- Medical Aid

- Currently Trending

The Best Medical Aids

- Compare Plans

- Gap Cover

- Best Gap Covers

- Hospital Plans

- Currently Trending

The Best Hospital Plans

- Medical Insurance

- Pet Insurance

Sirago Plus Gap

Overall, Sirago Plus Gap Cover is a trustworthy short-term insurance product designed to provide extra protection for those who already have medical aid. The Sirago Plus Gap Cover Plans start from R426 ZAR. Sirago has a trust score of 4.4.

| 🔎 Provider | 🥇 Sirago Plus Gap |

| 🟥 Years in Operation | 30 years |

| 🟧 Underwriters | GENRIC Insurance Company Limited (FSP: 43638) |

| 🟨 Market Share in South Africa | >10% |

| 🟩 Gap Cover Waiting Period | From 3 months (up to 12) |

| 🟦 Do Exclusions Apply | ✅ Yes |

| 🟪 Average Monthly Premium | R426 |

| 🟥 Oncology Benefit | ✅ Yes |

| 🟧 In-Hospital Benefit | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes |

Sirago Plus Gap Cover – 7 Key Point Quick Overview

- ✅ Sirago Plus Gap Overview

- ✅ Sirago Plus Gap Premiums

- ✅ Sirago Plus Gap Benefits and Cover Breakdown

- ✅ Sirago Plus Gap Exclusions and Waiting Periods

- ✅ Sirago Plus Gap vs Other Gap Cover Plans

- ✅ Our Verdict on Sirago Plus Gap

- ✅ Sirago Plus Gap Frequently Asked Questions

Sirago Plus Gap Overview

The Sirago Plus Gap is one of eight plans that starts from R426 per month. Sirago’s Plus Gap has benefits for hospital account shortfalls, PMBs, preventative care, illness, specialist consultation, trauma counseling, and more.

Sirago Gap Cover has eight plans to choose from:

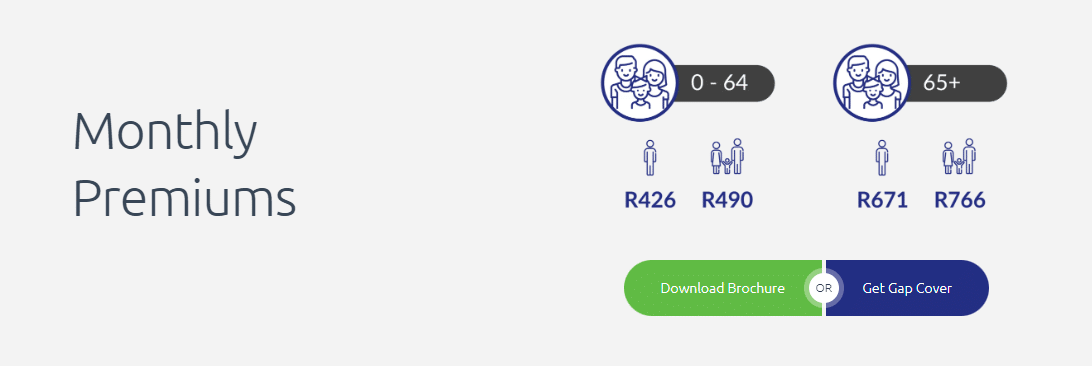

Sirago Plus Gap Premiums

| 🟥 Age Limit | 🟥 Monthly Contribution |

| 🟧 Overall Annual Limit per Beneficiary | 🟧 R191,000 |

| 🟨 Price per Individual who is between 0 – 64 years old | 🟨 R426 |

| 🟩 Price per Family with beneficiaries from 0 – 64 years old | 🟩 R490 |

| 🟦 Price per Individual who is >65 years old | 🟦 R671 |

| 🟪 Price per Family with a beneficiary of >65 years old | 🟪 R766 |

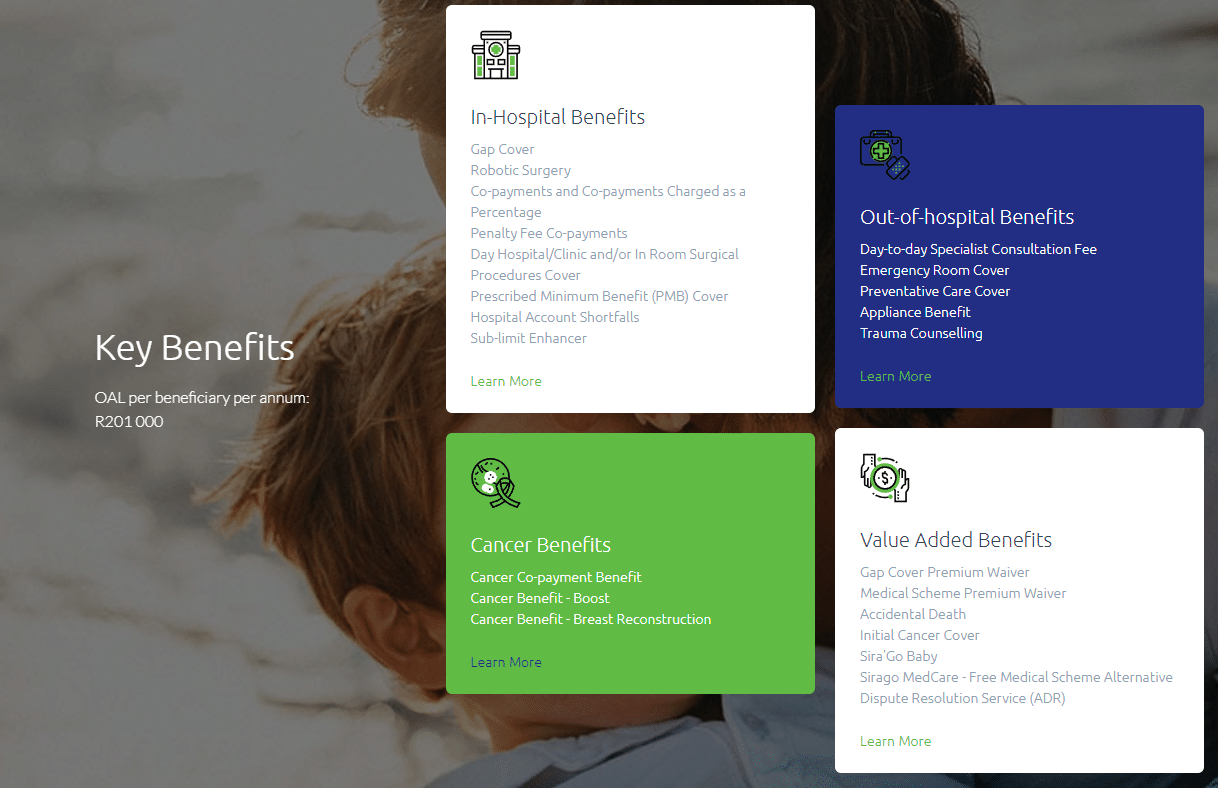

Sirago Plus Gap Benefits and Cover Breakdown

| 🟥 In-Hospital Benefits | 🟥 Description |

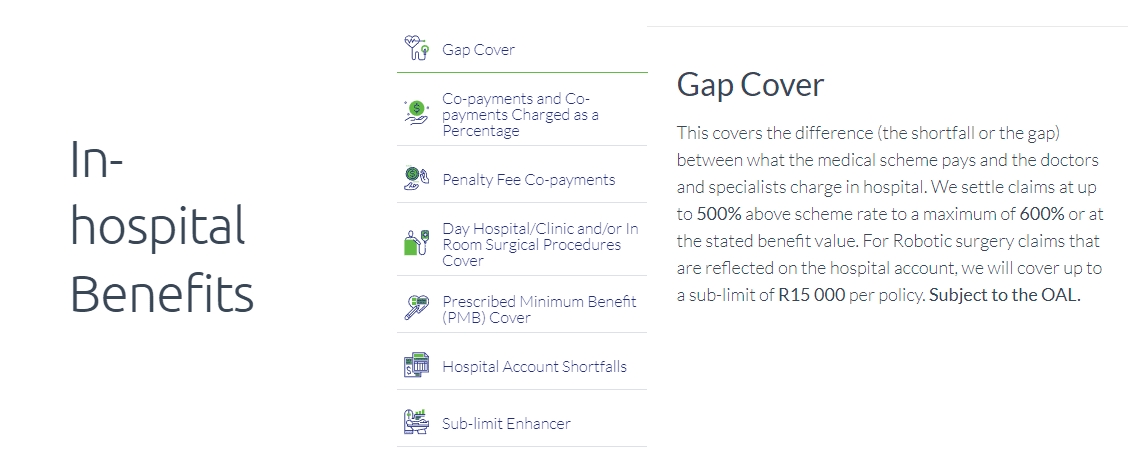

| 🟧 Gap Cover | Gap Cover pays the difference between the medical scheme rate and the rate service providers charge, i.e., doctors and specialists. The cover extends to 500% above the medical scheme rate or the stated benefit value, with a maximum of 600%. Covers up to R18 000 per policy, with a maximum of R6 000 per claim per beneficiary on robotic surgery. Subject to the OAL. |

| 🟨 Hospital Account Shortfall | This benefit will cover hospital account charges not covered by the medical plan, such as consumables and take-home medication. Sirago will pay up to R4,000 per policy, R850 per claim, and a maximum of three claims per beneficiary. A sub-limit of R1,000 applies to private room upgrades, and the OAL governs the benefit. |

| 🟩 Day Hospital, Clinic, In-Room | Covers the shortfall on any day hospital/clinic or in-room procedures if you elect to have the treatment normally performed in-hospital as an out-patient. Subject to the OAL. |

| 🟦 Co-Payments | The Co-payment Cover feature is intended to cover co-payments, excesses, and deductibles imposed by a medical scheme for specified procedures, hospital admission fees, scans, or surgical procedures. |

| 🟪 Penalty Fee Co-Payments | Covers penalty fees imposed by a medical scheme for using a non-designated service provider or network hospital. Sub-limit of R9,500 per claim, per policy. Governed by the OAL. |

| 🟥 Sub-Limit Enhancer | This benefit is subject to a sublimit of R30,000 per policy and R11,500 per claim. The sub-limit enhancer benefit is applicable when you have exceeded your medical plan’s benefit limit for MRI and CT scans and internal prostheses. The OAL governs this benefit. |

| 🟧 Prescribed Minimum Benefits | All scheme members are entitled to the PMB, which covers diagnosis and treatment for predetermined conditions. Covers costs incurred from using an unapproved medical professional for scheduled PMB procedures. This applies if you meet the OAL. |

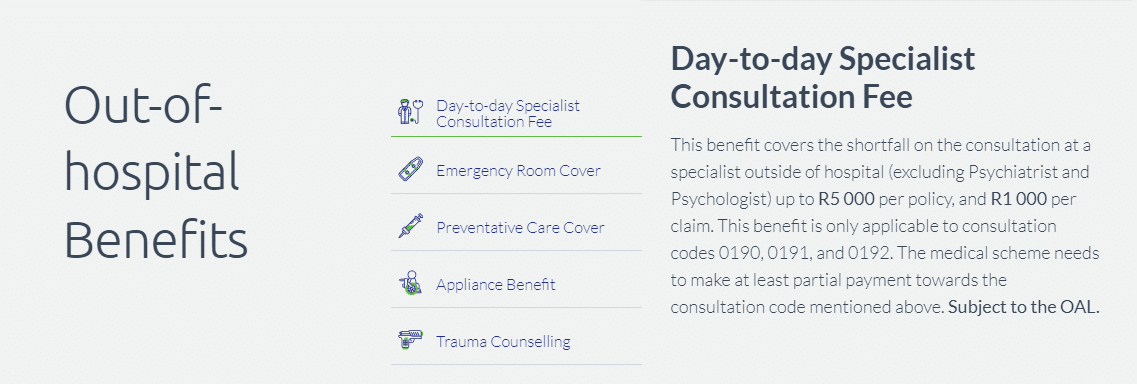

| 🟨 Out-of-Hospital Benefits | 🟨 Description |

| 🟩 Emergency Room Cover | Covers emergency costs at registered emergency facilities, hospitals, or casualty centers. There is a sub-limit of R6,500. |

| 🟦 Preventative Care | If your medical plan option includes preventative care benefits, an R4,000 sub-limit will apply. Each claim will receive up to R800. Covers pap smears, cholesterol tests, blood glucose testing, flu vaccines, etc. The OAL governs this benefit. |

| 🟪 Appliances | Covers up to R5,000 per policy and R1,200 per claim. Covers the difference between the tariff of the medical scheme and the service provider on hearing aids, wheelchairs, humidifiers, etc. |

| 🟥 Accidental and Trauma | Covers all costs associated with accidents or traumatic events. |

| 🟧 Illness | All costs associated with the emergency illness event will be covered and paid up to the sub-limit of R1,000 if you are responsible for paying the costs out of pocket or if paid from your medical scheme savings. |

| 🟨 Child Emergency Illness | Covers emergency treatment for children 8 and younger outside normal consultation hours. Covers all costs related to the event. Subject to the OAL. |

| 🟩 Trauma Counselling | This benefit covers trauma counseling with a registered medical professional following a traumatic event, such as dread disease, hijacking, or violent crime. A sublimit of R4,000 per policy and R800 per claim will apply. You are covered for the first six months following the incident. |

| 🟦 Day-to-Day Specialist Consultations | This benefit covers the difference between the medical scheme rate and the specialist’s consultation rate only if your medical aid pays a portion of the fee from your savings. Sub-limits of R4,500 per policy, R950 per claim, and three claims per beneficiary apply. The benefit is subject to the OAL. |

| 🟪 Value-Added Benefits | 🟪 Description |

| 🟥 Sira’GO Baby | A lump sum of R1,500 for a newborn child is paid if the birth certificate is submitted within 90 days of birth. |

| 🟧 Sirago Medcare – Free ADR Service | Offers free alternative dispute resolution (ADR) service for PMB claims over R9,000 not considered valid. Provides discounted rates (60%, 20%, or 15%) for claims under R9,000, including non-scheme disputes. |

| 🟨 Premium Waiver (Gap Cover) | If the Sirago policyholder dies or becomes totally and permanently disabled, the surviving spouse or adult dependent may file a claim for a Premium Waiver benefit. ·Sirago will hold your policy’s premiums as a credit for six months. |

| 🟩 Premium Waiver (Medical Aid) | Sirago will pay the medical scheme premium, up to R3,750 monthly over six months. In the event of the death or total and permanent disability of the Sirago policyholder and where all beneficiaries are linked to a single medical scheme, this will be paid to the beneficiary for the maintenance of medical scheme contributions. |

| 🟦 Initial Cancer Diagnosis | This benefit will pay a lump sum of R17,000 upon the initial diagnosis of stage 1 cancer. Before the policy is started, any cancer or pre-cancer is excluded, including skin cancer. |

| 🟪 Accidental Death | This benefit will be paid out in the event of accidental death at the following rates: R8,500 for the Sirago policyholder, R5,500 for adult dependents, and R3,000 for child dependents. |

| 🟥 Cancer Benefits | 🟥 Description |

| 🟧 Cancer Co-Payments | This applies if your medical plan’s cancer benefit has been exhausted and a co-payment is required. Includes co-payments for ongoing cancer treatments and biological medications. Ongoing treatment must comply with your medical plan’s registered treatment plan to be eligible for this benefit of up to R20,000 per claim. The Overall Annual Limit (OAL) governs this benefit. |

Sirago Plus Gap Exclusions and Waiting Periods

Plus Gap Exclusions

The following are excluded from the cover by Sirago Gap Cover:

- ✅ Any pre-existing disease, disorder, or condition for six months.

- ✅ Any pre-existing cancer condition, disease, disorder, or illness for one year.

- ✅ Claims for routine or recurring diagnostic medical treatment.

- ✅ Diseases or injuries caused by alcohol or drug abuse.

- ✅ Any psychological or psychiatric disorder.

- ✅ Suicide or attempted suicide.

- ✅ Cosmetic surgery unless defined as a covered benefit under this policy.

- ✅ Optional procedures.

- ✅ Diagnostic procedures, therapy, and surgery regarding eating disorders, obesity, etc.

- ✅ Body Mass Index (BMI), unless defined as a benefit under this policy.

- ✅ Diagnostic procedures, treatments, or surgical procedures on assisted reproduction.

Participation in any race or speed test involving Mechanically propelled vehicles or crafts, as a professional athlete, or in any hobby is defined as dangerous in the Policy Terms and Conditions.

Plus Gap Waiting Periods

Sirago Gap Cover applies the following waiting periods:

- ✅ General Waiting Period of 3 months for new policies and 10 months for pre-existing conditions.

- ✅ Policy-Specific Waiting Periods apply within the first 6 months of a new policy. After this, 50% of benefits are paid from months 7 – 10, with all benefits accessible after month 11.

- ✅ Waiting Periods for Specific Benefits include a 10-month pregnancy and delivery waiting period, a 3-month waiting period for death and disability (on plans that include this benefit) and new cancer diagnosis, and 12 months for pre-existing cancer conditions.

Cover Upgrades of 3 months apply when existing policyholders with a previous 12-month consecutive cover upgrade to a higher plan. Those with <12 months of existing cover will wait for the difference between the remaining period and a 3-month waiting period.

Read more about the 5 Top Medical Aids for Childbearing Women

Sirago Plus Gap vs Other Gap Cover Plans

| 🔎 Provider | 🥇 Sirago Plus Gap | 🥈 Netcare GapCare500+ | 🥉 Stratum Benefits Elite Gap Cover |

| 🟥 Years in Operation | 30 years | 27 years | 24 years |

| 🟧 Underwriters | GENRIC Insurance Company Limited (FSP: 43638) | The Hollard Insurance Company Limited | Guardrisk Insurance Company Limited (FSP 75) |

| 🟨 Market Share in South Africa | >10% | <5% | >5% |

| 🟩 Gap Cover Waiting Period | From 3 months (up to 12) | 3 – 12 months | 3 Months |

| 🟦 Do Exclusions Apply | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Average Monthly Premium | R426 | R335 | R404 |

| 🟥 Oncology Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟧 In-Hospital Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Out-of-Hospital Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟩 Maternity Benefit | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟦 Scopes and Scans | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Co-payment Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟥 Emergency Room | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟧 Accidental Cover | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟨 Trauma Counseling | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟩 Premium Waiver | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟦 Non-DSP Co-Payment | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟪 Prostheses | ✅ Yes | ✅ Yes | ✅ Yes |

| 🟥 Travel Cover Extender | None | None | ✅ Yes |

| 🟧 Accidental Death/ Permanent Disability | ✅ Yes | ✅ Yes | ✅ Yes |

Our Verdict on Sirago Plus Gap

According to our research, the Sirago Plus Gap plan offers a comprehensive suite of benefits that cater to a wide range of healthcare needs. The plan’s in-hospital benefits, co-payment cover, and cancer benefits are particularly noteworthy, providing substantial financial protection against the high costs of medical treatments and procedures.

Including unique benefits such as the Sira’GO Baby benefit, Sirago Medcare – Free ADR Service, and the Premium Waiver adds value to the plan and demonstrates Sirago’s commitment to providing comprehensive and customer-focused solutions.

However, it is important to note that the plan does have some limitations.

Sirago Plus Gap Frequently Asked Questions

What is the Overall Annual Limit per Beneficiary for Sirago Plus Gap?

The Overall Annual Limit per Beneficiary for Sirago Plus Gap is R191,000.

What are the premiums for Sirago Plus Gap?

The premiums for Sirago Plus Gap vary based on age and family size, ranging from R426 for an individual aged 0-64 to R766 for a family with a beneficiary over 65.

What are the in-hospital benefits of Sirago Plus Gap?

Sirago Plus Gap covers up to 500% above the medical scheme rate or the stated benefit value, to a maximum of 600% for in-hospital benefits.

Does Sirago Plus Gap provide co-payment cover?

Yes, Sirago Plus Gap covers co-payments, excesses, or deductibles imposed by a medical scheme for specific procedures.

What is the Premium Waiver benefit in Sirago Plus Gap?

If the Sirago policyholder dies or becomes totally and permanently disabled, the surviving spouse or adult dependent may file a claim for a Premium Waiver benefit.

Table of Contents

Free Medical Aid Quote

Our Trusted Partners

We work with leading medical aid companies in South Africa.

7 Actionable Ways to save 32% on your MEDICAL AID in 14 days.

- +27 72 7967 530

- [email protected]

- 2nd Floor, West Tower, Nelson Mandela Square, Sandton, 2196, Johannesburg, Gauteng, South Africa

🔎 Report a bug or outdated data to be updated to [email protected]

© Medicalaid.com | All rights Reserved |

Copyright 2024

Top 5 Medical Aids

Top 5 Gap Cover Plans