟥 Oncology Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟧 In-Hospital Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟩 Maternity Benefit | ✅ Yes | ✅ Yes | None |

| 🟦 Scopes and Scans | None | ✅ Yes | ✅ Yes |

| 🟪 Co-payment Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟥 Emergency Room | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟧 Accidental Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Trauma Counseling | None | ✅ Yes | None |

| 🟩 Premium Waiver | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟦 Non-DSP Co-Payment | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Prostheses | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟥 Travel Cover Extender | None | ✅ Yes | None |

| 🟧 Accidental Death/ Permanent Disability | None | ✅ Yes | None |

Our Verdict on Sirago Gap Assist

In our experience, Sirago Gap Assist offers a comprehensive range of benefits, including in-hospital cover, co-payment cover, and cancer benefits. In addition, the tiered premium structure provides flexibility for different budgets and needs.

Unique benefits like the Sira’GO Baby and Sirago Medicare-Free ADR Service add value. However, the lack of cover for scopes and scans, trauma counseling, travel cover extender, and accidental death/permanent disability cover may be drawbacks for some.

The plan’s exclusions and waiting periods are standard but should be considered. Overall, Sirago Gap Assist provides robust cover and valuable financial protection against high healthcare costs, but individual healthcare needs and circumstances should be considered before choosing a plan.

Sirago Gap Assist Frequently Asked Questions

What is the Overall Annual Limit per Beneficiary for Sirago Gap Assist?

The Overall Annual Limit per Beneficiary for Sirago Gap Assist is R191,000.

What are the premiums for Sirago Gap Assist?

The premiums for Sirago Gap Assist vary based on age and family size, ranging from R366 for an individual aged 0-64 to R636 for a family with a beneficiary over 65.

What are the in-hospital benefits of Sirago Gap Assist?

Sirago Gap Assist covers up to 200% above medical scheme rates or at the stated benefit value, to a maximum of 300% for in-hospital benefits.

Does Sirago Gap Assist provide co-payment cover?

Yes, Sirago Gap Assist covers co-payments, excesses, or deductibles imposed by a medical scheme for specific procedures.

What is the Premium Waiver benefit in Sirago Gap Assist?

In the event of the death or total permanent disability of the Sirago policyholder, the surviving spouse or adult dependent on the policy can claim a Premium Waiver benefit.

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans